Portrait of Chinese coin friend: 70% is less than 35 years old, mainly for high-income men

Highlights of this report:

- Summary

- Foreword

- Cryptographic investor portrait

- Cryptographic currency investment strategy

- Prospects for cryptocurrency

- Crypt currency future challenge

Summary

The survey received more than 100 Chinese cryptocurrency investors' feedback through questionnaires and interviews. According to the survey data, China's cryptocurrency investors are dominated by a group of young, strong, high-income and high-income people. Although most investors do not enter the market for a long time, they are more concerned about Bitcoin, preferring to be heavy and long-term, and they are generally optimistic about the prospect of Bitcoin. 30% of investors predict that Bitcoin will reach 30,000 in the next 12 months. The US dollar, and security and compliance issues are their biggest concerns about the investment platform. At present, investor education for cryptocurrency is still lacking, and the market potential of cryptocurrency financial services is huge.

Foreword

- Lawyer's point of view: Bitfinex litigation is getting worse, but USDT's long-term risk is still controllable

- Bloomberg: Bitcoin will be in the long-term between $8,000 and $20,000

- National Currency Magic Curse: A Digital Currency Discovery Tour in Latin America

In 2008, the US subprime mortgage triggered a global financial crisis, and the credibility of the traditional financial system was severely hit. In this context, on November 1, 2008, Satoshi Nakamoto published the Bitcoin white paper "Bitcoin: A Peer-to-Peer Electronic Cash System" and in January 2009, created the first district. Block – Bitcoin creation block. As a result, the human world has entered a new era of cryptocurrency finance.

Inspired by Bitcoin innovation, password geeks, IT experts, evangelists, entrepreneurs, and investors go forward and explore the unknown in the new world of blockchain opening, looking for forests and realizing their dreams. After ten years of development, the world of cryptocurrencies is still weak, but it shows a tenacious life force. In June 2019, Facebook launched the Libra project white paper, which further allowed the world to carefully review the blockchain and cryptocurrency.

As of August 2019, the market value of cryptocurrencies reached approximately $270 billion, of which Bitcoin accounted for more than 60% of the market value, valued at $180 billion, and Bitcoin has become the world's eleventh largest currency. In terms of market value alone, Bitcoin has surpassed the sovereign currencies of Brazil, Canada, Mexico, Australia and South Korea, second only to the Russian ruble.

In order to better understand the characteristics and behavior of Chinese cryptocurrency investors and explore the future trend of cryptocurrency investment, PayPal Finance took the lead and jointly linked the chain, the chain and the Planet Daily to jointly carry out this in-depth investigation of Chinese crypto investors. . Through the issuance of questionnaires, we have extensively contacted hundreds of cryptocurrency investors, and selected a small number of investors to conduct interviews, combining data analysis with qualitative judgments. On this basis, we released the PayPal Financial 2019 China Cryptographic Investor Wealth Report. 》. This is the first in-depth study of Chinese cryptocurrency investors. We expect this report to help regulators and partners deepen their understanding of the cryptocurrency industry and promote the further healthy development of the cryptocurrency finance industry.

First, the cryptocurrency investor portrait

The R&F, Kochi and high-income male groups are the mainstream of cryptocurrency investment

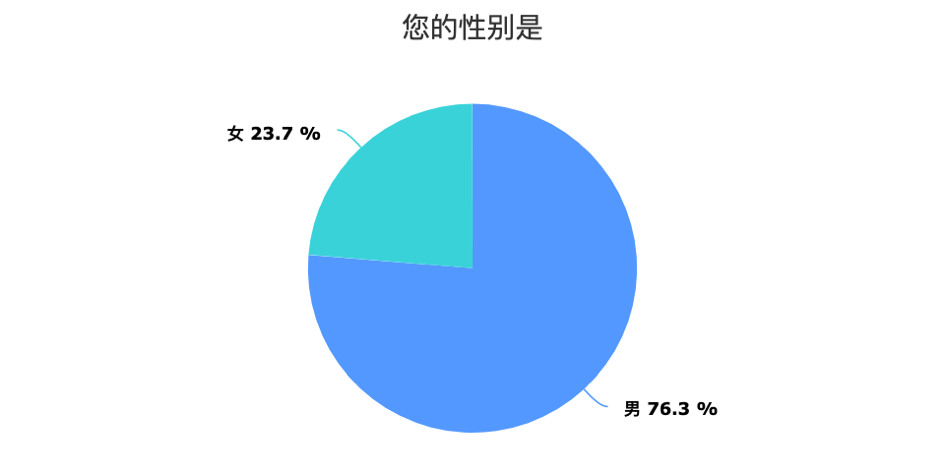

1. Male is the main investor in cryptocurrency

2. The cryptocurrency is favored by young and middle-aged

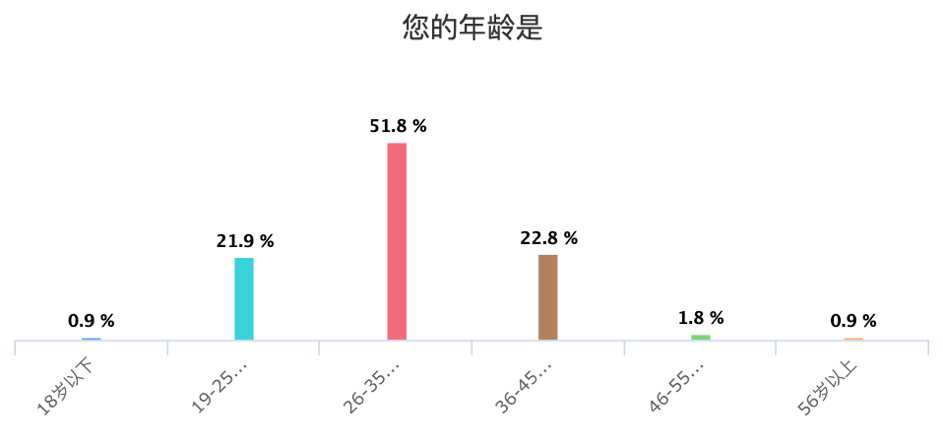

According to the survey data, the holders of cryptocurrencies are mainly young and middle-aged, and belong to the group of young and strong. Among the respondents, 51.8% were between the ages of 26 and 35, and the other 19 to 25 were 21.9%, 36 to 45 were 22.8%, and the 46-year-old cryptocurrency holders were few. .

