Layout for many years but little known? Exploring the full picture and opportunities of the Japanese Web3 encryption market

Exploring the full picture and opportunities of the Japanese Web3 encryption market, which has been around for years but remains relatively unknown.

Listing: Shenchao TechFlow

Written by: 0xmin & James

When you think of Japan, what is the first thing that comes to mind?

- PA Daily | Tether will allocate 15% of its net profits to purchase Bitcoin; Ripple acquires crypto custody company Metaco for $250 million

- Jump Trading’s Crypto Waterloo: Forced to Exit US Crypto Trading Market, Facing Terra Class Action Lawsuit

- With a massive user base in the world of cryptocurrency, could MetaMask become the Google of Web3?

Cherry blossoms, anime, Mount Fuji, Nintendo…?

While Japan has been involved in crypto trading and exchanges since 2017, it is still not well-known to most people in the industry, and many still have the impression that Japan’s market is closed-off and independent.

What is the true state of Japan’s crypto market? Who are the core players in the market? How can you participate in Japan’s crypto market?

In April, Shenchao TechFlow reporters visited Tokyo, Japan and spoke with local crypto industry professionals to learn about the current state of Japan’s crypto market. In this article, we’ll share what we learned. With no long-winded introductions, only practical information, this article was co-authored by James, a venture blocking partner at Emoote.

*This article is an excerpt from the “Web3 Truth in the Asia Pacific Market” report produced by Shenchao TechFlow.

