Don't use the trading volume to measure DApp. Learn about user behavior and investor metrics.

In the world of Web 2.0, operations, product managers, and bosses often stare at data such as daily activities, monthly activities, and retention conversions in an attempt to iterate over products. But in the world of Web 3.0, what kind of measurement framework do we need to provide product managers with product iteration methods and data?

DApp's metrics are terrible, it's no secret. Commonly used metrics, such as the number of transactions on the chain and the volume of transactions on the chain, do not necessarily reflect the excellence of the DApp. In addition, the data itself often has serious realism problems. When the Ethereum ecosystem moves into the next wave of DApp development, the market actually needs a unified framework that can measure DApps. By measuring user behavior metrics, DApps can be optimized, iterated, and grown. By measuring investor-centric metrics, DApp can find its own position for future financing to help grow. Asset and application level metrics

An asset indicator that indicates the relative strength of the network or the use of the asset.

- Gartner: Two-thirds of the world's governments have a strong interest in blockchain

- Oh, the value of bitcoin is not as good as a set of cards.

- Which project is strong? Tether unexpectedly turned out to be the least hype, far below Bitcoin

Fabric Ventures' Max Mersch, in his article " An Overview of Relevant Metrics in Web 3.0 ," is a good introduction to top-level asset metrics such as Bitcoin, Ethereum, and the Maker DAO ecosystem.

For example, asset metrics like Total Lockout Value (TVL) provide a glimpse of ETH usage in Decentralized Finance (DeFi) . The argument is that asset metrics are more representative than trying to use traditional metrics such as the number of daily users (DAU) .

How many people view their MakerDAO's Mortgage Debt (CDP) every day without performing CDP-related operations?

In traditional metrics, these users will be considered daily users. But from an asset perspective, this metric does not necessarily mean that an asset or agreement is being used.

A more comprehensive understanding of application-level metrics

Any application built on top of Ethereum will inevitably be bound to its high-end asset metrics.

If you're building a DeFi app, then what you care about is the value of the asset locked in DeFi. If you're building an application for a developer, you'll focus on the number of developers using Truffle/Ganache/Zeppelin/ other libraries. Moreover, the actual assets used by the application will also affect your growth.

If your DApp uses DAI, it may be more transactional. If your DApp uses ETH, it may be more focused on using or speculating. It is in this context that we can look at application-level metrics and a framework for unified metrics for all DApps.

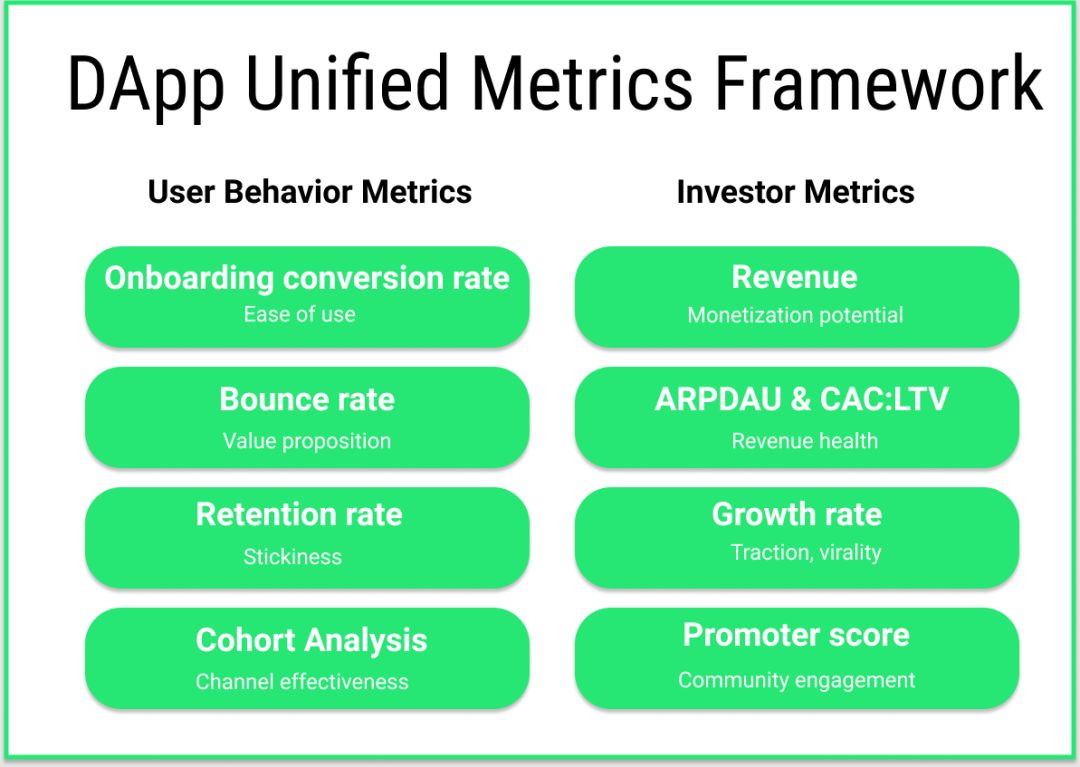

DApp Unified Metrics Framework (DUMF)

