Ethereum Merger One Year Anniversary What Changes Have Occurred in the MEV Supply Chain

Ethereum Merger - One Year Anniversary MEV Supply Chain ChangesAuthor: Fred & Danning Sui, Flashbots Partners; Translation: LianGuaixiaozou

To celebrate the one-year anniversary of Ethereum Merge and MEV-Boost 5 launch, we will provide insights and trends on the first year of off-chain MEV extraction on the Ethereum protocol. We will first look at the adoption of MEV-Boost by proposers, and then summarize the behavior of relays, builders, and searchers.

1. Rapid Adoption of MEV-Boost

The Ethereum Merge has brought significant changes to Ethereum, as the responsibility for block production has shifted from a few mining pools to thousands of global validators. This change has also led to a “hard reset” of the Ethereum MEV infrastructure. With this new group of proposers in control, all the relationships between searchers and miners have disappeared.

- Lawsuit tug-of-war escalates, SEC requests investigation into Binance.US assets

- Celebratory Token2049 and Serene Singapore

- Rollups are competing fiercely, will a monopolistic Rollup be emerged as a result?

One year before the merge, Vitalik Buterin introduced the concept of Proposer/Builder Separation (PBS) as a direct response to the risks MEV could pose to PoS Ethereum. If left unchecked, MEV would be accumulated by proposers with the most complex infrastructure associated with searchers. This would hinder individual staking, promote economies of scale, and threaten the network’s reliability and neutrality.

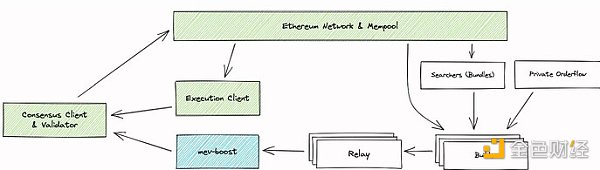

Flashbots, in collaboration with the Ethereum Foundation and the Eth2 Working Group, developed MEV-Boost as a temporary PBS solution that does not require any changes to the core protocol. MEV-Boost serves as an auxiliary tool for all CL clients in the merge, enabling off-chain PBS and establishing an open and competitive market for block builders. Through this separation, MEV-Boost democratizes access to MEV, allowing all validators to participate equally. This is particularly important for individual validators, as otherwise, they would be unable to participate and be blocked from accessing any MEV rewards.

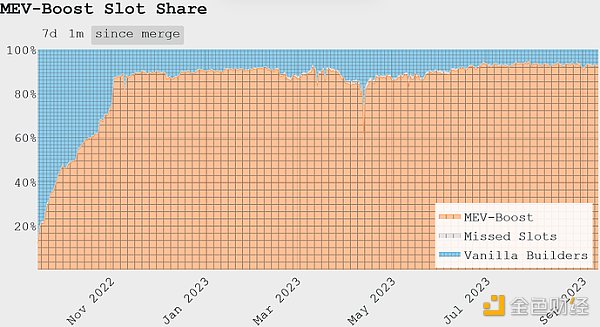

After the Ethereum Merge, MEV-Boost was quickly adopted, with 50% of validators running it in the first month and reaching 90% by the end of the second month. By outsourcing block construction with MEV-Boost, proposers receive the same median block reward, alleviating the centralization pressure MEV imposes on the Ethereum validator set.

