Fade out and rise of an old Defi project

Editor's Note: Original title was "Kyber's Fade Out and Rise"

In the DeFi project, the previous article of Blue Fox Note mentioned Uniswap "Understanding Uniswap", and today Blue Fox Note introduces another DeFi project, Kyber. Kyber is an old-fashioned project in the field of DeFi. It started trading in February 2018, and it is almost 2 years now. Prior to the 2017 bubble period, it was a hot project in the crypto space, and it was also supported by the V god. However, with the rise of DeFi's many projects, it once faded out of people's horizons, and has been tepid in 2018. However, since the second half of 2019, Kyber's development has improved and it has once again attracted attention.

Kyber's performance

First take a look at Kyber's data:

- The history of crypto dying 2020: On the widespread "crypto utopianism"

- 4 pictures to understand the performance of Dapp in 2019 and its future trends

- Opinion: Who is DeFi's second turn?

- Trading volume

On February 9, 2018, the trading volume on the first trading day was US $ 12,769.09 and the number of transactions was 31. On January 6, 2020, the transaction volume reached US $ 4,052,524.05 and the number of transactions was 2,964.

In terms of its overall progress, 2018 has been tepid. The real starting volume is February 24, 2019, and its trading volume exceeded US $ 1,00,000 for the first time. Although the trading volume has fluctuated since then, its average daily trading volume It can basically reach more than 500,000 US dollars, and ushered in the first peak between June and July 2019. The transaction volume has basically stabilized at more than 1,000,000 US dollars, but has since fallen back. From November 2019 to the present, there has been a clear upward trend. The daily trading volume in the past two months has basically stabilized at around USD 10 million.

Judging from the performance of its transaction volume, Kyber has basically established a foothold. Although its size is not large, its liquidity and network have basically completed a cold start, which can give it a chance to survive and develop.

- Number of transactions

As of the writing of Blue Fox Notes, its number of transactions has reached 577,450, with an average daily number of transactions of approximately 820.

- Trading tokens

The trading tokens are mainly SAI, LINK, USDC, MKR, and WBTC. Among them, SAI has the largest transaction volume and occupies the vast majority. As of the writing of Blue Fox Notes, it reached US $ 169,004,162.51, exceeding the sum of other tokens; the remaining LINK It is USD 38,966,566.13; USDC is USD 37,207,939,8; MKR is USD 29,991,124.74; WBTC is USD 27,114,960.17. It can be seen that the rise of Kyber is highly related to the overall development of the DeFi field, and is basically based on token transactions in the DeFi field.

- Reserve

As of the time of writing, there are 32 reserves in use, of which 5 have a daily trading volume of more than 100,000 US dollars, which is currently the main force to provide liquidity.

- transaction fee

As of the time of writing, the cost of destruction was 3,559,529.14 KNC, which was valued at USD 709,770 at the time; the total cost was 4,989,983.9 KNC, valued at USD 995,002. Its current circulating tokens are 169,674,270KNC, with a total supply of 212,065,819KNC, which means that the tokens it destroys account for 1.68% of the total token supply. From the destruction ratio of its tokens, it exceeds MakerDAO, and its MKR is destroyed. The amount is 1%.

- Lock-in assets

As of the time of writing, Kyber's locked-in assets are $ 3.7 million, ranking 11th in the DeFi space.

From the above data, its performance in the past year has not been as dazzling as the three big giants of Maker, Synthetix and Compound, especially in 2018. It was bland, but with the overall development of DeFi, starting from the second half of 2019, Kyber suddenly issued Force, began to rise. So how do you understand Kyber? Why does it suddenly rise after fading out of people's vision?

What is Kyber?

Kyber is a decentralized token transaction protocol on a pure chain, which can be executed on any blockchain that supports smart contracts. Anyone can contribute liquidity to Kyber. Token exchangers can realize the time currency exchange through the front end integrated with the Kyber protocol. In order to gain competitiveness, it tries to provide the best exchange rate for exchangers. The exchange is atomic, Without permission. In addition, it also plans to achieve seamless token exchange across the chain.

