Dry goods | Pure coins, points, stocks, three simple token valuation models

Source of this article: stafi

Author: Middle

The concept of blockchain is derived from Bitcoin and has been accompanied by a utopian dream since its birth. People are fed up with the fact that they are controlled and exploited by centralized institutions in the real world, but they are powerless, and they set their sights on a new technology paradigm such as blockchain.

What is more popular than the concept is that people are enthusiastic about investing in crypto assets and participating in data currency transactions. After many times, people still have great enthusiasm for investing in crypto assets.

- Has the golden age of the alliance chain arrived?

- Trust crisis for charity projects, but only blockchain can solve it?

- Cryptocurrencies behind Africa's economic "crash" have become a new battleground

However, compared to the stock market that has been developed for hundreds of years, digital currency is an immature market, full of gambling thinking, irrational, and money scams. The leeks have no idea or even know the underlying logic of a certain token, so they blindly invest. Some blockchain projects use the issue of tokens as a means of financing. The tokens are decoupled from the on-chain business, or they are forcibly linked and forced to join.

In my opinion, before we invest in a token, in addition to having an understanding of the project's prospects, we also need to be able to estimate the value of the token. Buffett's value investment philosophy, in addition to being used in the stock market, should also be applied to the currency market.

As a researcher on the Stafi project team, I need to participate in the design of the stafi token (FIS) circulation model, and I need to objectively value the FIS, so that early project participants can see the future. In the process, I found a way to distinguish between token models and evaluate them. Different tokens have different models, their valuation methods are completely different, and the value difference is also very large. Investors please brighten your eyes and see clearly before investing.

I divided the token model into three types: ① pure currency model ② integral model ③ stock model, we will discuss one by one:

1.Pure currency model

The pure coin model refers to a simple blockchain digital currency. The purpose of its creation was to be used as currency. The most typical is Bitcoin and various fork coins derived from Bitcoin. The token in the pure currency model is currency, which exists as a transaction medium and a value storage method, and its value support point comes from the consensus basis and the scale of use . The value of Bitcoin comes from its consensus base accumulated over a decade, whether in the physical sense (there are tens of thousands of Bitcoin complete nodes in the world), or in the sense of spiritual conviction.

Because of this, a pure currency model token without a consensus foundation is basically worthless. The token valuation of pure currency models is almost impossible, because the scale and strength of consensus are not measurable. When people estimate the value of pure currency models, they usually refer to a similar existence in the real society and economy, such as comparing Bitcoin. gold.

As the concept of blockchain is deeply rooted in the hearts of people, more developers are paying attention to application tokens, using tokens to solve specific problems, stimulating network growth, and regulating the distribution of benefits. Few people are working on projects in the pure currency model.

2.Integral model

The token in the points model refers to the token that can be used to purchase services provided on the chain. The word "points" may not be appropriate, and we will use them for the time being. In daily life, merchants receive points for consumption, and points can be used to redeem cash, or redeem gifts. Merchants use points to encourage consumers to repurchase or to perform some behaviors that businesses need. The integral model token in the blockchain world, compared to it, has a much larger role. It must bear the incentive to grow the network, adjust the supply and demand balance, and have more specific uses.

New projects issuing such tokens are essentially pre-sale of on-chain services. The valuation of this type of token can be calculated by a common sense formula.

The value of money flowing through in a period of time = the value of the goods (services) flowing through

On the left, the value of money flowing through can be disassembled into the unit price of money * the amount of money in circulation * the number of circulations

After substituting, we can deduce

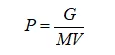

P (token unit price) * M (number of tokens in circulation) * V (number of tokens in circulation) = G (GMV)

We can change the formula to get:

With this is not enough, we need to ask for a discounted extremum.

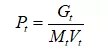

For example, in the expected t-year of a blockchain project, the transaction size GMV has reached a certain value. We use G t to indicate that according to the inflation rate, the number of tokens in the year is M t (Pos projects also need to lock stake The token is taken into account, an staking ratio is estimated, and the number of tokens in the lock position is removed. Based on the characteristics of the project, the average circulation number in the fifth year is estimated to be V t

Unit price of token at this time

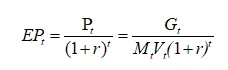

Assuming a discount rate of r, the present value of the unit price of the token in the n-th year, EP t , can be calculated according to the discount formula.

