Defi's core values, development logic and key trends

1. Summary

1. The main directions of traditional financial innovation are: faster value flow, greater flow range, and more penetrating risk assessment methods. Blockchain technology naturally matches the innovative direction of traditional financial services.

2. Traditional financial business application blockchain technology, which is the “blockchain financial business” that has been developed since 2014, currently achieves large-scale development in only a few areas. The fundamental reason is the need for the transformation of the underlying infrastructure of the traditional banking industry. For a long time, the optimistic estimate is 10 years.

3. “Defi” business is essentially different from “blockchain financial business”. Its most fundamental characteristics are: 1) not relying on financial intermediary trust, no access to financial institutions, 2 Financial assets represent the new rights and interests of the blockchain world, and the token Token is the only form of expression.

4. The biggest value of “Defi” business is: 1) Subverting the existing financial industry organizational structure and business model, achieving “going to the bank's crowds and self-integration”; 2) Increasing mainstream numbers such as BTC and ETH Money liquidity and the expansion of value recognition have prompted it to eventually become a stable “currency” and build a new business and financial system.

- Industry Blockchain Weekly News 6.07-6.14 | The country's first blockchain electronic ticket platform is launched in Zhejiang Province

- Bloomberg column: If the historical law repeats itself, the BTC will rise to a maximum of $400,000.

- Is BTC going to be a new high?

5. Stabilizing coins is an important prerequisite and foundation for all Defi applications. MakerDAO has dual attributes of stable currency and lending applications, contributing to the liquidity of the digital currency speculation market.

6. The lending application is the most important component of the current Defi business. There are many participants and the initial competitive landscape is presented.

7. Payments, options, futures, funds and other financial application innovations have begun to sprout, but the lack of basic assets and commercial consumption scenarios have constrained Defi's further development.

8. Decentralized exchanges are an important infrastructure for Defi's business development. Bitcoin public chain technology is limited to deploy Defi, sidechain cross-chain technology or bring new hope.

9. Identity authentication application is an important supporting tool for the development of Defi business, and it is expected to realize the “credit” and “credit” businesses in the blockchain world.

10. In 2019, with the further implementation of the high-performance public chain solution, the Defi ecological layout was initially formed. Among them, ETH and other head public chains and exchanges have obvious competitive advantages.

11. When the commercial consumption scenario of mainstream digital currencies such as Bitcoin is further developed and no longer only serves speculative demand, Defi applications will usher in a new round of explosive growth.

2. Bitcoin to Defi, from “non-nationalized free competition currency” to “de-banking self-integration and crowding”

Compared to any financial innovation in history, the existence of Bitcoin is particularly unique and powerful, because it directly hits the foundation of the financial system – currency. Based on the idea of “non-state free competition currency”, Bitcoin has created a new form of human wealth expression, and in the past 10 years, has realized the redistribution of some social wealth within a certain range. This is almost unimaginable for financial innovations of the past few thousand years.

The birth of money allows value to be measured and is the source of the existence and development of all financial industries. From the first “loan contract” of Mesopotamia more than 3,000 years ago, the “interest” was created, the venture capital of the Dutch East India Company, the prototype of the options and futures trading in Amsterdam, and the US inflation index bond. The invention and the invention of mutual funds, etc., the core of traditional financial innovation revolves around the two important foundations of “transversal of value and cross-regional transfer” and “risk transfer of uncertainty in the future”, while the main direction of financial innovation is – Faster value flow rates, greater flow ranges, and more penetrating risk assessment methods.

Speaking of this, we can further understand why traditional financial institutions have a special liking for blockchain technology because of the “global openness”, “transparency openness” and peer-to-peer “transaction-settlement” of blockchain. Naturally matching the innovative direction of financial business.

Therefore, since 2014, the world's major financial giants have begun to explore a large number of blockchain technology applications, which is what we have said in the past few years as "blockchain financial business", blockchain cross-border payment, blockchain bills, Blockchain L/C, blockchain ABS, blockchain-based supply chain financial platform, private equity trading platform, credit platform, common insurance platform, etc. “financial + blockchain” application POC emerges endlessly. The essence is to use the blockchain network as a registration and trading system for digital currency, bills and other types of financial assets. The blockchain system has the advantages of transparent and credible tampering and “transaction is settlement”.

However, to date, the “non-standard” of blockchain bills, private equity trading platforms and supply chain financial platforms may be the only ones that have already landed and are expected to develop in the next two years. The underlying reason is that the underlying infrastructure changes in traditional financial core businesses such as stocks, bond transactions and payment settlements have had to go through a long period of time. If you think about it optimistically, it may take another 10 years.