Kyber's decentralized token exchange model

Kyber was born to solve the security problems of centralized exchanges, as well as the problems of internal operations. At the same time, it is also to meet the needs of users to instantly exchange tokens through a decentralized method, to master the tokens themselves, not to register a centralized exchange, and not to worry about funds withdrawal, etc. In addition, it is also the user's best to obtain the best exchange rate demand.

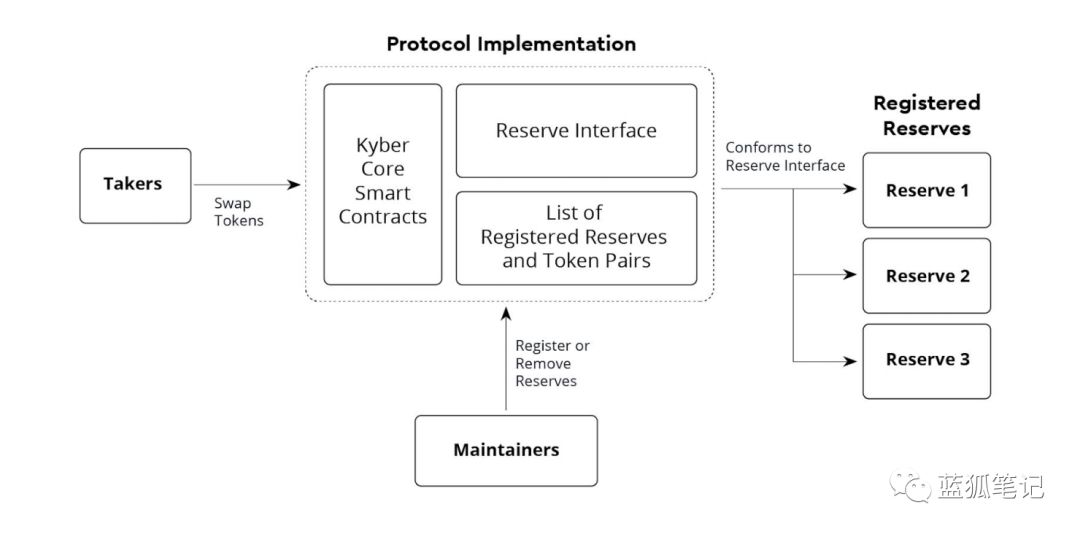

To meet these needs, Kyber's solution is to build a network that can connect token exchangers and liquidity providers through a set of smart contracts. In this exchange network, there are three cores: exchangers, liquidity providers, and kyber core smart contracts.

- Token Exchanger

Token exchangers in the kyber network include individual users or other entities, who make requests to smart contracts through portals such as websites, dApps, or wallets, requesting that their tokens be instantly converted into target tokens. In addition to individuals, a decentralized exchange or any smart contract can also initiate a conversion request, which is a license-free token transaction protocol. From this perspective, kyber has the opportunity to become the basic component of token exchange in the DeFi field. Currently some wallets such as Trustwallet and DEX such as Uniswap and Oasis are also working with Kyber.

