Introduction | Overview of the DeFi ecosystem and major protocols

Summary

As the first in our DeFi series, this article aims to provide an overview of DeFi's ecology and introduce several of the most important protocols. In this article, we analyzed the overlap between Maker and Compound on a user basis. In subsequent articles on DeFi, we also looked at user fundamentals and systemic risks. Keep an eye out for our continuously updated dashboard and Reporting tools to download all the data. We will also continue to push the DeFi Weekly.

Introduction

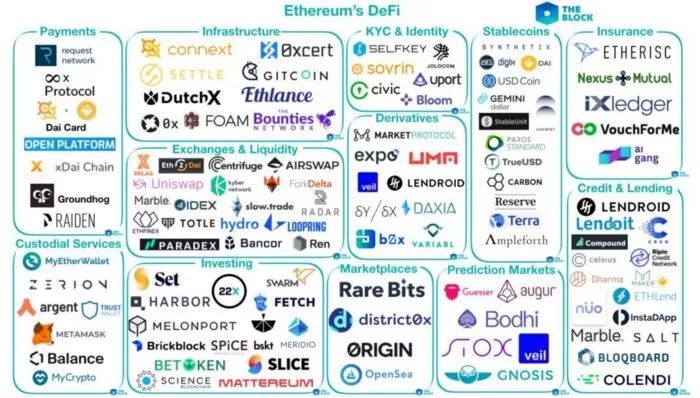

Over the past few months, various projects have emerged in the decentralized financial sector in Ethereum. We took a snapshot of the DeFi ecosystem from the block. The most popular agreements are divided into exchanges & liquidity, derivatives, forecasting markets, stable currencies and credit. We will conduct case studies one by one below.

– Figure 1 – DeFi Ecosystem Classification Overview (Source: https://www.theblockcrypto.com/2019/03/14/mapping-out-ethereums-defi/)-

- Go to the wave of cryptocurrencies! The telecom giant founded in 1881 began accepting six mainstream currency payments.

- New York University Professor: Private Digital Currency Brings Benefits to Governments and Citizens

- Doubt blockchain chain 28 | Let's talk about the pass economy, is it still a panacea?

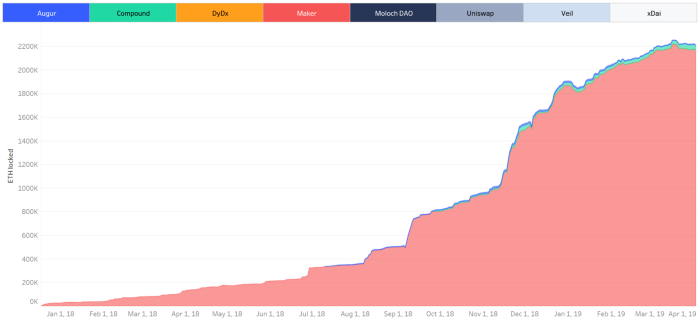

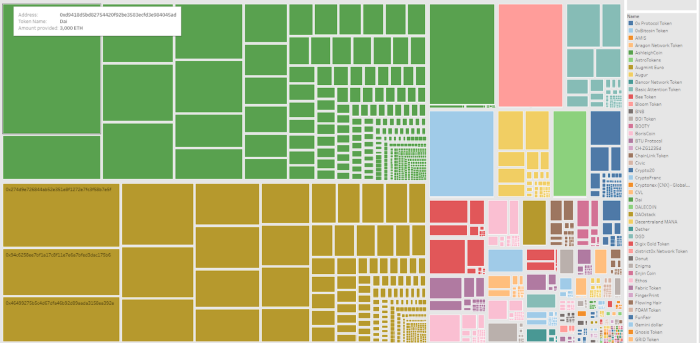

One concern of the community is that a large number of ETHs are locked into these DeFi applications as pledge assets. As of April 25, 2019, more than 2.2 million ETHs have been locked by the DeFi platform, accounting for 2% of the total ETH supply. Among them, Maker obtained the most ETH pledges – more than 90% of the main 6 DeFi projects (see below).

– Figure 2 – ETH locks in major DeFi projects (Source: https://public.tableau.com/profile/alethio.defi#!/vizhome/Overview_15567111639100/DeFiOverview)-

Maker DAO & DAI

What is DAI?

