Depth | From the history of currency and payment, Facebook’s “return to the ancestors”

I have to admit that the “payment” in the modern monetary system we often say is also imported, and the verb “to pay” comes from the verb “to pacify”, whose behavior can be traced back to the Middle Ages. Sin money, the victim of the crime, pays a fine to avoid a bloody dispute. In modern semantics, according to the Bank for International Settlements, it defines payment as “a set of tools that guarantee currency circulation, banking processes, and interbank money transfer systems.” (CPSS, 2003c), and thus “Payment” can be simply understood as “transfer of value from one agent to another”. A "payment system" can be understood as a rule and process, as well as an organized arrangement of value transfers. With this concept set, we can open up a simple and interesting review of the history of money and payment development. Please note that this history is slightly different from what we have in the official textbook.

First, the emergence of money and payment

According to research (Stavlianos, 1970; Manning, 2008, etc.), the earliest existing physical medium to be recognized as a currency is the clay token that appeared in the ancient Mesopotamia region. These clay coins are used to record savings and transactions in agricultural products such as barley and wool, agricultural tools, or metals such as silver, similar to current ledgers. And, at least until the BC-17th century, some of the terracotta coins had the documented proof of the exchanged goods and balances, although at the time there was no “account” tool to prove the account owner’s account for the account’s transactions. And ownership of the balance, but during the harvest season, holders of terracotta can obtain a certain amount of barley, or obtain a certain amount of precious metals, such as gold and silver (Davies, 2002; Ferguson, 2008). Interestingly, modern monetary economics theory (Kocherlakota, 1998) has proved that the essence of money is Money is Memory, or “perfect record-keeping is money”. Subsequently, during the BC10th century, the earliest species appeared in the Asia Minor region. Earlier evidence suggests that “credit” can be recorded even before the earliest coin was born, so that the unit of account can also perform some of the functions of the currency. Especially during the BC 20th century, in Egypt under the rule of Pharaoh, religious authorities may have used several different accounting units to record multiple commodity exchange activities between different religious departments (these unified accounting units include beer). , bread and later metal). Subsequently, the religious authorities also use these accounting units to record taxes and fees collected from others.

It should be noted that there are also archaeological clues indicating that the widespread adoption of the accounting unit has promoted the early barter. For example, in the Homeric epic Iliad, the trade of warrior armor, as well as the exchange of gold with slaves, are all based on cattle (Grierson, 1977; Tymoigne, 2006). This is instructive and practical in the history of money development: even if the cow can not be considered a fully mature currency, the use of cattle, or cattle that meet certain growth criteria as the accounting unit will promote the efficiency of commodity exchange, because the accounting unit Standardization helps to reduce the amount of relative prices between commodities that traders need to track , that is, in an economy with n commodities, the number of listings is reduced from n(n-1)/2 to (n-1) (Millard , 2006). It can be seen that the huge demand for so-called stable tokens in the world of a large number of cryptocurrencies can now be explained by such ancient historical evidence that the stable token represented by USDT solves the problem of uniform pricing of more than 2,000 cryptocurrencies. Greatly facilitates transactions between cryptocurrencies.

