IMF's latest report: E-money is in the upper position, the synthetic version of the "Central Bank Digital Currency" is welcoming the dawn

Allowing eligible payment institutions (here equivalent to e-money providers) to open a reserve account in the central bank like a commercial bank is nothing new. India, Hong Kong, and Switzerland have allowed non-bank technology companies to hold central bank reserves. The People's Bank of China has gone further. Starting from January 14, 2019, 100% of the payment agency's reserve funds are concentrated in the People's Bank of China.

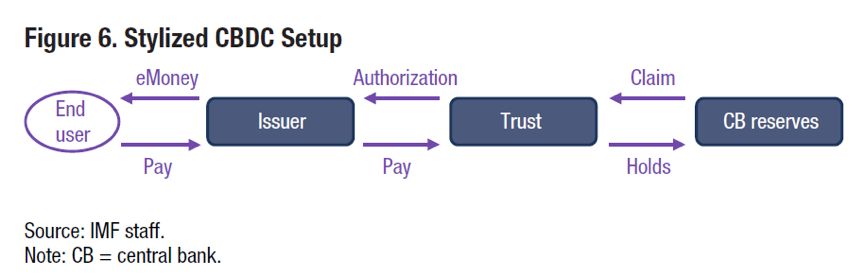

Allowing e-money providers to open a reserve account at the central bank is a way to create a central bank digital currency! If the e-money provider can hold and reserve reserves in the central bank reserve and e-money is issued at a 1:1 reserve rate, then this is essentially CBDC.

Alipay, WeChat Pay, Libra, M-Pesa, Paxos, Stablecoins, Swish, Zelle… Various payment instruments are emerging all over the world. While increasing the convenience of payment, it also attracts the deep concern of policy makers. Are they money? Is this important? How do we know the currencies that define these new digital forms? Will they benefit from rapid promotion? If so, what impact do they have on the commercial banking sector? How will central banks respond? Will the central bank benefit from these rapid developments, or is there just one more business that needs regulation?

- Will Libra bring the next Bretton Woods system?

- “Don’t be used by Facebook”, the four major consumer protection organizations urge members of the Libra Association to withdraw

- Psychological analysis of cryptocurrency investment, how many of you?

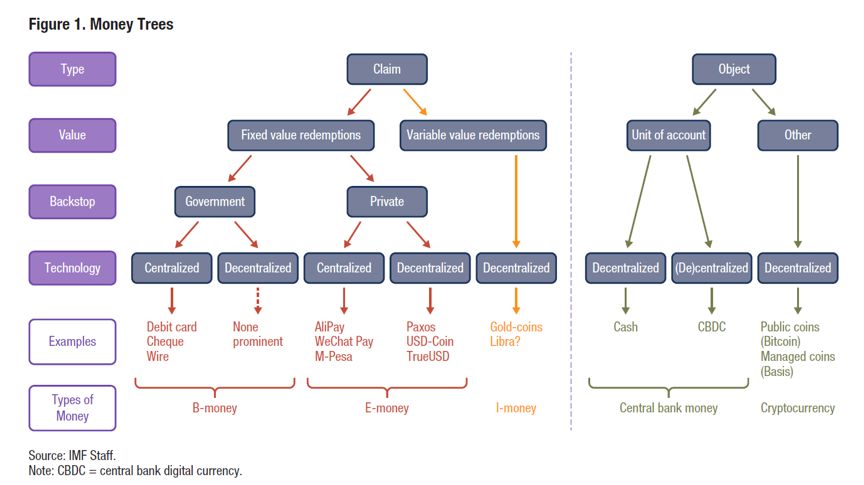

In order to answer the above questions, on July 15, 2019, the IMF released a special report "The Rise of Digital Money". The report first proposed a digital currency classification framework, and classified its advantages and potential risks, and considered its significance; Then it focuses on the possible impact of e-money on the commercial banking sector. I envision the three situations that b-money and e-money may exist in the future, supplementing, coexisting and replacing. Finally, considering the impact of e-money on the central bank, I boldly envisaged The possibility of the central bank cooperating with e-money providers to issue CBDC (central digital currency). It is worth mentioning that Libra, which has recently attracted widespread attention, is classified as i-money (investment money), which is considered to be a secured, redeemable currency, which is essentially a private investment. The share of the fund.

The original text of the report is long and divided into 4 parts and a total of 20 pages. This article will organize the main contents of the report to be streamlined for friends to think about.

