Cycle observation | New cycle? Four possibilities for Bitcoin's future

History is always strikingly similar.

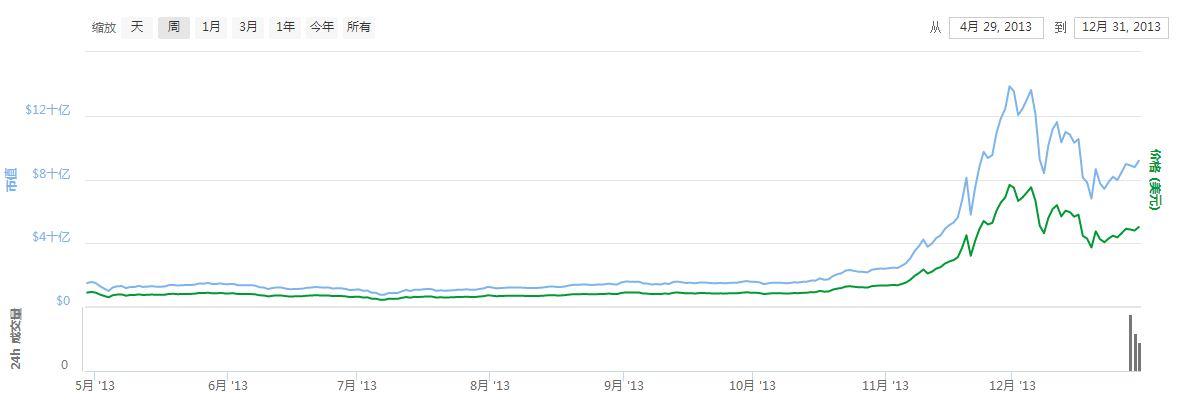

This year's bitcoin market has a certain negative correlation with the global macro economy , like the bitcoin in 2013. At that time, Bitcoin entered the public eye and ushered in the first big bull market.

- Research | Data Compliance, Reptile Technology Interprets Legal Issues

- Swiss FINMA issued a guide to the stable currency, proposing Libra to obtain the necessary conditions for payment of the license

- Close the back door of the transaction, Zcash is the biggest defect or is solved due to this program

So, will this year’s bitcoin market be repeated again in 2013?

In order to answer this question, we will start from the key factors of the macro economy and make predictions about the future changes in the global macro economy , in order to derive the investment preferences of the funds and OTC funds, and where the future Bitcoin will go.

Key factors in the global macro economy: the dollar economy

As the world hegemon, the US’s dominant dollar hegemony is the key to affecting the global macro economy. It can be said that the changes in the global macro economy are largely based on changes in the dollar. We assume that Bitcoin is still highly correlated with the US dollar economy in the future, so the Fed, which dominates the US dollar economy, determines the direction of the US dollar economy.

The Fed, an institution that claims to be independent, is the main gateway to the dollar supply, and is facing three major problems:

Monetary policy tool is invalid

The main currency instruments of the central bank of the Federal Reserve and other advanced economies are adjusting interest rates and buying and selling financial assets .

When the financial crisis occurred in 2000 and 2008, the Fed’s interest rate was 5% to 6%, and there was a certain interest rate cut to stimulate the economic recovery. However, since the interest rate cut was resumed in July this year, the current interest rate is only 2.25%, and there is not much room for interest rate cuts. This makes the stimulus and improvement of the economy weaker regardless of the magnitude and speed of interest rate reduction in the future.

Other developed economies, such as Europe and Japan, have long been at zero interest rates or near zero interest rates, and have basically lost room to regulate interest rates.

Lack of economic growth

This refers to the lack of growth expected in the future. Since the 2008 financial crisis, the only economies that are still growing are China and the United States, but behind the growth of GDP data, they are the faster-growing debts of the two countries.

As far as the United States is concerned, the main responsibility for the debt is the US government. In addition, the trade friction between China and the United States is heating up, and the market is pessimistic about the future economic growth of the United States.

