Exciting Changes in the Inventory of DeFi Stablecoins

Exciting DeFi Stablecoin Inventory ChangesAuthor: Ignas, DeFi Researcher; Translator: LianGuaixiaozou

Is the golden age of decentralized stablecoins coming? Don’t be misled by the total market value of stablecoins dropping from over $180 billion to $125 billion (DeFi stablecoins only account for 9%). Let’s take a look at the exciting changes that DeFi stablecoins have in store for the upcoming bull market!

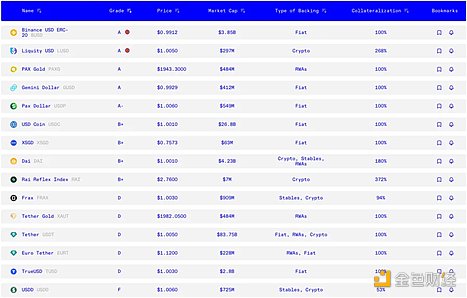

Safety comes first! Non-profit organization Bluechip has released an economic security rating for major stablecoins. Which ones have the highest rating? BUSD, LianGuaiXG, GUSD, and the safest DeFi stablecoin LUSD. It is even safer than USDC. In the USDC decoupling incident in March, LUSD acted as a safe haven.

- Opinion From the perspective of musicians, NFT is the best medium for creators in the new era to practice the 1000 true fans theory.

- Interpreting Polkadot 2.0 What are the impacts of the new parachain leasing mechanism on the demand and value of DOT?

- No More ‘Game Over’ Why is On-Chain Modification Rising?

DeFi stablecoins like DAI and RAI received a B+ rating, while USDD and Tron USDD received an F. These ratings are important because they will focus on experimental DeFi stablecoins. Whether you are a DeFi miner or risk-averse, there is a stablecoin for everyone.

Lybra

Let’s take a look at Lybra eUSD, which is a competitor to LUSD. As a fork of Liquity, it differs from Liquity by accepting stETH as collateral. This allows eUSD holders to earn approximately 7.2% APY. However, the distribution of eUSD earnings is done through the rebase mechanism, which leads to adoption issues within DeFi.

To address this issue and others, Lybra v2 has introduced a new stablecoin called peUSD. The upgrade also includes full-chain functionality for minting with various collateral options and easier integration with DeFi protocols. v2 is currently running on the Arbitrum testnet.

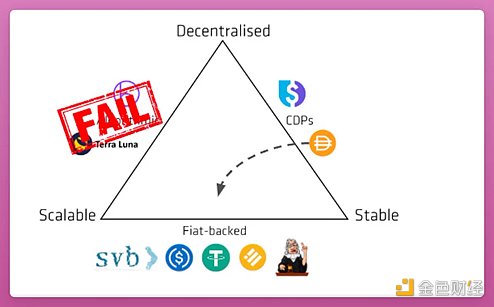

Zero interest rate simple liquidity, one-time borrowing fees, and censorship resistance are cool features. But in order to keep up with the competition, Liquid has launched the v2 version aimed at solving the “stablecoin trilemma” of decentralization, stability, and scalability.

Liquity v2 introduces principal protection leverage and secondary markets to ensure stability in the event of ETH price drops, thanks to the delta-neutral model supported by reserves. It’s complex, but it offers leverage, returns, and trading opportunities. Planned for release in 2024.

Synthetix

Why is the founder of SNX optimistic about decentralized stablecoins? I guess it’s because of Synthetix v3! Although the market value of sUSD has dropped to $94 million, the launch of v3 could change this trend. It heralds an exciting change in the Synthetix ecosystem.

The main improvements to sUSD are:

· Multi-collateral pledging: v3 supports different collateral options to back synthetic assets. No longer limited to SNX. Increased sUSD liquidity is expected.

· Synthetix Loans: Mint sUSD with no debt pool risk and no issuance fees.

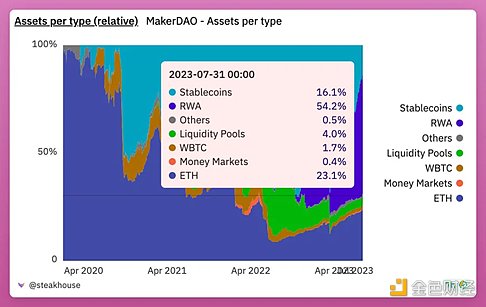

MakerDAO

Additionally, Maker is thriving:

· MKR has risen by 26% in one month.

· DAI is soon to earn 8% yield through DSR.

· SLianGuairk Protocol, a DAI-focused Aave fork, reached $57 million TVL.