Here, the discount rate r is related to the interest rate, which represents the cost of using the funds, and is also related to the risk of the project. The higher the risk, the higher the discount rate.

It is assumed that the project touches the ceiling in 10 years and enters a stable operation period.

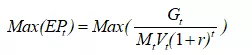

We can represent this maximum value as Max (EP t ), this number is the valuation of a single token. According to the above formula, we can get the final calculation formula

For your understanding, let us give an example:

Assume a blockchain project with a token model as an integral model. This year's on-chain transaction scale is 200 million US dollars (G 0 = 200 million US dollars). It is expected to grow at a rate of 30% in the next 10 years and enter stable operation in the 11th year. Growth rate to 5%

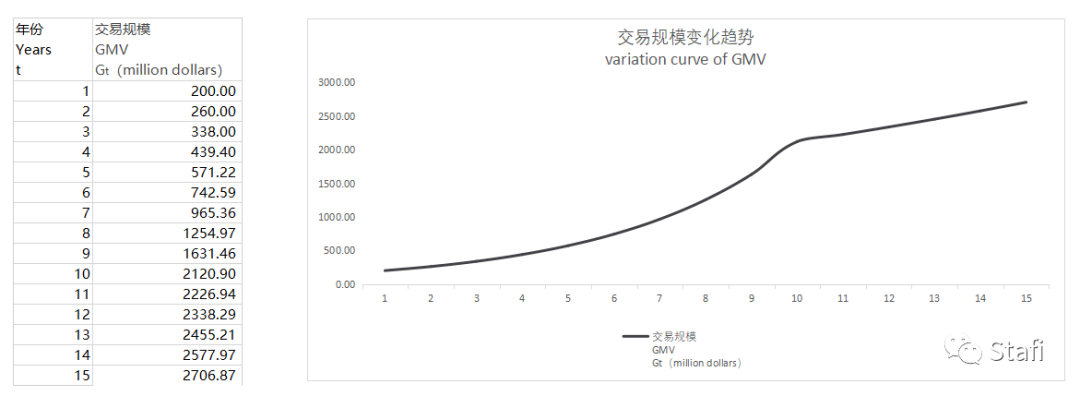

Then the future GMV change of the project, that is, the relationship between G t and t is as follows:

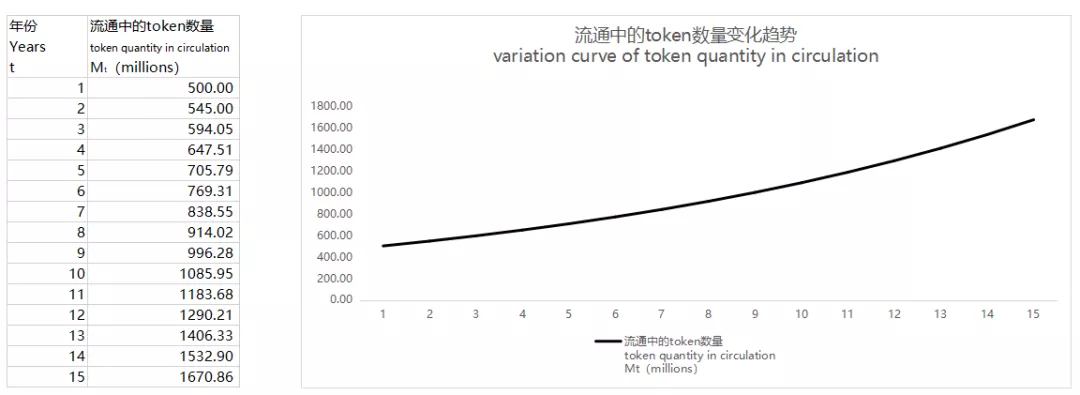

Assume that the total number of tokens of the project this year is 1 billion, the staking ratio is 50%, and the ratio will remain stable in the future; the annual increase rate after this will be 10%, and the loss rate (referring to lost coins, Slash, destruction, etc. will Token reduction ratio) is 1%, which shows that the net increase rate is 9%