Part 1: Digital Currency Classification Tree

The first part of the report reviews the differences in the models of various payment instruments. For the first time, a simple framework for categorizing various payment instruments is the most exciting and most intriguing aspect of the report. In order to better understand the new payment technology, the report does not discuss the strict definition of currency in the economic sense, but borrows the term currency itself to facilitate expression. The report refers to the new payment method as a new digital form of money (New Digital Forms of Money), so the digital currency in the context of the report refers to different types of payment methods.

The report classifies the digital currency according to four attributes. The four attributes are clear in hierarchy, from top to bottom, gradually diverging, forming a "reverse digital currency classification tree."

The first attribute is a type, that is, according to the presence or absence of collateral, it is divided into two types, Claim and Object. This paper translates it into a credit-type currency and a property-based currency.

The second attribute is value. For a credit-type currency, the key is whether it can be redeemed at the specified par value, that is, whether the value of the collateral is stable. If it is paid at a fixed face price, that is, the value of the collateral is stable, it is similar to a bond instrument (the interest may or may not be); if it is dealt with at a floating price, that is, the value of the collateral is unstable, it is similar to an equity instrument. For property rights currencies, no collateral is involved. A similar problem is their denomination. The legal currency is denominated in the currency units of each sovereign country. The gold in ancient times is denominated in its weight unit.

The third attribute is the supporter. This attribute is only for bond-type currencies that can be redeemed at a fixed face value, ie who can guarantee redemption at face value, government agencies or private businesses? This distinction is important and relates to consumer trust and regulatory attitudes.

The fourth attribute is technology, that is, whether the settlement method is decentralized or centralized. The centralized settlement method is settled by a dedicated central server. The decentralized settlement method uses distributed ledger technology or blockchain technology to settle on several servers. These servers can be designated small nodes (links chain) or open to the public ( Public chain). Decentralized settlement is relatively easy to cross national borders.

Five digital currencies

According to the four attributes, existing payment methods can be divided into five categories: central bank currency, cryptocurrency, b-money, e-money, and i-money. B-money is issued by the bank, e-money is issued by the private sector, and i-money is the abbreviation of investment money, issued by private equity funds.

The most common central bank currency is the daily use of banknotes and coins, which are issued by the central bank and are settled directly between the parties in a decentralized manner. The central bank currency, which is currently widely discussed, is referred to as the Central Bank Digital Currency (CBDC). CBDC does not have the anonymity of cash transactions. Its verification technology can be decentralized or centralized, and can provide interest. Mancini-Griffoli and others (2018) provide a detailed report on the design and significance of the central bank's digital currency.

Casting Light on Central Bank Digital Currency

https://www.imf.org/en/search#q=Casting%20Light%20on%20Central%20Bank%20Digital%20Currency&sort=relevancy

Another property type currency is the cryptocurrency. The cryptocurrency has its own currency unit, which is not issued by the bank and is issued directly on the blockchain. The cryptocurrency can be divided into a management currency (also known as an algorithmic stable currency) and a public currency depending on whether an algorithm is used to maintain the exchange rate stability of the currency relative to the legal currency. Although Basis proposed this model, the algorithm stable currency still lacks market testing. The most typical public currency is Bitcoin and Ethereum.

The most common creditor currency is b-money, such as deposits from commercial banks. In most countries, most of the daily payments are made through the transfer of funds between commercial bank accounts. This process may involve different accounts within the same bank, different interbank accounts, multinational bank accounts, usually centralized settlement methods, such as credit cards. , wire transfer, check, etc. The biggest feature of B-money is that the government guarantees its redemption. Commercial banks are strictly regulated and must maintain sufficient liquidity. When there is a liquidity crisis, the central bank will provide overnight loans or take urgent measures in the event of systemic risks. Most countries offer a certain amount of deposit insurance, so consumers don't have to worry about redemption.

E-money is becoming a strong contender in the payments arena. Compared to cryptocurrencies, E-money's biggest innovation is that it can be redeemed according to the value of the face currency. What distinguishes it from b-money is that the government does not guarantee redemption, and its security depends on the prudent management and legal protection of the private sector. If a commercial bank issues currency and does not enjoy deposit insurance, then this is also an e-money. The report believes that JPMcoin is an e-money. The settlement method can be centralized, such as China Alipay and WeChat payment, India's Paytm, M-Pesa in Eastern Africa, or blockchain-based, such as Gemini, Paxos, TrueUSD, and USD Coin (full report) Neither mentions USDT).