Overview of Japan’s Crypto Market

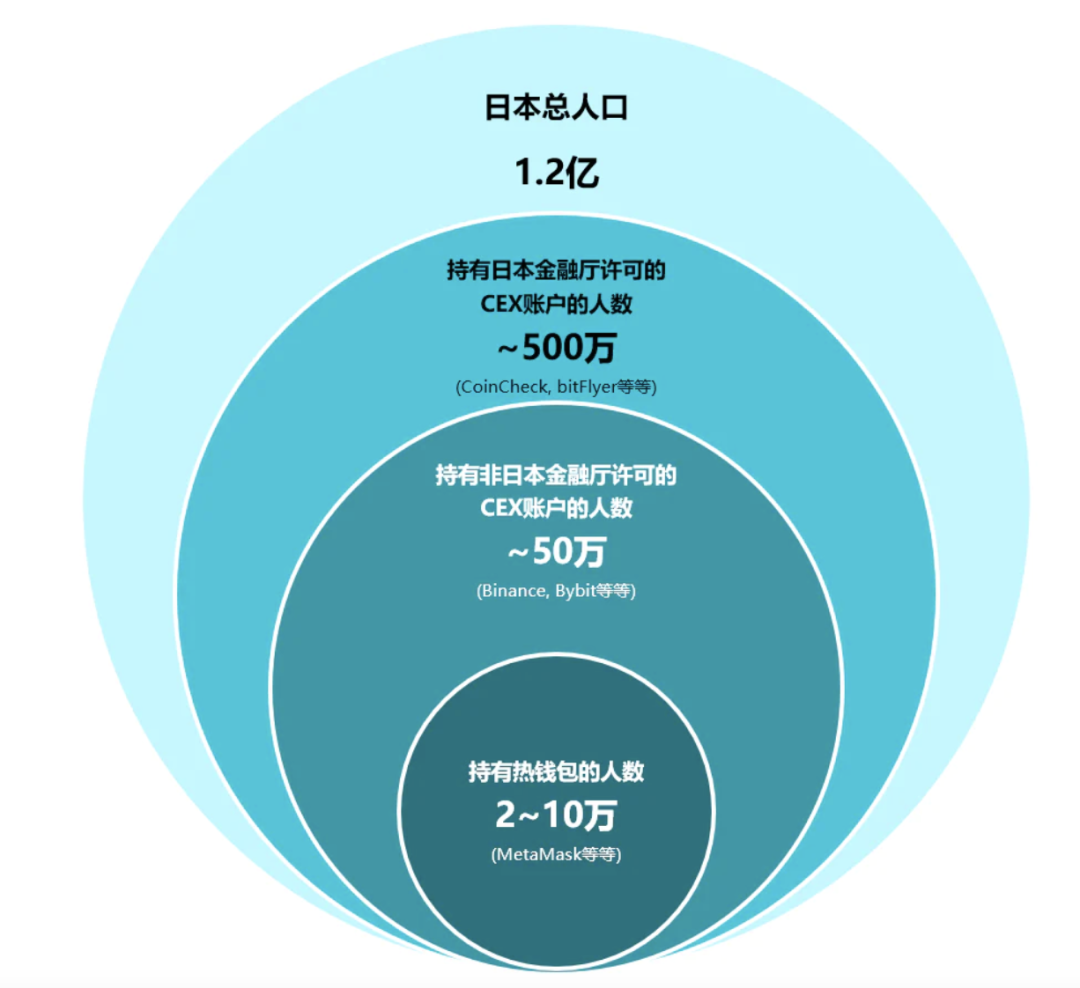

According to discussions with friends and third-party data, Japanese people who invest in virtual currencies can be divided into three groups, and the lower groups are subsets of the higher groups. Overall, there are over 5 million local crypto users in Japan.

Japan’s crypto market is full of peculiarities and contradictions, with three main aspects:

Compliant but Lacking in Vitality

In Japan, whether it is trading crypto-assets or operating exchanges, it can be done under a legal and regulatory framework, mainly regulated by the Japanese Financial Services Agency and the Japan Virtual Currency Exchange Association (a self-regulatory organization). The overall principle is: Prioritize the regulation of anti-money laundering and counter-terrorism financing, and then regulate the trading platform to protect user interests. For example, exchanges are required to keep customer assets separate from their operating funds, and at least 95% of an exchange’s assets must be stored in a cold wallet, which fully guarantees the safety of individual investors.

However, heavy regulation has also brought many restrictions, making the Japanese crypto market lack vitality. All tokens listed on compliant exchanges in Japan need to be approved by the Japan Virtual Currency Exchange Association (JVCEA), and this process takes at least 6 months to a year.

Secondly, Japan has a high tax burden. According to current Japanese rules, the tax rate on crypto-related income depends on an individual’s total income, and for high-income earners, the tax rate on cryptocurrency could rise to around 50%. This has also led to a phenomenon where, although it is legal to convert crypto assets into Japanese yen, there is still a high demand for OTC trading, and there are many OTC practitioners.

Hotspots are mismatched, strong purchasing power

The Japanese market is a relatively independent and closed market, which also means that its market hotspots may not be completely in sync with the mainstream global market, and there may be a certain degree of mismatch and delay. For example, when the NFT craze in China and the United States passed, various NFTs in Japan experienced a wave of popularity.

Secondly, the Japanese market still has a strong purchasing power among retail investors. Two of the most direct examples are:

1. Cardano issued its first tokens (ICO) from 2015 to 2017, focusing on the Asian market, with more than 90% of early funding coming from Japan, so it is also called “Japanese Ethereum”, but it is essentially a European and American project.