In addition to the above, some important and interesting factors make standardized accounting units a credit instrument, and the emergence of physical currency earlier than the function of the exchange medium can be established. For example, in the local community, all economic entities are close together and familiar with each other, and personal debt records can be reliably retained through neighborhood relationships and kinship, thus reducing the economy. friction. A historical case worthy of further study is the three banking crises experienced by the Republic of Ireland in 1966, 1970 and 1976 respectively. The longest of these occurred in 1970, when the Association of Banks was closed for six months. During that period, depositors found it almost impossible to withdraw cash from their bank accounts and were forced to find alternative payment instruments. In 1970, the deposits and savings deposits owned by the four participating banks (Irish Bank, Irish Union Bank, National Bank of Ireland and Ulster Bank) constituted 85% of the Irish money supply. Although these banks were closed during the crisis, banks and foreign banks were still able to operate and mainly provide services to enterprises. In addition, people close to the UK and Northern Ireland borders can take advantage of Northern Ireland's banking services, and some even try to use the banking services provided by the UK. Since the exchange rate of the Irish pound against the British pound was fixed at 1:1 during that period, the Bank of England's notes were freely accepted at face value in the Republic of Ireland, so there was no exchange rate risk. In fact, during the tourist season throughout the summer, British tourists brought Ireland a much-needed currency in the form of pounds, helping to ease the crisis. The total amount of British currency circulating in Ireland increased from £5 million in April to £40 million at the end of the crisis. However, the injection of these currencies is limited to specific areas, which makes it more time consuming to penetrate areas that do not have foreign banks and tourists or that are not close to the UK. In three crises, the Irish family found an effective response. When they want to make a payment, they issue a check to the other party. After the crisis, the holder can exchange it for cash. In fact, people print their own currency and act as guarantors of payments. How does the creditor ensure that the cheque issued by the debtor does not jump? The reason is that Ireland at the time was a close-knit society, and people usually only do business in the region. So they may know and trust the debtor, or they may go to a local store or pub to inquire about his credibility when they don't know the debtor (Central Bank of Ireland, 1971).

- Digital currency lending platform Dharma locks down nearly 75% in 30 days. System manual settlement decentralized doubt

- QKL123 market analysis | risk aversion continued to ferment, bitcoin attacked 12,000 US dollars (0806)

- Conversation Boca founder Gavin Wood: I don't want people to be slaves to tokens

Central bank of ireland

Once the transaction relationship becomes more complicated, for example, if the two sides of the transaction are far apart and the parties are unfamiliar with each other, and the powers and responsibilities between the exchange entities cannot be fully guaranteed, the accounting unit needs to present a specific physical object. Forms of expression, such as supply over a certain period of time, must be limited, difficult to counterfeit, relatively easy to carry and transported over long distances. This reflects the fact that even if the exchange entities disclose or share their previous complete transaction history as evidence, the debtor is pale in the face of the creditor’s promise to repay the debt in the future or prove its creditworthiness. This requires a third party to provide Some form of guarantee or guarantee, this can be a public sector with authoritative characteristics, or it can be a private (institution). In fact, cryptocurrencies that claim to “trust the machine” are also inseparable from such third-party institutions, such as highly centralized exchanges (platforms) in business logic.

Of course, some theoretical elements of Modern Money Theory (MMT) can also find its development trajectory in the history of money and payment, that is, the value of money comes from the value of its collateral. It is tangible or intangible. For example, the value of a clay coin as a unit of account is clearly derived from the fact that its issuer promises to accept and recover the unit of account at the time of payment (Tymoigne, 2006). For cattle or coins, the value is attributed to the value of the cow or the value of the (precious) metal, such as the use value of gold or silver for decorative purposes. Therefore, the coinage of a certain material becomes a means of supporting the bookkeeping unit, and its value is determined by the issuer. However, the face value of a coin is usually always higher than the market price of the metal from which the coin is made (Keynes, 1914; Wray, 2004). Otherwise, the holder of the coin will have the motivation to melt the coins held in the hand and then metal. Sold as a commodity. When the banknotes appear, the change in the value of the collateral is directly proportional to the power or influence that the issuer can exercise. For example, in the 13th century Mongolian Empire, Kublai became the first issuer of banknotes (based on legal tender standards), a historical event that reflected his supreme authority. Its subjects accepted the banknotes, and if anyone refused to use the banknotes, Kublai had the power to kill the subjects.