DApp has many use cases—from DeFi to games, from the market to the exchanges. Each category has specific metrics to help measure it, indicating its success or failure. All DApps, regardless of their category, have one thing in common, that is, access to users and sustainable funding. The DApp Unified Metrics Framework (DUMF) is a simple standard framework that can be applied to any DApp to help measure both of these.

Let us find out.

User behavior indicator

Tracking user behavior metrics is important to understand who is using your DApp, why they use it, and how they use it. The best quality DApps will use these metrics to iterate the user experience and continue to improve.

- User guided conversion rate

User-directed conversion rate is a measure of how successful a visitor is in your DApp. DApp's user conversion rate funnel is much more complex than web 2.0 applications. In the web 2.0 world, it usually involves getting into the application, registering, and then performing the necessary actions.

In the world of web 3.0, this funnel will now include access to the DApp, install MetaMask, get ETH, and then perform the necessary operations. In contrast, the user path of Web3 will obviously encounter more resistance.

What do you think is the average DAD user-directed conversion rate?

We are seeing more and more web3 components and component providers are reducing the resistance of new users. Let's think about the user funnel for an optimized web 3.0 application: this might include accessing the DApp, registering (processing the account contract on the back end), and performing a DApp operation (providing gas charges on the back end by the Ethereum Gas Station Network) ) . Users do not need to get ETH. This only requires three steps to complete, which is comparable to the ease of use of web 2.0 processes. No matter what choice you make – whether it's MetaMask's process or the use of a cryptocurrency wallet, or the cost of gas for your users, it's necessary to measure your user-directed conversion rate.

User-directed drag reduction = more users, more satisfied users, and more willing to explore your DApp users.

- Bounce Rate

Bounce rate is the percentage of users who visit a DApp and leave without visiting any other page.

What does the content of the DApp homepage look like?

Does it provide a compelling reason for everyone to use it?

Does it accurately clarify the value it can bring to users?

Measuring bounce rate is an easy way to detect if the information you pass can impress potential users. Inevitably, DApp is a drag-and-drop solution that makes it harder for users to understand their value than a quick centralization solution.

This is why there is a very clear answer to the question "Why should I use this thing?" before the user uses it.

If your bounce rate is high, it is necessary to think deeply about what the real value of your DApp is. What features does your DApp offer that are not available in a centralized solution? What novelty is it unique? After you think about it, modify it to reflect this new value proposition and then re-measure the bounce rate (this is an experiment! ) .

In addition to value proposition, bounce rate can also reflect the ease of use of the product. Think about how many times you have visited a DApp, but only see the pop-ups of the MetaMask plugin: Guess the pop-up rate of the DApp that connects to MetaMask when loading (say, guess)

- Retention rate

Retention is a measure of the percentage of users who perform operations within a DApp performing another DApp within a specified number of days.

This measures the stickiness of your DApp over different time spans, such as 1 day, 3 days, 7 days, 14 days, and 30 days. After all, it takes 21 days to develop a habit. Will users return to your DApp again and again? Does your DApp make users addicted? Provide user rewards? Did your users perform any actions on your DApp that would motivate them to form a habit?

Mechanisms such as random rewards, social interactions, or unlocking achievements can increase DApp engagement.

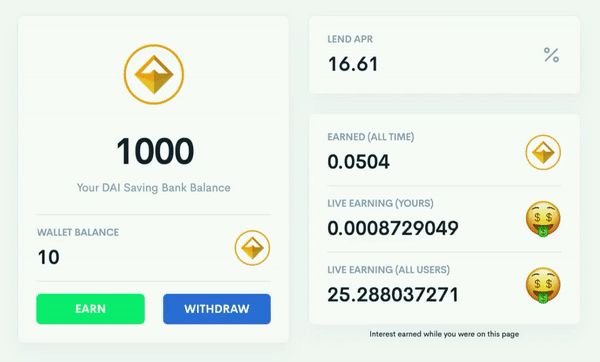

Think about the revenue interface of InstaDApp. It calculates your lending gains in real time. Of course, it is accurate to 15 digits after the decimal point, in order to increase the income every half second. However, the strange thing is that this is just addictive. When you attract users, you don't come back to check it once, right?

Real-time income = endorphin (generating euphoria)

Real-time income = endorphin (generating euphoria)

This attraction will allow your users to return to your DApp again and again. If they often go back to your DApp to see the proceeds, they are likely to perform other operations in the process.