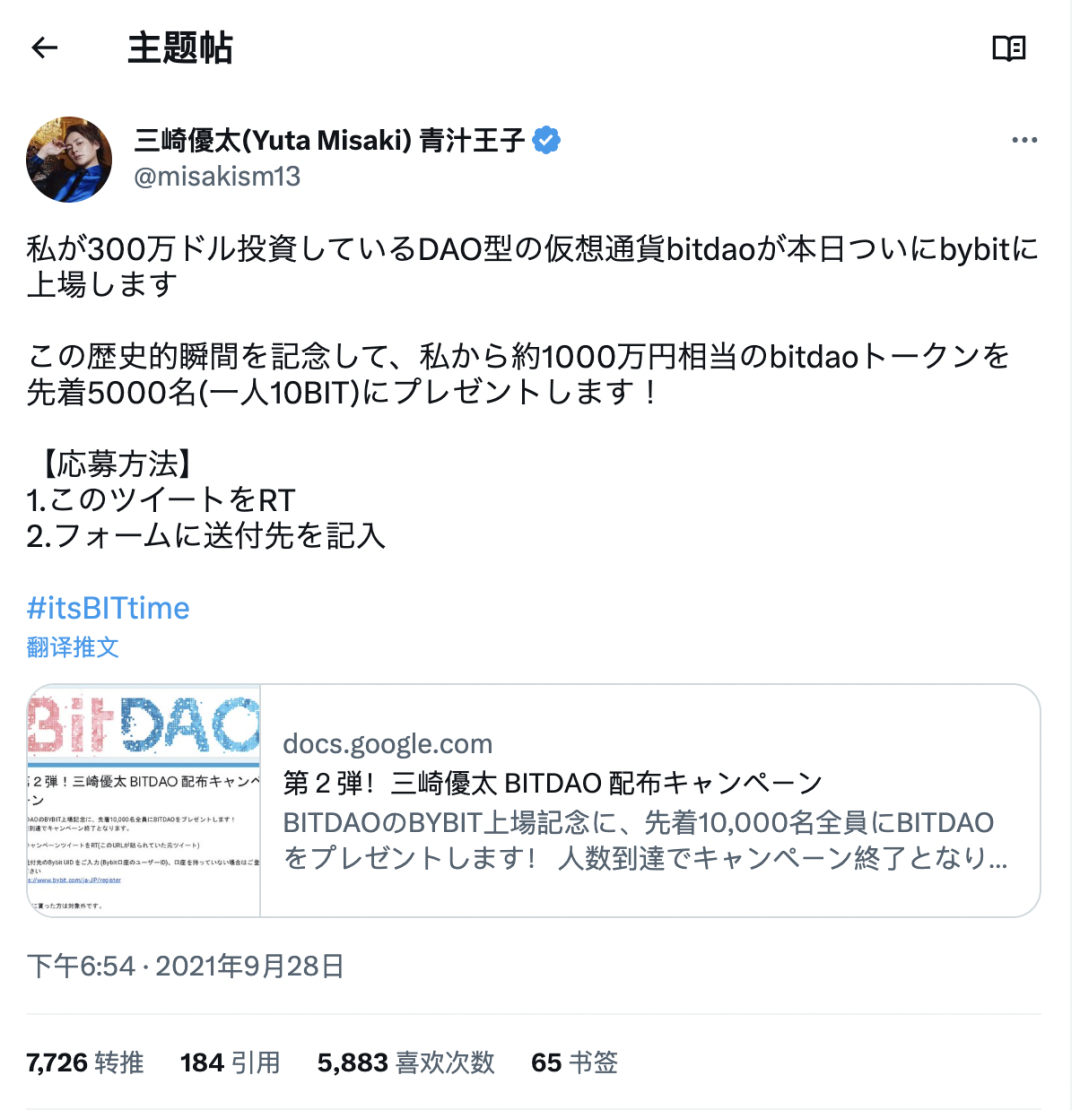

2. The well-known trading platform Bybit relied on the Japanese market from its establishment to its rise, and could not do without the promotion of a super KOL, Yuta Misaki, known as the Prince of Green Juice, and other well-known KOLs such as Tsubasa Yozawa\Hikaru.

Later, another futures trading platform, Bitget, entered the Japanese market and offered higher rebate conditions.

Compared with compliant domestic exchanges, offshore exchanges have no leverage but more coins and higher tax-free 100x contracts, which are very tempting for retail investors. Although the Japanese Financial Services Agency has continued to issue warnings to Bybit, MEXC, Bitget, and Bitforex, the effect has been minimal, or ineffective. Completely giving up the Japanese market or being completely compliant is not possible. For example, compliant exchanges Coinbase and Kraken both withdrew from the Japanese market at the beginning of 2023, serving as a warning to others.

Therefore, many practitioners in the Japanese market have reached a politically incorrect consensus: to make money, you cannot be too compliant.

Turning point: Japanese Financial Services Agency may relax some regulations

After communicating with relevant personnel of the Japanese Financial Services Agency, it was found that they have mixed feelings.

On the one hand, although the bankruptcy of FTX dealt a heavy blow to the entire cryptocurrency industry, and the billions of dollars of funds misappropriated by founder SBF have evaporated, thanks to Japan’s strict regulation of cryptocurrencies, the country’s individual investors have been protected and they are very proud of this.

