Behind the Curve Attack DeFi Contracting the ‘Yield Disease

DeFi Contracting the 'Yield Disease' through Behind the Curve Attack.This week, the Curve attack incident caused a lot of commotion. The programming language vulnerability is no longer the focus, and the massive liquidation faced by the founder has made the market restless, afraid of a complete collapse of DeFi. Although it is a relatively independent event, the FUD targeting CRV reflects the long-term problems that have plagued DeFi. Upon careful examination, behind this vulnerability exploit event is the liquidity dilemma that Curve has been facing, the unimproved yield problem of DeFi, and the game that the Curve founder has been playing for months.

“Bull and Bear Battlefield”, sorting out the CRV timeline

In fact, FUD targeting CRV is not the first time. Since the end of last year, CRV has become the main battlefield for the confrontation between bulls and bears. In the past year and a half, Curve and its founder have always appeared in our vision in various “peculiar” ways.

November 2022: “DeFi Defense War”

In late November 2022, “on-chain bear” ponzishorter.eth (hereinafter referred to as ponzishorter) set their sights on Curve, attempting to short its token CRV. Not long ago, Mango Market, which was also attacked by him, lost nearly $100 million. Therefore, the confrontation with the shorting force of CRV is called the “DeFi Defense War” by old DeFi players.

Since November 13th, ponzishorter has seized the opportunity of the founder’s “pledging for cash” and decided to take immediate action. He then deposited about 40 million USDC into Aave and borrowed a large amount of CRV for sale. Most of these borrowed CRV were collateralized by Curve founder Michael Egorov in order to borrow stablecoins.

- The Power Struggle behind the Stablecoin Bill Regulatory Dispute between the Federal Government and States, Beyond Partisan Politics.

- Polygon Zero accuses zkSync of copying code, founder responds Open source may not be suitable for you.

- Vyper Timeline of Hacks and Reflections

In the afternoon of November 22nd, ponzishorter decided to launch a full-scale attack and gradually borrowed more than 80 million CRV from Aave for sale. Retail investors noticed the price fluctuations and united to short, while Curve founder Michael added 20 million CRV to Aave to ensure his position would not be liquidated. With the continuous purchase in the spot market and the constant borrowing of tokens in the lending pool, CRV liquidity decreased sharply and the price rose from around $0.4 to around $0.6.

At about 9 pm, CRV rose above $0.63, and ponzishorter began to face liquidation. In the end, his collateral of over $60 million was completely liquidated, leaving about $1.7 million bad debt on the Aave platform. The next day, Curve released its Stablecoin “crvUSD” code and white paper, and the CRV price soared from $0.6 to $0.74, marking the complete failure of the “DeFi Defense War” by the bears.

May-June 2023: Buying luxury homes, fraud scandals, and “lending for cash-out”

On May 28th, according to the Australian Financial Review, Curve founder Michael Egorov and his wife Anna Egorova spent $41 million to buy Avon Court, a luxury mansion in Melbourne, setting a record for the highest property transaction in Victoria, Australia this year. In addition, they were also reported to have purchased a two-story five-bedroom Italian-style luxury mansion for $18.25 million in March last year. The community was in an uproar.