DAI is a cryptographic currency endorsed by pledge assets. It exists entirely on the blockchain. Its stability and anchorage with the US dollar do not depend on any intermediary. The DAI is endorsed by the pledged assets locked by the audited open smart contract.

How is DAI generated?

Through the CDP (Pledge Debt) mechanism, feedback mechanisms, and trusted third parties, Maker uses a range of smart contracts deployed on the main network to maintain the value of the Stabilized Currency DAI. Anyone can use their own ETH to generate a stable currency DAI.

The user who wants to generate the DAI first creates a CDP and then pledges the ETH into the Maker's CDP smart contract.

From a technical point of view, it is not the real ETH that is pledged, but PETH, also called Pooled Ether. First convert ETH to WETH (Wrapped Ether), which is a 1:1 conversion ratio of ERC 20 tokens to ETH. PETH acts as a “ether pool” – after you pledge ETH, you get a certain share based on the pledge. It should be noted that the exchange ratio between ETH and PETH is not 1:1 compared with the exchange ratio of ETH and WETH. Currently, 1 PETH = 1.04 ETH – the specific reasons will be explained later.

The ratio between the amount of ETH that the user pledges and the amount of DAI it generates is called the pledge rate. For example, if 1 ETH is deposited in a pledge contract, the user can generate 500 DAI if the pledge rate is 200% and 1 ETH is worth $1,000. At this point, the control of the ETH is no longer in the hands of the user – after the 500 DAI debt is repaid, the CDP will be closed and this part of the DAI will be destroyed.

If price fluctuations occur in ETH, the price of ETH in CDP falls to near the pledge rate – and there is a risk of liquidation. However, unless the assets in the CDP are liquidated, the user can increase the pledge by mechanism. And vice versa – if ETH appreciates, the pledge rate goes high – the user has two choices. You can choose to generate a new DAI based on the previous pledge rate, or take out a portion of the pledge ETH. Users can also transfer ownership of the CDP, repay all debts or completely cancel the account.

However, if the price of ETH in the CDP falls below the pledge rate and the user does not lock in more ETHs – the CDP will be liquidated. Once this happens, the ETH that is returned to the CDP owner will be deducted from the debt amount, the stabilization fee, and the clearing penalty.

(At the time of liquidation) PETH, which is a pledged asset, will be sold to DAI holders at a discount until the corresponding amount of debt in the CDP is paid off. If DAI is purchased at a premium, the premium portion will be used to repurchase PETH on the market and destroy, thereby raising the ratio between ETH and PETH (1 PETH = 1.04 WETH = 1.04 ETH).

(According to the Purple Book) The life cycle of a CDP can be divided into six phases:

– Figure 3 – 6 phases of the CDP life cycle –

-

Proud (PRIDE): CDP meets excess pledge conditions and does not meet the debt ceiling -

Anger (ANGER): The debt created by CDP reaches the upper limit -

Anxiety (WORRY): CDP's pledged asset prices fluctuate -

Panic (PANIC): CDP pledge is insufficient, or the price of pledge assets in CDP fluctuates beyond the grace period -

Grief (GRIEF): Triggering the clearing mechanism -

Despair (DREAD): Trigger and turn on clearing

Some revelations:

-

Pledged assets can be added to the CDP before the GRIEF phase. -

Pledged assets can only be taken out during the PRIDE phase, and some debts can be paid off during the ANGER phase. -

Ownership of the CDP can be given/assigned to others at any time, including during the liquidation phase. -

Each clearing action has a corresponding phase.

Risk Management: MKR tokens. It is an ERC-20 token that is automatically issued/destroyed based on fluctuations in DAI prices to maintain the price of MKR at around $1. In addition to the stabilization costs imposed by the payment system, MKR holders are responsible for participating in risk management by exercising voting rights. They can add/modify existing CDP categories (currently only support single pledge asset CDP), change the DAI savings rate (not currently used – this is part of the transition to multiple pledged assets CDP), and the choice helps Predictive machines for the precise pricing of pledged assets (appropriate incentives for external participants involved in the quotation), selection of oracles capable of triggering an emergency shutdown, and finally, (under the emergency shutdown mechanism), once sufficient votes are obtained, the voters can Trigger an emergency shutdown (an emergency shutdown can be triggered when a technology update or system encounters a severe attack).

