Global blockchain investment trend report for 2019

Due to the plunge in bitcoin and Ethereum prices, many projects failed and closed, and 2018 was the clearing year for the blockchain. But in 2019, it showed signs of a rebound. We look at major investment trends and possible new starting points for the blockchain industry from a data-driven perspective.

In 2008, during the peak of the Great Recession, Bitcoin's anonymous creator, Satoshi Nakamoto, proposed "a virtual cash that allows online payments to be transferred point-to-point." One year later, the first bitcoin block was dig it out.

To date: the blockchain industry has experienced several hype cycles.

A new wave of speculation in December 2017 brought the price of Bitcoin to a peak of nearly $20,000. At the same time, the unprecedented ICO boom means that blockchain startups have received a lot of money. Even traditional VCs suddenly turned to token sales and poured their enthusiasm.

- Depth | How digital currency changes financial ecology

- Read all the G7's regulatory response to Libra

- The value of BTC holdings in this country may exceed the gold reserve

Then 2018 proved to be a year of liquidation. The prices of Bitcoin and Ethereum quickly fell back in a few months. Many items have unexpected or closed.

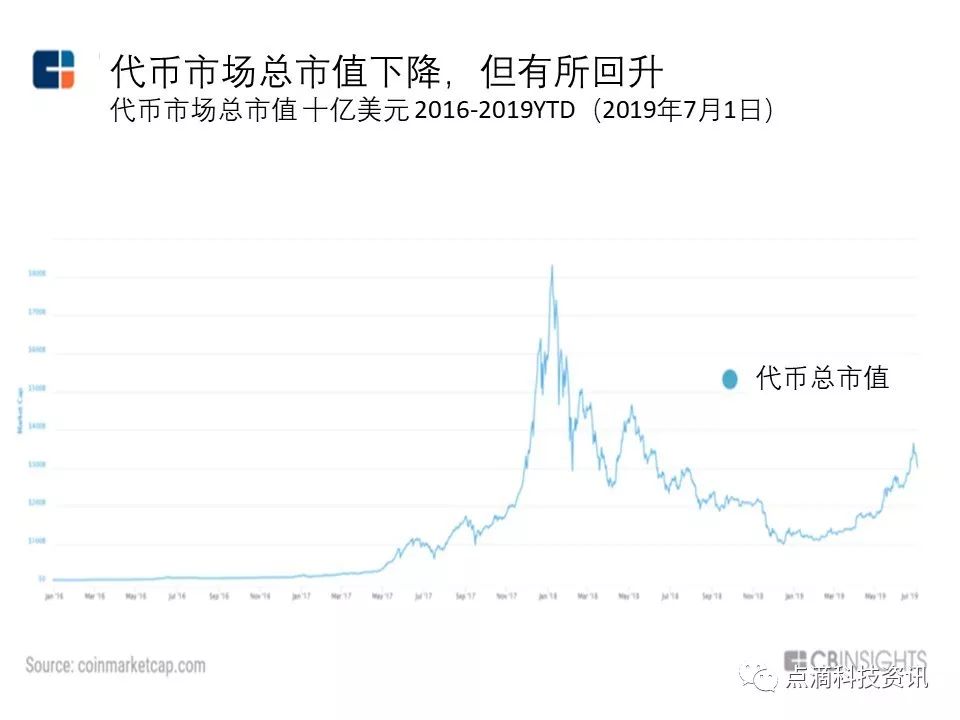

But so far, in 2019, the blockchain industry has rebounded. Since January 2019, the total market value of encrypted digital currencies has doubled (although it still only accounts for about a third of its peak). At the same time, the Wall Street Journal announced that “the ICO market has died” as the US Securities and Exchange Commission takes a more radical stance on token products.

So where do the blockchain industry start?

Analyzing the investment trends of venture capital, large companies and initial token financing through a data-driven approach, this report explores how various forces have shaped the current blockchain industry development landscape and provided some insights into the near future of the industry. .

Report highlights

table of Contents

Venture capital and equity investment trends

· VC financing trends

· Large business investment

· VC investor trends

· A well-funded company

ICO and token market development status

· ICO and direct encryption of digital asset investments

Looking to the future

· Newly discovered optimism

Venture capital and equity investment

· Venture capital investment in the blockchain industry fell sharply in 2019 . According to the current investment situation, there will be only 454 transactions worth $1.6 billion in 2019, which is a significant drop from the $4.1 billion invested in blockchain last year.