Egorov’s luxury mansion Avon Court in Melbourne

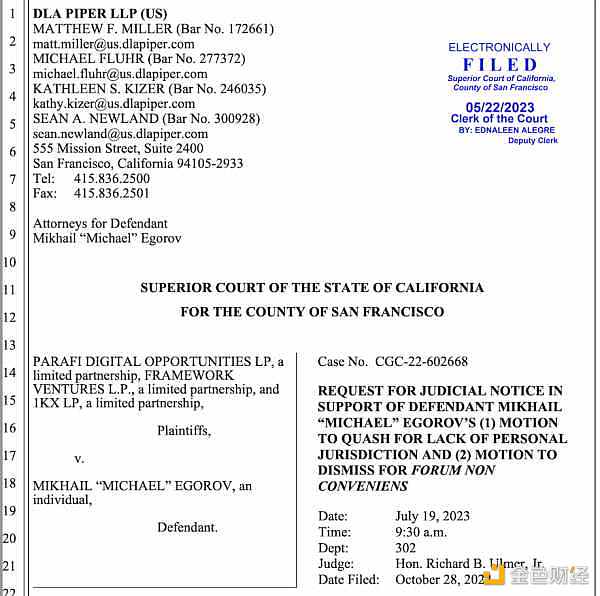

Subsequently, in early June, three well-known venture capital firms, LianGuairaFi, Framework Ventures, and 1kx, filed a lawsuit against Egorov, accusing him of fraud and misappropriation of trade secrets. The three venture capital firms claimed that Egorov deceived them into using the funds for recruiting developers, lawyers, and other staff, but actually used the funds to obtain Curve governance rights. Egorov’s defense team responded that the accusations were “misleading words”.

Lawsuit documents against Egorov by LianGuairaFi, Framework Ventures, and 1kx

At the end of the month, it was discovered that Egorov once again deposited approximately 38 million CRV into Aave. Due to the continuous decline in price, Egorov had to provide more collateral to reduce his liquidation risk. Up to this point, Egorov has deposited approximately $180 million worth of CRV into Aave, with a total quantity of 277 million tokens, and borrowed 64.23 million USDT, with a borrowing health factor of 1.68.

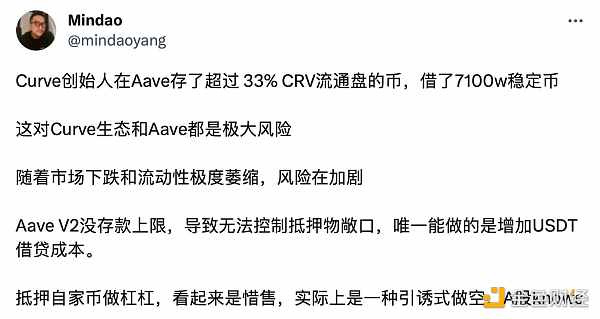

According to CoinGecko’s calculation based on the circulating supply of over 850 million tokens, Curve’s founder holds about one-third of the circulating supply of CRV. Many people interpreted Egorov’s borrowing behavior as a “cash-out” operation in the context of insufficient market liquidity. However, some believe that this may be a form of “short-selling” behavior.

mindao, the founder of dForce, believes that Egorov’s “collateral cash-out” is a form of short-selling.

July-August 2023: “Second Defense Battle”

In the past few days, the industry has begun to discuss the possibility of a major DeFi collapse. In the early morning of July 31st, the official Twitter account of Vyper, the Ethereum EVM compiler, tweeted that some versions of Vyper are vulnerable to reentrancy bugs, and any projects that rely on these versions should contact the team immediately. Subsequently, the Curve team tweeted that some stablecoin pools had been attacked.

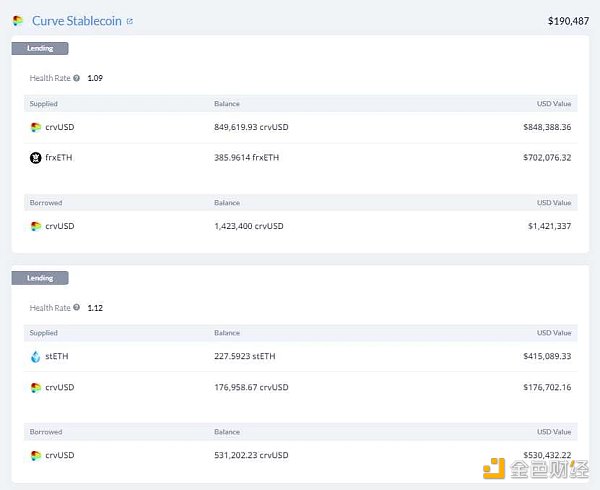

According to PeckShield’s monitoring, Curve lost about $52 million in just a few hours. As a result of the incident, Curve’s TVL plummeted from $3.2 billion to $2.4 billion, and the price of CRV quickly fell below $0.6. According to information from dexscreener, the price of CRV briefly approached zero in the early morning. Soon, the focus shifted to the founder of Curve. Due to the price drop, Egorov’s on-chain CRV collateral borrowing health ratio began to decline, and he transferred another 16 million CRV to Aave.

