In-depth analysis: What is the far-reaching significance of cross-border trade application of blockchain

Author: Duan Lin Xiao

Editor's Note: The original title was "The Mission of the Number One Trade Country in the Digital Economy Era (Part 2)-The Far-reaching Significance of Cross-Border Trade Application of Blockchain"

Customs pass, then trade pass; logistics pass, financial pass

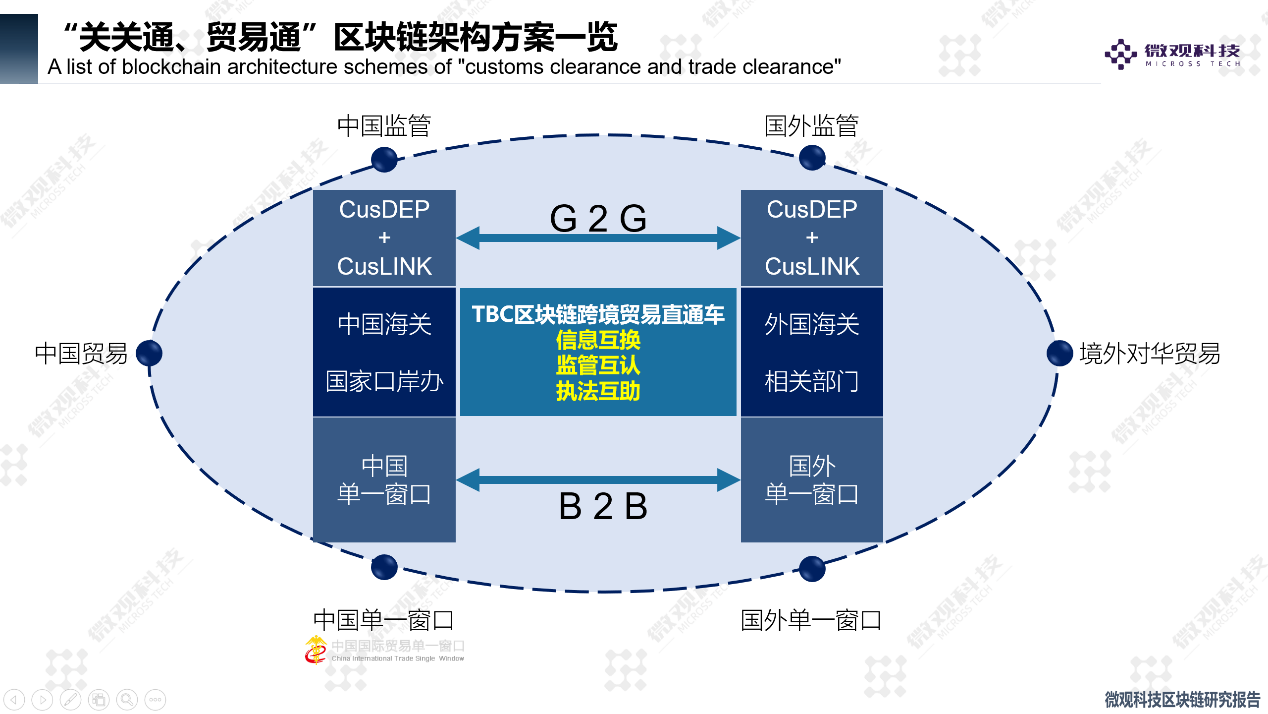

Why do you say "Guanguantong, then Tradelink"? The true nature of cross-border trade is not B2B , but BGGB , where G is the government supervision and the "order" in the definition of human economic activity . The so-called "cross-border trade" of "cross-border trade" is the customs of the exporting and importing countries in terms of logistics, and the foreign exchange management departments of the importing and exporting countries in terms of capital flow .

- Cambrian cryptography proves a big explosion, how to choose dozens of zero-knowledge proof systems?

- Will Bitcoin be a harder asset than gold? About value, scarcity, and S2F

- Bitcoin Core developers: Bitcoin build time has decreased by 42% since its peak and has dropped to 135 seconds

Economic exchanges and communication between countries are deepening at any time. When the heads of state exchange visits, the two countries will sign a government cooperation agreement on the Mutual Assistance Agreement on Customs Administrative Affairs. At present, the Chinese government and the General Administration of Customs have signed with more than 90 countries. this agreement. Information exchange, mutual recognition of supervision, and mutual assistance in law enforcement are the key points for the improvement of global trade efficiency in the future and the boost for global economic growth. However, there is currently no real “three mutual” between any two countries. Weihai, China and South Korea Incheon's "Four-Port Cooperation" is working towards this goal.

