Data Analysis 37 listed companies in South Korea hold approximately $160 million in cryptocurrency assets, which tokens are preferred?

37 South Korean listed companies hold approximately $160 million in cryptocurrency assets. Which tokens are preferred?Author: Jay Jo & Yoon Lee

Translation: Felix, LianGuaiNews

TL;DR

Despite the continuous decline in the Korean cryptocurrency market, the amount of cryptocurrency held by companies has increased. In fact, 37 listed companies hold cryptocurrency assets worth 201 billion Korean won (approximately 160 million US dollars).

- Friend.tech is gaining momentum alongside Telegram, how will the veteran social protocol Lens Protocol counterattack?

- Overview of International Cryptocurrency Regulatory Agencies

- What do legal experts think of the SBF trial?

The largest proportion of companies directly issue cryptocurrency for cryptocurrency-related business operations. They also hold stablecoins and other assets as investment reserves, or purchase BTC and ETH for investment purposes.

In the future, information disclosure by companies holding cryptocurrency assets will become mandatory, and a more transparent and secure investment environment is expected.

Introduction

Although the cryptocurrency market in Korea continues to decline, the amount of cryptocurrency held by companies is rising. In fact, according to a survey by the Financial Services Commission, as of June 2022, a total of 37 domestic listed companies have acquired and held cryptocurrency assets. In addition, the market value of cryptocurrency assets issued by third parties held by these companies is estimated to be approximately 201 billion Korean won (approximately 160 million US dollars). These survey results indicate that Korean companies are expanding their cryptocurrency-related businesses and actively investing in this market.

Virtual asset holdings of Korean listed companies (tokens issued by third parties), data source: Financial Services Commission