At noon, Bitmain and Matrixport co-founder Wu Jihan posted on social media, stating, “In the upcoming RWA wave, CRV is one of the most important infrastructures. I have bought in at the bottom, this does not constitute financial advice.” However, Egorov’s lending health situation does not seem optimistic, with a loan interest rate of 105% on Fraxlend’s $15.8 million loan, which will reach 10,000% in 3 days. Subsequently, CRV fell below $0.5, with a 24-hour decline of 20%. People began to worry if DeFi was about to collapse?

Egorov’s lending health situation was once close to the liquidation threshold.

But the situation quickly turned around. Around midnight, Huang Licheng confirmed on social media that he had purchased 3.75 million CRV from Curve’s founder through OTC and pledged to lock it in the Curve protocol. The next day, Sun Yuchen’s related address transferred 2 million USDT to Egorov’s address and received 5 million CRV. Rumors began to spread that Curve’s founder was conducting OTC trading of CRV at an average price of $0.4.

Following that, Yearn Finance, Stake DAO, and other projects, as well as DWF and other institutions and VCs, all participated in the rescue operation of CRV. According to monitoring, Egorov sold a total of 54.5 million CRV that day, bringing back approximately $21.8 million in funds, and the health ratios of its main loan positions all recovered to above 1.6. Subsequently, the price of CRV also rebounded to around $0.6, marking the end of the battle between longs and shorts on CRV.

What is really happening in DeFi?

Not only once deliberately short-selling, putting the protocol and the entire DeFi at risk. We can’t help but ask, what is the Curve founder really thinking? Undeniably, compared to other founders, Egorov is indeed quite “unique.” But the predicament faced by Curve is not an isolated case. Now, the entire DeFi is suffering from the “yield disease.”

A game of re-strategizing

When it comes to DeFi, what we talk about the most is decentralization and security. While these two are important, both traditional finance and decentralized finance cannot do without a core point, which is the ability to make money, especially for those who already have money. For whales and institutions with millions of dollars in on-chain assets, this is crucial. Allowing these people to make money is the most realistic problem that DeFi faces.

“Dog coins” with APYs of hundreds are unreliable. DeFi needs to be able to accommodate at least millions of dollars and provide substantial and stable returns for LPs in a “big pool.” For example, in the past, LUNA, with its financial engine Anchor, provided a fixed annual return of 20% for $18 billion in funds. After the collapse of LUNA, the old DeFi protocols became “popular” again. Although the APY is not as high as 20%, it has withstood the test of the market and time. However, the crypto market, after being hit by a triple blow from LUNA, 3AC, and FTX, did not provide much opportunity for these old protocols to make a comeback, especially Curve.

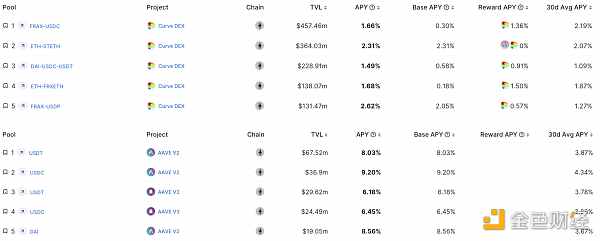

As one of the most important infrastructures in the DeFi stablecoin market, no one questions the important role that Curve plays in the ecosystem. However, when it comes to profitability, Curve is indeed showing signs of exhaustion. In terms of stablecoin basic income, there is a significant gap in income between Curve and the top five TVL liquidity pools on Aave, especially under the recent intense on-chain long and short game, Aave’s basic income far exceeds Curve. The main income of most of Curve’s liquidity pools still comes from CRV emissions.