Libra is an I-money

I-money is a potential new payment method that may or may not succeed. I-money and e-money are almost identical except for the significant difference in currency exchange at variable prices. Similar to stock instruments, I-money has claims for assets, which are usually commodities such as gold, or a share of the portfolio. Examples of gold as a reserve are DSG and Novem. Whether I-money is a currency is currently controversial. The report believes that if the assets behind it are widely accepted, safe, and sufficiently liquid assets, they should be called a currency.

Private equity funds can provide relatively safe and liquid investment tools that allow clients to initiate payments, such as money funds or transactional open-ended index funds. Such funds have been growing rapidly, but have not been a universal payment tool. Private equity investment shares need to be a payment tool that relies on mortgages or low-cost fast exchange of legal currency, which increases the difficulty of becoming a payment instrument.

However, it is now possible to tokenize the share of private equity funds. One coin represents a certain amount of shares, and the currency can be traded quickly and at low cost. This is I-money. The price of the currency depends on the valuation of the assets behind it. If the currency is liquid, the market price of the asset is transparent. If the asset is secure enough, the consumer will choose to hold i-money to purchase goods or services. In other words, I-money can be stable enough to make it a payment method. However, this i-money transaction requires the transfer of ownership of asset securities behind it, which is subject to strict regulation, thereby limiting cross-border transactions.

Facebook and Libral Foundation members announced that Libra will be issued as an i-money, which is secured by a portfolio of bank deposit vouchers and government short-term bonds. Libra can be converted into legal currency at any time according to the market value of the corresponding portfolio share, but the price is not guaranteed. The report believes that Libra's transaction is essentially a transfer of Libra's reserve share and can be a means of payment.

Part II: The great future of E-money

The second part analyzes the advantages and potential risks of E-money in detail, and discusses the stability of its value. The final conclusion is that E-money will be rapidly popularized as a payment method due to the advantages of network effect and online integration. bright prospect. Although this section discusses e-money, many of the conclusions apply equally to i-money.

Value stability

As a payment instrument, whether it is property-based or debt-based, a necessary condition is to maintain a stable value relative to a generally accepted currency. Only in this way, consumers can easily agree on the transaction price and are willing to hold the currency. The question is, to what extent a payment instrument is stable, or to what extent price fluctuations are acceptable to consumers. If it is unstable, its ease of use can make up for this deficiency and make it still widely used.

The report only considers the stability of nominal prices and does not consider inflation. According to the first part classification, cryptocurrency is divided into public currency and management currency. Public currency is similar to floating exchange rate system, such as bitcoin. The price fluctuation is very large and cannot be stable. The management currency is similar to peg management. The exchange rate system, the practice effect of this exchange rate system in some countries is not ideal.

Under the modern legal currency system, the central bank's currency cannot be exchanged for gold. It corresponds to the national debt on the central bank's balance sheet. That is to say, the solvency of the sovereign state is guaranteed by the legal value. There is no doubt that the nominal value of the French currency is the most stable. If a country’s fiscal system is not sound and the currency is over-extended, the currency will actually depreciate. In the credit currency, the risk of I-money depends on the risk of the mortgaged asset, b-money is guaranteed by the government, the stability is the best, and the stability of e-money is average.

4 major risks

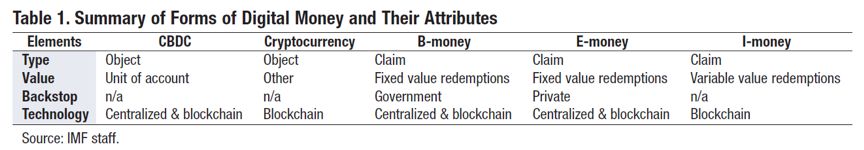

E-money is issued by private businesses and is not guaranteed by the government. There are usually four potential risks:

(1) Liquidity risk, that is, there is no guarantee that it will be paid on time.

(2) Default risk, that is, the electronic money provider illegally uses the client's funds to engage in high-risk investments or use customer funds to make up for losses in other businesses, resulting in failure to pay.

(3) Market risk, that is, the price of mortgage assets plummeted, and e-money providers experienced difficulties in redemption.

(4) Exchange rate risk, that is, if the mortgaged asset contains assets denominated in foreign currency, the value of the collateral is affected by exchange rate fluctuations, such as Libra.

