My coins have been stolen, how are they washed white?

Unfortunately, the road is one foot high and the height is one foot. From the current point of view, security issues cannot be eradicated, and only strengthening defense methods can reduce the chance of a crisis.

However, when most people pay attention to which exchange was stolen, how much damage was caused. Another question has been overlooked: How did these stolen or improperly sourced cryptocurrencies be whitewashed?

Blackmailing the "wrong" demonstration of listed companies

Bitcoin is well known by the public for its anonymity and decentralization, but it is not completely untrackable.

In 2014, Du Bing, an unemployed person who graduated from junior high school, discovered the internal information of the unfair business practices of the listed company Hongri Pharmaceutical (300026.SZ) and threatened the secretaries of Hongri Pharmaceutical. Dong Mi initially chose to ignore the threat of Du Bing, and after seeing the internal information possessed by Du Bing, he expressed his willingness to spend 300,000 to calm the incident.

- Bitcoin challenges $11,000, and mainstream currencies rebound strongly. Where is the market going?

- Research on the Correlation between Bitcoin and Gold

- Bakkt's crypto asset market expansion is a positive trend

However, the Du Bing lion opened his mouth and asked the secretary to pay 3 million yuan and pay in the form of bitcoin. Hongri Pharmaceutical agreed to this requirement after an internal evaluation. Hongri Pharmaceutical purchased 2,101.209 through the bank account of employee Wang, which was worth 3 million bitcoins. Du Bing transferred funds through multiple exchanges and wallet addresses, and after deducting the transfer fee, he finally realized Bitcoin 2099.

Since Du Bing uses a centralized exchange, KYC information needs to be provided to the exchange. The police confirmed the source of the funds from Hongri Pharmaceutical by comparing the transfer and the transaction information and the extracted mail content provided by the exchange.

In the end, Du Bing was sentenced to 13 years in prison and fined 50,000. The money and items obtained by extortion were also frozen.

The incident of Du Bing’s arrest means that it is not feasible to successfully cleanse the illegally obtained cryptocurrency through a centralized exchange.

Exchange owner acts as a money laundering third party

However, as long as sufficient benefits are given, it is not impossible to wash the money through a centralized exchange.

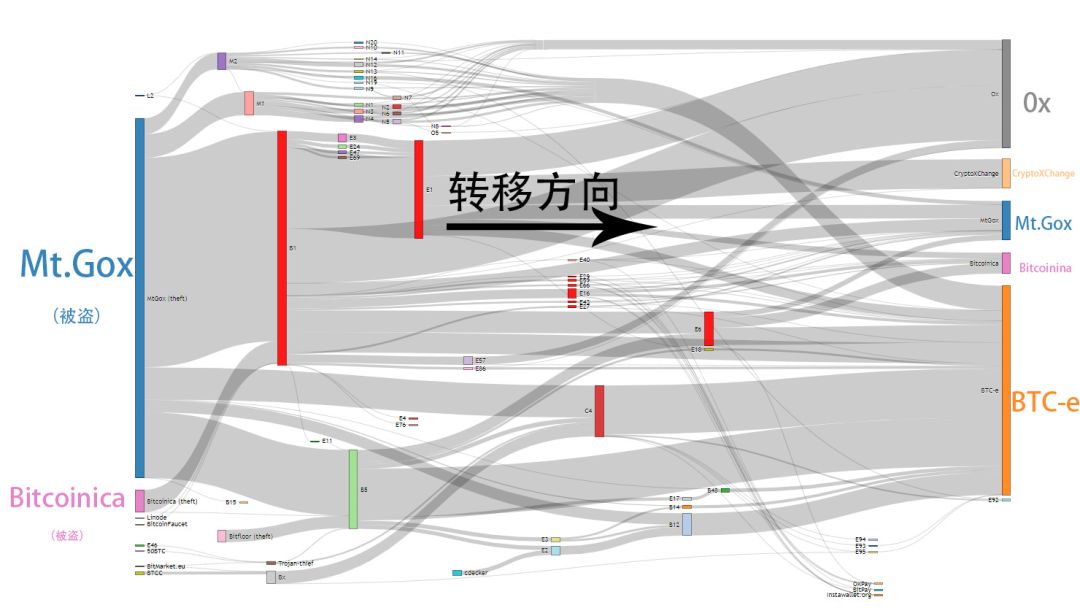

After the bankruptcy of Mt.Gox, Bitcoin security team WIZSEC analyzed the bitcoin flow chart shown in the figure below by analyzing the data on the chain and the wallet address of Mt.Gox.

Analysis shows that most of the stolen Bitcoin (about 410,000) has flowed to an exchange called BTC-e. Moreover, when transferring bitcoin, a user called "WME" (the red bar in the figure) appears multiple times and acts as a middleman.

Image source: WIZSEC

In July 2017, Russian Alexander Vinnik, considered to be the operator of BTC-e, was arrested in Greece. All kinds of information shows that Vinnik is "WME".

Prior to 2012, the established exchange Bitcoinica suffered three attacks from hackers, losing more than 100,000 bitcoins. In the process of whitewashing 100,000 bitcoins, Vinnik also appeared.

