Cryptocurrencies behind Africa's economic "crash" have become a new battleground

It is undeniable that in the context of global economic development, Africa's economy and the Internet have made certain developments in recent years, but Africa's economic development has never set foot on the fast track. Lack of an independent monetary policy, severe inflation, undue return on foreign debt, continued armed conflicts, and poverty-stricken Africa are mired in search of redemption.

Today, Africa has become a new battleground for cryptocurrencies.

According to the Global Digital Yearbook 2019 by social media management company Hootsuite and global agency Wearesocial, the number of users with cryptocurrencies in sub-Saharan African countries such as Ghana and Kenya has entered the top 45 in the world, and a large population of these countries holds Cryptocurrencies such as Bitcoin.

A new generation of Africans will buy virtual currency as an investment tool, and a small number of Africans will speculatively use cryptocurrencies to profit. At the same time, more and more Africans are using cryptocurrencies to meet financial needs, such as using cryptocurrencies to transfer goods, services and funds.

- Can smartphone + hardware wallet save HTC?

- Ethereum welcomes hard fork upgrade again, Reddit community supports block rewards reduced to 1 ETH

- The road to low-defense DeFi: how to achieve it? Let's take a look at these four options

Fiat currency collapses, Africans overwhelmed

Under the hundreds of years of colonial invasion and oppression in Africa, which had brewed the ancient Egyptian civilization, development was disrupted and delayed indefinitely, and development in some areas was even stagnant.

Since the mid-1990s, global economic growth has fluctuated, but African economies have maintained a restorative growth trend for more than a decade. According to statistics from the International Monetary Fund, from 2004 to 2006, the GDP growth rate in Africa once exceeded the world average.

Nonetheless, successive years of economic growth still cannot fill the base of Africa's poor and weak base. In addition, long-term ethnic conflicts in Africa, tropical diseases, destruction of the industrialized environment, post-independence regime corruption, and poor people's self-discipline have all made Africa the most concentrated region in developing countries in the world. 1%.

Public debt is high

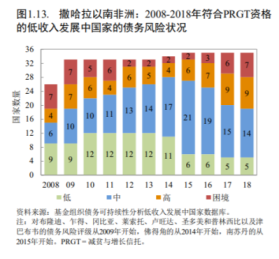

Africa's infrastructure is extremely backward, and economic development is still in the phase of infrastructure stimulus and economic production. However, Africa's own economic growth capacity cannot afford high infrastructure costs and can only rely on international loans. Over time, Africa has formed a large public debt problem. According to the World Economic and Financial Survey 2019 published by the International Monetary Fund, of the countries classified as high in debt risk or those already in debt, 16 are in sub-Saharan Africa.

The high level of debt has brought increasing tax burdens to people in Africa. According to the CME Group survey, when a country's total debt (including public sector debt and private sector debt) approaches 250% of its gross domestic product (GDP), the financial crisis takes root in that country. Looking at some countries in Africa, their debt ratios approach or even exceed this risk threshold.

The crisis doesn't stop there. In fact, in order to feed a huge population, some African countries will subsidize direct or indirect subsidies in the import of basic commodities such as food, sugar, salt, and diesel. If the country's debt is heavy, this supply will have to be cancelled, which will directly lead to a decline in people's living standards and purchasing power, and then trigger social riots.

Severe inflation

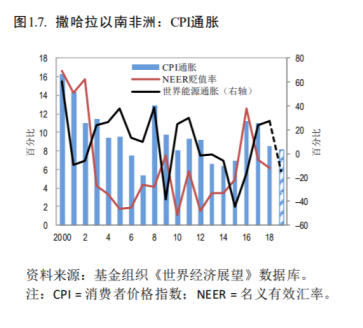

In recent years, the rise in petroleum prices has caused the production costs of oil importing countries to rise linearly, and prices have risen accordingly. In exporting countries, increased oil revenue businesses have stimulated domestic demand and prices have risen. As Africa is an important oil exporting country, in the face of this situation, some African countries have adopted a crazy way of issuing currencies to meet domestic demand, which has directly led to serious inflation in Africa.

According to World Bank data, the inflation rate in South Sudan from September 2016 to September 2017 was 102%. Other countries with double-digit inflation rates include Egypt, Ghana, Malawi, Mozambique, Nigeria, Zambia, and Zimbabwe. .

Take Zimbabwe as an example. The worst inflation situation in the country reached 10,000% at one time. Hyperinflation emptied the property of the people of Zimbabwe, and also brought down the economy of Zimbabwe. The collapse of the fiat currency system has not only laid a foundation for Zimba's continued weak economy, but also overdrawn public confidence in the entire banking system. In 2009, Zimbabwe implemented currency reforms and decided to use dollarized measures to save the domestic economy.

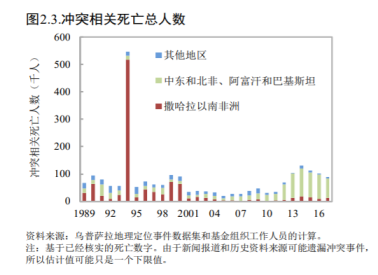

Ongoing geographical conflict

According to the IMF's Regional Economic Outlook 2019, violence has risen in Africa since 2010, and conflict-related deaths have risen rapidly. The average annual number of conflict-related deaths since 2014 is about 14,000.

History has proven more than once that conflicts can bring immeasurable calamities to humankind and hinder economic growth for a long time after conflicts. Protracted conflicts have made Africa's public finances more difficult, which ultimately led to rising fiscal deficits and public debt, which in turn undermined the currency system.