Yield situation of the top 5 TVL liquidity pools of Curve and Aave, data source: DeFi Llama

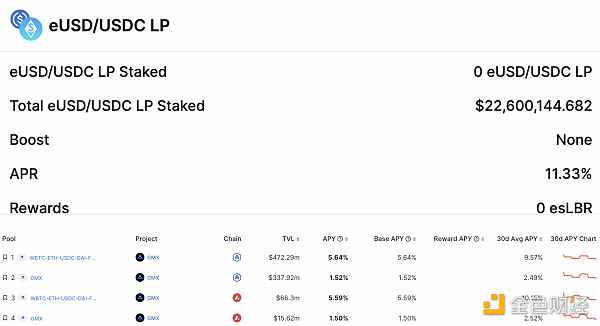

In an interview with BlockBeats, Bowen, founding partner of Smrti Labs, stated that in the current DeFi field, protocols that can accommodate a certain amount of funds and have considerable yields, such as Lybra and GMX, are more favored by large holders. The eUSD/USDC pool provided by Lybra currently has an APR of 11.3%, and the average yield of stablecoin pools on GMX in the past 30 days can reach 9.57%. They are all stablecoins, but for large holders, they will go where they can make more money. Therefore, Curve has always faced the problem of decreasing liquidity without increasing it.

Yield situation of Lybra eUSD and GMX pools, data source: Lybra Finance, DeFi Llama

With low basic income and poor price performance, how can LPs’ income situation be improved? The founder of Curve’s idea is to take a gamble in the market and make the price of CRV higher.

Unlike other veteran DeFi projects, Curve does have some unique “advantages” in this regard.

Firstly, due to the incentive mechanism of Curve’s veToken voting, most CRV tokens are locked, which makes CRV much less liquid compared to other high market value DeFi tokens. Sometimes, the cost of borrowing CRV on Aave is even lower than directly buying it on exchanges because low liquidity causes significant premiums for buyers during the purchase process.

In addition, as mentioned earlier, the Curve founder controls one-third of the total circulating supply of CRV, which provides a lot of possibilities for a team that wants to control the token price, including using “rare selling” as a means of inducing shorting behavior.

In terms of results, this approach was very effective in the “DeFi Defense War” at the end of last year, not only boosting the token price but also making Curve the focus of market attention once again, and doing a wave of PR for the upcoming crvUSD. However, in this CRV long and short battle, the Curve founder seems to have suffered a lot. Not only did the token price fail to return to previous levels, but he was also forced to sell a significant portion of his CRV holdings.

But from another perspective, Evgorov still got the result he wanted, as Bowen put it, “kidnapping everyone to help lift the CRV sedan.” Now Evgorov’s CRV holdings account for about 20% of the total circulation, but CRV has gained a group of powerful supporters, including Wu Jihan, Du Jun, Justin Sun, and other top players, as well as DWF and other “institutional friends.”

Now, everyone has a common interest, and both Curve and CRV have a promising future. In this regard, Egorov’s gamble is not too bad.

Earnings Dilemma: Big Players Can’t Make Money in DeFi

After the LUNA scandal, liquidity problems began to spread throughout the entire cryptocurrency market. Three Arrows Capital (3AC), which collapsed afterwards, was unable to generate targeted returns due to reduced market activity, leading to large clients withdrawing funds and ultimately collapsing. According to some former internal employees of 3AC who revealed to BlockBeats, in the later stages of the company’s operation, the team could hardly find any scenarios that could generate expected returns for the large-scale assets they managed. The FTX scandal at the end of the year made the market even worse.

Since the US Federal Reserve began its interest rate hike process, liquidity tightening has been eroding various markets globally, and cryptocurrencies, defined as risk assets, have been particularly affected. Despite the several scandals, people have been enthusiastic about the transparency and risk resistance of decentralized finance, but this has not prevented the tightening dagger from slowly piercing the heart of DeFi.

US one-year, two-year, and ten-year Treasury yields, data source: FRED

As of now, the yield rates for US one-year, two-year, and ten-year Treasury bonds are 5.37%, 4.88%, and 3.97%, respectively. Regardless of the yield curve, both short-term and long-term bonds have been steadily rising since the end of 2021. Compared to mainstream DeFi protocols such as Curve and Aave, even the yield rate of ten-year Treasury bonds is significantly higher than their average yield rate.