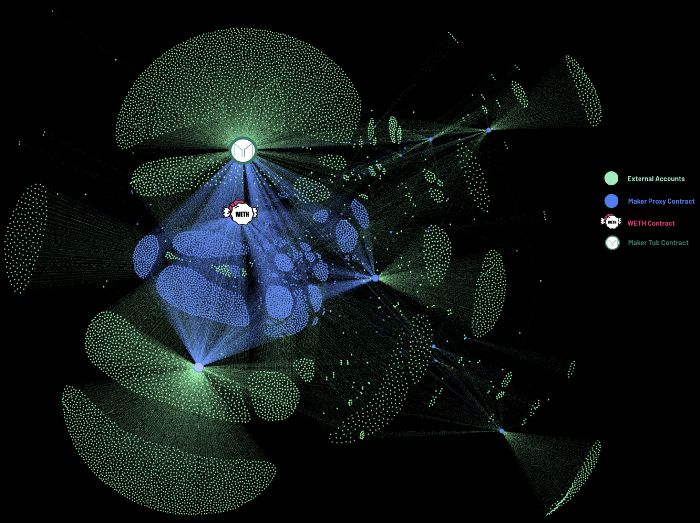

The image above shows the user's situation around the Maker pledged asset pool as of March 12th. The green node represents all external accounts that create CDP and pledged assets in the liquidity pool. Some of these nodes communicate through a proxy contract (blue node), first converting ETH to WETH, then massing WETH into Maker SaiTub, and other nodes sending WETH directly to Maker (that is, the green node around Maker). The total amount of WETH is the total amount of ETH locked in the Maker, currently about 2 million. (* 2% of total ETH supply, around 89% of the main 6 DeFi projects*)

Compound

Compound The protocol on the Ethereum blockchain uses an algorithm to determine the interest rate of its token pool based on the supply and demand relationship of each token. Each ERC-20 token has its own currency market, and its transaction history and historical interest rates are open and transparent.

The user sends the token directly to the Compound platform to obtain a floating interest rate without having to negotiate with the counterparty (instead, the borrower borrows the token from the platform and pays the interest rate).

The interest rate of the Compound agreement is not determined by the borrower and the lender, but is calculated based on the theoretical model that the interest rate rises as the demand increases. Every money market has to calculate this, so each token has its own interest rate model—a function of specific token utilization. Of course, the lending rate is lower than the borrowing rate – to ensure the economic stability and sustainability of the agreement.

What are the advantages of borrowing on the Compound platform?

The money market generates interest in real time and provides full liquidity – so users can view and withdraw their balances (including interest) at any time. Long-term holders can put their tokens into the money market and get an additional income.

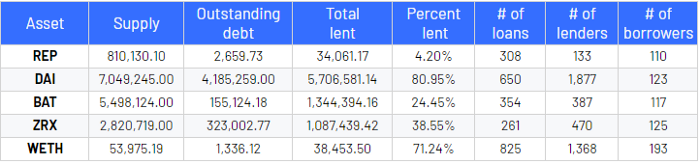

Platform usage

The table above summarizes the token usage on the Compound platform. The easiest way to determine supply and demand and its impact on interest rates is to look at the amount of the loan, the number of credits, and the number of borrowers. Another interesting indicator that explains the reasons for higher interest rates is that DAI and WETH are the two types of tokens with the most borrowing, as indicated by the percentage of lending at a given time to the total supply.

Token exchange: Uniswap

Uniswap is an agreement to automate token transactions on Ethereum. According to a post by Vitalik on Reddit, Uniswap is a series of smart contracts deployed on the main web. This platform does not have its own native token (it actually aggregates more than one token, and will be more and more later), without a centralized order book, the platform and platform creators do not charge any fees (liquidity provider) And the user will charge a fee). At present, 30,000 ETHs are locked on the Uniswap platform, and this number alone is enough to make Uniswap among the top five DeFi platforms. However, this amount does not represent all the tokens pledged on Uniswap – after that, Uniswap became the world's third-largest value-locked DeFi platform (after Maker and Compound).

Uniswap works primarily by creating separate currency markets for different ERC 20 – ETH token pairs. Everyone can deploy a smart contract on this platform to create a new exchange for any ERC 20 token. These smart contracts will stock some ETH and related ERC 20 tokens. Then, ETH is used as the trading medium to match the transactions between the two tokens – all smart contracts are connected through a register, and the register is used to record the transaction information. These tasks are completed by the uniswap_factory contract, which is both a factory and a register. Users can deploy a trading contract for the new ERC20 token using the createExchange() function.