This also makes the volatility of the US stock market rise, and the yield of US bonds is upside down. Market funds are more willing to buy long-term, safer US Treasury bonds.

In other words, the market has no confidence in the US economy in the current and future short-term cycles.

Inflation continues to slump

In an economy, inflation is directly related to employment. According to the Phillips curve, when employment is sufficient, inflation will rise and inflation will fall when the unemployment rate rises. In order to smooth the impact of economic fluctuations on society and put the economy in a stable upward state, the central bank generally controls inflation to a stable level.

Therefore, when the economy is overheated, inflation will rise, the central bank will consider raising interest rates to reduce economic growth, and when the economy is cold, inflation will fall, and the central bank will consider cutting interest rates to stimulate economic development.

But there are exceptions, such as the high unemployment and high inflation in the United States in the 1970s, and the low inflation and low unemployment in the 1990s and the past four years. This seems to be a good sign of the booming US economy.

But in fact, the current low inflation sentiment to the market is more pessimistic and sense of crisis. The reason may be that the truly increasing number of unemployed people have not been included in the statistics (unemployment for more than four weeks, and not actively looking for work is not counted in the number of unemployed.) , followed by the slow growth of labor income for most people, the gap between rich and poor Big.

These do not pose serious economic problems, but they are likely to bring political problems.

In short, from the data point of view, the Fed seems to have done a good job of its own performance, that is, to maintain the balance between economic growth, inflation and unemployment. Recently, whether Chairman Powell or the internal report, there are frequent words such as “the strongest economic expansion in history” and “creating the historical job market” .

But the Fed’s actions show us more:

"We have tried our best, and we can't complete these tasks without relying on monetary policy."

Four possibilities for the future

In order to properly solve the above problems, we can observe the four situations that will occur in the future by observing the public information of the central banks, governments, and parties of developed countries, and analyze the impact of several possibilities on the price of bitcoin: To the small instructions)

1. New helicopters throw money"

The concept of "helicopter money" was emphasized by former Federal Reserve Chairman Ben Bernanke in previous years. This policy refers to the state central bank directly issuing money to households or consumers in the form of tax rebates or other names, stimulating consumption, reducing unemployment rate, and overcoming deflation . The Fed’s several quantitative easings have also come from this in the past few years.

