Taking history as a lesson, combining with the macro perspective before the next bull market arrives, we still need to go through a ‘FTX-style major collapse’.

Learning from history and considering the macro perspective, we must endure a FTX-style major collapse before the next bull market.Author: Ann Translation: jk, Odaily Planet Daily

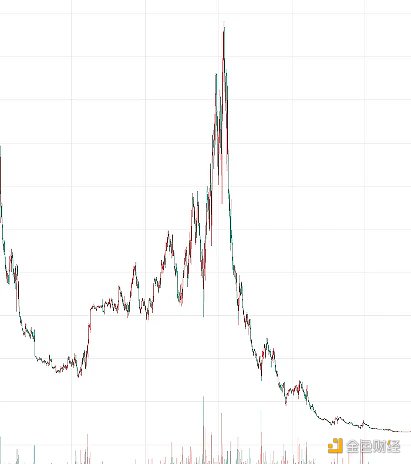

Bear markets usually experience a large-scale price drop, and their value remains at the bottom for a long time until it ends many years later. The previous market cycle (2018) went through such a situation, followed by the black swan event of 2020 – the macro market crash caused by the new crown. In November 2022, when FTX had problems and the price of Bitcoin reached $16,000, it experienced a similar 50% price plunge as in 2018. And we are about to face a second similar crash.

2018 = 2022, 2020 = ?

There are unsettling similarities between the market crashes of 2018 and 2022, which are more caused by the cryptocurrency industry itself rather than macroeconomic reasons. This is an obvious cryptocurrency event, not caused by the collapse of the entire market. Yes, there was a rate hike by the Federal Reserve before this crash, but the final blow was personally implemented by our Sam Bankman.

The crashes in 2018 and 2019 were the first “shocks” after reaching historical highs and the first low points.

- Weekly Selection | Worldcoin launches WLD token, sparking market discussions; zkSync ecosystem suffers heavy blow; Twitter homepage logo changed to X.

- Weekly Summary of the Cryptocurrency Market (7.22-7.28) Bitcoin Volatility, Altcoins Welcoming a Breathing Space?

- Liquidium The first NFT lending protocol in the Bitcoin ecosystem, a solution for ordinal inscription liquidity.

Market crash after the bull market from 2012 to 2019

Fourth quarter of 2022, FTX crash

After these two crashes, there was always a rebound that made people think “the market is back”, but in fact, before the bear market truly ends, there is usually a process of retesting.

In the previous bear market, this “retesting” was the market crash caused by the new crown. I believe we are now also facing a similar situation, waiting for the equivalent event of 2020.

For the second crash, I have noticed some characteristics:

-

Before the crash, there was a sentiment of rebound and “the market is back”. Not only did the prices rise, but developments such as institutions adopting (such as Blackstone Bitcoin ETF) were also in this atmosphere.

-

The seeds of the next bull market have already been planted. It was the “DeFi Summer” from 2019 to 2020. And now, any market similar to the DeFi summer is the “Infra Summer”. I believe restaking will play a huge role in it.

-

More importantly, unlike the first crash, the second crash is influenced by major macro events and is completely beyond the control of the cryptocurrency industry.

The rise of US stocks will stop

Regarding the last point, signs of those macro influences have emerged. In the past year, the Nasdaq index has shown vulnerability and recently had its worst performance since February. Interestingly, cryptocurrencies did not follow this rise, which may indicate that traders have more doubts about the “dead cat bounce” of Nasdaq.

This is like digital assets not believing in this rebound. It can be imagined that if the Nasdaq falls, the price of cryptocurrencies, which already have skeptical sentiment, will not have a good response.

Economic recessions often occur during interest rate cuts

In addition, interest rate hikes should have an effect. In the past, economic recessions did not occur when the Federal Reserve raised interest rates, but when they started cutting interest rates.

As shown in the following figure, the gray overlay layer marks the economic recessions, and it can be seen that they always occur during interest rate cuts. This is true whether it was in the 2008 financial crisis or the bursting of the dot-com bubble in 2000.

Source: https://www.macrotrends.net/2638/sp500-fed-funds-rate-comparison

Second quarter performance

We are also about to see the release of the financial reports for the second quarter of 2023, and it is expected that these reports will be disappointing as the post-pandemic prosperity has begun to fade.

The company is expected to announce its financial report this week. We can expect market volatility, while the price of Bitcoin has remained stable in recent weeks, indicating readiness. (In technical analysis, this indicates that the Bollinger Bands are contracting, which means a calm period before the storm.) This means that volatility is about to approach, although the price trend cannot be determined solely based on this indicator.

