Data analysis: how to maintain the emerging market structure of digital currencies under the market waterfall

Translation: Ziming

The digital currency market is still in an emerging stage. What we are currently experiencing is the market that has experienced the largest decline since the collapse of MtGox six years ago. But since then, many new exchanges have sprung up, derivatives have also appeared in the market, and the amount of funds flowing into digital asset transactions has soared.

In this article, we will study how the market is under pressure from recent selling and whether the unique market structure of digital currency has exacerbated this waterfall.

BitMEX clearing spiral

Coin Metrics' real-time reference exchange rate records two major BTC price changes that occurred on March 12 and 13:

- Ethereum 2.0 first design specification review results released: reasonable structure, strong security measures, only fine-tuning required

- QKL123 market analysis | Bid Bitcoin? Understand these signals (0325)

- U.S. $ 6 trillion economic stimulus plan is immediate, Bitcoin may become the biggest winner

- On March 12, from 10:00 to 11:00 UTC, the price of BTC dropped from $ 7,300 to a low of $ 5,690.

- From 11:00 PM on March 12 to 2:15 AM on March 13, the price of BTC dropped from $ 5,800 to a low of $ 3,900.

During the second price drop, one of the exchanges played a particularly important role: BitMEX.

BitMEX is one of the largest new derivatives markets emerging after MtGox. It created the "Perpetual inverse swap", a leveraged financial product that allows the use of BTC as margin collateral for USD-denominated BTC permanent futures contracts.

On March 13th, at 2:16 AM UTC (the second price drop period mentioned above), due to hardware problems encountered by the exchange, the transaction speed on BitMEX slowed down. The problem was later identified as an intentional DDOS attack, and the attack almost made people unable to trade on BitMEX.

As soon as BitMEX was attacked, BTC price rebounded and surged to $ 5,300.

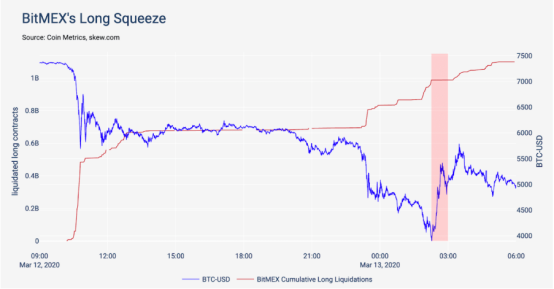

Red area indicates that BitMEX is under DDOS attack

From 9 AM UTC on March 12th to 6 AM on March 13th, long positions worth 1.1 billion contracts were cleared (one contract represents $ 1 position). As more and more traders are liquidated, open positions (the number of contracts still held by traders) are gradually decreasing:

BitMEX allows BTC leveraged trading, but also ensures that no trader can lose more than his margin. This is usually not possible in traditional markets, and BitMEX uses two functions to achieve this.

First, if a position position is liquidated (that is, the remaining margin is insufficient), the automated system (clearing engine) will take over the position. The system is operated by BitMEX and is designed to close the trader's position at a sufficiently favorable price so that no residual margin is zero. If this is achieved, the profits will flow into the insurance fund. Otherwise, withdraw funds from the insurance fund (as of writing, the fund exceeds 30,000 BTC).

The second function is automatic deleveraging. If the clearing engine cannot close the liquidated position in a way that can make a profit, and the insurance fund has insufficient funds, it will take funds from the winning trader to make up for the loss of its position. This is the last solution, because arbitrarily changing a trader's position on one exchange may affect their overall financial position, as they also often run strategies on many other exchanges. Since the crash, BitMEX has released in-depth explanations of these mechanisms.

When BitMEX was attacked by DDOS, the chaos was only partially contained. This has led many to wonder if the exchange's approach to clearing positions has caused or exacerbated the crashed market.

They think so:

When a long position is closed, just like when the price has fallen, the engine must sell the contract. With the increase of liquidation contracts and the weakening of market liquidity, the engine will run into difficulties: it has a lot of contracts to sell, but with deteriorating price conditions, more liquidations and more contract sales will result. This leads to a vicious circle that is difficult to stop.

When trading on BitMEX became very difficult due to a DDOS attack, the clearing engine of BitMEX, the largest seller in the market, failed, and the price naturally rose.

