Digital currency lending platform Dharma locks down nearly 75% in 30 days. System manual settlement decentralized doubt

Dharma's decentralization is a false proposition. The system does not have an automatic clearing function. It needs manual settlement. The borrowing is approved by a centralized organization. The source of currency information, interest rate information, and platform development and update are centrally controlled.

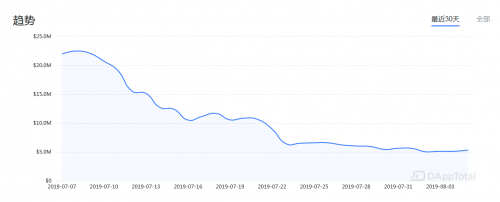

The decentralized lending platform Dharma's chain-locked assets continued to decline. According to DAppTotal data, Dharma's chain-locked assets decreased by nearly 75% in 30 days. As of August 5, only $5.33 million remained.

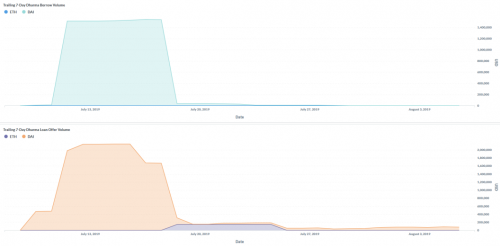

From the Dharma platform loan data, DAI's borrowings from Dharma from July 18 to July 19 decreased from 1.53 million to about 40,000, a decrease of 97%. DAI's loan disbursement decreased from 1.66 million on July 18 to 6074 on July 20, a decrease of 99%.

- QKL123 market analysis | risk aversion continued to ferment, bitcoin attacked 12,000 US dollars (0806)

- Conversation Boca founder Gavin Wood: I don't want people to be slaves to tokens

- What kind of logic is Bitcoin “artificial bull market”?

On July 25th, Dharma's administrators said in their Telegram community that they will close the Dharma platform's lending function from July 25, and there will be a series of good news in the next few weeks. The team is fully upgrading the Dharma platform. If the user has a pending loan request that has not been matched, he can withdraw the money at any time. However, the favorable forecast released in advance did not improve Dharma's loan sales. On the contrary, the user's delay in the withdrawal of coins, closed contracts and other news made the user continue to withdraw money. The platform is currently in a state of continuous asset outflow.

In April of this year, Dharma announced the official opening of a 90-day fixed-rate encrypted lending service, supporting cryptographic assets including ETH and Dai. In a month, Dharma's lock-in assets surged to 10 million. In May, Dharma launched a lending business for the stable USDC, allowing users to lend the USDC at a 1.5x mortgage rate or lend the USDC to other users at an 8% interest rate. Dharma said it hopes to attract more mainstream users to use its products through the USDC lending business. As of early July, the Dharma platform had more than 25 million locks.

However, according to The Block, Dharma's borrowing data from Dharma's May borrowing data fell by 60% from April. According to the analysis, users' confidence in decentralized financial (DeFi) products is declining. The decline in Dharma's platform borrowing may be related to the suspension of subsidized loans in early May, the vulnerability of the website, the system failure for nearly a week, the long waiting time for loan orders and the inflexibility of term options. These factors have prompted Dharma users to accelerate the loss.

In addition, Dharma's contract closure has attracted community attention. In response, its administrator replied in Telegram on July 20th: "Dharma's contract has been closed sourced, and all of our core contracts have been audited by ZK Labs, Trails of Bits, Zeppelin, etc. We received some User requirements for liquidation. Our first version of the system does not have automatic clearing function, so we need manual settlement. For those who have already paid off the loan, we will follow up individually."

It is reported that Dharma is a recently-recognized DeFi (Decentralized Finance) eco-lending product. In Dharma, Smart Contracts acts as a “guarantor” to assess the asset price and risk of the borrower. The creditor decides whether to lend to the borrower according to the evaluation result provided by the “guarantee party”, and when the borrower fails to repay the loan on time, the “guarantee party” automatically performs the liquidation procedure. The Dharma platform has a loan period of up to 90 days and the loan interest is fixed. The lender is locked in during the lending period and only begins to earn interest after matching the borrower.

However, at present, Dharma's decentralization is a false proposition. The system does not have automatic clearing function. It needs manual settlement. The loan is approved by the centralized organization. The source of currency information, interest rate information, and platform development and update are centralized. controlling.

Source: Financial Network · Chain Finance

Author: LornaQ

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Reuters: UN report says North Korea attacks banks and cryptocurrency exchanges to make a profit of $2 billion

- Opinion: Where is the strength of Wal-Mart's currency?

- Multinational privacy regulator issues a joint statement: six soul tortures against Libra

- Decentralized Network Governance: Psychological Analysis of Motivation of Node Cooperation

- Lenovo, Nokia, Anheuser-Busch InBev, etc., have joined IBM's latest blockchain project

- Exploring Zero Knowledge Proof Series | Understanding Zero Knowledge from "Simulation": Parallel Universe and Time Back

- Twitter Pickup: Bitcoin is rising because the Chinese are buying? not at all!