Therefore, Mamoru Yanase, deputy director of the Strategic Development and Management Bureau (SDMB) under the Japanese Financial Services Agency, which specializes in cryptocurrency and financial technology issues, said that Japanese regulators have begun to urge regulators in the United States, Europe, and other regions to implement regulatory measures for cryptocurrency exchanges similar to those for banks and securities firms.

On the other hand, the vitality of Japan’s cryptocurrency market is insufficient, especially after Coinbase and Kraken withdrew from the Japanese market one after another, and offshore exchanges have thrived in Japan, so they are also trying to make some adjustments.

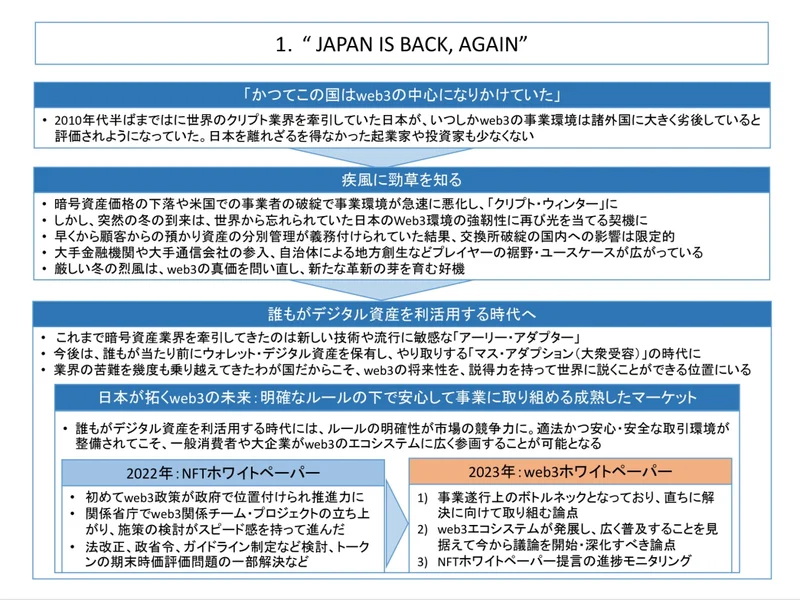

In April 2023, the largest party in Japan, the Liberal Democratic Party, released the “Japan 2023 Web3 White Paper” with the slogan “JABlockingN IS BACK, AGAIN”, trying to relax regulations in various aspects, mainly:

- Tax reform: Previously, investors were required to pay a high income tax of up to 55% due to the appreciation of tokens. After the tax reform, holding tokens issued by their own company will be exempted, and holding tokens issued by other companies can also be exempted from taxation if there is no “short-term trading purpose”.

- Token review/issuance/circulation: The Financial Services Agency will assist in reviewing the listing of overseas token trading, increasing listing efficiency, and making regulations for the issuance and circulation of stablecoins.

- NFT: Restrict NFTs from being used for gambling, money laundering, etc., and clarify the regulations for NFT rights and revenue feedback.

