For the "half of the market" power, BTC computing power and other network indicators hit a record high

Bitcoin network indicators hit record highs (ATH)

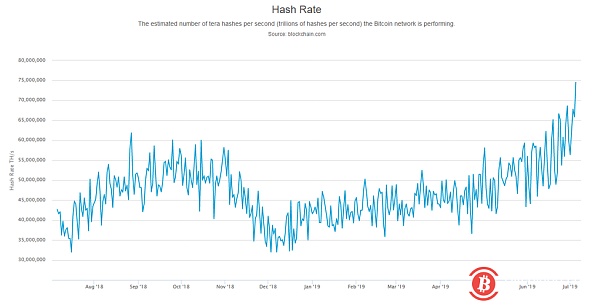

As Bitcoin block rewards will be halved in less than a year, network activity parameters continue to hit new historical highs. Data from Blockchain.com shows that bitcoin network computing power, difficulty, blockchain size and unspent transaction (UTXO) counts are all at an all-time high.

- Bitcoin hash rate hit another record high!

- Why banks are not eager to implement blockchains

- Are the Internet of Things and blockchain ready to embark on the road to success?

As of press time, the network computing power is 74.5 quintillion hashes per second (74.5 million TH/s per second). This figure shows that computing power to protect cybersecurity has increased by nearly 140% since the end of 2018.

At that time, due to the 80% drop in BTC prices, the profitability of the mining industry declined, and many nodes withdrew from the network, and people were worried that there would be a mining death spiral. After half a year, the situation is exactly the opposite.

These huge improvements in network fundamentals have led to a large investment in the mining industry. Earlier in July of this year, Northern Bitcoin, a German-based cryptocurrency mining company, announced that it would purchase 5,000 ASIC miners from mining machine manufacturers Jianan Zhizhi and Bitian.

Will the bitcoin price hit a record high before halving?

Even before halving the block rewards in 2020, many people speculated that new price highs might appear. Bitcoin's current price is around $11,000, up 120% from the beginning of the year. Tradercobb.com's cryptocurrency trader Craig Cobb expects bitcoin prices to hit a new high of $27,200. However, Cobb said Bitcoin could fall below $9,000 and then rise to a new high of more than $20,000.

So far, the highest ranked cryptocurrency has seen a 20% to 30% decline in the 2019 trend. For Cobb, each callback will only bring the BTC back to the "cradle zone" (price activity area within the 10-20 cycle moving average).

As for what happens after halving, past historical records may provide some insights. After the halving of the block award in 2016, the price of BTC rose by more than 900%. This trend peaked in mid-December 2017, when Bitcoin almost broke through $20,000.

Price analysis, such as model analysis of tradable shares, is expected to surge to $55,000 in the halving of 2020. If you reproduce 10 times growth in 2016, then by the end of 2021, Bitcoin will exceed $500,000. (Babbit)

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Garbage classification: What can a practice of distributed computing for all people learn from blockchain?

- Facebook Libra stepping on Bitcoin and want to play a currency monopoly?

- Twitter releases bitcoin and Facebook Libra's sentiment index

- Analysis of the madman market on July 5: Once you have Bitcoin, the world will be happy with you.

- Research says Bitcoin consumes 64 billion kWh a year more than the whole of Switzerland

- Mysterious Nakamoto Satoshi, the legend of creating Bitcoin

- The conflict between the United States and Iran has intensified, can Bitcoin reproduce "magic"?