Proposer Earnings and Major Events

Proposer Earnings and Major Events

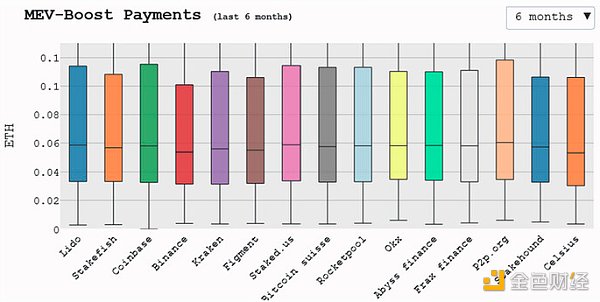

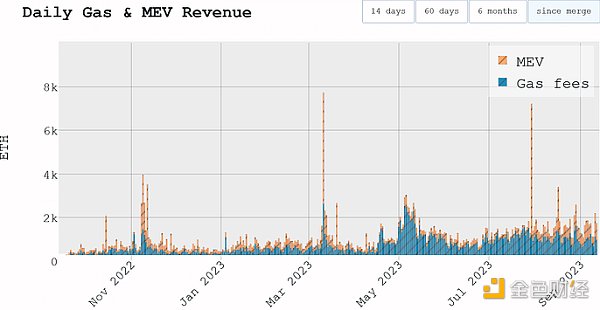

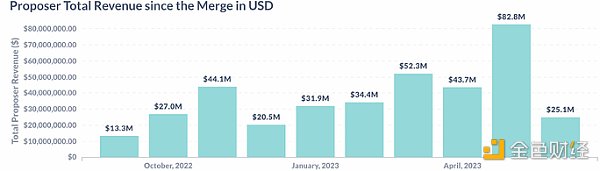

In the first year after Ethereum PBS, validators earned over 300,000 ETH from the blocks they proposed, including gas priority fees and MEV. While gas priority fees typically make up the majority of proposers’ earnings, during periods of market volatility, MEV fees can greatly exceed gas fees.

Last year, there were three periods of large-scale MEV fees. We will briefly discuss them here.

-

November 9, 2022: After the FTX crash, there was a five-day market liquidation, resulting in a total of 14,585 ETH being paid to proposers for gas priority fees and MEV.

-

March 11, 2023: The SVB Bank run and the decoupling of USDC triggered a surge in on-chain activities, resulting in a total of 7,694 ETH being obtained by proposers.

-

July 30, 2023: After the Vyper hack attack series, arbitrageurs rushed to eliminate the price difference between detached assets in various Curve pools. A total of 7,187 ETH was paid to proposers. During the turmoil, a transaction was made to eliminate arbitrage opportunities between Alchemix ETH and Frax ETH, which included a payment of 570 ETH, making it the second largest MEV fee in Ethereum history.

The transaction with the highest single MEV fee in history was 678 ETH paid by whitehat c0ffeebabe.eth to Beaverbuild, as Beaverbuild discovered a vulnerability in the contract in advance, avoiding funds being stolen in a hack, and therefore received this huge reward. Beaverbuild transferred this MEV to the block proposers to win the auction.

2. Relay Ecosystem

MEV-Boost introduced the role of trusted relays between builders and proposers, responsible for verifying and hosting blocks. Anyone can run a relay node, and proposers can register as many relays as they trust. In order to help Ethereum launch a diverse and healthy relay market, Flashbots opened our relays under the LGPL copy-left license one month in advance. Blocknative followed suit and also deployed open source.

As Ethereum transitioned to proof-of-stake on September 15, validators were able to connect to seven different relays, which receive bids from 27 unique block builders. To avoid enshrining Flashbots relays, we deliberately did not set it as the default option in MEV-Boost.

(1) Audit Issues

The rapid adoption of MEV-Boost still exceeded our efforts to foster a diversified relay market. One month before the merger, OFAC added the Tornado Cash contract address to the sanctions list. This led to many relays, including Flashbots, choosing not to accept blocks containing these transactions. The architecture of MEV-Boost separates block builders and proposers completely. Validators must blindly sign the blocks they propose and cannot add any further transactions to bypass this audit.

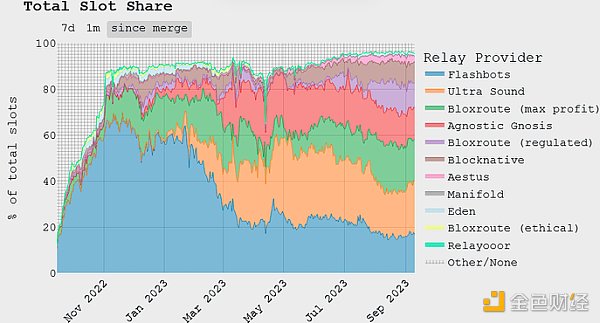

Flashbots is the only permissionless relay in the Ethereum merger, allowing any builder to submit bids. It became operational as the second permissionless and the first uncensored relay on October 26 last year. Nevertheless, Flashbots remained the most popular relay in the initial months, peaking on November 11, forwarding 69% of all new Ethereum blocks. On November 21, the proportion of blocks from audited relays reached a historical high, accounting for 79% of all new Ethereum blocks.

