Encryption Currency Amway Guide: From Gold to Petroleum Coins and De-US Dollarization

We found that at the US Congressional hearings on the Facebook Libra project, most members of Congress did not understand cryptocurrencies. Obviously, we need to take good care of our cryptocurrencies to our elders. We suggest that the benefits of cryptocurrencies can be explained to the elders from a complex and highly controversial history of money.

Written by: Sam Aiken

Compile: Chen Chunzhen

Have you ever tried to explain the benefits of cryptocurrencies to your elders, but they can't understand most of what you said?

- Cheng also Xiao He, defeat also Xiao He | market analysis

- Holds 225,000 bitcoins! Grayscale's fund size is at a new high while institutional interest is declining

- Eight major problems in current blockchain technology

Have you ever heard the argument that bitcoin does not have any endorsement, just a pure speculation.

Does your friend show a strong interest in cryptocurrencies when the currency price soars, and such interest disappears during the bear market?

Have you given up on your parents how to use e-wallets after a few attempts?

Ok, we have all experienced these things more or less. We all tried to convince our family at the table that the encryption industry would subvert the entire financial world. But the feedback we get is that Bitcoin has no value. It is pure speculation, scams and bubbles.

To help your family eliminate these misunderstandings, I wrote this step-by-step guide to Amway, which will help them open the door to cryptocurrencies.

First of all, we must recognize the reality. I know that you can't wait to introduce cryptocurrencies like the world at once, after all, the best time to buy and start using encryption to pay. However, one's ideas don't change overnight, because everyone has some prejudice or prejudice. Especially for the elderly, they tend to be more conservative, not proficient in technology, and often brainwashed by corporate or national media.

So don't rush to seek success. Do a few weeks or even months to have multiple conversations with the same person. Persistence is the key.

Remember, if you are eager to achieve, the other party may take a very conservative attitude. In this case, it is important to take a step back and give them more space until they are more interested in cryptocurrency again.

(This is usually related to price spikes and media coverage) and take action. At the same time, you can learn some persuasive techniques or deepen your research on cryptocurrencies to become a more powerful encryption advocate.

Be persistent, but don't indulge in it.

Here are the main steps that all encryption advocates need to do:

- Initiate a discussion about cryptocurrencies

- Encourage people to understand cryptocurrencies

- Give a strong basic background to legal tender

- Explain the main benefits of cryptocurrency

- Explain how to store and transfer cryptocurrencies

- Explain how to buy cryptocurrency or give away some free

- Explain why the dollar price average calculation method is safer than the lump sum payment

- Encourage them to pay in cryptocurrencies once they have the opportunity

How to initiate a discussion about cryptocurrencies

Always talking about cryptocurrencies may have the opposite effect. After all, many people don't like being forced to think. The cryptocurrency price spike period will be the best chance, because your friends and relatives will ask you about cryptocurrency related issues.

However, the best time to introduce cryptocurrencies is during the bear market, when the price of cryptocurrencies and transaction costs are lower and the network is not congested. The problem is that most people are less interested in cryptocurrencies during a bear market, so you have to make sure you know all the basic information and can start a conversation.

Proactively starting discussions about cryptocurrencies can be a bit risky, and you may face a lot of resistance, so it's best to slowly move existing discussions to topics such as investment, diversification, decentralization, democracy, or blockchain, and then Start talking about cryptocurrencies.

- "I have read some articles recently about stocks and real estate bubbles, Chinese ghost towns and market cycles, etc. Are you concerned?"

- "Right, I am still studying how to diversify my assets. It is best to hedge the risk of the next recession. Do you have any recommendations?"

- "I heard that blockchain technology can improve voting by allowing citizens to monitor government spending records, reduce corruption and make the budget more transparent. What do you think?"

- "Have you seen John Oliver's episode about cryptocurrency tonight's show tonight? It can be said that it is very funny."

Encourage people to understand cryptocurrencies

In my experience, encouraging people to understand cryptocurrencies is often much easier than other topics such as health, environment, politics, animals, and human rights, because you can always mention the huge gains from early cryptocurrency-related people. This usually causes the other party's attention and triggers a basic discussion.

However, although the possible high returns are a good start, they are not a good long-term motivation, because most people will not have such crazy gains, and we cannot forget the huge risks associated with cryptocurrencies. Ideally, one should realize that there are many other benefits to understanding cryptocurrencies, such as:

- People can diversify their portfolios to hedge against risks such as inflation, a bursting real estate bubble, a stock market crash, and a global recession.

- People will learn new techniques that will benefit brain health (especially for the elderly) .

- People will be part of the encryption community and will be able to participate in encryption-related discussions online and offline.

- People will get fast, cheap and privacy-conscious cross-border transactions.

- People will contribute to the global Central Bank and the oppressive regime on a global scale.

History of money

"As long as I can control the currency issue of a country, I don't care who makes the law." – Meyer Rothschild

Once you get some attention, it's time to show your talents and explain that the legal currency is not “endorsed” by the economy of gold, oil or the issuing country, because since 1971, the entire financial system has shifted from commodity or representative currency to no endorsement. Electronic legal currency. Modern money is simply a file or number in a database, and people agree to use it as a means of exchange and value storage.

