Telegram signing purchase agreement guarantees that counterfeit money purchased by investors outside the market is worthless

Many of the Gram sold by OTC trading platforms are not held by Telegram investors, but counterfeit currency issued by the OTC market. Even if TON's main online line, OTC traders may not get the Gram they bought, and the currency of these over-the-counter transactions may be a scam.

Telegram tokens are circulated in unauthorized cryptocurrency exchanges and over-the-counter markets. According to Coindesk reports, an early investor at Gram revealed that Telegram had signed a purchase agreement with an early investor that would not allow Gram's early investors to offer, pledge, sell, or transfer directly or indirectly before the main online line. Sell or trade Gram. It is reported that the purchase agreement was drafted by the US law firm Skadden, Arps, Slate, Meagher & Flom LLP and has legal benefits.

“Telegram is the first project that legally prohibits early investors from selling their shares.” Some early investors revealed to Coindesk.

According to the purchase agreement, investors need to comply with the rules, and once Telegram finds that an investor has violated the agreement, it has the right not to recognize the investor's subscription share. In other words, retail investors who purchase tokens Gram on an OTC or unauthorized exchange may be at risk. If Telegram finds that an early investor has resold Gram in violation of the agreement, then Telegram has the right not to recognize the purchase at an OTC unauthorized exchange. The currency held by the investors of Gram, that is, the value of the currency held may become zero.

- Why has Shenzhen become a test field for digital currency innovation?

- BTC forced the sun, the market began to turn long?

- What is Web 3.0?

From January 29th to February 13th, 2018, the encrypted instant messaging application Telegram completed the first round of ICO financing, and then completed the second round of ICO financing on March 14th, raising $850 million. Telegram's two rounds of ICO raised a total of $1.7 billion. According to its white paper, ICO will raise funds to support the development of Telegram communication applications and launch the blockchain platform "Telegram Open Network". It is reported that Telegram will launch the Telegram Open Network (TON) network in the third quarter of 2019.

In addition, according to RBC, the token gram sold for $0.38 in the first round, while the token price rose from $1.10 to $1.45 in the second round of ICO.

OTC trader Vladimir Cohen said that although Telegram signed a purchase agreement with investors, it still couldn't stop the early investors from secretly selling Gram on the sidelines. At first, Gram sold for $0.37 at OTC and then rose to $1.33. Currently, Gram is priced between $1.6 and $2 in the OTC channel.

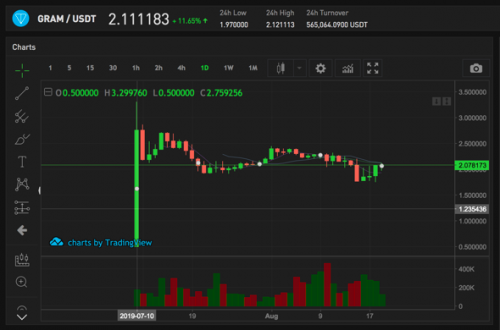

The GRAM/USDT trade on the coin-based BitForex is 0.5USDT on the line, up to 3.3USDT, and the current price is 2.1USDT.

Gram/USDT

Since the main network has not yet been launched, the Gram tokens sold in the market are futures, some of which are sold in cooperation with TON investors and others are resold after the trading platform is purchased. For example, Lbank launched Gram in March 2018 and promised to exchange the main network currency Gram with 1:1 after the TON main online line; CoinBene sold 625,000 Gram, and the withdrawal time was determined by the main online line. BitForex will sell 1 million gram in IOU form, and the withdrawal time will be 24:00 (GMT 8) on the fifth day of the main online line.

Under normal circumstances, when the number of circulating tokens is insufficient but the market demand is large, the exchange will actively form an internal disk. The exchange sells the user an expected currency voucher and promises to buy the currency to meet the user's cash withdrawal requirements. However, due to the centralization of the exchange and the opaque data, it is difficult to verify the authenticity of these documents.

Cohen said: "A lot of over-the-counter trading platform sales of Gram are not held by Telegram investors, but counterfeit currency issued by the over-the-counter market." He added: "Even TON's main online line, OTC traders may end up You won't get the Gram you bought, and these over-the-counter currencies may be a scam."

Source: Financial Network · Chain Finance

Author: LornaQ

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Blockchain Weekly | A week of financing 13 over 80 million US dollars, the public chain is favored by VC

- "New and old" exchanges compete on the same stage, how can you play in the future? | Interview with SheKnows

- Popular Science | Looking at the footprints of Ethereum from previous upgrades

- The State Council supports Shenzhen to launch digital currency innovation applications; Bakkt officially launched Bitcoin futures in September

- The pledge mining ecology has gradually prospered, but still faces many challenges. Can you still feel comfortable with Staking?

- My coins have been stolen, how are they washed white?

- Bitcoin challenges $11,000, and mainstream currencies rebound strongly. Where is the market going?