Interpreting Polkadot 2.0 What are the impacts of the new parachain leasing mechanism on the demand and value of DOT?

Polkadot 2.0 Interpretation How does the new parachain leasing mechanism affect DOT demand and value?Author: PolkaWorld

The flexible allocation method of Coretime will provide more flexibility and efficiency for parallel chains, parallel threads, and parallel shards, and also bring more revenue to the treasury. These revenues can be used to fund projects in the ecosystem or to burn DOT, thereby increasing the scarcity and value of DOT.

At the recent Polkadot Decoded conference, Polkadot founder Gavin Wood proposed the vision of Polkadot 2.0. One important point is that Polkadot 2.0 will change the allocation method of Coretime, the core resource of blockchain, improving the flexibility and efficiency of resource allocation.

What changes have occurred in resource allocation in Polkadot 2.0? What impact will it have on the demand and value of DOT?

- No More ‘Game Over’ Why is On-Chain Modification Rising?

- Intent centric or could become a new innovation that triggers a huge wave

- NFT Digital Collectibles Platform Involved in Crime, How is the Criminal Amount Determined?

Changes in Polkadot 2.0

1. Slot leasing → Coretime purchase

One major change in Polkadot 2.0 is the allocation method of Coretime.

Coretime refers to the time required for verification and consensus execution on the relay chain in Polkadot, and it is the scarcest resource in the Polkadot network.

In Polkadot 1.0, Coretime was allocated to parallel chains through slot leasing. Slot leasing is an auction mechanism that allows parallel chains to bid for a fixed period of time (6 to 24 months), during which the parallel chain can use a slot, which is a fixed block time period.

In Polkadot 2.0, Coretime will become a liquid, tradable, and accumulative resource that can be used to purchase or sell block time. Coretime can be obtained through two methods in the primary market: bulk purchase and instant purchase.

Bulk Purchase: Coretime is sold for a fixed price for a four-week period. Similar to slot leasing, but more flexible. Parallel chains can obtain a continuous block time period through auction or direct purchase and pay the corresponding Coretime fee. This method is suitable for parallel chains with long-term demand for block time.

Instant Purchase: Pay-as-you-go, with prices determined by the market. Can be used to increase transaction throughput and reduce latency.

If a parallel chain, parallel thread, or parallel shard has surplus Coretime, it can sell Coretime to other entities that need block time and receive corresponding revenue. In this way, Coretime forms a secondary market, making the allocation of block time more flexible and efficient.

2. Locking DOT to use slots → Paying to use Coretime

Although both Polkadot 1.0 and 2.0 mention “leasing,” the ways they capture value are completely different.

In Polkadot 1.0, after a parallel chain wins the slot auction, it only needs to lock DOT in the network for a period of time (6 months to two years), and these DOT will be fully returned at the end of the period.

So essentially, the “leasing” of slots in Polkadot 1.0 is different from what we usually mean by “leasing” in real life. It only requires a deposit without paying rent. It’s like renting a house where the landlord tells you to only pay a deposit of, for example, 10,000, without needing to pay rent. After the one-year lease term, the full deposit is returned to you.

In this model, the only cost incurred by the parallel chain is the opportunity cost of locking DOT in the slot during the parallel chain period. This means that if you choose to lock DOT in the slot, you cannot use DOT for other purposes, such as staking and earning around 10% annualized returns.

In Polkadot 2.0, on the other hand, it is directly selling Coretime, and chains/applications pay a certain price to obtain the right to use Coretime. This form is actually more similar to “renting” in our daily context, and the income obtained from selling Coretime is essentially rent. It’s like renting a house, and the landlord tells you that you need to pay 3000 yuan in rent every month to stay for a month, and the rent is not refundable in the end.

In this model, chains/applications pay for the direct cost.

3. The income from selling Coretime can enter the treasury for redistribution

In Polkadot 2.0, the income from selling Coretime may enter the treasury for resource redistribution. And the greater the market demand for Coretime, the more income will flow into the treasury.

Under the governance mechanism of OpenGov, the treasury is managed by DOT holders. Essentially, holders can use DOT to vote and decide how the money in the treasury should be handled.

On the one hand, funds can be used to support projects in the Polkadot ecosystem, which is what the treasury has been doing. As Polkadot is an interoperable ecosystem, the better the development of various projects in the ecosystem (storage, computing, NFT, DID, etc.), the more it can attract more projects to join the ecosystem.

On the other hand, holders can also choose to destroy (all or part of) these DOTs to reduce the supply of DOTs, thereby reducing inflation, or even turning it into deflation.

