The pledge mining ecology has gradually prospered, but still faces many challenges. Can you still feel comfortable with Staking?

All blockchain networks have one thing in common: transactions need to be verified. For example, Bitcoin uses Proof of Work (PoW), the so-called mining, which requires a lot of power. Proof of Entitlement (PoS) is another kind of consensus mechanism. It has different evolution forms and mixed modes. We call these pledges, namely Staking.

The pledge of the pass allows the holder of the pass to gain some decision-making power over the blockchain network and to vote and earn income. This is very similar to the fact that people get interest by holding money in a bank account and giving money to the bank to make a profit.

One of the main benefits of pledge certificates is that it no longer requires constant purchases of expensive hardware and energy. Unlike the workload proof blockchain network (with a random process to obtain low probability rewards), the equity certification system provides guaranteed returns and predictable sources of income.

01 Industry Development Forecast

The value of the pledged funds depends on two main factors: the underlying asset price and the pledge ratio.

Next year, Ethereum will bring about $30 billion in liquidity to the existing $20 billion in market assets. In addition, other markets, such as Polkadot and Dfinity (which have market capitalizations of nearly $1 billion), will also bring more liquidity.

Taking into account these current prices and a flat pledge rate of 40% for all assets, the total value of pledged assets in a year will reach $19 billion (an increase of 271%).

Legend: The total value of the pledge certificate

The next few years may be an important development period for decentralized finance (DeFi) . Especially once many real assets are deployed on the blockchain , decentralized or open finance will surely usher in a round of rapid development.

If decentralized finance allows a large number of assets to smoothly transition to the blockchain and complete open and transparent contract transactions in the market, then it will inevitably ensure the security and transparency of assets between investors and borrowers. It is possible to solve the huge problem of financial opacity.

Julian Buttrup of Stake Capital said: "Decentralized finance will not replace traditional finance, but it provides another solution for people. The open Internet needs open finance. At present, there are many projects in the decentralized finance sector that are in the development stage. It is expected that the funds targeted for decentralized financial projects will reach about US$2 billion in the coming year.

Although the prospects for the pledge ecology are encouraging, its further development still faces many challenges.

02 main challenge

In addition to the lock-in time of pledge and the final introduction of penalty measures, user education on mortgage-related responsibilities and risks remains a huge challenge. Unlike proof of work, proof of equity is a more specific and intuitive way that everyone can participate directly or indirectly, but many users are not aware of this measure.

Of course, the user experience is also a challenge . Using the public and private keys every day is not what the user wants to do. Creating a non-technical experience of joining the pledge will greatly enhance the user experience of using the pledge service.

A healthy user community is also essential. The cryptocurrency community is usually driven by emotions, but it is important that the community focus on the users, let them understand the developments, and educate them to maintain a healthy ecosystem. And the community. Communities should provide users with sustainable value propositions, demonstrating ongoing research and development, prevention and disclosure of fraud.

At the same time, pledge is still a very small market, basically there is no regulatory measures. Communities, pledge service providers, and regulators need to address issues such as relationships between pledge service providers and anonymous principals, tax treatment, disclosure, customer protection, and user fund custody.

The general feasibility of proof of equity has not been confirmed, and people may be skeptical until they see evidence of survival in the Black Swan event, such as an attack or multiple verifier failures. In addition, the pledge cryptocurrency requires a private key to be signed with a large number of passes, which exposes the funds directly to the risk of exposure.

The security of the network depends on the quality of the pledge service operations. Given the deep understanding and active involvement of the protocol, service providers must skillfully allocate their resources because they do not have the ability to operate on all of these protocols.

Another big challenge is the wider adoption of pledge mechanisms in practical applications . Many blockchain networks based on equity certificates use inflation as the primary mechanism for incentives. For users who are not involved in the pledge, this means that their share of the system will be diluted with the new pass. In order to overcome this problem, rewards need to be obtained from transaction costs and the like. Through widespread use, the agreement can reduce inflation. Increasing availability (a list of trading platforms with mobile trading pairs), motivating the use of blockchain networks, and creating a simple join experience may be a way to increase adoption rates.

In terms of protocol design, in order to find the right balance between security and economic incentives, we must collect more empirical data from the real-world use cases of the application . We may or may not find the "best" version of the equity certificate. Governance on the chain is a fair form of consensus formation, but it is still possible to consider certain centralization factors to act quickly and solve problems during critical periods.