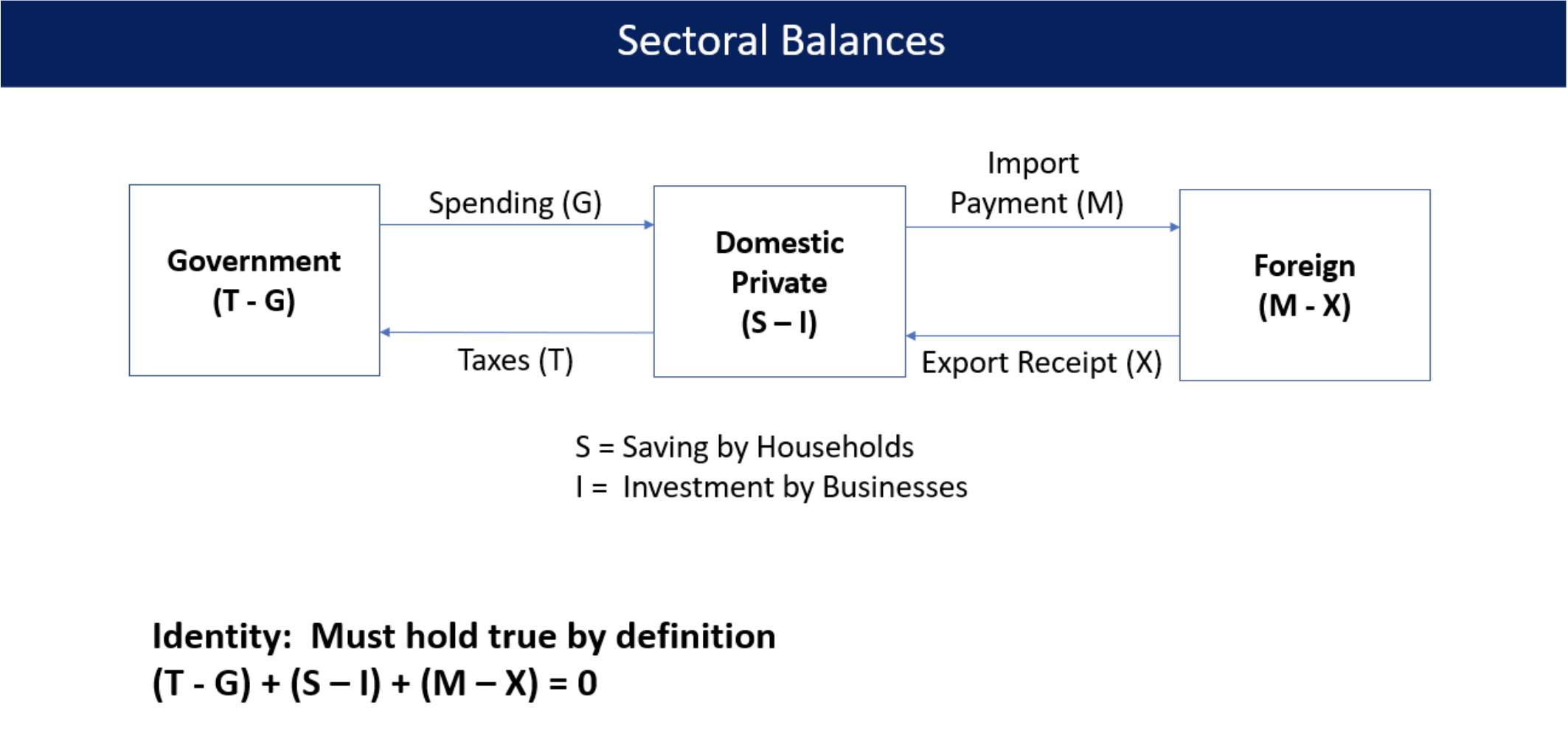

The "new helicopter sprinkling money" (that is, the "MMT-modern currency theory" that was hotly debated in the first half of the 19th year) went further. In short, the idea is that the government's income is the company's expenditure, and the government's expenditure is the company's income.

Therefore, when the central bank cannot rely on monetary policy to achieve its goals, it must rely on and obey fiscal policy. In times of economic recession, the central bank needs to adopt a more radical fiscal policy to force, such as reducing interest rates directly to zero, increasing the deficit and creating more job security.

This is different from the previous central bank purchasing assets in the secondary market . MMT requires the central bank to complete the operation directly in the table. Because the past "spending money" only concentrated the funds to large monopoly technology companies, this also brought new problems. This part, we will discuss in detail in the next section. (Note: Regarding MMT, overseas academics, finance, politics, and technology circles have detailed discussions and discussions. The academic community can refer to Wray's Modern Money Theory (Chinese version of the book has been published, translated as "Modern Monetary Theory"), Finance The community can refer to "Helicopter Money: Or How I Stopped Worrying and Love Fiscal – Monetary Cooperation" by McCulley and Pozsar (the domestic translation of the article into the "Reinterpretation of Minsky" by the Zhibao team), the domestic popular discussion and Explain that there are two articles on "Modern Monetary Theory Is Heresy" or "Modern Monetary Theory: Antidote or Poison".)

There is a lot of discussion in the above literature about whether MMT is correct and its advantages and disadvantages, and we will not make judgment here.

What we need to pay attention to is, what actions will the Fed take if it takes measures that favor MMT?

At present, we expect to observe two points: the rate of interest decline and the speed at which new government bonds are issued.