· Large enterprise participation is declining dramatically.

· More and more equity investments are mainly invested in early start-ups , indicating that the field is not yet mature.

· Digital Currency Group, Boost VC and Blockchain Capital have been at the forefront of blockchain investments over the past five years.

Development status of ICOS and token market

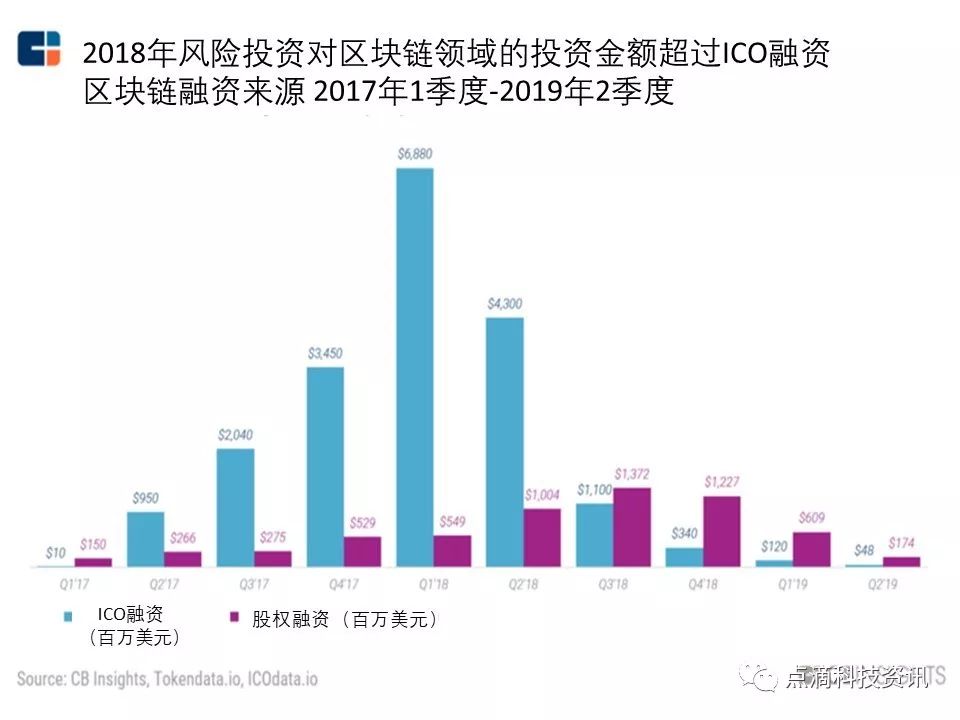

· The initial token sale financing ( ICO ) has died and has been exceeded by VC investment for four consecutive quarters . Although both types of financing are declining, the amount of VC investment has exceeded the scale of ICO financing.

· However, speculation and overall market confidence seem to have rebounded . The market value of tokens and encrypted digital currencies indicates a renewed interest in the industry after the market crash.

Looking to the future

· The market is highly uncertain, but there will still be new developments – such as Facebook's Libra coin – bringing a second wave of development to the blockchain industry. Mike Novogratz, founder of Galaxy Digital, an encrypted digital currency hedge fund, said big companies' new interest in the Libra project is the main catalyst for recent price spikes. A well-known economist recently said that encrypted digital currencies would be “universally accepted”. However, the funds that startups receive from large companies are still falling.

· Even if financing is reduced, the interest shown by big companies may be a good sign for blockchain startups. Blockchain expertise is rarely found internally and will grow as the industry continues to grow.

Venture capital and equity investment trends

Venture capital changes over time. Venture capital firms first support companies that explore Bitcoin as a currency and then focus on private blockchain providers that serve financial services and other vertical industries. Today they are investing in the token economy.

The continuing challenges facing the blockchain industry include cryptocurrency price volatility and regulatory setbacks – such as the US Securities and Exchange Commission's lawsuit against Kik, and the strict BitLicense in New York – and the expansion of trading speeds (which in particular hinder Bitcoin and The development of Ethereum).

Venture capital investment trend

With the end of the second quarter of 2019, we are expected to see a $1.6 billion investment in 454 transactions this year, which will be a significant drop from last year's blockchain investment of $4.1 billion.

