Depth | How digital currency changes financial ecology

The digital economy has changed our lives and is reflected in almost all areas. Monetary and financial nature is no exception. Digital currency generally refers to a new form of currency that uses digital as a carrier. Unlike cash in circulation, its trading and storage is done by electronic accounting and transfer. Specifically, what is digital currency is controversial. The market is more concerned about bitcoin (representative of the encrypted "currency"), stable currency linked to legal tender, and central bank digital currency. Facebook's recently proposed libra stable currency program has become a global hotspot, and the possibility of the central bank issuing digital currency has also received greater attention. I would like to talk about the development potential of digital currency and its impact on the financial ecology.

Is the return of commodity currency or the national currency upgrade?

Reflecting changes in technological progress and the institutional environment, the currency form is constantly evolving. From the perspective of modern history, we think about the form and connotation of money. There are two dimensions: whether it is a commodity currency or a credit currency, whether it is a private currency or a national currency. Gold coin is a commodity currency whose function as a currency depends on its intrinsic value as a commodity. The goldsmith issued a bill of exchange secured by gold deposits, which improved the efficiency of payment. Later, the goldsmith issued banknotes or deposit certificates without 100% reserve support, which was part of the bank credit currency. Later, the bank deposits were basically secured by loans. It became a complete bank credit currency.

- Read all the G7's regulatory response to Libra

- The value of BTC holdings in this country may exceed the gold reserve

- Market Analysis: There are more uncertain events. At this time, radicalism is no different from thunder.

Behind the credit currency are liabilities, private sector liabilities or government debt. Bank deposits (liabilities) collateralized by bank loans (credits) are private currencies, and the currency issued by the central bank is endorsed by government credit, which is the government currency or the national currency. In the contemporary era, the currency issued by the central bank is mainly the cash in circulation and the deposit reserve of the commercial bank in the central bank, which is called the base currency or the base currency. Bank deposits are broad money, and institutional arrangements have evolved to this day. The deposit insurance system, the role of the central bank's last lender, and superimposed financial supervision make today's commercial banks a public-private partnership. Bank deposits are no longer purely private, but have government credit. support.

From the above two dimensions, Bitcoin is similar to commodity currency. Although there is no intrinsic value, some investors believe that it can be a token (token) and play a role as a trading tool. According to Facebook's white paper, Libra is linked to the main convertible legal currency, which can be said to be a derivative of the government currency. Subsequent to Libra as a payment and stored value tool, if it evolves into credit creation, it may generate a credit currency similar to bank deposits. The central bank's digital currency is a new form of legal tender. It is a simple substitute for the cash issued by the central bank, or the function of raising the base currency as a means of payment and stored value, depending on the specific design.

When we discuss the development of digital currency, an important question is whether we will return to the commodity currency society in the future, and the private credit currency will be more developed. Or will the digital currency expand the circulation scope and function of the legal currency? Whether it is the return of commodity currency or private currency, or the national currency upgrade, this will have important implications for the ecology, system and structure of finance. A brief review of the function and evolution of the currency helps us to think about it.

Textbooks tell us that money has three major functions, payment methods, stored value tools, and accounting units. Which of the three functions is most important in determining what is a currency? How is it reflected in digital currency? Economics has two major schools of commodity currency theory and national currency theory.

Commodity and currency theory believes that the most important function of money is the means of payment. Market competition ultimately determines which goods bear the means of payment, and the wide circulation of payment means helps it become a stored value instrument and a unit of account. People who are optimistic about Bitcoin generally think that the government credit currency and bank credit currency are over-issued, which brings many economic and financial problems. Market competition will eventually lead to the return of commodity currencies such as gold and bitcoin.

The national monetary theory believes that the most important function of money is the accounting unit (value scale). With this function, people are willing to use it as a means of storing value for inter-period wealth transfer, and willing to use it as a means of payment to complete commodity transactions and Liquidation of debt and debt delivery. The characteristic of the bookkeeping unit is that its nominal value will not change. A dollar is always a dollar, and a dollar is always a dollar. The national monetary theory believes that the accounting unit is derived from public power. Even in the primitive society, the tribal leader decides the accounting unit, and the currency is always the product of the government's public power.

According to the national currency theory, whether Bitcoin or Libra can become a currency ultimately depends on the government and regulators, not market competition. We can put aside the controversy over the origin of money. The evolution of modern monetary and financial systems is in line with the logic of national monetary theory. It is not easy to change the national monetary system, but this does not mean that market competition and private sector innovation will not be in the future of money. Play a role in evolution. The interaction between the government and the private sector is key, and the recent controversy and discussion that Libra plans to raise in the United States highlights the public policy perspective of digital currencies and is instructive for us to think about related issues.