The former is specifically expressed as whether the Fed will comply with the pressure from the president and implement the market-reduced interest rate cut. The latter can be either an increase in the amount of new government bonds or a listing of new varieties of government bonds, such as the 50-year period similar to that of European countries. Super long-term national debts such as 100 years.

2. Rebalance within the United States

The imbalance within the United States is mainly reflected in large technology groups. They earned too much money but did not assume the corresponding obligations.

The data shows that before Trump's tax cuts (ie 2007 to 2015) , the average tax rate of the S&P 500 companies was 27%, while the tax rates of the four major technology companies: 17% for Apple, 16% for Google, and 13 for Amazon. %, Facebook is 4%.

If you compare peers, Amazon has paid a total of 1.4 billion US dollars in income tax since 2008, while Amazon's subversive rival Wal-Mart has paid $64 billion.

According to statistics, half of the surpluses of US technology companies and multinational corporations that have avoided taxation for more than a decade have been used for commercial expansion, such as R&D expenditures, acquisitions, etc., which are supported by the government.

The remaining money is used in the market capitalization of the capital market and capital arbitrage, which is embodied in a complex set of financial magic, the steps are as follows:

1. Multinational companies have obtained overseas tax-free cash through operations;

2. Because the balance sheet is in good condition, the company issued low-interest financial bonds in the United States;

3. After the bond is issued, the company obtained on-the-spot cash in China;

4. The company divides this part of the US dollar cash, or buys back the stock, the stock price of the dollar-denominated price rises, the salary of the executive is linked to the stock price, and the tens of millions of dollars are paid;

5. The overseas tax-free cash has not moved. The company chooses to invest in other countries' national debts to obtain spreads.

The entire process benefits the company's shareholders, company executives, and financial intermediaries involved in the process. In addition to government taxation, there are also ordinary employees of the company. They have neither stocks nor the income from rising stock prices. The wage income will also decrease. Because shareholders increase their stock prices and increase their stock prices, they will definitely reduce their wages. expenditure.

The interests of SMEs will also suffer, because they can only attract people to buy by issuing higher interest bonds.