The core foundation of Guanguantong and Tradelink is the need to establish a mutual trust mechanism. The establishment of a mutual trust mechanism depends only on the form of an agreement. It cannot form a systematic paradigm mechanism. The blockchain will effectively establish a systematic model between two countries and between multiple countries. Paradigm trust mechanism .

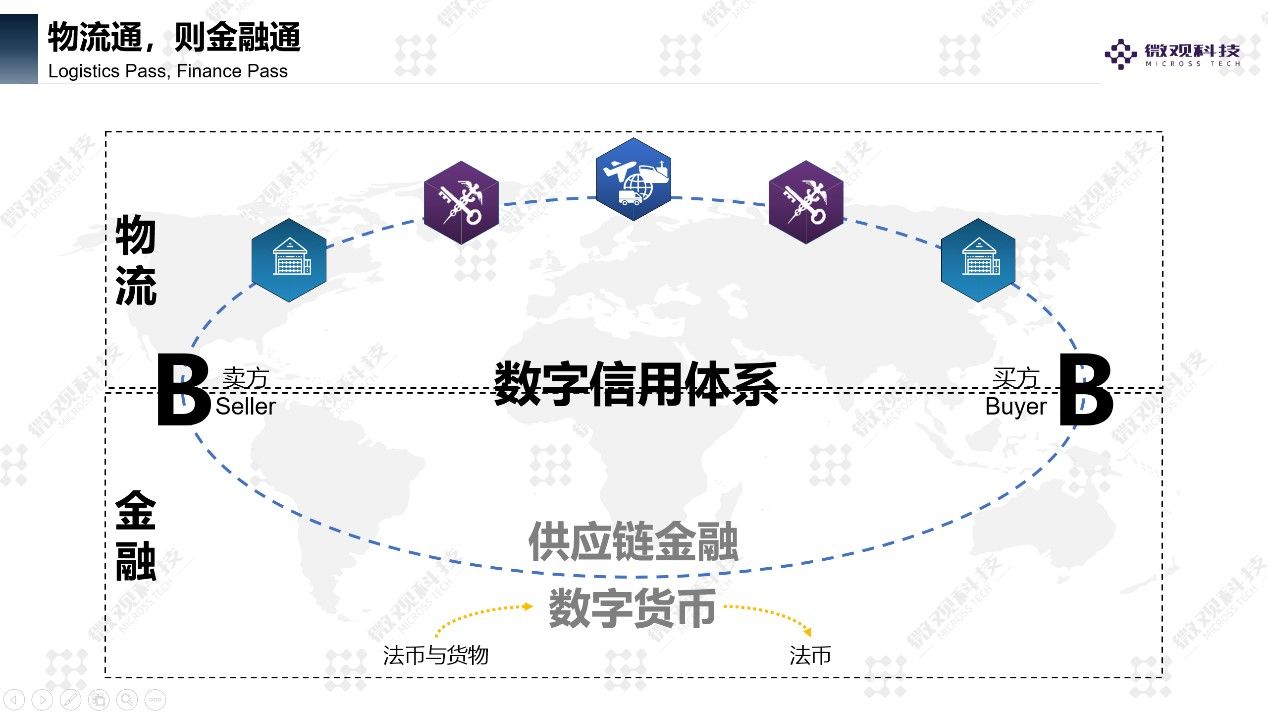

Logistics links, financial links. For a long time, supply chain finance has been criticized by the financial industry as a false proposition, and financial institutions have invested a lot of money in risk control. The core of risk control mainly focuses on two points. First, if the financial properties of the goods are good, control the goods control link. If the financial properties of the goods themselves are poor, grab the business. Therefore, the control of goods, corporate credit, and secured collaterals are of most concern to financial institutions, and as a result, many leveraged financial products have been generated, such as futures hedging, ABS asset securitization, and so on. The risk control arm length of financial institutions combines corporate credit, collateral and leveraged financial products to form a comprehensive financial risk control capability. However, in the field of supply chain finance, a series of risk control has led to excessive risk control costs for financial institutions. The burden is heavy, and the threshold for obtaining financial support from financial institutions is high, making it difficult to obtain low-cost funds.

