The world's most "calculating" companies are vying to lay out the blockchain, the transformation of the four major accounting firms such as PricewaterhouseCoopers.

On August 19 this year, Deloitte, one of the Big Four accounting firms, launched a blockchain platform that was mainly used for demonstrations. In addition to Deloitte, the other three accounting firms, PricewaterhouseCoopers, Ernst & Young and KPMG, have made a lot of layouts in the blockchain.

The Big Four accounting firms are the “ultimate” career dreams of many graduates in finance and economics. Now, the layout of the blockchain of the Big Four accounting firms will give these graduates a "fatal blow". Will blockchain technology lead to a gradual streamlining of accounting work, and the final one-click completion?

Today, let's take a look at "blockchain + accounting / auditing" and the layout of the big four accounting firms in the blockchain.

01

- Technical Teaching | Solidity Programming Language: Address

- Proof of validity and proof of error in Science-2 |

- Economist Ba Shusong: The Application Value of Blockchain Technology in the Financial Field

Hundreds of billions of dollars in the market

No matter which industry, whether the size of the company is large or small, accounting personnel are an indispensable part. Most of the work of accounting staff is bookkeeping, accounting, accounting, settlement, tax filing, etc. Although simple but particularly cumbersome, it is very time consuming and labor intensive.

If the company is large enough or has already been listed, it needs to conduct regular audits of trusted third parties and timely disclose the company's financial status to regulators and investors through audit reports. Just for the financial audit of large companies, the global amount of money is hundreds of billions of dollars per year.

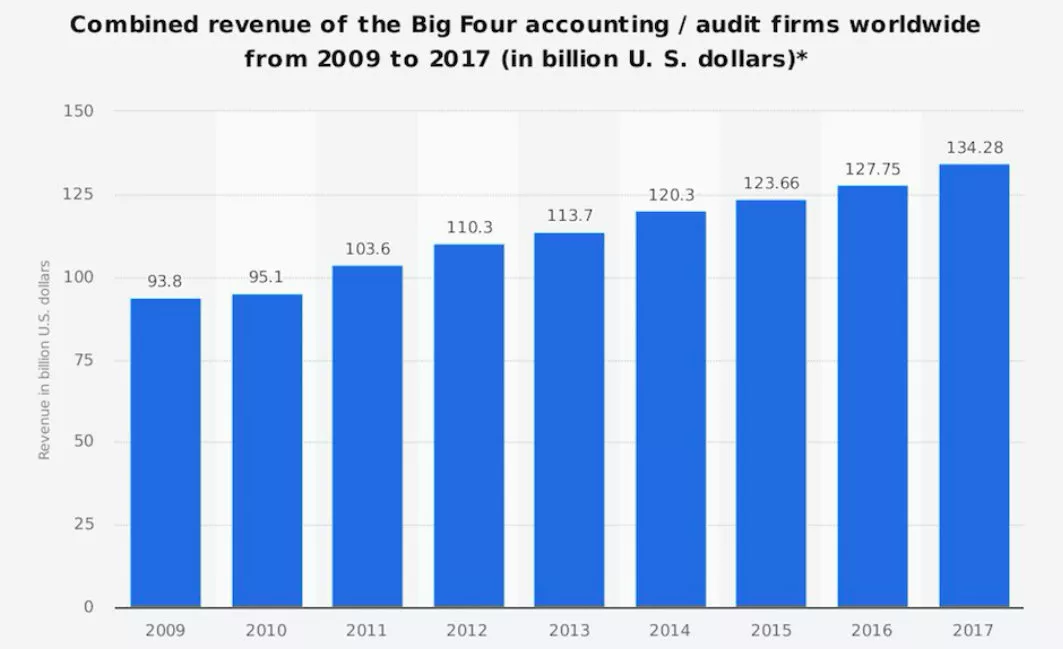

With the rapid development of the global economy in recent years, the demand for third-party auditing has increased, and the revenues of the four major accounting firms that dominate the audit market have also increased. In 2009, the total revenue of the Big Four accounting firms was only $93.8 billion. The total revenue in 2017 was $134.28 billion. Last year, it exceeded $148 billion, an increase of 57.8% in ten years.