So how do we explain this to our family and friends?

Don't worry, you don't have to be a professor, because telling a complete history of money often makes them bored. However, in order to engage in dialogue, you should know some key concepts:

- Commodity currency (shell, salt, gold, silver, etc.)

- Depreciation – the depreciation of metal coins

- Intrinsic value and face value

- Exchange medium, account unit, value storage, control system

- Borrowing (from ancient Chinese banknotes to European banknotes)

- Central bank

- Partial reserve banking system

- Inflation and deflation

- Demand drives inflation and costs to drive inflation

- Gold standard and representative currency

- Federal Reserve, US Treasury Bond, Federal Fund Rate

- Bretton Woods Agreement to link other currencies to the US dollar

- De Gaulle converts a large amount of dollars into gold

- Nixon gave up the gold standard

- Coinage tax

- Legal tender, statutory subject matter and law enforcement

- Oil dollar and oil dollar

- 2008 global financial crisis

- Quantitative easing and inflation exports

- Capital controls, hyperinflation (Venezuela, Zimbabwe, Argentina)

- De-dollarization

Here are the important events and contacts we need to explain to everyone:

Gold and silver

Money is a tool for storing the time (labor) you spend. With money, people can get rid of the cumbersome barter trade and make complex work special.

We should be able to explain what commodity currencies are, why silver and gold are valuable (portable, durable, separable, replaceable, limited in quantity) , and how they maintain purchasing power in the long history of the loss of value in countless legal currencies.

Governments depreciate the currency for war and public works deficits, causing all gold and silver coins to disappear from circulation because people tend to consume ordinary things while keeping rare things (Grechen's Law) . And how such a move will lead to an increase in the market price of goods and services. This concept is also the key to understanding how the United States exports inflation to other countries.

Banknote

It is important to understand how the borrowings have evolved from ancient Chinese banknotes to European banknotes. We should understand how the legal currency enforced in the first country emerged and why they are valuable (the threat of death penalty) .

What is the bank run and how the central bank acts as the lender of the commercial bank. We need to explain the shift from banknotes issued by commercial banks to national banknotes issued by the central bank, which brings more convenience to people, but also concentrates on the issuance of currency.

The rise of the dollar has become the world's reserve currency

It must be emphasized that in 1933, US President Franklin Roosevelt banned the export of gold and forced Americans to hand over gold to the Fed in exchange for dollars, thus fighting the deflation caused by the Great Depression. This allowed the Fed's vault to accumulate a large amount of gold and allowed the US government to repay its debt in dollars rather than gold.

