Economic bandwidth without trust: why Ethereum is irreplaceable

Source: Crypto Valley Live, original title "Ethereum Economic Bandwidth Classification"

Author: Ryan Sean Adams, Lucas Campbell

Translation: Ziming

Economic bandwidth is the driving force behind open, decentralized financial services. In Eth2, economic bandwidth can also ensure Ethereum as a global settlement layer. The more economic bandwidth on the network, the higher the capacity of financial services and the security of the entire network.

- Vitalik: Ethereum state explosion problem, polynomial promise solution can solve

- How to correctly understand DAO tokens?

- Data Increment: New Business Opportunities for Enterprise Services + Blockchain

In order to promote a decentralized, trustless financial economy, Ethereum will need trillions of dollars of economic bandwidth. But where does it come from?

Yes, economic bandwidth comes from the total value of network assets.

But we need more specificity, because not all economic bandwidth is equal.

Trustless economic bandwidth

Today, Ethereum's token ETH has become a major reserve asset, providing economic bandwidth for its token protocol and financial applications.

Importantly, Ethereum provides the most valuable form of bandwidth-economic bandwidth without trust. ETH is the value without trust, which provides economic bandwidth for Ethereum's license-free token protocol.

In order to build a trustless economy, we need trustless value. Imagine that if USDC is the main reserve asset of Ethereum, the entire system will be controlled by Coinbase, Silvergate and the Federal Reserve, and it will still be a centralized system.

Only through fully decentralized, on-chain settlement, encrypted local assets like BTC and ETH without the support of a central bank, can we realize the value without trust.

The total flow value of these untrusted assets is the network's unlicensed economic bandwidth. In other words, the total economic bandwidth of Ethereum denominated in USD is the liquid market value of ETH.

But can ETH also become a source of economic bandwidth without trust?

Tokenized assets as economic bandwidth

Although the tokenized assets on Ethereum provide economic bandwidth, it cannot be completely regarded as economic bandwidth without trust.

E.g:

Synthetix is an Ethereum-based synthetic asset distribution agreement, and it represents the native asset SNX. Although Synthetix has launched ETH-based collateral, and this move will greatly increase Synths' economic bandwidth, today its synthetic assets rely almost exclusively on the economic bandwidth provided by SNX.

So can other DeFi protocols use SNX as economic bandwidth?

Yes, but they must trust Synthetix.

Although SNX has proven itself to be a form of economic bandwidth in the Synthetix ecosystem, it still lacks the most important feature in terms of economic bandwidth for the broader trustless economy: it is not trustless. When SNX is settled on-chain, the Synthetix team has sufficient control to intervene in the issuance of SNX.

SNX has a trustless settlement method because it is based on Ethereum settlement. But it does not have a trustless distribution method, as its supply is manipulated by a third party. Therefore, SNX cannot be regarded as an untrusted asset like ETH.

There appears to be a range of trust in the process of issuance and settlement. Can we apply it to a broader asset classification?

Trust quadrant

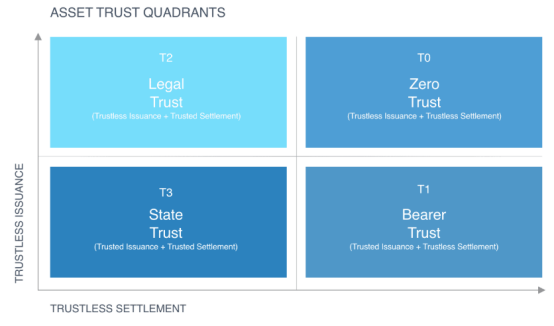

Let's define the degree of trust related to assets through two parts: issuers that don't need trust and clearers who don't need to trust.

- An untrustworthy issuer means that the asset's issuance policy is independent and cannot be manipulated by self-interested third parties.

- A trustless settlement party means that the finality of the transaction of the assets does not depend on, and cannot be controlled by, self-interested third parties.

The combination of assets with an untrusted issuer and an untrusted clearer is the best form of economic bandwidth for a decentralized system. Zero-trust assets are assets in the upper right quadrant.

- Zero Trust Assets (T0)-Issuer without trust & clearer without trust.

Let's take a look at the other quadrants:

- Bearer Trust Assets (T1) -Trust issuance & settlement without trust.

- Legal Trust Assets (T2)-Issuance & settlement without trust.

- State Trust (T3) -Trust Issuance & Trust Settlement.

ETH, BTC, and gold are the three least trusted forms of economic bandwidth that exist today. Unfortunately, because gold's trustlessness is limited by its physical form, it has less useful bandwidth in the digital native economy.

