Crazy currency contract: leverage up to 125 times, and overnight positions of 2 billion US dollars

Text: Ratchet

Source: A blockchain

100 times leverage, 125 times leverage … More and more players in the currency circle have begun to engage in highly leveraged contract transactions.

- Vitalik argues with Bitcoin developers: Bitcoin is first P2P cash, second is digital gold

- Bitcoin Exotic 8Q: Why was block 620826 born 1 second earlier than block 620825?

- Satoshi Nakamoto may be the creator of Monero. Do you accept the findings?

In this case, if the currency price rises by 1%, their assets can be doubled; but if the currency price falls by 1%, they will lose their money.

This is a very risky game, the currency circle becomes a dangerous casino, and the exchange is the driving force behind it.

The contract market is full of the myth of getting rich overnight, but "99.5% of retail investors will be out of stock."

In the end, even the exchange itself is often difficult to survive.

This path of greed leads to the abyss.

For contract players, the evening of March 12 was a cold night of slaughter. 01 short positions

That night, in 15 minutes, the price of Bitcoin dropped by more than 15%.

Everything was caught off guard. Coin contract player Xiao Zhang said that at the time, he received a text message from the exchange and was informed that he was about to close out. He quickly opened the software and was ready to close the position manually.

Almost at the same time, he received a text message reminding him of a warehouse outage-more than 100,000 yuan disappeared.

According to AICoin data, on the evening of March 12, the currency market had US $ 2 billion in capital short positions, with a maximum position amount of US $ 10 million, with an average position amount of US $ 51,000.

Around this short-selling event, there is another passage that is widely circulated in the circle:

A contract novice shorted Bitcoin on March 12 but did not know to set a take profit or stop loss. That night, Bitcoin dropped sharply, and his thousands of yuan became hundreds of thousands.

After making a big profit, he felt that the price of the currency would rise and opened more orders.

In the early morning of the next day, Bitcoin continued to plummet, and the hundreds of thousands of dollars he had just earned died out.

Come out and mix it up, sooner or later.

In the currency circle, contract trading has long been established. In short, it is futures trading.

Similar to the traditional futures market, contract trading in the currency circle focuses on two major gameplays: one is to be able to go long and short, and players can make a profit in both directions;

The first currency exchanges to enter the contract market were OKEx and BitMEX. In the early years, they divided the domestic and international contract markets.

Subsequently, Huobi, Binance, Matcha, BiKi, and Gate also entered the contract market.

"Now, most of the fierce battles between Huobi, Binance and OKEx are related to contracts." An exchange practitioner pointed out.

OKEx CEO Jay fires Huobi's contract business on Weibo

How fast have contract transactions developed? There is a set of data from non-small numbers to illustrate intuitively:

In 2018, two of the top ten exchanges with global trading volume opened contract transactions;

Today, eight of the top ten exchanges in the world by volume have opened contract transactions.

The leverage they have issued is also increasing, even to a staggering level.

Earlier, the contract leverage of many exchanges was 5 times, 10 times, and up to 20 times.

Today, some exchanges are offering leverage ratios far beyond that. For example, OKEx's perpetual contract can provide up to 100 times leverage, and Binance can provide 125 times leverage …

Such high leverage carries great risks.

Take the 100 times leverage provided by OKEx as an example: if the player is long, the asset can be doubled if the currency price increases by 1%; but if the currency price drops by 1%, the player will liquidate the position and lose all the principal.

In the contract market, getting rich and losing property are often instantaneous.

02 Gambling

What players are attracted by the contract market? They are people with a typical gambler mentality and often laugh at themselves: "Give me a lever, I can lose the entire planet."

"There is no 'Buddha player' in the contract market." Ding Cai, a player in the currency industry, told a blockchain.

"The real-time rate of return of each order is displayed on the exchange app. After 100 times the leverage is opened, the rate of return changes by three digits per second. The previous second may be 200%, and the second second may be 300%. "He said.

In the face of such dramatic ups and downs, almost all players will always watch the disk. The 7 * 24-hour trading in the currency market has made many players feel struggling.

"When opening a high magnification contract list, I couldn't sleep at all, and I had to swipe my phone all the time." Ding Cai said.

Even more frightening is that people who have played contracts for a long time, just like veteran gamblers, will become "heart addicted" and cannot be quit.