Japan 2023 Web3 Whitepaper

Local trading habits

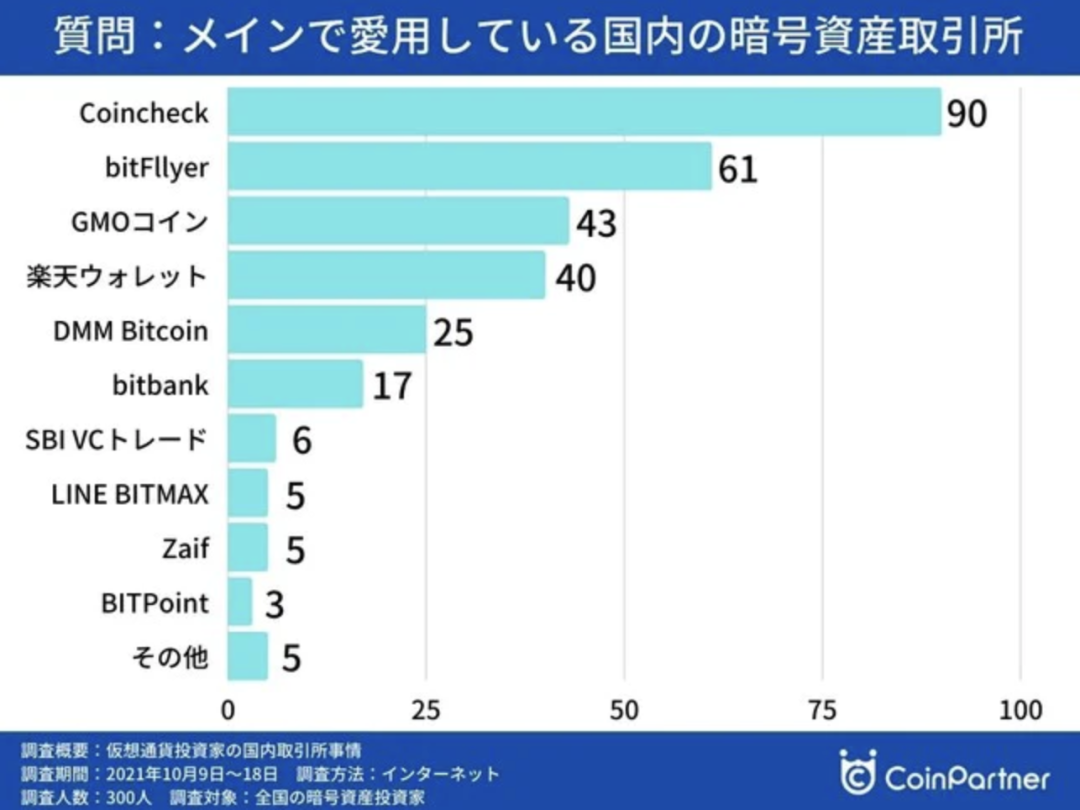

According to a survey of 300 Japanese exchange users, the most popular exchanges in Japan include Coincheck, bitFlyer, GMO Coin, Rakuten Wallet, DMM Bitcoin, and bitbank.

Among unlicensed exchanges in Japan, the most commonly used exchanges by Japanese people are Binance and Bybit, both of which have been warned by the Financial Services Agency.

There are not many well-known crypto projects in Japan, especially lacking grassroots heroes who started from scratch. Most of the projects have a deep background of traditional resources. The currently more core projects include Astar Network, Oasys, HashPort, Jasmy, etc.

In terms of social media, Twitter is still the main information and communication channel in Japan, followed by Instagram and Facebook. Some people collect and exchange virtual currency-related information through LINE Open Chat (similar to a QQ chat room, where anyone can enter and exit freely), but this channel is not mainstream, and the largest chat room has only 5,000 participants.

In Japan, vertical media aimed at the general public includes CoinPost, CoinTelegraph JP, CoinDesk JP, Virtual Currency Watch, Atarashii Keizai, and Bitpress.

From the perspective of influence and traffic, the largest crypto media in Japan is currently Coinpost. Tokyo-based crypto practitioners have stated that Coinpost has previously received investment from Chinese crypto capital.

Although the above-mentioned media all have flash news services, the only service that is deeply involved in flash news and is used by all Japanese companies (including non-blockchain-related companies) is PRTimes, which is well-known among Japanese office workers.

At the same time, there are also some self-media on Twitter that collect blockchain-related information from Japan and overseas and translate it into Japanese. Of course, many vertical media also create accounts on Twitter to increase their presence. Some well-known ones include dAppsMarket, CRYPTO TIMES, BlockchainGame Info, and NFT JPN. In addition, CoinGecko JaBlockingn should not be underestimated.

In terms of in-depth research (similar to Messari’s service), the best one is HashHub Research, whose interface and layout are very similar to Messari.

Aside from the aforementioned types of media, there are also many affiliate media (such as Kasobu) and newsletters, as well as personal blogs that rely on SEO. The most famous newsletters are CoffeeTimes, Nobumei, Manabu, and Ikehaya.

Regarding KOLs, we attempted to categorize and provide representative examples (not exhaustive) of each type. The analyzed accounts were mainly concentrated on Twitter, and there were some KOLs who spanned multiple types.

Researcher/Academic KOLs

Japan’s orthodox KOL groups perform due diligence when deciding whether to promote a project for the sake of their reputation. These KOLs need to maintain objectivity and neutrality, so they rarely write advertorials.

shingen: Mainly analyzes ETH-related technologies and projects.

arata: Founder of the Japanese blockchain media CryptoTimes.