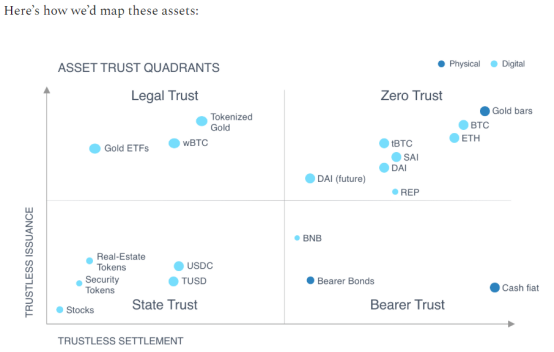

The following figure shows the positioning of several types of assets in the four quadrants:

Let's take another example of these four types of assets.

First take a look at zero-trust assets:

- BTC: Zero-trust assets when settling on the BTC network;

- ETH: Similar to BTC, but compared to BTC, the degree of trust without issuance and settlement of ETH is lower;

- DAI: Supported by ETH, but because of Oracle and governance, it is less trustless than ETH.

Bearer trust assets:

- Fiat currency: Settlement can be completed only with possession, but its issuance requires government credit.

Statutory trust assets are generally neutrally issued assets within the framework of legal guarantees:

- Tokenized gold: The mining and distribution of gold cannot be manipulated, but if the gold in the vault PAXG disappears, it can only be resorted to legal channels.

- wBTC: Digital currency issued by BTC as an endorsement based on the Ethereum ERC-20 standard, settled by the legal system.

Absolute trust assets include almost all asset types of the traditional financial system:

- Stocks: Increased circulation through shareholder voting and settlement through corporate law.

- USDC: Although it is settled on the surface of Ethereum , it is actually settled in US dollars of the banking system.

- Treasury bills, derivatives, bonds, CDs: all of these are absolute trust assets.

Maybe you change the position of some of these assets in the diagram, but do you see how the model works? The assets represented by the left and bottom quadrants are guaranteed by force and government, while the assets of the upper right quadrant are not required.

Why gold is a zero-trust asset: The distribution of gold is determined by the physical environment. Surface supply of gold is expensive, so increasing supply is hampered (unless technology makes a leap in ocean or asteroid mining). The settlement of gold is also trustless-when the ownership of a unit of gold is transferred from one person to another, the settlement is over. And ownership means the end of settlement.

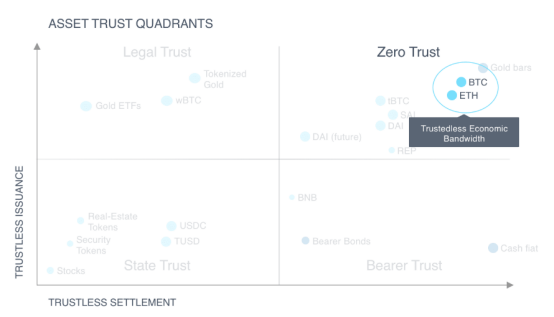

ETH and BTC are the only digital assets that occupy billions of dollars in the Zero Trust Quadrant. And DAI, tBTC will also rely on ETH and BTC to reach the same scale. This is why digital currencies are so important.

But BTC also has some problems:

Although BTC settles on their respective networks in a trustless manner, if deposited into Coinbase, the settlement depends on the third party. BTC will not be a zero-trust asset, but a statutory trust asset.

Because BTC is limited by its network functions, it is more used as a network for point-to-point value transfer, rather than a network of programmable currencies. Most monetary behavior of BTC requires a trusted crypto bank.

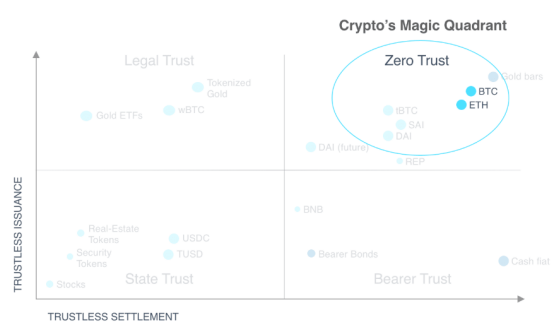

This is why ETH is so important. The characteristics of Ethereum mean that we can create a complete currency system in the Zero Trust Quadrant.

This is why ETH is irreplaceable.

(Have you heard of Gartner's Magic Quadrant? The upper right quadrant can also be regarded as the magic quadrant of digital currency)

Types of Ethereum Economic Bandwidth

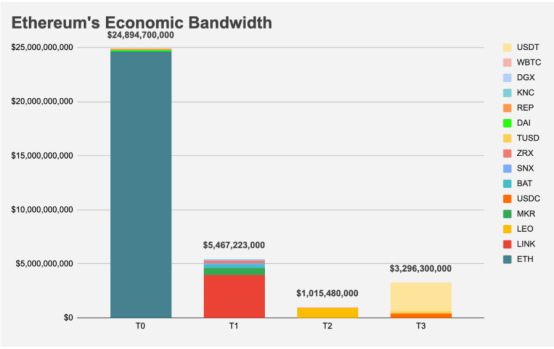

Let's calculate some data. Compared to other currencies based on Ethereum, what is the available economic bandwidth of the Zero Trust Economy (T0)?