3. Cryptographic investors have a "double high" feature of high knowledge and high income

1) Kochi group is the main population of cryptocurrency investment

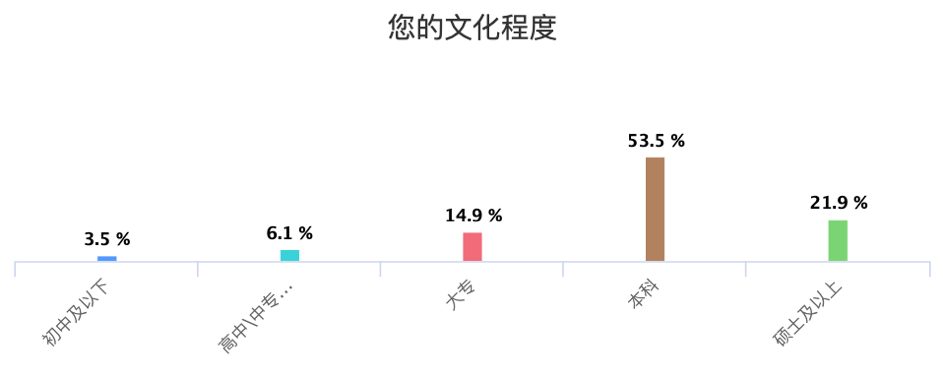

Due to the high cognitive requirements of cryptocurrencies, the overall level of education of investors is also high, which is also confirmed in the investigation. According to the survey data, 53.5% of the respondents have a bachelor's degree, and 21.9% have a master's degree or above, while those below the high school level account for less than 10%.

2) Middle- and high-income groups are more inclined to invest in cryptocurrency. The income level of cryptocurrency investors is mainly middle-to-high income. About 46.4% of the respondents have monthly incomes of between 1-3 million yuan and 14.3% in 3-5. Between ten thousand yuan, a few people with high incomes have a monthly income of more than 50,000, and a monthly income of less than 10,000 is only about 30%.

Second, the cryptocurrency investment strategy

Investors have not entered the market for a long time, but generally prefer Bitcoin, and are more willing to hold heavy positions and long-term holdings.

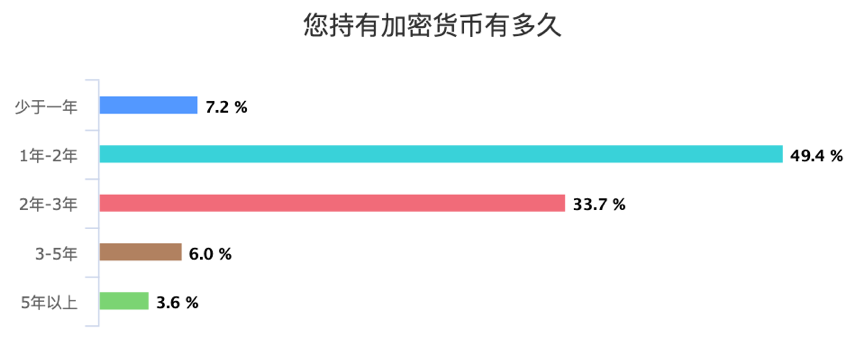

1. Eighty percent of investors have entered the venue for less than three years:

The vast majority of respondents started to hold Bitcoin in the last 1-3 years, accounting for 83.3% of the total, while only 3.6% of the respondents who held cryptocurrency for more than 5 years.

This shows that the ICO bubble and the crazy rise that began in 2016 attracted the attention of a large number of people to the cryptocurrency. Despite the bursting of the bubble, it also brought about the popularity of bitcoin awareness, leaving many investors.

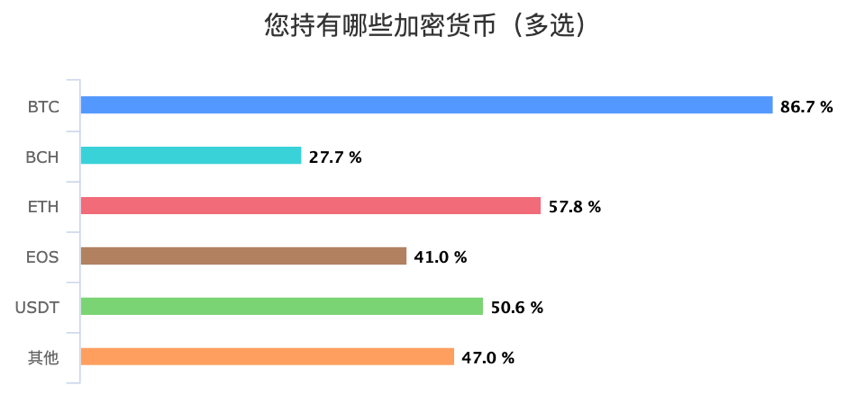

2. Bitcoin status is difficult to shake

From the perspective of holding cryptocurrency distribution, Bitcoin is still the most recognized investment choice, with 86.7% of respondents holding Bitcoin. Secondly, the highly recognized cryptocurrencies were Ethereum, Stabilized Currency USDT and EOS, with 57.8%, 50.6% and 41% respectively.