やす@暗号通貨: A versatile player whose research covers all aspects of virtual currencies.

GameFi-related KOLs

One key point to note is that GameFi is not a widely circulated keyword in Japan, and the term that people prefer to use is BCG, which stands for Blockchain Games. When conducting related searches, it is important to be aware of this.

魔LUCIAN: Undoubtedly the most influential KOL in the GameFi field among Japanese people. His influence extends far beyond Japan, and he serves as the Japanese ambassador for the star GameFi project Defi Kingdom. His Call success rate is frighteningly high, and he is capable of exerting substantial influence on the market’s trends. Recently, he created his own community, LFG (Lucian Finders Guild).

Makai Witch: A rising star who frequently translates and retweets main-chain games on various chains (XANA, Sand, Star Atlas, and others).

onchan: Although the number of followers is not high, he is the Japanese community administrator for many well-known projects (LOA, Defina, GameStarter, H&E, Monsta Infinite, Guildfi, RIFI, Demole).

DeFi-related KOLs

shingen: See above.

lagoon: Mainly analyzes coins approaching listing IDOs and projects that may or will be airdropped in the near future.

仮想戦士ロイ: A rising star who often interacts with LUCIAN to open Twitter SBlockingce, mainly focusing on AVAX chains and analyzing Defi and gamified Defi projects.

KOLs related to the Demon World

High-risk high-return currencies (similar to the Chinese term “hundred-fold coins”) are called “demon world” by the Japanese due to their “once you enter the deep pit, it is as deep as the sea” characteristics. Demon World currencies are mainly divided into Defi, GameFi, and CX currencies based on their content.

KOLs who claim to be deeply rooted in the Demon World include the following: Mo LUCIAN, Makai Witch, Yuan GA, Ragu Raguprin, and others.

KOLs related to NFTs

miin: has been committed to discovering excellent Japanese NFT projects and collecting related information, and updates the Japanese NFT ranking list every week.

ikehaya: an early investor in NFTs, holding Crypto Punk and BAYC, with a fan base of more than 340,000 people.

Ameyumi: the person in charge of SBI’s NFT business department, a well-known Internet company in Japan, often shares information about NFT business of large Japanese companies.

KOL groups

Kudasai: Japan’s largest and oldest KOL group. Its Telegram community has more than 18,000 participants and is one of Japan’s largest virtual currency-related communities. Its core members are more than 20 KOLs, each with their own responsibilities, some of them for project contact, some for research due diligence, some for project promotion, and some for translation/AMA, etc. The leader is Watacchi.

Sophie Kura: the second largest group with influence after Kudasai. Its Discord community has more than 12,000 participants. The leader is Sophie Cherie.

Scam Dunk: mainly shares information about Demon World projects and conducts AMA for them (high-risk high-return coins, commonly known in Chinese as hundred-fold coins). The leader is Sendou.

Otaku Guild: mainly shares chain games and metaverse-related projects.

Giveaway / airdrop information collection type KOL

Giveaway type KOLs are relatively special, and some of them are not deeply involved in the virtual currency industry, but will accept any type of airdrop (coins, cash, vouchers, etc.), so they need to be extra careful. The KOLs mentioned here are all deeply involved in the Crypto field.

Fig: previously gained fame for receiving a four-digit RT for the STEPN airdrop and liking it.

ADMEN: ADMEN is a KOL who often participates in various celebrity and heavy weight projects airdrops. Recently, because of his high popularity, he has established his own welfare group called ADMEN DAO.

Business Leaders

Yusaku Maezawa: A Japanese billionaire who was the first private passenger to orbit the moon on SpaceX and established a private friendship with Musk. He is also known as the “Japanese Musk” and has a 10 billion yen (approximately 70 million US dollars) cryptocurrency investment fund called MZ Web3 Fund, under which there is also MZ DAO.

Hiromi Shikura: The founder and former chairman of Gumi. After leaving Gumi, he founded Third Verse and Financie. Although he has left Gumi, his influence still runs deep, as evidenced by his role as co-founder on the gaming chain Harmony, which Gumi recently invested in.

