Weekly Summary of the Cryptocurrency Market (7.22-7.28) Bitcoin Volatility, Altcoins Welcoming a Breathing Space?

Weekly Summary Bitcoin Volatility, Altcoins Taking a Breather?1. Macro Liquidity

The monetary liquidity is tightening. The Federal Reserve raised interest rates by 25 basis points in July as scheduled, although it did not indicate whether there would be further rate hikes, the overall stance is dovish. This round of rate hikes has now reached 11 times, a total of 525 basis points, and the interest rate has risen from 0.25% to 5.5%, basically reaching the highest level since the turn of the century. As the Federal Reserve approaches the end of the rate hike cycle, the US dollar index has fallen below 100 points. In recent weeks, BTC has underperformed compared to tech stocks.

2. Overall Market Situation

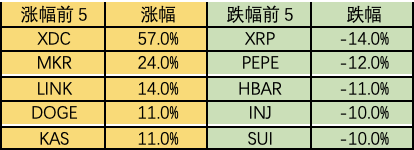

Top 100 market cap gainers:

- Liquidium The first NFT lending protocol in the Bitcoin ecosystem, a solution for ordinal inscription liquidity.

- Unveiling Satoshi Nakamoto Has the creator of Bitcoin been right under our noses?

- Arthur Hayes DAO is the company of the AI era, and DEX is the financial market of the AI era.

The market has been weakly adjusted this week. The dominance of altcoins has rebounded. There is insufficient market liquidity, and opportunities are mainly in small and new coins on the chain. In the previous bear market, speculative funds were focused on capital rotation, while in this round, it has shifted to speculative “meme” coins. The projects that have performed well in this round are those that have real income and use the income for dividends and buybacks. The market hotspots are trading robots and RWA (Real World Assets).

- WLD: The goal is to issue coins to everyone globally and establish the first global-level public chain for real human identity narrative, which can be used for payment and financial scenarios. The risks lie in the need for cooperation with local authorities for biometric data such as iris recognition. The token economics adopts a model of low circulation and high market value. It has entered the top 10 in terms of market value, but there is relatively limited room for further growth.

- MKR: The leader in bringing real assets onto the chain, with 70% of its income coming from the RWA track. Recently, the data of its new business, lending, has also reached a historical high. The end of the reduction of its major shareholder A16Z is approaching, and the factors that have long suppressed the token price will be eliminated.

- UNIBOT: The leader in the trading robot track, benefiting from the popularity of “meme” coins on the chain. UNIBOT has some innovations, allowing users to place orders and trade directly on Telegram at a faster speed than Uniswap, and it has real income and dividends. However, the token model, which adopts a similar transaction tax model as “meme” coins, has been criticized.

3. BTC Market

1) On-chain data

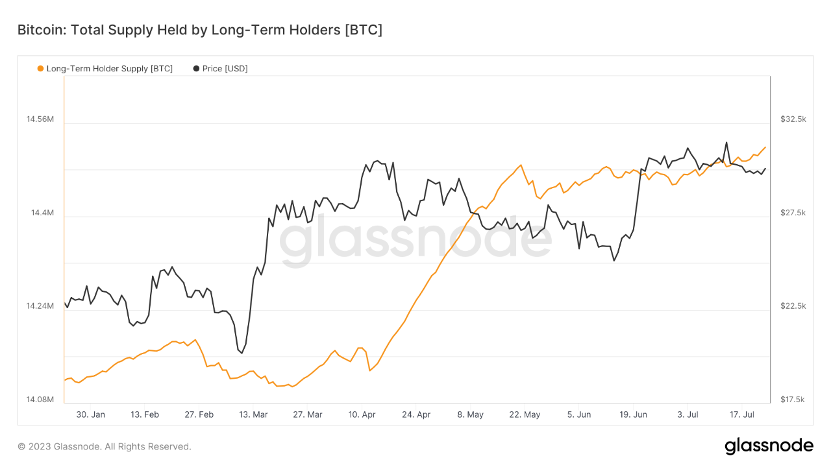

The number of BTC involved in transactions is decreasing. The number of investors holding BTC for more than six months and more than one year has reached new highs, with 75% of the BTC held for more than six months not being moved, and 69% of the BTC held for more than one year.

