The original market maker is not "Zhuang"? What is the significance of the coin safety ball recruitment market?

On September 30th, the company announced that it has launched the Global Markets Program and will recruit Market Maker for the world.

Many people may have heard of the word "marketer", but did not have a deep understanding of what is a city business, why the trading platform is to recruit marketers. Today, let's take a look.

1. What is market making?

Market making refers to the act of a trader providing liquidity to both buyers and sellers in the market. Liquidity is the degree to which assets can be quickly traded without significantly affecting their price stability. Marketers buy and sell assets through quotations, thereby “making markets”.

- DCG Annual Survey: What is the future of the blockchain seen by more than 60 portfolio companies?

- What issues are explained by the IRS's updated cryptographic tax guide?

- US SEC rejected the latest proposal to create Bitcoin ETF

For example, suppose that Zhang San is the market share of a trading platform EOS/USDT trading pair. The current transaction price of EOS is 3USDT. Zhang San may hang the same number of buy orders and buy orders at the same time, such as the 1000EOS sell order at 3.05USDT and the 1000EOS buy order at 2.95USDT.

In reality, city quotients are generally executed automatically by computer programs.

2. Why do we need a market?

For a given asset, the difference between the best bid price (buy one price) and the best bid price (sell one price) is called the “buy-and-sell spread”. Markets with low liquidity usually have large bid-ask spreads in their order books. The size of the spread will directly affect the market's trading volume. In general, the narrower spread means more trading volume.

A major role of market makers is to promote market liquidity by issuing smaller spreads, thus making the market more efficient.

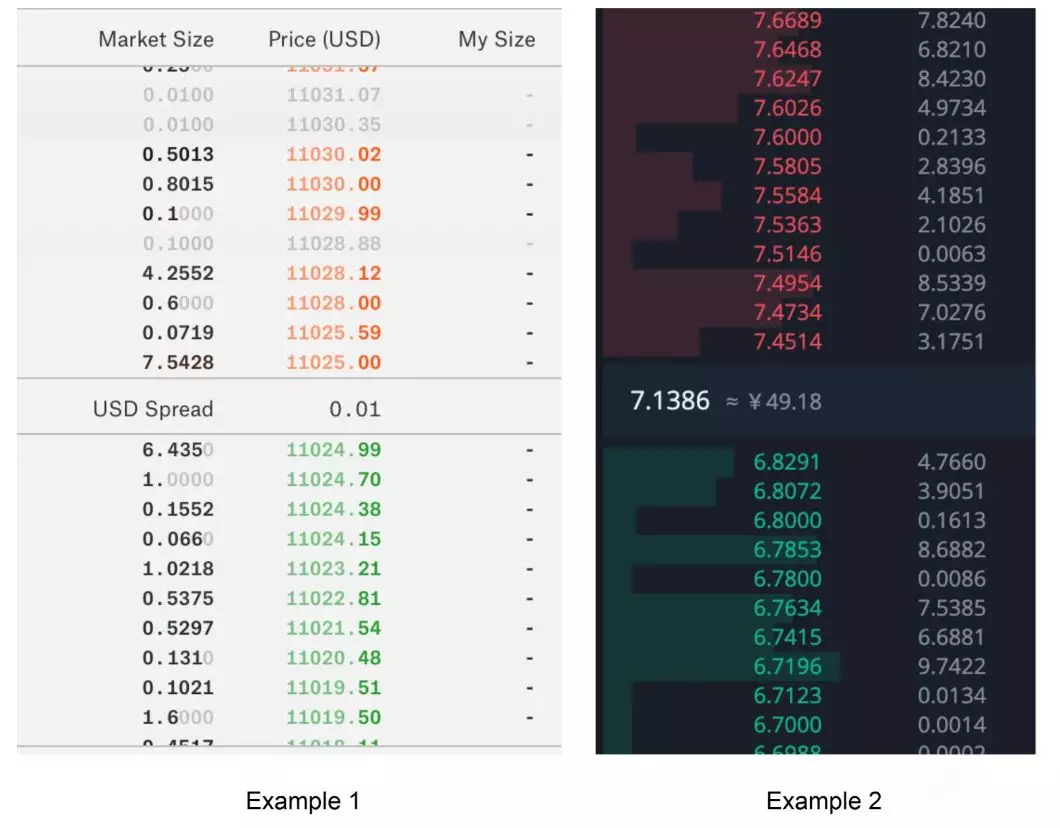

On the left side of the above chart is the BTC/USD trading pair in a trading market with a spread of $0.01; on the right, the EOS/USDT trading pair has a spread of 0.6223USDT.

In addition to the bid-ask spread, another factor in determining asset liquidity is the order book depth, which is the number of assets that can be purchased at a given price level.

In the example above, market participants can buy and sell thousands of dollars in BTC with negligible losses. On EOS, even if a trader buys and sells only a small number of tokens, they will lose 8% immediately. If you want to buy and sell EOS worth thousands of dollars, the loss will be more serious because of insufficient depth and poor liquidity.

3. The benefits brought by the market

Whether it is for ordinary investors, project parties, trading platforms, marketers can bring benefits.

For ordinary traders, market players bring more liquidity, and investors can buy and sell their own encrypted assets at a more reasonable price.

For the project side, the market ensures that Token always has potential buyers and sellers, providing a basis for the future development of Token's economy and projects.

For the trading platform, because the market provider provides liquidity, the price difference between the trading pairs is tightened, which is beneficial to increase the order quantity of the trading platform, and finally attract more customers to the trading platform for trading. This is also a major reason why the company has to recruit market players on a global scale.

In addition to market makers, what other factors do you think will affect market liquidity? Feel free to share your opinion in the message area.

——End——

『Declaration : This series of content is only for the introduction of blockchain science, and does not constitute any investment advice or advice. If there are any errors or omissions, please leave a message. You are not allowed to reprint this article by any third party without the authorization of the "Baihua Blockchain" sourced from this article. 』

Compile | JackyLHH

Source | Hackernoon

Produced|Baihua blockchain (ID: hellobtc)

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Heavy! Zuckerberg will attend the US Congressional hearing on October 23 to testify for Libra

- Learn how to upgrade multi-mortgage Dai

- Bitcoin ETF countdown, Yes or No?

- Talk about MOV than the three major heads of the original chain: Fully promote the cross-chain DeFi landing, the world blockchain conference released cross-chain test network

- The Bitcoin ETF has been sung, and the last big profit in 19 years has to be lost?

- Talking from NuCypher, why is $100 million a standard for future projects?

- “High-yield” and “unsecured”? The rivers and lakes behind the digital currency derivative industry chain