Facebook Libra is right and wrong

According to Facebook's white paper, Libra's mission is to create a simple, transnational border of money and financial infrastructure to promote inclusive finance. Libra is a mechanism similar to a stable currency. Libra is not tied to a legal tender, but is linked to a basket of currencies. Consumers can purchase Libra in a fixed currency or exchange Libra for legal tender. Libra is backed by an asset pool that gives it intrinsic value, and the Libra Association (an independent membership organization) is responsible for governance. Libra has caused great repercussions and controversy since its publication. The US regulators include the Fed and the Treasury, and the US Congress and the President have commented. The regulators and industry in other countries also have great interest in watching and watching. discuss.

At present, Libra is only a plan, but it attracts such high attention. The main reason lies in the synergy effect of the network scale advantage of the technology giant platform company and currency under the digital economy. Platform companies have huge network and scenario applications, which bring economies of scale. The more people use, the lower the marginal cost, and the more people they use. There is a self-reinforcing mechanism. Both Facebook in the United States and WeChat in China have a large community. Ali in China and Amazon in the United States also have huge e-commerce users. Money also has a network scale effect. The more people use, the lower the marginal cost of trading, the more people use it, and the more monetary it is. This makes Facebook have a greater advantage in developing digital currencies than traditional financial institutions.

Payment means

We can analyze Libra's development prospects and possible impacts from the three functions of money. As a means of payment, Libra's biggest advantage is that it can rely on social platform network promotion. Facebook social platform is similar to WeChat. Users are personal, and network effect is associated with retail payment and micropayment. We can imagine that it can use incentives like WeChat red packets to attract users, and the huge user base of the platform may make Libra start very fast.

But Libra also has a disadvantage as a means of payment. Libra is linked to fiat money, but a non-one-to-one transparent link is tied to a basket of currencies, which increases transaction costs in two ways. First, exchange rate fluctuations make transaction costs between the US dollar and Libra. So, will there be goods in the United States with Libra price tag? The economics literature is called the menu cost. The store has to mark two sets of price systems, and Libra prices fluctuate every day to bring about cost changes. Of course, it is possible to settle in Libra in US dollars, but there is still transaction cost between Libra and USD. Therefore, Libra's space as a means of payment in the United States should be limited.

However, the transaction costs associated with the aforementioned currency conversion are not new issues in cross-border payments, and, technically, Facebook can leverage its global network platform to reduce cross-border payment costs. Because of this, cross-border payments or remittances are considered to be Libra's strengths and breakthroughs. However, high cross-border payment costs are not only technical but also regulatory costs. When commenting on Libra, US regulators particularly emphasized issues such as anti-money laundering and counter-terrorism financing. From some emerging market countries, there may also be cross-border capital account control issues. These regulatory costs are not eliminated by the advancement of payment technology.

Assuming Libra has made a big breakthrough in cross-border payments and formed a certain scale effect, can Libra expand the role of payment instruments in some developing countries? It is also used for local payments. Libra is tied to a basket of developed countries' currencies, and people should be more confident in it than some developing countries. Under normal circumstances, people are willing to spend money with unstable currency before spending money. The currency in circulation is more bad money, which is the so-called bad money to drive out good money. Therefore, Libra has doubts about the means of payment if it places its hopes on the monetary role of developing countries where the local currency is unstable.

Stored value tool

In one aspect of the disadvantage, changing the angle may be an advantage. Looking farther, Libra's most promising place is as a stored value tool. The stored value tool is a good currency to drive out bad money. It is easier to become a stored value tool when the value of the currency is stable. As a stored value tool, Libra may squeeze the currencies of some developing countries. Due to the backwardness of its financial market and financial infrastructure, and the instability of its currency, it is difficult to obtain liquid assets with high liquidity and high transaction costs in some developing countries. Depending on its vast network, Libra may provide general residents with liquid assets with lower transaction costs.

Libra is a liquid asset based on its main convertible currency. Libra's design is similar to SDR, but SDR is primarily a bookkeeping unit that acts as a liquidity asset only for official institutions between IMF member countries, and even if transactions between member states are small. The potential advantage of Libra is that its holders are general residents rather than a few government agencies, and their application scenarios are broad and deep, closely linked to the economic activities of the private sector.

According to this logic, Libra may be popular in some countries with high inflation or large exchange rate expectations, and it has a choice of security assets for local residents, but it has an impact on the monetary system of these countries. Currency substitution reduces the effectiveness of monetary policy. It is conceivable that Libra will be resisted by some government or monetary authorities. From historical experience, moderate inflation is difficult to lead to large-scale currency substitution. Only high inflation countries have a so-called dollarization, that is, the US dollar replaces the local currency.