Traditionally, on a centralized exchange, the way users provide liquidity is to choose a few price points to make a trade – either a buy order or a sell order, or both. All trader orders are recorded in the order book. However, at Uniswap, the liquidity of both parties of the transaction is brought together and then automatically marketed according to the algorithm. Uniswap has a very obvious feature – that is, liquidity will never be exhausted. It is true that such an exaggerated goal cannot be without sacrifice. The approach taken by the Uniswap algorithm is to increase the token price through a progressive function. So, the more tokens you want to buy at one time – the higher the unit price you have to pay, which creates a trade-off. The predators are no longer able to make big deals, but at the same time – the system is always liquid – there are deals that are made every moment.

What does it mean for liquidity providers?

When providing liquidity to the Uniswap exchange, it is not possible to provide liquidity only to the party to the transaction – this will change the ratio between the two tokens and change the transaction price (actually, x token / y ETH = price), with this change in price ratio, liquidity providers who want to arbitrage will lose money.

Cost structure

1. ETH ➡️ ERC 20 Token Trading

-

Pay 0.3% of transaction fee with ETH

2. ERC 20 Token ➡️ ETH Trading

-

Pay 0.3% of transaction fee with ERC 20 token

3. ERC 20 Token ➡️ ERC 20 Token Trading

-

Use ERC 20 tokens to pay 0.3% of the transaction fee and exchange ERC 20 tokens for ETH -

Replace ETH with ERC 20 by paying 0.3% of the transaction fee with ETH -

The actual transaction fee for tokens is 0.5991%.

Forecast Market: Augur

Augur is a platform on which users can create predictive market projects. In these forecasting markets, players can bet on which results will actually happen. Because the person who guessed the result can be rewarded after the event, people are motivated to contribute wisdom (ie, bet, buy and sell) on different projects, and the final result brings together the participants' predictions.

Creating a market

As long as it is not happening, you can create a forecast market. The creator sets the event deadline and specifies the reporter for the outcome of the event (if the reported result is considered to be wrong, the community can challenge the event reporter). The creator can also choose a source of resolution – to determine the outcome (almost from all sources). It is also necessary to decide the fee that should be paid to the market creator by the person who settles the market.

Market creators also need to pay a deposit: the validity period (paid by ETH, if the market is not effectively settled, will be returned to the creator – based on the number of recent invalid results, used to motivate the creator to open a clear forecast market) and Default Margin (Pay with REP – will only be returned to the creator when the designated reporter submits the report within three days – this will motivate the creator to choose a reliable reporter so that the forecast market closes as soon as possible) .

transaction

The bet on the outcome of the event is achieved by trading shares. In fact, when users buy and sell "shares" of different results in the market, they use ETH to bet on different outcomes. Augur's pairing engine creates a complete set of shares, and all shares of each possible result are included.

report

Once the event corresponding to the forecasted market actually occurs – the market will determine it based on its outcome and begin liquidation, and the benefit-driven predictor acts as the reporter and states the true outcome of the event. The REP holder may participate in the report and make a final appeal to the outcome of the incident.

Market settlement

User Overlap Analysis – Maker & Compound

Among all the protocols mentioned above, the only two shared market agreements (see the “Loan” column in the lower right corner of the first picture) are Maker and Compound. These two protocols happen to be the two largest protocols so far (the Maker is a few times larger than the Compound). Therefore, you can analyze their user base.

The users of Maker are those who create CDP, and the users of Compound are both borrowers and borrowers, because both are equally important to the platform. The difference is that the Maker user locks ETH (creates CDP) to borrow DAI, and the user of Compound can be either the borrower or both, or both.

475 debits on Compound (2549 borrowings)

-

230 users have had 1 borrowing -

135 users have had 1 to 5 borrowings -

54 users have had 5 to 10 borrowings -

More than 10 borrowings occurred in 55 users (7 of them have borrowed more than 50 times, up to 171)

-

1527 users have had 1 loan -

1133 users have had 1 to 5 loan actions -

338 users have had 5 to 10 loan actions -

199 users have had more than 10 loans (four of them have had more than 100 loans, up to 160)

-

6 CD users have created 1 CDP -

1091 users created 1 to 5 CDPs -

91 users have created 5 to 10 CDPs -

28 users have created more than 10 CDPs (two of them have created more than 1000 CDPs – 1360 and 4893 respectively)