- Group analysis

Group analysis measures how much different user groups use your DApp.

As you can imagine, there are many ways to group users—through referrals to social platforms (are they jumping from Telegram or Twitter? ) , demographic types, DApp usage, and more. Which user group is your most active? Which one is the most profitable? Which user groups on Twitter and Telegram are the best in promoting your DApp?

Measuring the most active user base can help you locate more effectively while getting new users with similar characteristics.

Take the gamified trading application Hxro as an example – they relatively quickly found out which group is the most profitable for them, that is, users who are both gamers and traders. So they started streaming live on Twitch, specifically to cater to this group:

Every DApp may have a mixed target audience. Finding this group of hardcore users is the hardest topic.

Does DApp measure user behavior metrics?

Does DApp measure user behavior metrics?

Investor indicator

User behavior metrics make it easy to optimize and iterate your DApp. An equally important consideration is which metrics will you show potential investors or funders to prove the utility or growth potential of your DApp?

Sources of funding in the web3 are evolving. There are also projects like MetaCartel that are funded in the form of DAO. In the future, APPDAO may promote revenue sharing as a chain version of revenue-based financing. Of course, there are also many venture capital firms that focus on Web3.

All three entities may need some metrics to better understand the current usage and future potential of your DApp.

- income

More and more DApps are experimenting with and implementing sustainable business models to generate revenue. For investors looking for investment opportunities or DAOs, the profit potential of any DApp is an important consideration.

In addition to pure revenue growth, there are some revenue-related metrics that provide more detailed information to help us understand what drives revenue growth – whether it is high revenue per user or a lot of gains. Customer cost.

Average Daily Active User Revenue (ARPDAU) – Does your majority of your income come from a small number of active users, or have you converted a large number of users into users who are willing to pay? The ratio of customer lifetime value to customer acquisition cost (LTV:CAC) – marks the sustainability of revenue growth. If this ratio is too low, it means that the cost of obtaining customers is too high, which indicates that current growth may not be sustainable unless subsidized by future funds.

- User growth rate

The DApp user growth rate is defined as the percentage increase in the total number of daily active users per week. This can prove the "traction" of the product. In addition to traction, some of the growth is related to the "viral coefficient." Virus Factor – A user who has been converted from an existing user. This only applies to DApps with virus components. For example, for games and content platforms, the virus factor is very important for bringing new users to the DApp.

- Recommended value

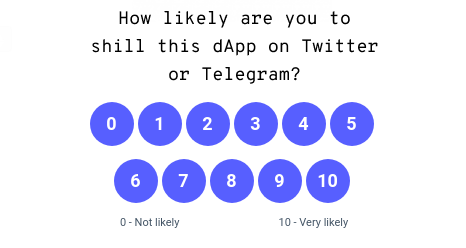

Web 2.0 applications typically measure Net Promoter Score (NPS) .

NPS is measured by a simple question: "How likely are you to recommend to friends from 0 to 10?"

Anyone who gives 0-6 is considered dissatisfied with the product, a person who gives 7-8 points is considered a passive user, and a person who answers 9-10 is considered a recommender. In the encryption circle, especially in the Ethereum community, users use Twitter and Telegram extensively. If you stumble upon a great app, it's probably discovered by someone who forwards it on Twitter or Telegram.

Therefore, the equivalent of NPS in Web3 may be the Twitter recommendation value (TPS) or the Telegram recommendation value (which is also referred to as TPS) . TPS can be measured by a simple question: "From 0 to 10, how likely are you to promote the app on Twitter or Telegram?"

This may sound silly, but… the adoption of the DApp by the community is really important. These platforms and high recommended scores are often a good sign that the community is really involved in your DApp. Testing DUMF on DApp If your DApp is valued for growth, sustainable funding, or both, remember to consider measuring DUMF and let your team be responsible for achieving a specific metric benchmark.

It's a proactive experience. It's not just about measuring data for data, it's learning from standards, experimenting with it, measuring the effectiveness of the experiment, and integrating the necessary changes into your DApp. At least, this will be an eye-opening experience. So, it might just help you position your DApp, get more users, generate more revenue, get the funding you've been applying for, or ultimately get an investment.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- World Bank uses blockchain technology to issue more than $33 million in bonds

- Spanish bank giant Santander expands Rippo technology adoption to create an instant “international payment corridor”

- The pilot digital currency in Shenzhen is a big chess game for the country to develop a modern industrial system.

- Shenzhen from the "Special Zone" to the "Demonstration Zone", the national policy gives the digital currency the first opportunity to land

- Xiao Lei: US digital currency goes ahead, China's official digital currency will be born in Shenzhen

- Research says cryptocurrency has three positive effects on the existing monetary system

- BTC's trend has been decoupled from gold, will go independent or linked to other