Global assets under the "epidemic": BTC rose over 12% to become the best in the world

Analyst | Carol

Production | PANews

In the Spring Festival of 2020, the war against "epidemic" will begin nationwide. Affected by the new crown epidemic, the first day of the year of the rat opened, the Shanghai Composite Index opened 8.42% lower, the lowest record in nearly 23 years. As of the close of the day, the Shanghai Stock Exchange Index fell by 7.72%, the Blockchain 50 Index fell by 8.41%, the Blockchain sector fell by 9.16%, and nearly 3,200 stocks in the Shanghai and Shenzhen stock markets fell.

In the context of loosening monetary policy in 2019, all types of assets around the world have achieved positive returns, with annual returns such as CSI 300 and crude oil exceeding 30%. In contrast, the beginning of the global economy in 2020 is not optimistic.

- Conjectures about digital wallets and central bank digital currencies

- Was arrested for false evidence? Auburn's farce is added

- Ethereum 2.0 audit report announced next week, giving green light to multi-client testnet

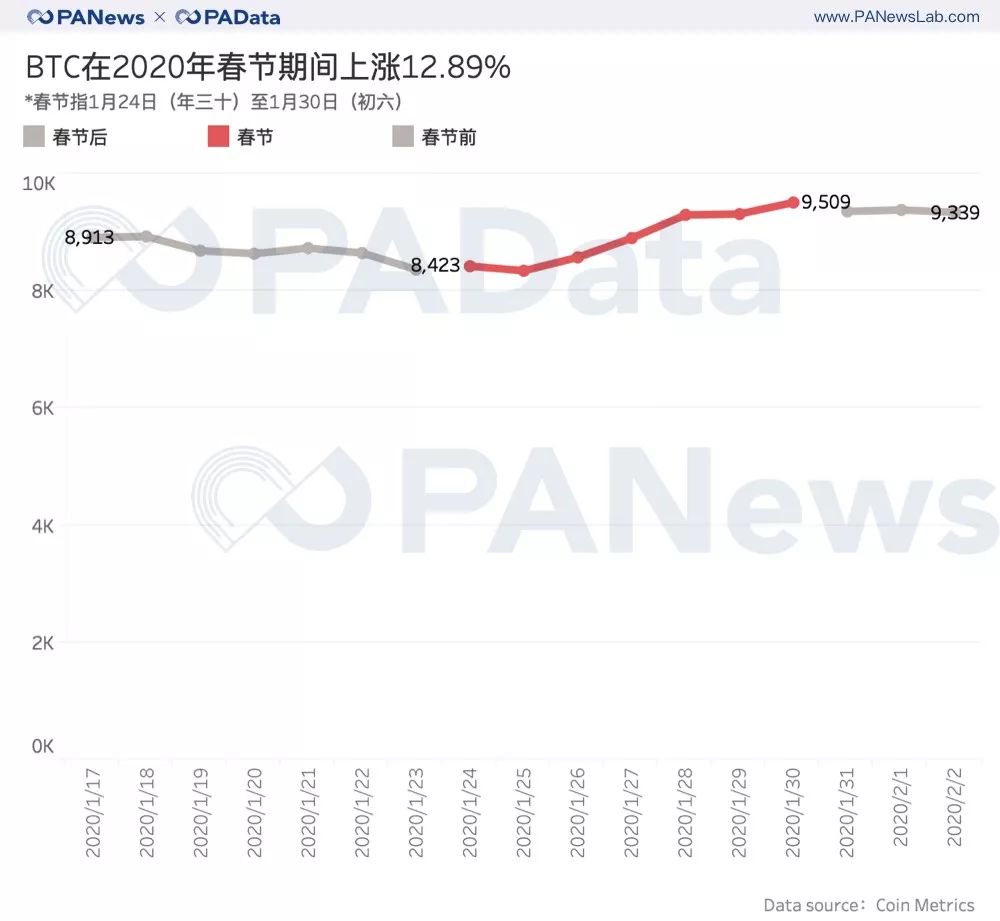

This year's Spring Festival BTC rose over 12%, the highest in the past five years