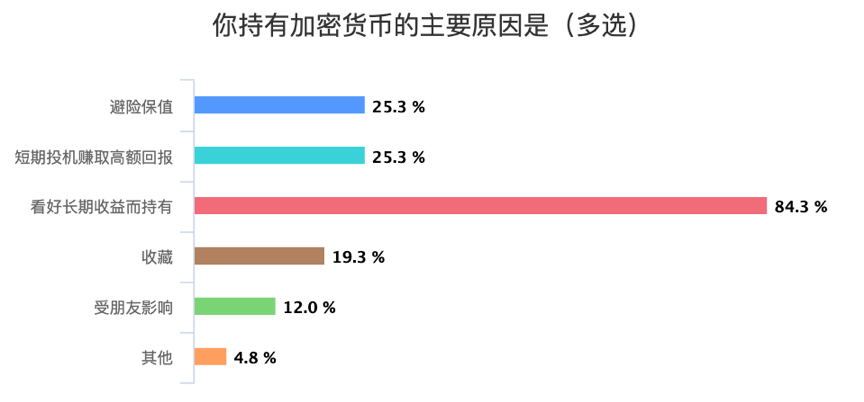

3. Most investors are optimistic about cryptocurrency for a long time

Optimistic about the long-term gains of cryptocurrency is the reason why most respondents hold cryptocurrencies. 84.3% of cryptocurrency holders said that they held cryptocurrency because they were optimistic about their long-term benefits, and 25.3% chose safe haven as the reason for holding cryptocurrency. The proportion of short-term speculators also reached 25.3%.

Column

Global economic turmoil drives investors to choose cryptocurrencies

In the eyes of many Bitcoin investors, Bitcoin has become a safe haven. They all agreed that under the background of the US trade war against China, the global economic growth situation is grim, and the turmoil in the stock market will inevitably further promote the safe-haven characteristics of Bitcoin, which will trigger a new round of price increases.

Panos Mourdoubout, columnist, professor and head of the Department of Economics at Long Island University, said that "bitcoin is becoming a new gold." He explained, "China holds more than one trillion US dollars of US Treasury bonds. If the trade war escalates, China may start selling these bonds." This is because the profitability of funds forces these funds to seek a relatively stable market. Avoid it. And if these bonds are sold, the funds will flow to other US Treasury bonds, such as German government bonds and Japanese government bonds. Bitcoin, as a means of value storage, will be favored by a large number of institutions, traditional investors and investors with idle investment funds.

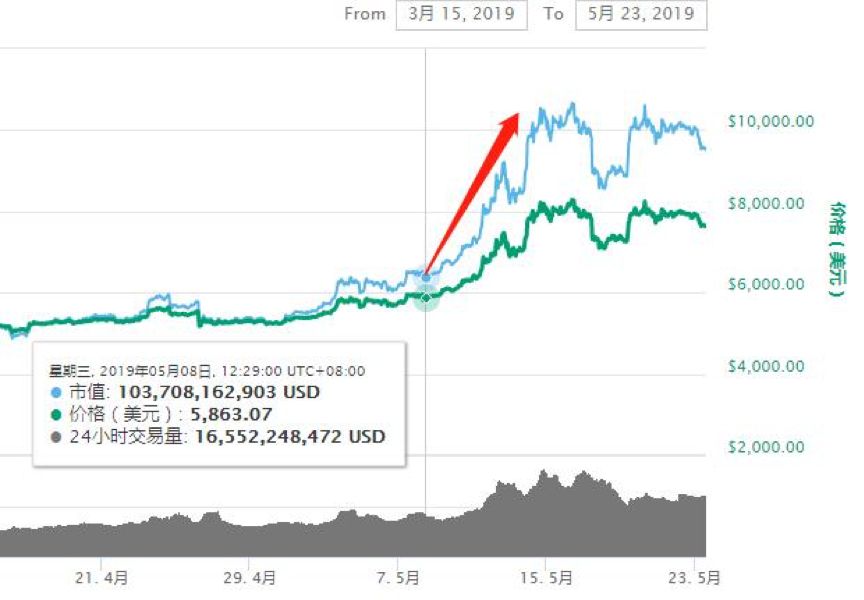

What can be seen is that since the United States announced the start of tariff increases in May 2019, US stocks are under pressure, and bitcoin has gradually increased in price, almost doubling from more than 6,000 US dollars, and the highest is about 14,000 US dollars. Obviously, for investors, Bitcoin has become a safer “safe haven”.

(The chart of Bitcoin after the US announced an increase in tariffs on May 8)

(The chart of Bitcoin after the US announced an increase in tariffs on May 8)

The respondent Xiao Wang, who has a mining background, agrees. According to him, there are already a lot of capital, especially the addition of state-owned capital, in the purchase of hardcore assets in the blockchain industry – mining machines, joined the mining army. This made him more confident in the subsequent rise of Bitcoin.

Once the consensus of this safe haven is recognized, the price of Bitcoin is bound to lead to a new round of gains. On the morning of August 8, the price of Bitcoin began to rise from 9:00, and within half an hour after the RMB exchange rate against the US dollar broke, the price of Bitcoin rose rapidly by US$200 within half an hour. This is because investors believe that the uncertainty of the global economy has increased, which has created a risk aversion and promoted this wave of gains.

