DeFi transaction: A large number of CDPs appear on MakerDAO, but the amount of collateral is close to 0

Create a large number of CDPs in MakerDAO

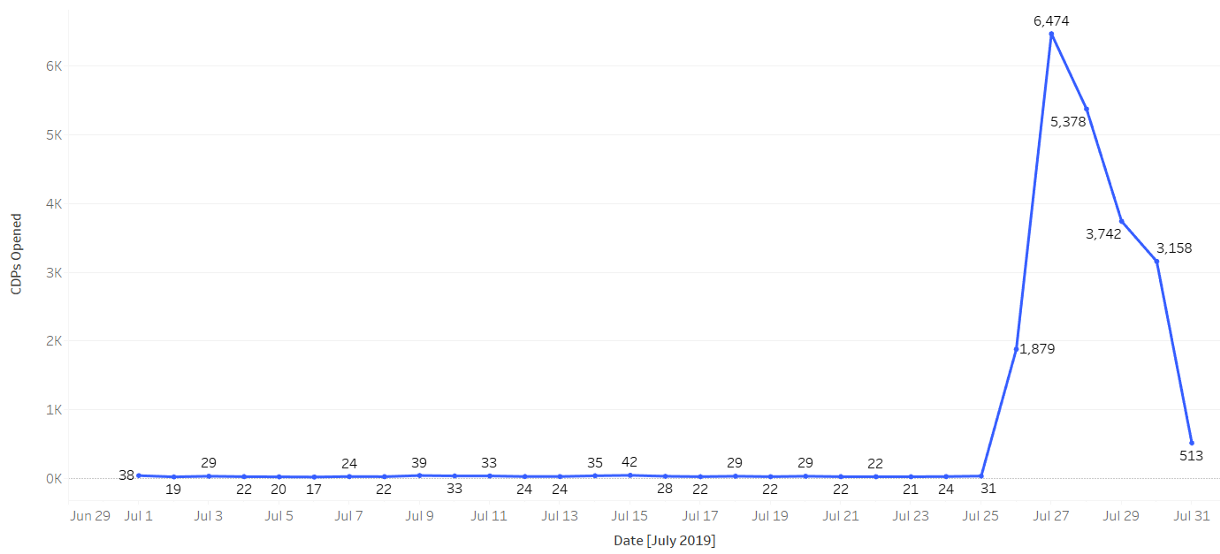

Through Alethio's monitoring data, we noticed that in the past two weeks, the Maker CDP's Open action has soared:

Figure 1 – CDPs began in July 2019

- Bitcoin fork 2 anniversary: fork is very annoying, but this is fatal

- Bitcoin futures for physical delivery have been officially launched, and Bakkt has gotten up early in the morning.

- Digital currency "national team": big countries have to control, the third world wants to overtake

From July 26th to July 30th, the peak on the chart lasted for 5 days. At the peak – July 27, 6,474 new CDPs (mortgage debt position contracts) were opened. After 2 days, the activity gradually decreased, and the cumulative CDP id increased from 19,000 to 40,000 (as of July 31).

(Note: CDP (Collateralized Debt Positions) is a smart contract, users can send mortgage assets to CDP for locking, and generate DAI according to a certain mortgage rate. For example, if the mortgage rate is 150%, then you mortgage 100 For ETH, you will get 66 DAIs. When you return these 66 DAIs, CDP will be automatically destroyed and the mortgaged assets will be returned to the original account.)

Considering that in the first few months, the number of CDPs created each day was between 20 and 30, and the number of different addresses that created them was between 10 and 20, so this kind of activity is very unusual. As for the amount of collateral previously deposited – almost always in thousands, the average collateral deposit for each CDP is tens or hundreds of ETH.

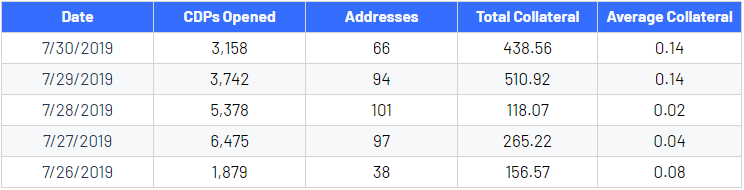

In the five days mentioned above, the previous data has changed a lot.