However, the equity investment in 2019 may exceed the sum of 2017, when the number of companies decreased, and there is no bubble fever to promote private transactions.

Note: The blockchain transactions included here are traditional equity financing and may omit token financing.

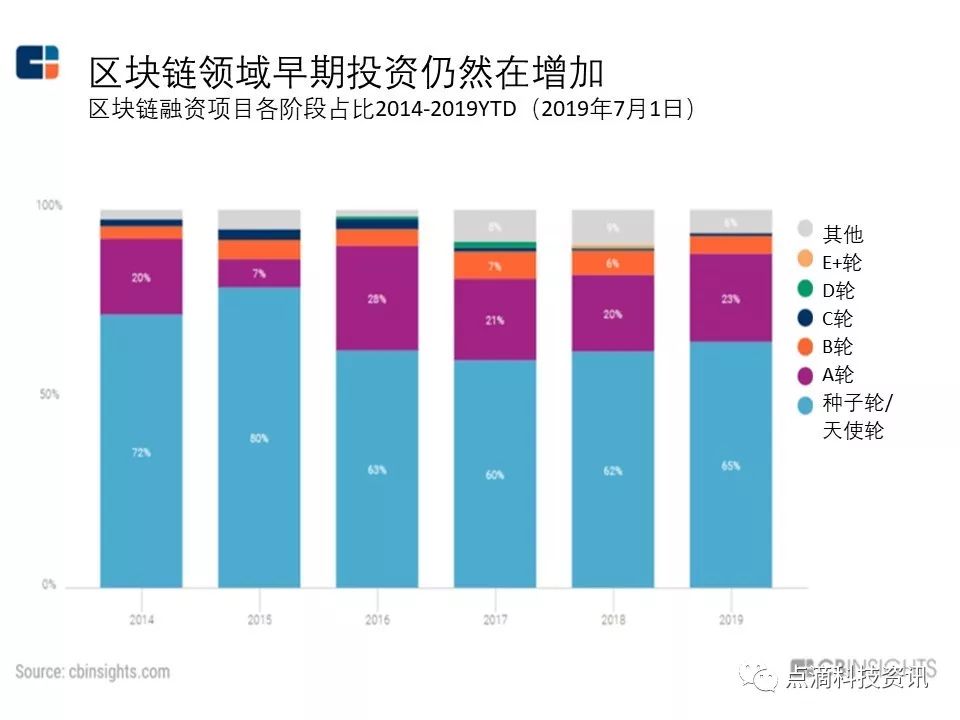

Further analysis of the various stages of the transaction, the traditional equity investment in the blockchain industry is increasingly turning to early start-ups, seed round / angel round and A round of equity trading jumped from 80% in 2017 to 88% in 2019.

At the same time, the proportion of medium-term transactions (B and C) remained relatively consistent, while late transactions (D and later) were barely visible.

The growing share of early trading suggests that blockchain is still a very emerging technology area. When the emerging technology sector matures, the A and B rounds of financing usually occupy a place in the total transaction. But so far, there is no indication that this has happened.