Current situation of Korean listed companies with cryptocurrency assets

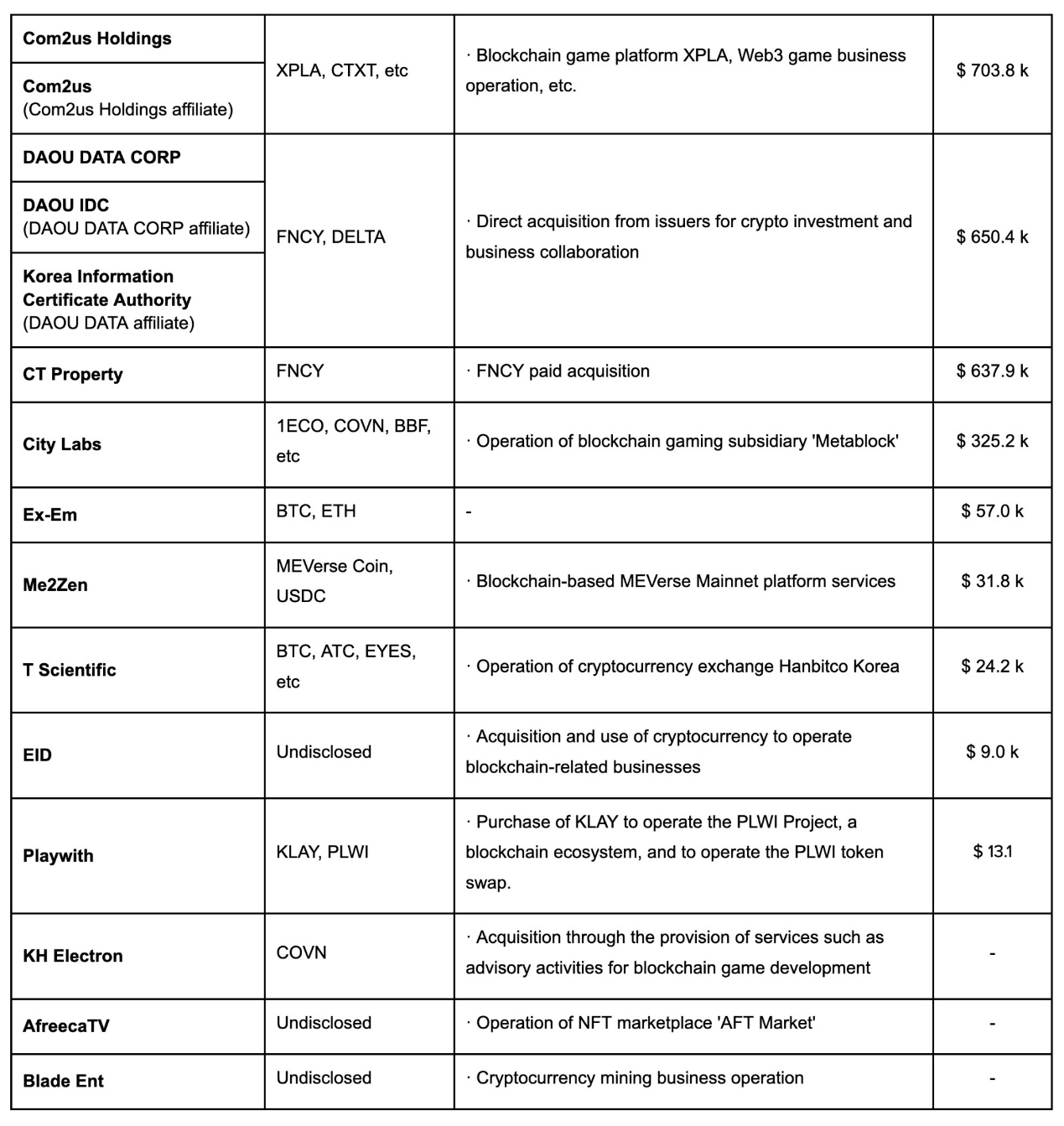

The “2022 Survey on Cryptocurrency Holdings of Domestic Listed Companies” by the Financial Services Commission does not disclose detailed company names, making it difficult to determine which companies hold cryptocurrency. Through independent research, it has been found that as of December 2022, many listed companies hold cryptocurrency assets. Most of them are game companies such as Neowiz, WeMade, Netmarble, or companies operating payment settlement businesses such as Danal, GalaxiaMoneyTree. The amount of virtual assets held is also quite large. Their paths to acquiring cryptocurrency are as follows (note: the “2022 Survey on Cryptocurrency Holdings of Domestic Listed Companies” by the Financial Services Commission is a survey conducted as of June 2022, while the author’s research is based on the financial statements of confirmed listed companies as of December 2022, so there may be differences in the overall amount of cryptocurrency holdings):

- Paid acquisition: Obtaining cryptocurrency through cryptocurrency exchanges, ICOs, private placements, etc.

- Free acquisition: Obtaining cryptocurrency through self-developed cryptocurrencies, airdrops, etc.

- Exchange acquisition: Obtaining virtual assets by exchanging tokens issued by third parties with tokens issued and held by the company.

- Provision of services: Obtaining virtual assets through the provision of consulting and development services (participation as members of various foundation governance committees and node validators)

- Blockchain mining rewards: Directly obtaining virtual assets through operating virtual asset mining businesses, staking services, etc.

Therefore, listed companies obtain and hold cryptographic assets through various channels, mainly by issuing cryptographic assets through overseas subsidiaries to operate cryptographic-related businesses.

The amount of cryptocurrency held by 29 listed companies in South Korea (excluding self-issuance), data source: respective companies

