Encrypted market sentiment index: from greed to extreme panic! What happened this week?

On the 16th, eToro's senior analyst Mati Greenspan shared an astonishing amount of data and said that factors such as the decline in the market value of the cryptocurrency market have caused investors to become more and more uneasy. He wrote in Twitter:

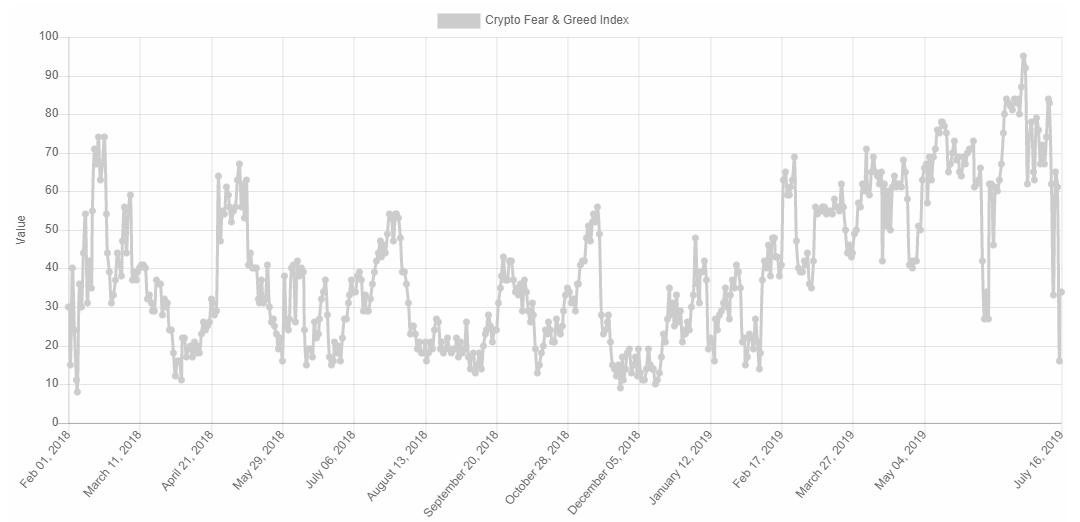

The Fear Index has just experienced the most exciting wave of declines, which fell from 83 to 16 in the first week since its creation in February last year. (0 stands for extreme fear/panic, 100 stands for extreme greed, counts your fear greed index!!)

The above picture is the fear and greed index of cryptocurrency, which captures the emotional changes of crypto investors from February 2018 to July 16, 2019. But the market sentiment has changed from "high greed" (83) to "high fear" (16) in just one week. It is really unexpected.

- International Monetary Fund (IMF) report: Electronic money may replace traditional currency

- The G7 summit will be in unison against libra, and the BTC will usher in a critical bottom.

- Regardless of Libra's fate, Facebook is a big winner.

In the past seven days, Bitcoin has lost $10,000, and the cryptocurrency market has generally suffered from Waterloo for seven days. Perhaps the sudden change in the market has caused investors to lose control.

The onion market shows that Bitcoin is still continuing to decline, and has now fallen to around $9,100. The top 10 currencies in the market have generally fallen by more than 10%. For the future trend, many analysts in the market are very pessimistic, and many views have seen Bitcoin as $8,000. If the market continues to decline, investor sentiment will only be getting closer to extreme panic (0 value).

There is also a market view that the cryptocurrency market is currently eliminating bad money worship users and achieving “reduction of staff and efficiency”. However, this has caused the cryptocurrency market to be at a crossroads where market value has fallen and prices have been sideways. User sentiment has mixed. In January of this year, the arrival of Xiaoyangchun, the cryptocurrency market, gave birth to a number of new projects and token products, but it also attracted the participation of bad users.

In addition, speculators may agree that the rising greed of the market will be controlled by the adjustment of traditional investors. Although market instability has caused market panic to rise, the decline in the total market value of the cryptocurrency market actually reflects the irrational reaction of the public to sudden price falls.

Although the fear and greed index is closely related to the total market value of the cryptocurrency market, Ethereum founders V God and Charles Hoskinson all said that their ultimate goal of joining the cryptocurrency market is to broaden the application and adoption of cryptocurrency. In fact, the purpose of most of today's encryption ecosystems is no longer limited to increasing the total market value of its cryptocurrency market, but rather to providing more use cases.

This article was translated from: https://ambcrypto.com/fear-1-fomo-0-cryptoverse-exhibits-telltale-signs-of-an-investment-hiccup/

Source: Shallot APP

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- US House 怼 Facebook: The currency is not "not you can't"

- Web 3.0 does not require a blockchain

- Encrypted Currency Bull Market Revelation: Was the last round the same as this round?

- Libra Hearing Opinion: The blockchain is real and should not be blocked because it is not understood.

- The Libra hearing was the second impeachment for a five-hour wheel war. The points that the members asked and Marcus answered were here.

- Dash Wallet MyDashWallet private key leaked for two months, the specific loss is unknown

- The first encrypted derivative for ordinary investors? LedgerX launches $100,000 bitcoin call option