Trusted data is the primary means of production for finance, but how is it created? How to get? Before the birth of the blockchain-based mode of trusted production relations through technology, this has been a core pain point for financial institutions.

With the help of the Internet of Things and other technologies, the logistics system can provide financial institutions with all the status information of goods in transit. Therefore, data integration in the logistics system is a very difficult task, and the cross-border trade logistics system is more complicated, including not limited to manufacturers, Overseas transportation, overseas warehousing, tallying, overseas inspection, booking (cabin), transportation (shipping, water transportation, land transportation, air transportation), port, tallying, domestic storage, inspection, delivery, domestic transportation, etc. There is mutual exclusion of interests under the "weak trust relationship" between the links. Today, science and technology are so developed that no institution, government, enterprise, or platform in the world can integrate these links to form a "strong trust relationship between each other." "If these links can be established as a" strong trust relationship "for collaboration, the information and data of the goods will be generated in a" strong trust relationship "environment for collaboration through technologies such as the Internet of Things, and the advantage of the blockchain will be used to realize the indispensability of data. Tampering, then, these data are the first means of production for financial institutions-"trusted data" . With the trusted data generated under the “strong trust relationship” environment of the logistics system's cooperation, financial institutions can realize the right to goods, and technologies such as the Internet of Things and the blockchain are involved in the logistics system. Data unique path.

The trading company completes the entire trade process on the blockchain platform. The trading company and the logistics, finance, and regulatory parties jointly document the trading behavior of the trading company, and build an enterprise credit from "self-certified" to "other certificates, multiple certificates." Trusted data. Financial institutions' credit to trading companies, and various types of certifications of trading companies by supervisors have a credible data basis of "other certificates and multiple certificates." It breaks the traditional credit and certification process in finance and supervision. Rent space. Therefore, on the blockchain cross-border trading platform, companies rely on their own integrity business to form a true "corporate credit" through "other certificates, multiple certificates". Blockchain has promoted this great innovation-the enterprise Credit digital assets .

The formation model of blockchain enterprise credit digital assets is: enterprise → business → business process data accumulation on the blockchain platform → enterprise credit digital assets . In the future, blockchain enterprise credit digital assets will be the core basis for the supervision of corporate authentication, bank-to-business credit and financial support. This is also the model of value transfer.

Foreign exchange is one of the economic pillars of a country. Foreign exchange management is the government's management of the order of capital flows in cross-border trade. The traditional foreign exchange management model for cross-border trade is that an enterprise submits various trade documents to a commercial bank, and after reviewing these documents, the commercial bank submits these documents to the foreign exchange management department. The foreign exchange management department obtains these documents and obtains the corresponding information from the customs data center. Cross-comparison of the trade data of the company, verify that the settlement of foreign exchange is allowed without error, and the card will be exchanged if the verification is incorrect. On the blockchain cross-border trade platform, trade, logistics, finance, and supervision jointly record and jointly participate in the trusted data of the entire process of trade. Therefore, customs can not only use the blockchain cross-border trade platform to achieve trade facilitation services, Foreign exchange can also provide foreign exchange settlement facilitation services with the help of blockchain cross-border trading platforms.

The significance of cross-border trade application of blockchain

To sum up, blockchain is used in the field of global cross-border trade, and trading companies and logistics companies have gained trust from financial institutions and regulatory parties. Therefore, blockchain is not only a credit enhancement path for trading companies and logistics companies, but also a financial The path extended by the institution's risk control arms will greatly reduce the threshold and lower interest rates. Inclusive finance, technology finance, and supply chain finance will all be realized, which will increase the liquidity of funds. Therefore, the blockchain cross-border trading platform is not only a financial institution's rights confirmation platform, a risk control platform, a technology finance innovation platform, but also a financial institution's innovation path from technology finance to financial technology .

The industrial application of blockchain cross-border trade brings the spirit and concept of synergy and cooperation to world trade; provides a fair and interactive environment for data and information in a secure and encrypted state; and creates a credible trading environment for world trade.

With the continuous expansion of the industrial application scope of blockchain cross-border trade, in the future, the application scope of digital currencies in various countries will continue to expand with the expansion of trade borders, and blockchain-based digital currencies have also been proven to be able to get rid of the SWIFT system and achieve Peer-to-peer cross-border payments will not only greatly improve trade efficiency and get rid of the inefficient SWIFT system of singularization and centralization, but also, with the expansion of the scope of trade borders, the application of digital currencies will realize that world trade will no longer be subject to hegemonic sanctions and true freedom Trade cross-border payments. The RMB will also be internationalized in the form of digital currencies.

