Ethereum price history: from 2015 to 2020

Text from Medium , original author: Jeffery Hancock

Translator: Odaily Planet Daily Moni

Ethereum is a cryptocurrency protocol, and because it is very different from Bitcoin, Litecoin, and other payment technologies, it also brings more value and potential to it. This article will analyze the price fluctuations of Ethereum from the perspective of historical development, outline the price trend of Ethereum in the past and the history of hard forks, and of course, look forward to the future of Ethereum.

- 66% of Bitcoin transactions have adopted Segregated Witness (SegWit), more mainstream exchanges will support

- Viewpoints | Difficult to Buy Insurance? Buying insurance in the blockchain era will be as easy as taxiing in the internet era

- Bitcoin: 2020 debut

The first version of the Ethereum protocol was called "Frontier" and was released on July 30, 2015. In fact, there was no concept of a so-called "Ethereum." Although we can give some analysis and get some conclusions about the value of the Ethereum token based on the initial sales data from July 2014 to September 2014 (the price is about 0.3-0.45 USD), during that time the price actually Not the most noteworthy thing of Ethereum, after all, the price is formed based on the transaction demand and supply ratio. However, just a month later, Ethereum was listed on the cryptocurrency exchange for the first time, and now Ethereum has become the second largest cryptocurrency by market value.

2015: Ethereum takes the first step

According to Etherscan.io data, Ethereum's first valuable transaction history took place on August 7, 2015, and ETH was added to the Kraken exchange that day for $ 2.77. But after three days, the price of Ethereum has shrunk by four times to $ 0.68-the reason for such a big drop as soon as it goes public is likely to be the result of the quick sell-off by the earliest investors.

When the time came to August 13, 2015, as the market discovered that Ethereum was an emerging crypto asset and renewed interest in its investment, the price of Ethereum rose to $ 1.8, and it remained at this price for three Days (it takes six months to return to this price). On August 18, 2015, the first major milestone event of the Ethereum blockchain network occurred-the 100,000th block was mined, but at this time the price fell to $ 1, and in the following two months Within the declining. In fact, the price trend of Ethereum at that time represented almost the state of the entire cryptocurrency market, and the earliest investors of Ethereum also began to sell to the market the tokens they obtained during the presale stage.

In October 2015, when the price of Ethereum reached $ 0.43, the downward trend was contained, and then it steadily rose to $ 1.3. After three months of adjustment, the price has basically consolidated in the $ 0.8-1 range. During this period, more and more cryptocurrency enthusiasts started to understand ETH gradually. On November 9-13, 2015, the first Ethereum Developer Conference Devcon was held. Representatives of industry giants such as IBM, Microsoft, and UBS participated in this conference, and also actively participated in discussing the way of Ethereum development. Made a special contribution to the popularity of Ethereum.

2016: DAO, hackers, and Ethereum Classic

On January 11, 2016, the price of Ethereum finally broke the $ 1 mark again. From that day on, the price never returned to less than $ 1. (Star O-daily Note: At least as of this writing of). In the next two months, the price of Ethereum has been rising rapidly, because there was news in the market that Ethereum was about to upgrade to a more stable version of the network protocol (Homestead). On March 13, 2016, the price of Ethereum reached $ 15, which also caused the market value of Ethereum to exceed $ 1 billion for the first time. On March 14, 2016, Ethereum implemented the Homestead hard fork. As a result, the price fluctuated violently. By the end of April of that year, the price of Ethereum had fallen twice, until it fell to $ 7.3.

As the success of the DAO project was widely reported by the media, the price of Ethereum reached the next high point and reached the highest level of 2016: $ 20.6. As part of the token sale, the DAO project has raised more than 12 million ETH (approximately $ 150 million). This project can almost be regarded as a landmark event in the era of the initial coin offering (ICO), which also determines the initial token issue. The project is sited in ETH to attract investor funds.

But what happened next did not let many people think of it, and it also brought a huge blow to Ethereum: hackers exploited vulnerabilities in DAO code and stole about $ 50 million from the project on June 16, 2016. ETH-The market began to panic, which also caused the price of Ethereum to fall to $ 11 in the next two days, a drop of almost 50%. In fact, many people in the crypto community know that Ethereum co-founder "V God" Vitalik Buterin is very optimistic about the DAO project and supports it in every possible way, which is why the price of Ethereum is affected. One.

In the following month or so, the community started a lively discussion on the proposal of Vitalik Buterin's plan to restore the Ethereum network to a pre-attack state by implementing a hard fork, and to recover the stolen funds. In the context of these hot discussions, the price of Ethereum has also been greatly affected, leading to increased volatility: One week after the DAO hacking incident, the price of Ethereum fell to 14.3 US dollars, and then fell once, when the time came to 2016.7 On July 7, the price of Ethereum has reached the $ 10 support level.

On July 20, 2016, Ethereum implemented a controversial hard fork, which led to the current Ethereum Classic (ETC) project. When Ethereum Classic was just launched, the price had recovered to nearly $ 15, but it hasn't escaped the fate of falling, and it returned to $ 8 in early August 2016.