Figure 2 – Statistics of CDPs from July 26th to 30th

As you can see, the number of CDPs opened by multiple addresses has increased dramatically, and the number of these addresses is not directly proportional to historical activity. However, when these CDPs were created, the value of the total collateral and the average collateral value stored were reversed—down.

Figure 3 – Number of CDPs open days (x-axis), number of different users (y-axis), and collateral quantity (bubble size) over the past 2 months.

The gif map shows that a large number of collateral and a small amount of CDPs and the user's basic behavior – in the past week turned into a small amount of collateral and a large number of CDPs and users.

The data on the MakerDAO portal also shows that more than 22,000 CDPs were created in the last week of July. Suppose the latest CDP id is 40302 – we can see that the total number of CDPs has more than doubled.

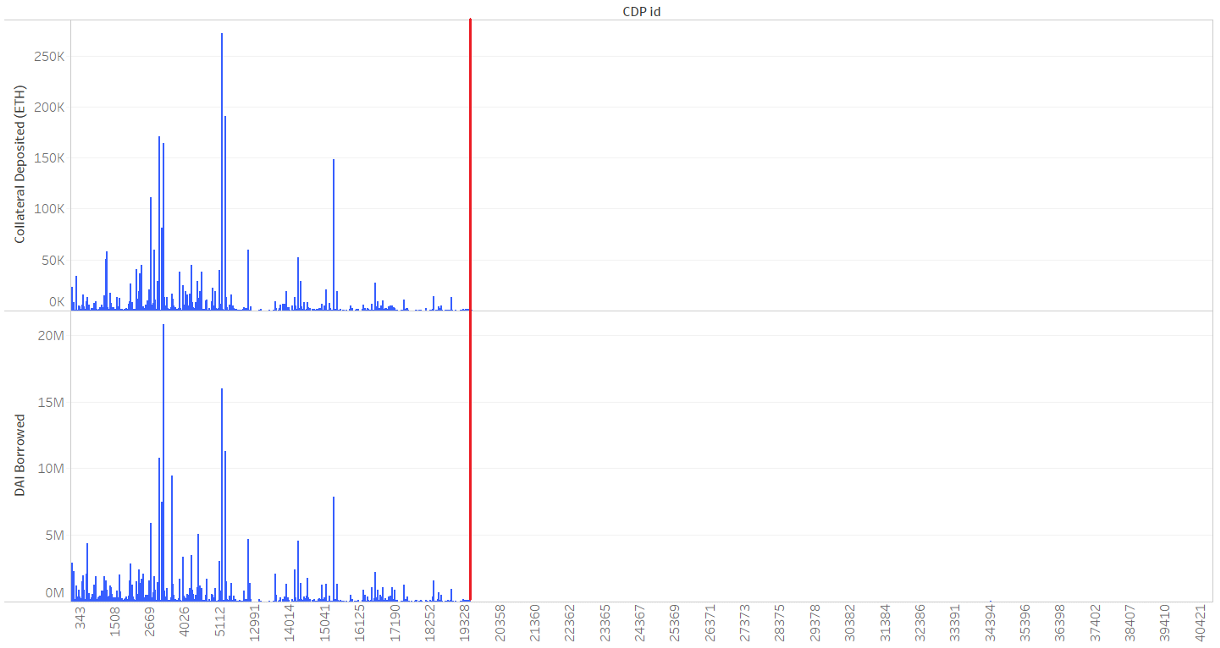

Further research on CDP allocation activities, we note that there is almost no deposit and lending behavior in these newly created CDPs: this indicates that after CDP id 19407, the ETH and DAI deposit amounts for all newly created CDPs are close to zero.

