Bitcoin continues to wait for direction, two indicators need to attract the attention of short-term investors

There have been a lot of news about the international political and economic situation in the past two weeks, which has stimulated the sharp rise and fall of Bitcoin. At present, the news has gradually calmed down, and the bitcoin market has gradually recovered. At present, it is dominated by shocks. But Bitcoin will eventually choose the direction. Up or down is not important for long-term investors, but it will have a major impact on short-term yields for short-term traders. The following two data may hint at the short-term direction and share it with short-term investors.

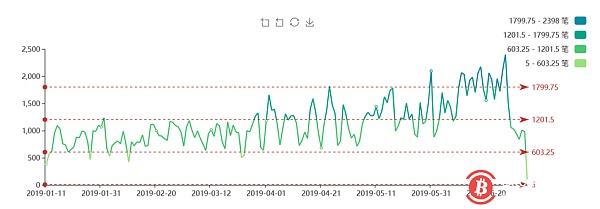

First of all, there is a big change in the chain. Last night, there were two large transfers worth $200 million in the BTC chain. Although the recent large amount of transfer is still not small, but from the number of transactions, there has been a decline. According to Tokenview, since 19 years, the number of large-value transaction (>100BTC) transactions in the bitcoin chain has been rising, and the highest point appeared on June 27, when there were 2,398 large transaction transactions. However, after entering July, the large-scale transaction has experienced a cliff-like decline, which has already broken the upward trend of large-value transactions.

- Buy Bitcoin? Trump said that the United States should "match" Chinese money printing games

- JPB Liberty launches class action lawsuit against three major social giants to ban advertising

- Graphic Tracking PlusToken Asset Transfer Tracking BTC section has 1,203 inflows

Since the earliest time of the large amount of transaction data that can be found at the beginning of this year is the beginning of this year, from the comparison of the trend of the data and the market, the two have a significant positive correlation in the first half of this year. We can't prove that the current trend of large-value trading data will definitely affect the price of Bitcoin, but for short-term traders, this may be an indicator of short-term risk. Here, it is only for short-term investors. reference.

The USDT off-market premium level also hints at the recent BTC correction. Usually we will use the discounted premium level of the USDT off-market price to judge the different stages of the market, but this indicator is at least not a leading indicator. Because the premium of USDT is often caused by more investors entering the USDT and entering the market due to the rising market, the market premium is caused. For short-term investors, avoiding buying BTCs during periods of a fall in the USDT premium may be a relatively effective way to avoid short-term losses. At present, the USDT premium level has dropped significantly since June 27, and has formed a downward trend.

During the narrow fluctuations of Bitcoin, other mainstream currencies did not form a significant rotation effect. The BCH mentioned yesterday also saw a simultaneous decline with the decline of Bitcoin this morning. But for now, the reason for the entry (deviation) is still in place, and the price does not touch the stop loss position ($381), so it can still be held.

OKB changed its position yesterday night, rising to a maximum of $2 and currently oscillating above $1.80. The reason we entered before was that we successfully broke the red line resistance position ($1.81) on June 26 and stepped back on this area. Last night's rise of $2 was already partially profitable, leaving half of the position to continue to hold.

XTZ is a poorly performing currency in the mainstream currency. It has been in a downturn since mid-May, but there was a large increase in volume on July 3. The closing of the day was just on the edge of the downtrend line from the high point. Currently, XTZ needs to be observed. Whether the price can break through the downtrend line and whether the volume on the 3rd can continue. (CoinNess)

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Wall Street Journal: Facebook can't escape regulation, Libra like money market fund

- FCA proposes to ban cryptocurrency-based derivatives

- wake up! Is IMFCoin really coming?

- Quotes: The total transaction volume of 140 billion US dollars has reduced the amount of imagination.

- Note that the US Ohio government is about to use BCH-based SLP tokens.

- Redefining Bitcoin: Making the World Gradually Overlapping

- In this round of bull market, you may not be able to wait for the outbreak of the altcoin