The market value of on-chain stablecoins has slightly decreased. The market value of the four major stablecoins has decreased by about 400 million US dollars. BTC is still more likely to remain in a volatile state until there is no new news about spot ETFs.

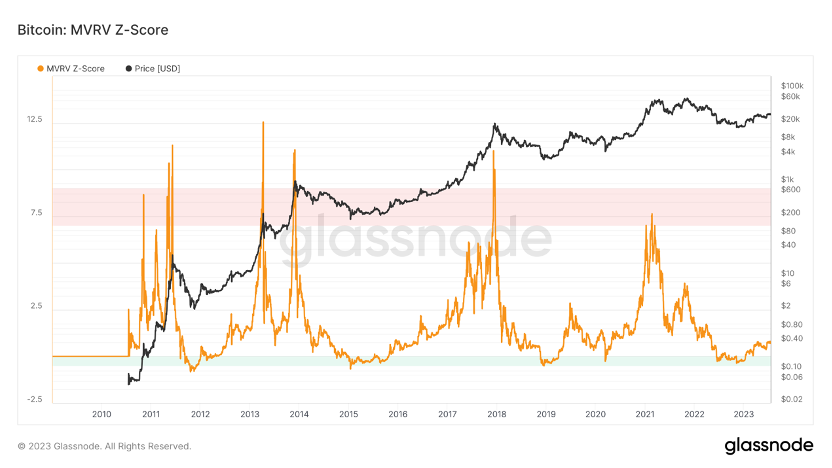

The long-term trend indicator MVRV-ZScore is based on the total cost of the market and reflects the overall profitability of the market. When the indicator is greater than 6, it is in the top range; when the indicator is less than 2, it is in the bottom range. When the MVRV falls below the key level of 1, holders are generally in a loss state. The current indicator is 0.69, entering the recovery phase.

2) Futures Market

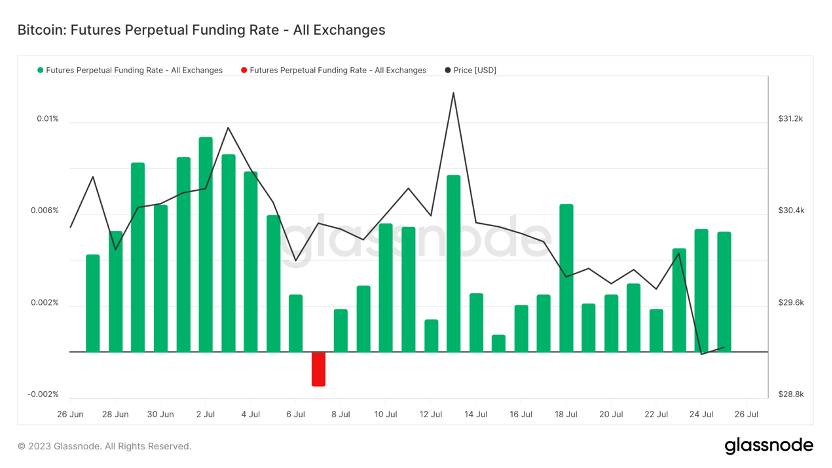

Funding rate for futures: Neutral this week. Rates ranging from 0.05% to 0.1% indicate a higher long leverage, signaling a short-term top in the market; rates ranging from -0.1% to 0% indicate a higher short leverage, signaling a short-term bottom in the market.