Continuous impact on liquidity

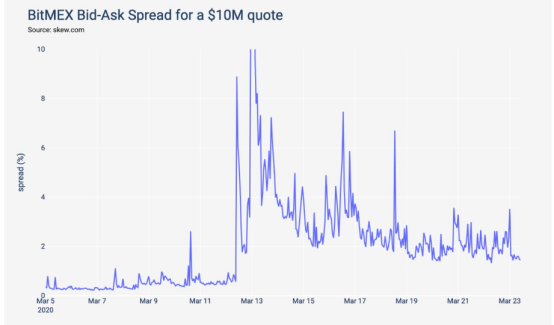

A common way to measure market conditions is to look at the bid-ask spread, which is the difference between the best bid (the price a buyer is willing to pay) and the best bid (the price a seller wants to charge). It is usually measured in base points (0.01% equals 1 base point or bps).

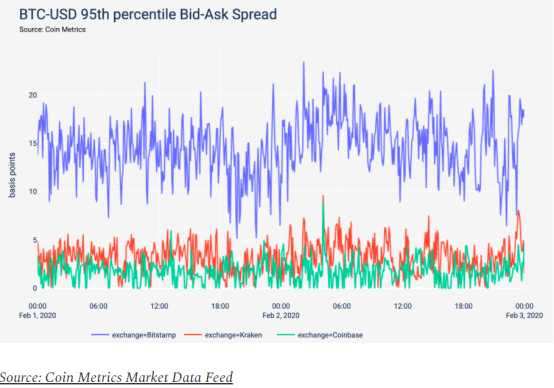

For BTC, which is still an emerging asset class and the fees of each trading venue are different, under normal trading conditions, the bid-ask spread is mostly below 20 basis points. From the table below from February 1st to 3rd this year, you can see this in the following three exchanges:

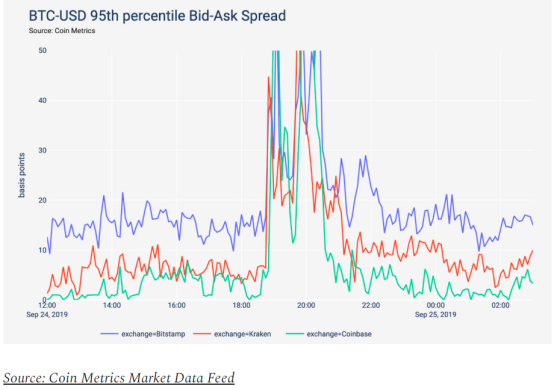

The large price change directly affects the bid-ask spread because market makers respond to fluctuations by expanding the bid and ask prices. In the next chart, we can see the effect of the price drop from $ 9,500 to a low of $ 8,000 in 2 hours in September 2019 (the Y-axis cap is 50bps):

Once the large price fluctuations are over and a steady state is achieved, the spread will return to the previous level.

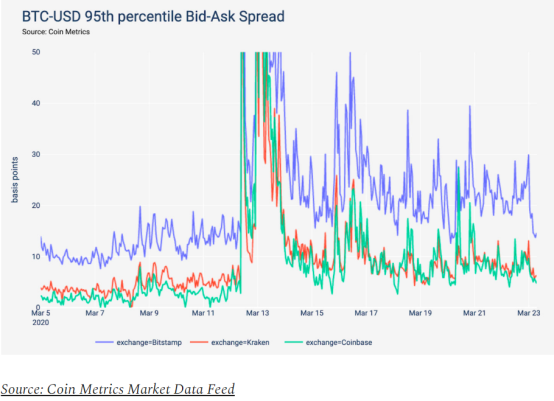

However, the actual situation from March 12 to 13 did not meet expectations, because the spread has not recovered to its previous level.

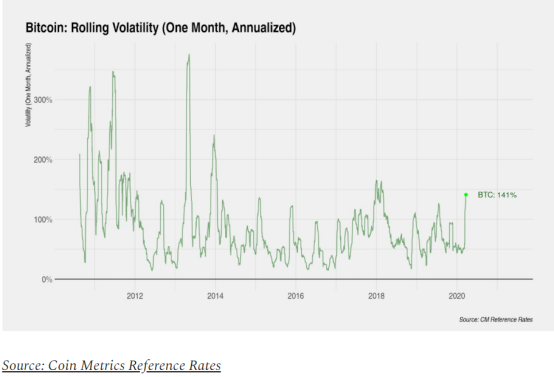

There may be multiple explanations as to why the spread did not return to the level before March 12. Market participants expect volatility to continue and prepare for it by widening the spread. The price change range of BTC in the past month has reached its highest level in six years.