Many protocols have the technical ability to support a sufficient set of decentralized verifiers. However, due to the initial allocation of certificates and the limited degree of decentralization, it is indeed facing the enormous challenge of transforming from an early adopter of pledge to a broad-based holder. Finding good incentives without sacrificing decentralization will also be a challenge.

In some agreements, you need to maintain a pledge ratio, which means you need to constantly add a pass for self-binding. You can choose to continue to purchase these passes (which will put a lot of money at some point), or invite someone to fund this self-binding in exchange for higher returns. While pledges and authorizations are unregulated in most cases, in this case, it creates additional risks and processes for the verifier and its customers.

One of the biggest challenges to proof of equity and pledge is sustainability. Operating the verifier node requires various operational costs, including server and infrastructure costs, staff, rent, and so on, depending on the certifier's settings. In most cases, these fees are paid after converting the pledge award to fiat currency. For this reason, the blockchain with equity proof may bring great difficulties to the node operators when the price fluctuation of the agreement within the agreement.

The last point is standardization . Each of the Evidence Proof is almost always using different technical means, so there is a lack of standardization. Fragmentation due to lack of interoperability is one of the main challenges of pledge.

03 How do users choose a mortgage service provider?

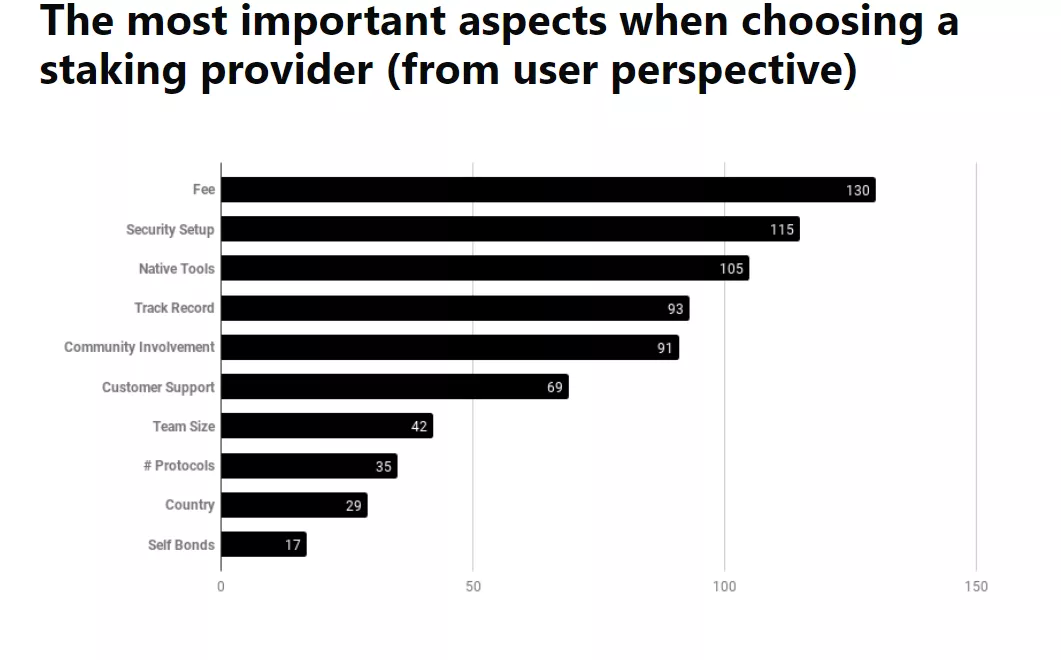

Obviously, for most users, the charge is the most important factor when they decide to use a pledge service provider. Through security settings, tools, and community involvement, we have seen that providers are correctly addressing issues at the demand level.

Users seem to be less concerned about the size of the team, the number of support agreements, the country in which the team operates, or the amount of money the service provider controls. In terms of fees, providers still have a lot of potential to educate users. Fees should not be predatory, otherwise they will lose attention to some very important aspects and everyone will suffer losses.

Legend: The main factors to consider when choosing a pledge service provider from a user perspective

04 The impact of large companies entering the market

1, pay attention to the big shark

All larger participants will provide some form of pledge service in 2019. Small-scale service providers must act quickly to compete with the comprehensive products of large companies, which require clear value propositions and innovations to differentiate themselves from the services of large enterprises.