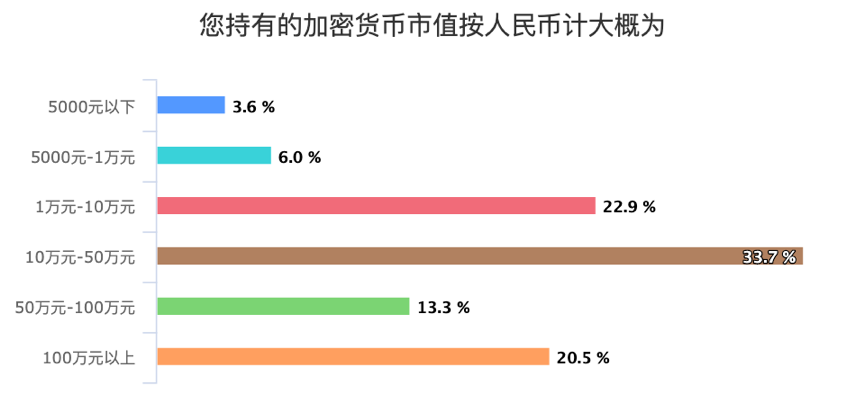

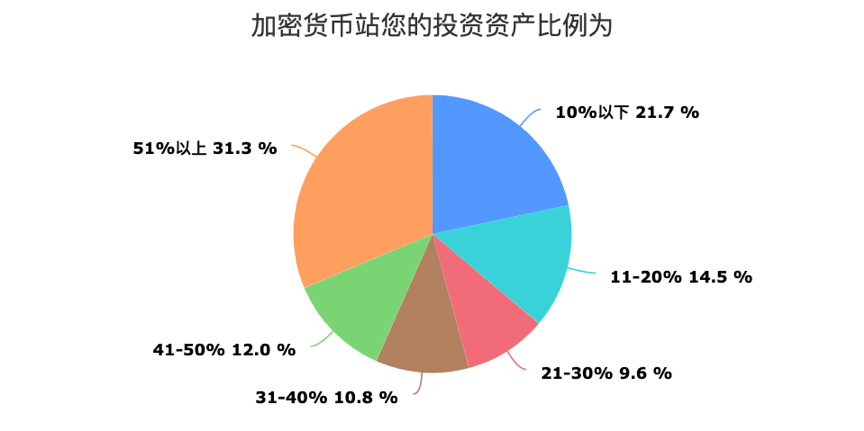

4. Cryptographic investors prefer to hold heavy positions

The value data of the cryptocurrency held by the cryptocurrency investor shows that about 33.7% of the investors have a cryptocurrency value of 100,000-500,000 yuan. However, there are also a few heavy investors, and 20.5% of investors say their crypto assets are worth more than one million yuan.

In terms of investment proportion, 31.3% of investors said that the proportion of investment in encrypted assets exceeded half of all their investments, and another 12% said that the ratio was between 41-50%, and 10.8% said at 31-40. Between %, a total of more than 50% of respondents hold cryptocurrency as a proportion of investment assets more than 30% abroad. Investments that are sufficient to see cryptocurrencies are increasingly favored by everyone and become an important asset allocation path for investors.

Interview:

Respondents: Senior brokerage practitioners bought Bitcoin in the second half of 2018, and the current profit is about double.

Q: What is the forecast for Bitcoin's trend in the coming year?

A: The feeling will still rise, because the function of bitcoin risk avoidance is gradually formed. It is not highly correlated with traditional investment products. It is similar to gold, and more can be used as a safe haven. Compared with gold, Bitcoin has the advantage of the Internet, which is more convenient and convenient. It can be said to be a new generation of gold. After all, gold is a kind of thing, it is rare, but it has to find a place to store, and bitcoin is a virtual currency, which can be stored in an electronic wallet, so the convenience of bitcoin is really much higher.

Q: Are there any investments in stocks, bonds, real estate, etc? What is the proportion of encrypted assets?

A: It may be about 10%-20%, because the house is a heavy asset of the Chinese, and everyone has more assets in the house. Not particularly optimistic about domestic stocks, so I didn't participate too much.

Q: What is your current investment strategy?

A: The fluctuations in Bitcoin are relatively large, and strictly speaking, it is not suitable for trading. I feel the best way is to hold.

Q: Do you think about futures contracts?

A: I think it's still necessary to be cautious, because the norm is not enough at this stage, so as a general individual investor, many rules may be detrimental to investors.

Q: Have you introduced cryptocurrencies to your friends? What is their attitude?

A: This actually has a threshold. It may be difficult for some older comrades, at least the Internet and some IT knowledge.

Q: How do you evaluate the impact of Facebook's Libra?

A: The first one is definitely a good thing, because it at least raises the digital currency from the private to the top company is a qualitative change, and will let more people have a more positive blockchain. A perception of the direction. Therefore, this is actually an epoch-making event. Digital currency has really come to the fore. From government to regulation to financial institutions, whether it is good or bad, there is no opinion, at least this has already appeared. This is a very important thing.

Third, the prospect of cryptocurrency

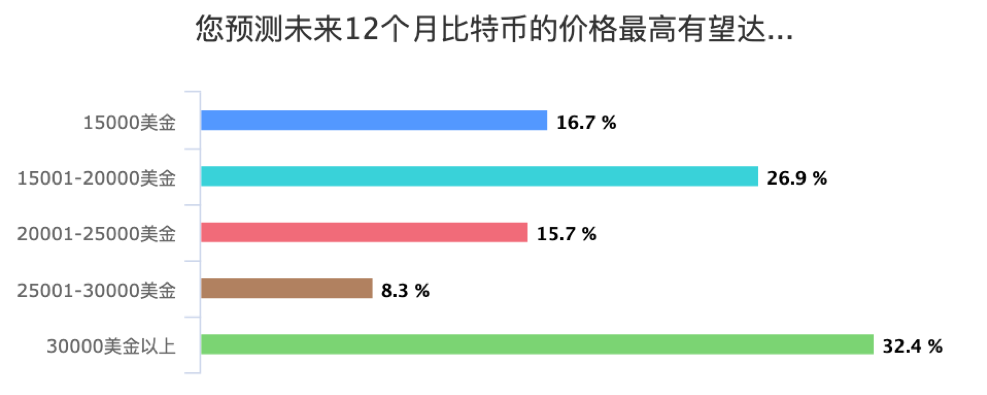

Investors are generally optimistic about the prospects of Bitcoin, and 30% of investors predict that Bitcoin will reach $30,000 in the next 12 months.

With the hot blockchain and crypto assets, Bitcoin has become more and more concerned, and its value has become one of the most important concerns of investors. In the more than 10 years since the birth of Bitcoin, the price has been like a roller coaster. It has been declared a crash many times, but it has been revived many times. In 2010, the price of Bitcoin was only 0.003 US dollars per piece, and the highest price in 2017 was 1989 US dollars per piece, which has increased by more than 6.5 million times. Bitcoin then entered a downward trend, and the rebound was weaker than once, until it reached the end at the end of 2018, only $3,122 per piece.

According to this survey, most investors are bullish on Bitcoin in the next 12 months, and even have very optimistic expectations, and believe that they will double. 32.4% of respondents believe that Bitcoin is expected to rise to over $30,000 in the next 12 months, 8.3% will be between $25,000 and $30,000, and 15.7% will be in the range of $20,000 to $25,000. between.