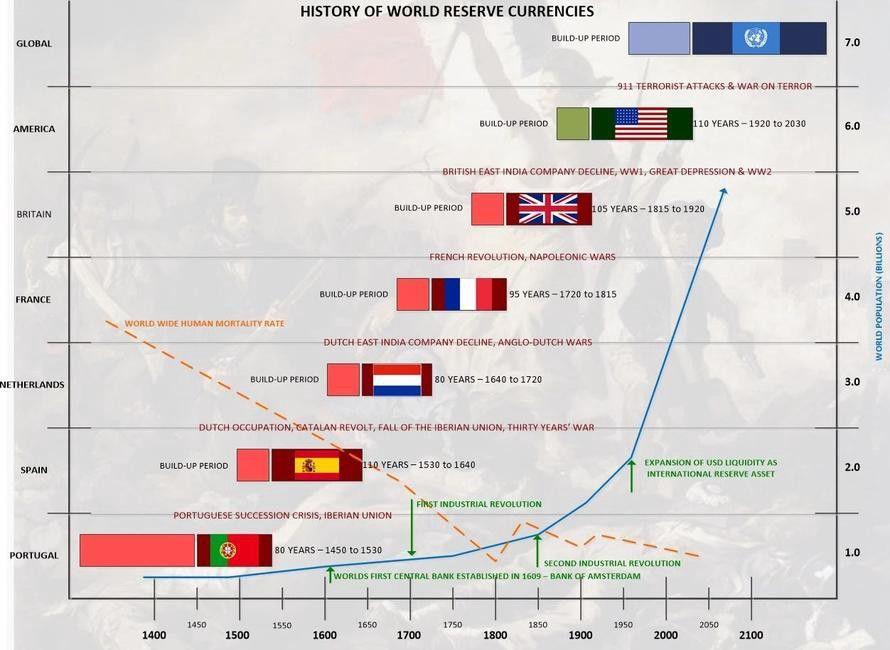

Figure 1: World Reserve Currency History Source: ZeroHedge

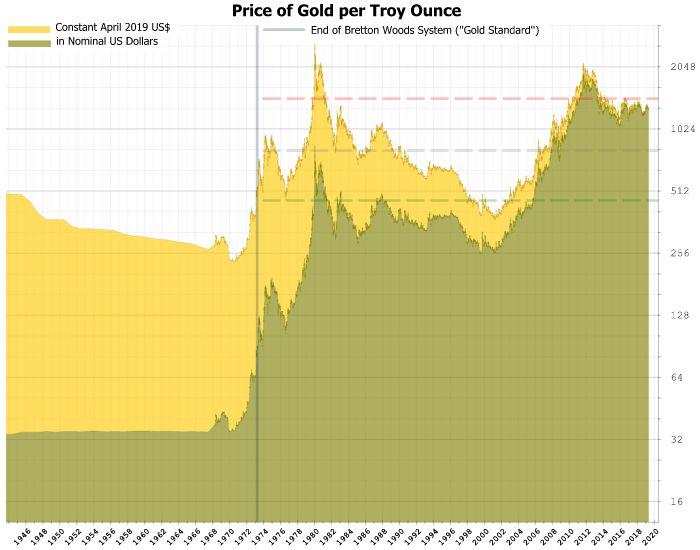

Figure 2: Gold Price / Oun Source: wikipedia

We should tell our families that many governments have suspended the strict gold standard because they printed a large amount of gold without gold support during the First World War and the Second World War to finance their wars. Huge inflation.

How do most economies deal with war? Turning farmers into soldiers and turning car production into tank production, while the United States has accumulated a large amount of gold reserves, it exports food, goods and war machines to allies, while allies often use gold or other minerals as a means of payment. Due to the 1944 Bretton Woods Agreement , the currencies of Western European countries, Canada, Australia and Japan are linked to the US dollar.

How the spending of the Korean and Vietnamese wars caused the dollar to weaken, causing other countries to lose confidence in the dollar and suspect that the US dollar issued far exceeds its gold reserves. In the end, France and Switzerland sent most of their dollar reserves to the United States in 1965 for conversion to gold.

This forced the United States to unilaterally withdraw from the Bretton Woods agreement, abandon the gold trading standards, causing the dollar to depreciate, and the OPEC organization stated that they would price oil at a fixed amount of gold.

Oil dollar, trading with Saudi Arabia

The United States is negotiating a military defense of oil fields in Saudi Arabia. In return, Saudi Arabia will only accept the US dollar as a payment for its oil exports and invest the remaining oil revenues in US debt instruments and capital markets. By 1975, all OPEC oil producing countries accepted the same agreement.

Why do many developed countries are forced to hold large amounts of dollars to continue to import oil, and how this will continue to demand the dollar without considering the state of the US economy, thus enabling the US government to achieve high budget deficits.

Saddam Hussein began selling oil in euros in 2000, but after the US invasion of Iraq in 2003, Iraq returned the face value of oil sales back to the dollar. Why Gaddafi plans to sell oil for the gold dinar, and how the United States invaded Libya for crimes against humanity, so that the country now sells oil only in dollars and has an open slave market as a reward.

In summary, OPEC countries are forced to sell oil only in US dollars, which has led to a growing global demand for US dollars, allowing the United States to issue US dollars for deficit spending without uncontrolled inflation.

inflation

We should explain to our families that legal currency will often depreciate over time, which will punish those savers and force them to invest or speculate. How do governments improve their currency exchange rates to reduce the real value of their debts and make their exports more competitive on the international market.

How the US government issues bonds (IOUs) with the help of the Ministry of Finance, and uses banks as intermediaries to sell these bonds to the Fed, and the Fed creates funds out of thin air. The government uses funds for social planning, public works, and war. How the money was deposited in the bank, the vast majority of them were not created by the government, but by the partial reserve banking system, which increased the money supply by 10 times and created from the debt. Currency, because money is redeemed and released repeatedly.

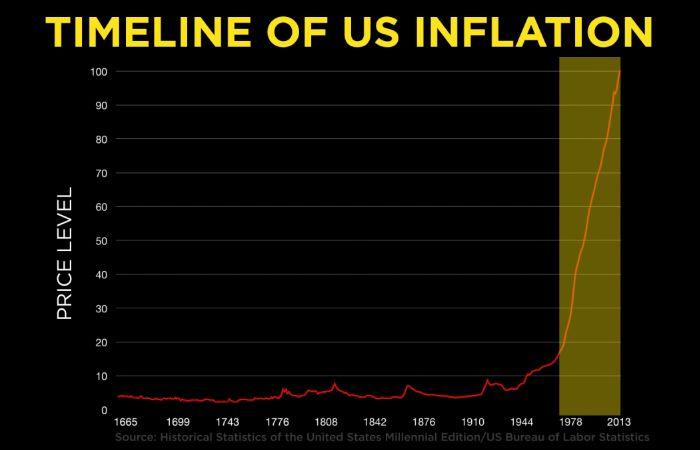

Figure 3: US Inflation Timeline Source: ChrisMartensondotcom

Why inflation is a form of taxation is the result of a debt-based monetary system. People lose their purchasing power during periods of high inflation, so they hope to buy goods as soon as possible, which speeds up the circulation of money and thus pushes inflation further. That is to say, the price increase leads to expectations of price increases, resulting in higher prices.

Why mortgages can lead to rising house prices, as consumers will have more money to raise the price of goods and services, leading to demand-driven inflation. Low interest rates and speculation

Helps create a bigger bubble because the price of an object is determined by market expectations rather than by its intrinsic value (Bo silly theory) .

How Treasury bills (T-bills) have a significant impact on the risk premium charged by market investors, as they are the safest investments, other investments must provide a risk premium in the form of higher returns.