Accounting unit

Libra's resistance as a unit of account is not small, and it is much more difficult than its means of payment and stored value. Because the unit of account is generally prescribed by the government. Unlike Alipay and WeChat Pay, Libra is completely dependent on the renminbi. It is a derivative of a basket of currencies. It is not transparent to the US dollar and it is difficult to become a unit of account. In a few countries, there have been two prices and two units of measurement for the same commodity. For example, what is the US dollar and what is the local currency? This is the case when a very small number of currencies are highly unstable. We can imagine Libra playing the role of a bookkeeping unit in a country where the legal currency is unstable, and there is a “dual currency system”, but historical experience tells us that this dual currency system is difficult to sustain.

How to maintain the stability of Libra currency?

In terms of Libra's liquidity and security as a currency, two issues deserve attention. First, the price of Libra will fluctuate with fluctuations in the fair value of the reserve assets. The SDR holding the IMF is interest-bearing and its interest rate is the weighted average of the official interest rates of a basket of currencies. Paying interest will undoubtedly increase the attractiveness of Libra as a liquid asset. According to the white paper, although reserve assets invest in high-grade bonds such as treasury bonds and bank deposits in a basket of currencies, Libra does not pay interest.

There are market comments that Libra's price will fluctuate with the price of reserve assets. I think this is unlikely. Libra's own price should be stable, that is, holding a Libra today should still be a Libra, but the conversion In other currencies, such as the US dollar, the price will change as the exchange rate between the US dollar and other currencies changes. We should distinguish between the payment of interest on the principal, such as deposits and asset price fluctuations such as bonds, the former being more liquid than the latter.

Another issue is the mechanism of Libra's preservation. Libra's reserve assets are invested in highly secure government bonds and bank deposits, which normally serve to preserve value. Libra does not pay interest to the holder, and over time the fund's accumulated investment income will provide more than one-to-one backup support. Some comments refer to reserve fund operational risks, including asset custody, cybersecurity, etc., but these have a technical approach, especially when the scale is small.

So how big will Libra be? Is there a problem with over-issuance? A basic concept is that Libra's circulation is determined by trading needs before the creation of derivative credits, that is, passively determined by the needs of consumers. Libra can be understood as cash. Cash is not how much the central bank wants to send. The cash that exceeds the trading demand will be returned to the central bank. Because there is no interest in cash, the average person will not put a lot of cash in the wallet. Trading needs are determined.

Libra's issuance and exit mechanism is somewhat similar to the Hong Kong dollar currency board system. Under the linked exchange rate system, when the demand for transactions increases, people withdraw Hong Kong dollar cash from the bank. If the bank stocks are not enough, they can get the exchange rate of US dollars at 7.8 Hong Kong dollars. In exchange for Hong Kong dollar cash from the Hong Kong Monetary Authority, it is reflected in the balance sheet of the HKMA as a debt-issuing banknote issuing certificate (technically speaking, the three major banknote issuing banknotes, but the essence is the money issued by the HKMA) and foreign exchange reserves. At the same time, when the trading demand changes in reverse, the HKMA's balance sheet will shrink, and the changes in the stock and increment of the cash will support the one-to-one change of the US dollar assets. This mechanism of preservation is effective.

However, we have observed that investors are worried about the sustainability of the Hong Kong dollar linked exchange rate system when financial market turmoil. This is because Hong Kong's financial system and financial ecology greatly exceed the simple currency board mechanism mentioned above, especially the banking system creates Hong Kong dollar deposits through credit. There is no one-on-one support behind US dollar assets. . Even so, Hong Kong's linked exchange rate system has withstood the impact of international financial market volatility, including the Asian and global financial crisis, although it has paid a certain amount of intergenerational, that is, Hong Kong's economic and asset price fluctuations. In contrast to Libra, the simple distribution mechanism described above should work effectively in its infancy. If Libra's development leads to credit creation, the problem will become complicated (discussed further below).

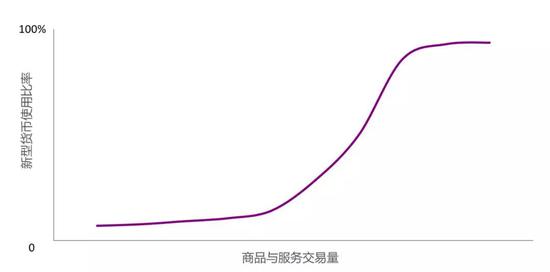

In short, Libra's potential as a currency, my judgment is in the initial stage, the means of payment may be a breakthrough, but after a certain scale, the role of stored value means is more important, is the main force to promote Libra truly become a currency. Historically, the circulation of a new type of currency has a non-linear character. It is difficult at the beginning of the initial stage because no one uses it, but once it reaches a certain key point, there is a certain scale of use, and the progress is accelerated (Figure 1). Libra is now 0, and it will be slower to start with common sense, but we can't underestimate the scale effect of its community network. The key is to see how regulators can balance innovation and regulation. There are many new issues involved, some of which are reflected in the electronic money of China's large technology platforms.