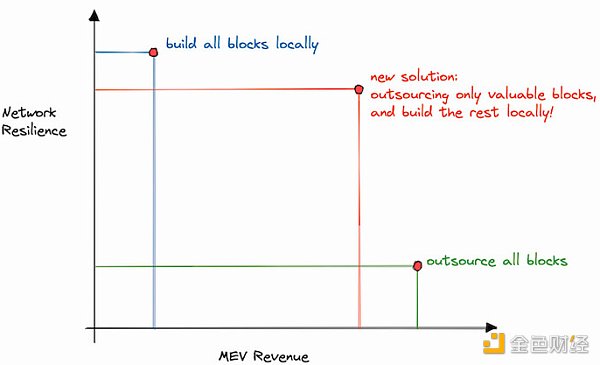

On November 22nd, we published an article titled “Flexible Costs.” The article encourages validators to use the newly added -min-bid flag to propose locally built blocks if the MEV-Boost bid is lower than the minimum bid value. By using this feature, validators will no longer risk missing out on high-value MEV-Boost blocks while still being able to maintain Ethereum’s network elasticity by proposing locally built blocks unrelated to content (including transactions) during low MEV periods.

On November 30th, two new permissionless content-agnostic relays were announced – Agnostic Relay and ultra sound relay. To support their initial growth, Flashbots developers started sending blocks to them over the next week. In addition, we also released a technical guide and knowledge base on how to scale MEV-Boost-Relay to help everyone operate their own relay infrastructure effectively. Aestus began operations in December last year, becoming the fourth content-agnostic permissionless relay, bringing the total number of relays to 11.

(2) Diversification and Stability of the Relay Market

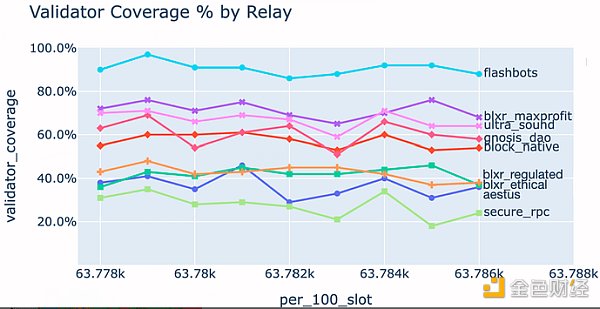

Although Flashbots remains the most popular relay among validators, the slot sharing situation of this relay has shown a considerable degree of diversification in the past six months. In April of this year, the slot sharing levels of Agnostic relay and ultra sound relay grew to the same level as Flashbots relay. Currently, ultra sound relay and BloXroute are in the lead. Although the top 6 relays account for 90% of the market share, none of them have a market share exceeding 25%.

The number of blocks reviewed by relays reached a low point of 17% in April. Since then, it has shown an upward trend and is currently close to 30%. It is worth noting that after the Ethereum merge, less than 2% of blocks contain one or more transactions interacting with sanctioned addresses. Due to the scarcity of these transactions, the majority of blocks from reviewing entities actually do not delay any unconfirmed transactions from being included in the chain. Additionally, since these transactions do not rely on timely inclusion, they do not fail due to increased latency.

The number of blocks reviewed by relays reached a low point of 17% in April. Since then, it has shown an upward trend and is currently close to 30%. It is worth noting that after the Ethereum merge, less than 2% of blocks contain one or more transactions interacting with sanctioned addresses. Due to the scarcity of these transactions, the majority of blocks from reviewing entities actually do not delay any unconfirmed transactions from being included in the chain. Additionally, since these transactions do not rely on timely inclusion, they do not fail due to increased latency.