Total revenue of the Big Four accounting firms in 2009-2017 Source: statista

The essence of the blockchain is a “distributed ledger” , and the term “book” is naturally associated with accounting. So, what kind of sparks will blockchain technology and accounting and auditing collide?

02

Blockchain + accounting, auditing

Blockchain technology is hailed as one of the key technologies that can trigger the fifth technological revolution, and all industries are accelerating the use of blockchain technology. The integration of blockchain with accounting and auditing is the current trend, and it is very likely to bring subversive changes to the traditional accounting and auditing modes of operation.

The advantage of blockchain technology is that book sharing, open-chain data is transparent, everyone can be verified, and it is not easy to tamper with. Accounting and auditing take advantage of these advantages of blockchain technology.

Let us explain it with a simple example.

Xiaohei is an employee of a company and travels frequently. In the past, when I came back for reimbursement on a business trip, Xiaohe had to sort out and put a lot of paper invoices for reimbursement, which was very time-consuming and laborious. The company’s financial staff got the reimbursement materials of Xiaohe every time, with a careful and rigorous spirit. First verify that these invoices are true and effective. The date above matches the travel schedule of Xiaohei. Finally, the calculator should be used to accumulate the amount on all invoices to ensure that the reimbursement amount is correct.

Later, there were electronic invoices issued by the national unified code, unified anti-counterfeiting, and unified release by the tax bureau. With electronic invoices, Xiaohe tries to use electronic invoices every time he travels. When he returns to the company for reimbursement, he can upload it in the form of an attachment, which saves the trouble of sorting invoices and invoices in the past; the financial staff is also verifying the invoices. Pseudo, tax returns and other aspects save a lot of time.

On August 10 last year, Shenzhen Taxation Bureau and Tencent Company successfully opened the first blockchain electronic invoice in China . Compared with the previous electronic invoices, blockchain electronic invoices have the characteristics of complete traceability of the whole process and irreversible information. The source, invoice, and account information of the invoice can be queried by one click, and the one-digit over-report and false-reporting are solved. The traditional invoices, such as offsets, true and false, and other invoices, can also effectively reduce costs, streamline processes, and ensure data security and privacy. This is of great benefit to merchants, consumers, and regulators.

On August 18 this year, Shenzhen was once again entrusted with a heavy responsibility and received strong support from the state in “developing innovative applications such as digital currency research and mobile payment”.

Since then, Xiaohe especially likes to go to Shenzhen for a business trip. In Shenzhen, even if it is small enough to travel daily, you can use the WeChat to pay for the subway ticket, you can issue blockchain electronic invoice.

In Shenzhen, you can use the WeChat payment for the subway ticket to issue a blockchain electronic invoice . Source: www.hellobtc.com

Blockchain technology not only brings great convenience to the company's accounting, but also has many benefits for third-party auditing.

"China Auditor" has issued a document saying:

Blockchain auditing is a combination of distributed auditing and shared auditing. It is a high-level development stage of big data auditing. It is characterized by networking, distribution, and non-tampering.

……

From a pragmatic perspective, national auditing has many similarities with blockchains and is an ideal application scenario. With the advantages of blockchain technology, such as account book sharing, open and transparent data, everyone can be verified, and not easy to tamper with, auditors can save a lot of intermediate processes and speed up the audit process when reviewing the company's financial status.

Of course, the premise of blockchain auditing is that the company's financial data is on the chain. If one day, many companies will link their financial data (this chain can be a chain of alliances or a private chain), the invoices issued after we go out are all blockchain electronic invoices, blockchain audit will Become the mainstream.

03

The blockchain layout of the Big Four accounting firms

Since blockchain technology has so many advantages in accounting and auditing, the four major accounting firms, PricewaterhouseCoopers, Deloitte, KPMG and Ernst & Young, will naturally turn a blind eye.