In contrast, in the 1890s, when the politically weak ruler of the Yili Khanate, Keikhatu directly copied the blueprint of the Yuan Dynasty design, and adapted to the local situation by adding Muslim religious beliefs. The concept of banknote circulation was input to the Persian region, and since he did not stipulate that anyone who did not use the banknote as a means of settlement of transactions would be severely punished, the business activities in the area plummeted and stagnate (Morgan, 1987). Of course, history also shows that it is practicable to abandon the death penalty by using a relatively moderate method to force the public to accept a legal currency. For example, a government may decide to issue a special unit of account as a “legal currency”, meaning that the creditor must The legal currency is accepted from its debtor to pay off the debt. In general, the ruling authority (such as the military, religious authorities) or the later sovereign state government before the formation of the state, through taxation or other debt methods, such as various fines, including redemption, created an economic activity relative to The debtor who rules the authority, and the creditor is willing to accept the debtor using the currency instrument it issued to pay the debt created. Therefore, the ultimate source of the value of money is the acceptable level of money instruments that can be returned to the issuer. For example, the gold medal issued by the Kuomintang government in 1948 is worthless. For the government, the value of legal tender money comes from taxation and finance. (Innes, 1913).

Golden Coupon issued by the Kuomintang government

Often, if a government is overthrown, the currency it issues will lose value. Although there is a “cipping” in the Middle Ages in Europe and a traditional “copper-lead” ratio adjustment in China, or the excessive issuance of legal tender in modern society, inflation causes the currency to depreciate, but after the currency has served as a means of payment for thousands of years. Historical records tell us that all payment activities between economic agents do not go beyond simple bilateral relations: one party produces a certain commodity while the other party buys the commodity in cash. Therefore, the above transaction process requires the emergence of bank and bank payments to create conditions for economic development in a more complex way.

Second, the emergence of bank payments

Modern banking has developed from a number of different starting points. The 10th century Arab Muslim gathering area has developed banking business. In the Middle East, the bankers not only engaged in currency exchange and loan business, but also used a variety of fixed payment methods to carry out payment business. Cheques have been introduced from the Byzantine to the region, and other payment instruments, such as suftadja (a deferred payment payment tool commissioned by credit authorization), are not only effectively used in the daily retail business between different cities in the region, but also In the government and large (wholesale) payment business (Ashtor, 1972). Contrary to the Middle East, in the Western Christian community, many regions have a variety of coins from different sources. For example, in the 13th century Venice, money changers have expanded their professional role in the valuation and testing of metal coins. Providing payment services and other banking services based on the deposits it holds (Kohn, 1999; Mueller, 1997). In the 14th century, the two banking families in Florence (the Peruzzi and Bardi families) established a banking network across Europe, enabling long-distance payment within the bank, but in 1348, due to the debt of King Edward III of England Closed by default, other banking families replaced them. For example, the Medici family has a similar network of branches and correspondents in various important financial centers in Europe during the Renaissance. For the next 100 years, the Augsburg family and the Fuggers family, as well as other banking families in southern Germany, provided loans to a number of European elites, especially Spanish rulers (Kindleberger, 1993). In other regions, such as London in the mid-17th century, the embryonic form of the banking industry has emerged in the Goldsmith industry, and similar banking has evolved from providing special services such as safekeeping and convenience facilities.

Spanish gold coin in 1641

Whether the banks in Western countries originate from money changers or goldsmiths, merchants can deposit their own gold coins and get a receipt. Merchants can then trade through a money changer or goldsmith's book, or by transferring their issued receipt. In fact, the discussion of cryptocurrency practitioners about the account paradigm and the so-called token paradigm has also been traced in the history of European banking. The difference between the two paradigms and competition affects the evolution of modern banks through the intermediary's ledger or receipts with token functions, such as the transfer of bank notes. In continental Europe, cross-bank transfer payments based on books and even current accounts have gradually become the mainstream payment method, while banknote payment based on token functions has been eliminated. However, at least in the 19th century before the AC, in the United Kingdom or the United States and other non-Continental countries, the issuance of bank notes is still very common. However, bank payment systems in countries where bank notes are issued will also use account-based payment transfer forms and vice versa. It can be seen from this that regarding the account paradigm or the token paradigm, the two are not incompatible in history or parallel development. Different payment methods also reflect the different costs required to address their inherent deficiencies. Based on the account paradigm-based payment system, it is necessary to verify the identity of the account holder and continuously record the business reputation of the account holder. Such systems are vulnerable to identity theft and costly to keep records. In contrast, the token vouchers of the token paradigm need to verify the authenticity and reliability of the value of the collateral corresponding to the token being circulated, or the degree of credit. With the development and progress of the times, especially with the large-scale application of computers and information technology, the cost of higher identification and continuous recording in the early years has been greatly reduced. The advantages based on the account paradigm are more significant and easier to meet the government. High demand for financial integrity (Kahn and Roberds, 2009).