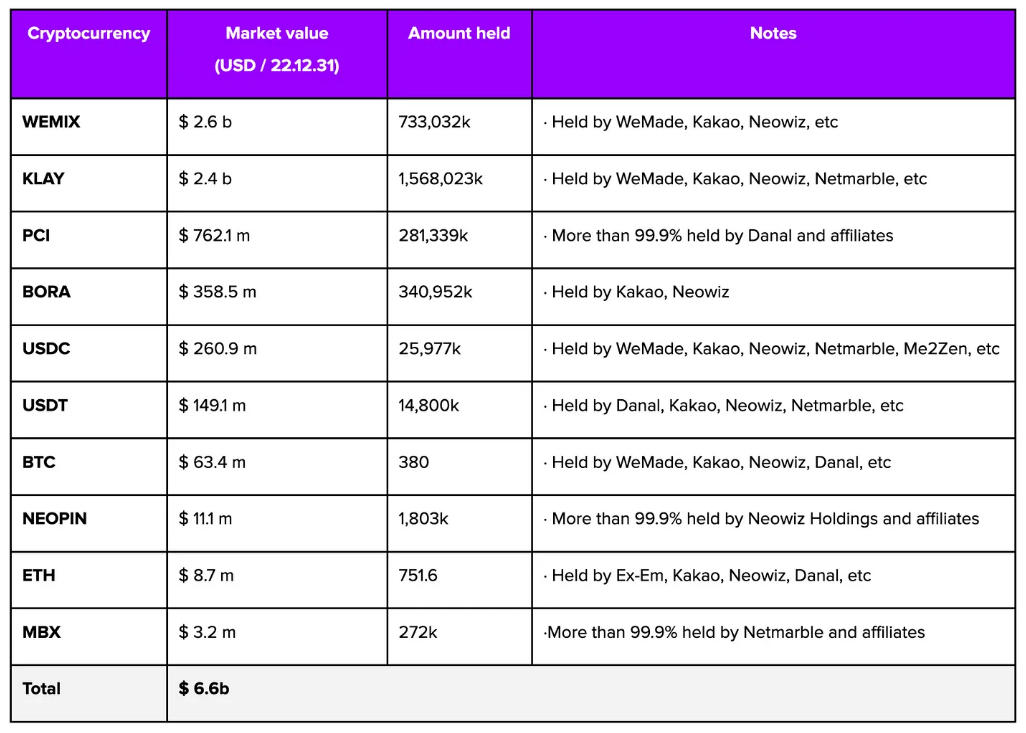

Types of cryptocurrency held by listed companies in South Korea

The top 10 types of cryptocurrency held by listed companies in South Korea are as follows. These companies have the following three characteristics:

1. They directly issue or purchase cryptocurrency to carry out their own blockchain business, with the largest proportion of cryptocurrency holdings being blockchain game-related cryptocurrencies issued mainly in South Korea, such as WEMIX, BORA, NEOPIN, etc.

2. Approximately 51.7 billion Korean won (approximately 39.8 million USD) is invested in stablecoins such as USDC and USDT. These funds are either used as reserve funds for providing funds to blockchain projects through ICOs or for marketing and commission purposes.

3. Cases were also found where major cryptocurrencies such as Bitcoin and Ethereum were purchased for investment purposes.

Types of cryptocurrency held by private companies

It has been confirmed that private companies also acquire and hold virtual assets and disclose them transparently through annual audit reports. These are mainly companies that operate virtual asset trading businesses such as Dunamu, Bithumb, Coinone, Cobit, GoLianGuaix (Streamy), etc. In addition, some companies obtain a certain amount of cryptocurrency by logging into Web3 games on platforms such as Gurobal Games and XL Games. Cryptocurrency investment companies such as Uprise hold cryptocurrency as investment assets, such as Bitcoin or Ethereum. Even among private companies, cryptographic assets are mainly held by companies that operate or plan to operate cryptographic-related businesses, such as game companies, investment companies, and IT-related companies. In addition, even if they do not directly operate cryptocurrency-related businesses, there are cases where they acquire cryptocurrency by participating in the Klaytn and XPLA mainnet validators.

Conclusion

Many Korean companies are acquiring and holding virtual assets and attempting to disclose these assets through information disclosure. Despite these efforts, many companies still face difficulties due to the ambiguity of current virtual asset accounting standards.

In addition, the disclosure of virtual asset holdings is not yet mandatory. Many companies have not yet publicly disclosed their virtual asset holdings or have not explained the method of acquiring virtual assets, which further confuses investors. However, starting from next year, a new regulation will be formulated that requires cryptocurrency holders to disclose the following information. From then on, listed companies will be able to disclose their cryptocurrency holdings more transparently and create a safer investment environment. The expected disclosed information is as follows:

- General information of virtual assets (name, characteristics, quantity, etc.)

- Accounting policies applicable to virtual assets (account classification, cost and revaluation models, etc.)

- Information on the acquisition methods, acquisition costs, book value, market value, etc. of virtual assets

- Information on the calculation of the market value of virtual assets (exchange name, calculation time, etc.) and price volatility risks

- Information on the nature of risks related to holding virtual assets

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- FTX Reappearance? JPEX Embezzles User Assets and Is Involved in a High-Value Fraud Case

- Behind the Balancer attack incident In addition to the downsizing of the security team, we should pay more attention to the hidden concerns of centralized front-ends.

- Where are the criminal risks of crypto market makers?

- Telegram against MetaMask It is not only a battle for Web3 traffic entrance, but also a battle between Web2 and native encryption.

- SubDAO Divide and Conquer, a key step in the endgame of MakerDAO

- LianGuai Daily | JPEX involved amount has reached HKD 1.2 billion; Cryptocurrency startup Bastion completes $25 million financing.

- How did North Korean hackers use LinkedIn and social engineering to steal $3.4 billion in cryptocurrency?