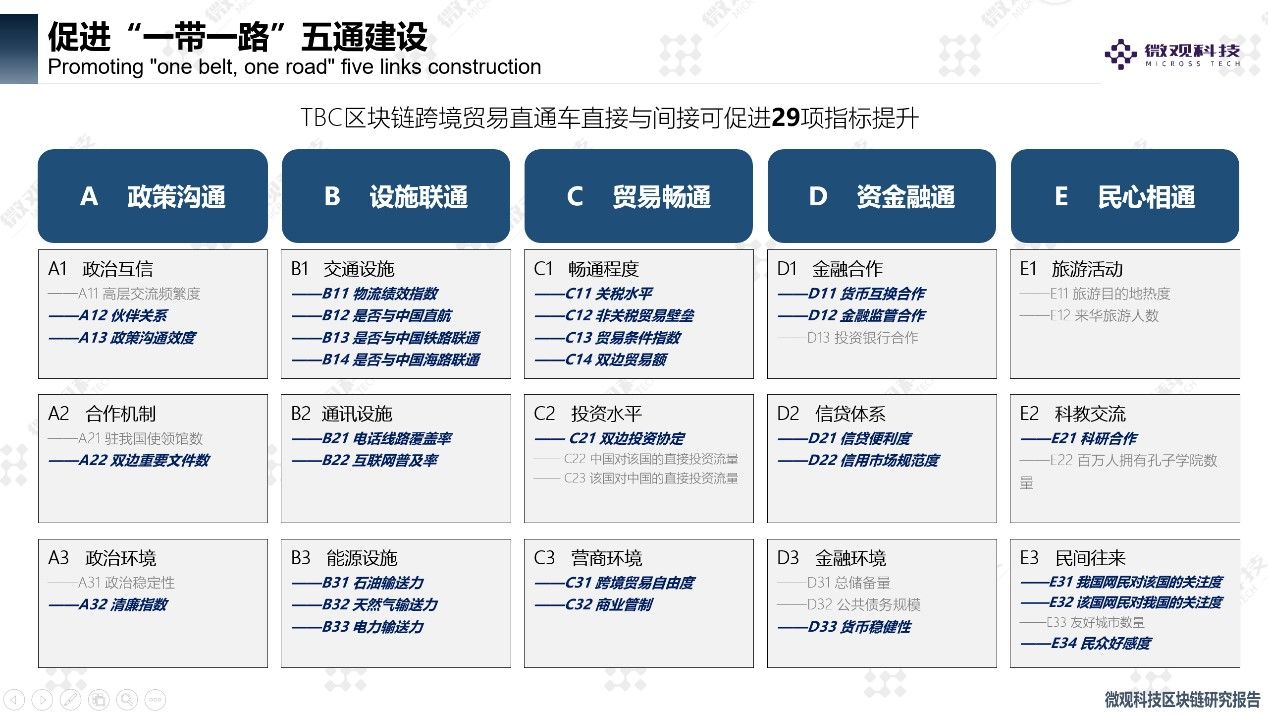

In the promotion of the “Belt and Road” strategy, the application of blockchain in the cross-border trade field will directly or indirectly promote the improvement of 29 classified indicators (as shown in the figure below). In order to implement the five-way construction between China and the “Belt and Road” countries, Provide a development path for digital infrastructure and consolidate the foundation for development.

Blockchain is a digital trade infrastructure that creates a “new order” and “new credit system” for free, fair and honest trade globally. This is a great global systems project that requires joint efforts among governments and businesses. As the world's largest trading nation, the world's second largest economy, a permanent member of the United Nations, and a member of the SDR , China should shoulder the historical mission of leading the "digital infrastructure" in the global digital economy era .

Note: This article has been uploaded to the security network for blockchain copyright protection.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Dry Goods Sharing | How to Build a Professional Crypto Asset Portfolio

- Demystifying 9 Myths About Bitcoin

- Facebook's redemption: dare not miss the blockchain, regret defining Libra as currency

- Federal Reserve: We don't need digital currency, but New York has quietly started to do it

- Monroe Research Lab releases latest research paper: new technology Triptych will significantly improve online anonymity

- RBA: next-generation cryptocurrency may be widely used, there is currently no need to issue CBDC

- 2019, I'm on the scene | Idealism to the left, Realism to the right, this is a contradictory world