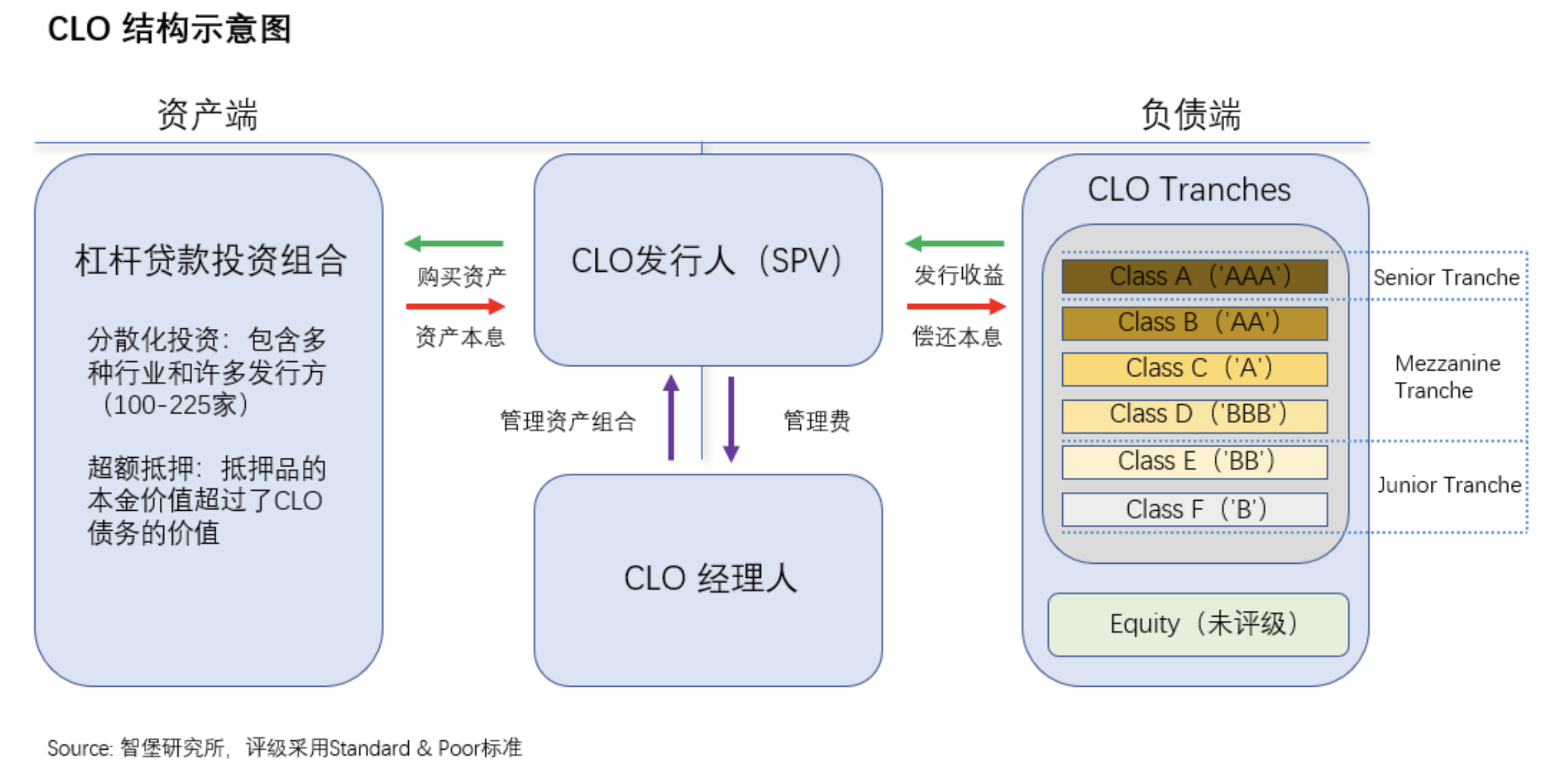

Despite the smooth financing of SMEs, Wall Street has developed a new tool, CLO, a financing tool similar to the 2008 financial crisis CDO, which bundles SME bonds and bonds from these high-tech companies.

Of course, the current risk of CLO will not be immediately exposed. On the one hand, CLO's main new buyers are Japanese banks and asset management companies, which are not enough to impact the US banking system. On the other hand, as the Fed cuts interest rates, the future can rely on Redeem the new and old.

But overall, the competitiveness of SMEs has been affected. To this end, Republicans and radical Democrats are considering anti-monopoly to suppress and split large-scale technology companies.

Traditionally, large Silicon Valley technology companies and multinational corporations are the basics and gold masters of the Democratic Party. Therefore, Republicans are politically willing to earn protection fees from technology companies and benefit from subsidies to manufacturing and energy companies. So whether it’s the hot-skinned Facebook privacy issue in the past two years, or Peter Til (the first Silicon Valley-backed Trump-sponsored investor) publicly declared Google’s treason, Trump aimed at the semiconductor industry chain to launch Sino-US trade frictions. They are all the vane to suppress large technology companies .

On the other hand, since the Democratic Party’s 16-year general election, the two houses and the Supreme Court have retreated all over the country. In order to regain political power, some of the internal radical forces have begun to act and have achieved results, thus gradually upgrading.

Such incidents have occurred in the Republican Party, the "Tea Party", a radical group that was launched during the Democratic Party in 2009, and finally joined forces with Trump in 2016 to help the Republican Party re-elect.