Interbank clearing and settlement also has a long history of development. After the early 14th century in the AC, the Venetian record seemed to indicate that payers who opened accounts in the same bank could pay between each other by means of book transfer. However, there is no definitive evidence that these banks also use book transfer to conduct peer-to-peer transactions (Mueller, 1997). In fact, a small number of banks in these banks also open proxy accounts with each other like the merchants they serve, thereby providing some means of netting for inter-bank debts and debts, but these banks There is insufficient incentive to develop and form a regulated interbank clearing system arrangement. Following this clue, the settlement system arrangement may be similar to a medieval trade fair, such as the Champagne Market, where most payments take place in the bank, and a series of credits or debits on the initial accounts of the seller and the buyer are subsequently bought in the opposite direction. Incoming and selling offsets, at the end of the trade fair, the remaining (net) amount is settled by coins (Kohn, 1999). The development of the AC in the middle of the 14th century, accompanied by the collapse of a large number of local banks and the decline of market trade, the Venetian began to call for the establishment of a public bank, the bank has the ability to complete the payment process, and can evade the credit risk inherent in bank vouchers. The development of this kind of bank was brewing for more than two centuries, and it was not until 1587 when the Riyadh Bank was established. However, in other parts of the Mediterranean Coastal Trade Zone, the municipal bank (Taula de la Ciutat) was established as early as the early fifteenth century, including Barcelona (1401), Genoa (1407) and Valencia (1408). . Taula allows banks to use a portion of their deposits as reserves and use these reserves to pay off inter-bank payments.

In terms of settlement, exchange of bank notes reduces transaction costs relative to exchange of coins. According to the prevailing rules, commercial banks have a more direct private incentive to accept bank notes from each other. Because this can make the bills of any bank more widely acceptable, and commercial banks can increase their issuance of interest-free liabilities, which in turn increases interest-earning assets, which is a profitable business (Selgin and White) , 1987). At the same time, the opportunity for any bank to overissue bank notes is subject to the right of the counterparty bank to guarantee its redemption of the notes. If a bank over-issues its own bank notes, it may not be able to punish other banks for redemption of the bank notes issued, resulting in insufficient liquidity of the issuing bank, which in turn threatens the ability of the issuing bank to continue to operate. In fact, improving the efficiency of clearing and settlement is an important way to reduce the cost of mutual credit and debt acceptance services provided by banks to customers. Credit and debt acceptance services also have credit risks. For example, a bank goes bankrupt due to insolvency before it pays off its holdings. At the same time, the settlement of creditor's rights and debts is also costly. The cost of paying off debts and debts mainly comes from three aspects. One is liquidation. For example, calculate the amount of funds receivable and payable by banks, and confirm whether the bank settlement assets in the borrower position are available and sufficient (similar to the management of the current net debit limit). ). The second is to maintain a certain reserve as a settlement asset to fulfill the debt payable, which is the opportunity cost. The third is to settle and transport the cost of the settlement assets in physical form.

Throughout the history of payment and liquidation development, the cost of clearing creditor's rights and debts has gradually decreased in technological progress and institutional improvement. After the 1760s, goldsmiths in London launched a banking business that issued bank notes on the basis of coin deposits, and then created currency and currency instruments by issuing bank notes to borrowers. Bank-to-bank bank vouchers are bilateral clearing every few days. The method of liquidation is to settle the (net) difference between coins by coin, thereby reducing the excessive holding compared to gross settlement. The opportunity cost of the reserve. The frequency of settlement depends on the publisher's business reputation. The higher the credibility of the banker, the longer the other bankers are willing to hold the bank notes issued by the bank, thereby reducing the transportation cost of the settlement assets (Quinn, 1997). ). It can be seen that the hidden cost of bank credit risk is converted into the explicit cost of holding and transporting settlement assets, which is a major advance in the history of payment system development.