Yuzo Kano: Co-founder of one of Japan’s largest exchanges, bitFlyer, and representative director of the Japan Blockchain Association (JBA).

Sota Watanabe: Founder of Polkadot parallel chain Astar Network. Many Japanese VCs have high hopes for him to give Japan a place in the Web3 industry.

Yoshihiro Yoshida: HashPort CEO, operator of Japan’s first IEO token $PLT, and Japan’s largest NFT market, PLTPlace. Fluent in Chinese.

Noritaka Okabe: CEO of JPYC, the largest yen stablecoin project in terms of issuance. One of his greatest pleasures in life is to take people to the sauna for deep conversations.

Yosui: Founder of the Hokusai project, which provides integrated NFT issuance solutions for Japanese companies.

Many influencers operate their own communities. By choosing influencers in corresponding niche areas, such as Gamefi/Defi/investing/airdrops, the marketing effect can be significantly improved.

Japanese Crypto VCs

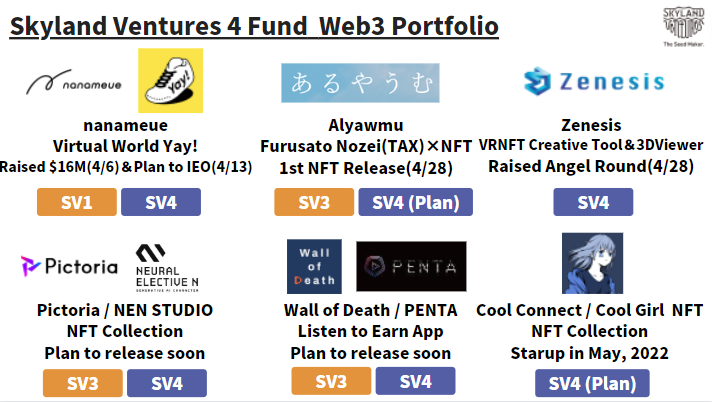

According to our understanding, traditional venture capital in Japan is not particularly active, and VCs that are truly dedicated to Crypto and Web3 are rare, and most can only make equity investments. Skyland Ventures is a more active Japanese crypto fund, and it has established a seed fund dedicated to Web3 investment in its fourth fund.

On April 13th, Skyland Ventures announced that its Web3 fund, “Skyland Ventures No.4 Fund,” raised a total of ¥5 billion (approximately $38 million) and announced its investment in the Ethereum ZKEVM solution Takio.

Emoote is a Web3 fund established by Japanese game company Akatsuki, with an initial fund size of $20 million. Formerly known as Akatsuki Crypto, it has invested in 24 projects to date, including STEPN, BreederDAO, ETHSign, and Akinetwork, among others. Miss Bitcoin, a well-known Japanese KOL, is an advisor to Emoote.

SoftBank and Line’s joint venture, Z Ventures, also has its sights set on the Web3 field and has made some layout, investing in NFT trading platform X2Y2, blockchain game development platform double jump.tokyo, encrypted live broadcast platform Stacked, and others, all of which are equity investments.

Japanese financial group SBI Group also has a layout in the cryptocurrency field and is Ripple’s core investor and spokesperson in Asia, as well as investing in numerous local trading platforms.

Among the incubators operated primarily by Japanese people, the most famous is Fracton Ventures, which does not itself engage in investment business, but the original team recently raised funds from numerous Japanese VCs to establish Next Web Capital, which participated in investments in projects such as EthSign.

Among the other VCs primarily operated by Japanese people or centered around Japan, the most famous is Gumi Cryptos. Hirokazu Hamamura founded Gumi in 2007 and successfully took the company public in 2014. It is worth mentioning that Hirokazu Hamamura studied at Fudan University in Shanghai for four years in 1996, but his Chinese language ability has greatly deteriorated since then. In 2021, Hirokazu Hamamura retired from Gumi and went all-in on blockchain and VR, but still has a significant influence on Gumi.

Currently, Gumi Cryptos has invested in dozens of crypto projects such as Opensea and YGG, but Hirokazu Hamamura is also concerned that many of the overseas projects he has invested in cannot be launched in the Japanese market or promote the development of the Japanese market.