A few days after the birth of Ethereum Classic, the price of Ethereum recovered to $ 11, and it remained in the range of $ 10-12.25 for about a month and a half. In mid-September 2016, it was reported that the Ledger Nano S hardware wallet will increase support for Ethereum, stimulate the price recovery of Ethereum, and raise the price to $ 15 (the highest price of the year).

On September 22, 2016, everyone knew that the Ethereum network had been attacked by DDoS, resulting in a significant decrease in the performance of the blockchain network. This incident also became the trigger for the price of Ethereum to fall again. As a result, it fell for two and a half months. When the time came to December 5, 2016, the price of Ethereum closed at only $ 6, and then until the end of the year, Ethereum prices are hovering between $ 7-9.

2017: The amazing bull market is here!

Maybe many people don't know that the “starting price” of Ethereum at the beginning of 2017 was only $ 8, but the price in January and February of the year was steadily increasing, and it reached the price of $ 13. On February 23, 2017, Ethereum was added to the social trading platform "eToro", which also became the seven points for Ethereum's faster growth. It is worth mentioning that on the same day, unconfirmed transactions in the Bitcoin network reached 100,000. More and more cryptocurrency investors believe that the Bitcoin network is too slow and out of date, so they started looking for other investments. Way, so turned attention to Ethereum.

In the first ten days of March 2017, Ethereum tried several times to break through the $ 20 resistance level, but the results ended in failure and did not achieve a substantial breakthrough. But in the following week, the price of Ethereum suddenly surged to $ 45 (the price even reached $ 55 on some cryptocurrency exchanges), and the average daily transaction volume even reached $ 450 million. In that month, the price of Ethereum basically remained in the range of $ 53-59, and then continuously adjusted in the range of $ 40-50.

On April 26, 2017, the price of Ethereum began to rise, and the price almost doubled in just ten days. On May 5, 2017, the price of Ethereum soared to $ 95, and about the same day, Bitcoin's unconfirmed transaction volume has exceeded 500,000 coins, and its network speed has become even slower, one of the reasons is that many Miners have moved to the Ethereum blockchain.

However, Bitcoin was also in the growth stage in 2017 and set the direction for the entire cryptocurrency market. Many cryptocurrencies have followed Bitcoin's development at an alarming rate. On May 18, 2017, Ethereum was added to the AVATRADE trading platform, which also stimulated its price to rush to new heights-in less than a month, the price of Ethereum increased fourfold (June 12, 2017 Date, the price of Ethereum reached $ 400), which means that if an investor who bought Ethereum six months ago sells it at this time, the return on investment will be 50 times! Not only that, the ratio of Ethereum's market value to the total market value of the entire cryptocurrency market also reached a record high, reaching 31.5%, compared to only 4% at the beginning of 2017.

In addition to the above reasons, Ethereum has also been widely used in the crypto community and dApps developer environment. The initial token issue project has increased the demand for Ethereum tokens (many projects have chosen ETH to accept payments during their token sale period). Major cryptocurrencies), these factors have contributed to the rise in Ethereum prices.

After such a rapid price increase, adjustments naturally occurred because the regulator started to pay attention to the initial coin offering project and "hit" it. As a result, the price of Ethereum has fallen for a month. On July 16, 2017, the price of Ethereum fell back to $ 150, but a new wave of growth soon appeared. By September 1, 2017, the price of Ethereum was once again. Back to the $ 400 high. However, there have been corrections for two consecutive weeks, especially after the release of the “94 Crypto Ban”. The initial token issue and cryptocurrency transactions were banned in the Chinese market, which caused the entire cryptocurrency market to plummet. $ 200.

Until mid-October 2017, with the news of the Byzantine hard fork, the price of Ethereum began to gradually recover. On October 15, 2017, the Ethereum hard fork upgrade was activated, and the price began to appear smooth correction. When the time came to mid-November 2017, the price of Ethereum basically consolidated in the range of 275-300 US dollars, but when the time came to November 23, the price of Ethereum quickly broke through the $ 400 level, and at this support The position has been maintained for two and a half weeks-the reason for this is largely because the initial token issue bubble continued to inflate, and Ethereum is still the main payment method for these project financing. On the other hand, the price of bitcoin soared to the $ 20,000 price during this period, which also raised the overall price level of the cryptocurrency market.

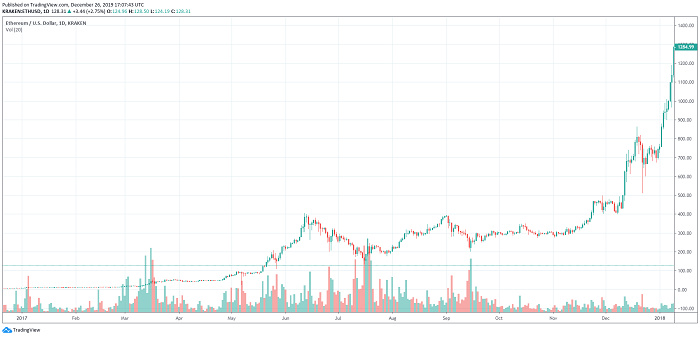

On December 11, 2017, the price of Ethereum entered its final growth phase since 2016, during which time it reached the level of $ 800. In addition, like most other cryptocurrencies in the market at that time, with the 80% pullback of the Bitcoin price, the price of Ethereum was also corrected, and fell to the range of 500-600 US dollars in a short time, and at the end of the year Many times hope to break through the $ 750 level.