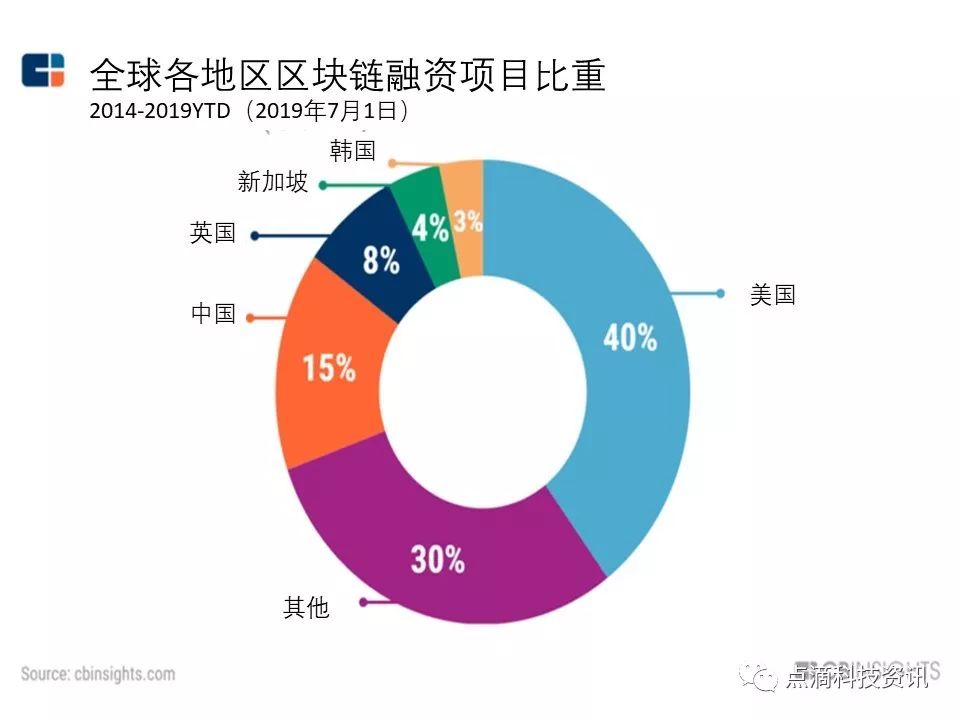

Finally, in terms of geographic location, 40% of equity financing in the blockchain sector occurs in the United States. Then there are China (15%), the United Kingdom (8%), Singapore (4%) and South Korea (3%). It turns out that Asia has become a hot spot for startups, and China is home to several of the world's most financed blockchain companies (more on this below).

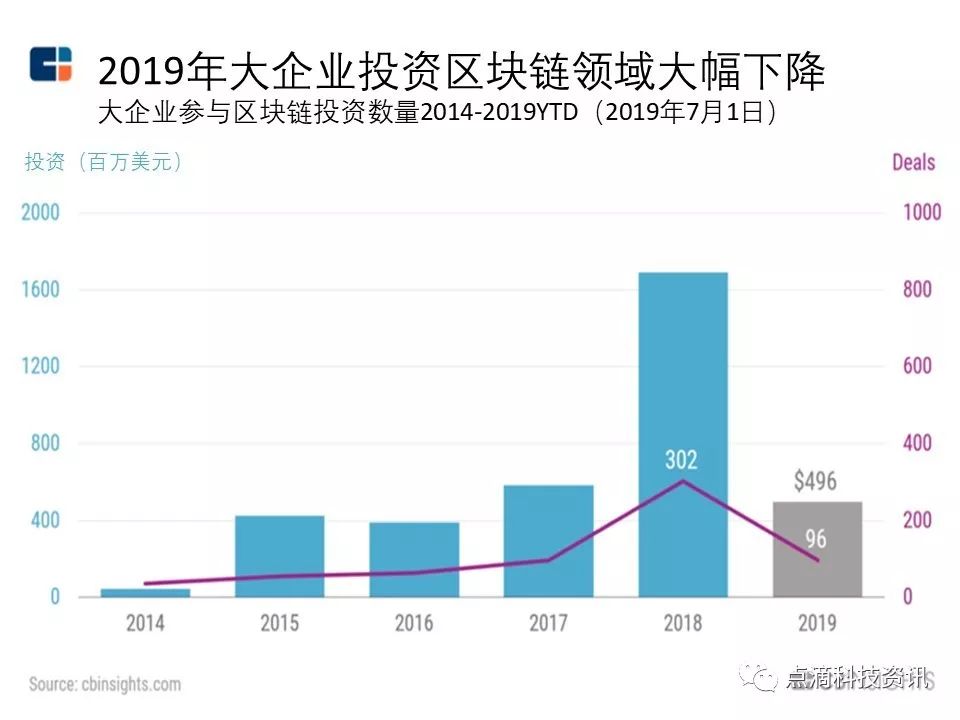

Large enterprise investment

The participation of large companies in the blockchain sector has declined significantly. So far, there have been only 96 large company investment cases in 2019. According to the current situation, the number of large companies will be 36% lower than the 302 transactions in 2018.

Venture capital investment trend

Reflecting the propensity to fund, the institutions on the list of many of the most active investors are early investors who are friendly to the blockchain. At the forefront of the most active investment institutions are institutions that invest only in encrypted digital currencies, such as Digital Currency Group, Pantera and Polychain, leading edge technology accelerators (Boost VC ranked 2nd), and venture capital firms with professional blockchain practices ( A16z).