In addition to short-term reactions, this week’s financial reports may become the first domino in a larger macro event. We will soon find out.

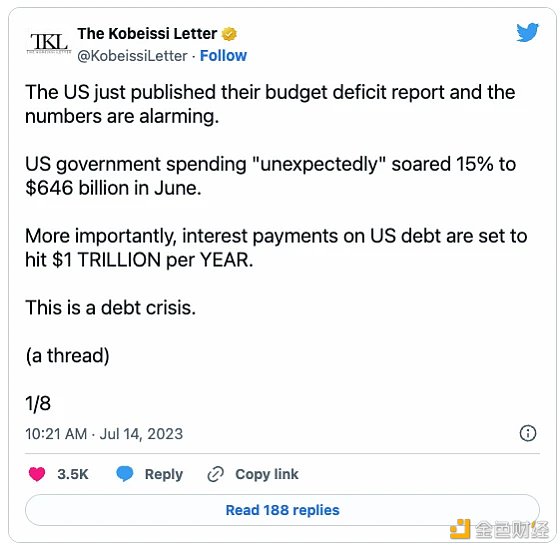

A debt crisis is emerging. Now, due to interest rate hikes, US interest payments have soared to $1 trillion. It is unclear how the government will pay for this huge expenditure without cutting spending in other areas, but it is worth paying attention to.

US government spending increased by 15% in June

How to prepare?

For all potential doomsday events, the more urgent question is how should we, as individual market participants, deal with potential volatility.

I have a few suggestions, among which the most important ones are:

1. Do not lose money by trading low-quality coins

What is different about this bear market is that we are still being inundated with garbage coins and inferior projects that were once popular. From trends like Azuki in 2022 to the recent frenzy over “memecoins”, the market has always been trying to scam your last bit of money.

Just as I am writing this article, another very dissatisfying project called “Worldcoin” has launched their token. If I were to list some of the recent popular scam projects on social media, I would include Rollbit, Hamster Coin (what are you thinking, people on social media!), and Arkham Intelligence Company on the fraud list for June to July 2023.

This seemingly endless attempt to make you give up your money seems relentless. Never fall into their trap.

2. Income-generating assets

I know you might think that even if Ethereum has a 5% return, it cannot offset the loss when digital assets plummet by 50%. But looking at the return alone is not enough. For me, the biggest benefit of “harvesting” my digital assets (I use the term “harvesting” broadly, covering various DeFi strategies that allow me to generate income) is that once the assets are securely stored in the DeFi vault, I become too lazy to intervene. For example, unlocking certain tokens may require a 7-day wait. It can help prevent panic selling during significant price drops.

It’s not so much about the return rate as it is about preventing shaky hands.

3. Observe the level of loans

Recently, as the price of Bitcoin rose to $20,000 and Ethereum rose to $2,000, some people started borrowing more boldly (using temporarily appreciating assets as collateral).

I’m not a fan of this practice. The market volatility over the past year is indeed not suitable for managing loans. The price fluctuations are too big and can make you sweat. Unless you enjoy this kind of excitement, I believe loans will only bring too much trouble, too much risk, and little return.

4. Relax… and watch the world burn

When I tweeted that I like bear markets, I wasn’t exaggerating at all. The recent ETHCC event held in Paris and all its associated activities showed that the crypto community is more vibrant than ever after the visitors left. Development work has not stopped, and there are more projects that can help you stay focused.

In addition, the chaos in the traditional financial sector seems worth watching. We will see how the old ways of traditional finance end their weaknesses, and if they collapse, crypto will rise as the new generation financial system. I suggest we all grab some popcorn and watch.

This may sound cold, but understand it as “relax, don’t worry too much”. The situation may get worse before it gets better. Human society has its own mysterious way of evolving, and this may be just one of the processes.

Most importantly, hold onto your money and survive.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Unveiling Satoshi Nakamoto Has the creator of Bitcoin been right under our noses?

- Arthur Hayes DAO is the company of the AI era, and DEX is the financial market of the AI era.

- The short-lived boom is hard to sustain, the second major crash after FTX is on its way.

- Bitcoin ETF Competition Coinbase Emerges as the Biggest Winner?

- Why will Ethereum dominate most of the RWA market?

- The Impact of Cryptocurrency Wealth on Family Consumption and Investment

- When the post-2000 generation who entered the circle in 2020 are called OG, reviewing the three cycles of the crypto industry in the past ten years.