Column

The bull market will not be late and will not be absent

——Analysis on the expected trend of bitcoin price

( 1 ) The climate that affects bitcoin prices:

1. US Treasury bond interest rate is upside down, indicating economic downturn and loose monetary policy

The upside down of the US debt interest rate curve is a forward-looking indicator of the US economic recession and the loosening of the Fed. With the 10-year US Treasury yields below the 1-year yield, the US Treasury yield curve has been upside down for the past nine recessions, with an average lead time of 14 months. The short-term three-month US Treasury yield is higher than the 10-month Treasury yield, which means that short-term borrowings need to pay higher interest rates than long-term borrowings. This means that the downward trend in the economy makes the market expectation of the Fed policy to become looser in the future.

The 2018 Fed FOMC meeting minutes show that many officials are pessimistic about the future economic development of the United States. So in December 2018, the United States stopped raising interest rates. In March 2019, the Fed’s FOMC held a “one pigeon and another pigeon”. The dot matrix indicates that it will not raise interest rates again in 2019, and announced the timetable for ending the contraction in September. The Fed’s monetary policy has become a foregone conclusion. That is, the dollar is about to "depreciate." On July 31, the Fed announced that it would cut interest rates for the first time in more than a decade. From a global perspective, the price of goods priced in dollars (such as bitcoin) will rise. At the same time, after the interest rate cut, the liquidity in the market will increase, the public investment is expected to rise, and the funds flowing into the gold and bitcoin markets will also increase, which will help to promote the rise of bitcoin prices.

2. The monetary policy in other parts of the world keeps pace with the Fed’s monetary policy

In January 2019, the scale of social financing in China increased significantly, exceeding RMB 4.5 trillion, which even exceeded the total amount of financing in the past few quarters. In addition, the balance of RMB loans has also increased significantly. This shows that the flow of funds in the market is increasing, facing the risk of inflation and rising prices, which means that the price of bitcoin in China will “rise”.

As of August 19, 2019, according to the Bloomberg Barclays Global Negative Yield Bond Index, the current global negative-yield bonds have exceeded US$16.39 trillion, a new high, and the global monetary policy easing environment has been further strengthened.

(2) The medium climate affecting the price of bitcoin

In the long run, the price of bitcoin is not random, but has mathematical laws. Excluding the influence of human factors, the bitcoin price and time are horizontally parabolic, and have an exponential relationship with the number of users (the log function, the S-curve, the number of users using the active address as an indicator).

Except for the exceptions of the three periods of 2011, 2013 and 2017, the logarithm of the bitcoin price and the time are horizontally parabolic, as shown in the following figure. The abscissa is the time since July 16, 2010, and the vertical axis is the logarithmic coordinate of the bitcoin price.

The exceptions for the three periods of 2011, 2013 and 2017 are mainly due to outside manipulation of the Bitcoin market. For example, in the big bull market in 2013, Mentougou continued to use the robots Markus and Wiley to purchase Bitcoin in large quantities to push up the price of Bitcoin. In 2017, Bitfinex's massive issuance of USDT was one of the driving factors for Bitcoin's climb to nearly $20,000. These human factors may be the main determinants of short-term price and liquidity, but in the long run, bitcoin prices are still going to return to real value.

Excluding the influence of human factors, the relationship between bitcoin price and number of users is an exponential relationship. This is a class of equations that biologically describe the relationship between the number of species over time, so the number of Bitcoin users is "growing like a virus." The growing number of Bitcoin users also means an increase in the number of people who recognize and accept Bitcoin, that is, the “consensus” of Bitcoin has increased.

Libra's launch will drive a wider audience around the world to start knowing Bitcoin. We also noticed that Bitcoin's price has increased by more than 50% since the launch of the Libra white paper, which confirms the market's relationship between Bitcoin prices and its subscribers. Associated expectations.

How to evaluate the value of consensus? We need to go back to an original question: the value of "money." Regardless of the shells we used in the past, copper coins, or current banknotes, they are actually worthless, just a "value symbol." And they can be circulated, can be used for trading and trading, because most people "recognize" its value, these items can not be created and distributed at will, there is a certain scarcity, and their circulation is based on our consensus. By the same token, the consensus of Bitcoin has increased, the scope of circulation will expand, the circulation rate will increase, and the price of Bitcoin will increase.