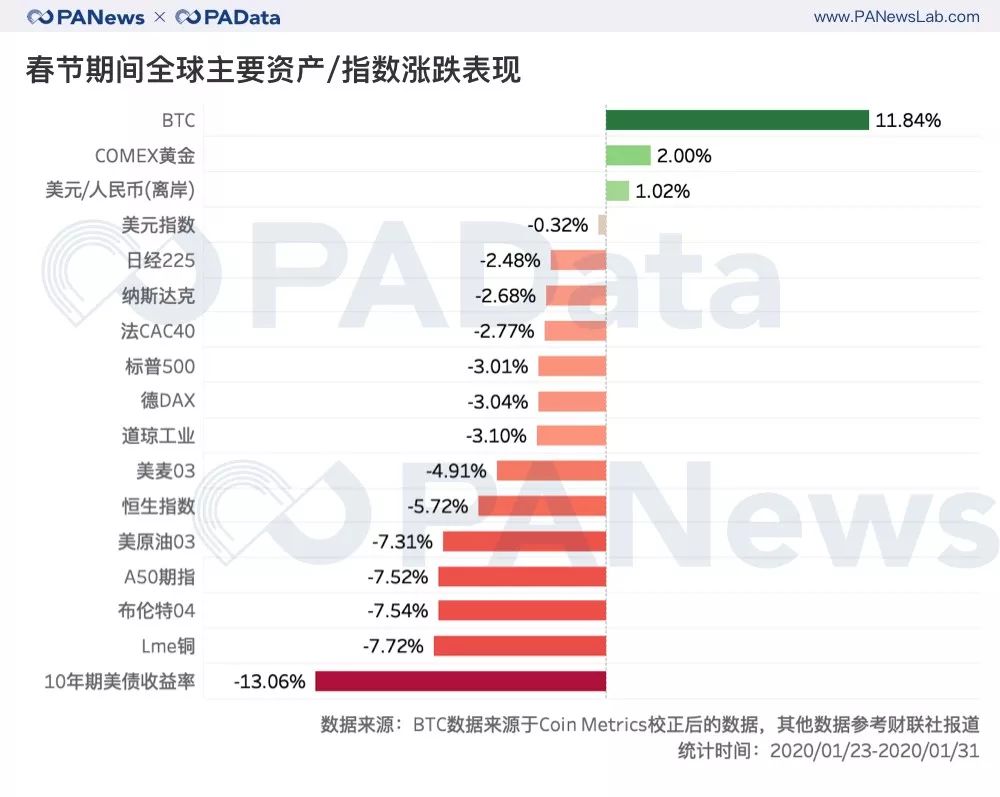

Except for the closing of the A-share market during the Spring Festival, other global assets are in the open state. According to statistics, during the Spring Festival of 2020, only three of the 17 major assets / indices worldwide rose, and the highest increase was BTC. According to the coin price data corrected by Coin Metrics, BTC rose by 11.84% from January 23 to January 31, and the performance of earnings is far superior to other underlying ones. Second is COMEX Gold (New York Gold), which rose 2% during this period, and USD / RMB (offshore) rose 1.02%.

In addition, the remaining 14 major assets / indices fell to varying degrees. Among them, the 10-year U.S. Treasury yield fell the most, falling 13.06% from January 23 to 31. Lme Copper (London Copper), Brent (crude oil) 04, A50 futures, and US crude oil 03 fell. They are all over 7%. The smaller decline was the US dollar index, which fell by only 0.32%, and the Nikkei 225 index, the Nasdaq index, and the French CAC40 index also fell less than 3%.

According to the "Bitcoin and Gold Correlation Research Report" released earlier by the Gate.io Research Institute, gold and the US dollar index and other important stock indexes (Dow Jones index, Nikkei 225 index, French CAC40 index, etc.) mainly show a negative correlation. BTC presents the statistical conclusions of gold-like risk aversion. When the economic market price fluctuates greatly, gold and BTC have a hedging property, and BTC returns perform better.

PAData analyzed the trend of BTC during the Chinese New Year (2011-2019) during the Chinese New Year (2011-2019). The results show that during the Chinese New Year in the past 9 years, Bitcoin increased by 7 The return is 6.02%, the highest return is 26.54% (2011), and the highest return is 9.48% (2017).

But around the Spring Festival this year, or due to the local conflict between the United States and Iran and the epidemic of China ’s new crown, the market ’s risk aversion has risen sharply. The level of the same period was the highest in the past 6 years.

BTC dropped slightly after the holiday and was in the sideways adjustment stage. On February 2, BTC closed at $ 9,339, down 1.79% from January 30. In the next four months or so, BTC will also be affected by production cuts.

BTC trading volume is generally stable during the Spring Festival

There is a saying circulating in the currency circle that domestic investors are too boring to go out of their homes due to the epidemic, but A shares are closed, so they can only trade Bitcoin.