In the Japanese market, another influential figure is billionaire and self-proclaimed “Japanese Elon Musk” Yusaku Maezawa, who has millions of followers on Twitter and is arguably Japan’s biggest KOL. He founded the Web3 fund MZ Fund using his name abbreviation, with investment amounts ranging from $1-5 million. It owns Japan’s largest Web3 guild, Web3 Club, with 30,000 crypto-native user members, as well as Japan’s largest “crypto education platform,” MZ DAO, which claims to have 300,000 non-crypto-native user members.

Currently, MZ Fund has invested in many projects, among which are several projects with Chinese backgrounds, such as MetaOasis, Akiprotocol, SINSO, etc.

In addition, there are local VCs such as Headline Asia (and its subsidiary cryptocurrency fund Infinity Ventures Crypto), i-nest Capital, and THE SEED.

Japanese market strategy

Previously, the success of STEPN in Japan demonstrated the potential of the Japanese market. As of February 25th last year, 35% of its active users, 21000 people, were Japanese users. Analyzing its publicity path, it can be found that many top KOLs have carried out Giveaway activities, and some even purchased shoes at their own expense for Giveaway. This shows that as long as multiple top KOLs participate and their token model has good sustainability, Japan is still a market with considerable purchasing power.

However, considering the user base and the cautious attitude of Japanese KOLs, it is recommended not to focus solely on Japan at the beginning. But if a certain amount of popularity can be gathered in Japan, it will make it easier for the project to radiate to surrounding markets, especially Southeast Asia.

In addition, Japan as a whole is a market that is easy to defend but hard to attack. Although the language barrier (the fact that Japanese people have a psychological barrier to English is well known) and the cautious attitude of Japanese KOLs make market promotion more difficult, looking back, as long as the project side is not running away and is actively working on it, Japanese users will show a more tolerant and understanding attitude than users in some other markets, which is helpful for the creation of a benign community atmosphere.

Another interesting question is that we initially thought that Japanese people would be more proud of domestic projects and have a higher sense of vigilance towards Chinese projects. However, according to the author’s survey of Japanese users, Japanese people have a complex feeling towards Japanese projects, and actually some people think that China’s attribute is a bonus for Chinese projects, because many excellent projects are made by Chinese people (of course, the attribute bonus of European and American projects goes without saying).

On the other hand, due to the success of many Chinese and Western projects, people who pay more attention to this field for a longer time will view this attribute as a bonus. However, it should be noted that the number of people who fit this user profile is limited.

All in all, in terms of localization, the author still believes that it is necessary to have a community administrator who is a native Japanese speaker and understands Japanese culture (knows what Japanese comedy is like, knows about sports and political memes and popular language for youth, and can skillfully use popular punchlines (eg. “全米が泣いた”)).

Of course, if there is good cooperation with the administrator, it is also worth considering bringing them into the team. After all, from the perspective of the user’s mindset, there is a big difference between core members and external cooperative members. In this way, it can not only make Japanese people feel comfortable because there are Japanese people in the team, but also the team is global enough to make Japanese people feel that the project has “future”.

“The Truth about Web3 in the Asia-Pacific Market” is a special report produced by TechFlow ShenChao focusing on insights into the current state of the encrypted market, users and practitioners’ portraits in various regions of the Asia-Pacific. We will continue to release market research in multiple regions, and consult experienced local practitioners to provide more complete and truly practical research content for more Web3 peers. If you have an in-depth understanding of the encrypted market in your region and are willing to work with ShenChao to build this special report, please contact us through TechFlow ShenChao’s official Twitter: https://twitter.com/TechFlowPost

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Inventory of the current situation of top NFT fragmentation protocols: the overall market has turned cold, with both trading volume and user activity plummeting.

- Is the BRC-20 that cuts through the night sky a nova or a meteor?

- Deep observation of the NFT market in 2023

- Opinion | When Bitcoin prices plummet in the next few years, gold will "land on the moon"

- Institutional investors boost Bitcoin to $ 7,000

- Babbitt column | How to predict the extreme price of cryptocurrency? Here are a few data to help you

- QKL123 market analysis | It is obviously related to dark web activities, and the demand for Bitcoin has dropped sharply? (0402)