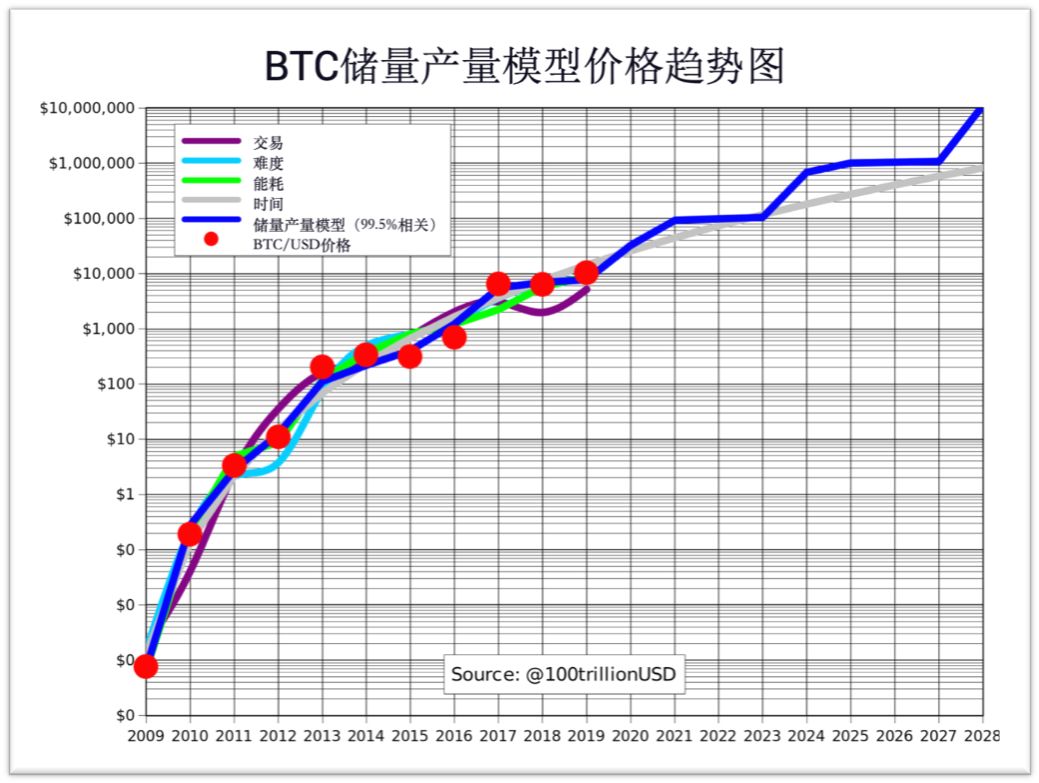

( 3 ) Microclimate affecting bitcoin price: half cycle of bitcoin production

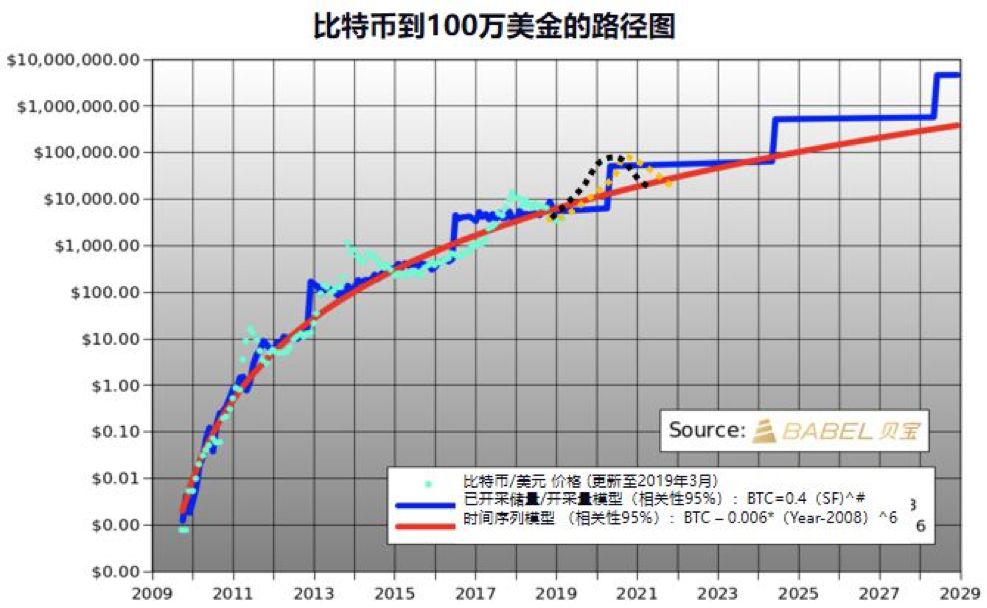

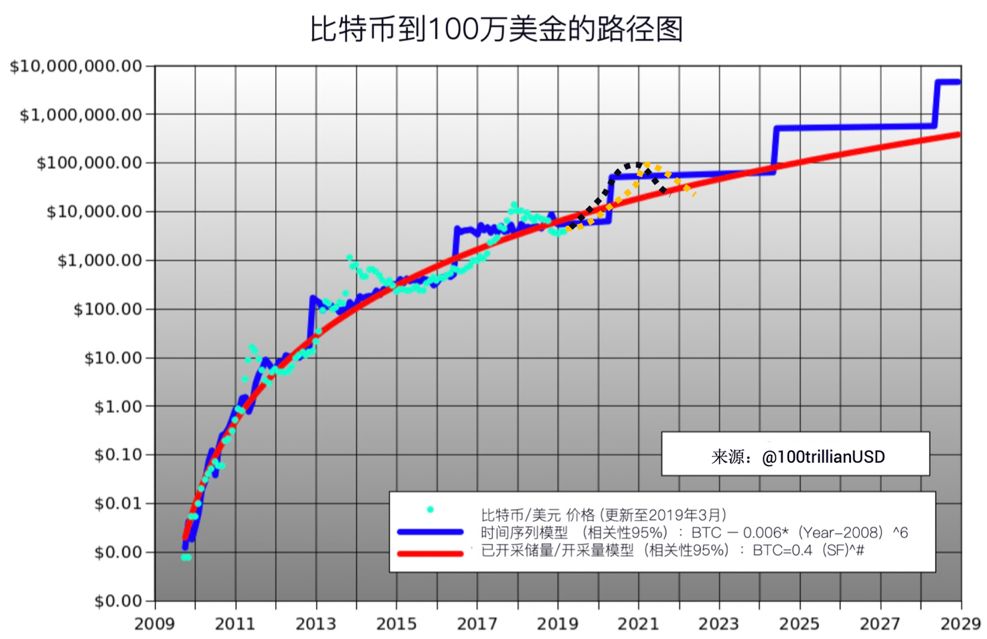

According to forecasts, Bitcoin has 10 months remaining in the halving cycle of May 2020. Each time Bitcoin is halved, the price will increase. We perform the analysis based on a time series model (red line), which is calculated by dividing the daily production by the current production of bitcoin mined.

