Will Bitcoin be a harder asset than gold? About value, scarcity, and S2F

Author: Hope (NPC community members)

Source: NPC Source Program

The halving of Bitcoin block rewards in May 2020 is a hot topic, and each halving is accompanied by large fluctuations in the entire cryptocurrency market. Related to this is the S2F (Stock to Flow) model. This model is not the first time it has been proposed. In the "The Bitcoin Standard" published in April 18, the author Saifeean Ammous applied S2F to the valuation of Bitcoin. But in the Chinese community, few people have described this model, so we asked Hope, a member of the NPC community, to bring this article to everyone.

As a store of value, its value comes from its scarcity, which is the time cost of production. From this perspective, Bitcoin will be a more "hard" asset than gold.

- Bitcoin Core developers: Bitcoin build time has decreased by 42% since its peak and has dropped to 135 seconds

- Dry Goods Sharing | How to Build a Professional Crypto Asset Portfolio

- Demystifying 9 Myths About Bitcoin

The future has come, but it has not yet spread.

TL; DR

1. Stock-to-flow (the inverse of annual supply growth rate, hereinafter referred to as S2F) is an index derived from the commodity market and used to quantify asset scarcity, or "hardness". Until recently, economist Saipedean Ammous applied it to the relevant analysis of Bitcoin.

2. After the expansion of analyst Plan₿ (@ 100trillionUSD) and his valuation model based on S2F, people found that there is a strong correlation between the market value of Bitcoin and S2F, and that future prices can be predicted accordingly.

3. But even the best mathematical models can fail when trying to predict the future. A major challenge of the S2F model will be the halving of Bitcoin in May.

4. However, even if the prediction fails, S2F is a good inspiration for understanding Bitcoin. Obviously, Bitcoin itself is designed as a "super hard" asset. After halving in May, its "hardness" will reach the level of gold. After another reduction in production in 2024, the "hardness" of Bitcoin will increase significantly again and surpass gold.

Worldwide, central banks are adopting a new round of quantitative easing. At the same time, a total of about $ 15 trillion in securities worldwide is negative, and the scale is still expanding. Coupled with the turbulent times in the Middle East today, it is not surprising that the tension between the United States and Iran has increased the value of gold: after the gold price broke the $ 1,500 / ounce mark for the first time in the third quarter of last year, To the highest price point in nearly 6 years. As we all know, as the oldest value storage asset in human history, the attractiveness of gold lies in the stability of its supply side, and the limited annual gold production will only gradually increase its originally very large inventory. Therefore, under the quantification of the "hardness" index of a given asset, S2F of gold, a precious metal, has reached an astonishing 62 (for comparison, the current S2F of silver is only about 22). That is, it takes 62 years to produce the same amount of gold as current stocks. As a result, gold has no risk of falling into the so-called "cheap currency trap." It will not lead to a significant increase in output due to price increases, which will further dilute existing stocks to a certain extent and start a downward spiral in prices.

