DeFi, the current difficulties, the future can be expected!

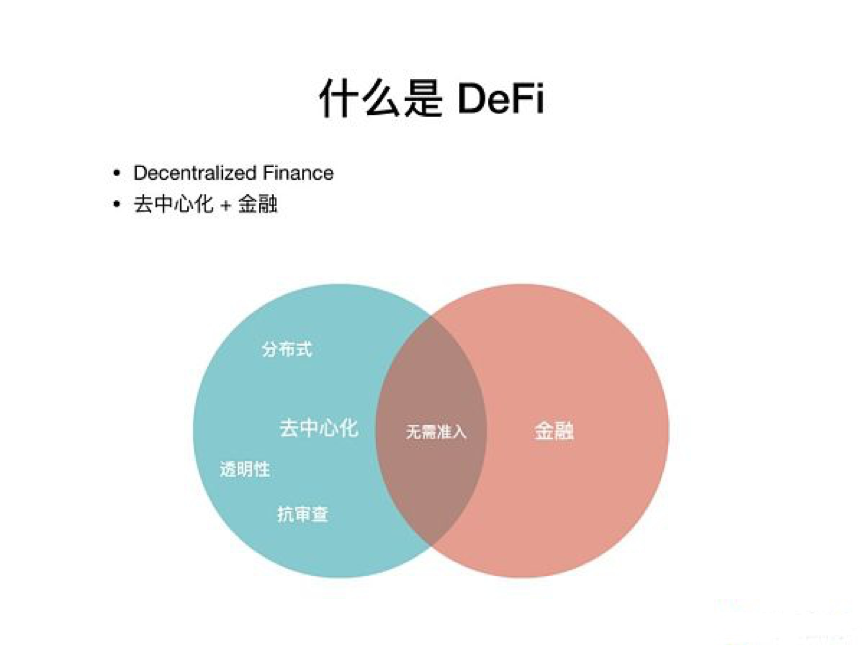

DeFi, English for Decentralized Finance, or distributed finance, can also be understood as decentralized finance. It must be made clear that this concept is based on the blockchain blockchain as the basis for the underlying R&D technology.

Defi is a concept relative to the existing financial system and technology finance. In terms of the distributed nature of the blockchain, the existing financial system is a centralized financial, and there is a clear financial institution as the main body of operations, such as banks, securities companies, insurance companies and other wealth management companies. Asset/fund matching services. Centralized finance, developed to the present, is the most mainstream financial model in the world, and there are also some drawbacks. For example, using information asymmetry, capital advantages, etc. to manipulate the market, and even tampering with transaction data, guarding against self-stealing, and causing a crisis of trust, there are many such cases.

Before talking about DeFi, look at FinTech (Finance Technology), which is financial technology. Financial technology is more a product of the Internet, aiming to improve the efficiency of financial transactions by means of technology. For example, the latter Alipay is to reduce the complicated transaction process between users and banks with FinTech, and exchange the convenience of user transactions with a small amount of fees.

- The top ten characteristics of the amaranth in the currency circle, how many of you?

- Market Analysis: The market opened the downtrend channel, paying attention to the weekly lineback

- The Consensus Art of Blockchain: The Core Value of Money is Currency Consensus

DeFi, the product of the blockchain era, uses blockchain technology to solve problems that are fundamentally different from those solved by FinTech. In short, when the transaction efficiency problem required by the user is solved by FinTech, further demand for financial transaction privacy security is handed over to Defi.

The application of DeFi is gradually enriched and perfected

The earliest and most famous non-MakerDAO in the DeFi application project is a killer product. DAO (Decentralized Autonomous Organization) means decentralized autonomous organization, MakerDAO is one of the DAO projects, which was established in 2014, is an automated mortgage platform on Ethereum, and is also the issuer of the stable currency Dai. The stable currency Dai is issued by a full-backed mortgage on the chain, and is 1:1 anchored to the US dollar. Users can create a Mortgage Debt (CDP) on the MakerDAO platform, a smart contract that allows users to borrow Dai by depositing valuable collateral. Users can obtain safe-haven assets and liquidity without risk of centralization by redeeming Dai or lending to Dai.