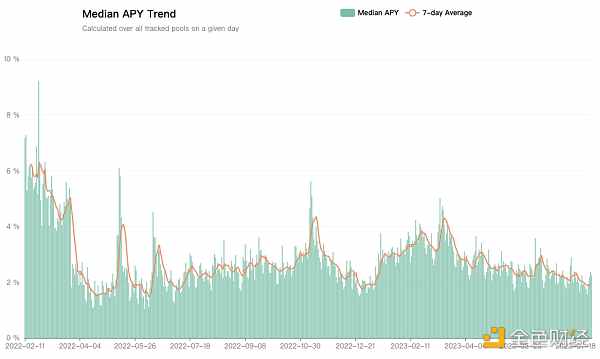

On the other hand, the earning levels of DeFi have gradually declined. According to DeFi Llama data, the median DeFi yield has dropped from 6% at the beginning of last year to 2% in July of this year. For big players, this is almost unprofitable. “Why would you take a 3% return in DeFi with a two to three times risk multiplier, when you can get a 5% return in US Treasury bonds?” Bowen explained to BlockBeats.

Changes in median DeFi yield, data source: DeFi Llama

For clients with large amounts of funds, DeFi is no longer as profitable as it used to be. In the past, not to mention a year, there could be a 3% return in just one day. Therefore, under the dual shadow of liquidity tightening and regulatory scrutiny, it does not seem to be a wise choice to keep funds in DeFi. Bowen believes that most of the funds still remaining in the DeFi market may be inconvenient or even unable to “get onshore.” “The rest of the money has already run away.”

Since we can’t leave, we need to solve the problem internally. Apart from PoS staking rewards and protocol token emissions, what other ways can provide stable and substantial income for large holders?

The first thing that comes to mind is Real Yield. Essentially, Real Yield refers to the protocol paying users income based on its actual revenue, denominated in native tokens such as ETH or stablecoins such as USDC, to eliminate the inflation and income instability caused by token emissions. GMX, which became popular at the end of last year, is the leading representative of this narrative.

According to Nansen data, by the end of August 2022, the trading volume of GMX had surpassed Uniswap, becoming the protocol with the highest weekly trading volume on the Arbitrum network. In GMX’s whitepaper, the team explicitly stated that GLP token holders (i.e., LPs) not only receive GMX token rewards but also earn platform fee income denominated in ETH. After the GMX token price surged to $56 in September, the Real Yield narrative also became a new hope for saving DeFi.

However, in reality, during the bear market, income generated from the so-called “actual protocol revenue” is not reliable. Soon, people discovered that, except for protocols like Uniswap and GMX that have strong attraction and can accommodate large amounts of funds, most DeFi protocols cannot generate income during the bear market. In an interview with BlockBeats, Anton Bukov, the co-founder of 1inch, revealed that without DeFi aggregator products, most DEXs would not survive during the bear market because these DEXs lack liquidity.

Related reading: “Interview with 1inch: How to Innovate in the DEX Field under the Shadow of Uniswap Monopoly?”

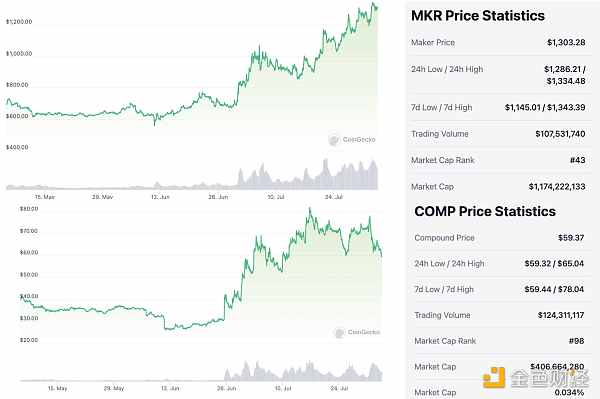

After a brief “spring frenzy” at the beginning of the year, the market entered a deep bear market in April. Apart from the batch operations of “hair-raising studios,” on-chain activities have become few and far between, and the Real Yield narrative quickly died out. However, surprisingly, since June, the tokens of two veteran DeFi projects, Compound and MakerDAO, have started to rise and reached new highs for the year.