(3) Reducing Latency with Optimistic Relay

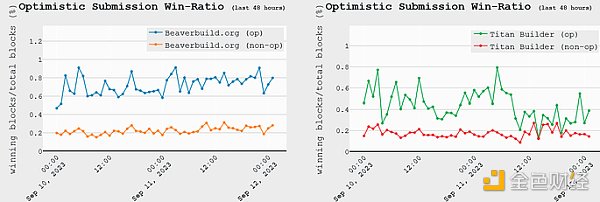

To reduce latency in block production, ultra sound relay introduced the concept of optimistic relay. In optimistic relay mode, blocks are directly forwarded to proposers without going through relay simulation to ensure their validity. This relay process saves about 100 milliseconds and allows builders to create higher-revenue blocks, giving relays an advantage in competition. To ensure honest operation by builders, they must provide collateral for the relay.

This allows builders to adjust more flexibly at the end of the slot. The graph below shows that the bid acceptance rate for Beaverbuild and Titan Builder submitted in optimistic mode is nearly three times that of normal bidding. On March 17th, ultra sound relay enabled optimistic relay and remains the only relay that effectively utilizes this feature.

(4) Brief Introduction to the April 2nd Relay Attack

On April 2nd, a malicious proposer exploited a vulnerability in MEV-Boost-Relay and manipulated the ultra sound relay, stealing approximately $20 million from multiple sandwich robots. The malicious proposer received blocks from the relay, unbound the sandwiches created by the induced searchers, and bundled their transactions together. This vulnerability allowed the proposer to send invalid block headers to the relay to ensure their victory in the block blur competition. The vulnerability was patched on the same day, but the number of forks on the network increased in the following days.

3. Evolution of the Builder Market

After the Ethereum merger, Flashbots initially won 95% of the blocks from MEV-Boost. However, compared to the relay market, block construction diversified faster. Just one week later, with the addition of BloXroute, the number of Flashbots builders dropped to less than 60%, occupying a 25% share, and other early adopters such as Blocknative and builder0x69 also started winning blocks. In November, we open-sourced our block builders, witnessing the joining of more builders.

Beaverbuild entered the scene in January, further decentralizing the builder landscape, where no entity currently produces more than 30% of the blocks. However, Beaverbuild’s unique position as a searcher-builder (able to access exclusive high MEV arbitrage flow) gives them a significant competitive advantage. Vertical integration allows Beaverbuild to produce 40-50% of the blocks in the volatile market in a short period, far surpassing other builders, temporarily leading to centralization in the market.

More competing builders have entered the market and gained considerable market share. In March, rsync joined the market, and in May, Titan Builder also joined. Unlike the relay market, the builder market is driven by economic incentives. The competition remains fierce, with new participants joining and strategies improving to win the competition. As of the time of this article’s publication, the top 4 block builders occupy 90% of the total market share.

The block builder ecosystem has evolved into a complex game, with builders adopting various strategic methods to gain a competitive advantage, such as:

-

Vertical integration of searchers and builders: Considering Ethereum’s 12-second block time, off-chain high-frequency markets (such as Binance) benefit from transaction finality and greater control. Therefore, from an economic perspective, searchers can also become builders. It is worth noting that CEX-DEX arbitrage constitutes a significant part of the searcher-builder strategy and heavily relies on access to off-chain capital. On-chain data shows that searchers generally consider searcher-builders less trustworthy than neutral builders. Some searchers strategically avoid sending data to these entities to mitigate the risk of data leakage or censorship, especially in cases where competition may exist in the same data flow. With the emergence of multiple searcher-builders, searchers need to strategically decide which builder to send their transaction bundles to.

-

Strategic bidding: builder0x69 was the first notable builder that bid not only the total value of the block. They adjust their bids by subsidizing blocks with their own funds, sometimes exceeding the block value, and sometimes reducing the bid for profitability. By subsidizing blocks, they have a higher chance of winning slots, increasing their market share, and attracting more private order flow. This strategy is increasingly adopted by newly joined builders.

-

Order flow sharing: With the rise of MEV-share and MEVBlocker auctions for order flow, as well as the emergence of Telegram Bots requiring private mempool settlement, builders face increasing pressure to quickly include transactions and optimize user experience. Due to the decentralized nature of the builder market, sharing order flow between builders has become a solution to speed up transaction inclusion time. This practice makes order flow tracking complex until more standardized solutions are developed.

