Domestic block chain policy release intensive in January: 10 ministries and commissions of the central government issued 11 documents to support 12 places in government reports

Article | Interlink Pulse Institute

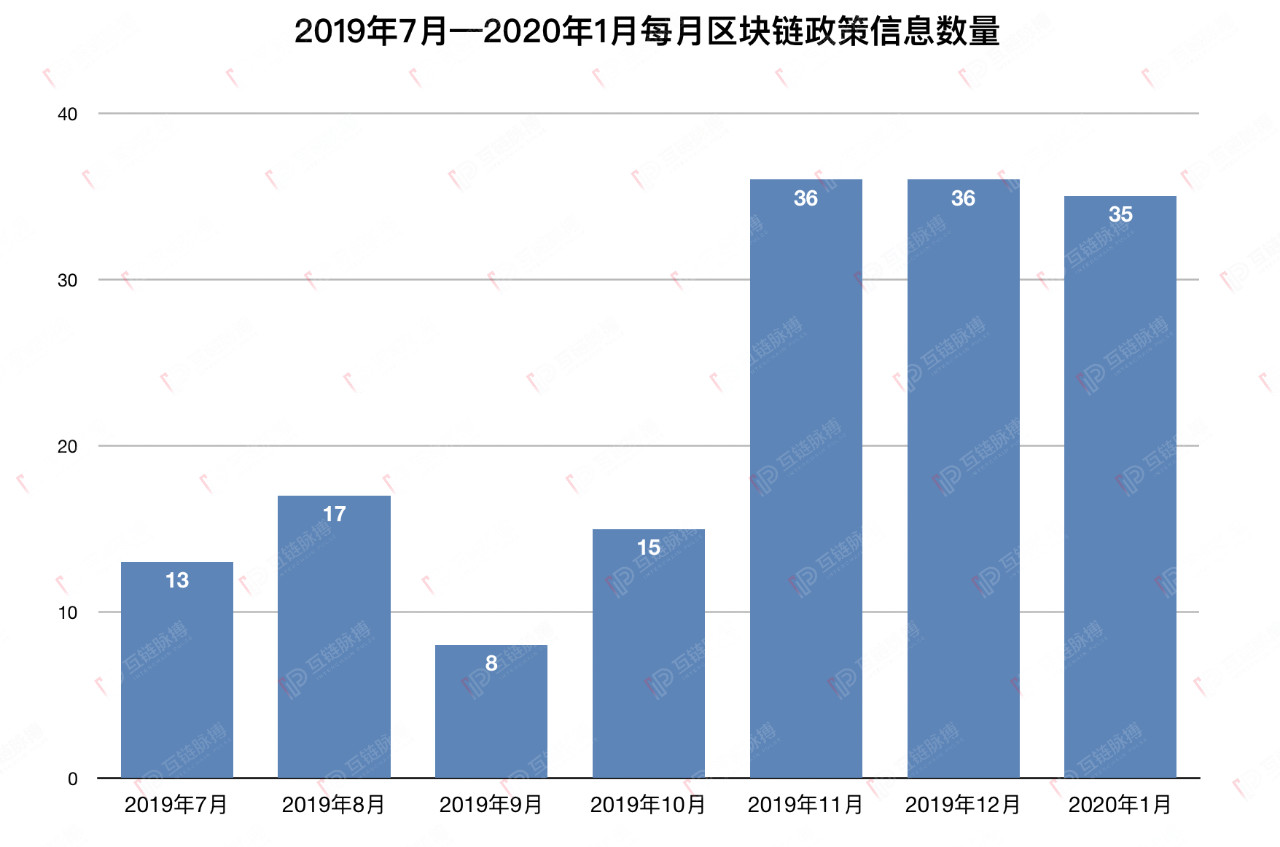

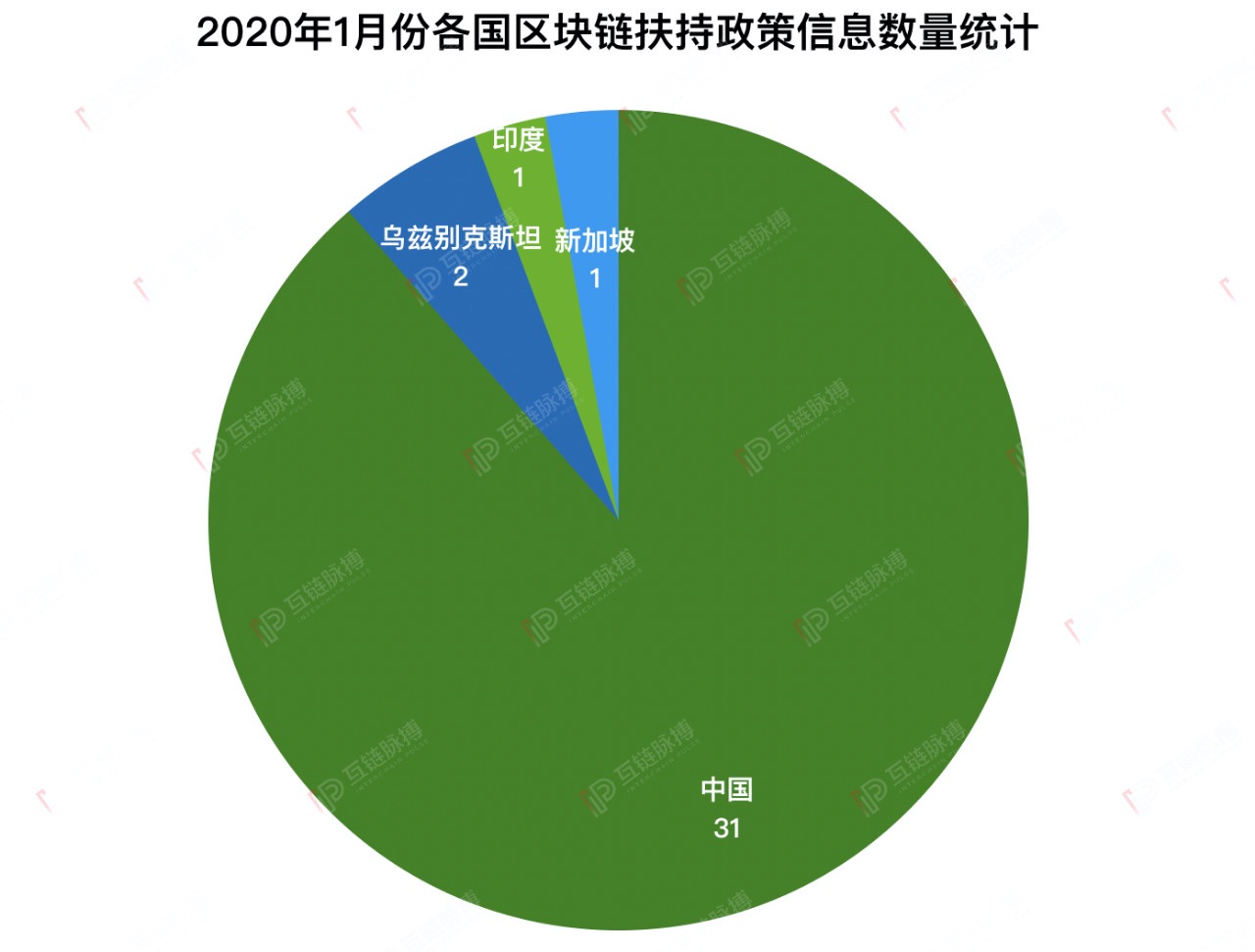

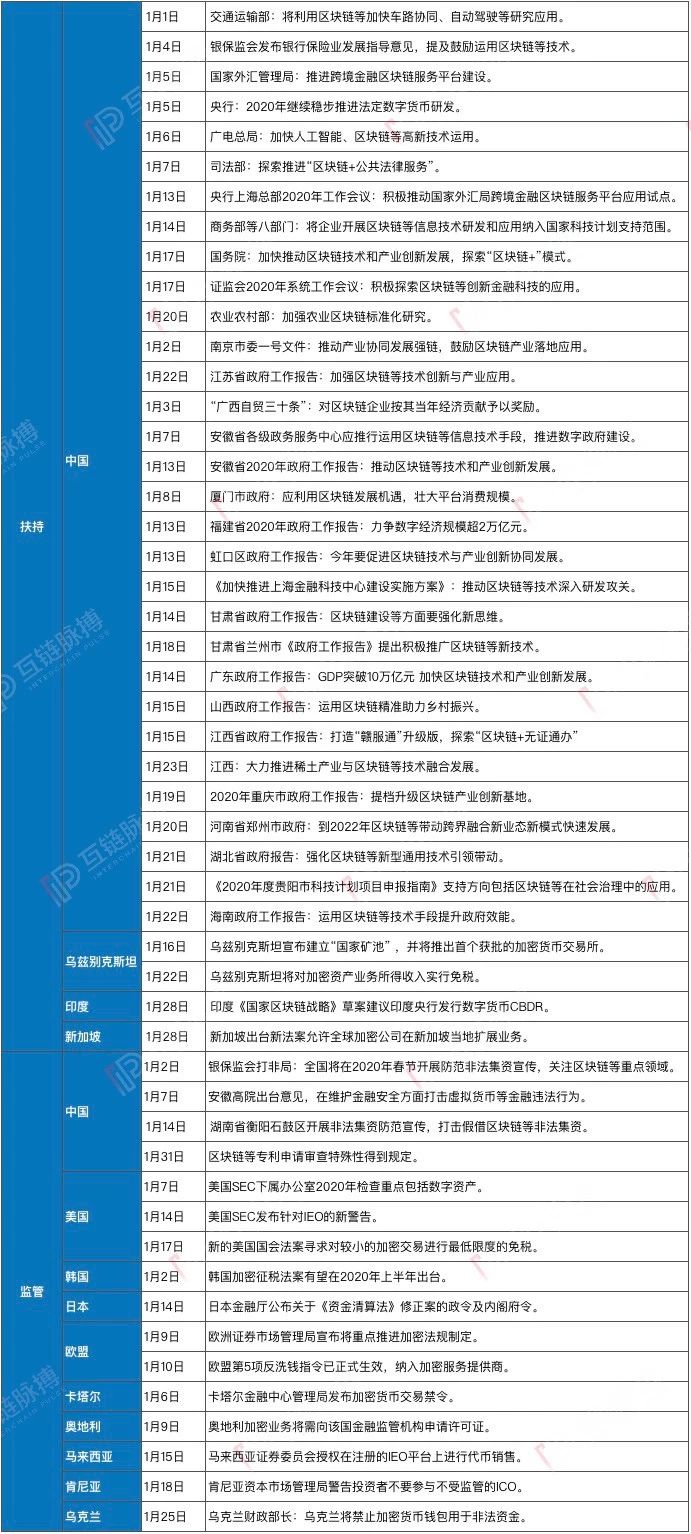

Starting in 2020, there will be more obvious differences in domestic and foreign blockchain policies. Interlink pulse statistics. In January, the number of domestic policy information was as high as 35, and the focus was on support; while foreign policy information was 16 in total, focusing on supervision.