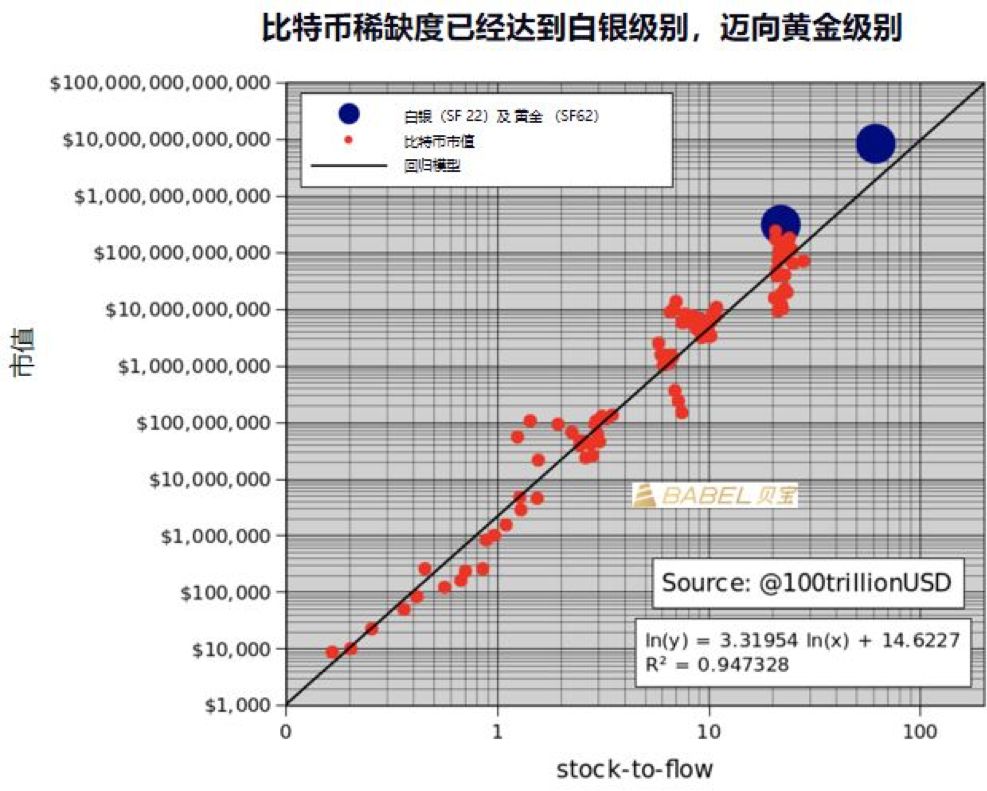

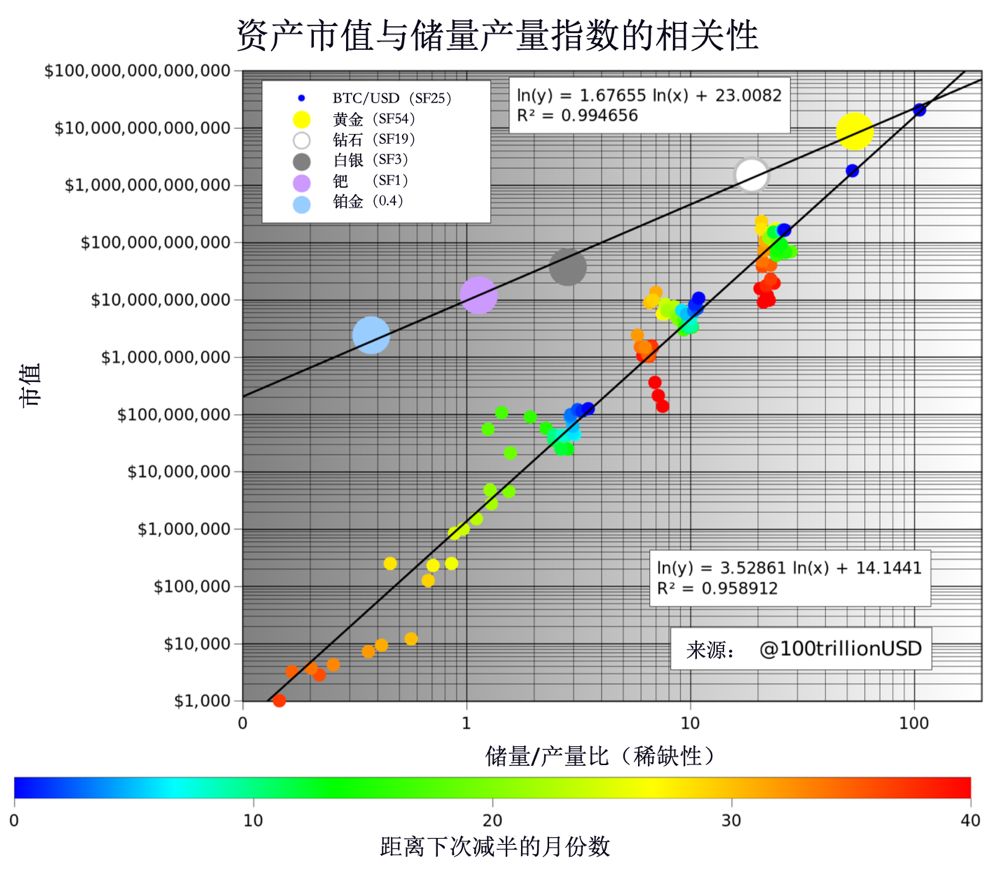

Why is this model useful? This is because the model was originally a gold mining model, and Bitcoin's mining volume and its correlation are as high as 94.7%, so they can be considered relevant. As you can see from the chart, in the past period, the scarcity of Bitcoin is getting stronger and stronger, and it is now able to reach the level of silver. Every time its output falls, the scarcity doubles, which means that after almost two halvings, its scarcity can reach the gold level.

According to this logical analysis, what will the price trend of Bitcoin be like after the next halving?

Past experience shows that Bitcoin will start to rise in the first eight months of halving, and it will start to decline in the first ten months after halving. That is to say, starting from the beginning of October this year, Bitcoin will enter a halving cycle. According to the halving model of Bitcoin, each halving in the past is gradually halved and then gradually keeps up with the price of the model after halving, and gradually surpasses the model price. Therefore, the first possibility of the price trend of Bitcoin is to completely re-enact the history, and then reduce the price of the model after halving (yellow line); the second possibility is due to the hype of professional institutions. Or for other reasons, the price after halving appears before the model price (black line).

Based on the above analysis, it is expected that future bitcoin price increases should grow according to the model, but this is only a user-supported price predicted by the active address, and does not include any manipulation or other changes that may occur in the market. In short, the bitcoin bull market will not be late or absent.

Fourth, the future challenge of cryptocurrency

There is a huge gap in investor education and financial services, and compliance and security issues have become the biggest concern for investors.