With the advancement of agriculture and industry in the 18th and 19th centuries, economic activity has gradually increased, requiring more and more distant payments, and the amount and value of inter-bank debt has increased. The corresponding interbank clearing and settlement system arrangements are also becoming more standardized. For example, in 1771, regular bank voucher exchanges took place in Edinburgh, where bank voucher exchanges were made twice a week. Since 1775, the Bankers' Clearing House in London has been conducting daily settlements. When these clearing houses are established, the development of bilateral clearing into multilateral clearing becomes inevitable. The innovation of multilateral clearing further reduces the amount of settlement assets and costs required for banks to meet their net debts. This is another major leap, laying an important foundation for the formation of modern payment systems.

Before 1770, bankers in London no longer used coins for settlement, but used bank notes issued by the Bank of England for settlement. The reason why the bank notes issued by the Bank of England were chosen instead of the bank notes issued by other banks in London as settlement assets, the important reason is that the bank has certain special policy advantages, especially since its bankers are from government delegation. It is the only legal joint-stock bank. For example, throughout the 18th century, British law restricted the establishment of banks to no more than six partners, which means that the funds for these banks to develop their business are limited. On the contrary, the Bank of England has an exclusive exemption from this restriction, which has led to the issuance of a large number of currency notes. In 1797, perhaps earlier, the bank's debt was highly reliable (Selgin and White, 2002). In order to further enhance the credibility of the bank notes issued by the Bank of England, it has issued a seven-day check, which is similar to a bank note, but cannot be paid at sight. Therefore, the possibility of such a check being stolen is relatively small. The settlement of interbank debts through bank accounts can completely eliminate the shortcomings of bank notes in the form of banknotes being easily stolen. With the most fashionable vocabulary available, this seems to be the earliest "smart contract."

Interior view of the Bank of England

Third, the emergence of the central bank

Before the dramatic changes in the American Civil War in 1860, similar banks in the Bank of England and other countries were evolving into “central banks” in their respective countries , but this did not mean that a clearing house or bank should be in a national payment system. The central location is an inevitable trend. For example, in Canada, in the early twentieth century, a reciprocal Bankers Association was established in accordance with relevant laws and regulations, officially using text form to regulate the organizational structure of the regional clearing system arrangements developed in the previous decade. However, as technical constraints continue to weaken, especially in Canada's payment systems, the opening of telegraph communications between different regions, strong economies of scale, push payment systems toward concentration.

It was not until 1927 that the debt settlement of Canadian banks (still using government-issued autonomous territorial banknotes as settlement assets) was concentrated on the Royal Trust Corporation. The Royal Trust Company has nothing to do with the Bank of Canada, which was established in 1935 and took over its settlement function. Similarly, in the United States after the Civil War, a system of common clearing houses was established. During periods of financial instability, its members even issued joint debt vouchers to settle claims and debts. The Fed, founded in 1913, represents a new starting point in the history of US currency development.

Wilson signs the Federal Reserve Act of 1913

Can the private sector be determined to perform this "ultimate pursuit"? The answer given by history is no. For example, the Bank of England became the supplier of final settlement assets at the end of the 18th century. Here is a brief introduction to "final settlement", a term that is extremely important but overlooked by many people. “Final settlement” means that when banks begin to establish mutual creditor-debt relationships, they need to be able to liquidate or “settlement” these claims at a certain point in time, so there is a so-called “final settlement”. “Final Settlement” is accomplished by transferring assets that are generally accepted by banks, and these assets are referred to as final settlement assets. The final settlement asset can historically be a coin, a bank note, a portfolio of assets, and fiat currency. Prior to 1946, the Bank of England had been a private bank of private shareholders who provided banking services to private companies and governments. During the financial crisis that occurred many times in the 19th century, the Bank of England was repeatedly asked by the government and the public to support other banks that were about to close down, but the sharp conflict between private interests and the public interest prevented the Bank of England from fully exercising the public of modern central banks. Function. Such conflicts can also be observed in certain other countries where the private sector is gradually evolving and performing settlement functions.