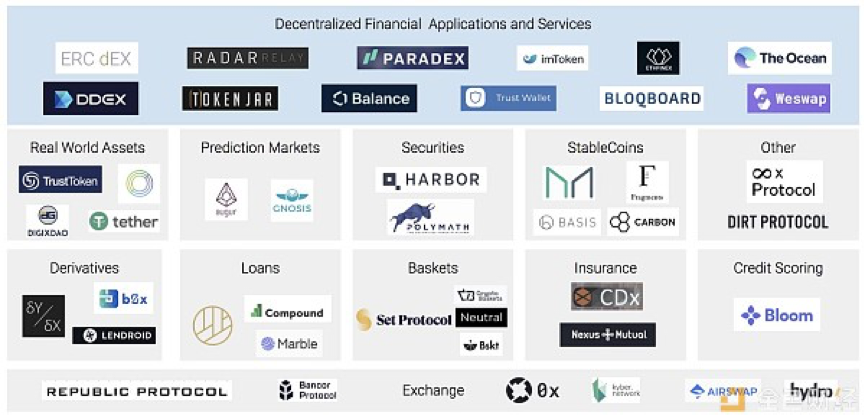

MakerDAO is just a typical case of DeFi application. There are many applications and services of DeFi. The above picture is a rough arrangement.

Overall, DeFi applications include: stable currency, decentralized exchanges, wallets, payment networks, lending and insurance platforms. For example, key infrastructure, markets and investment engines, the entire DeFi ecosystem is booming. The total value of the global DeFi industry is expected to reach $500 billion by the end of 2019.

DeFi has a bright future and it is difficult today.

The bottom line of the DeFi project is smart contracts, and the products generated through these smart contracts are interoperable and do not require third-party intermediary trust mechanisms, which are not available in traditional finance and FinTech. At present, DeFi products are developing rapidly, and there are more than a thousand projects in a short time. The whole ecology is full of vitality. These DeFi products, one of which is an open financial platform, enables individuals around the world to participate in new and transformed financial systems without the need for intermediaries; the other is to transform existing financial solutions by implementing distributed financial solutions. Some centralized financial institutions.

However, DeFi products, like other blockchain applications, have many landing issues, such as high barriers to entry and poor user experience. For a variety of reasons, DeFi products are more like sacrificing user experience and efficiency in exchange for decentralized privacy security and information symmetry.

At the same time, the security issues of DeFi are also worth noting. The 2016 DAO incident and the 2018 Blockchain APT were hacked, and both DeFi and other blockchain projects faced various security threats. In addition, many DeFi companies are start-up small businesses, whether it is shortcomings in experience, technology or financial strength, code review, smart contract verification and trading infrastructure, etc., it is difficult to avoid.

Investment predators have targeted the DeFi project

As early as 17 years, the DeFi project's employers have already appeared in the form of venture capital predators such as Sequoia Capital China and IDG Capital. Sequoia Capital invests in Defi projects such as Iost, Firecoin, Bitcoin, Filecoin, Orchid Protocol, UgChain, Polychain Capital, Metastable and Orchid Labs. According to reports, the recent expansion of the DeFi project Founder Robert Leshner's fund for the encryption project Robot Ventures has received millions of dollars from Bain Capital and Ripple's Xpring.

Ordinary investors entering the market are more curious or speculative, but the traditional VC entering the DeFi market is undoubtedly a tonic, at least the first to stand on the track.

Despite the twists and turns of the road, how DeFi will develop, and indeed there are too many uncertainties, DeFi practitioners are also cautious, practice in thin ice, especially at the regulatory level.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Suspected of misappropriation of lock funds? Let DEX make transactions more transparent

- Bitcoin has been "forked" more than 100 times in two years, now how about those forks

- Looking at the moon in the mist, how to distinguish you is a cow is a bear

- Is the decentralization of the decoupling on the Korean line? Is it a pseudo-proposition?

- Five solutions for implementing dApp extensions

- Innovation workshop talks about blockchain: core business has not yet appeared

- Grab the PoS: Fire coins, fish ponds and the sea, leaving little room for you.