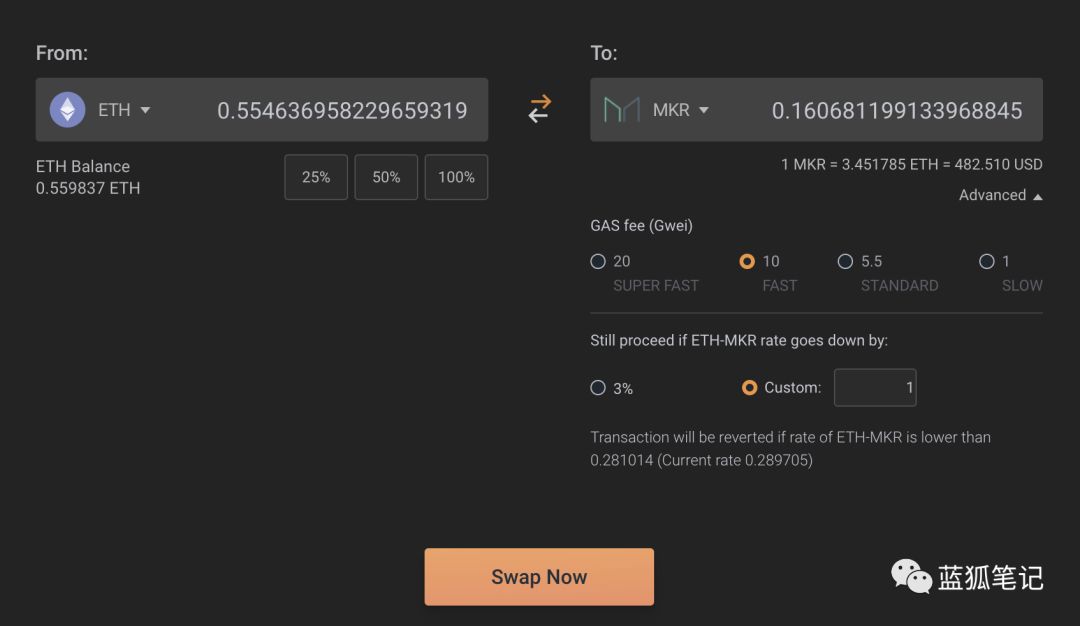

When redeeming, the redeemer needs to specify the tokens and target tokens to be exchanged, the minimum acceptable exchange rate, and send the corresponding number of tokens. The transaction is atomic, and either all exchanges are successful or all return (if it fails), there will be no partial transaction and some non-transactions. The following figure is the KyberSwap exchange interface integrated with the Kyber protocol:

- Reserve

Repositories are liquidity providers in the kyber network, and they provide token exchange for exchangers. The reserve can be an individual with rich tokens, or a professional market maker, project team, DEX (such as Oasis and Uniswap), etc.

However, unlike the token pool of Uniswap, the reserve exchange rate and token pair are defined by the reserve manager. These reserves have great flexibility and can be defined through smart contracts. There can even be manually managed reserves. Market makers can actively participate in the management of prices and tokens through manual work.

- Kyber core smart contract

The main function of Kyber's core smart contract is to connect and connect participants, so that token exchangers can instantly exchange tokens from the reserve.

Kyber core smart contracts support the functions of the on- and off-reserve reserve pools and trading pairs. Trading pairs include bidding tokens and corresponding tokens. For example, in the Ethereum blockchain, ETH is used as a bidding token as an exchange medium and a unit of valuation . If the exchange between ERC20 tokens is similar to Uniswap, it is also done through ETH as a transaction medium. For example, to exchange 10MKR for DAI, first the MKR token of the token exchanger will be exchanged for ETH, and then ETH will be exchanged for DAI. Of course, every time you exchange a contract, you will find the best exchange rate.

In order to give token exchangers a chance to get a good exchange rate, Kyber's core smart contract will ask the registered reserve bank for its exchange rate and choose the best exchange rate to complete the transaction. That is, once the token exchanger sends a request, the smart contract of the Kyber agreement does not randomly select the reserve to complete the token exchange, but queries from different reserves and compares the best exchange rate before executing it. transaction.

It should be noted that this process does not require permission, and there are potential attacks, such as reserve spam attacks (the attacker sets up and registers many reserves), malicious reserve execution (refusal to execute the bid conversion rate, etc.).

In addition, Kyber also plans to support cross-chain token exchanges. It plans to use the relay method used by many projects to conduct two-way relay through the block headers of two blockchains. The block headers of one blockchain are continuously submitted to another. Blockchain smart contracts,

It performs light client logic to verify the validity of the block header and vice versa.

In general, the core of the Kyber agreement is the exchange of tokens, which provides the convenience of exchange for token exchangers and liquidity providers, including instant settlement, atomicity of exchanges, and public exchange rate verification ( Anyone can verify the exchange rate of the reserve), without permission, it can also be integrated into other smart contracts to meet the needs of more scenarios.

How does Kyber's token capture value?

Kyber's token KNC, what value does it capture? From the current design of Kyber, KNC is the value carrier of its network and can play its role in security assurance, governance, and ecological development.