Figure 1: Network effects of new currency use: nonlinear features

Source: Authors

Large Technology Platform (BigTech) Electronic Money

I think the market is paying too much attention to Bitcoin, Libra and central bank digital currency. In fact, the electronic money and financial services of large-scale technology platforms have already blossomed in China, including Ant Financial, Tencent, Baidu Finance, and Jingdong Finance. We have seen payments for derivative financial services. For example, the money fund behind Yu'ebao, other financial products such as insurance distribution, and even credit creation, Ant Financial and Tencent have similar banking institutions. Although they do not absorb retail deposits, they are financed through asset securitization. Libra's development has similar appeals, not just the means of payment, but the new financial infrastructure to provide other financial services.

After the announcement of Libra, many people think of Alipay and WeChat payment. The similarities between the two are based on the existing large-scale technology platforms supported by the Internet and mobile communications, all of which provide convenient and low-cost payment services. The starting point is linked to the legal currency, and the value of the currency is relatively stable. It can be collectively referred to as “stabilized currency”. Alipay and WeChat payment have made great achievements, improved payment efficiency, and facilitated consumers. It can be said that Facebook has set up a successful model. But Libra seems to be more ambitious. Libra is attached to a basket of currencies and once successful will be a new global currency.

How fast Libra will develop in the future, to a large extent depends on how regulators view its evolution and its broader impact on the economy and society. China’s Ant Financial and Tencent are ahead of the field in payments and financial services, thinking about Libra Future development is also a reference. At the same time, the emergence of Libra may also prompt Chinese regulators to re-examine the financial service model and regulatory issues of large technology platforms. The financial services of large-scale technology platforms have a good side, developing inclusive finance and improving payment efficiency, but they also bring some risks and new challenges, which need to be taken seriously by supervision. There are five aspects of concern that deserve attention.

First, the payment system is stable and financial stability. Alipay and WeChat pay a 100% reserve to the central bank to ensure the security of the payment. Libra has a similar arrangement, but it is not linked to a legal tender, not to the central bank. In any case, the stability of the payment system is ultimately closely linked to the stability of the entire financial system. From the perspective of financial stability, there are two aspects to the impact of financial services on the technology platform. One is the impact on the traditional banking business model, and the other is the challenge to the regulatory efficiency of its mixed operations.

Second, the coinage tax. What is the source of profit for the traditional banking system? Bank loans create deposits, and the spreads they receive are divided into two parts. One is the management of credit risk (assessment and management of credit risk), and the other is the income obtained by providing liquid assets such as bank deposits. Liquid assets are similar to immediate purchasing power, helping us cope with unpredictable shocks. We are willing to give up some of the gains for liquidity. This is the coinage tax. Traditionally, the government obtained a coinage tax by issuing cash, and the bank obtained a coinage tax by creating deposits, and now a new mint tax beneficiary has been added. Of course, transferring the coinage tax obtained by the bank to other institutions is not necessarily a bad thing. There is no reason to say that this tax should be obtained by the bank. It is always good to have competition, but the problem is that the large technology platform has a natural monopoly.

Third, new types of integration of industry and finance and monopoly. Facebook and Tencent are large social platforms. Ali is a large e-commerce platform. These large platforms have not only improved our lives, but also improved the efficiency of economic activities, and also brought a monopoly of winners. These platforms participate in financial services, and there is also a balance between efficiency and fairness. This new type of monopoly is actually a combination of new industry and finance, a combination of banking and industry. A typical example of a traditional combination of industry and finance is the opening of a factory in front of the store, and the bank lends the absorbed deposits to the industrial company of its major shareholder. The US financial system took almost 100 years, especially in the 70 years after the war. History certainly won't be repeated. Facebook Libra may lead to a new combination of production and integration, opening up a bank and opening a social platform. The combination of new production and integration is a real problem for China's e-commerce platform and social platform.

Fourth, the combination of new production and integration and consumer rights protection. In the recent US Congressional hearing on Libra, consumer rights protection, especially privacy protection, is one of the focuses. With the expansion of the technology platform and the deepening of the impact on consumer activities, the protection of consumer rights such as privacy protection will become a prominent problem, especially in China.

Fifth, the internationalization of currency. After the Libra white paper was released, there was a view that the Fed would support it because it is expected that the US dollar will account for the largest weight of the Libra basket of currencies, and Libra will help strengthen the dollar's international reserve currency status. There are also views that connect Libra with the internationalization of the renminbi and think that Libra will become a competitor of Alipay and WeChat payment internationally. The perspective of currency internationalization and competition should not be exaggerated. Currency internationalization should not be at the expense of internal financial stability and consumer rights protection.