At the top of the list is the DigitalCurrency Group, which invested in blockchain early on. So far the company has invested in four companies in 2019, including $Figure $25 million in Series B financing. Other investment transactions include Livepeer, DEFI supplier Staked and Encrypted Digital Currency Futures Exchange CoinFLEX.

BoostVC, a leading edge technology accelerator led by Adam Draper, has invested in nearly 50 blockchain companies over the past five years. Recent investments include the decentralized DNS service UnstoppableDomains, which predicts the market Guesser and Swiss financial technology company Amun.

BlockchainCapital is also one of the earliest blockchain venture capital firms, ranking third.

Many Chinese blockchain investors have poured into this field. For example, distributed capital has invested in more blockchain companies over the past five years, surpassing industry giants like Pantera and Polychain.

Note: The blockchain transactions included here are traditional venture capital investments.

There is an interesting name here for the mining giant Bitland, which is the second-largest funded blockchain company (China's largest company), behind Coinbase, raising $450 million. Bitcoin has been planning to go public on the Hong Kong Stock Exchange in 2019, but reports of difficulties and losses due to reduced demand have led to an extension of its IPO application.

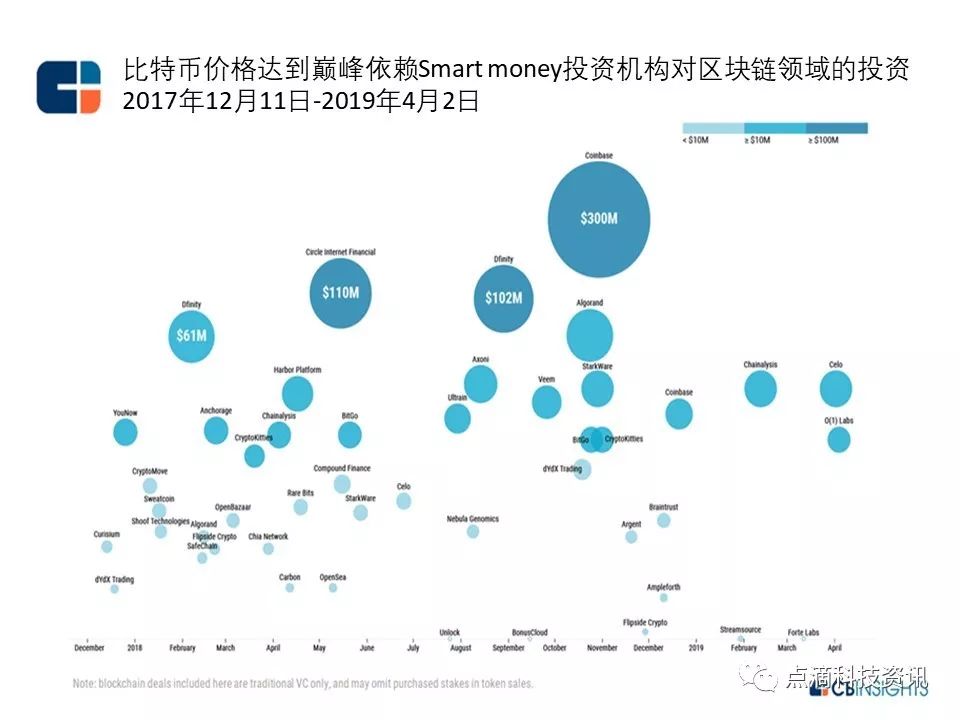

Prior to this, we studied smart VC institutions investing in blockchain and found that many top investors still bet on the “encrypted digital currency winter” of 2018.

Well-funded company

Look at the most funded companies in this sector, many of which are exchanges or companies that provide infrastructure technology.

The company with the most funding is Coinbase, which finally raised $300 million in the E round in October 2018. The Chinese mining company Bentland raised funds of $450 million. In third place is TZero, the encrypted digital currency division of Overstock.com, which specializes in distributed ledger technology for financial technology purposes. tZero raised $324 million in private equity from GSR Capital.

Also noteworthy is Bakkt, an encrypted digital currency exchange supported by ICE (the parent company of the New York Stock Exchange). The company is awaiting a license from CFTC to trade Bitcoin futures and was recently approved by LedgerX.

Many of the most funded companies raised significant funds in 2018, including Circle's $110 million E-round (General Catalyst) and Dfinity's $102 million financing (Andreessen Horowitz).