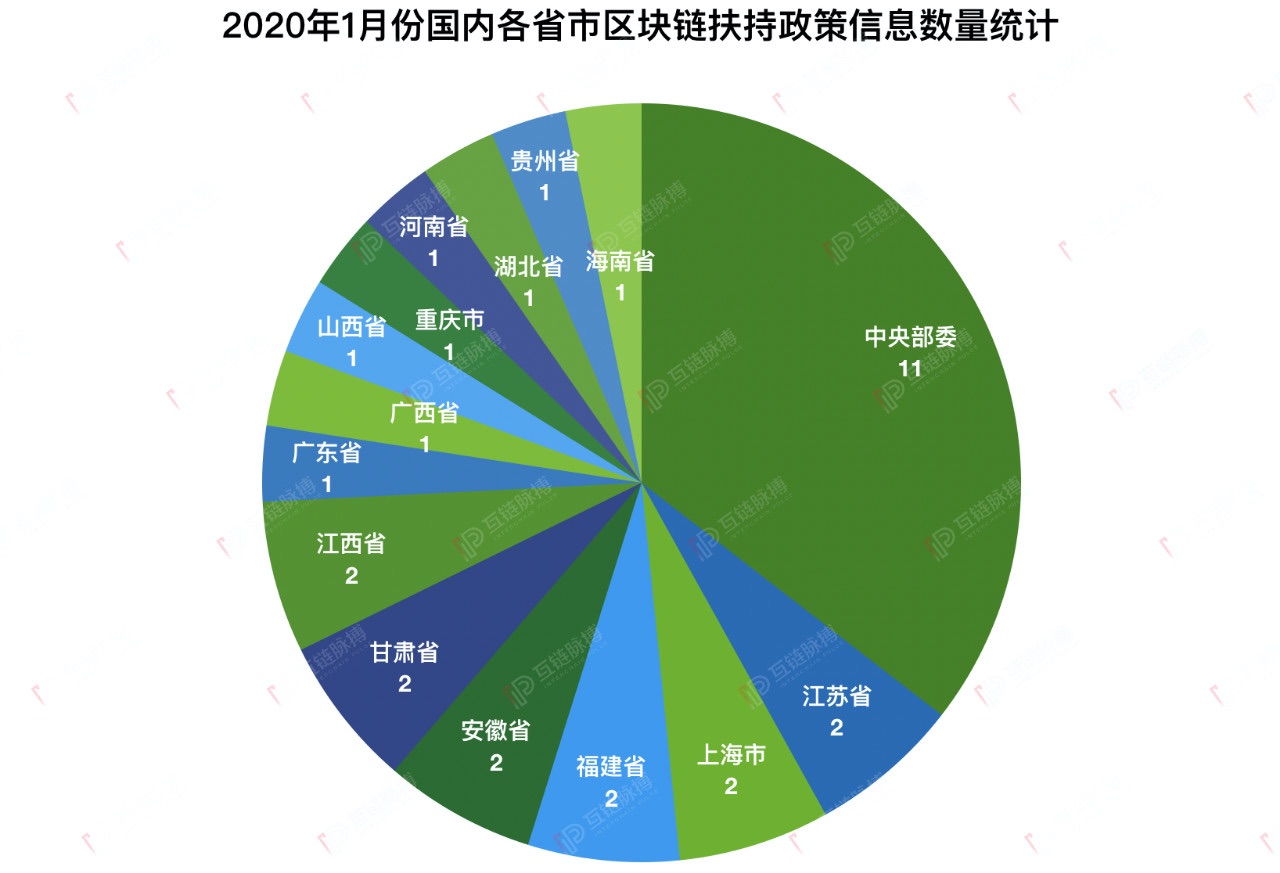

At the same time, the mutual chain pulse observed that in January the domestic central ministries and commissions and various provincial and municipal governments were actively deploying the blockchain field.

On the one hand, the central bank, the Ministry of Transport, the State Administration of Foreign Exchange, the State Administration of Radio, Film and Television, and the Ministry of Justice and other departments announced 11 policy information to promote the integration of blockchain with various fields; Provinces, cities, and districts proposed strengthening the application and development of blockchain in the 2020 government work report.