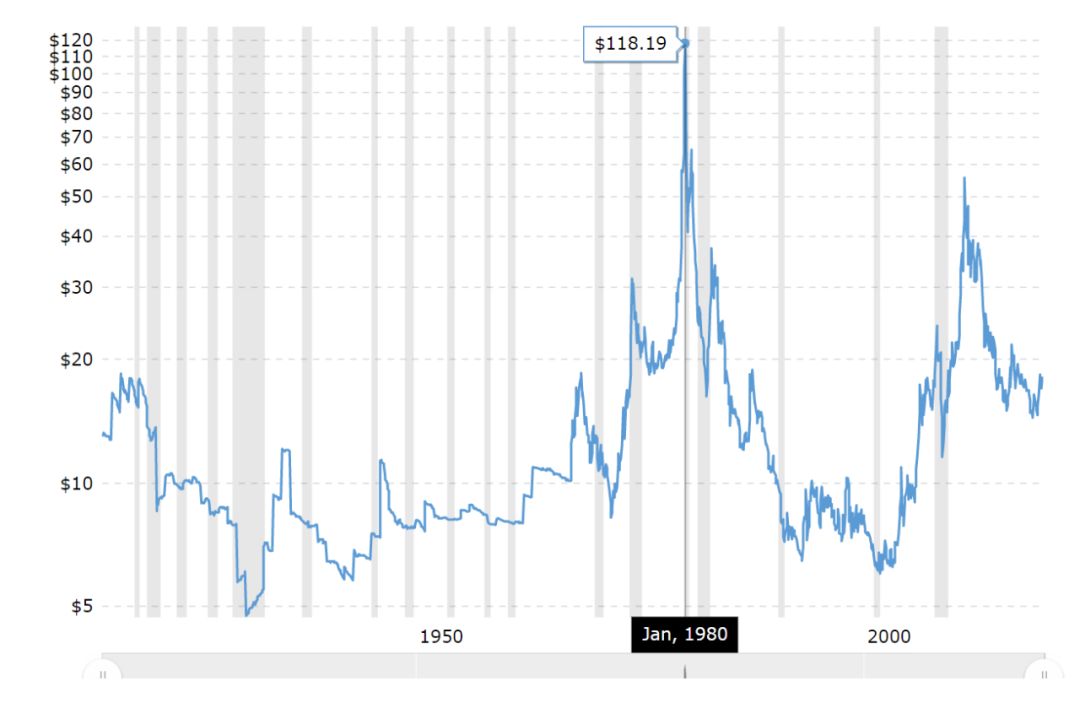

Chart: Silver's price trend in the past century. The Hunt Brothers fell into the "cheap money trap" in 1980. They tried to remonetize silver, hoping to keep buying the metal, pushing it up to a level where it could be used again as money. Initially, the plan worked, and speculators boosted its uptrend. However, output surged with rising prices and eventually caused the price of silver to plummet.

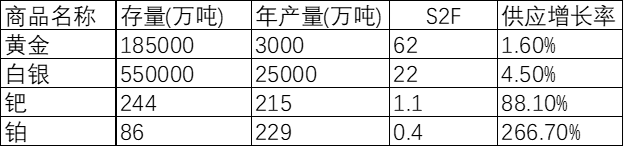

S2F is also a yardstick for measuring monetary goods. Historically, commodities with the highest S2F values at all times have been used as currency at all times. Because this maximizes the assurance that the value will not disappear over time. In this value, it is not the limited inventory of assets that plays a leading role, but the ratio of inventory and current "capacity". For example, in an absolute sense, the stock of palladium is much smaller than gold, only one thousandth of the latter, but this does not make palladium a harder commodity. Because the production capacity of palladium is relatively high, it is easy to dilute the inventory of palladium in the case of rising prices, so that it will fall into the trap of cheap currency.

Figure: S2F of several precious metals. Today's Bitcoin S2F is about 26, and after halving in May it was about 53.

Similar to palladium, many of the precious metals for industrial use are not high in S2F, and their annual output is consumed in the same year or next year. This point also shows that if monetary commodities are of little use other than as a currency (transaction medium and store of value), it is in their favor. Because only in this way, the annual output will not be consumed in large quantities, but will be gradually hoarded and protected over time.

“ S2F and Bitcoin ''

In The Bitcoin Standard, the author Saipedean Ammous uses S2F, which was originally used for commodity market analysis, on Bitcoin. This is also in line with Bitcoin's design philosophy, because it was originally designed as a new currency-like commodity in the form of a precious metal. As Satoshi Nakamoto said, "Suppose there is a base metal that is as scarce as gold, but has the following characteristics: monotonous gray, poor conductivity, not particularly hard … without any practical or ornamental use … and a special, Amazing attribute: can be transmitted through communication channels. "Like gold, new Bitcoin cannot be mined arbitrarily. Because Bitcoin is purely digital, it is often referred to as "digital gold."

S2F provides a simple quantitative framework for analyzing the price trend of Bitcoin: This is an indicator with strong explanatory power, making Bitcoin comparable to gold and its close relatives. And through a simple calculation, we will find that today's Bitcoin S2F is about 26. After 4 months, Bitcoin S2F will reach a level similar to gold, and in 4 years, it will far exceed gold. How did this happen?

"Bitcoin's" unfair "issuance mechanism"

Given that Bitcoin is purely digital, its complete issuance mechanism can be determined at the beginning of the agreement. One can indeed say that the creator of the bitcoin under the pseudonym "Satoshi Nakamoto" "cheated" in the white paper, because the sharp and mechanical halving of the Bitcoin supply side every 4 years is impossible for any element in the real world. Comparable. Satoshi Nakamoto's genius move is to decouple the supply of Bitcoin from its price and mining work (ie, computing power). The difficulty adjustment system is not seen by any predecessors of Bitcoin such as Bit Gold.