ICO and token market development status

Since the introduction of Bitcoin, the blockchain field has been operating outside of traditional finance. Bitcoin is still self-service and is completely peer-to-peer. Similarly, the ICO boom has raised billions of dollars for blockchain projects through token sales, bypassing venture capital and crowdfunding sites altogether (read further here).

Interestingly, the current trend has changed: the amount of VC investment accounts for a large proportion, exceeding the amount of ICO financing, marking the end of the ICO era.

ICO and direct encryption digital currency investment

Since the third quarter of 2018, traditional equity financing has exceeded the ICO financing scale every quarter. Since ICO has almost died, equity financing has received much more money than ICO in 2019. However, it is worth noting that both ICO and venture capital funds are seriously declining, while the second quarter of 2019 is the lowest total amount since the beginning of 2017.

However, given the recent surge in the market value of encrypted digital currencies, it seems unlikely that the field will die. Traditional venture capital is now seen as a special signal of quality, especially from smart money investing institutions.

In the world of tokens and encrypted digital currencies, confidence is rebuilding and more money is entering the asset sector.

Looking to the future

In 2019, the blockchain has its uncertainties, but there is also the possibility of cautious optimism.

Yes, the ICO era is nearing completion. The amount of venture capital also fell from its peak period. The market value of tokens and cryptocurrencies is only a small fraction of the market value of the peak.

But encrypted digital currencies like Bitcoin and Ethereum have seen speculation and volume surges in recent months. The recent moves by major companies such as Facebook, JPMorgan Chase and Visa indicate that big companies are gradually renewing their interest in the blockchain industry.

Newly discovered optimism

The recent enthusiasm is most likely due to Facebook's plans to launch libra stable coins. The project aims to be closer to Venmo than a new bitcoin designed to provide a stable currency for customers with no bank accounts worldwide.

Facebook has attracted an impressive array of supporters for the Libra project, with partners from payments, shared car rental, e-commerce, venture capital and blockchain startups.

In terms of payment, the company received support from Visa and MasterCard and other well-known companies. Smart money investment institutions in the blockchain sector, such as USV and Andreessen Horowitz, are supporters. Major telecommunications companies Iliad and Vodaphone are also involved, both from Europe.

Xapo, which only supports Bitcoin, is also involved in the project, as well as the well-funded startups in the field of encrypted digital currency, Coinbase, Anchorage and BisonTrails.

Well-known technology companies such as Stripe, PayPal, Lyft, Uber and Spotify have also joined.

The project seems to have encountered some legal obstacles and regulatory review (including the president's negative tweets), but this well-known company is interested in the huge support for the blockchain industry.

Mike Novogratz, founder of Galaxy Digital, an encrypted digital currency hedge fund, said Facebook's plan is part of the recent rise in bitcoin: "Investors" are excited about Facebook. They are happy because Uber and Mastercard and Visa say "we want to participate in the world of encrypted digital currency." He added that the entire project "completely legitimizes the idea of encrypting digital currencies."

In addition, Bloomberg's Taylor Cowan recently emerged from many high-profile economists and wrote that “encrypted digital currency (possibly) is generally accepted.” Cowen believes that encrypted digital currency is a politically unstable region, and trade war is turbulent. And the future wealth tax provides a safe asset.

For all these reasons and more, the blockchain industry seems to have ushered in a second wave of development.

This may be good news for startups. Because the blockchain industry is highly technical, startups can help large companies and institutions enter the field. The concept of blockchain is only 10 years old. When companies decide to “build and acquire”, they may be more inclined to acquire.

Whether this newly discovered optimism will translate into a significant rebound in venture capital is something that deserves attention in 2019.

Source: CB Insights

Report Translation: Director of the Financial Research Office of Liu Bin China (Shanghai) Free Trade Zone Research Institute (Pudong Reform Institute)

Cooperative translation: Zhao Yunde

Source: Drip Technology Information (Public Number)

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Market Analysis: There are more uncertain events. At this time, radicalism is no different from thunder.

- Babbitt Depth | Xing Shi asked "the most" OTC, the old money entered the crisis

- How to distinguish between currency currency and fund tray?

- Blockchain engineering: one of the most overlooked places in the industry

- Criticize Bitcoin Guide

- IMF's latest report: E-money is in the upper position, the synthetic version of the "Central Bank Digital Currency" is welcoming the dawn

- Will Libra bring the next Bretton Woods system?