2018: The bears conquered the Ethereum market

Since the first day of 2018, the price of Ethereum has skyrocketed. That's right, it's no exaggeration to use "crazy" to describe it. On January 13, 2018, the price of Ethereum reached its highest level in history-$ 1400. Of course, during this period, the prices of most altcoins have also risen in sync, and some have also created record levels.

But soon, as the price of bitcoin began to pull back, the market "thrill" began to weaken. Although the price of Ethereum rose for a short time on January 28, 2018, and reached the $ 1250 mark, it quickly fell. One of the main reasons for the lower Ethereum price at that time was that it was affected by the decline in the price of Bitcoin, and it followed this downward trend throughout 2018.

On February 5, 2018, Ethereum rebounded from the $ 700 price for the first time that year, and the price rose to $ 900 at one time. On February 14, 2018, the Ethereum developer announced that the Ethereum Go Iceberg client was about to be released. The news immediately stimulated a slight rise in the price of Ethereum and reached the $ 1,000 price point on February 18, 2018. But since then, the price of Ethereum has been declining until April 2018, and finally fell to $ 380. From this level, the last major rebound of the Ethereum price in 2018 was on April 12, 2018, when the Ethereum price recovered to $ 500.

This rise triggered a wave of growth, but it did not last long. By May 5, 2018, the price of Ethereum had risen to 830 US dollars, but since then it has been steadily declining until mid-September (the rebound is small).

Although the initial token issuance stimulated the rapid rise of Ethereum price in 2017, it had a huge negative impact on Ethereum throughout 2018. A large number of initial token issuance projects began to sell Ethereum tokens, which caused the price of Ethereum to fall much faster than other cryptocurrencies, and once fell to about $ 180 in September 2018, but then stabilized at The price range of $ 200-300 was maintained and maintained until mid-November 2018. At this time, the Ethereum community hopes to maintain the price level, and the news of the hard fork in Constantinople in November also made the market see some positive signals.

What was unexpected was that (in fact, it was also expected), the activation update of Constantinople was postponed, and then encountered a "cryptic winter" for up to six months-November 14, 2018 The Bitcoin price fell below $ 6,000, cutting it in just one month. During this period, the price of Ethereum even plummeted to the level of $ 85. At that time, the market value of Ethereum had slipped from the second place and was replaced by XRP for a month.

By the end of 2018, the price of Ethereum had risen slightly, basically maintained at $ 130-140, which also means that compared to the historical high of $ 1,400 set in January 2018, the price of Ethereum in 2018 It fell 10 times during the year.

2019: initial signs of price recovery

According to CoinMarketCap data, in the first week of 2019, the market value of Ethereum returned to the second place, when the price of Ethereum was about 160 US dollars. During this time period, almost all cryptocurrencies have no price trend at all, basically keeping pace with the price trend of Bitcoin, and the cryptocurrency community is not quite convinced of any possibility of reversal. Most people in the industry think The market will shrink further.

Later, as the Bitcoin price adjusted slightly again, Ethereum followed suit and fell to $ 100 on February 7, 2019. From that moment, the value of Ethereum seems to have reached an upward channel, rising to two small highs of $ 160 and $ 180 in a short time. Then, on February 28, 2019, the Constantinople hard fork was finally implemented in the Ethereum network, but the matter did not seem to have much impact on the price.

In early April 2019, the price of Bitcoin suddenly increased by about $ 1,000, but Ethereum, like other cryptocurrencies, did not keep up with the price trend of Bitcoin, but continued to move on the downtrend channel. However, when the time came to May 11, 2019, the bitcoin price rose by about $ 1,000. At this time, the cryptocurrency market believed that the "cold winter" had passed, and the price of Ethereum began to rise sharply, taking only five days. It broke the $ 280 mark.

At the time of writing, according to CoinMarketCap data, the price of Ethereum is about $ 138.91, with a 24-hour increase of 3.26%.

As we move into 2020, with the halving of Bitcoin block rewards coming, many cryptocurrency investors believe that it will stimulate the price of Bitcoin, and will Ethereum respond positively? Let us wait and see.

If reprinted, please indicate the source.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- New Diss Chain in Blockchain Industry: Fundamentalism vs Industrial Trends

- Introduction | Liquidity and Bank Run Risks in DeFi

- Analysis | "Sea Urchin" Project-Digital Currency of the Bahamas Central Bank

- Is fiat digital currency a transnational Alipay?

- Blockchain builds an energy security ecosystem: digitalization of processes in the energy industry chain, multi-dimensional grid connection, and multiple sharing

- Read the major cryptocurrency events of 2019 in one article

- American Computer Society: What exactly can blockchain technology do?