Libra’s head of staff said in a US Congress hearing that “if the United States cannot lead digital currency innovation, other countries will preempt the United States to do it”, which is very eye-catching. Similarly, China's large-scale technology platform can also say similar words. Like traditional finance, the development of digital currency and finance will also face regulatory competition and arbitrage. This kind of competition and coordination may not be limited to the private sector, and the central bank’s issuance of digital currency has also received great attention.

Central bank digital currency

The central bank's digital currency can basically be understood as similar to the deposit of the holder in the central bank. Now that we hold the cash issued by the central bank, we can use the digital currency to book and transfer funds directly. The central bank's balance sheet is open to everyone. Of course, there are other modes in technology. The central bank can realize the central bank's digital currency trading through an agent institution such as a commercial bank. The commercial bank holds the central bank digital currency for non-financial companies and individuals. The actual effect is similar to the 100% deposit reserve. The effects of these two models are similar in terms of the impact of the central bank's digital currency on macro finance and the economy.

The cash issued by the central bank is anonymous. Is the central bank's digital currency anonymity or cryptocurrency? If the technology allows, will the central bank be willing to do it? The illegal behavior caused by cash transactions has always been a problem that some central banks are trying to solve, such as withdrawing large amounts of cash. It is estimated that many central banks will take this opportunity to solve this problem, that is, issue non-anonymous digital currency. But for residents, anonymity is an important consideration. Anonymity does not necessarily mean protecting crime but protecting personal privacy. This is a controversial issue.

Another important question is whether the central bank pays interest on digital currencies. If you do not pay interest, the main effect of the central bank's digital currency is to replace cash and improve payment efficiency. However, the comparative advantage of electronic money such as central bank digital currency and Alipay and WeChat payment is not obvious. If the central bank pays interest on the digital currency, its property as a liquid asset will rise, which may have a major impact on the monetary and financial landscape.

The “destructive” impact of the central bank’s digital currency

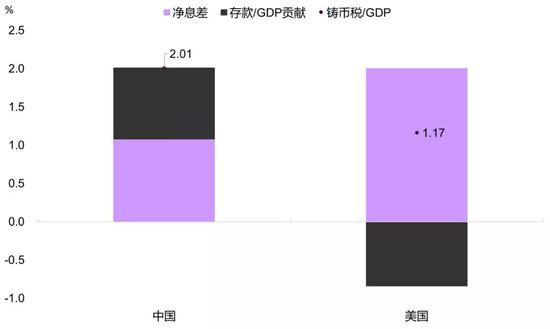

First of all, look at the "destructive" influence of the central bank's digital currency. Adding a quotation mark here refers to the impact on the existing pattern of interests. This kind of impact is not necessarily bad. If the central bank's digital currency pays interest, it will be similar to bank deposits. Strictly speaking, it is a liquid asset with higher security than bank deposits, which may cause residents to convert some bank deposits into central bank digital currency. In this case, part of the coinage tax will be transferred from the commercial bank to the central bank, or return to the source. From the current situation, how much is the coinage tax obtained by commercial banks? Figure 2 is the estimated seigniorage tax of China and the United States in the past ten years. The annual coinage tax paid by Chinese banks is about 2% of GDP, and the US is lower, about 1%. The difference between the two mainly reflects Chinese banks. The industry is larger than the US in terms of GDP.

Figure 2: Estimation of the “Coinage Tax” of Commercial Banks

Source: FRED, Wind, Everbright Securities Research Institute.

The net interest margin is the loan-to-deposit spread of commercial banks after deducting credit risk and liquidity risk. The data is the average of 2011Q1 to 2019Q1.

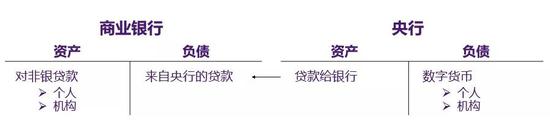

We can imagine an extreme situation (Figure 3). Individual and institutional deposits in banks are all converted to central bank digital currency. The central bank uses this funds to lend to commercial banks. Commercial banks use central bank loans to issue loans to individuals and institutions. . In other words, all liquid assets are borne by the central bank's digital currency, commercial banks become a capital distribution agency, commercial bank profits come from the credit risk assessment and management of loans, rather than providing liquid assets, all coinage taxes Return to the central bank. This extreme situation is unlikely to happen in reality, but it helps us to think about the impact of the central bank's digital currency growth on the bank and its business model. The issuance of digital currency by the central bank has led to a decline in bank deposits, which in turn has squeezed credit and the bank has received less coins. This does not mean that the bank’s profit model is lost, and banks can still benefit from maturity conversion and credit allocation. The financial services of large technology platform companies may be more impacted than traditional banks, because the central bank's digital currency will form direct competition for electronic money in terms of payment efficiency.