- Venezuela's digital currency "experimental" encounters difficulties

- US Marshal's Bitcoin Auction: Tim Draper's Digital Kingdom

- Global assets under the "epidemic": BTC rose over 12% to become the best in the world

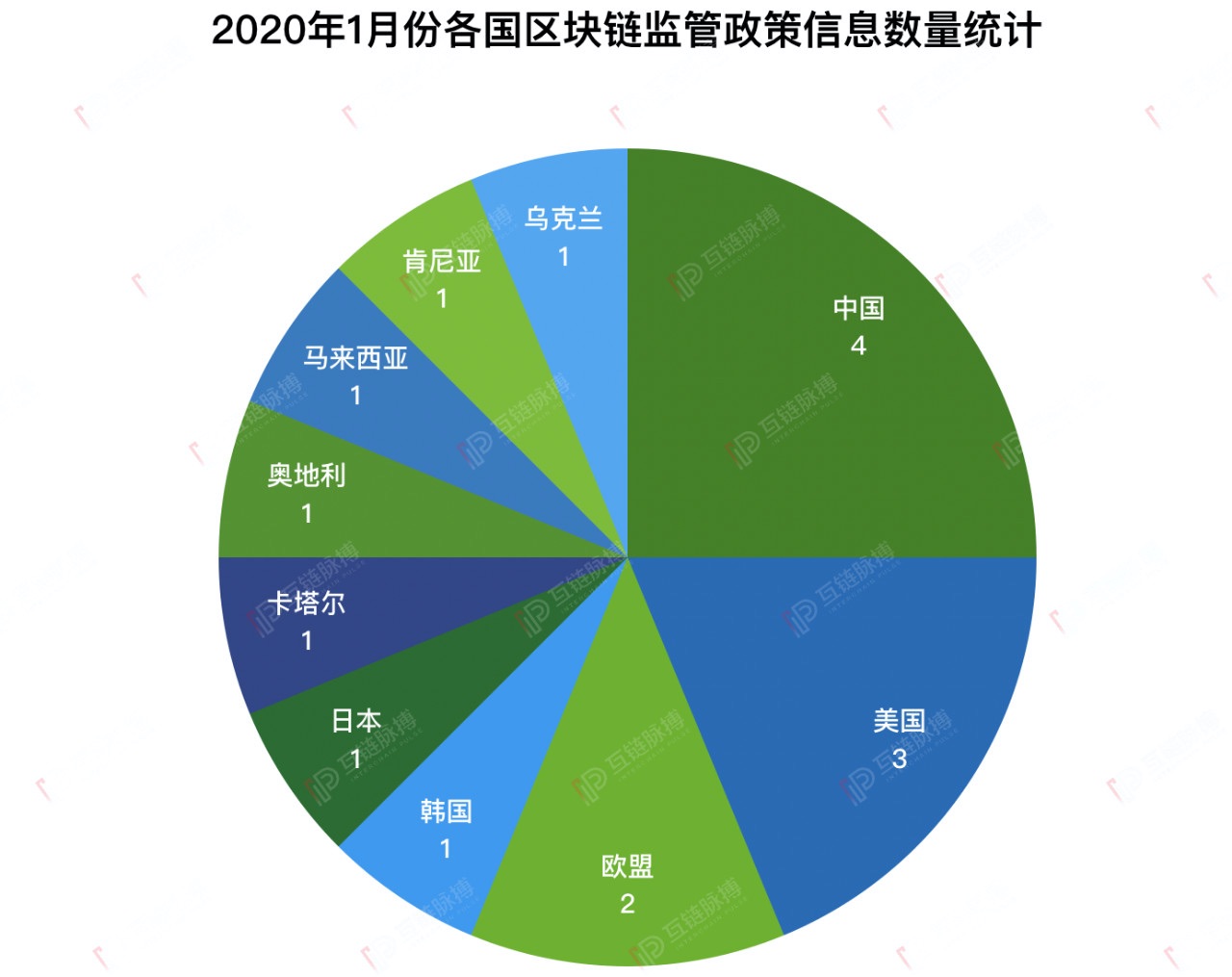

The foreign policy information is mainly based on the US SEC's supervision of digital assets and the EU's supervision of crypto service providers. In addition, it was also in January that Uzbekistan and Singapore implemented more open policies on the blockchain field.