But the emergence of Defi brings us new ideas and possibilities.

Defi (Decentralized Financial), decentralized finance, can also be called "distributed finance" or "open finance", creating a new financial system independent of the traditional financial industry. Many people confuse Defi with financial institution-led blockchain financial applications. In fact, they have very clear differences.

The two fundamental differences between the two are: 1. Do not rely on the financial institution's subject credit, and do not have access to financial institutions. 2. Financial assets represent the new rights and interests of the blockchain world, and the token on the chain is the only form of expression. (excluding traditional financial asset mapping)

Therefore, the development of Defi business will realize two important values: 1) subvert the existing financial industry organizational structure and business model, realize “department and self-inflation of the bank”; 2) increase the flow of mainstream digital currencies such as BTC and ETH Sexuality and the expansion of value recognition, which will eventually become a stable "currency" and build a new business and financial system.

On the one hand, financial institutions are not allowed to get started, subverting the foundation of existing financial institutions – relying on scarce licenses to obtain business authorization. Fundamentally, if technology and perfect autonomous rule design can build enough trust, the financial world will no longer need financial service providers to prove subject trust by paying great access costs. Just as the concept of “following the crowd” proposed by Simon Dixon’s book “The World Without Banks” is also in line with the concept of “self-finance” behind the new trend of supply chain finance development, human business and economic activities will enter new Historical phases.

On the other hand, more importantly, when financial products based on mainstream digital currencies such as BTC and ETH grow and develop, BTC and ETH will gain higher liquidity and lower transaction friction, and achieve “price discovery” more efficiently. Thus, it completes its ultimate mission – a new "currency asset" with a stable value scale. In fact, when more and more people use BTC and ETH as collateral to borrow and use them as benchmark assets to invest in new assets, these are the processes in which their value identification is constantly being established and expanded.

Only when the blockchain world has a "currency" with universal universal value, can we build the cornerstone of the new business system on the chain, and the financial chain can come out of "speculation" to have long-term vitality. Imagine that more than half of the “commodities” in human business activities will be created through blockchain open collaboration organizations, including more and more digital products such as culture, entertainment, games, etc., and financing generated during the creation of goods. Demand is resolved through the chain's financial business and ultimately paid through the blockchain “currency”. This will be a subversive change in the human business and financial system. Before the advent of this change, the development of “digital currency” and Defi applications with stable value scales was crucial.

In the short term, the main value of Defi applications exists compared to centralized financial applications. The core performance is: 1) the assets on the chain are transparent and traceable, avoiding the central credit risk; 2) the intelligent contract is automatically executed to avoid the risk of non-performance of the counterparty.

3. Defi application development status and trend

“Loan lending” is the first step in increasing liquidity in financial markets.

Similar to the development path of traditional finance, lending applications have become the type of business that Defi has developed first.

However, it is clear that unlike traditional financial development, there is no “money” that forms a complete function in the financial world of the chain. It cannot be used as a stable value scale to value mortgage assets and calculate interest. So the first special financial application developed in the entire Defi ecosystem is the stable currency.

The star project MakerDAO in the ETH public chain took the lead in realizing the model of chain-based mortgage-issuing stable currency, and based on its stable currency DAI, developed a mortgage lending business for digital assets.

1. MakerDAO – Stabilizing the currency, borrowing and applying the dual identity, kicking off the Defi prologue

Mortgage ETH issued stable currency DAI, extremely high asset mortgage rate and dynamic adjustment mechanism

MakerDAO was the first concern of the blockchain industry because it succeeded in implementing the stable currency issuance mechanism under the “ETH Digital Asset Mortgage” model following the USDT “Finance Mortgage” model.

Under this digital asset mortgage issuance model, the entire process of issuing ETH mortgage locks and stable currency DAI is automatically completed through the CB (Collateralized Debt Positions) on Ethereum, and the number of mortgage assets and the number of issued stable coins are transparent. The problem of subject credit risk under the legal currency mortgage mode such as USDT is avoided. However, ETH prices as collateral assets are highly volatile, and asset collateral rates are typically much greater than 100% (the collateral here is the collateral ETH value/distributable stable currency DAI value, denominated in US dollars).