Figure 4 – Distribution of total collateral deposits and lending DAI for all CDPs

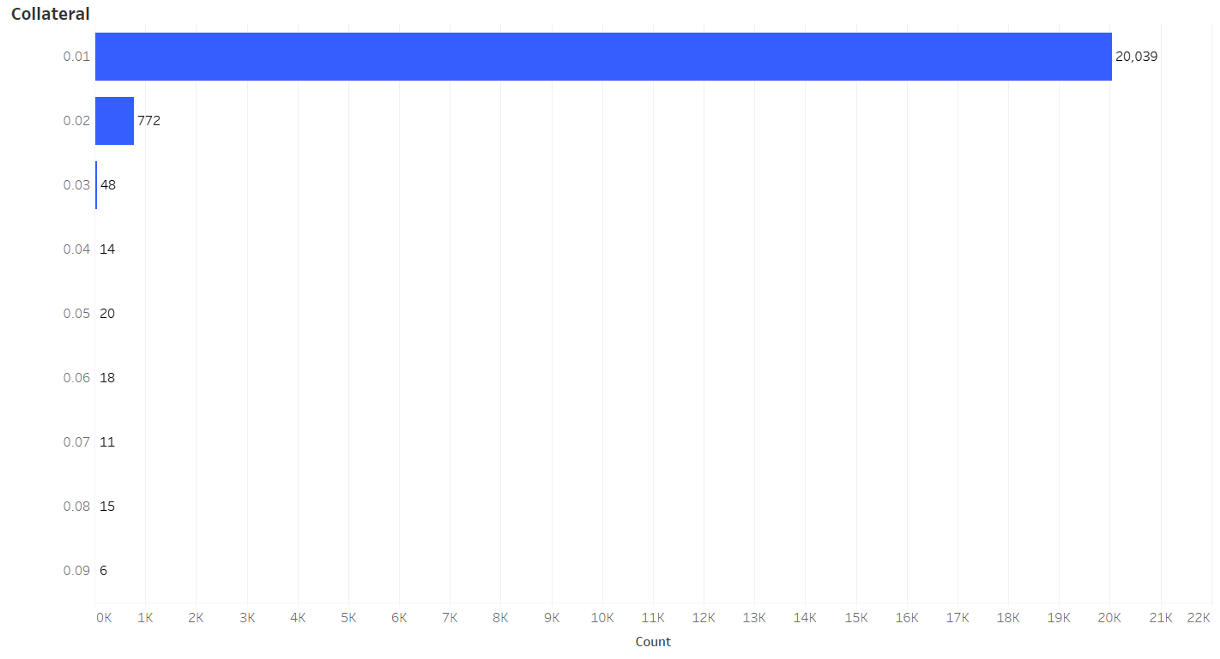

To augment the CDPs created after July 24th, we collected data on deposits with less than 0.1 ETH as collateral.

As shown below:

Figure 5 – Collateral distribution of CDPs after July 24, 2019 (below 0.1 ETH)

Of the 2,039 newly created CDPs, each CDP has the same amount of collateral – 0.01 ETH.

Fortunately, with the team's opinion, we believe this is due to the huge interest in the newly released Coinbase course. However, this kind of activity is unusual and deserves more attention from the society.

(Note: Recently, Coinbase Earn formed a DAI event that paid $200,000 as a reward, driving more than 14,000 CDP creations.)

Overview: The growing DeFi universe

In the past few months, the DeFi user community has become larger and more interoperable than the May chart.

