Digital currency has become a dominant school: 6 kinds of coins have begun to bear value, and institutional entry has led to mainstream

The current digital currency has become a dominant school and is welcoming key nodes for rapid development.

On August 21, the People’s Daily published an overseas version stating that at present, China is still in the stage of accelerating research and development in terms of digital currency. Mu Changchun, deputy director of the Bank of China's central bank payment and settlement department, revealed that the current development of the central bank's digital currency is in a "horse race" state, and several designated operating agencies have adopted different technical routes for research and development.

On August 20th, the Chinese version of China Daily reported that experts predict that if all goes well, the digital currency supported by the Chinese government may be earlier than the official release date of Libra.

At the same time, Libra is responding to more regulatory challenges. According to Kim's August 21 news, Facebook's cryptocurrency Libra was reviewed by EU antitrust agencies; Reuters news on August 20, Swiss Federal Data Protection and Information Commissioner said it is expected to receive Facebook before the end of this month Details of Libra.

- Spent 260,000 to settle the SEC accusation, the rating agency black box operation was exposed

- Portrait of Chinese coin friend: 70% is less than 35 years old, mainly for high-income men

- The central bank talked about digital currency three times in 20 days.

Digital currencies that have not yet been launched but have received “public consensus” are entering a sprinting phase; the mainstream digital currencies that have been launched are driven by consensus, affecting finance and a wider range of applications.

Inter-Chain Pulse recently conducted a statistical analysis of 10 mainstream digital currencies, and found that digital currency has become a dominant school from the previous pressure to the current application, from non-mainstream to mainstream. The key to the transformation is two aspects: further recognition by the public, institutions, and government; the value anchoring of its own is highlighted.

Digital currency gradually reached consensus on the international scale

The digital currency has always been recognized by the public, institutions, and the government as a gradual process. However, the launch of Libra and the entry of more giants have promoted the process of large-scale development.

From the recent attitude of the central bank to the digital currency, we can see the central bank’s development of “recognition” of digital currency.

On August 10, Mu Changchun, deputy director of the Department of Payment and Settlement of the People's Bank of China, introduced the central bank's digital currency at the Financial Forty Forum and compared the transaction peaks of the network directly with the trading volume of Bitcoin and Ethereum.

Xiao Lei, a well-known financial writer, commented that this revealed that the central bank had no concerns when referring to Bitcoin and Ethereum. It did not explain any bitcoin and Ethereum directly. This shows that from the central bank level, it has already acknowledged the bit. The objective existence and rationality of the currency, the Ethereum and the future Libra.

In addition to the recognition of ideas, legal recognition is also the basis of its development.

As early as April 2017's "Funding Algorithm" amendment, Japan has officially recognized cryptocurrency as a legal means of payment and incorporated it into the legal regulatory system.

In June 2017, the US Securities and Exchange Commission issued an investigation report under Article 21(a) of the Securities Exchange Act, in which the virtual currency to be investigated was defined as “securities” and was subject to US federal securities transactions. The rules of the bill. The report is instructive for the definition of US virtual currency and will have an impact on the characterization of virtual currency in US states.

Since then, many countries have defined the legal level of digital currency. Although countries have different degrees of recognition of digital currencies from different levels of law and thought, the “consensus” that has been continuously reached in the development process has pushed the digital currency to further mainstream and application.

Mainstream digital currency value anchoring highlights

The establishment of digital currency recognition is based in part on the definition of its value.

Inter-Chain Pulse has pointed out in the previous article "Institutional push bitcoin value June "landing" development 10 years end ruler" , starting from June, bitcoin fluctuations and gold have a high correlation, and more and more The positioning of “Digital Gold” has gradually become a safe-haven asset.

Bitcoin has a clearer value anchor and is no longer the castle in the air. The value anchoring of mainstream digital currencies other than Bitcoin is also highlighted.