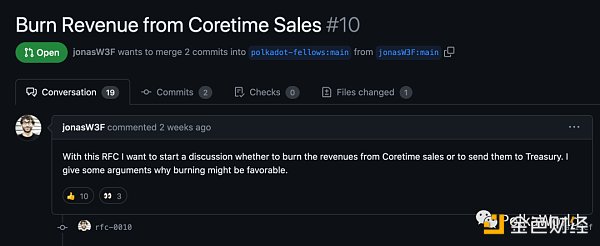

W3F’s Jonas initiated a discussion on the destruction of Coretime revenue: https://github.com/polkadot-fellows/RFCs/pull/10

How much demand will there be for DOT in Polkadot 2.0?

There are many factors that can affect the demand for DOT in Polkadot 2.0, making it difficult to estimate. However, based on historical data on Kusama slot auction prices, Rich, a member of the Polkadot community, simulated the demand and price of Coretime, which can serve as a reference.

Original post: https://forum.polkadot.network/t/kusama-historical-analysis-spending-coretime-demand-and-treasury-roi/3436

Rich’s calculation method is roughly to find out the acquisition cost of all Kusama slots in the past (the price of KSM at that time multiplied by the locked KSM quantity). As mentioned earlier, the cost in Polkadot 1.0 is an opportunity cost, which needs to be converted into a direct cost. Since the KSM locked in the slot cannot participate in staking, we take the staking yield of Kusama (approximately 10% annualized) as the opportunity cost, so we multiply the acquisition cost of the slot by 10% to get the opportunity cost. Based on this, we can calculate the cost every 4 weeks (bulk purchase) and the cost per block (real-time purchase).

According to Rich’s calculation, the average annual Coretime demand from July 2020 to July 2023 is $18.19 million. If Coretime is priced based on historical data, the average price of immediate Coretime should be $8.78 per block, and the average price of bulk Coretime for a four-week period should be $1.54 million.

However, these calculations are based on historical data and do not take into account the potential increase in demand if Polkadot 2.0 is launched. The more flexible usage of Polkadot 2.0 may attract more projects to purchase Coretime, resulting in higher demand.

Furthermore, purchasing Coretime is not the only use case for DOT. In the new model of Polkadot 2.0, the following factors could drive the value of DOT:

-

Demand for earning rewards through native staking: DOT holders can participate in the validation and consensus of the Polkadot network by staking DOT and earn rewards. The staking yield depends on the staking rate and inflation rate, typically ranging from 10% to 15%. Staked DOT is locked and cannot be used for other purposes, reducing the circulating supply of DOT and increasing its scarcity and value.

-

Demand for increased voting weight: DOT holders can use DOT to participate in the governance of the Polkadot network, including initiating proposals and voting. Holding more DOT increases the voting weight and influences the decisions of the Polkadot network.

-

Demand for purchasing Coretime: DOT can be used to pay for Coretime. The price of Coretime is determined by market supply and demand, so an increase in demand would lead to an increase in Coretime price, thereby increasing the value of DOT.

-

Demand for purchasing Coretime on the secondary market: Entities with excess Coretime can sell it to other entities in need of block time and earn corresponding profits. This allows Coretime holders to derive value from block time when not in use. The secondary market for Coretime is also determined by market supply and demand, so a decrease in supply would lead to an increase in Coretime price, thereby increasing the value of DOT.

-

Demand for participating in DeFi: There are various decentralized finance (DeFi) services available on the Polkadot network, such as lending, trading, insurance, and oracle services. These services provide opportunities for DOT holders to earn more income. Additionally, these services increase the liquidity and utilization of DOT in the Polkadot network, thereby increasing its value.

-

Demand for DOT burning through the treasury: The revenue generated from selling Coretime goes into the treasury, and DOT holders decide how to use the funds in the treasury. If DOT holders decide to burn a portion of the funds in the treasury, it would reduce the circulating supply of DOT, increasing its scarcity and value.

Conclusion

Polkadot 2.0 is a major upgrade to the Polkadot network, breaking the inherent pattern of resource allocation in blockchain and introducing Coretime as a core resource. The flexible allocation of Coretime will provide more flexibility and efficiency for parallel chains, parallel threads, and parallel shards, while also bringing more revenue to the treasury. These revenues can be used to support projects in the ecosystem or to burn DOT, thereby increasing its scarcity and value.

Polkadot 2.0 is an incredibly innovative and forward-thinking project that may bring about tremendous changes and opportunities for the Polkadot network and the entire blockchain industry. Let’s look forward to the official launch of Polkadot 2.0 together.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The right and wrong of zkSync and Polygon are escalating into a dispute over the open-source spirit.

- ERC-4337 User On-chain Activity Analysis What are the new opportunities?

- Copying code from zkSync? Polygon Zero and Matter Labs engage in a remote confrontation.

- Hong Kong allows retail investors to buy and sell virtual assets on two exchanges, and one company’s stock price has risen by more than 60%.

- Behind the Curve Attack DeFi Contracting the ‘Yield Disease

- The Power Struggle behind the Stablecoin Bill Regulatory Dispute between the Federal Government and States, Beyond Partisan Politics.

- Polygon Zero accuses zkSync of copying code, founder responds Open source may not be suitable for you.