Figure 3: Central Bank Digital Currency ➙ Narrow Bank: An Extreme Scenario Hypothesis

Source: Author drawing

The problem is not that simple, because the ability to run on itself gives us confidence in the bank. We are willing to put money in bank deposits because we believe we can withdraw cash at any time. Imagine, assuming that Alipay and WeChat payments lead to a cashless society, we have no way to withdraw cash from the bank, then we still have the money to deposit in the bank? If the central bank's digital currency replaces cash, we can always use bank deposits as the central bank's digital currency when needed, which may increase consumer confidence in bank stability. So the impact of the central bank's digital currency on financial stability may not be as simple as some intuitive understanding. So will the central bank's digital currency affect financial stability? First, in terms of financial structure, the central bank's digital currency to increase the supply of liquid assets will reduce the kinetic energy of bank credit creation of liquid assets and reduce the leverage ratio of the private sector, which is conducive to financial stability. However, the central bank's digital currency also provides a more effective and convenient channel for the bank deposits. Therefore, there is a view that the central bank's digital currency has increased the possibility of bank runs when the market panics, thus increasing the risk of financial instability.

The "constructive" influence of the central bank's digital currency

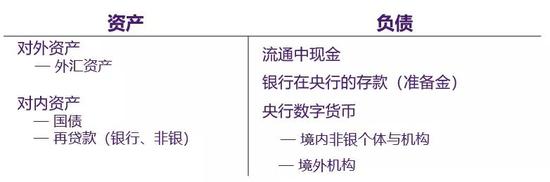

From the central bank's balance sheet (Figure 4), the debt side originally included cash in circulation and bank deposit reserve, and will increase the central bank's digital currency in the future. The holders are institutions and individuals in the non-financial sector. At the asset end, it is a foreign exchange asset or a domestic asset. The central bank can issue the digital currency by buying foreign exchange, national debt or refinancing. The central bank’s monetary policy has added an operational tool. The central bank can adjust the amount or price of the digital currency as the target of policy operations, and because the digital currency is held by individuals and companies in the non-financial sector, the monetary policy transmission mechanism bypasses Commercial banks, the efficiency of transmission and the accuracy of regulation will increase.

Another important impact is reducing government financing costs. The Ministry of Finance can issue a digital currency through the central bank to make up for the deficit, without necessarily issuing national debt. Even if there is a barrier to the monetization of this direct fiscal deficit, the central bank's digital currency will indirectly reduce the cost of issuing government bonds. Through the construction of the central bank's digital currency payment system and related financial infrastructure, there will be more participants in the national debt market, especially retail individual participants. Individual investors are less sensitive to changes in interest rates, and their increased participation is conducive to lowering the issuance rate of government bonds.

Figure 4: Central Bank Balance Sheet

Source: Author drawing

As a result, the central bank's digital currency will increase the fiscal and monetary links. Recently, modern monetary theory has caused much controversy. Modern monetary theory believes that in essence, the fiscal and central banks are one. The central bank can issue currency to compensate for the fiscal deficit. Therefore, local currency bonds are unlikely to default. In the case of inflation control, the fiscal deficit and The space for government debt is greater than what mainstream economics has believed in the past few decades. All of the modern monetary theory is concerned because people reflect on the problems that bank credit (including shadow banking) has become the main channel for money delivery in the past few decades. In fact, think about it, the central bank's digital currency may be the mechanism and operational tool for the modern monetary theory. The central bank's issuance of digital currency can directly or indirectly reduce the issuance cost of national debt and increase the space for fiscal expansion.

In addition, if the central bank issues digital currency, such as the US dollar or the renminbi, residents of other countries are willing to hold it, which will increase the internationalization of the currency. It is clear that the currencies and convertible currencies of large countries benefit more from the role of digital technology in promoting the use of money in international trade and finance. International competition may become a focus of the central bank's digital currency, and central banks in small countries may gain competitive advantage through differentiated means, such as issuing anonymous digital currencies. In short, the central bank's digital currency also has problems of international competition and coordination.

Liquidity preference is the key

Summarizing the above discussion, how should we think about the impact of digital currency on the financial ecology and financial structure?

