Why should Wal-Mart also develop digital currency?

Libra's advancement has been blocked recently. In addition to the general ignorance of the traditional financial community, the US political circles have been expressing concerns about this project. In the just-concluded two US hearings on libra, even some members directly fired guns. anger.

Rep. Brad Sherman: "…Libra's damage to the United States is comparable to 9/11. For drug dealers, evaderers and other criminals, Libra is definitely a godsend…if Libra is used for terrorist attacks, 100 lawyers can't keep Zuckerberg, he is waiting to accept the trial of the American people!"

While Facebook’s libra, a digital cryptocurrency program, was blocked, another traditional industry giant, Wal-Mart, which topped the Fortune 500 list in 2019, also announced a high-profile announcement that it would develop their own digital cryptocurrency. The digital currency will be directly linked to the US dollar. Why is Wal-Mart a high-profile announcement to develop cryptocurrencies in a libra-prone environment, and what does this cryptocurrency peg to the US dollar mean? What is the difference with facebook's libra, let's take a closer look.

On August 2, 2019, according to foreign blockchain media, the USPTO recently released documents showing that retail giant Wal-Mart is studying the issue of stable currency linked to the US dollar, an encrypted number similar to Libra. currency.

- Wright halved, miners distressed

- KuCoin Hangzhou has been working hard for a year and a half, and the tricks are frequent.

- The era of big country game | The central bank accelerates research and development of digital currency, in parallel with international competition

The document outlines a method of “generating a digital currency unit by linking a digital currency unit to a conventional currency”, a stable currency linked to a legal currency.

The document adds that this blockchain-based digital currency “may be linked to the US dollar” and may “use only in selected retailers or partners”. In addition, this may help low-income households find solutions to the high cost of banking services, and they can choose to “solve funding issues in an organization that meets most of their daily financial and product needs.” "The introduction of digital currency allows people to use credit and debit cards where they don't need cash, greatly increasing the ease of payment."

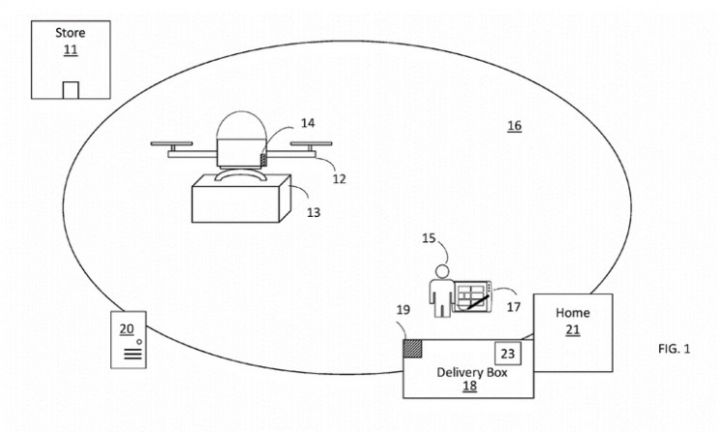

A brief review of Wal-Mart's history of using blockchains reveals that Wal-Mart has attempted to combine existing services with blockchains from an earlier point in time. According to foreign media reports in March 2018, according to the United States Patent and Trademark Office (USPTO), Wal-Mart is developing a UAV-based cargo transport service based on blockchain technology, which will improve the current cost of the US transportation industry. Improve Wal-Mart's supply chain services, and even cargo distribution services, to accurately transport the goods ordered by the customer network to the destination through the blockchain technology.

In September 2018, according to Reuters, US retail giant Wal-Mart and its Sam's Club will require green leafy vegetable suppliers to implement a farm-to-store tracking system based on blockchain technology. Developed in collaboration with IBM, Wal-Mart hopes to track and trace fresh fruits and vegetables.

This time, Wal-Mart's resubmission of the patent on the blockchain is also a consistent development attitude towards this technology. It hopes to improve the format and service of the retail industry through the blockchain. But the significance of this time is fundamentally different from the development of blockchain technology in the past. Wal-Mart's ambition is to issue its own digital cryptocurrency, and then apply it to Wal-Mart's own ecosystem, so that cashless payments become More feasible and convenient.