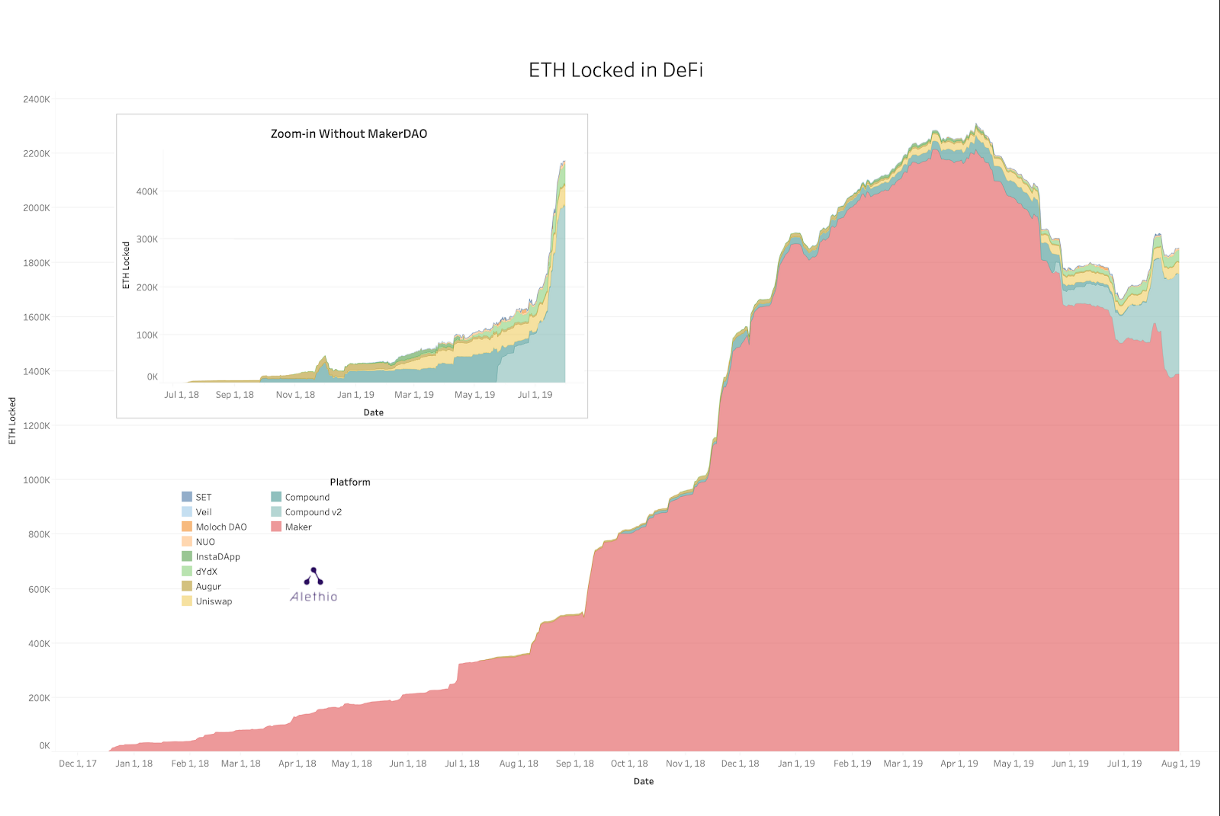

On the ETH lock volume, MakerDAO dominates, followed by complex, NUO, and dYdX. However, compared to the enlarged view, we can see that since the beginning of April, although the value of MakerDAO has begun to decline, other platforms have been collecting value. This may be because the stability of the manufacturer has been increasing since then.