The current minimum mortgage rate is 150%, which means that ETH with a mortgage value of $150 can lend a DAI worth $100. If the ETH price drops and the mortgage rate is lower than 150%, the ETH mortgaged by the user will be automatically liquidated by the system (the ETH is sold at a price lower than 3% of the market price and the DAI is repurchased to guarantee the solvency of the DAI). Usually the user will lock more ETHs or return some of the DAI before clearing the warning line, so that the mortgage rate is raised to a safe level. And there are already some applications that are being rolled out to help users monitor changes in mortgage rates and avoid sudden liquidation of mortgage assets. If the mortgaged asset is sold, an additional "penalty" is required after the loaned DAI is repaid.

In theory, MakerDAO only needs to satisfy 1) DAI=1 USD pricing, 2) over-collateralized asset reserve (including timely closing and holding) in the mortgage issuance of CDP smart contract, and can realize the smooth redemption process (change with DAI) Back to mortgage ETH), then the market price of DAI will be difficult to deviate from $1 for a long time. Because once the market price deviates, generating an arbitrage opportunity for the exchange price and market price difference within the CDP, the arbitrage operation will adjust the market supply of the DAI, thereby bringing the DAI price back to $1. (If the market price of DAI is 0.9 US dollars, the exchange price in CDP is 1 US dollar, the arbitrageur buys 10,000 DAIs from the market and converts them into ETH in CDP, which is equivalent to the cost of 9000 US dollars in exchange for ETH worth 10,000 US dollars; Driven by arbitrage, the supply of DAI in the market will decrease. According to the general supply and demand theory, the price of DAI will rise back to 1 US dollar.

In fact, in order to improve the arbitrageur's motivation, MakerDAO also set a “target price change rate feedback mechanism”. When the DAI market price is lower than 1 US dollar, the price of DAI in CDP is higher than 1 US dollar. The arbitrage space to speed up the process of DAI returning to $1.

In addition, the issue of redemption of DAI requires payment of a "stability fee." MakerDAO has specially set up a “stability fee dynamic adjustment mechanism” to further strengthen the stability of DAI prices. It is stipulated that when the DAI market price is lower than 1 US dollar, the stability fee will be increased, and the cost of obtaining DAI will be increased, thereby reducing the market supply of DAI to suppress the decline of Dai price; otherwise, the stability fee will be lowered. Currently, as the DAI price is less than US$1, as of April 29, MakerDAO has adjusted the stability fee continuously in more than two months, and the rate has increased from 0.5% to 1.5%, 3.5%, 7.5%, 11.5%, 14.5%. 16.5%, which brings the price of the stable currency DAI closer to $1.

(The blue line represents the Dai stability fee, the green represents the newly generated Dai supply, and the red represents the reduced Dai supply)

In addition, in September 2018, Marker Dao launched the DSR Savings Rate (Dai Savings Rate), which is similar to the remaining coins, and the deposit can be earned continuously by Da (the interest is generated by the borrowed Dai). When the DAI price is less than $1, increase the deposit rate, encourage the storage of DAI, reduce the circulation of supply to promote price increases, and vice versa.

Overall, in the past 533 days, the DAI price deviated from 3% of the number of days has 131 days, the total deviation rate is 24.5%. Although the deviation rate is still not ideal compared to the stable dollar of the US dollar mortgage model, its deviation from the price is more than 1 dollar for 58 days, less than 1 dollar for 73 days, the risk of stable failure is small, and Dai was in 2018. Successfully withstood the 80% decline in ETH prices.

For users who are unwilling to give up holding ETH, mortgage ETH in exchange for DAI is a lending investment behavior, injecting liquidity into the investment market.

MakerDAO mortgage ETH issued stable currency DAI, can also be regarded as the user mortgage ETH lending DAI behavior. The customer mortgage ETH in exchange for DAI for investment is derived from the particularity of the digital asset investment market – the price of the benchmark asset ETH used for investment is still unstable. Users are worried about investing in other assets with ETH and missing the growth gain of ETH itself. Therefore, mortgage ETH is exchanged for other benchmark assets for investment, and it is a good choice to enjoy the two benefits of ETH and new asset growth. From this perspective, the stability fee paid by the mortgage ETH in exchange for DAI can be understood as a kind of interest on borrowing. Obviously, when the investment in the entire market increases, interest on borrowing is also growing with the size of borrowing funds.

Although MakerDAO does not have any leveraged business, it essentially provides investment funds for users who are not willing to invest in new assets with ETH, which expands the investment scale and liquidity of the entire market.