Two years ago, the OKEx exchange was questioned as "unplugging the network cable" could not be traded, and Ding, a contract player, was one of the victims.

"I received a text message at the time, reminding me that I was about to run out of money. But I couldn't open the app, and I couldn't do anything. I could only watch my liquidation." Ding Cai recalled, "The feeling of despair No way to describe it. "

In order to speculate, he overdrawn all credit cards and faced hundreds of thousands of debts every month. "Playing to the end, every time you see the number when you open the bill, you don't think it is your own money."

In order to quit contract transactions in 2019, Ding Cai applied to the exchange to cancel his account and was informed by customer service that "there is no such service." Angrily, he went to the mobile business office and cancelled his mobile phone number for more than ten years.

He endured for a while, but eventually couldn't bear it. Next, he registered a new exchange account with his new mobile phone number, and once again entered into contract trading.

He said that now that he is playing contracts on Binance, he is opening up to 125 times the leverage, setting the take profit and stop loss in advance, and avoiding short positions. "Loss is a matter of minutes."

"The currency market itself is very volatile, plus 100 times the leverage, contract transactions are no different from gambling." Blockchain researcher Zhou Wei said.

"For some people, futures (contracts) = online gambling." Jiang Zhuoer, CEO of Leibite Mining Pool, also pointed out bluntly.

The continued popularity of contract transactions reflects a major problem in the current currency circle-more and more speculators buying and selling, and fewer and fewer "Bitcoin believers" who are firmly committed to hoarding coins.

"I used to be a" Bitcoin Belief ", only hoarding coins and not speculating. But the price of bitcoin has not improved in the past two years, and the legendary halving market has not seen any shadows. Occasionally, I do bands and speculate on contracts It is also to reduce the devaluation of the currency in hand. "Xiao Zhang said.

In the eyes of some players who do not play contracts, it is precisely the proliferation of contract transactions that has led to the continued slump in bitcoin prices-a large amount of funds have been invested in highly leveraged gambling games.

"The exchange should cancel contract transactions and prohibit short selling, so that all funds go to the spot area, and everyone stores coins, and the currency price can rise." Someone said jokingly.

In the face of highly leveraged contract transactions, most retail investors in the currency circle will be reduced to leeks.

"Many players mistakenly believe that as long as they outperform 50% of the people, they can make money in the contract market." Zhou Wei said, "but the truth is that they are not going to outperform 50% of the people, but 50%. Funds. Behind 50% of funds, maybe 98% of people. "

In his view, under high leverage, the player's assets may increase 10 times overnight, or they may return to zero instantly. The benefits and risks appear to be equal, but they are not.

"When the market is good, many players close their profit early without waiting for the asset to increase by 10 times. When the market is not good, they often hold their coins in their hands and wait to return to zero." He explained, "Retail investors' investment psychology determines that they cannot make long-term profit in the contract market."

"99.5% -99.9% of retail customers will be exploded in the contract market." Jiang Zhuoer concluded, "Playing contracts is no different from gambling and drug use. Many players will not have any remorse unless they lose their assets."

03 Pusher

Why are the contract transactions in the currency circle so crazy? In the eyes of many currency players, the exchange is the direct promoter of this market.