For another example, comparing the different outcomes of New York and Chicago during the 1907 “Banker Panic” crisis, one can draw a meaningful conclusion: the difference between the two can be largely explained by the response of the local clearing house: New York Clearing House Most of the members are limited to national banks and state banks. The trust company is considered to be a strong local bank competitor and is therefore largely rejected by the New York Clearing House. In Chicago, trust companies, like national banks, are direct members of the Chicago Clearing House. The source of this risk is the trust company in New York. The clearing houses (centers) of both places are ready to provide emergency loan assistance, but in New York, the private interest conflict caused by the competition threat of the trust company has become an emergency loan for New York liquidation. The additional factors that need to be considered when deciding, that is, New York’s liquidation tends to assist direct members such as banks, which makes the NYSE passively responded, so that the various anti-crisis measures of the NYSE ultimately fail, and the Chicago Clearing House treats trust companies equally. The assets of the trust institutions were mastered in a timely manner, and effective measures were taken to quickly control the spread of the crisis. It can be seen that private conflicts of interest have produced different responses to the financial crisis in the banking industry in both places (Moen and Tallman, 2000).

Therefore, only by letting the central bank become the public sector can we finally overcome these conflicts and solve the repeated problems in history. For example, the Bank of England was nationalized in 1946. In the 20th century, in other countries where there was no rudiment of the central bank (whether for reasons of liquidation duties or other reasons), it was a general trend for the government to form a public central bank from scratch. The establishment of the Federal Reserve in 1913 was also the result of a reaction to the 1907 financial crisis.

In the historical process of the central bank becoming a public sector, private banks that control asset-liability and assume central bank responsibilities are also motivated to reduce the systemic threats to the financial system, especially from the payment settlement system itself. Therefore, the function of integrating the functions of the settlement institution into the central bank brings many advantages: under normal circumstances, the bank needs to pay off the debts of each other through an institution; in an emergency, the bank expects to obtain final settlement from the same institution. Assets to supplement the mobility of life-saving. Today, central banks around the world are extremely concerned about ensuring the efficiency, system flexibility and stability of payment settlement infrastructure operations. Moreover, the central bank played a leading role in resolving the systemic risks that may arise during the settlement process. The emergence of systemic risk of payment settlement infrastructure will damage the vitality of modern financial markets, thereby disrupting the smooth transfer of funds from savers to investors and undermining the normal operation of the modern monetary economy. During periods of market turmoil, and even more so, for example, during the financial crisis of late 2007 and 2008, continued trust in financial market infrastructure was essential, ensuring that transactions in major securities markets continued. This shows the necessity and importance of the article borrowing Greenspan's argument.