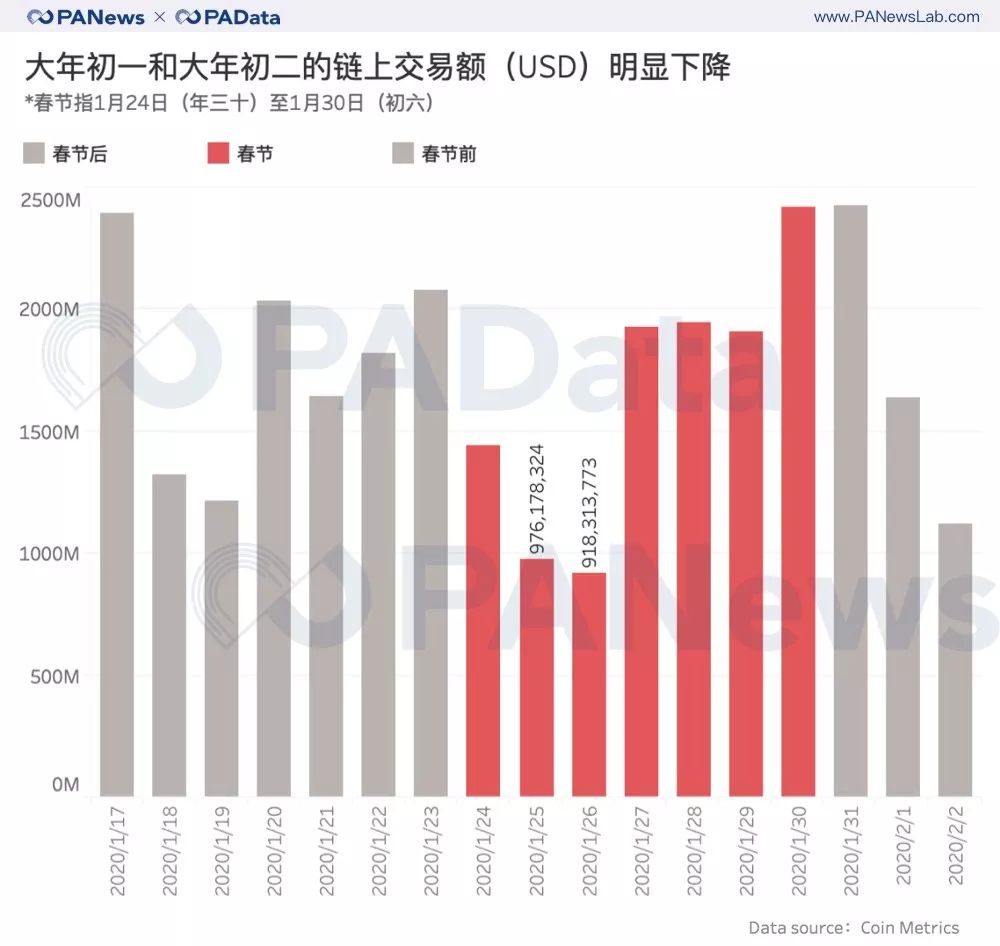

Regardless of the data performance of the on-chain transaction amount or the data performance of the secondary market transaction volume, except for the first and second day of the year, there is no significant difference compared with usual during the Spring Festival. In general, except for the first day (January 25) and the second day (January 26), the trading volume of BTC during the Spring Festival was significantly reduced, and the rest of the time was relatively stable, and there was no significant difference from before and after the festival.

According to the on-chain transaction data corrected by Coin Metrics, the average daily on-chain transaction value of BTC during the Spring Festival this year was approximately 1.649 billion U.S. dollars, of which the first day (January 25) and the second day (January 26) were two days respectively. Only $ 976 million and $ 918 million, about half the daily average. But on the third day (January 27), the on-chain transaction value of Bitcoin has recovered to US $ 1.929 billion.

From the perspective of the trading volume of the secondary market, before the Spring Festival to the Spring Festival, the trading volume of BTC showed a mild U-shaped curve. According to CoinMarketCap's daily trading volume statistics, from January 21st to January 26th, the average daily trading volume of BTC is relatively low, averaging approximately $ 23.115 billion, which constitutes the arc bottom of the "U" curve. Among them, the two days of the first day (January 25) and the second day (January 26) were only 19.647 billion US dollars and 22.177 billion US dollars, respectively, which were slightly lower than daily levels. However, the BTC trading volume has gradually recovered since then, and on the last day of the national holiday (January 30), it has reached 25.771 billion US dollars.

It is worth noting that after the opening of the A-shares, the 1,000-share limit fell, and it was in deep liquidity crisis. However, BTC's secondary market transaction volume is relatively stable and there has been no sudden decline. Among them, the transaction volume on February 2 and February 3 both exceeded US $ 30 billion.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Analysis of CBDC's international R & D dynamics (II): Thailand and Hong Kong join hands to open up the "second pulse of Rendu"

- Defi's Reasonable Logic and Aging Status

- "Determinism" and "uncertainty" on the eve of Bitcoin's cuts, how should miners and investors respond?

- Year-to-date soaring 47%, will ETH become the dark horse this year?

- Commentary | Epidemic promotes China's digital economy to enter a higher version of the crisis

- ConsenSys restructures core business and cuts staff by 14%

- God V: central bank digital currencies can interact with cryptocurrencies