In fact, the four major accountants have already begun to lay out the blockchain.

1. PricewaterhouseCoopers (PwC)

Among the Big Four accounting firms, PricewaterhouseCoopers is the most active member in exploring the blockchain.

In 2017, PricewaterhouseCoopers announced that some services are acceptable for users to pay using Bitcoin (BTC). In March 2018, PricewaterhouseCoopers worked with asset management company Northern Trust to implement real-time equity audits through blockchain. In May 2018, PricewaterhouseCoopers invested in VeChain, a blockchain startup that engages in network services, supply chain management and anti-counterfeiting.

In July 2018, PricewaterhouseCoopers was invited to audit Tezos, the underlying public chain project of the blockchain; on March 29, 2019, the Tezos Foundation announced that the audit work of PricewaterhouseCoopers had been successfully completed.

On June 11 this year, the Tezos Foundation revealed that PwC blockchain expert Roman Schnider joined the Tezos Foundation as the Foundation's CFO and Head Of Operations.

2, Deloitte (DTT)

As early as May 2016, Deloitte established the first blockchain laboratory in Dublin.

In 2016, Deloitte installed the Bitcoin ATM at its Toronto office in Canada; in August 2018, Deloitte released a report titled “Breaking the Blockchain Open: 2018 Global Blockchain Survey”.

In addition, according to foreign media reports, three of the four largest banks in Ireland are using Deloitte's blockchain solutions to verify employee qualifications.

3. KPMG

In 2017, KPMG joined the Wall Street Blockchain Alliance (WSBA) and became an important member.

In addition, KPMG has partnered with the US Food and Drug Administration (FDA) to integrate blockchain technology into the US pharmaceutical supply chain; partner with Microsoft, R3 and Tomia to develop blockchain technology solutions; The chain startup Guardtime collaborates to provide customers with blockchain-based services.

4. Ernst & Young (EY)

In April 2018, Ernst & Young launched the first generation of Blockchain Analyzer, which helps Yongan's audit team collect all transaction data of an organization across multiple blockchains and import it into Yongan. The software client performs multi-dimensional big data analysis such as trend analysis and outlier identification.

On April 16 this year, Ernst & Young launched the second generation of blockchain analyzers, adding new functions such as financial reporting, transaction monitoring, and tax calculation.

In March of this year, Ernst & Young also introduced "Encrypted Asset Accounting and Taxation (CAAT)" to help its US customers submit IRS tax returns related to cryptocurrency assets.

In May of this year, Ernst & Young announced that it would help the Tattoo e-commerce platform use blockchain technology to trace imported European wines to consumers in Asia and around the world.

In addition, in February of this year, Gerald Cotten, the founder of QuadricaCX, a Canadian cryptocurrency trading platform, died of an accident when traveling to India, resulting in the inability to extract crypto assets worth about $145 million. Ernst & Young was appointed as the bankrupt trustee of QuadrigaCX.

04

summary

Blockchain technology will undoubtedly be a powerful tool in the accounting and auditing fields, and the four major accounting firms have each begun to lay out in the blockchain.

No major changes in the industry can be completed overnight. In the face of change, in the face of transformation, the most important thing is not to affirm or deny, but to adopt an open and open attitude.

Author: Original: Fang Fang, JackyLHH

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The volume is falling, is it a dishwashing or a shipment?

- Bitcoin becomes a sovereign currency? There are three obstacles to overcome

- Blockchain and healthcare: By 2025, the value of the blockchain in the medical market will exceed $1.6 billion

- The technical path of WEB3: from economic logic to the development of blockchain technology architecture

- Analysis | How will fragmentation technology achieve blockchain expansion?

- Heavy Coinbase plans to launch the IEO platform, while waiting for the opportunity to launch STO products

- Order Pizza Win Bitcoin Award, Domino's plan gives 100,000 Euro BTC