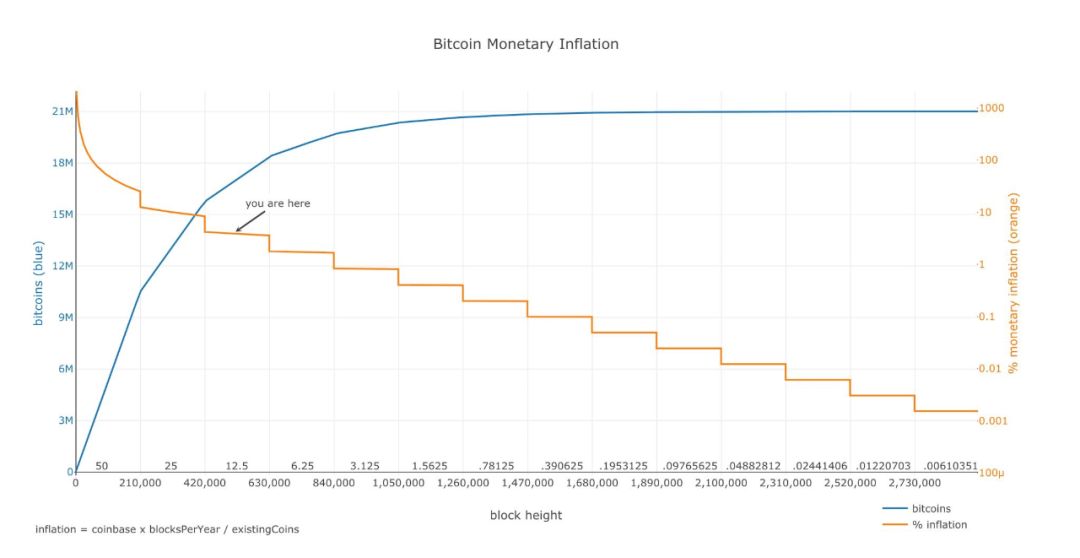

On the Bitcoin network, a new block is mined by a miner approximately every 10 minutes. In addition to transaction fees, each block initially contained a block reward of 50 Bitcoins, and was reduced to half the original amount after 4 years. After two halvings, each block now contains 12.5 Bitcoin rewards. After halving again in May this year, the block reward will be reduced to 6.25. When the price of bitcoin rises, more miners (computing power) are added to the mining, and the system will automatically increase the difficulty of mining to keep the block production time at an average of 10 minutes. When the price drops, some miners quit mining, The system will automatically reduce the difficulty and keep the block production time at an average of 10 minutes. Therefore, no matter how the price or computing power fluctuates, it ensures that the target amount of bitcoin enters circulation.

Also due to its complete digitization, another special feature of Bitcoin is that it cannot be used as decoration or industrial raw materials like gold. At first glance this may seem like a disadvantage, but from an S2F perspective, it's not. Considering that Bitcoin has no other use, the demand-side composition has remained unchanged for a long time (for example, there will not be a new industry because it needs to use Bitcoin as "raw material" and consumes its inventory in large quantities), so there is no need to worry about other factors. Its price composition. Due to the fixed issuance mechanism, naturally, no additional bitcoin will be mined, which will impact the supply side.

Chart: 1892-1912 Gold production in Yukon, Canada. Starting in 1896, driven by material benefits and high unemployment in the United States, a total of about 100,000 gold prospectors came to the Klondike River in Yukon, Canada. The gold rush continued until 1899, and this additional supply of gold also temporarily reduced the global price of gold. Historically, there have been many examples of the increase in gold output caused by the gold rush and its impact on the supply side.

Because of high production costs, long enough accumulation time, and first-mover advantage (because of the existence of natural gold ore, it means that gold could be used as a currency commodity long ago, in contrast to industrial precious metals such as palladium and platinum until modern times Was discovered by human beings), allowing gold to obtain today's high S2F, and once became the only standard currency in the world. Even if gold is decoupled from fiat currencies in the future, it will still be the largest valued storage asset by market value.

Figure: Bitcoin's currency inflation (yellow) and supply curve (blue).

Because of the special issuance mechanism, especially the halving every four years, Bitcoin has achieved S2F similar to gold in just 11 years. This set of game rules determined by Satoshi Nakamoto is jointly supervised by all users running full nodes through a global point-to-point network to ensure that it cannot be tampered unilaterally.