The number of tokens in circulation in the future of the project changes, that is, the relationship between M t and t is as follows:

Assume that the average annual circulation of the token (or the average annual turnover) of the project is 3.5 and will remain stable in the future, that is, V = 3.5

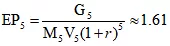

We try to calculate the present value of the unit price of the token in the fifth year EP 5

Calculate in the formula:

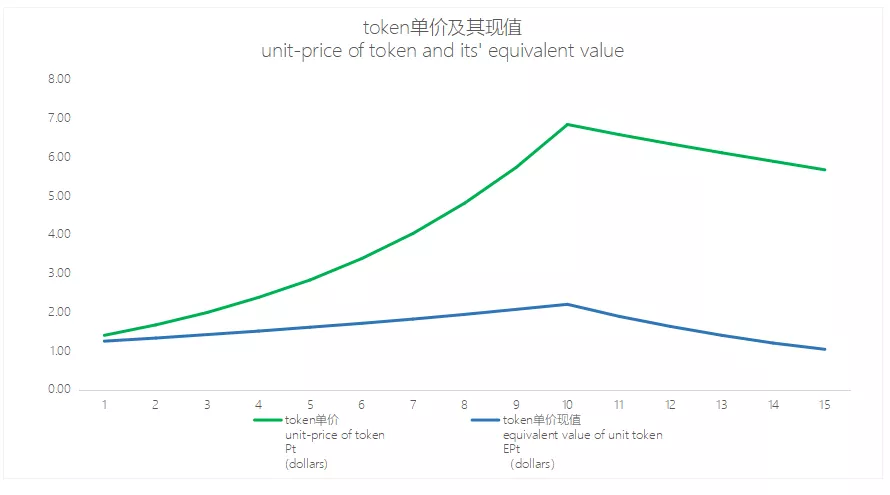

Based on the initial data, we can use excel to calculate the token unit price data for each year in the next 15 years.

There may be two questions here. First, if there is an item whose sustainable growth rate is greater than the discount rate, then the curve in the figure above will go up indefinitely. Without an inflection point, such items as Max (EP t ) = ∞ are Without a ceiling, it is impossible to exist in reality. Second, if it is an infinite deflation model, under the condition of stable business scale, the amount of money in circulation has been decreasing, and P t can grow infinitely at a rate beyond the discount rate. Will Max (EP t ) be infinite? If you only look at the formula, it will, but the model of infinite deflation, the deflation process is more like dividends to all holders . This fits the stock model rather than the integral model, which we will talk about later.

Some friends saw the previous formula for calculating the unit price of tokens, and they felt very familiar, especially those who are studying finance. Isn't this the Fisher formula?

Fisher formula

MV = PQ

Where M is the quantity of money, V is the velocity of money circulation, P is the unit price of goods and services in the society, and Q is the quantity of goods and services. However, the trading equation proposed by Fisher only expresses the correlation between various variables, and is not a tool for quantitative calculation. Because for real society and economy, it is very difficult to measure M, P, and Q accurately. We can only judge whether it is more or less. More difficult is V. In Fisher's concept, V is an abstract concept that represents the velocity of currency circulation and is relatively stable in a certain historical period. It can be viewed as a constant. Only when discussing different historical periods, V has meaning as a variable, such as the currency economy, V must be greater than the precious metal currency economy.

However, in terms of a blockchain project, the economic model is very simple, and the services provided are basically limited or even single.

The estimation of Q becomes an estimation of the development scale of a business; the estimation of V becomes an estimation of the transaction frequency.

The most interesting is M. In the real world, there are various forms of financial behavior, so there are different concepts of broad money and narrow money. The amount of money in real circulation becomes unmeasurable. In blockchain projects, token is token. If you intercept a historical period, how many tokens are in circulation, and how many times each token is in circulation, you can know its accurate data. Even if the future value is estimated, it will be much easier than the actual social economy. There is no borrowing, no securitization in the chain, no various financial behavior, only M0, no M1, M2, M3. (The financial behavior outside the chain does not affect the token ecology in the chain), as long as the inflation rate and loss rate are combined, The staking pledge rate (if any) can relatively accurately estimate the value of M in a certain period in the future.