2008 global financial crisis

US Treasury yields continue to fall, so large investors (global funding pools) seeking low-risk, high-return investments are beginning to inject capital into the US real estate market, creating more demand for mortgage debt.

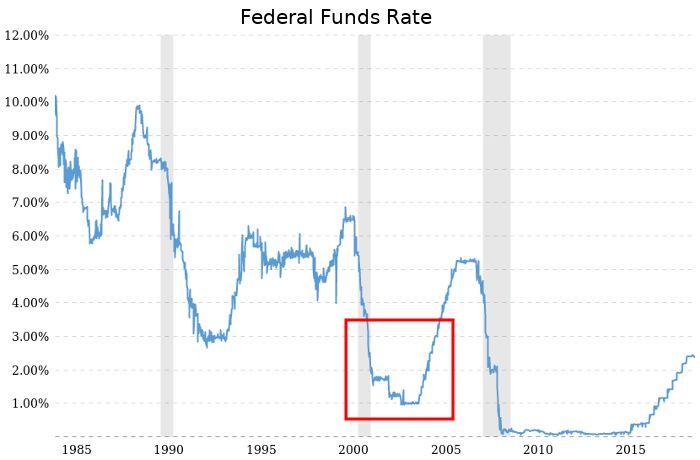

Figure 4: 1-Year Bond Interest Rate Source: macrotrends

In the early 21st century after the dot-com bubble burst, the Fed substantially reduced interest rates (Federal Fund rates) from 6% in response to the economic downturn.

1%, allowing people to get cheap credit and motivating Wall Street to use a lot of leverage in risk trading.

Figure 5: Federal Fund Interest Rate Source: macrotrends

Large financial institutions (Wall Street) began borrowing billions of dollars from low interest rates to buy thousands of personal mortgages to combine them into mortgage-backed securities (MBS) and mortgage debt bonds (CDO) , and then Sold to large investors. Credit rating agencies tell investors that these MBS and CDO are safe investments in AAA ratings.

Banks sell mortgage debt to Wall Street instead of holding it for 30 years, so they relaxed the standard and even offered loans to people with very low credit scores (subprime mortgages) , which increased demand and pushed house prices up.

Unregulated over-the-counter derivatives such as credit default swaps (CDS) allow speculators to place large sums of money when the value of mortgage securities rises or falls. In addition, financial institutions such as American International Group (AIG) also provide swap insurance to CDS that do not have sufficient capital reserves.

From 2003 to 2006, the real estate market was in a typical speculative bubble, as home loans were easily available, so more people bought homes. As people begin to view housing as a low-risk investment, increased demand for housing leads to higher house prices, which in turn creates greater demand.

In 2007, the real estate bubble burst, when many homeowners defaulted on mortgage loans, re-launching a large number of homes and creating more supplies, so house prices collapsed. As prices fall, many borrowers' mortgages exceed the value of their homes, causing them to default and push prices down further. As a result, lenders, large financial institutions and large investors have fallen into the quagmire of bad debts.

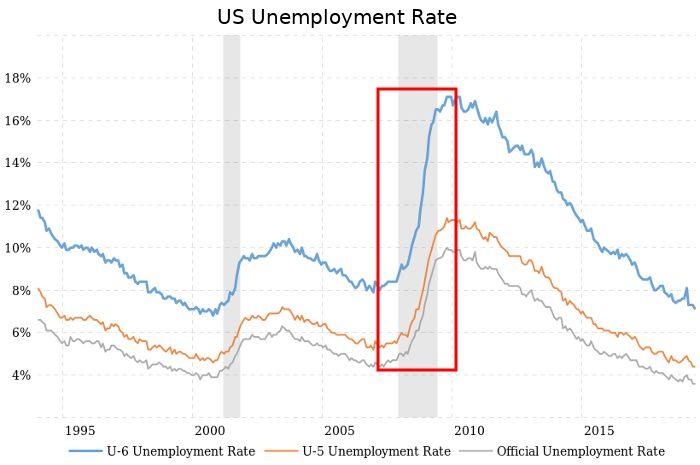

Figure 6: US unemployment rate source: macrotrends

Fear then spread throughout the economy, because no one wants to borrow money, and the company cannot borrow in the commercial paper market to meet demand. As a result, many companies filed for bankruptcy or closed some business activities, resulting in an increase in unemployment. Consumer confidence has fallen, people have begun to hoard rather than consume, greatly reducing the speed of money circulation.

Figure 7: Actual GDP growth in 2009 Source: wikipedia

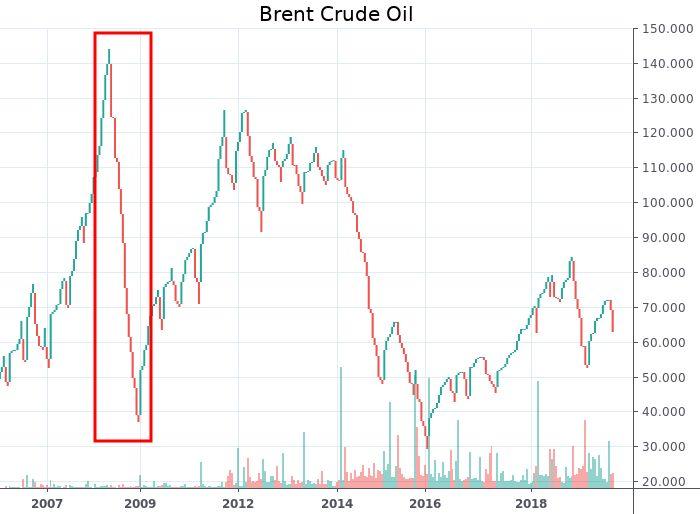

The largest investment bank in the United States is either bankrupt (Lehman Brothers) , or sold to other banks, or given a government emergency loan (TARP) to ease the dilemma. The trade and credit markets are frozen and the stock market collapses, leading to a global recession and a drop in fuel demand.

