The road to low-defense DeFi: how to achieve it? Let's take a look at these four options

Foreword: Blue Fox Note yesterday's article talked about one of the most important issues that DeFi currently needs to solve is the problem of high mortgage rates. Today's topic is about how to solve this problem. How to achieve low mortgage DeFi? At present, there are four main schemes. One is to imitate the method of recovering private keys of smart wallets to ensure repayment security through social methods. The other is to construct an encrypted credit score and grant credit based on the score. The third is to use zero-knowledge proof to evaluate personal financial information. The fourth is to build a DAO of the credit market. From the perspective of Blue Fox Notes, combining zero-knowledge proof and credit market DAO may be a breakthrough, and there is more room for innovation. Alex Masmejean, author of this article, is translated by "CoL" of the "Blue Fox Notes" community.

As in the past, the future of DeFi lies in low mortgages. Of all the growth signals in the crypto world, the DeFi movement is the most obvious: its total locked-in asset value is more than $ 600 million, an increase of more than 6 times over the beginning of 2018. But its use cases still revolve around "speculation based on speculation," primarily driven by venture-backed startups such as Compound. (Blue Fox Note: I don't agree with it here. Except Compound, MakerDAO, Synthetix, dYdX, InstaDApp, Uniswap, etc. are all promoters)

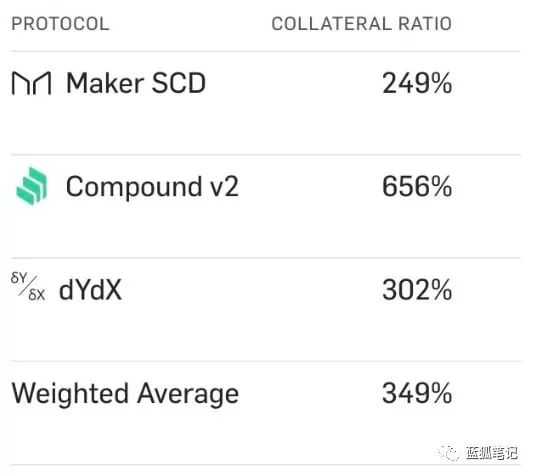

This market includes margin trading that crypto natives seek to stimulate, or whale lends its assets to obtain considerable returns, and its annualized interest rate can even hover above 15%. In order to force the repayment of these highly volatile loans, these platforms use "excess mortgages" as security guarantees.

MakerDAO's Dai has an average mortgage rate of 394%, which means that for price stability, excess ETH is locked. The arrival of multi-collateral Dai will mean new possibilities. And less liquid assets such as Synthetix have a staggering 750% mortgage rate. Lock in so much value, the utilization efficiency of these locked value assets is very low.

- DeFi's windfall, ConsenSys researchers find that DeFi is driving Ethereum decentralization

- Nine developments, based on the performance of Lightning Network in a year, can you submit satisfactory answers?

- Industry Blockchain Weekly News 丨 Leaders in many places support the blockchain, the party secretary of Shanghai

Although this is understandable in the emerging crypto markets, this is not the way most financial worlds operate. It is reasonable to assume that most people in this world will be unwilling or unable to deposit more than loan funds for loans: in the United States alone, student loans totaled $ 1.4 trillion in the first quarter of 2019, And this is just the tip of the iceberg. Cryptocurrencies need to address this challenge by introducing a low-collateral model. But how to financially enforce things without financial support? Here are four scenarios:

Social Fund Recovery

The first solution is to shift the financial burden from the lender to a more suitable entity: in the event of a default, let others guarantee repayment. Just as the smart contract wallet has a "social key recovery" function, where enough unrelated friends can help a person restore their ability to access the wallet, "social fund recovery" relies on trusted parties to purchase and be able to insure and share their Mortgage cost options.

For example, Alice borrowed $ 100 through the new service and persuaded five of her friends to buy $ 20 options to cover the full amount. Since the purpose of most people's borrowing is to purchase goods or services in advance, rather than betting on the future of cryptocurrencies, the borrowing itself will be stable, thereby alleviating the problem of volatility. However, the logic also shows that we usually maintain close relationships with people with similar financial conditions, and those who need fast liquidity are not always surrounded by relatives who can help. (Blue Fox Note: Social methods need to give enough incentive to the surrounding participants to continue)

New credit score

A more ambitious way to achieve low mortgages is to replicate the "credit score", allowing expansion from the circle of friends to the macroeconomic level. The "crypto credit score" will take into account factors such as salary over the past n years, income stability, default precedent, and whether someone is able to repay the loan. If the answer is yes, it determines its loan interest rate and repayment frequency based on the person's financial health. The former may be unstable and will be found in real time.

But this opens up the pitfalls of identification: In the crypto world, can't the defaulters escape directly? Similarly, even if you successfully solve the identity layer problem, the risk lies in designing a review system that allows for loans other than loans. In this case, Alice does not repay her $ 100 loan, freezes her account, and borrows as much assets as possible in the crypto world. She just logs out and creates a new account with a different address. Her credit score became neutral again.