It has to be said that blockchain is a great invention that allows us to try a variety of economic models, which in turn may teach us a better understanding of the complex real-world economy.

3. Stock model

Some exchanges issue tokens and promise to repurchase them at a specific price in the future. This is more like debt financing. Tokens are similar to bonds or preferred stocks. This model is not very typical, but is more like tokenization of securities in reality. . The design more in line with the token economy thinking is the stock model token.

The typical stock model token is to let the development of the holder and the chain always "share the same glory and disgrace". For example, MKR is a MakerDAO-like equity token. When a user mortgages ETH on MakerDAO to lend a stable coin DAI, the CDP contract will begin to charge. Finally, when the user returns DAI to redeem the collateral, the user will be charged a fee and fee. It is related to the amount and time of DAI borrowed by users, and to the stable fee rate dynamically adjusted by MKR holders through governance voting. This fee is called a stabilization fee.

The user needs to pay the stabilization fee in MKR. The paid MKR will be burned and disappeared by the system directly. Yes, you read it correctly, it was burned. In this way, the system pays dividends to all MKR holders in disguise.

Because the value of the burned MKR will be reflected in the increase in the price of MKR coins, this part of the value is equivalent to being distributed according to the proportion of holdings. If you do not hold MKR, this part of the value has nothing to do with you.

Of course, MKR is more than that. As a work token, holders need to participate in governance and determine various key parameters of the system through governance voting. The voting right is directly proportional to the proportion of MKR you hold. This is another aspect of MKR and stocks. Similar place. We will not talk about this point, work token is also a small topic, there are many wonderful discussions in the industry, everyone is interested to learn on their own, this article mainly discusses the issue of token valuation.

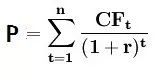

Since it is a token of the stock model, it can be valued according to the stock. The most classic and most commonly used method of stock valuation is DCF (discounted cash flow) . Its essence is to convert all expected future earnings per share into present value.

Discounted cash flow calculation formula:

Evaluation value of P-enterprise;

n the life of an asset (enterprise);

CF t -the cash flow generated by an asset (enterprise) at time t;

r-discount rate of expected cash flow

Since it is income, why is it cash flow instead of profit? This is because the profits in the company's finance are easy to be faked, so "cash flow discounting" is used in valuation practice instead of profit discounting. But for blockchain projects, the use of profit discounting is completely fine.

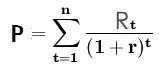

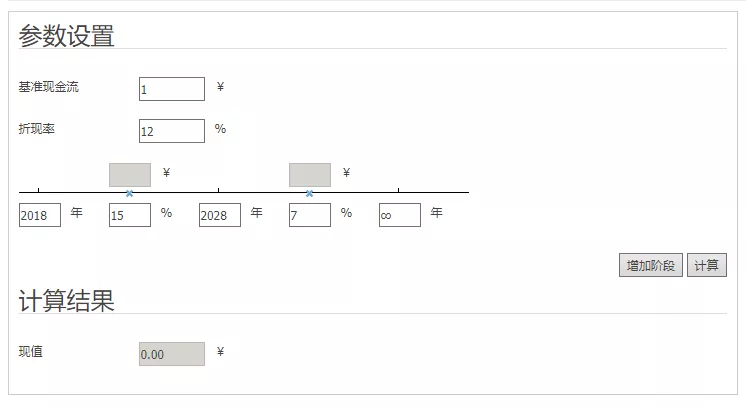

So we can replace CF t with R t (revenue at time t), where R represents revenue

We need to enter these variables, the first is the discount rate, and the second is the beginning scale of the on-chain business and the growth rate of each year in the future.

It should be noted that many tokens have an inflation rate, and it is necessary to take the inflation rate as an adjusted value to participate in the calculation.

We can understand this adjustment value. Although we hold a certain number of tokens, the proportion of the number of tokens we hold in the total tokens in the system is constantly changing. This is the difference between a token and a stock. If you hold the stock of a listed company, the company cannot issue new shares at will, diluting your equity. The stock you hold represents a fixed shareholding ratio.