The current radical influence of the Democratic Party is called " Justice Democrats/JD" . The representative figures are Sanders and Warren, and the living force is "Net Red" Alexandria Ocasio-Cortez ( AAC ) . Sanders focuses on collecting heavy taxes on the rich and big companies; Warren advocates breaking up the technology giants in the name of anti-monopoly. To this end, Warren wrote an article on "How to split a large technology company" on the medium ("Here's how we can break up Big Tech" https://medium.com/@teamwarren/heres-how-we-can- Break-up-big-tech-9ad9e0da324c)

3. Transfer of international expenditure obligations

To discuss this topic, we need to understand two concepts: the Triffin puzzle and the current account.

Triffin's problem: If the US dollar is the international core currency, because of trade and settlement, the US dollar must be circulated a lot abroad, so the US will remain in a deficit for a long time. Current account: One of the balance sheets of each country reflects the data of a country's import and export of goods and services.

Therefore, the combination of the two can be thought of, the US current account should be in a long-term deficit, and so is the fact.

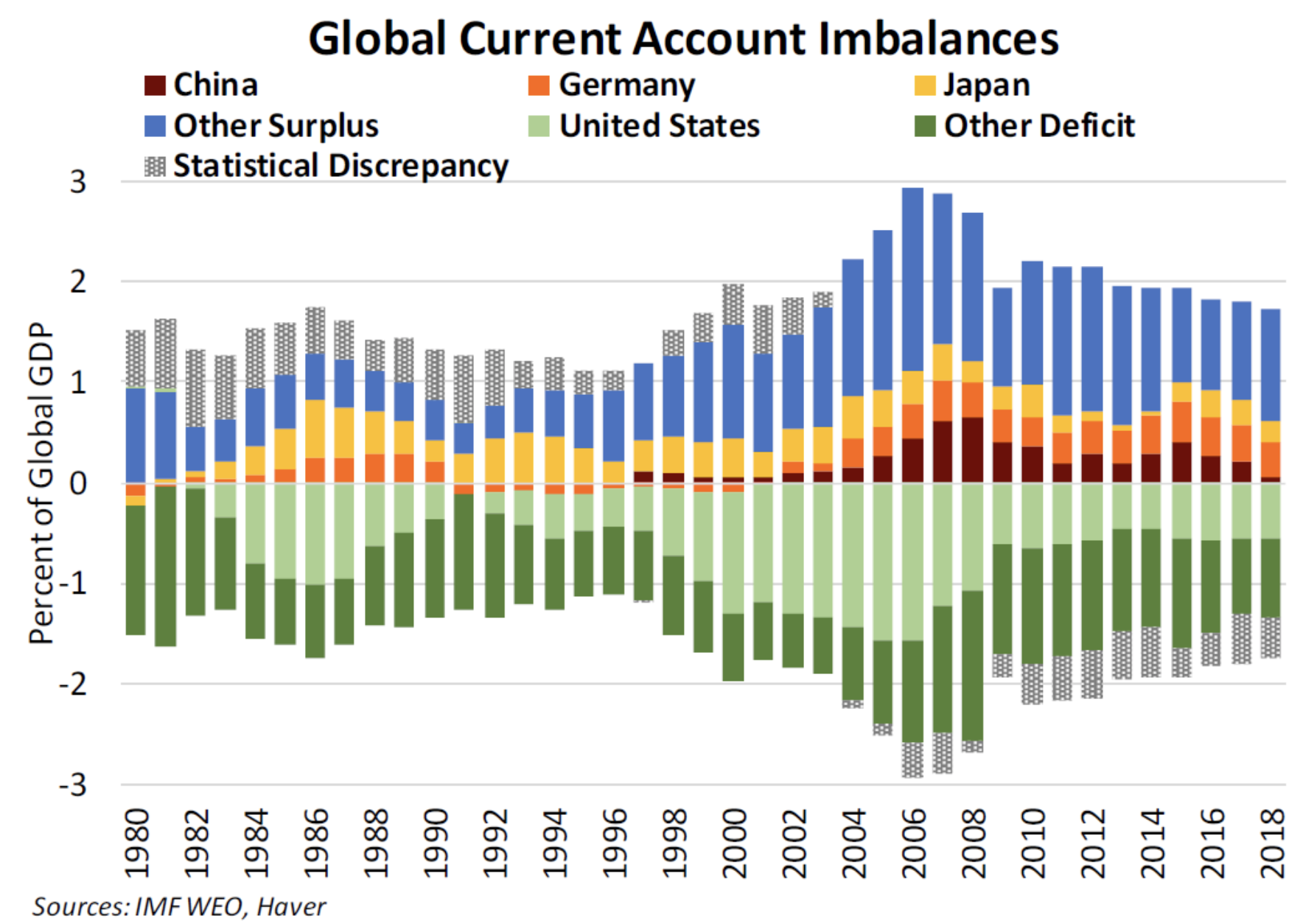

Which countries in the world are in the surplus and what are the US deficits? Please see the picture below:

From the figure, we can see that China, Germany, Japan, and some European developed countries have been in a surplus for a long time. Except for the United States, the remaining countries with deficits include Middle Eastern oil countries and emerging market countries.

Trump hopes that the US manufacturing industry will return and hopes that the United States will reduce its trade deficit , which means that China, Germany and Japan will need to take more responsibility for imports and expenditures in the future.

Japan hopes to be the smallest, because the national government has a huge debt, which is more than twice the national GDP; China’s central government debt is very low and it is gradually implementing the Belt and Road strategy and opening up to the outside world, but this process will not be very fast because of local debt. And the future invisible debts such as pension and medical insurance are very stressful.

The biggest hope lies in Germany and some developed European countries.

Relevant signs can also be found by observing public policies in European countries:

1. The EU will set up a “European Future Fund” with a scale of 100 billion yuan, and focus on investing in “European enterprises with strategic importance industries” in the form of equity.