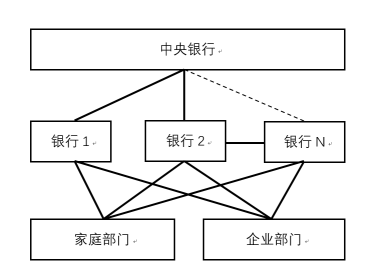

The central bank's supervision and management of the payment and settlement system, and even direct operation, have made the monetary system not only the stratification of M0/M1/M2/M3, which is familiar to us, but also the more essential based on the payment settlement perspective. The currency hierarchy, that is, the central bank's outside money and the inside money. Figure 1 is a good representation of the differences and relationships between the two settlement currencies. The solid line connection between the central bank and banks 1, 2 means that the central bank is the direct provider of the bank's final settlement assets (direct participants), while the dotted line represents the central bank only fulfilling the indirect provision of final settlement assets to bank N Bank 2, which is connected to Bank N, has a direct obligation (indirect participant). The solid line connection between each bank and the real economy department (family department, enterprise department) represents the bank settlement currency, forming various forms of bank deposits. The real economy department believes and is willing to hold the bank settlement currency because it believes its deposit can be freely converted into the central bank's settlement currency (usually cash). If a bank runs out of its own funds or is pledges registered with the central bank to obtain reserves, it loses its ability to purchase central bank settlement currency from the central bank, and its commitment to convert the deposit to the central bank’s settlement currency will also become a document. Not worth it, people will be rushing to convert their deposits into cash, which may trigger a bank run. When necessary, the central bank will perform the “ultimate pursuit” and provide final settlement assets to the bank that will be closed down through the final lender function, maintain the continuity of the payment system operation, and protect financial stability. It can be seen that whether it is involved in the payment settlement function in the historical process, and thus evolved into a later central bank, or a central bank established by the government and relying on the statute to perform its duties, they are naturally responsible for the final settlement assets. It has a specific core mission – the ultimate pursuit of currency stability and financial stability.

Central bank settlement currency and bank settlement currency

Fourth, Facebook's "return to the ancestors" feature

(1) Facebook's "Champagne Market" feature

The “Champagne Market” is not a trading market related to champagne, but an international trade market with an important position in the medieval European continent, located near Paris, France. As mentioned above, the net liquidation in the market adopted by the Champagne Market and the settlement of coins or transaction tokens is an important stage in the history of payment clearing, which greatly promotes the economic development of the medieval European continent. Although Facebook Libra does not specify whether Libra will use Libra for internal fund settlement, such as the card card organization such as Mastercard and the third-party payment institution such as Paypal, such as Uber, Companies such as lyft and Vodafone offer cross-institutional payment settlements with Libra as the unit of account (regardless of whether Libra is accounted for in accordance with accounting standards), but this is fully predictable. There is no doubt that such Libra has the function of “coin” settlement in the “Champagne Market”, but this can only be used inside the “market”, or because it is subject to the limitations of the technical conditions at the time, so that it is external. It is difficult for the settlement assets to be accurately identified by the members of the market, and it is difficult to confirm the credit level of the external settlement assets. The “Champagne Market” is therefore internally settled. Of course, even if Facebook's Libra Association encourages member institutions to use Libra as a transaction token for internal settlement, this is not new.

As early as 2007, I studied the business model of Bartercard International, which is based in Australia, and used partial equilibrium method to model the trade activities of bartercards for bartering. Benefits of non-member institutions (profits): If the transaction token and fiat currency are completely replaced, the existence of the transaction currency does not affect the pricing level of the member institutions, and when the supply of the transaction currency is subject to the “market” Or the control of the "association", then as long as the member institutions conduct more trade in this "market", the more the transaction currency income is obtained, the higher the profit and utility satisfaction can be obtained, and thus the adoption of the transaction currency The internal settlement method is incentive compatible. However, for non-member institutions, the welfare improvement of member institutions is at the expense of the profit and utility level of non-member institutions, so this trade mechanism is not Pareto optimal for society. Further, since both member institutions and non-member institutions have a certain level of monopoly pricing power, the ratio of marginal substitution rate (MRS) of member institutions to non-member institutions is not equal to the marginal technology replacement rate (MRTS) of member institutions providing goods and services. The ratio with non-member institutions, therefore, from the perspective of partial equilibrium, such a transaction token internal settlement scheme is not optimal. What is more policy-making is that the greater the monopoly power of member institutions, the smaller the size of the “market” or the number of member institutions, so that higher profits and utility levels can be obtained. This theoretically proves that the number of member institutions of Facebook Libra Association is controlled by 100 or so monopolistic forces that objectively maintain or even expand the membership of Facebook and various for-profits, thus in fact deteriorating the deadweight loss of consumers. (deadweight loss).