Figure 8: Brent crude oil price source: tradingview

We should explain to our families that large financial institutions have got rid of their greed and poor management, but have not paid for bad decisions. This creates a dangerous precedent because if big banks know that they will receive government bailouts in the event of a disaster, they will have the incentive to invest in venture capital with a lot of leverage. If they succeed, the rich will become richer, but if they fail, the Fed will save them with lower levels of inflation spending.

Quantitative easing

When the Fed or other central bank issued a check, they were creating money because the check did not have a bank deposit.

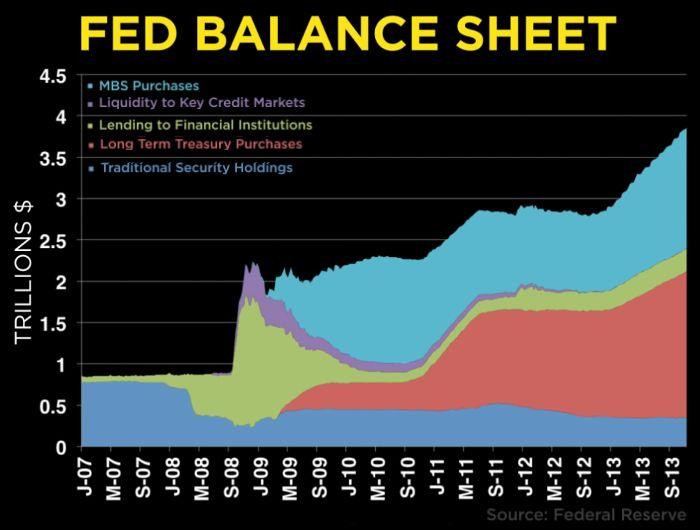

We need to focus on how the Fed tries to prevent the next Great Depression by issuing emergency loans to financial institutions and buying troubled assets such as mortgage-backed securities (MBS) , thereby injecting money into the economy.

Figure 9: Federal Reserve Balance Sheet Source: ChrisMartensondotcom

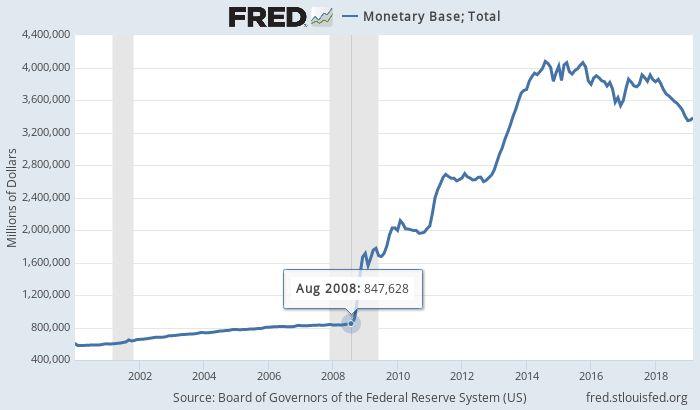

In other words, quantitative easing is just a beautification of large-scale printing of fiat money to encourage capital landings and investments. The United States expanded its monetary base from $850 billion to $4 trillion from 2008 to 2014.

Figure 10: Total monetary base source: FRED

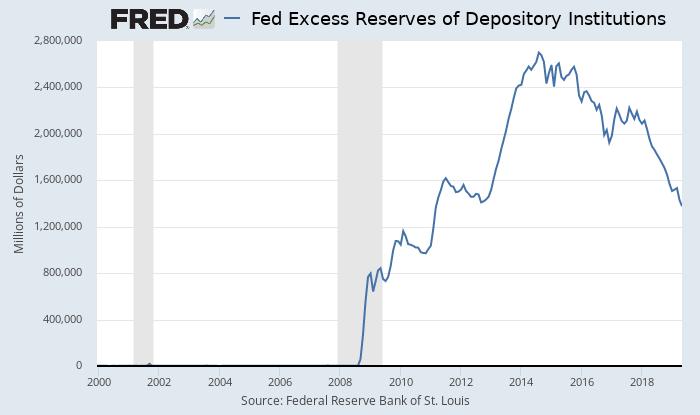

However, despite the Fed’s massive injection of funds into the financial system, most of the newly issued $3 trillion did not appear in the mainstream market in the form of new loans, but in the form of a Fed excess reserve with a 0.25% interest rate.