2. The possibility of a hard Brexit in the UK is gradually increasing. At the same time, Germany’s economic data continues to be sluggish this year. It is necessary to reverse expectations through fiscal stimulus and to unite more closely with the European countries;

3. In early 2019, the German Minister of Economy launched a National Industrial Strategy 2030 plan named “Economic Nationalism” by the media. The content is roughly to allow the government to buy stocks, to support industries with significant economic significance, and to formulate German companies. For "national leading enterprises" and so on.

However, the above assumption of the transfer of international expenditure obligations is not your wish, and will not be completed soon, because it has shaken the absolute dominance of the US dollar in the world, and there will be a large number of games in the future.

4, the above assumptions are all invalid

The failure of the three major assumptions means that the Fed continues to maintain "independence" and hesitates to cut interest rates and cooperate with the Ministry of Finance; the two parties in the United States continue to carry out infighting rather than implementing policies, whether it is the Republican Party’s larger tax cuts. The anti-monopoly of the Democratic Party; the shift in international spending obligations was blocked, and the EU moved slowly. The results are expected to be in two directions: the increase in geopolitical conflicts and the recurrence of financial crises. If it is similar to the 2008 financial crisis, the US debt will be sought after again.

What effect will it have on cryptocurrency?

What happens to the price of Bitcoin and other cryptocurrencies when these four conditions occur and advance? One thing to note is that the above ideas are not mutually exclusive, they may progress at the same time, or they may alternate.

We believe that the future market has the following possibilities:

How do you think? Feel free to share your opinion in the comments section below.

Source: X-Order

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- What kind of consensus algorithm do we need?

- Liang Xinjun: In the next fifteen years, blockchain restructures social production relations

- Encrypted synthetic assets DIY era is coming, UMA brings DeFi new explosion point?

- It’s better to chase the wind than to create the wind – to pay tribute to the participants in the Ant Blockchain Innovation Competition

- Babbitt Column | Cai Kailong: Is Bitcoin a safe haven asset?

- Babbitt column | "Privacy-transparency" binary paradox is broken, blockchain positioning faces crossroads

- EOS daily support appears, but it also needs to pay attention to the market dynamics