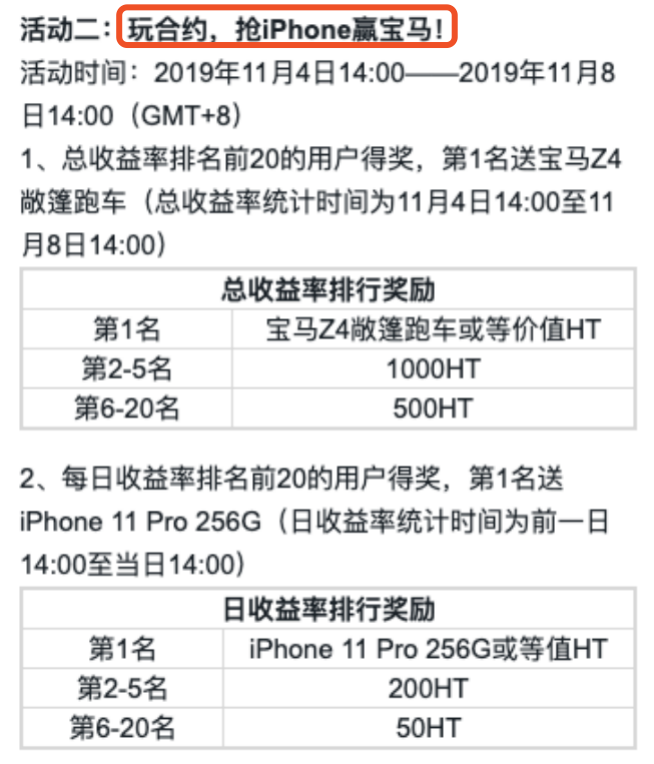

For example, the three major exchanges of Huobi, OKEx and Binance have launched contract competitions to reward players with prizes such as luxury cars and iPhones.

Huobi Contract Masters slogan "play contract, grab iPhone to win BMW" slogan

So why are exchanges so keen on contract trading markets?

The answer is simple-contract trading is more profitable.

Entering 2019, ICO, trading is mining, and model currency are no longer popular, and it is difficult for exchanges to make money by listing fees. The return to the trading service itself has become a common choice for many exchanges.

In the trading market, the volume of contract transactions is much larger than the spot market.

TokenInsight data shows that in January 2019, the contract trading volume on the OKEx exchange accounted for only 60%, and by October, this number had climbed to 81%.

Non-small data shows that on March 30, on the Huobi platform, Bitcoin's 24-hour trading volume was 2.2 billion yuan, while the contract transaction volume during the same period was as high as 28.5 billion yuan, which was 13 times the former.

"The player's greed makes the exchange more and more tricks. And these patterns have increased the player's greed." Zhou Wei said.

Jiang Zhuoer also told a blockchain: "Now there are more and more financial derivatives in the currency circle, which directly increases the leverage of the entire industry."

In the face of high leverage of 100 times, the operation of the exchange itself is also facing huge risks.

This is because, in general, in the contract market, once the currency price hits the player's liquidation line, the exchange will automatically close the position.

However, when the price of the currency soars and plummets, the exchange may not be able to close the position immediately, resulting in “pasting positions” and the platform ’s own assets being damaged.

When the currency market plummeted on March 12, some of Binance's profitable users received an official notification called compensation for exchange losses, and their assets were "automatically lightened."

In other words, due to the sharp fluctuation of the currency price, the exchange itself suffered a loss of funds. Some players who have made money have been deducted by the exchange to make up for their losses.

"Actually, all major exchanges have similar 'cash-through remedy' mechanisms. However, the mechanism of Binance will give priority to the largest earners to make up the money, while the mechanism of OKEx is that all profitable users are evenly distributed." Zhou Wei explained.

"Neither mechanism can be completely fair, but Binance's mechanism has caused greater losses to a small number of users, so the dispute is even greater." He said.

He believes that since 2018, most rights protection events related to multiple exchanges are related to contract transactions. In these incidents, some players stood on the rooftop to fight against each other, even drinking dichlorvos in front of the exchange.

"It is pathetic to be fooled because of being deceived. But in any case, the gamblers in the casino are not worthy of sympathy." Zhou Wei said.

Buffett has been a staunch opponent of leverage.

"I've seen too many people with high IQs who have messed up their business with leverage. They are very smart, but they went bankrupt overnight because of leverage. They have nothing." In 2019, he once said this at the company's shareholder meeting.

Everyone wants to be the next Buffett, but not everyone's listen to Buffett's warning.

* Some respondents in the text are pseudonyms.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- A war on asset devaluation: BTC will witness the occurrence of financialization

- Monthly Financing Report | Global Blockchain Private Equity Financing in March was 3.767 billion, 90% of the funds flowed to the US market

- Crypto market battered in March, Tether becomes biggest winner

- Danger and Change: Can China Seize the Breakthrough Opportunity of the Digital Economy?

- Viewpoint | Scenario matching and technology maturity, why hasn't the blockchain made a large-scale application yet?

- Mutual Gold Association: Risk Tips on Participating in Speculative Hype of Overseas Virtual Currency Trading Platforms

- 2020 Central Enterprise Blockchain Development Report Released: Nearly 40% of central enterprises are involved in the chain, and supply chain finance has the most landing applications