"There is a strong correlation between Bitcoin's market value and S2F"

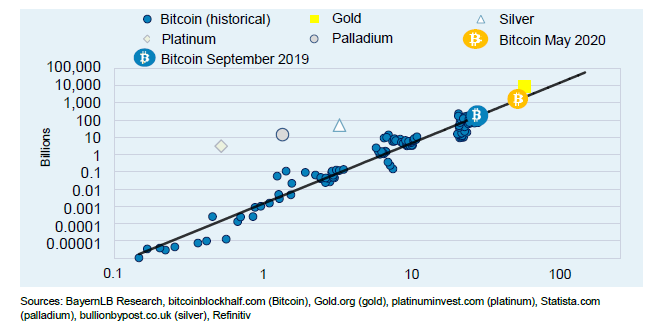

After the expansion of the analyst Plan₿ (@ 100trillionUSD), and his valuation model based on S2F (see “Modeling Bitcoin's Value with Scarcity” for details, see the appendix), people found that the market value of Bitcoin in different periods and its stage S2F has a strong correlation. Here we try to prove it in an econometric way.

First, as a public database, the total amount of bitcoin and the inventory and block rewards up to each block are known or can be obtained by simple calculations. In 2010 and after, as exchanges have sprung up, the historical price of Bitcoin can also be easily obtained. It is naturally not difficult to calculate the market value of Bitcoin at all stages. The only problem is the "lost bitcoin" (or, more accurately, the lost private key), because no one knows how many coins will never be circulated again. In the calculations here, we assume that there are 1 million, those Bitcoins that are believed to be held by Satoshi Nakamoto and have never been used. In order to verify the reasonableness of the obtained valuation, we have additionally plotted the market value and S2F of gold, silver, platinum and palladium in the figure. This part is relatively simple, the data used are from official publications.

Figure: S2F of different products. In terms of "hardness" or scarcity, Bitcoin is keeping up with gold.

When we plot the obtained data on the coordinate axis, we will find that the market value of Bitcoin has a logistic linear regression relationship with S2F. In other words, the higher the Bitcoin's S2F value, the harder its "hardness" as an asset, and the greater its value. Of course, someone may point out that the blue data points we sampled are not completely located on the regression line. However, these errors are within the allowable range. Interested friends can refer to "Falsifying Stock-to-Flow As a Model of Bitcoin Value" by @phraudsta and "Reviewing 'Modelling Bitcoin's Value with Scarcity'-@Part II by @BurgerCryptoAM: "The hunt for cointegration" (see appendix for a link), only the former conclusion is quoted here: If we consider the value of Bitcoin as a drunkard, then S2F is not his real follower dog, but more like he walks The way. A drunk man wanders around the road, sometimes stopping, slipping, missing a bend, or even taking a short cut on the road; but in general, he will go home in the direction of this road.

If you look closely at the chart, it is not difficult to find that platinum and palladium are clearly located on the regression line. This shows that their market value mainly or a large part comes from their practical value as industrial metals, and there is only a very low currency premium. In contrast, gold can be said to almost coincide with the regression line, of course, this is also completely logical, because the ancient metal such as gold mainly exists as a value store, and its industrial demand is very small.

Of course, the most interesting question is naturally what will happen to the market when we know that after May 2020, the next time the Bitcoin S2F will increase from about 26 to 53 now? And now the gold's S2F is 62, and then Bitcoin will only be lower than it. The answer is that if this valuation model is established, the price of Bitcoin will reach 90,000 US dollars. This also means that Bitcoin's halving effect is not included in the current Bitcoin price (interestingly, according to the S2F valuation model, the current "reasonable" price of Bitcoin is exactly $ 7,500.

"Conclusion: Bitcoin is moving towards an asset that is harder than gold"

appendix:

1. Modeling Bitcoin's Value with Scarcity: https://medium.com/@100trillionUSD/modeling-bitcoins-value-with-scarcity-91fa0fc03e25

2. Falsifying Stock-to-Flow As a Model of Bitcoin Value: https://medium.com/swlh/falsifying-stock-to-flow-as-a-model-of-bitcoin-value-b2d9e61f68af

3. Reviewing 'Modelling Bitcoin's Value with Scarcity' – Part II: The hunt for cointegration: https://medium.com/burgercrypto-com/reviewing-modelling-bitcoins-value-with-scarcity-part-ii-the-hunt -for-cointegration-66a8dcedd7ef

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Facebook's redemption: dare not miss the blockchain, regret defining Libra as currency

- Federal Reserve: We don't need digital currency, but New York has quietly started to do it

- Monroe Research Lab releases latest research paper: new technology Triptych will significantly improve online anonymity

- RBA: next-generation cryptocurrency may be widely used, there is currently no need to issue CBDC

- 2019, I'm on the scene | Idealism to the left, Realism to the right, this is a contradictory world

- Ripple's big customers: a decade of blockchain and banking

- U.S. SEC makes crypto compliance a priority in 2020, but hints at a more modest approach