Domestic Blockchain Policy Released in January: Work Reports in 12 Provinces mention the development of blockchain

According to public information statistics, in January 2020, a total of 35 blockchain policy information was announced in China, of which 31 were around blockchain support, and only 4 were related to blockchain regulation. According to monthly statistics, the amount of domestic blockchain policy information has continued the momentum of November and December 2019, and remains at a high level. Compared with December, the amount of domestic blockchain support policy information has surged and regulatory policies have increased. The amount of information has declined.

(Drawing: Interlink Pulse Academy)

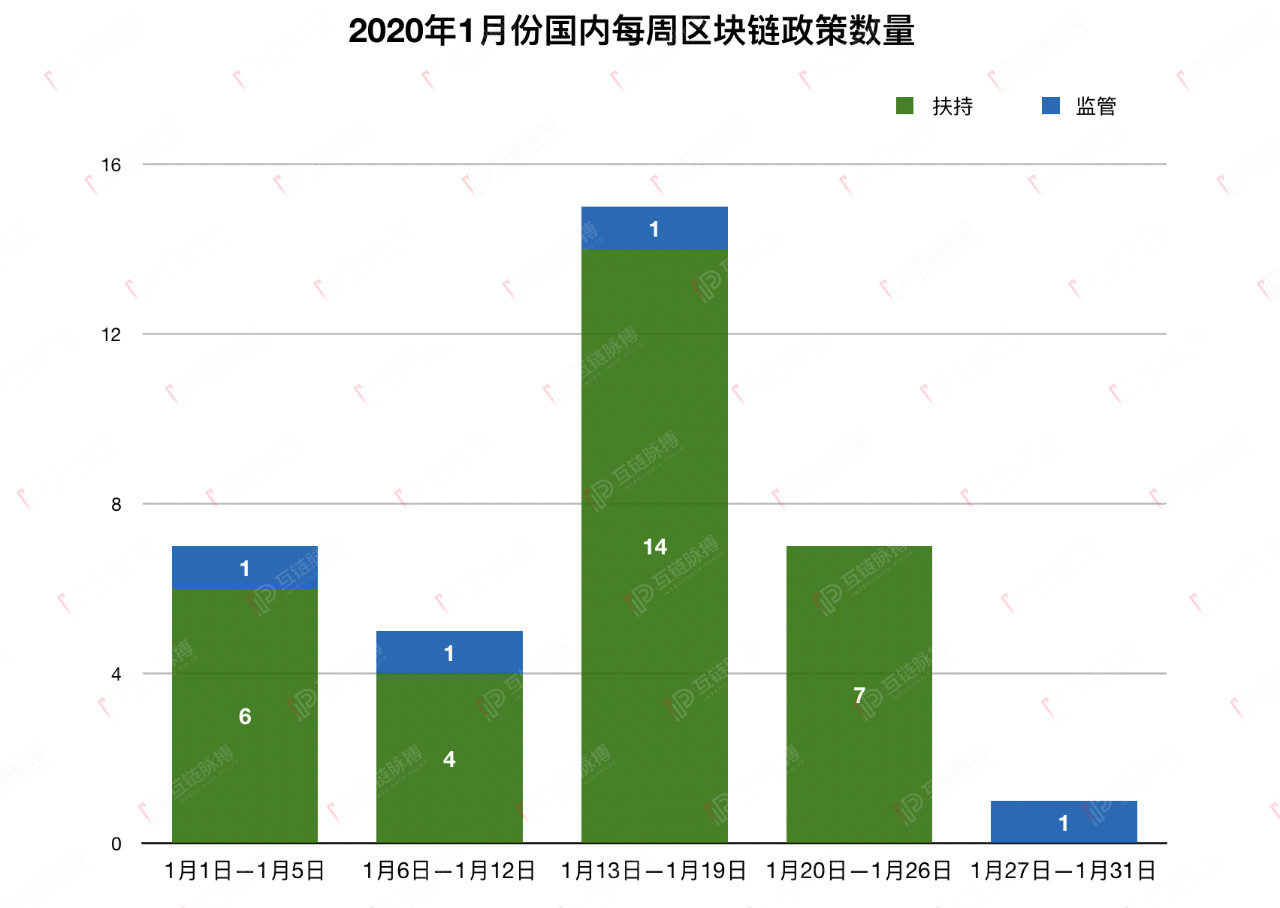

And if you further observe the amount of weekly blockchain policy information in January, it can be seen that the announcement of support policy information is relatively concentrated during the period from January 13 to 19, especially on the 13th. Many provinces and cities mentioned in the government work report Information on the development of blockchain is released in a centralized manner.

According to the statistics of the inter-chain pulse, in January, there were 12 provinces, cities, and districts in China including Guangdong Province, Lanzhou City, Gansu Province, and Hongkou District of Shanghai. In the 2020 government work report and conference report, it was proposed to strengthen the blockchain. Application and development. Among them, Shanxi Province has proposed in the government work report to use the blockchain to precisely assist rural revitalization; Jiangxi Province has proposed in the government work report to build an upgraded version of "Ganfutong" and explore the "blockchain + certificateless office" "Chongqing City mentioned in the government work report that upgrading the blockchain industry innovation base and other aspects combined with practical application areas.

(Drawing: Interlink Pulse Academy)

In addition, 11 domestic support policy information was released by the central ministries and commissions in January. The central bank, the Ministry of Transport, the State Administration of Foreign Exchange, the State Administration of Radio, Film and Television, the Ministry of Justice, and the Ministry of Agriculture and Rural Affairs have each proposed the use of blockchain technology to accelerate Application and development in various fields. The General Office of the State Council also stated in the "Guiding Opinions on Supporting Deepening Reform and Innovation in National New Districts and Accelerating the Promotion of High-Quality Development" issued on January 17 to accelerate the promotion of blockchain technology and industrial innovation and explore the "blockchain + "Model to promote the deep integration of blockchain and the real economy.