From the perspective of the origin of money, commodity monetary theory considers that payment means is the most important. National monetary theory considers that the accounting unit is the most important, but in the modern economy, the most important carrier of economic influence on economic and financial activities is the stored value instrument. The stored value tool is a means of inter-temporary value preservation and transfer of wealth. Real estate and stocks can play this role, but currency as a stored value tool has two special advantages. The first is safety. The nominal value is relatively stable during the duration. The second is liquidity, which means that it can be instantly converted into payment means without having to bear the loss. Long-term national debt is a safe asset, but it is not a liquid asset, as it may be lost if it is realized before it expires. Traditional liquid assets include cash, bank deposits, short-term government bonds, etc. The future digital currency will become a new category of liquid assets.

Why are liquid assets important? With the development of the economy, the productivity of labor has increased, the modern society has become more and more affluent, the output has surpassed the consumption of current consumption, and the savings have realized the inter-temporal transfer of wealth. Some of them must be assets with high liquidity and security. Liquid assets help consumers cope with the negative impact of possible future income and wealth to smooth consumption. From the production side, if there is no liquid assets to protect against unpredictable shocks, everyone will save the physical form for future consumption, and the whole society will have problems of insufficient investment and insufficient utilization of resources. This is because in general, only some people face negative impacts, and those who are not affected by the impact are ineffective resource utilization.

How to define security and liquid assets? There is a concept in economics called no question asked (NQA) without asking any questions. I will pay you a hundred dollars in cash. You will not ask me if this one hundred yuan is safe. I will transfer 100 yuan to the bank. You will not ask if it is safe. But if someone recommends buying a stock, would you ask the listed company how effective? What is the risk of falling stock prices? Those who do not have private information can arbitrage are security assets. In the case of listed company stocks, research helps to grasp more information about the company's fundamentals. Some people even know that insider information, which generates value, is difficult for most people to obtain, so stocks are risky assets.

No one has private information about the cash issued by the central bank, and it is difficult to obtain private information about bank deposits. The collateral or support assets of bank deposits are numerous loans. It is difficult for the average investor to study and analyze the bad debt rate of these loans. The cost of producing private information is too high. But just because no one can do it, it is safe. In the past few years, bank financing has been the same. Similar to bank deposits, we don't know what the underlying assets behind it are. No one has the ability to have enough time to research, so it becomes a more secure asset.

Of course, such security is fragile, a belief, and this belief is a double-edged sword. Once there is new unfavorable information, a bank problem may lead everyone to doubt the stability of all banks, because the average investor does not have Ability to distinguish between good and bad. This is why it is difficult to break the rigid redemption of non-net-worth wealth management products for small investors. These wealth management products are either security assets like deposits, or break the rigid redemption and lead to even financial risks. The solution to this vulnerability is government guarantees, but government guarantees bring moral hazard problems, leading to excessive expansion, so government regulation is needed.

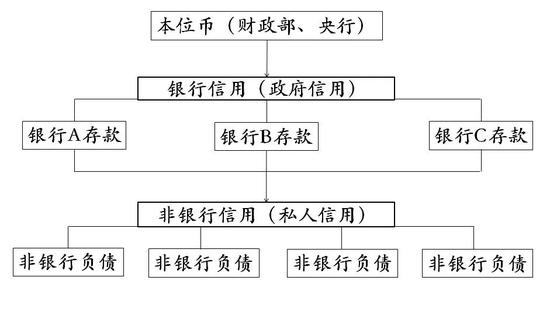

Minsky portrays the modern monetary system as a pyramid (Figure 5). At the highest level is the local currency issued by the Ministry of Finance or the central bank, with the highest security liquidity. The second layer is the bank credit currency. Bank deposits are safe under normal circumstances, but generally speaking, their security is lower than the government-issued local currency. Under the current mechanism arrangement, thanks to government guarantees, even if the bank has a problem, the deposits of retail depositors are guaranteed. The third layer is the liquid assets derived from certain non-bank credits, such as asset-backed securities issued with future cash flows as collateral. Asset securitization discounts future cash flows into short-term liquid assets.

Figure 5: Currency pyramid

Source: Authors

In the above framework, we compare traditional money and digital currency, and there are three basic observations.

First, bitcoin is not a currency, and it is difficult to become a currency in the future. Bitcoin is not a currency now. There is no dispute. The price fluctuates greatly. Few people use bitcoin as payment and stored value, let alone as a unit of account. In the future, it is hard to imagine that Bitby has become a token that some people hope for, and its limited supply is the biggest obstacle. Similar to gold, the low supply flexibility of the local currency will encourage bank credit expansion to create liquid assets and increase economic fluctuations and financial risks. Therefore, Keynes called the gold standard system "the remains of the barbaric era." Of course, there are many kinds of "cryptocurrency" similar to the bit ratio, the supply is unlimited, but there is no supply of physical assets behind the unlimited supply of MLM is not possible. Over the past 100 years, the government's functional currency and bank credit currency have experienced excessive expansion in different periods, resulting in high inflation or asset bubbles and financial crisis. In the past 40 years, in the context of fiscal prudence and financial liberalization, the lack of liquid assets provided by the fiscal and central banks has prompted commercial banks and shadow banks to create liquid assets through credit expansion, resulting in asset bubbles. ,financial crisis. Will digital currency increase or reduce the imbalance in the modern financial system?