Before the emergence of the Defi lending application such as MakerDAO, the centralized lending service platform has existed for a long time, and there will be a big business growth at the beginning of each investment boom. Compared with the decentralized lending application, it has better reliability and security, and there is no risk that the loan platform will run. However, the user needs to bear the technical operation risks such as the blockchain system failure.

2. Compound, Dharma, dYdX, ETHLend many loan applications developed to form a preliminary competitive landscape

Following MakerDAO, many loan-based Defi applications have been developed. The basic model can be divided into two types: fund pool lending and point-to-point lending. Point-to-point lending, such as Dharma and dYdX, is a point-to-point agreement that combines lenders and borrowers to match lenders and borrowers, and has clear sources of repayment for borrowers; Pool lending, such as Compound, can be added to the total fund pool by borrowing funds. The new loan demand is borrowed from the total fund pool, and the borrower has no clear source of repayment. MakerDAO is special, and has the stable currency DAI distribution attribute, no borrower, close to the fund pool mode. In addition, different applications can meet the needs of richer users by different requirements such as assets, interest, and asset mortgage rate.

In addition, the EOS-REX, a similar mortgage lending platform on the EOS public chain, is also growing at a very fast rate. However, it has more specific application scenarios, mainly serving developers, helping its low-cost access to EOS to purchase CPU computing resources and NET broadband resources, which is closer to a financial leasing platform, and the core operating mode of the above fund lending applications and The main uses are different.

Since the release of REX, the lock EOS has steadily increased. As of June 13, REX locks the EOS to 610 million US dollars, surpassing Maker Dao, becoming the largest Dapp in the DeFi field.

Source: https://www.dapptotal.com/defi

The data is as of the date of 2011.6.13

3. Payment, options, futures, insurance, funds and other financial application innovations have begun to sprout

In addition to lending applications, various other Defi applications have also achieved varying degrees of development.

Among them, Augur itself is a predictive market application that allows users to create forecast contracts for any future events and to trade freely. Since the forecast results are only divided into "will occur" and "do not happen", it is equivalent to a "binary option contract." If the user can create a forecast market where “ETH will rise next month”, users who purchase “will rise” contracts in the market and users who purchase “can’t rise” contracts become counterparties.

Lightning Network is a BTC-based chain expansion solution. Both parties to the transaction can temporarily create a payment channel. The “virtual bank” smart contract will record the multiple transactions between the two parties in the channel, and only record the final net difference on the BTC main network, thus increasing the efficiency of a large amount of small payments. According to the 1ml data of the statistical website, as of June 14, Lightning Network has 8,748 nodes, 34,788 payment channels, and the payment channel has a total of 949.17 BTC (about 7.8 million US dollars).

Generally speaking, the current Defi applications are still in the early stage of development, and they face obvious development bottlenecks: 1) the number of basic assets with broad value recognition is limited, the space for derivative innovation is limited; 2) the property speculation property is strong but the commercial application is insufficient. The financial system is not sound. We may wish to boldly envisage that in the future, a blockchain content sharing community such as “steemit” will develop to reach a Facebook-like user scale. Steemit’s token will generate a variety of derivatives Defi trading market, including options and futures. The various insurance services of the content authors will be launched and the entire Defi application will have more possibilities.

4. Decentralized exchange DEX is an important infrastructure for Defi's business development

To truly decentralize the financial closed loop, Decentralized Exchange DEX is essential. In fact, in the past few years, before the concept of Defi was born, decentralized exchanges have been silently developed for many years. To this day, the decentralized exchanges within the single public chain of ETH and EOS are well implemented and can support peer-to-peer transactions between digital assets of the same public chain and the same technical standards.

Decentralized exchanges have gradually evolved into three models: the order-selling model on the chain, the order-selling model under the chain, and the repository model. Exchanges that use the chain order book model are completely decentralized exchanges, such as EtherDelta, which are costly and inefficient. In order to increase the speed of transactions and reduce costs, people began to adopt the "chain-down + chain-settlement" model; in order to further improve efficiency, people have designed a "repository" model, which provides funds to support transactions, so directly It is more efficient to remove the link, but in a strict sense it is not a decentralized exchange.

It is worth noting that the blockchain network, the largest digital currency in the blockchain digital world, is unable to implement complex smart contract code commands due to its smart contract design based on simple stack language and UTXO model. Difficult to develop BTC-based Defi applications. At the same time, it also adds great difficulty to the cross-chain interaction between BTC and other public chains.