Figure 6 – ETH is locked in DeFi over time

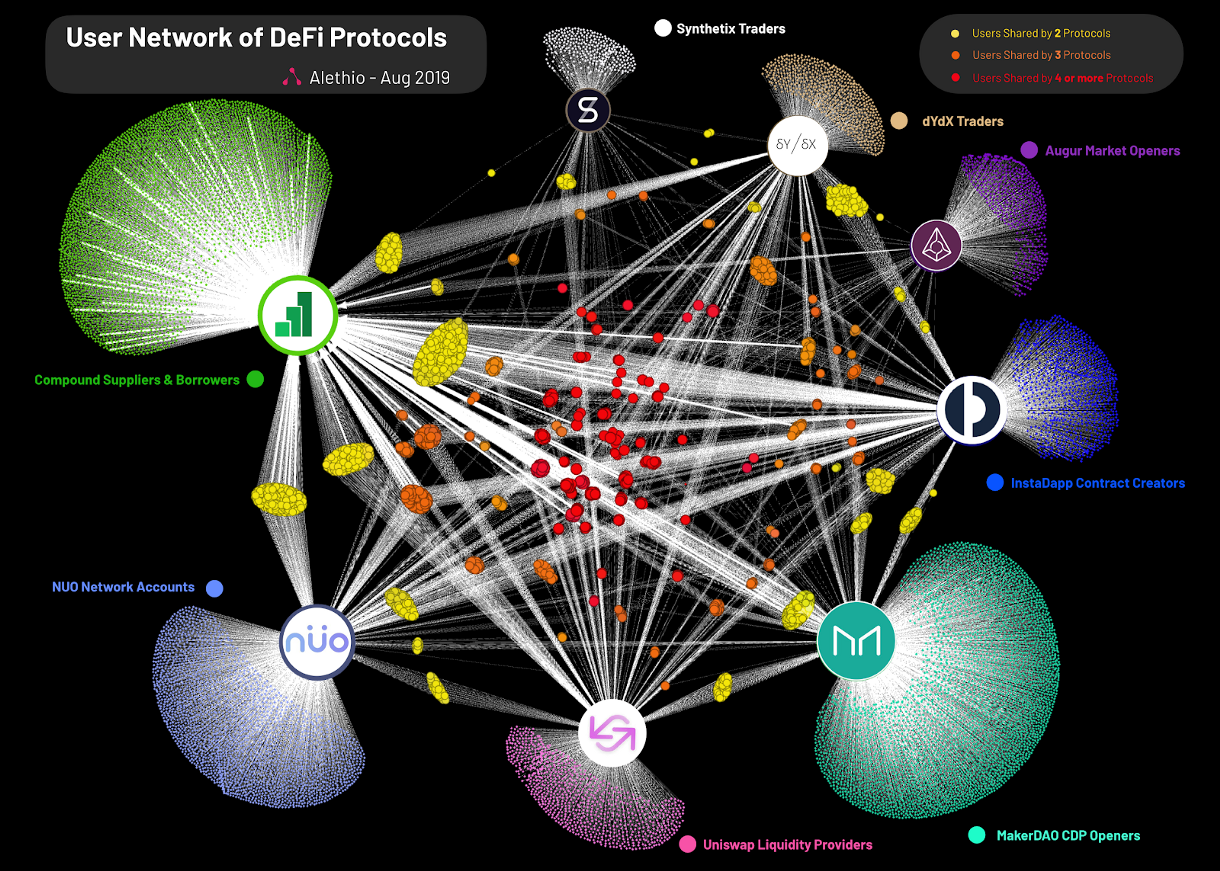

Below, in the refresh view of the DeFi ecosystem network, the colored nodes surrounding the platform logo represent addresses that only interact with the protocol pointed to by their logo (in this context, understood as users); in the middle, these yellow nodes appear in 2 DeFi system. Orange nodes are users shared by 3 platforms, and red nodes are users who have tried 4 or more DeFi products.

To clarify, the definition of the "user" role is different because of the different attributes and products offered by each platform. For example, CDP openers are the origin and owner of all agency contracts running on the MakerDAO system, while Compound allows suppliers and borrowers to better describe their users.

Figure 7 – Network diagram with user interaction with DeFi protocol

As we can see, Compound now has the largest private user base (light green nodes) with the same size as MakerDAO (dark green node). The NUO network has developed rapidly in a short period of time and has the third largest user base in the DeFi protocol.

In addition, Compound has the largest public user base and is shared with InstaDapp. At the same time, there are a large number of common users such as MakerDAO, Uniswap, NUO network, and dYdX.

One thing to note is that there are no shared users (yellow nodes) that are completely owned by Uniswap and dYdX. This may be because dYdX provides switching capabilities through the 0x protocol and OasisDEX to obtain mobility, so users are less likely to seek Token exchange services on Uniswap.

Author: Alethio

Compile: Sharing Finance Neo

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The Hollywood blockbuster "Cryptographic Currency" was released for 4 months without any interest? The director does not understand the blockchain?

- Wanchain launches the Global Ambassadors Program

- The well-known beverage manufacturer's share price soared 500% to alarm the FBI, just because the name is added to the blockchain?

- Getting started with blockchain | From ordinary computers to ASIC mining machines, are ordinary people still suitable for mining?

- Grayscale tells you: How do traditional investors who buy stocks and bonds look at bitcoin?

- EU advisory body: vigilant blockchain is monopolized by elites

- Ready to participate in Ethereum Staking? How to get the benefits in the Ethereum 2.0 system?