Figure 11: Alcatel Reserves Excess Reserve Source: FRED

We should explain to our family that quantitative easing is the largest monetary fiscal experiment in human history, and risk assets are beginning to indulge in cheap funds, so the Fed must continue to inject funds into the economy to prevent potential economic turmoil.

At this point, your friends and family may have questions, why is there no runaway inflation in the United States? Here are some explanations:

- As people are afraid of lending or spending money, the speed of money circulation has slowed significantly (for example, the Fed’s excess reserves have increased) . However, once the economy begins to recover, people will become more confident, so less money will flow into the Fed's excess reserves, which could trigger high inflation.

- In the past decade, there have been many technological innovations that have led to deflation (for example, smartphones have become cheaper every day) .

- The skyrocketing stock, bond and real estate prices are also a form of inflation, which means that money is losing its real value, so even though we have experienced high inflation, it is not so obvious to the average consumer. Interestingly: the United States and the United Kingdom do not include house prices in inflation calculations. This makes the government say that the cost of living has not risen, because even if house prices skyrocket, inflation is still very low.

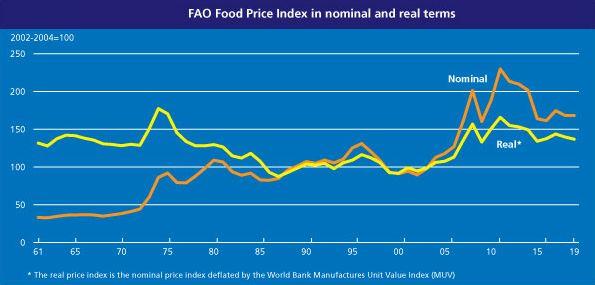

- Because of the large global demand for the US dollar, the United States often exports inflation to other countries. Why is this happening? The United States uses dollars to import physical goods and resources to developing countries, so many dollars eventually flow into the country’s local economy. Since people usually have more confidence in the US dollar than the local currency, they began to hoard the US dollar (Grechen's Law) , and the local currency eventually flows into the market, which weakens the purchasing power of the local currency and leads to inflation. For example, after 2008, global food prices soared, triggering the “Arab Spring”.

Figure 12: Sources of nominal and actual food indices of the Food and Agriculture Organization of the United Nations: FAO

It is worth noting that quantitative easing has greatly increased asset prices . Since most of the assets are owned by the rich, it can be said that quantitative easing makes the rich more affluent, leading to social unrest.

Control System

We should say that money is no longer just a means of exchange, account units and value storage, but a control system that goes beyond the full supervision and enforcement of the judiciary. The authorities can freeze your bank account and prevent you from accessing the money. For example, in 2015, the Greek government froze all banks and implemented capital controls to limit the amount that savers transfer to overseas accounts and limit individual withdrawals to only $67 a day. In 2016, the Indian government suddenly abolished 500 and 1000 rupees (86% of the currency in circulation) to fight corruption, but this caused a huge cash crisis and plunged the Indian economy into chaos.

We can also explain that under the traditional democratic theory, if the government wants to expand its activities, it must ask citizens to increase the amount of tax, that is, citizens control the government institutions. However, in the era of central banks and fiat currencies, the government can issue money for public spending (or increase its debt) without the consent of citizens, and gradually move from democracy to autocracy. It is worth mentioning that during the deflationary period, debt issuance will decline as the value of debt rises.

De-dollarization

When we can explain the history of money, let us turn to the political aspects of the current financial system to show how fragile the system is.

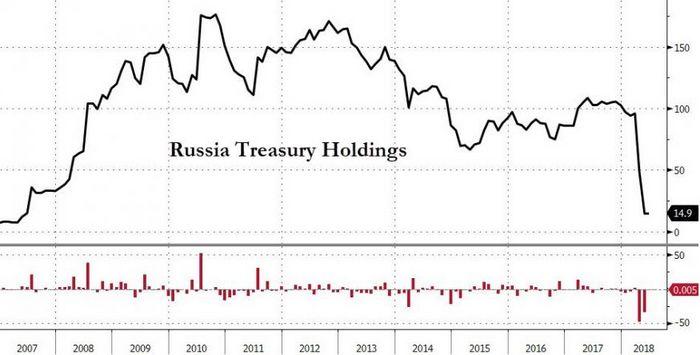

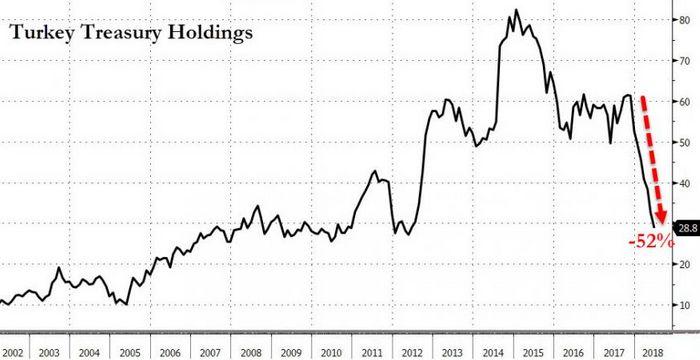

We should explain how the dollar dominates the global economy. How money becomes a control system, and many countries join the dollarization campaign to bypass dollar-based economic sanctions: Russia, Iran, Venezuela, Cuba, Sudan, Zimbabwe, Myanmar, North Korea, Pakistan, Turkey, and other countries.