-

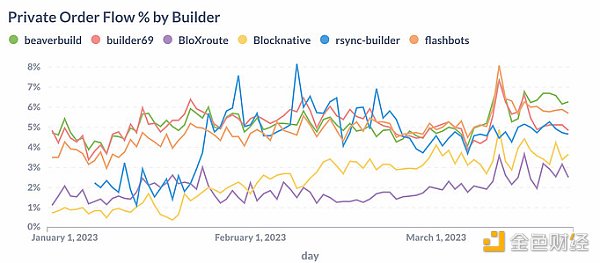

Private order flow acquisition: Acquiring private order flow containing MEV value is crucial for builders to compete for blocks. Most prominent builders have adopted private order flow, either through their RPC endpoint products or through exclusive transactions purchased from applications.

The empirical analysis of “Builder Behavior Profiles (BBPs)” by Thomas Thiery provides a deeper analysis of the strategies used by builders. This research introduces a series of indicators to describe how builders construct blocks and act in MEV-Boost auctions, providing insights into their strategies and optimizations. The research data shows that during the period from June to mid-July, exclusive order flow accounted for 25-35% of the total number of transactions by builders, but accounted for 80% of the total value.

One of the main issues with the current PBS architecture is the centralization and censorship resistance of builders. MEV-Boost does not generate these centralized forces, but MEV does. MEV-Boost simply shifts the risk from validators to builders, where it is easier to address these risks.

4. Searcher Profits After Ethereum Merge

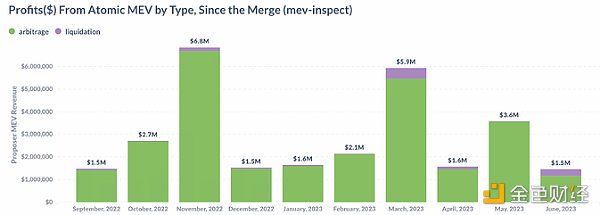

(1) Atomic MEV: Most profits are paid to proposers

Using mev-inspect-py to identify atomic MEV, such as arbitrage and liquidation, we are able to quantify that the monthly profit of atomic MEV hovers around $2 million and can soar to $4 million during periods of high market volatility.

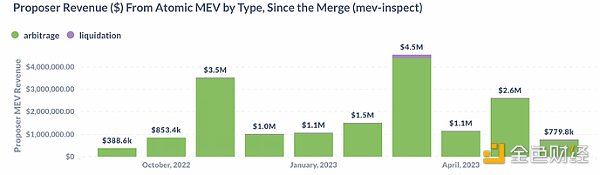

We estimate that the total proposal revenue benefiting from atomic MEV transactions is between $1-4 million. Compared to the overall proposal revenue during the same period, this only accounts for 5-10%. Please note that this is a conservative lower-bound estimate due to the limitations of mev-inspect-py scope.

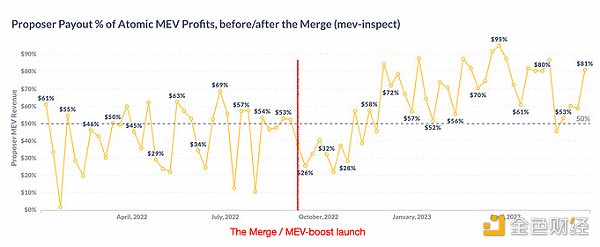

Before the Ethereum merge, searchers had to increase gas prices to prioritize processing transactions within blocks. After the merge, with the adoption of MEV-Boost, searchers can now obtain additional fees through MEV fees, in addition to the standard gas fees, to prioritize processing their transaction packages. The percentage of MEV paid to proposers shows an interesting paradigm shift before and after the merge:

-

Before the merge, the proposers’ share of MEV revenue was on average less than 50%.

-

After the launch of MEV-Boost, when there was almost no competition among builders, the share of profits forwarded to proposers initially decreased and then increased.

-

Starting from 2023, as more and more builders enter the field, the share forwarded to proposers stabilized at over 50%. Proposers increasingly capture the majority of profits from atomic MEV, sometimes as high as 80-95%.