To avoid this pitfall without revealing identity, healthier systems are subtle and have independent identities with varying degrees of anonymity. Financial identity issues will bring together all the financial information of an individual without having to obtain any other type of data about that individual. Non-financial prestige (such as social identity) will not be auditable, even if it proves to be a poor borrower.

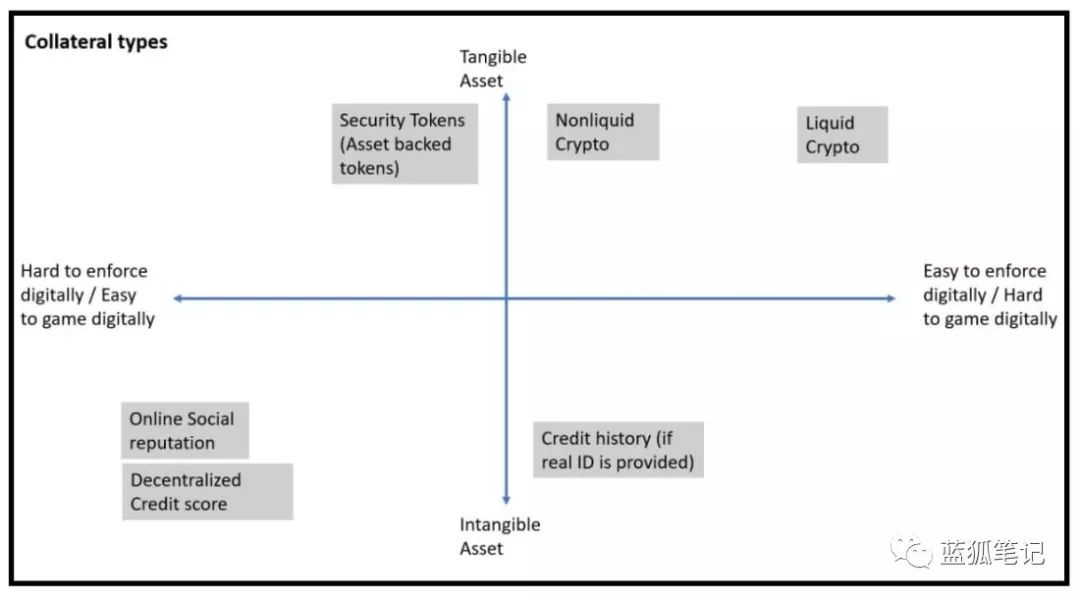

Implementation issues: Mortgage asset types are sorted by physical range.

Implementation issues: Mortgage asset types are sorted by physical range.

Zero Knowledge Proof (ZKP)

Another solution is to use zero-knowledge proofs. In layman's terms, this means that you can ensure that someone has a convenient crypto credit score without revealing any information about the person, thus taking into account the advantages of encryption and traditional finance. . In the future, going to the bar to verify that your age should not reveal the complete ID information to the doorman, instead, there will be an immutable certificate stating whether a person is over 21 years old, which can also protect your credit rating.

One problem is that the data that can be used to objectively evaluate our encrypted credit score is not on Web3. We did not provide enough data on the borrower's target market to make inferences.

We have two choices. One is to get along with Web2 and try to integrate the data. Even if the data is "semi-centralized". Logging in through social media to obtain identity, and also integrate revenue data from some platforms, such as Airbnb or Uber, which can meet certain elements of personal credibility. The second is to extract data from traditional finance. Although this is an obvious choice, it will significantly slow down the process and implement a review system, repeating the inaccuracies we are trying to replace the system with.

Credit Market DAO

This is not innovation. Blindly copying past patterns is unlikely to help. As Peter Thiel has said, the next Google will not be a search engine. Here's the new thing: if the Internet supports a tight trust network, on average, everyone on the planet can connect to anyone with an average of 3.5 connections, and there is also the wisdom of the public. Can this measure people's ability to repay loans? ?

Social groups can form alliances to alleviate loan risks and share profits from interest rates, thus strengthening together. A DAO-like system can incentivize these groups to act correctly, thereby rewarding successful repayments in proportion. This system can even create new types of "credit check" jobs.

Individuals will not be judged solely by themselves, but overlapping judgments between different groups to which they belong, to maximize betting on people in groups. This may stimulate a positive-sum game in which liberating someone from the borrower's situation may eventually strengthen a group.

Maybe some of the above methods or a combination of these methods will become popular, or maybe someone will come up with a completely different solution. But one thing is clear, low mortgage is the future of DeFi, and the entire ecosystem will push it to achieve it in the least trusted way.

Risk warning: All articles of Blue Fox Note can not be used as investment advice or recommendations. Investment is risky. Investment should consider personal risk tolerance. It is recommended to conduct in-depth inspection of the project and make good investment decisions.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- What the turbulence of the currency market means for cryptocurrencies

- Zero-knowledge proof study notes: background and origin

- Can Ethereum survive without monetary policy?

- "Blockchain + insurance" is not without disadvantages, two major problems to be solved

- Free and easy week review 丨 US government agencies research fiat cryptocurrencies through fork BTC

- Babbitt weekly election 丨 Central European Central Bank pays close attention to stablecoin risk; Ripple raises US $ 200 million and is valued at US $ 10 billion

- U.S. regulation and processing of cryptocurrency