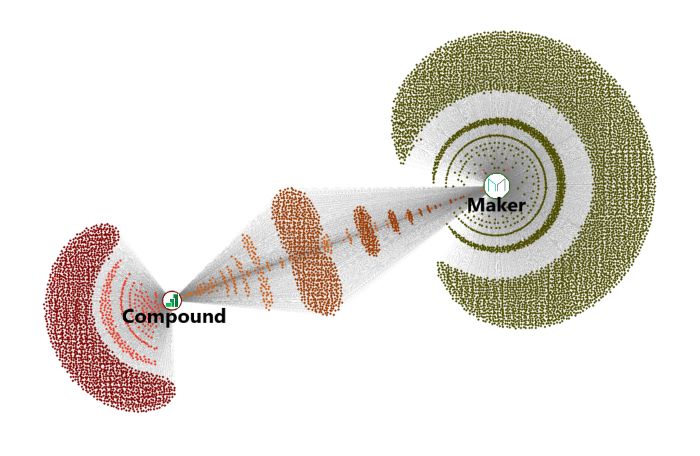

From the above total of 30,353 behaviors (corresponding to the shape shown in the figure below, in order to avoid too clutter, some of the behaviors are not shown in the figure, currently only 11109 behaviors are shown in the figure – in the figure, one line is shown) It can be seen that there are a total of 9539 addresses that generate these behaviors (one point in the figure).  – Figure 9 – Network diagram of user overlap between the two major lending platforms –

– Figure 9 – Network diagram of user overlap between the two major lending platforms –

At first glance, we'll notice the difference in size between the two platforms, the sheer number of addresses between the two (and a few other addresses pointing to only one of the platforms) and the ring around the nodes representing Maker and Compound. Shape. Let us describe these sets of addresses to better understand the content of the above figure. First, you can think of the nodes of Maker and Compound as having some kind of "gravitational". The closer they are to the nodes, the more interaction they will have.

The largest set of addresses in the middle, that is, the addresses that interact with the two protocols, there are approximately 775, and the amount of interaction between these addresses and each protocol is equal or approximately equal (with two protocols each 1- 2 interactions).

Each group address distributed on both sides is an address that interacts with two protocols, except that which protocol is more "gravity" and more with which protocol. In other words, the closer the distance between these groups of addresses and the protocol, the more interactions with this protocol. For example, we see the reddish-brown dots near the Maker in the graph—all of which represent users who have more CDP creations (10 or more) and only have 1 interaction with Compound.

The same is true for users who form the halo part around the protocol. The outermost aperture indicates only one interaction. One aperture inside indicates two interactions, and so on. We mentioned it before. For example, you can see the address of 4893 CDPs created ( where 1/7518 users create a CDP of 1/4 of the total, and 3/1000 users create a CDP of 1/2 of the total! ) It overlaps with the Maker's nodes (it's hard to see in the picture, but you can find it next to the letter "k").

Of all accounts (3318 users on Compound and 7518 users on Maker), 1223 addresses interacted with both protocols. In terms of percentages – 37% of users on the Compound have created CDP on Maker. Similarly, 16% of users on Maker have borrowed on the Compound platform.

Disclaimer: Alethio has no preference or bias for any of the items described in the article. The agreement discussed in this article is limited, and we will discuss more projects later, making our views more comprehensive. Alethio insists on maintaining neutrality by providing facts and best arguments based on objective facts and/or verified information. This article is by no means a guide to malicious conduct or trading advice. (Finish)

(A lot of hyperlinks are provided in the article, please click to read the original text to get the EthFans website)

Original link:

Https://medium.com/alethio/the-defi-series-an-overview-of-the-ecosystem-and-major-protocols-da27d7b11191

Author: Alethio

Translation & Proofreading: Min Min & A Jian

(This article is from the EthFans of Ethereum fans, and it is strictly forbidden to reprint without the permission of the author.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Lock in a million dollar BTC and earn $1 a day! What is the lightning network node map?

- QKL123 market analysis | When the market is extremely scared, the greed! (0821)

- Sichuan floods, millions of bitcoin mining machines washed away by water

- Why do I have to quit the coin, All in shoes?

- How to enter the Vietnamese blockchain market? We chatted with the biggest public chain and the first movers in the country.

- Research | What is the relationship between the difficulty of bitcoin mining and its price?

- Cryptographic currency and Stockholm syndrome