Figure 13: Russian US Treasury Bonds Source: ZeroHedge

Figure 14: Turkish Treasury Bond Holdings Source: ZeroHedge

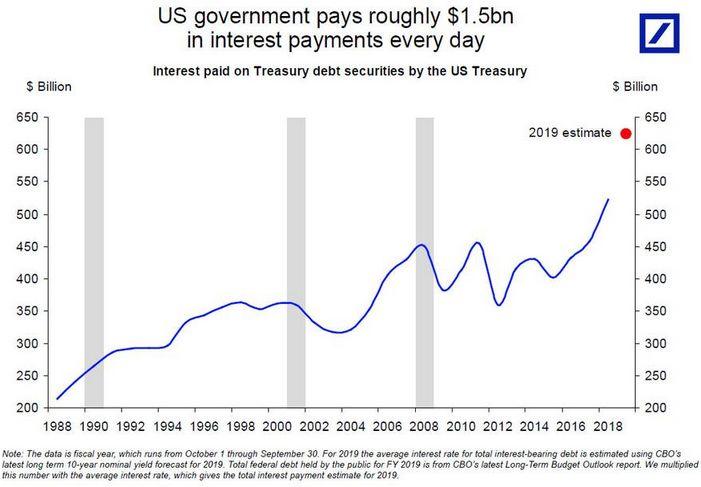

How did Turkey and Russia sell US Treasury bonds and buy gold instead. More than 40% of the US extra-budgetary deficit is only to pay $325 billion in interest on past debt issues, and this number will explode in the next few years.

Figure 15: The US government pays approximately $1.5 billion in interest per day: ZeroHedge

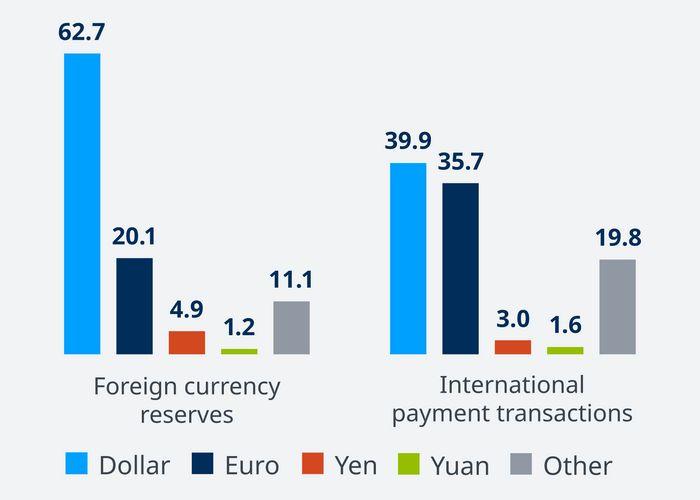

How does Russia and China develop their own SWIFT payment system to allow thousands of banks to conduct cross-border financial transactions. And how the EU develops an international payment system that is independent of SWIFT.

Figure 16: Foreign exchange reserves and international sources of payment: DW

"If you are an American, the United States is great. If you come from other places, the United States is terrible."

– Scott Horton

Iran

The democratically elected Iranian prime minister nationalized the oil industry because Britain is depriving its national resources. The United States and the United Kingdom planned a coup in 1953 to abolish him and restore power to the pro-Western dictator Shah. Shah returned oil under the control of Britain, the United States, the Netherlands and France.

The United States helped Shah to suppress any dissident until he was dismissed in the 1979 Islamic Revolution. The United States imposed economic sanctions on Iran for the first time during the hostage crisis. At that time, Iranian students occupied the US Embassy, fearing that the United States might once again interfere in overthrowing the revolution.

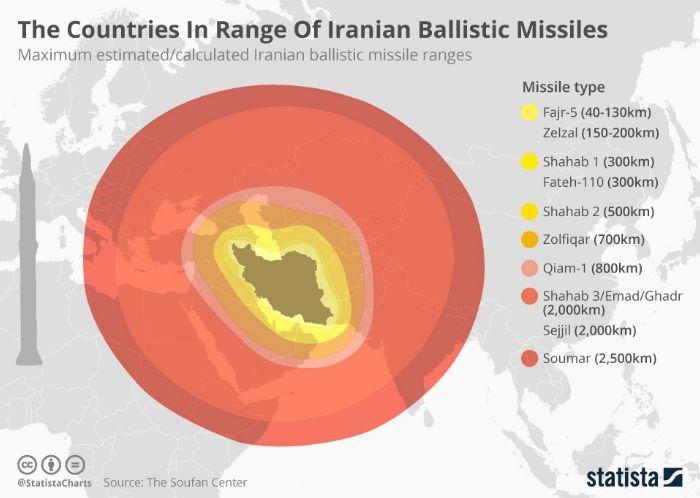

Iran stopped selling oil in dollars, weakening the oil dollar hegemony, while the United States surrounded Iran with military bases and continued to increase sanctions until a nuclear deal was reached in 2015. Trump unilaterally withdrew from the agreement in 2018 and announced new sanctions, while the EU also tried to lift US sanctions against Iranian trading nations and protect EU companies from US sanctions.