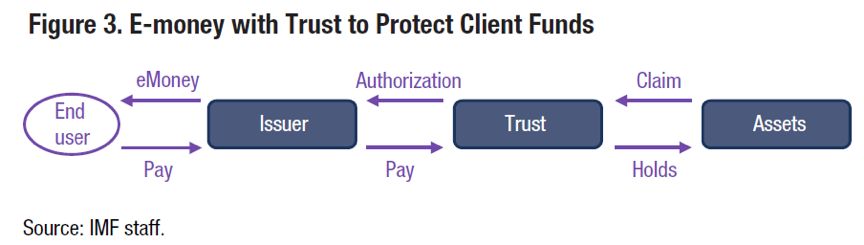

In order to solve the above risks, e-money can adopt a system similar to the currency board to embrace transparency. Specifically, first, hold safe and liquid assets, such as short-term government bonds, and even hold central bank reserves where possible. Second, keep the issuing power of the currency, but don't overdo it. Third, holding assets must be managed to ensure that they are not misappropriated. Fourth, e-money providers must have sufficient self-owned capital to increase their ability to resist risks. In reality, e-money providers usually hold bank deposits, but because of their wholesaler status, their funds are not protected by deposit insurance, and there is also the possibility of default. In order to solve this problem, the design of the trust is usually introduced.

6 advantages

On the other hand, e-money has at least six advantages:

(1) Convenience, payment function is better integrated in digital life, and the technology companies that issue it know that user-centered design of e-money.

(2) Universality, cross-border payments have become easier.

(3) Complementarity. If it is distributed on an interactive blockchain, automatic and seamless payment can be realized, avoiding manual background operations and greatly improving efficiency. The open source community can provide suggestions and source code to help develop more features.

(4) Low transaction costs, almost zero-cost transactions.

(5) Trustworthy, in some countries, technology giants are more trusted by consumers than local banks.

(6) Network effect, the network value increases as the user increases.

If the top five advantages are the fire of the stars, then the network effect is to help e-money burn the spring of the global payment market. E-money can be integrated into social software, and if someone else uses it to pay, the word-of-mouth network effect will soon be promoted. Also, don't forget the fun of e-money payments, which can be combined with emoticons, text messages, pictures, etc., making consumers more willing to pay for them.

After analyzing the potential risks and advantages of e-money, the report believes that due to the strong addition of network effects, more knowledgeable technology companies will quickly push e-money or i-money to the world, making it an important payment. means.

Part III: E-money has come in the future

The third part first discusses the risks and regulatory responses of the popularity of e-money.

The risk of bank disintermediation exists and needs to be taken seriously, and the existing regulatory framework should be revised and strengthened accordingly. A regulatory principle is regulated by the type of business and the nature of the risk. For example, if a technology company provides banking services, it should receive supervision from similar banks; if it provides agency services, it should also receive corresponding supervision. Similar to CNAV (constant net asset value), E-money has the risk of impacting consumer protection and financial stability. In addition to this, there are four risks:

(1) Market monopoly. The E-money industry is a natural monopoly industry due to the existence of network effects and the need for large amounts of fixed capital investment in the early stage. The monopolist will hinder newcomers from coming in, drawing rents and maintaining a competitive advantage.

(2) Data privacy. E-money providers will have consumers' massive payment data to guess user behavior, and even they can combine other types of data to analyze user behavior in all aspects, such as social data, traffic data, and so on.

(3) Transmission of monetary policy. In countries with high inflation, the national currency unit may be replaced by foreign E-money, such as the dollarization of some African countries, and eventually the central bank will lose control of monetary policy.

(4) Financial integrity. Blockchain-based decentralization technology makes regulation such as anti-money laundering and counter-terrorism financing difficult. In understanding users, monitoring and reporting suspicious transactions, global entities need to work together to avoid regulatory arbitrage and regulatory dilution.