1. Insufficient investor education

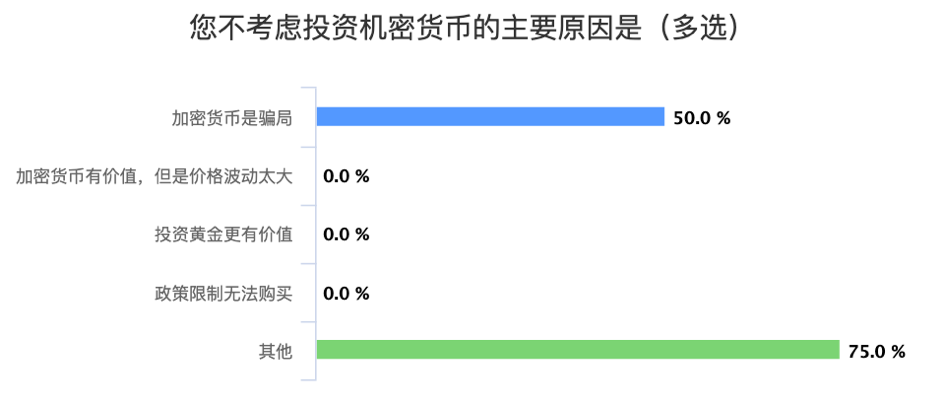

Although Bitcoin has been developed for more than a decade, and the entire cryptocurrency industry has undergone tremendous changes and has been valued by various countries, there are still a large number of people who hold different views on this new thing. From the questionnaire, it can be found that 50% of the respondents who do not consider investing in cryptocurrency still consider cryptocurrency to be a scam.

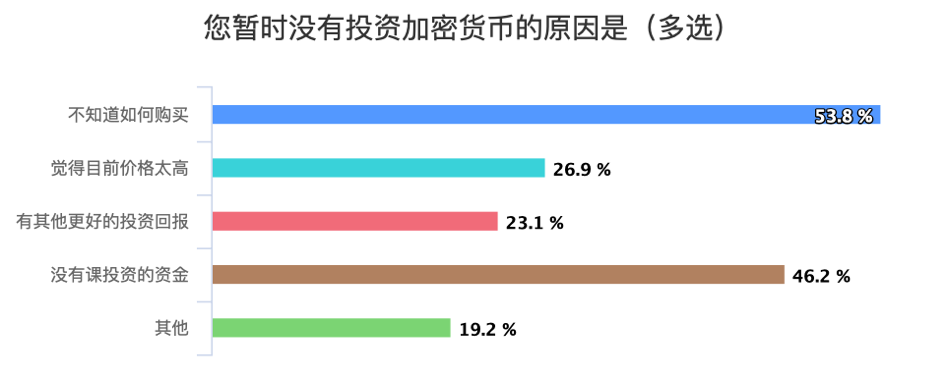

In addition, more than half (53.8%) of investors who are interested in investing in cryptocurrencies have not yet invested because they do not know how to purchase cryptocurrencies.

This shows that whether it is to eliminate the scam image of cryptocurrency, or to let more people know how to invest in cryptocurrencies, it requires a lot of work in cryptocurrency investor education.

2. Platform security becomes the biggest worry

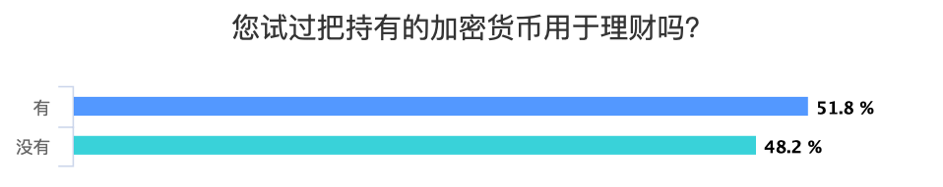

Among the respondents who hold cryptocurrency, the proportion of cryptocurrency held for financial management has exceeded 50%, indicating that cryptocurrency holders are a group with high investment awareness and demand for financial services products. And the willingness to try is stronger.

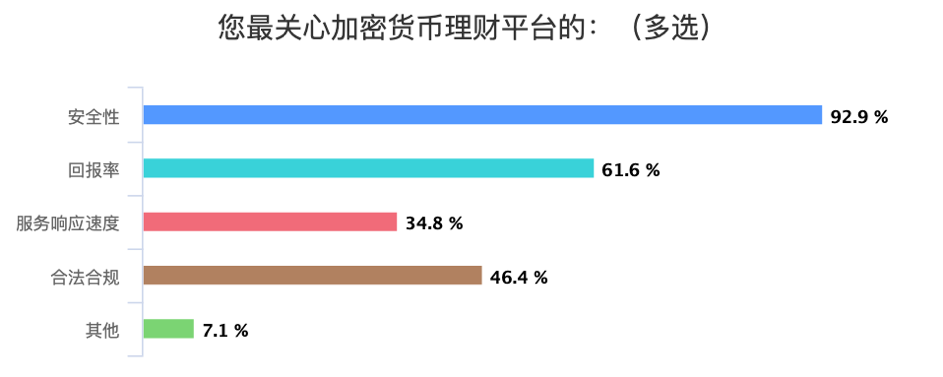

However, from the feedback of the questionnaire, almost all of the investors surveyed valued the security (92.9%) and legal compliance (46.4%) of the cryptocurrency investment platform. During the interview, the respondents also repeatedly mentioned the issue of “regulation and compliance” and said that the compliance of some exchanges and project parties needs to be improved.

The impression of high risk in cryptocurrencies is often related to “hacking”, “fraud”, “wallet vulnerabilities” and “attacks” in reports related to cryptocurrencies in the media. Before the cryptocurrency was recognized by a wide range of investors, the “security” problem must be solved adequately. It is gratifying that many companies have been working to solve the blockchain security protection, but this will be a long exploration process.

In order to respect and protect the request of the interviewee, the interviewers are anonymous, and PayPal Financial reserves all copyrights.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- BTC tests the bottom track of the up channel again. Is the long cool?

- "Don't speculate, let's go to the shoes."

- Observations | Several famous schools have become blockchain harvesting amaranth tools?

- How to truly decentralize DeFi?

- I am not Nakamoto.

- DeFi, why did you go after standing up?

- Big event | Tether is about to launch RMB stable currency