(Drawing: Interlink Pulse Academy)

In addition to the policy information for the development of the blockchain proposed by the central ministries and commissions and provinces and cities in the work report, the provinces and cities that mentioned the blockchain in the newly released policy in January include Nanjing, Jiangsu, Guangxi, Anhui, and Fujian. Xiamen City, Shanghai Province, Zhengzhou City, Henan Province, and Guiyang City, Guizhou Province. Among them, Nanjing City, Jiangsu Province, and Guangxi Province policy documents specifically mention the direction of the blockchain.

At the beginning of January, Nanjing issued the No. 1 document of the Municipal Committee of 2020 "Several Policies and Measures on Further Deepening the Construction of Innovative Famous Cities and Accelerating the Enhancement of Industrial Basic Capabilities and the Level of the Industrial Chain". The document states: Promote the collaborative development of strong chains in the industry, encourage the application of blockchain in the industry, support leading enterprises to build alliance chains, and promote the industry to climb to the mid-to-high end of the value chain.

Also at the beginning of the month, the "Thirty Articles of Guangxi Free Trade" was released, which mentioned that blockchain companies were rewarded according to their local economic contributions in that year, and the free trade pilot zone became an important base for new economic development in Guangxi.

In addition, mutual chain pulse observations, domestic regulatory policy information is still centered on preventing illegal fundraising and cracking down on virtual currency financial violations.

January foreign blockchain policy: U.S., EU heavily regulated Uzbekistan, Singapore more open

According to incomplete statistics of the interchain pulse, in January there were 12 pieces of information on foreign blockchain regulatory policies, of which the United States still accounted for a large proportion.

The US regulatory policy information is still mainly focused on the US Securities and Exchange Commission's (SEC) supervision of digital assets. On January 7, the SEC compliance inspection office announced the focus of inspections in 2020, including digital assets. It is reported that the office will continue to identify and inspect SEC registered companies working in the field of digital assets, as well as registered investment consultants that provide services to customers through automatic investment tools and platforms. On the 14th, the SEC issued a new warning against IEO. According to the notice, over the past few years, some of these IEOs have been investigated by the SEC as unregistered securities offerings. The SEC says that although IEO providers may claim that their sales are different from ICOs, they may still violate federal securities laws.