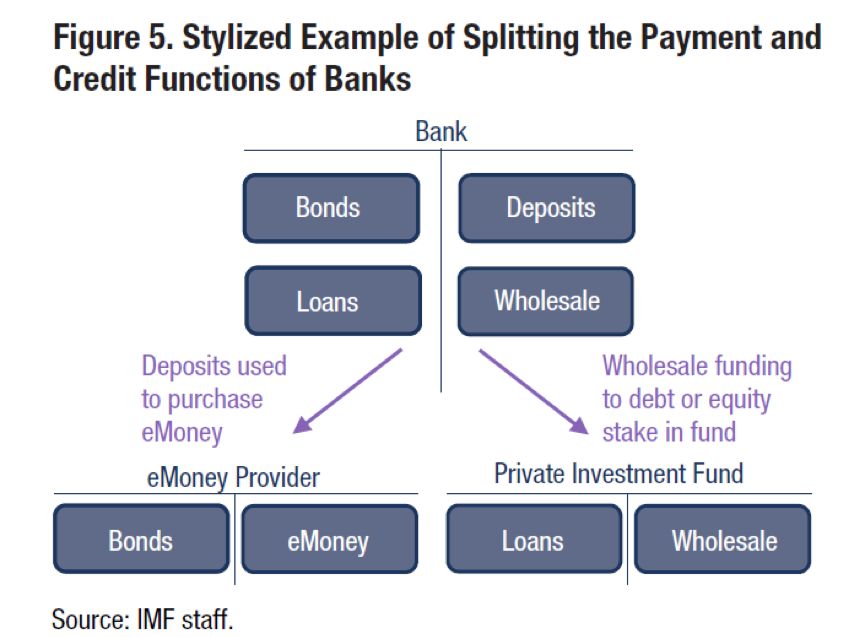

Today's most common forms of currency (banknotes and bank deposits) will face a fierce competition with e-money and may even be replaced by e-money. The third part of the report focuses on the possible impact of the popularity of e-money on the banking industry and envisages three possible scenarios: one is that electronic money is a supplement to banks; the other is that electronic money is a substitute for banks, but banks have The ability to compete for deposits; the other is that after a large outflow of deposits, banks are converted into private investment funds.

coexist

In the first case, e-money and b-money coexist and competition will continue. The banking sector's comparative advantage is that it has a large user base and a wide range of outlets, providing a variety of cross-cutting financial services, such as providing credit cards and overdrafts to help consumers prepay.

As mentioned earlier, the e-money provider has the advantage of providing better user-centric services and the convenience of network effects. The situation at this stage is shown in Figure 4. Consumers' purchase of e-money for retail funds leads to a large outflow of bank deposits, while e-money providers use customer reserve funds to purchase bank deposit certificates or other short-term products.

The bank’s losses are three. First, the source of funds has changed from the cheap and stable retail funds of retail investors to the expensive and volatile wholesale funds of e-money providers. Second, it has cut off contact with users and lost valuable data. Third, wholesale funds will be concentrated in a few large banks, and small banks will face greater pressure on storage. The report pointed out that in order to deal with the unfavorable situation, banks have three ways: to raise interest rates, improve services, and find other sources of funding.

supplement

The second scenario is that the e-money provider complements the banking sector and the two work together. This has happened in some low-income countries, such as the rapid increase in credit volume in the years following the use of e-money in Kenya. The traditional financial facilities in these countries are weak, and e-money providers are using new technology to make many people who are unable to enjoy financial services enter the financial system. They can have financial accounts, buy e-money, use express payment, and apply for loans. Wait.

Even in some developed countries, the relationship between e-money providers and the banking sector exists. E-money providers can use big data to portray their users and provide credit reports to the banking department to help banks improve their mortgage efficiency. At the same time, some large e-money providers may further develop their banking business, which may lead to the extinction of some existing banking brands, but the banking model itself will not disappear.

Replace

The third scenario is the fundamental transformation of the banking model. Banks rely mainly on wholesale financing, and credit is completely left to the market as an intermediary. The report believes that the possibility of this situation is the lowest, but it must be considered.

As shown in Figure 5, in this case, the commercial bank's fund-raising deposit and credit functions will be opened, people will deposit the funds for payment in the e-money provider's account, and the e-money provider will use the funds. Buy government bonds or hold central bank reserves; deposit funds for savings in mutual funds, hedge funds, and capital markets, which in turn use funds for credit allocation, or wholesale financing may remain in the banking sector.

Banks are under pressure from e-money to provide better services or similar products to meet the challenges. In any case, policymakers should be prepared for some disruption in the banking industry. Perhaps in the future, newcomers who break into the payments arena will eventually become banks and target lending based on mastery of big data. According to the report, in this sense, the banking model itself is unlikely to disappear.

Part IV: The top of e-money and the dawn of sCBDC

The fourth part discusses the risks and benefits that allow e-money to hold the central bank's reserves. It is pointed out that the sCBDC model is a lower cost and less risky than the central bank's development of CBDC.