From the perspective of value capture, the most direct is the destruction of its tokens. Since Kyber already has data, this is very intuitive: as mentioned earlier, as of the time of writing of Blue Fox Notes, the destruction of KNC has reached 3,559,529.14 KNC, accounting for 1.68% of its total tokens, which has the same meaning as the token capture value of other projects. By reducing the amount of tokens, the value of each token is increased. The destruction of its tokens comes from its transaction fees. At present, 0.25% is charged for each transaction (the fee can be adjusted through governance), and 70% of it is used to destroy KNC. In other words, the larger the transaction volume of the kyber network, the more transaction fees it captures.

In addition, the liquidity provider of the reserve needs to pledge certain KNC tokens (for security purposes), and KNC token holders can obtain governance rights and pledged benefits (such as depositing tokens into KyberDAO, and then Governance at various protocol levels, including parameters of the token economy, upgrade decisions, token listing, reserve management, etc.), cross-chain exchange relays or validators' token pledges (for security purposes). These three aspects are likely to lock in some tokens, increase the demand for KNC, and thus increase its value. However, from the current practice, the most direct value capture is mainly transaction costs.

The acquisition of transaction costs mainly comes from the expansion of Kyber's business.

Why did Kyber pick up in the second half of 2019?

The core of the Kyber extension is that it becomes a basic component in the DeFi field. Whether its transaction scale can be expanded mainly depends on whether other dApps, smart contracts, wallets, DEX, DeFi projects, etc. are willing to integrate Kyber.

So how do you make others willing to integrate the Kyber protocol? The first is to bring value to users of these dApps, smart contracts, wallets, and DEXs, especially a good exchange experience, including better exchange rates, faster exchange speeds, and pure on-chain transactions. The second is that it can provide economic incentives for the expanders of these ecological networks. Kyber can use the tokens of its KNC financial library to encourage related R & D and ecological partners. At the same time, according to the degree of participants' contribution to the network, the corresponding revenue is distributed, such as giving more KNC rewards to dApps that bring more transaction volume, and even considering the sharing of transaction costs for other dApps. This allows other partners to share the success of the kyber network. Third, Kyber is easy to integrate and can use Kyber protocol to serve its users without spending too much work.

Once the problem of incentives is solved, the Kyber network will have the opportunity to integrate into more wallets, dApps, and DeFi projects, which will help it expand the transaction scale. This is the most important reason why Kyber gained momentum in the second half of 2019. At present, in addition to kyberSwap, Arbitrage Bot, Nuo Network, Fulcrum, Trust Wallet, 1inch.exchange, MyEtherWallet, etc. have brought transaction volume to the Kyber network.

As for how far it can develop, one is to look at the scale of demand for decentralized transactions, and the other is to see how satisfied it is with these partners. The next two or three years will be an important year for Kyber's development. Whether we can go to a higher level depends on the above two aspects.

Conclusion

Kyber's future size mainly depends on the scale of decentralized transactions in the DeFi field, which is a large pool. The rest depends on Kyber's own efforts. It mainly depends on whether kyber can become the basic component of decentralized transactions. Its biggest value is to help other dApps achieve a good token exchange experience. If it can do that, then it will have the opportunity to broaden its path while bringing value to other partners.

Risk warning: All articles of Blue Fox Note can not be used as investment advice or recommendations. Investment is risky. Investment should consider personal risk tolerance. It is recommended to conduct in-depth inspection of the project and make good investment decisions.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- In-depth analysis: What is the far-reaching significance of cross-border trade application of blockchain

- Cambrian cryptography proves a big explosion, how to choose dozens of zero-knowledge proof systems?

- Will Bitcoin be a harder asset than gold? About value, scarcity, and S2F

- Bitcoin Core developers: Bitcoin build time has decreased by 42% since its peak and has dropped to 135 seconds

- Dry Goods Sharing | How to Build a Professional Crypto Asset Portfolio

- Demystifying 9 Myths About Bitcoin

- Facebook's redemption: dare not miss the blockchain, regret defining Libra as currency