It is also a token. When the total number of tokens is 100 million, the representative equity is 1/100 million of the total project revenue. When the number of tokens inflated to 110 million the following year, it can only represent 110 million points of the entire project's revenue Of 1

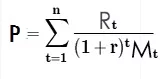

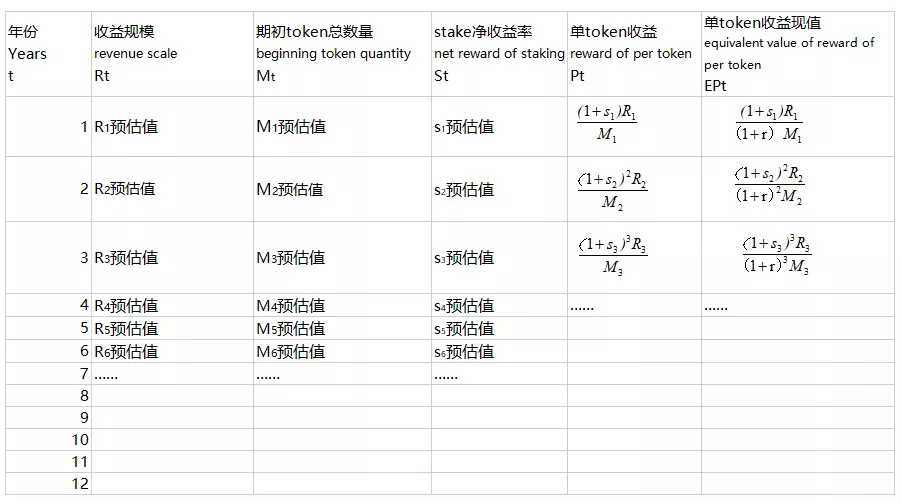

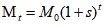

Therefore, in the case of calculating the P value, taking into account the inflation rate, we cannot directly divide by the "total number of shares" to obtain the "value per share". Since the number of tokens is constantly changing, we take the number of tokens in year t Expressed as M t , M t is a function of t.

After plugging in, we can express the value of each token as

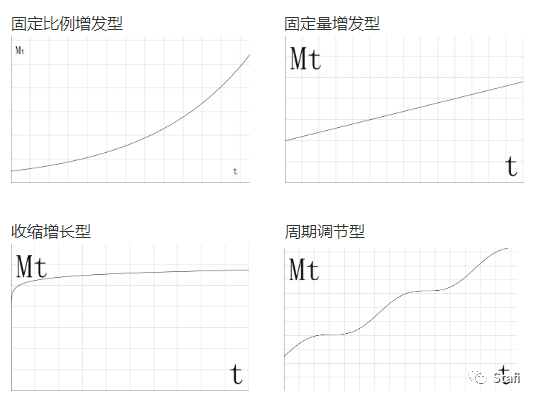

In the specific calculation, we also need to know the expression of M t . Different items have different inflation strategies. The expressions of the functions of M t and t are not the same. We use graphical representation.

Why there is no deflation model here. In blockchain projects, inflation and deflation are different in nature. Inflation is often the issue of new tokens to dilute the rights of holders, while deflation is often the destruction of some tokens, which is given to all token holders in equal proportions Assigning value does not change the token holder's holding ratio, and of course, it does not change the holder's equity. As mentioned earlier, destruction is more like a dividend to token holders.

It should be noted that in a project where both inflation and deflation models exist, when calculating M t , it is necessary to assume that the deflationary token still exists, otherwise the benefits of deflationary allocation will be double-calculated.

Most application chains use the PoS consensus mechanism. In the token valuation of such projects, we can completely assume that the tokens we hold are participating in staking. Due to the existence of stochastic parameters in the consensus mechanism, the return of stake fluctuates in the short term, but in the long run its return is equal to the inflation rate divided by the stake ratio.

Stake yield = inflation rate / stake ratio

Here we subtract the operating cost of participating in stake is the net return of stake. The operating cost of stake refers to electricity costs, system maintenance costs and the like.

Stake net return rate = stake return rate-stake cost

In fact, we have a simpler option, which is to entrust the token to professional stake service providers (such as Chorus, Wetez, Certus, Hashquark, etc.) and pay a certain percentage of commission from the staking income (the market is about 10-15%).