Figure 17: National source within the Iranian ballistic missile range: statista

In 2019, the United States threatened to sanction countries that continue to buy oil from Iran, including major consumers such as India and Turkey. As a result, India began negotiations with Iran to use the Indian rupee to pay for oil to bypass US sanctions and damage the dollar's international currency status.

Venezuela

In 1999, after the Socialist Party took power in Venezuela, why is the relationship between Venezuela and the United States, the world’s largest holder of proven oil reserves, tense? How does the government nationalize most of the oil industry and how to deliberately strengthen US sanctions? After the sharp drop in oil prices, the economic crisis in Venezuela escalated, leading to hyperinflation and crime.

Republicans ignore the devastating effects of US sanctions and falling global oil prices on the Venezuelan economy. In order to win more votes against democratic socialists in the 2020 US elections, they repeatedly accused Venezuela of the disaster as socialism. Western corporate media portrayed the US-led right-wing coup as a legitimate move to justify the change of regime and erase the identity of non-white countries as members of the international community.

Russia used the American oil company Citgo as a mortgage to pay loans to Venezuela, provide weapons and begin to build military power in the country. Venezuela began selling oil in Indian rupees, Russian rubles and Japanese yen, further weakening the dollar's dominance in the oil industry. At the same time, the Russian government helped Venezuela launch its own cryptocurrency Petro to evade US sanctions.

It is worth mentioning that, so far, Petro has not received any major use, and in the cryptocurrency world, it is known as fraud. However, this is a strong evidence that even countries such as Russia and Iran are not interested in decentralized currencies, as this will reduce their control over their population. These governments still support cryptocurrencies because cryptocurrencies may undermine the hegemony of the dollar and help bypass US sanctions. For example, the head of the Russian oil giant Rosneft recently said that in the future, oil can be purchased in cryptocurrency.

Saudi Arabia

Saudi Arabia, the world's largest oil exporter, threatens to sell its US Treasury bonds if the US Congress asks the Saudi Arabian government to be held responsible for any role in the September 11 attacks in US courts.

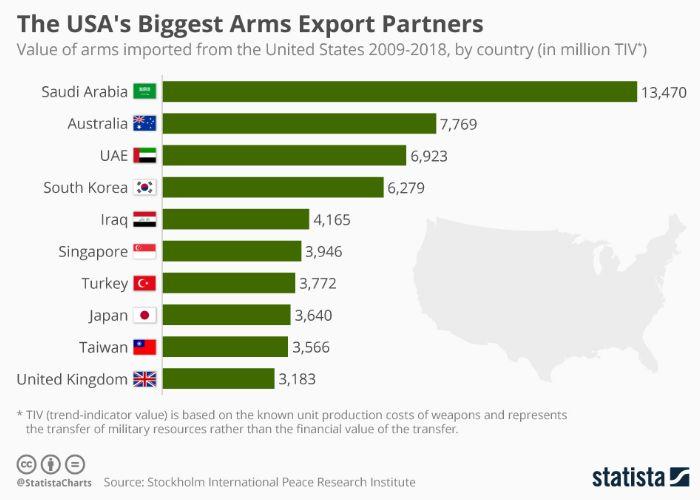

If the United States passes the "Prohibition of Oil Production and Export Cartel Act" (NOPEC) , Saudi Arabia will threaten to sell oil in currencies other than the US dollar. The bill will make international oil cartels illegal and expose OPEC members to US antitrust lawsuits.

Figure 18: The largest arms export country and region in the United States Source: statista

Despite the growing anti-Saudi mood, even after the Washington Post columnist Jamal Hasjiji was murdered in Istanbul, the United States did not cancel the arms sales to Saudi Arabia because of human rights issues. Donald Trump vetoed a bill passed by Congress aimed at ending military aid in the Yemeni anti-Iranian armed war led by Saudi Arabia, which has killed thousands of civilians and caused devastating famine. .

in conclusion

Once you understand the above, people will be happy to talk to you because you will be a fun and useful source of information to help them better understand what a real currency is and help them prepare for the next recession.

You will be able to explain why the current financial system is a huge experiment, the legal currency does not have any support, the entire financial system may collapse at any time, and the price of an asset or currency will only rise if the buyer is more than the seller. Regardless of its intrinsic value or the economic situation of the issuing country.

The knowledge you have will definitely impress your family and friends, so once you start explaining how encryption can help us solve these problems, separate the funds from the state and outside the control of the bank and the state. Realizing cross-border transactions with fast privacy, they will give you more credibility.

The author authorizes the chain to translate and publish the Chinese version. The peer-to-peer Ethereum token trading platform Localethereum sponsored the article.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Your circle of friends may affect the price of coins, and they begin to predict the market through social media.

- The principle and importance of lightning network "justice trading"

- Can Libra win Bitcoin? How to break the high buy low sell spell? Everything you want to know here

- Libra vs. US Congress, a few questions about gunpowder

- Report: 96% of BSV transactions are from this weather app

- Facebook's first robbery of money: fetal death

- Will BTC and BCH be halved at the same time? The former's computing power grows to narrow the latter's lead