MKR and COMP token price movements, data source: CoinGecko

The market’s explanation for the rise is RWA.

In the crypto market, the concept of Real World Assets (RWA) has been repeatedly hyped in the past few years, and this time it is being used in the DeFi space. Since it is not possible to generate sufficient income on-chain, can real-world income be brought into DeFi? The founder of MakerDAO previously sparked a discussion about RWA in an article titled “Endgame” after the Tornado Cash incident.

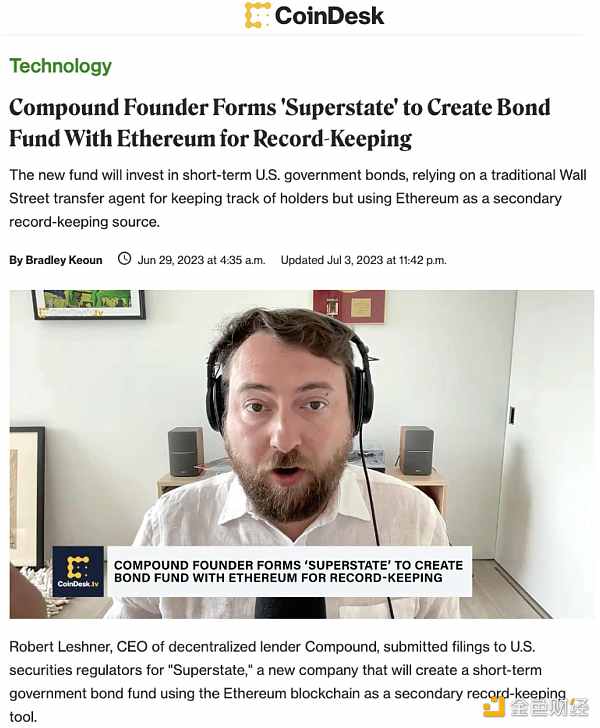

Now there are rumors in the market that MakerDAO’s income has significantly increased in the past few months by using treasury funds to purchase U.S. government bonds. The founder of Compound also announced his newly established company, Superstate, at the end of June, which is dedicated to bringing bonds and other assets onto the chain and providing potential clients with returns comparable to the real world. After the news was announced, the COMP token price increased by over 23% in 24 hours.

Report on the founder of Compound’s new company Superstate

Under the wave of compliance in Hong Kong, the heat of RWA has reached a new high. Most of the Web3 offline activities in Hong Kong since June are related to RWA. People not only hope to gain better on-chain returns through this narrative, but also hope to attract more traditional funds to enter and create a new round of the cryptocurrency cycle.

However, at present, RWA may not be able to fundamentally solve the “yield problem” of DeFi. Because the asset management model is not yet mature, the current RWA is mainly limited to exposure to national debt, especially US Treasury bonds. On the one hand, this reduces the regulatory resistance of DeFi, and on the other hand, it also means that once the Federal Reserve reverses, RWA protocols relying on US bonds will fail again and enter an irreversible trend of declining returns. And in the eyes of many people, the Federal Reserve is not far from reversing.

Whether it is Staking, veToken and other token economics, or Real Yield, RWA and other narrative trends, they all reflect the painful struggle of DeFi in the face of the “yield problem”. The current innovations in the DeFi field seem to be only addressing the symptoms rather than the root cause. Perhaps the only remedy to cure this disease is to “wait for the bull market”.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Ripple SEC Case Ruling A big step forward for the cryptocurrency industry

- How is the amount of criminal offenses determined when an NFT digital collection platform is involved?

- ChatGPT has become popular in the past six months hot money, giants, and regulation

- Talking about Polygon’s accusation of zkSync copying code

- Why choose decentralized trading platforms

- Bob the Solver Architecture Interpretation Intent-based Transaction Infrastructure

- Nansen Data Which assets are crypto VCs adding?