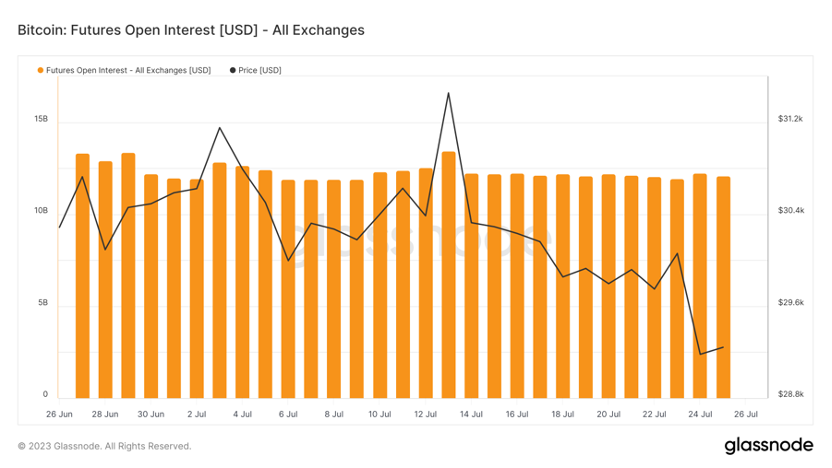

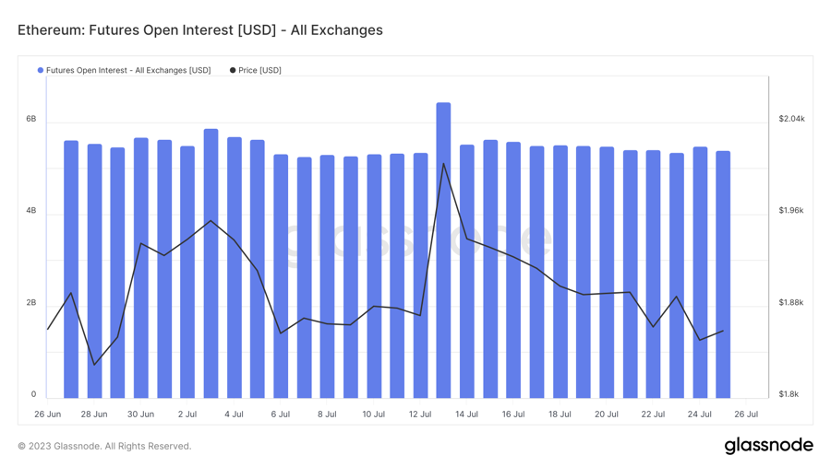

Futures open interest: Total open interest has slightly decreased this week, with main players withdrawing.

Futures long/short ratio: 1.3. Market sentiment is neutral. Retail sentiment is mostly a contrarian indicator, with below 0.7 indicating fear and above 2.0 indicating greed. The fluctuation of the long/short ratio data weakens its reference significance.

3) Spot Market

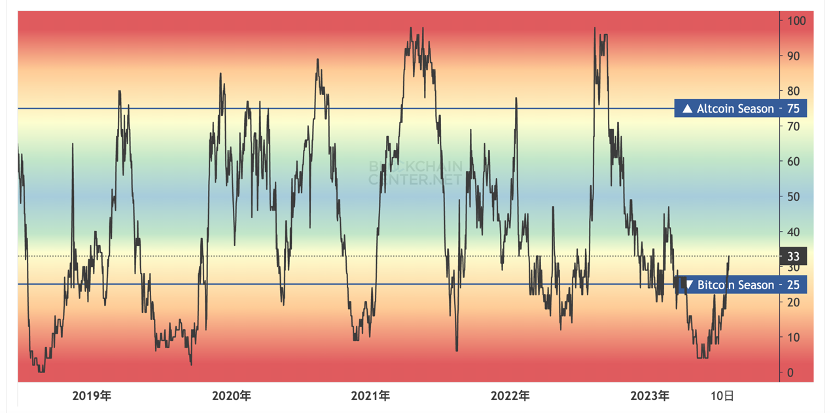

The market has been weakly oscillating this week, but with the Fed’s interest rate hike landing, it is expected that the short-term negative impact will be exhausted. BTC is still above the weekly line, relatively bullish, but the upward space is relatively limited. The altcoin index has seen more rebounds recently, and there may be an opportunity for a rebound in changing altcoins.

Disclaimer: All articles by Foresight Ventures are not investment advice. Investments involve risks, please assess your personal risk tolerance and make investment decisions cautiously.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The short-lived boom is hard to sustain, the second major crash after FTX is on its way.

- Bitcoin ETF Competition Coinbase Emerges as the Biggest Winner?

- Why will Ethereum dominate most of the RWA market?

- The Impact of Cryptocurrency Wealth on Family Consumption and Investment

- When the post-2000 generation who entered the circle in 2020 are called OG, reviewing the three cycles of the crypto industry in the past ten years.

- Bold Bitcoin Strategy by BlackRock Suggesting High Bitcoin Portfolio Allocation

- Huobi Research Institute’s latest research report | A comprehensive analysis of the current situation, risks, and future development of the cryptocurrency financial product market.