(2) 1:1 reserve issuance method

Therefore, it is good for Libra, or for other so-called stable tokens that have already appeared or are about to be released, as long as the collateral value (or reserve) behind them is not lower than the price of the token, and can be passed through the token. Free redemption, then the market has enough motivation to "melt" it, Libra can only become a medium for exchanges for holders to exchange reserve currencies (especially the US dollar), and it is difficult to become a currency exchange medium to enter the market. On the other hand, this will cause a chain reaction, which will at least lead to the “insufficiency” of the token circulation, that is, when the circulation of the contemporary currency is less than a threshold (in terms of the increase in market share), the member institutions will not accept Libra. Such tokens are used as internal settlement assets. Thus the 1:1 reserve distribution method became a difficult paradox for Facebook Libra Association.

(3) Private conflict of interest, and who is the lender of last resort?

I have to admit that an important revelation of the history of money and payment development is that Libra can become a net saver of Libra as long as Libra can become a standardized accounting unit inside and outside the association and through the accumulation of Libra balances by members of the association. And those who lack Libra's position (whether for legitimate or illegal purposes) will become Libra's net borrowers, which in turn will form a Libra lending market, regardless of whether traditional financial institutions are involved (and likely to participate). There will always be a third-party organization engaged in standardization and large-scale Libra deposit and lending services, and then a historical market rhythm to produce a Libra-based asset market, and even Libra-based derivatives market. Therefore, no one can guarantee or say that Facebook Libra Association can hardly guarantee that Libra-based money creation institutions and processes will not occur, and such financial activities will directly affect enterprises and individuals outside the association, and will also affect the government and Public Sector. A prominent influence is who will provide the final settlement assets for the Libra payment system? This undoubtedly returned to the long and chaotic financial development history of the central bank before it became a public sector.

Of course, even if the Facebook Libra Association can provide the last purchaser when necessary, this is not the lender of last resort. The former only sells low-selling Libra's price on the reserve currency in a way that stabilizes the fund, while the latter is the ultimate responsibility of the central bank as a public sector for monetary stability and financial stability. Not only that, but even more regrettable, even if Facebook Libra has a full willingness to inject sufficient final settlement assets into the Libra payment system, the 1:1 reserve issuance method will seriously restrict the performance of the association, and ultimately make the Facebook Libra system. In the wake of the collapse of the Bretton Woods system, it is ultimately necessary to rely on the state power to inject capital or assets into the Libra reserve system, so that the unprecedented moral hazard is undoubtedly the blackmail of the Libra Association to the people of the world!

Facebook's Libra Association not only has the "too big to fail" of traditional systemically important financial institutions, but also the extreme dilemma of "too big to bail out".

In summary, there are many unsolved problems and mysteries in the history of currency and payment development, but the designers and fans of Facebook Libra obviously need to supplement the curriculum in this aspect, knowing how to be in front of the currency behemoth. Be humble and calm, and try to reduce the scourge of money brought about by your own greed and ignorance.

Monetary theory is like a Japanese garden. The beauty of the whole lies in its diversity: under the seemingly simple appearance, there are hidden complexities; under the seemingly calm water surface, the dark tide is surging. Only by observing and examining from various angles can we fully appreciate and appreciate the beauty of it only if we conduct research in a calm and in-depth manner. – Milton Friedman

Author Zhao Wei

School of Economics and Business Administration, Beijing Normal University

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- What kind of logic is Bitcoin “artificial bull market”?

- Reuters: UN report says North Korea attacks banks and cryptocurrency exchanges to make a profit of $2 billion

- Opinion: Where is the strength of Wal-Mart's currency?

- Multinational privacy regulator issues a joint statement: six soul tortures against Libra

- Decentralized Network Governance: Psychological Analysis of Motivation of Node Cooperation

- Lenovo, Nokia, Anheuser-Busch InBev, etc., have joined IBM's latest blockchain project

- Exploring Zero Knowledge Proof Series | Understanding Zero Knowledge from "Simulation": Parallel Universe and Time Back