· Maker has reduced its reliance on USDC from 65% to 17%.

· It is now the third largest revenue source, surpassing Lido.

FRAX

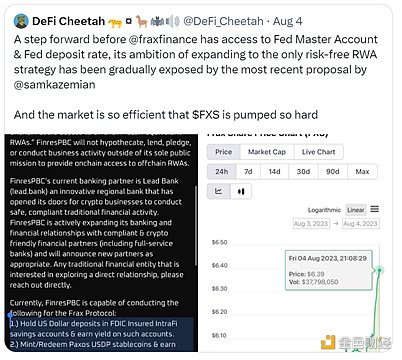

Now let’s look at FRAX: it holds a D rating in blue-chip stocks (unsafe). The concerns are partial collateralization of FXS and heavy reliance on centralized assets, but this situation may change soon with the release of v3.

While details have yet to be fully disclosed, Frax is currently voting to collaborate with FinresPBC to jointly hold and manage low-risk cash equivalents assets. This will enable on-chain access to traditional assets and generate revenue for the Frax protocol while reducing reliance on USDC.

Aave

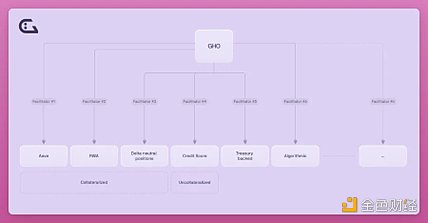

Meanwhile, Aave recently launched the stablecoin GHO, with a market cap of $11 million, marking a stable start. GHO’s potential goes beyond Aave: it serves as a facilitator for minting GHO using real-world assets, treasury bills, or partial algorithms (such as the FRAX model).

Key points to know about GHO are as follows:

· It’s overcollateralized and can only be minted/destroyed by approved facilitators.

· Accrued interest is set by Aave governance (currently at 1.5%).

· It cannot be supplied to the Aave Ethereum market.

· stkAave holders provide a lending discount model.

Curve

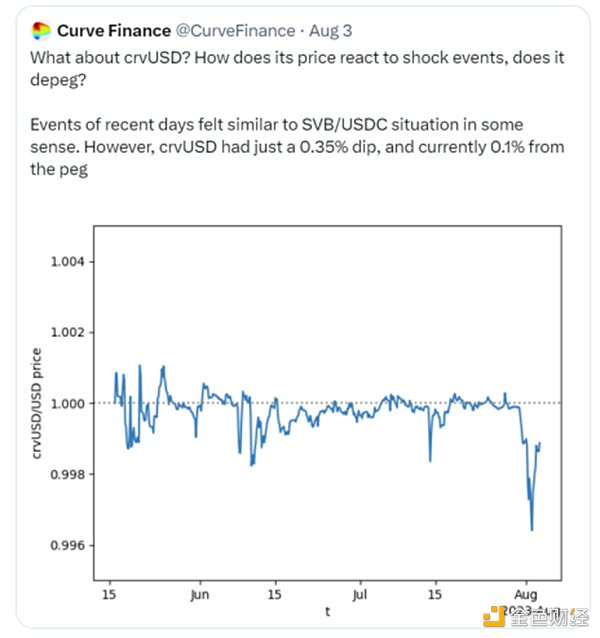

It turns out that the release of crvUSC by Curve is crucial for the platform. After the hack, crvUSD played a key role in providing liquidity to the Fraxlend CRV/FRAX lending pool and the TriCypto pool, while maintaining peg. It was a very timely release.

The lending liquidation AMM algorithm based on soft liquidation mechanism sets crvUSD apart. It solves liquidation issues and brings more trading volume through gradual conversion between collateral and crvUSD—selling collateral when the price drops and repurchasing collateral when the price rises.

The collapse of UST and decoupling from USDC taught us a valuable lesson and made us aware of the areas that need improvement. What works today may not work tomorrow, and what seems impossible now may become the norm in the near future. In these lessons, DeFi stablecoins are striving for progress.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Intent centric or could become a new innovation that triggers a huge wave

- NFT Digital Collectibles Platform Involved in Crime, How is the Criminal Amount Determined?

- The right and wrong of zkSync and Polygon are escalating into a dispute over the open-source spirit.

- ERC-4337 User On-chain Activity Analysis What are the new opportunities?

- Copying code from zkSync? Polygon Zero and Matter Labs engage in a remote confrontation.

- Hong Kong allows retail investors to buy and sell virtual assets on two exchanges, and one company’s stock price has risen by more than 60%.

- Behind the Curve Attack DeFi Contracting the ‘Yield Disease