As expected, ETH has provided the most economical bandwidth of T0 to date-more than $ 24.6 billion in bandwidth for Ethereum. Other forms of untrusted economic bandwidth include DAI and REP.

The T1 economic bandwidth forms a total available bandwidth of $ 5.4 billion, as it includes most tokenized projects such as LINK, SNX, BAT, etc. These are liquid assets that have a trustless clearer but have a trusted issue. It is because their respective teams have sufficient control over their distribution that they are trusted to issue assets.

That is to say, if these T1 tokens can minimize the impact of individual entities and individuals in the crypto ecosystem, then many such T1 tokens in the future are likely to become untrusted economic bandwidth. For example, there was a time when BTC was in the T1 quadrant.

The scale of loans provided by the economic bandwidth T2 and T3 is slightly higher than $ 1 billion and $ 3.2 billion, respectively. Recall that T2 assets have issuers that do not need to be trusted but have forms of trust settlement, such as wBTC and tokenized gold.

T3 assets include USDC, TUSD, and USDT, which have trust settlement and trust issuance functions and stable currencies backed by fiat currencies, which makes them heavily dependent on traditional financial systems. UDST provides the highest economic bandwidth of T3. With a total circulating supply of $ 4.3 billion in the report, more than $ 2.7 billion has been tokenized on the Ethereum platform.

Economic bandwidth consumed by DeFi

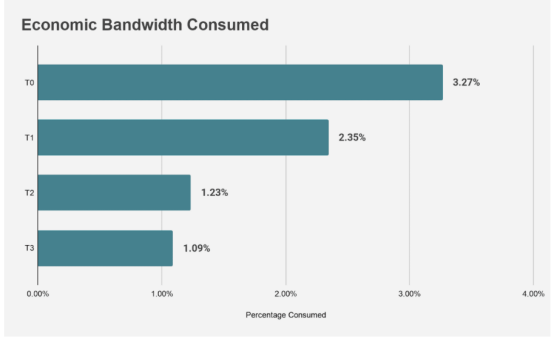

We can also measure the economic bandwidth consumed by the DeFi protocol. Today, Ethereum's DeFi consumes more than 3.27% of the available T0 economic bandwidth. This is the most decentralized DeFi event on Ethereum.

But of course, DeFi protocols (such as Compound, Uniswap, and Maker) are not strictly limited to untrusted economic bandwidth. For example, Compound has a trustless lending market for a range of Ethereum-based assets, including USDC.

Although USDC has a relatively high utilization rate in DeFi, due to the lack of DeFi's adoption of Tether, its overall T3 bandwidth consumption is still very low-USDT is the largest T3 economic bandwidth provider in our data set.

In the end, we can see that the token protocol of Ethereum not only consumes economic bandwidth without trust. Liquid and untrusted assets have the potential to provide the economic bandwidth of a wider crypto ecosystem.

move on

Although the DeFi protocol can take advantage of a trusted form of economic bandwidth to improve financial products, it is essential that we always focus on the core task of decentralized finance: trust minimization.

Trustless economic bandwidth is the smallest driver of trust in an open economy. Combining it with untrusted cryptocurrency protocols can generate an unstoppable force across the entire digital currency and financial realm.

It is precisely because our goal is not limited to rebuilding traditional financial systems that we need economic bandwidth without trust. This is the most important thing we must remember in this financial revolution.

to sum up

The purpose of this article is to propose an economic bandwidth classification. By analyzing assets on the trust quadrant, we have established a framework to understand the importance of assets without trust to decentralized finance.

Trustless economic bandwidth has two core components: (1) issuer without trust and (2) clearer without trust. Assets such as ETH in the zero trust quadrant have these two attributes and form the basis of the digital currency system with the least trust, and cannot be replaced by assets in other quadrants.

Of course, any tokenized asset can take advantage of the trustless, programmable and open nature of the Ethereum financial system and benefit from Ethereum settlement. Tokenization is good for both digital currency and the world. But we should keep in mind that only zero-trust bandwidth can promote the decentralization and security of Ethereum.

A trustless economy will require trillions of dollars of trustless economic bandwidth.

ETH is an irreplaceable economic bandwidth.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- DeFi pattern or big change, Tether announces entry into DeFi, integrates Lightning loan agreement Aave

- Is individual mining a thing of the past? Mining these coins in 2020 is still profitable

- QKL123 market analysis | Crypto assets are highly correlated, and Ethereum wants to go independent? (0311)

- Why doesn't Bitcoin look like a bull market?

- What is the reason for the Bitcoin crash? The decline in the traditional market, or the sale of PlusToken

- YouTube cryptocurrency ban strikes again, this time they deleted two videos

- Tracking Plus Token: Bitcoin dropped 20% in 2 days, is it the smashed disk?