Ideally, the further development of cross-chain sidechain technology will promote the trading of BTC and other types of assets, that is, more complex financial business innovation. But for now, the “relay chain” solution in Cosmos, a representative solution for cross-chain technology, is still a semi-centralized existence. It can be predicted that at least in the past few years, the cross-chain asset transactions and the absolute decentralization in a larger scope cannot be combined.

5. Identity authentication application is an important supporting tool for the development of Defi business, and it is expected to realize the “credit” and “credit” business in the blockchain world.

It is also worth mentioning that the credit and credit business is still missing in the Defi business at this stage, which is essentially due to the “no identity authentication” feature brought by the anonymity of digital assets in the blockchain. However, with the further development of financial services, identity authentication applications will play an increasingly important role in the financial system, such as selfkey, bloom, and uport. There are also specialized applications for lending credit evaluation, such as colendi.

4. What type of public chain is DeFi more suitable for?

"What kind of public chain does DeFi are more suitable for?" This question ultimately needs to answer "What are the conditions for the financial infrastructure of the blockchain world?" We believe that at least three dimensions can be judged: security, transaction efficiency, and liquidity.

The security of blockchain asset trading is mainly determined by the security of the underlying blockchain system and the security of smart contracts. The security of the underlying blockchain system can be reflected to some extent by the degree of decentralization; transaction efficiency is mainly Relying on the transaction performance of the public chain system, that is, concurrent processing capability; the evaluation of liquidity is relatively complicated, and it is necessary to comprehensively consider the size of a public chain user and the size of funds for financial applications.

Security: new fragmentation consensus such as POW>VRF+POS> POS /POC>DPOS / BFT (sorted according to the degree of decentralization of the consensus algorithm)

Transaction efficiency: alliance chain>multi-chain fragmentation>DPOS>DAG>large block (sorted according to public TPS data representing the public chain)

Mobility: Headline public ownership with large-scale users and Defi applications, as well as exchanges and wallets with a large number of convertible users and financial services capabilities have outstanding advantages

Taken together, we sort the public chains that are suitable for Defi development:

1. POW/POS+ multi-chain fragmentation + large-scale users and applications = ETH 2.0 after POS and fragmentation technology (high technical update speed uncertainty)

2. POS/DPOS + multi-chain segmentation + large number of convertible users and financial services capabilities = OKChain, Binance Chain, etc. (initial development)

3. POS/DPOS+ large-scale users and applications = EOS, Tron (centralized risk, insufficient security)

4. POW+ large block + ecologically rich public chain = BSV after ecological (it is difficult to support complex Defi applications)

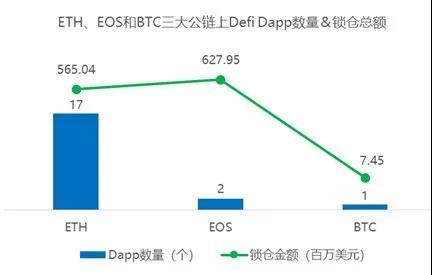

At this stage, due to the early development stage of Defi application, ETH 1.0 is still sufficient to support the current transaction efficiency requirements, and also has a rich ecology, and the degree of decentralization is also high, so Ethereum is the most suitable in the current stock public chain. The soil that DeFi develops. It can also be seen from the current TOP20 ranking of locked assets in the DeFi field, mainly concentrated in the Ethereum.

Source: https://www.dapptotal.com/defi

The data is as of the date of 2011.6.13

In the long run, we will actively promote the decentralized exchanges and stable currency exchanges in the Defi ecological layout with uncompromising competitive strength.

5 Conclusion

Defi's short-term vibrancy comes from the speculative boom, but Defi's core value is not only here, its long-term vitality should come from the construction of a new business system and financial system to create a new, rich and diverse financial format.

The next development trend of Defi is:

1) Develop from a single lending application to a diversified application;

2) The DEX and identity authentication applications accelerate the process;

3) The exchange's public chain competes with the current head public chain for ecological layout.

Original article, the authors: OK Research.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Central Bank Digital Bank of the Blockchain View of the Central Bank’s Monetary Secretary Sun Guofeng

- The test of the kidnapped Fed vs digital currency

- Market Analysis: The currency bombs thunder, but it opened up the rising channel for BTC?

- Facebook "Stable Dollar" cooperation node is exposed in advance and will be piloted in more than ten countries around the world.

- LTC has a high level of innovation and a large demand for callback

- Institutions have bought Bitcoin in a big way, and the average daily trading volume of CME futures has increased by 250% compared with the same period of last year.

- Opinion: 5G+ blockchain innovation is at the B end, China has obvious advantages