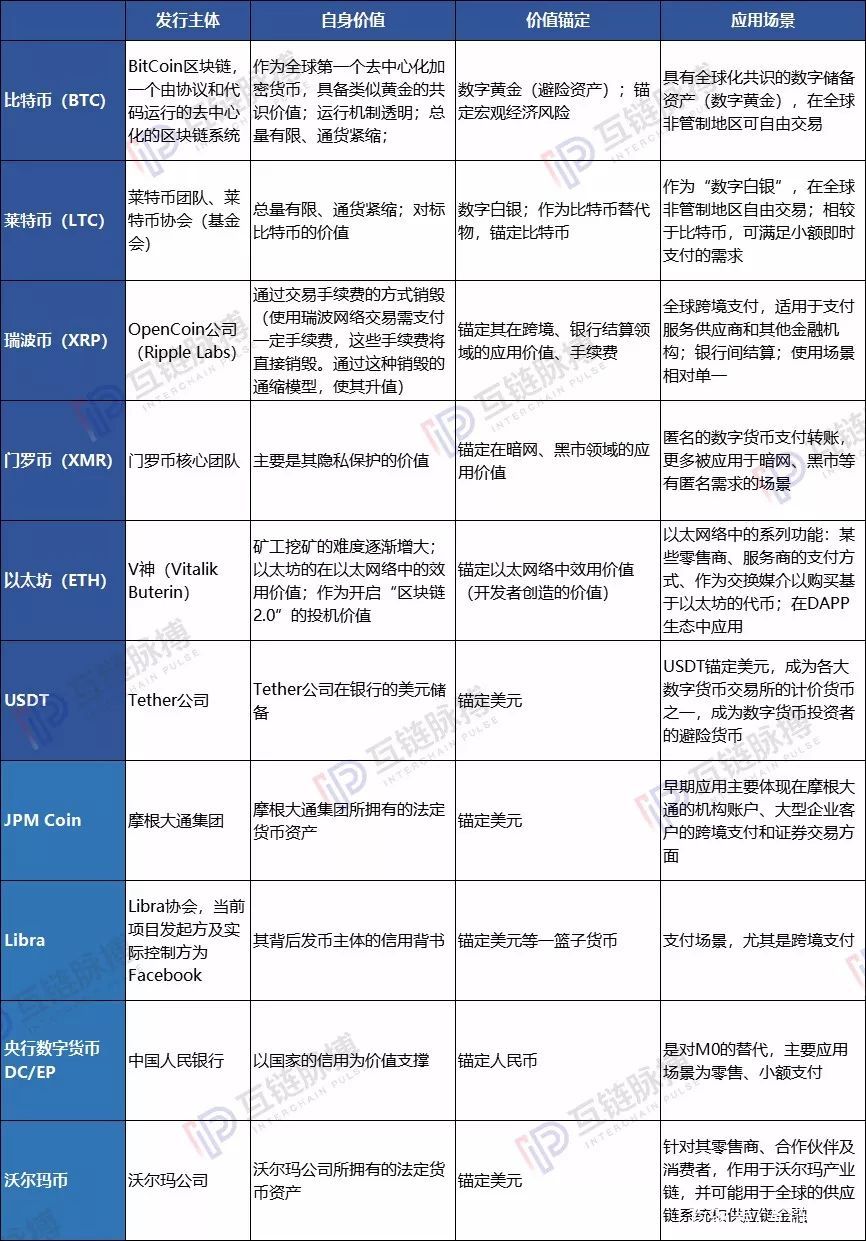

The inter-chain pulse counts digital currencies such as Bitcoin, Litecoin, and USDT that have gained consensus from the majority, as well as digital currencies such as Libra, central bank digital currency, and Wal-Mart, which have not yet been launched but have a large user base, and observe their respective anchors. the value of.

As a "digital gold", Bitcoin anchors macroeconomic risks to a certain extent; Litecoin is the "digital silver" for benchmarking bitcoin, and the value of bitcoin is anchored. The early development of digital currency such as Ripple, Monroe, and Ethereum has its anchored value mostly derived from their own application scenarios and operational mechanisms. The value of Ripple is mainly due to its deflation model, which is destroyed through transaction fees, and the value of appreciation, as well as its application value in global cross-border payment and inter-bank settlement.

Based on its privacy protection features, Monroe can make anonymous digital currency payment transfers, and more applications are applied to dark networks, black markets, etc., so its value comes from the application in specific scenarios; Ethereum mainly meets the requirements of Ethernet networks. Series functions: as a payment method for some retailers and service providers, as a medium of exchange to purchase tokens based on Ethereum, applied in some DAPP ecosystems, so it is anchored in the utility value of the Ethernet network, that is, The value created by the developer.

In addition to the above-mentioned digital currency, the stable currency such as USDT is anchored by the US dollar-based legal currency, but their respective value-related forms are not the same.

The USDT anchors the US dollar, which is one of the currency of the major digital currency exchanges. It is more used as a bridge between the US dollar and the digital currency, and as an intermediary for currency transactions; unlike Libra, JPM Coin, and Wal-Mart, directly Anchor the dollar or a basket of currencies and use them for application. Libra, JPM Coin, Wal-Mart, etc., while anchoring the legal currency, also have an endorsement of the credit value of the main body of the currency.

Finally, as a central bank digital currency that is supported by national credit and replaced by M0, its value anchor is naturally RMB.

Digital currency application prospects

When the value of mainstream digital currency is anchored more clearly, its “consensus” can be continuously achieved, and more and more rational funds will enter the digital currency field. First, small companies with strength and real facts enter the market, followed by large institutions and investors to recognize the intrinsic value of digital currency.

The impact of this will often be the first to act in the financial sector.

Mutual chain pulse observed that on August 16th, Bakkt CEO Kelly Loeffler issued a document announcing that Bakkt will be officially launched on September 23. The article stated that it has obtained the approval of the CFTC through the self-certification process, and the user acceptance test has also begun. This means that Bakkt is about to officially open a physical delivery bitcoin futures contract.

The opening of a fully compliant, physical delivery bitcoin futures contract is believed to provide unimpeded access to institutional entry and will allow large amounts of money to enter the encrypted world. The application of digital currency in financial transactions will attract more financial investors.

Mutual chain pulse observation Libra, JPM Coin, Wal-Mart and other upcoming digital currencies, the main application areas are also cross-border payment, supply chain finance, securities trading and other financial areas.

Under the advanced demonstration in the financial field, it can be imagined that mainstream digital currencies can be applied to a wider range of scenarios afterwards; they are occasionally replaced by each other, but more are “individuals”, in their applicable fields and scope, Directors of each exhibition.

Original link

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Lawyer's point of view: Bitfinex litigation is getting worse, but USDT's long-term risk is still controllable

- Bloomberg: Bitcoin will be in the long-term between $8,000 and $20,000

- National Currency Magic Curse: A Digital Currency Discovery Tour in Latin America

- BTC tests the bottom track of the up channel again. Is the long cool?

- "Don't speculate, let's go to the shoes."

- Observations | Several famous schools have become blockchain harvesting amaranth tools?

- How to truly decentralize DeFi?