To put it bluntly, Wal-Mart will replace some or all of the bank's functions, create a closed financial system in its own business empire, and let its own "libra" become the only currency, allowing upstream suppliers to pay downstream B-side. Services, and then to the C-side services, all through the digital cryptocurrency, let the cost down, service upgrades, and finally realize a new ecology of the retail industry. This is another bold attempt by the business giant.

The point that this attempt is smarter than Facebook is that the digital cryptocurrency that was announced will be directly linked to the US dollar, which will greatly reduce the wariness and resentment of domestic financial institutions in the United States, and may speed up the progress of the project, even before Libra. It is not necessarily online.

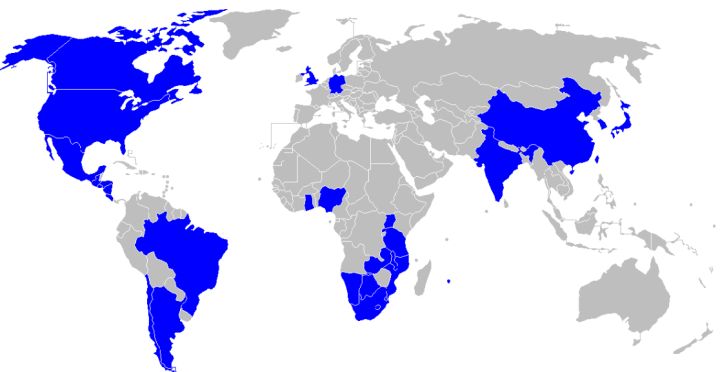

From an objective point of view, how to anchor digital currency is actually a science. The main users of facebook are all over the world. You can see that all continents except the United States are full of users. In particular, the number of users in Europe is very large, about 300 million. Large user base, so Facebook doesn't want to anchor the dollar to the dollar alone, and setting the headquarters in Switzerland is understandable.

In addition to learning the lessons of Facebook, Wal-Mart also has a relatively low distribution of Wal-Mart itself in North America, China, Europe and other regions, so anchoring the US dollar is a matter of course.

It is worth noting that Facebook is more than a Facebook company, and more giants are optimistic about the future of digital cryptocurrency. This is a thing that is gratifying to the world, but no matter which country or enterprise develops anchored digital cryptocurrency, it is worthwhile. We are wary of things, because the issue of currency is one thing, but the globalization of the dollar behind it and the establishment of a new financial system are more worthy of attention. In short, it is to use the influence of the company to sell the digital cryptocurrency it develops. The world will then extend the dollar anchored behind it to more remote areas and consolidate the dollar hegemony. This is what really deserves our vigilance.

Of course, it is gratifying that China has stepped up its development of our own digital cryptocurrency.

On July 9, 2019, Wang Xin, the director of the Central Research Bureau, made it clear that he wanted to build China's own digital cryptocurrency.

The People's Bank of China held a video conference for the second half of 2019 on August 2 to make arrangements for key tasks in the second half of the year. The meeting requested that eight key tasks be done in the second half of the year. One of the key tasks is to develop financial technology, strengthen follow-up research, and actively meet new challenges. Accelerate the pace of research and development of China's legal digital currency (DC/EP), track and study the development trend of virtual currency at home and abroad, and continue to strengthen Internet financial risk remediation.

On August 5, 2019, it was affected by the Fed's heavy volume and 10% of the tariff. On the shore of the offshore rmb through the break 7, the trade war financial war is so severe, the country so much emphasis on the creation of the next generation of financial system, is very far-sighted. Perhaps when our own "libra" appears, there will be more weapons against the dollar hegemony.

The copyright of this article belongs to the author, please do not reprint it.

Author: white

Source: Win and Finance – Nanjing Blockchain

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Analysis: How does the halving of Litecoin become a good one?

- Investment bank analyst: Wal-Mart cryptocurrency project is easier for legislators to accept than Libra

- BTC daily line seven consecutive Yang, near 12,000 US dollars or have strong resistance

- Forbes: cryptocurrency is preparing to fundamentally change finance

- A-share: Bitcoin prices return to the blockchain sector and then rise to the catalyst

- Pivot: Will halving really lead to a rise in the price of the currency?

- lCO six years of concise history: genius, scam and myth