Take the oil major Nigeria, for example. Since the merger in 1914, the internal conflict in Nigeria has never ceased, which has led to the 21st century Nigeria becoming a "melting pot" of conflict and violence. The value of the depreciation was 450 naira in October 2016.

Downside risks to the economic outlook have made fiat currencies in some African countries extremely unstable. In these countries, holding domestic legal currency means a sharp decline in purchasing power, while traditional hedges such as foreign exchange and gold have higher thresholds and are not easily available. In this context, cryptocurrencies have naturally become the best way for Africans to hedge.

Looking for speculative salvation

African people are seeking new ways of redemption outside the collapsed fiat currency system.

Data show that there are about 326 million adults in Africa, and 80% of them have no bank account. In sub-Saharan Africa, less than 3% of people use credit cards. Although banking coverage is extremely low, mobile phone penetration in Africa exceeds 70%, which provides a prerequisite for the development of cryptocurrencies. It is extremely important that there are fewer cryptocurrency websites on the African continent, which means that this is a natural area for cryptocurrency to be mined.

In 2019, South Africa's cryptocurrency holdings ranked first in the world, with about 10.7% of Internet users holding cryptocurrencies, and Nigeria ranked behind with 7.8%.

In 2017 alone, 15 new digital currency exchanges emerged in South Africa. Compared with the standard currency issued by the government, cryptocurrency users can remit money to any place with an Internet connection without paying the interference of third parties such as government banks. At present, African cryptocurrency users conduct 17,000 Bitcoin transactions per day, an increase of 130% compared to 2018.

As transaction volume and bitcoin prices continue to rise, bitcoin mining in Africa has also increased. According to Coindesk, a company called Ghana Dot Com in Ghana opened the first major bitcoin mines in the country in 2016. This year, a physical mine in South Africa called Bitmart opened.

"I started mining bitcoin in Nairobi, Kenya in September 2017, and by far this is the best business I've tried," said miner Gladys Laboi.

Cryptocurrencies have enabled African people to find a way to redeem themselves. Cryptocurrencies have begun to spread in Africa, which has affected African governments. More and more African countries have begun to develop virtual currencies to rescue paralyzed economies.

In November, Tanzania signed a $ 175 million contract with Russia, and payments will be made in the cryptocurrency Prizm. On November 7, according to the Russian state news agency TASS, the Tunisian central bank launched a digital version of its national currency, Dinar (Dinar), "E-Dinar". Mauritius has sandboxed legislation for blockchain, allowing blockchain technology companies to operate in the African and Indian markets and launching blockchain commercial applications.

In addition, most African countries' policies on cryptocurrencies and blockchain are still blank, and most of Africa is still in the state of ICO unregulated, which leaves great development space for local blockchain development, which also attracts A large number of exchanges and cryptocurrencies went to pan for gold.

In Sudan, a large number of blockchain-related businesses have begun to take root, including Codexi, a company focused on blockchain development, and mining company SG Mining, which uses gold assets as a reserve for cryptocurrencies. In Nairobi, Kenya, BitHub Africa provides consulting services for companies developing blockchain businesses; bitPesa, a payment and transfer platform service provider, has established partnerships with more than 60 banks and operates 7 mobile wallets.

At the same time, more and more blockchain startups have settled in Africa, and there is a great potential for sparks. Some giant companies have already established branches in Africa, such as Consensys, Ripple and Rightmesh.

Scams pile up, Africa plunges again

"Africa is a hotbed of bitcoin fraud."

Cyber scams in Africa have a long history.

In 2012, 3M Company (Mavroj Global Savings Tank), one of the oldest and largest Ponzi schemes in the world, had already entered the African region, and attracted a large number of investors with a high inflow of 50%. 5 Years later, the founder of 3M died, the platform went down, and thousands of Kenyan investors' assets were locked up.

Prior to this, the 3M scam also deceived thousands of South Africans and Nigerians in their lifetime savings.

In recent years, bitcoin-led cryptocurrency scams have been frequent in Africa, which has made the African economy and African people into a more severe mire.

The Africans were caught off guard by the inconceivable scam and Calabar, which has the same scamming methods as 3M. Calabar has packaged itself as a bitcoin trading company, and its claimed 30% interest return made it popular with Nigerian investors as soon as it appeared. However, the company went bankrupt after only a few weeks of operation, with the assets of more than 1,000 people looted.

Similar scams are endless in Africa.

In 2018, South Africa-based Bitcoin Global opened its business with huge amounts of money after only two weeks of operation.

In 2019, hackers took control of the official Twitter account of the South African Cricket League and used it to hype up the scam.

In March 2019, Velox 10 Global, a Brazilian investment company, closed down after a year of operation. Thousands of Kenyan investors lost their money and fell into desperation.

Taking advantage of the weak awareness of the public and the lack of government supervision, the scam, which had failed in other regions, has rediscovered the breeding ground in Africa.

The problem in Africa is a malady that has taken root for many years. The potential needs and energy of this continent echo the problems that the cryptocurrency itself can solve. Perhaps with innovative applications, Africa can become the next battlefield for cryptocurrencies.

Author / Darcy Editor / Never

Operations / Harry Production / Star Media

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- DeFi's windfall, ConsenSys researchers find that DeFi is driving Ethereum decentralization

- Nine developments, based on the performance of Lightning Network in a year, can you submit satisfactory answers?

- Industry Blockchain Weekly News 丨 Leaders in many places support the blockchain, the party secretary of Shanghai

- What the turbulence of the currency market means for cryptocurrencies

- Zero-knowledge proof study notes: background and origin

- Can Ethereum survive without monetary policy?

- "Blockchain + insurance" is not without disadvantages, two major problems to be solved