Stake net return = (1- commission commission ratio) stake return

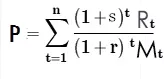

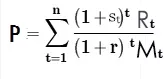

Assuming the net return of stake is s, then take stake into account in the valuation formula. The final formula for the valuation of a single token in a stock model project is:

among them:

t stands for time

s is the net yield of stake

r is the discount rate

R t is the total profit of the on-chain business at time t

M t is the total number of tokens on the chain at the beginning of time t (the ones that were destroyed during time t at the time are also included, and those that are destroyed before time t are not included )

If there is a large difference in the yield of the take in different periods, then we need to replace s in the formula with s t (the yield of the take in the period t)

We can enter the initial data through the excel form, that is, our estimation of M t , R t , s t in each future year, and set an r, then we can do the calculation.

The sum of all the values in the rightmost column using the Sum function in excel is the result value we require . Since the asset life n tends to be infinite, the longer the table is pulled, the larger the t value is, and the closer the calculation result is. The final value.

This is still quite troublesome. In practice, we can sacrifice some accuracy, make such assumptions, do not consider the cost of the take, and assume the take ratio is 100%, then the net return of the take is equal to the inflation rate, so

(M 0 is the number of tokens at the beginning of the period)

Available after substitution

In this formula, the equity increase generated by stake and the equity reduction caused by inflation and stake cost are essentially offset. Under this assumption, the proportion of tokens we hold to the total number of tokens remains unchanged. After simplification, the valuation of tokens will be almost the same as the valuation model of stocks.

In this way, you can use mature DCF valuation calculation tools to calculate and enter the initial value to get the calculated valuation result.

DCF stock valuation calculation tools:

https://www.iguuu.com/app/dcf

Summary and explanation

Above we introduced three models of tokens and their respective valuation models. In addition, I have three explanations. First, each project in the blockchain field is geared towards solving different needs. The circulation of tokens and the use scenarios are different. There are a variety of different scenarios, but from the perspective of valuation, these three modes Basically adequate. The token model of many projects is not a pure one, but a combination of multiple models . We can follow two principles to value. One is to see which one of the main models of the model belongs to, and we take the main aspects, and the other is to see Which model is used for higher valuation, we take it higher. I see that many application chain tokens have both points and stock attributes. We should use a higher-valued stock model.

Third, some tokens have long deviated from their value. In addition to the general pessimism or optimism that has nothing to do with business, there is another possible reason, which is that the price of the token in the pure coin model exceeds the price in the other two models. In other words, the currency attributes of such tokens have been fully explored, resulting in prices higher than their application value, just as the price of gold far exceeds its practical value in industry and life. However, this situation is not necessarily a good thing for application tokens. Although the token price is too high, making the core team with more coins have more funds to develop the system, but it will also lead to distortion of the role of participating roles on the chain. Has an adverse effect on the growth of the network.

We know that the speculative factor has always been an important part of the token price, but the healthy development of the business on the chain actually requires the token to have a stable price (or stable and predictable growth or decrease), and we can strip it in one way. The speculative factor in the price is to transfer non-business transactions off-chain. M1 and M2 are created outside the chain, making the flow of native tokens more service for the on-chain business itself. The off-chain circulation is the bond that can be used to exchange the native tokens. So, the dilemma is self-explanatory.

The Stafi protocol can play such a role.

Due to personal thinking limitations, if there is any rigor in the text, I also ask friends in the industry to correct it. If there is a better method for token valuation, it is also welcome to explore.

By Middle Stafi blockchain researcher

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Can smartphone + hardware wallet save HTC?

- Ethereum welcomes hard fork upgrade again, Reddit community supports block rewards reduced to 1 ETH

- The road to low-defense DeFi: how to achieve it? Let's take a look at these four options

- DeFi's windfall, ConsenSys researchers find that DeFi is driving Ethereum decentralization

- Nine developments, based on the performance of Lightning Network in a year, can you submit satisfactory answers?

- Industry Blockchain Weekly News 丨 Leaders in many places support the blockchain, the party secretary of Shanghai

- What the turbulence of the currency market means for cryptocurrencies