Second, digital currency attached to or derived from fiat currency has a side that increases the efficiency of payment, but its role as a currency depends largely on how it changes the supply and demand of liquid assets. Libra may provide a new class of liquid assets for developing countries, but its underlying assets are the national debt and bank deposits of major developed countries, which increases the global demand for liquid assets in the United States. Historical experience tells us that the resulting liquidity shortage will encourage bank (shadow) credit expansion to produce more liquid assets and increase financial risks. In the future, Libra's derivative credit creation is more likely to produce its own liquid assets. Alipay and WeChat payments have already derived liquid assets including Yan Bao, Ant Financial, Tencent's Zero Money Pass, and loan-backed asset-backed bonds.

Third, the central bank's digital currency is a new form of the local currency, the most secure and liquid asset. People's demand for liquidity fluctuates greatly. One of the biggest problems with non-government credit-backed liquid assets is that when everyone is pursuing liquidity, “total liquidity does not exist” (Keynesian), in the private sector. When the preference drops sharply, the government becomes the only counterparty and only the government can provide sufficient liquid assets. From the perspective of improving financial structure and maintaining financial stability, the central bank's issuance of digital currency is crucial.

Finally, what is the meaning of digital currency for financial markets? There are three main aspects. One is the risk-free rate reduction. For example, the reduction of the cost of issuing government bonds, Libra increases the demand for US Treasury bonds. More broadly, the internationalization of the currency may bring damage to the big countries. Many overseas people holding the digital currency issued by the People's Bank of China will lower the interest rate of Chinese government bonds. Second, some developing countries' exchange rates may face new depreciation pressures. Third, the risk premium has risen, commercial bank credit has been squeezed, and the reduction in loan supply has led banks to allocate more scarce loans through prices. At the same time, the new financial platform like Ant Financial Tencent uses big data to assess credit risk, which may better manage the credit management of loans, the dependence of credit on collateral declines, and the credit hierarchy is more distinct.

Private sector innovation, government regulation

Will the future digital currency form be government/national currency or private sector currency? In fact, the two are not completely mutually exclusive, and there is competition and complementarity. The driving force for innovation comes from the private sector, but when private sector innovation develops to a certain degree and is of systemic importance, it requires government regulation to manage risk and negative externalities.

The history of currency evolution is like this. The emergence of gold coins and silver coins was innovative at the time, which was conducive to payment transactions. However, some people made coins with insufficient gold and silver to make profits, which led to the loss of confidence in such currencies and even caused a financial crisis. How to do? The government stamped the gold coins and increased people's confidence in the monetary system through government acceptance and certification.

Bank deposits were also innovating at the beginning of the currency. Later, the evolution was that the proportion of reserves was getting lower and lower. Banks used loans as collateral to issue bank notes/deposits, which brought many problems, including banking crises. How to do? The government intervened to increase the confidence of individuals and institutions in the non-financial sector as a currency for bank deposits. Government intervention is reflected in the deposit guarantee mechanism, the role of the central bank's lender of last resort, and the strengthening of supervision. The price at which financial institutions enjoy government guarantees is regulated.

Today, Facebook Libra may soon become systemically important after its launch, requiring regulatory precautions. Alipay and WeChat payment are financial innovations that are beneficial to society and are conducive to the development of inclusive finance, but their scale is of systemic importance, especially the derivative financial services including mixed operation and new combination of production and finance may be for financial stability and consumption. The protection of rights and interests has an impact, so it is necessary to strengthen supervision. There are a lot of examples in history that cannot catch up with the systemic problems caused by private sector innovation. We need to pay special attention to its public policy perspective when thinking about the development of digital currency.

Source: Sina Finance

Author: Peng Wensheng

(The author of this article: Global Chief Economist and Director of Research Institute of Everbright Securities. Former Chief Economist of CITIC Securities.)

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Babbitt Depth | Xing Shi asked "the most" OTC, the old money entered the crisis

- How to distinguish between currency currency and fund tray?

- Blockchain engineering: one of the most overlooked places in the industry

- Criticize Bitcoin Guide

- IMF's latest report: E-money is in the upper position, the synthetic version of the "Central Bank Digital Currency" is welcoming the dawn

- Will Libra bring the next Bretton Woods system?

- “Don’t be used by Facebook”, the four major consumer protection organizations urge members of the Libra Association to withdraw