It may also be that some market participants have exited completely, reducing liquidity. For example, after the market crash, the number of open positions did not increase, while market makers who quoted a bid-ask spread of $ 10 million have increased significantly:

Increase in the number of stablecoins

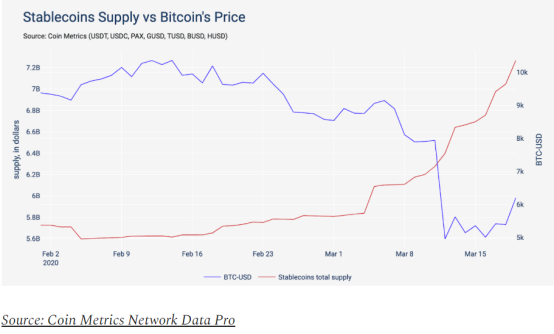

When the impact of COVID-19 on the global market began to appear (S & P's historical high was February 19), Coin Metrics observed an increase in the supply of all stablecoins. And after the sharp fall in BTC, the supply of stablecoins seems to have increased.

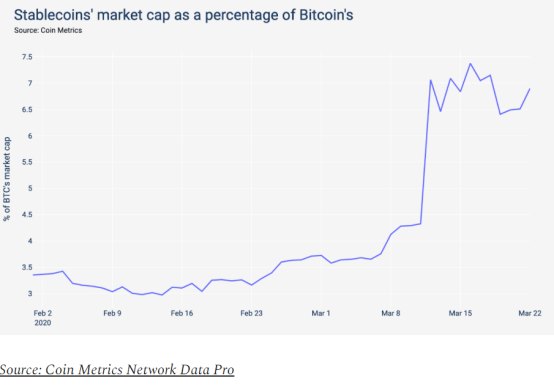

The dual impact of halving the value of BTC's U.S. dollar and the large issuance of stablecoins has resulted in the market value of stablecoins as a percentage of BTC's doubling in recent days:

in conclusion

The recent market trend is staggering and is the largest in BTC's recent history. It has many meanings: as people scramble to deposit BTC, the spread between the spot and futures markets has widened, on-chain fees have soared, and stablecoins have gained more market share.

We also need to think about some questions: Should a circuit-breaker be installed? If the value of BTC is halved in a few hours, does it still have true value storage? Or is this just the role of the nascent market structure?

Although many questions remain unanswered, people are getting closer and closer: Huobi has recently implemented a liquidation circuit breaker for all of its derivatives. Although it is called a circuit breaker, it is not the same as a traditional circuit breaker (if the price of the product being traded drops too quickly, the transaction will stop). It did not stop trading, but controlled the clearing engine to avoid a vicious clearing cycle (that is, the more clearing orders received by the engine, the lower the BTC price, and the more participants will sell BTC). It is unclear whether this will prevent such cycles. In addition, even if the price drop is well-founded and not caused by its clearing engine, it may eventually cause the exchange to suffer huge losses.

Although the price has risen, this incident raises concerns about the structure of the BTC market (stability from the expiry date). Since the market crash, as the number of BTC held by BitMEX has continued to decrease, it will also make traders lose confidence in the exchange.

Sudden pressure and change often bring innovation and restructuring. During these turbulent times, the structure of the digital currency market may continue to be tested, and it is expected to mature and become stronger as a result.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Panda Power, a technology-based mining comprehensive service company, received a 30 million yuan A round of financing, which will be used for cloud computing platform construction, etc.

- QKL123 Data Analysis | Bitcoin UTXO Age Distribution: Market Underground?

- Halved + Federal Reserve flood, the best show time for Bitcoin whales is here!

- Bitcoin price rebounded strongly by nearly 50%, miners are back

- Demystify Bybit's new product "black technology", you can open both long and short, insurance contracts!

- Nic Carter: Crazy growing stablecoin could be bad for Ethereum

- CFTC issues guidelines for digital asset delivery, chairman promises to encourage innovation