E-money upper position

Under the modern central bank system, commercial banks need to open a reserve account in the central bank for settlement between banks. The bank adopts a partial reserve system, that is, the bank does not need to leave all the deposits as reserves in the vault or deposit it in the central bank. It only needs to pay the reserve according to the statutory reserve rate. The statutory reserve rate is the minimum reserve maintained by the central bank. The ratio of deposits.

Allowing eligible payment institutions (here equivalent to e-money providers) to open a reserve account in the central bank like a commercial bank is nothing new. India, Hong Kong, and Switzerland have allowed non-bank technology companies to hold central bank reserves. The People's Bank of China has gone further. Starting from January 14, 2019, 100% of the payment agency's reserve funds are concentrated in the People's Bank of China. Allowing e-money providers to hold central bank reserves helps them eliminate liquidity risk and redemption risk, making it a narrower bank. The reason why it is a narrow bank is that e-money providers are required to issue e-money at a 100% reserve rate and cannot carry out credit business, so it is only a payment tool.

Five benefits

(1) Ensure that the e-money value is stable. With central bank reserve guarantees, e-money can avoid risks such as defaults and liquidity crises discussed in the second part.

(2) Increase interoperability. In theory, different payment institutions can transfer funds to each other after the central bank opens an account. For example, the future Alipay account may be able to transfer funds to the WeChat payment account, thereby improving the user experience.

(3) Avoid dollarization. The development of large e-money providers is inevitable. Instead of letting foreign e-moneys pass through the country, it is better to support the national e-money and allow domestic e-money providers to hold central bank reserves. The central bank also retained the coinage tax without providing interest.

(4) Monetary policy transmission is more effective. If the central bank provides reserve interest for e-money providers, this will be more conducive to interest rate liberalization.

(5) Facilitate supervision. The central bank will determine the e-money provider's qualification for opening a reserve account beforehand, and there will be more comprehensive and effective regulatory measures afterwards.

(6) Exploration of sCBDC. The next section is discussed in detail.

Synthesize the dawn of the central bank's digital currency (sCBDC)

Allowing e-money providers to open a reserve account at the central bank is a way to create a central bank digital currency! If the e-money provider can hold and reserve reserves in the central bank reserve and e-money is issued at a 1:1 reserve rate, then this is essentially CBDC.

The sCBDC model is not the same as the mature CBDC model that long-time policymakers envision. In the mature CBDC model, the central bank, as the person in charge of the issuance of CBDC, is responsible for the following numerous steps: completing customer due diligence, providing or reviewing wallets, developing or selecting basic technologies, providing settlement platforms, managing customer data, monitoring transactions, and Customer interaction. These links increase the risk of failures and cyber attacks, bring huge costs, and may hit the central bank's reputation.

The sCBDC model provides a completely different new path, which is issued by the government and the private sector. The central bank is only responsible for reviewing the qualifications of the payment institutions that open the central bank's reserves, as well as the settlement transactions of the reserves in the central bank account. All other functions mentioned above will be the responsibility of the private e-money supplier under supervision. Of course, the user should be partly responsible for knowing that sCBDC is not completely a central bank product. Just as today's commercial banks hold reserves, but fraud or technical failures associated with personal debit cards should not be attributed to the central bank. In this way, even if there are problems in certain links, the reputation of the central bank will not be damaged.

Therefore, compared to the central bank's independent development of fully mature CBDC, sCBDC is an effective way to lower costs and reduce risks. It maintains the private sector's strengths in technological innovation and customer interaction, while maintaining the central bank's strengths in providing trust and efficiency.

Will sCBDC become the future central bank digital currency? Will it compete with b-money and potential i-money? These decisions, which rely on central banks, regulators and entrepreneurs, are for further observation. But one thing is certain, innovation and change may change the existing landscape in the banking and monetary sectors.

Author: Whitefish

Editor: Tang Wei

Produced: Carbon Chain Value (ID: cc-value)

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Libra may have a huge impact, China should actively participate in the digital currency revolution

- In the currency circle, how to play the reversal?

- Bakkt tested the settlement of Bitcoin futures products on Monday, Ethereum or became the next "favored target"

- BTC is about to break out, and the mainstream currency market is in the confirmation stage.

- Reduce the possibility of disputes and litigation, will the blockchain replace lawyers in the future?

- Hao Yi, Bank of China Institute of International Finance: Libra has taken a solid step toward world currency?

- Xiao Lei: The US dollar ignited the global currency war, gold soared, bitcoin was crazy, libra was