2, need to weigh the advantages and disadvantages of the exchange

Most people think that trading platforms, custodians and wallets will dominate the pledge market because they naturally have a capital advantage and a large number of users put assets there. Pledged services may not be extremely attractive to trading platforms because their primary source of revenue is transaction fees. The custodian’s pledge cost is often high and involves many risks.

In addition, users should also make trade-offs when using the trading platform for pledge. First, you need to trust the trading platform. If you store the pass there, even if a larger number of passes are pledged from the cold wallet, there will be some available for immediate sale. Not everyone is willing to take on such risks, especially if they have a large number of passes.

3. As a differentiated niche market

The advantage of small companies is that they can focus on certain chain ecosystems, such as one or two chains, without the need for an integrated model. They may be able to participate deeply in certain ecosystems, which may lead to differentiated competition.

Small suppliers and large supply when smaller suppliers find niche markets, provide localized customer service, develop tools for ecosystems, and operate strategically when larger participants find too small or specific areas Businesses can grow together.

4. New methods of operation

Smaller pledge service providers can use new methods for pledge, mainly using development tools, smart contracts or contributing to core agreements. For example, Cryptium Labs is making some changes to the core protocols that will enable programmable pledges, allowing vendors of any size to write smart contracts that implement different policies or terms of service.

Small companies have the opportunity to become pure participants, so they can take the lead in educating the community, participating in governance, and ensuring that their infrastructure is first rate. If the agreement is too concentrated, the community can build better incentives for decentralization. In order to further develop the pledge service ecosystem, there is still a need to raise awareness of pledge services.

5, availability

Many of the operations on the chain are complex and users have doubts about their security systems, including their convenience. We need to focus on end users who can take advantage of the network without technical knowledge. Ideally, people will not realize that they are interacting with the blockchain.

6, secure hosting solution

Benefits should be ahead of fear of hackers and technical barriers. Therefore, a secure regulatory infrastructure, a robust blockchain agreement and a platform that allows people to pledge are critical. Trading platforms and lending platforms will play a vital role in motivating customers to become pledges.

7. Compliance

It is also important to clarify compliance. It may release huge amounts of money from institutional investors and pension funds. The current total market value of pledge is still too small and may be easily manipulated.

8. Dilution of non-pledgers

Since holding a pledge token without pledge will incur huge costs (this is a tax on not protecting the blockchain network), every investor and business needs to be familiar with the concept of collateral. Therefore, the products and services surrounding it will inevitably become the main topic in the next few years.

9, Pioneer

Knowledgeable institutional investors and funds will play an important role in large-scale adoption. As these funds will seek to diversify their portfolios in the encryption market, there will be more and more people involved.

10. Education

We can participate in the ecosystem itself by making the user aware that the pledge is a profitable opportunity. They should be well aware of the quality of each verifier in multiple areas and should be aware of current issues and governance on the network.

11, deal with economic collapse

We have seen that people need a valuable storage. Weak monetary policy has led to hyperinflation in several countries around the world. If the world of encryption can survive the difficult economy or in the international financial crisis, then the perception of new governance models – pledge, decentralized economy and encrypted intrinsic value will increase.

Message mining : Have you participated in Staking? How is the experience? Feel free to share your opinion in the message area.

——End——

『Declaration : This article was translated from Stakingrewards by Gleb Dudka and Mirko Schmiedl. The article is an independent view of the original author, does not represent the vernacular blockchain position, and does not constitute any investment advice or advice. You are not allowed to reprint this article by any third party without the authorization of the "Baihua Blockchain" sourced from this article. 』

Original: Compilation: Wayne

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Bakkt's crypto asset market expansion is a positive trend

- The blockchain is “useless”, why are we still gambling on the future and not willing to leave? | 2019 than the original chain global developer conference

- Korean media: 97% of the Korean exchanges are on the verge of bankruptcy, and the project side seeks overseas currency

- The report shows that the stable currency platform is the first Ethereum, and the second is the bit stock.

- A shares | China Construction will soon set up a blockchain financial platform, the stock price reached a new high within a year and a half

- Received more than 100 million US dollars in cryptocurrency, Fidelity announced 4 years of cryptocurrency charity record

- How much does it cost to maintain a blockchain startup?