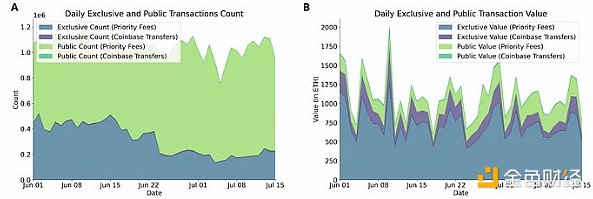

(2) Non-atomic MEV: Higher income, higher profit margins

(2) Non-atomic MEV: Higher income, higher profit margins

Searchers can engage in cross-market arbitrage involving both DeFi platforms and CeFi platforms… Tracking these profits becomes particularly challenging because some of the transactions are off-chain. In the article “The Stories of Two Arbitrages,” the author concludes:

“…In the first quarter of 2023, compared to atomic arbitrage and CeFi-DeFi arbitrage, CeFi-DeFi arbitrage generated a revenue of $37.8 million, while the revenue from atomic arbitrage was $25 million. 91-99% of the revenue from atomic arbitrage is paid to validators, while only 37-77% of the revenue from CeFi-DeFi arbitrage is paid to validators.”

This helps us draw the following conclusions: compared to atomic MEV, non-atomic MEV flows contribute a similar amount to proposers’ income; searchers can obtain a higher profit margin from the total revenue.

5. Conclusion

(1) The Future of PBS

MEV-Boost was developed as a temporary solution for Ethereum PoS until protocol-level research is conducted, and enshrined PBS becomes part of the Ethereum roadmap. Relays were initially seen as a temporary component in the current protocol’s external PBS structure, but they are likely to continue to play a role even in enshrined PBS. There is still much work to be done in relay diversification, and we are committed to open-sourcing our work, sharing our experiences, and actively participating in discussions, encouraging the development of an open, transparent, and permissionless MEV market.

To support current and future research, development, and operation of PBS on Ethereum, the MEV-Boost community has proposed the PBS Guild. The PBS Guild is a non-profit ecosystem development funding organization that supports the development of the PBS ecosystem. Its goal is to leverage decentralized characteristics to address short-term, medium-term, and long-term research, development, and operational challenges of PBS. The initial goal is to raise $1 million for independent relays, research, data transparency, and PBS promotion and education.

(2) Illuminating the Future with Data Transparency

As the MEV supply chain evolves into a complex supply network, tracking the lifecycle of order flow across stacks becomes challenging. While MEV-Boost’s open-source relay data API helps understand the final steps before on-chain settlement, the initial entry points for tracking orders remain opaque.

Flashbots is committed to providing transparency to the MEV ecosystem and offering research data to contributors and collaborators. The recently released Mempool Dumpster provides historical mempool transaction data from five different node providers. It aims to provide freely accessible data for any community research or development building projects.

To ensure good data quality and increase protocol coverage, we invite contributors to maintain and improve mev-inspect-py through a new data license.

(3) Looking Ahead

The transition of Ethereum to proof of stake, coupled with the rise of MEV-Boost, fundamentally reshapes the transaction supply chain landscape. While this achievement is significant and worth celebrating, the centralized power of MEV continues to pose inherent challenges to the neutrality and decentralization of blockchain. The future path will be filled with analytical research, intense debates, and innovation to ensure these centralizing effects are carefully addressed. The development of Ethereum has always been community-driven. As we move into the next chapter, let us guide our collective energy to protect the spirit that initially brought us here. The future is exciting, and let us embrace the challenges together.”

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Popular Science What is the statelessness frequently mentioned by Vitalik in recent speeches?

- How to understand that the TVL of Friend.tech is stable, but the price of Key is declining?

- Exploring Blockchain Space Creation, Use, Valuation, and Transaction

- Token2049 – Post-disaster reconstruction of industry credit and some real variables

- Interpreting the intent-centered landing challenges starting from UniSwapX and AA

- Summary of The Biography of Musk Want to Learn from Ma Yilong? Are You Crazy? Note Ma Yilong is a Chinese martial arts actor known for his unique fighting style. The original text is making a playful reference to learning from someone like Ma Yilong while discussing the biography of Elon Musk.

- Shanghai Metaverse’s major application scenario ‘Hero’s Post’ has a follow-up. Baidu, Alipay, and others are competing for it, and the achievements are being realized.