Grayscale Bitcoin Trust successfully registered with the SEC, institutions running into the market?

Original: ambcrypto.com

Source: Planet Daily

Translator: Qin Xiaofeng

On January 21, 2020, the Grayscale Bitcoin Trust was successfully registered with the SEC (Securities and Exchange Commission) and became the first cryptocurrency investment tool to report to the SEC.

- Dry Goods | What is UTXO Merger?

- 5 consecutive years of decline, can BTC break the January curse?

- Six major central banks such as Britain, Japan and Europe hold a group to explore fiat digital currencies, China is temporarily in a leading position

"Grayscale Bitcoin Trust" is a product of the US-based crypto asset management company Grayscale Investments. The company obtained the SEC's private placement exemption registration in 2013; it was approved by the Financial Services Regulatory Agency (FINRA) for listing in 2015, and became the world's first publicly traded Bitcoin investment vehicle.

In order to improve compliance standards and gain investor confidence, in November 2019, the fund decided to apply to the SEC for registration and submitted a Form 10 registration statement. Grayscale expressed the hope that more government oversight would make its Bitcoin Trust more attractive to institutional customers.

Grayscale said: "The successful registration is a landmark event for our products, gray companies and the digital currency industry."

Gray SGM General Manager Michael Sonnenshein said, "Grayscale has voluntarily accepted this appointment and will continue to work within the existing regulatory framework. Today's statement should send a signal to investors that our regulators are willing to participate in our Products and the entire (cryptocurrency) industry. "

Grayscale added that in addition to its annual and quarterly reports, the trust company will now submit audited financial statements to the SEC. "These reporting standards are the same as those for listed companies and products traded on national exchanges."

The successful registration of the Grayscale Bitcoin Trust has also greatly enhanced the liquidity of its products. Previously, investors who bought GBTC (Bitcoin Trust) through private placements had to wait 12 months before reselling on the secondary market. Today, investor holding time can be significantly reduced, from 12 months to 6 months, provided that the gray trust meets all the requirements of the Securities Act 1993.

It is worth noting that the grayscale Bitcoin Trust should be distinguished from the Bitcoin ETF (Exchange Traded Fund). In a statement last November, Michael Sonnenshein stated that the submission of the application file was not to convert GBTC into a Bitcoin ETF, although both are invested with Bitcoin and have similar structures.

"The structure of the trust will not change, and it will continue without redemption plans and will not be traded on the national stock exchange." Grayscale said.

GBTC is one of the few cryptocurrency trust products currently, and it is also sought after by many traditional investors. According to the gray company's 2019 annual report , the amount of gray fundraising increased sharply last year. The annual fundraising reached 607.7 million US dollars, which exceeds the total amount of gray products raised in the past 6 years. Among them, in the fourth quarter of 2019, gray has raised US $ 225.5 million; since its establishment, the cumulative investment of Grayscale products Reached $ 1.17 billion. The maximum single quarter investment amount of the Bitcoin Trust Fund is the fourth quarter of 2019, totaling $ 190 million. Grayscale's user size has also increased by about 24% in 2019, accounting for about 24% of new investment.

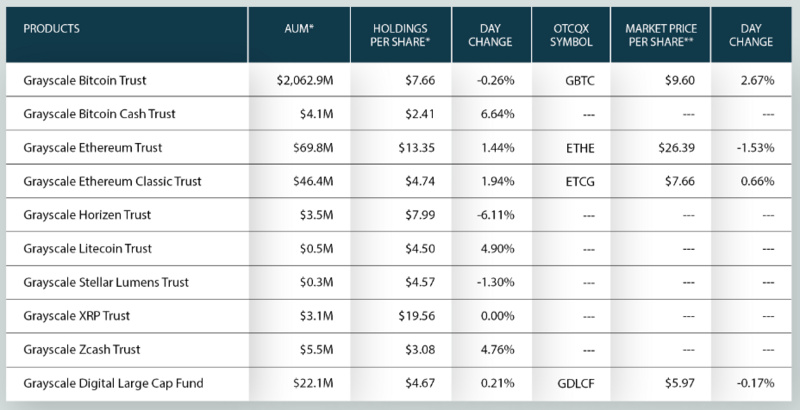

In addition, Gray Management Assets (AUM) reached USD 2.3 billion on January 8 this year, the highest level this year.

As of press time, GBTC quoted $ 9.74 on OTCMKTS, a 24-hour increase of 3.28%; with the rise of the Bitcoin price, GBTC's cumulative increase this year has reached 22%.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Academician Rong Chunming: The blockchain system is still based on U.S. China or overtaking on curved roads

- Square Crypto Announces Lightning Network LDK Plan, Will Bitcoin Become Stronger?

- Microsoft Windows 7 system found high-risk vulnerabilities, there is a huge risk of malware mining

- Babbit Column | Malaysia IEO Regulatory Reviews

- Opinion | Ethereum will continue to develop after Phase 2, the future blueprint is still unclear but the future looks bright

- Stealing electricity into the game, which one do you choose, bitcoin and personal freedom?

- Overview of blockchain system governance: how to design a governance mechanism to ensure the long-term development of blockchain?