It is not difficult to see the two incidents. Vinnik is a middle-money laundering third party that connects the thief and BTC-e, but this third party is the owner of the exchange.

Due to the large number of wallets and large amount of funds, the exchange frequently transfers funds of hot wallets, and most of the cryptocurrencies are homogenized currencies. The cryptocurrency obtained by illegal means can be easily washed in the exchange.

This situation will be exacerbated if the exchange itself does not perform KYC verification. Assuming that the exchange performs KYC verification on the user, it can also split the large amount of cryptocurrency into a large amount of small currency, after multiple transfers, and mix a large amount of security funds into it, and finally transfer it to the exchange for whitewashing.

In September 2018, the Japanese exchange Zaif was stolen 6,000 bitcoins, with a total loss of about 60 million US dollars. According to Blocktrace, a blockchain analysis organization, Zaif's stolen cryptocurrency was washed out on the currency security and fire currency exchanges by splitting and mixing a large amount of security funds.

The money exchange exchange was stolen

With the advent of the era of big data, the importance of privacy has received more and more attention. As the main privacy, anonymous decentralized exchanges and anonymous coins have attracted much attention in the cryptocurrency industry.

However, anonymity is a double-edged sword that protects the privacy of users while providing a breeding ground for illegally sourced cryptocurrencies.

One of the things worth mentioning is the decentralized exchange EtherDelta, which has been used by hackers to wash coins.

In January of this year, the New Zealand exchange Cryptopia was stolen. According to the survey, as of May, at least 4,383 Ethereum has flowed into EtherDelta for whitewashing.

The decentralized exchange can wash the stolen coins and does not mean that the decentralized exchange is absolutely safe and will not be attacked by hackers. EtherDelta is a place where hackers wash their coins, but it was also hacked in 2017, losing more than 308 Ethereum.

Because of the CryptoNote protocol, the Monroe currency, which is different from most mainstream currencies, cannot be used by a few people to display illegal transactions through the blockchain, the address of both parties to the transaction, and the specific amount. The characteristics of the Monroecoin are also very popular among users of the Darknet, so it has become the most popular currency among the Darknet users except Bitcoin.

A part of the illegal cryptocurrency was changed to the Monroe currency by going to the Sinochem Exchange Biaq, and the currency was successfully washed. Therefore, the price of a number of mainstream anonymous coins such as Monroe is highly linked to the price of Bitcoin. In 2018, the price correlation between Monroe and Bitcoin was as high as 80%.

In addition to Monroe, there is also a coin blender, such as ChipMixer. The user can send the bitcoin to the address provided by ChipMixer, and then ChipMixer will send the private key of multiple addresses to the user, each address containing a small amount of bitcoin (minimum 0.001 bitcoin), the total number is unchanged.

According to a research report issued by Clain, a Luxembourg-based tracking crypto-equity company, at least 4,836 of the 7,000 bitcoins stolen in May 2019 were cleaned in ChipMixer.

Over-the-counter grey business

If you feel that it is too cumbersome to wash money through exchanges, currency, etc., there is one easiest way – over-the-counter trading.

Since most people lack the ability to monitor token sources and most mainstream currencies are homogenized tokens, this makes a large amount of coins whitewashed off-site. Of course, over-the-counter trading can not only wash white coins, but also money laundering.

Where there is profit, there is business. In the cryptocurrency OTC market, there is a business that discounts illegal sources of cryptocurrency. The acquirer buys at a price below the market price, then goes through a series of professional cleanings and then sells at a market price to earn a difference.

Of course, there are also some people who, for various reasons, are willing to spend more than the market price to acquire the cryptocurrency that has just been dug up.

Early cryptocurrency exchanges have not been as developed as they are now, and many fans mostly buy and sell bitcoins through over-the-counter transactions. Even though on-floor trading is now well established, over-the-counter trading is still an important part of cryptocurrency trading due to the depth and privacy of the exchange.

However, the source of funds and the source of cryptocurrencies are worthy of every trader's vigilance.

Security issues have always been a negligible presence in the blockchain industry. At present, it seems that the emergence of security problems is inevitable, so how to solve the problem more properly after the problem is the problem that most people should think about.

When the cryptocurrency is stolen, it should happen. As a part of the industry, it should avoid participating in the “coin-washing” process. The premise of all this may be: to understand the operation mode of this gray industry chain.

This article is deep chain Deepchain ( ID: Deepchainvip) original. Unauthorized reproduction is prohibited.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The blockchain is “useless”, why are we still gambling on the future and not willing to leave? | 2019 than the original chain global developer conference

- Korean media: 97% of the Korean exchanges are on the verge of bankruptcy, and the project side seeks overseas currency

- The report shows that the stable currency platform is the first Ethereum, and the second is the bit stock.

- A shares | China Construction will soon set up a blockchain financial platform, the stock price reached a new high within a year and a half

- Received more than 100 million US dollars in cryptocurrency, Fidelity announced 4 years of cryptocurrency charity record

- How much does it cost to maintain a blockchain startup?

- Hat analysts wearing XRP "mainstream coin speculation" also cautiously viewed it