In addition, on January 16, the Washington, DC-based crypto advocacy group, Coin Center, issued the 2020 Virtual Currency Tax Equity Act. The goal of the bill is to exempt the cryptocurrency transaction if the calculated related gain is less than $ 200. If approved, the bill will cover transactions occurring after December 31, 2019.

(Drawing: Interlink Pulse Academy)

On the other side, the EU also announced two pieces of regulatory policy information in January. The fifth anti-money laundering directive issued by the European Union in April 2019 took effect on January 10 this year. 5AMLD for the first time expanded its scope of supervision by including crypto service providers such as virtual currency-fiat exchanges or escrow wallet providers. Cryptocurrency companies in Europe are working to meet the new regulatory guidelines proposed by 5AMLD. But as new laws require extensive knowledge of their customers and anti-money laundering procedures, many businesses are closing.

On January 9, the European Securities Market Authority announced that it will focus on promoting data security in the financial industry, especially for crypto assets. In the "Strategic Direction 2020-2022", the European Securities Market Authority revealed its plan to introduce the legal Finance Magnates framework for digital currencies.

At the same time, it is worth noting the Japanese and Malaysian sides.

On January 14th, the Financial Services Agency of Japan announced a government decree and a cabinet decree on the amendments to the "Clearance Algorithm". The system of virtual currencies is at the core of this revision. Reorganized relevant rules and regulations such as the prior application of registration of the "crypto asset exchange", and lowered the transaction threshold that needs to be confirmed when trading.

The Malaysian Securities Commission announced on January 15 detailed guidelines for the digital asset industry, stipulating the sale of tokens on the IEO platform. In addition to the compulsory issuance of token sales on the IEO platform, regulators have also set a cap on the maximum funds they can raise.

In addition, the Qatar Financial Centre Authority issued a ban on cryptocurrency transactions; Austria's crypto business will need to apply for a license from the country's financial regulator; the Kenyan Capital Markets Authority warns investors not to participate in unregulated ICOs.

(Drawing: Interlink Pulse Academy)

In terms of support policies, there are only 4 information on blockchain support policies abroad this month. The country that focuses on support is Uzbekistan. In January, Uzbekistan announced the establishment of a "national mining pool" and launched the first approved cryptocurrency exchange. In addition, Uzbekistan is prepared to waive taxes on income derived from cryptocurrency operations.

At the end of January, the National Intelligent Governance Institute, a non-profit public institution registered by the Indian government, submitted the National Blockchain Strategy. The draft states that it is necessary to clearly distinguish between different types of blockchain systems. At the same time, it is recommended that the Indian government and the Reserve Bank of India issue a central bank digital INR (CBDR) and support decentralized applications.

Singapore, at the end of the month, introduced new payment legislation that provides global cryptocurrency companies with an opportunity to expand their business in the country by applying for an operating license for the first time. It is reported that the "Payment Services Act" is the first comprehensive regulation for companies engaged in activities ranging from digital payments to token transactions such as Bitcoin and Ethereum.

Interchain Pulse Blockchain Policy Statistics in January 2020:

This article is the original [Interlink Pulse], please indicate the source when reprinted!

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Conjectures about digital wallets and central bank digital currencies

- Was arrested for false evidence? Auburn's farce is added

- Ethereum 2.0 audit report announced next week, giving green light to multi-client testnet

- Analysis of CBDC's international R & D dynamics (II): Thailand and Hong Kong join hands to open up the "second pulse of Rendu"

- Defi's Reasonable Logic and Aging Status

- "Determinism" and "uncertainty" on the eve of Bitcoin's cuts, how should miners and investors respond?

- Year-to-date soaring 47%, will ETH become the dark horse this year?