Hong Kong VASP License Exam: Who Will Be the Lucky One to Obtain the License?

Hong Kong VASP License Exam: Who Will Win the License?After the implementation of the new virtual asset policy in Hong Kong, both native cryptocurrency exchanges like OKX and traditional financial institutions like Tiger Securities have crowded into Hong Kong to seek compliance and obtain virtual asset service provider (VASP) licenses.

With the formal implementation of the virtual asset trading platform license system, Hong Kong has become a new continent for the compliant development of the encryption market and even the entire Web3 industry. However, obtaining a license is not easy.

SFC replied in an email to “Metaverse Daily” that the Securities and Futures Commission did not set any restrictions on the number of licenses for virtual asset trading platforms. “Under the new system, virtual asset trading platforms will be subject to regulatory requirements, as well as certain requirements applicable to the characteristics and risks of virtual assets, including asset custody, Know Your Customer (KYC) procedures, anti-money laundering/counter-terrorism financing, prevention of market manipulation and irregular activities, accounting and auditing, risk management, avoiding conflicts of interest, and network security.”

When the new policy was released, the SFC also emphasized that it will issue circulars and provisions for frequently asked questions from time to time, and if there are any inconsistencies between them and the “Guidelines for Virtual Asset Trading Platform Operators,” the more stringent provisions will apply.

- CEO of Hong Kong Securities and Futures Commission: Cryptocurrency trading is an important component of the virtual asset ecosystem.

- Hong Kong banks refuse to open accounts despite new cryptocurrency regulations? How are regulatory agencies responding to these concerns?

- Commonwealth Bank of Australia suspends some cryptocurrency payments to ensure investor asset security

The strict threshold is like an exam paper prepared for issuing licenses, and it is thrown to all virtual asset trading service providers who want to obtain licenses in Hong Kong, testing the applicants’ sufficient preparation. Even OKX, a cryptocurrency trading platform established six years ago, has prepared for more than a year for the licensed application, and claimed to have operated in Hong Kong in a quasi-qualified state in accordance with the expected regulatory requirements before applying.

Hong Kong licenses are attractive, but they are also serious with 152 opinion letters and a 99-page “Guideline.” Opportunities will be left to those who strive to comply and are willing to fight a protracted war.

New and traditional institutions are rushing for Hong Kong licenses

On June 1, Hong Kong, China, established a brand new licensing system specifically for centralized virtual asset trading platforms. The Securities and Futures Commission of Hong Kong (SFC) stated that all virtual asset trading platforms that operate virtual asset trading exchanges in Hong Kong or actively promote their services to Hong Kong investors must apply for and obtain digital asset licenses and virtual asset service provider licenses (VASP licenses) under the premise of the “Anti-Money Laundering and Counter-Terrorist Financing Ordinance.”

On the previous day, the SFC issued two consecutive circulars on its official website, clarifying the issuance system and transitional arrangements before the issuance for companies and individuals intending to operate virtual asset trading platforms in Hong Kong. Once the circulars were released, the SFC began accepting applications for the issuance of virtual asset trading platform licenses from operators.

Related circulars released by the Hong Kong Securities and Futures Commission

The establishment of an issuance system marks the presence of Hong Kong’s regulatory framework. For the virtual asset industry, which has difficulty waiting for specialized regulatory rules in most regions, this is a milestone event and is also regarded as the “most explicit policy benefit in 2023” by the Web3 industry.

Cryptocurrency exchanges that emerged from Bitcoin have gradually become a new industry as the types of cryptocurrencies have increased, the roles of participants have become more diverse, and the market size has grown. They have increasingly desired orderly development from ten years of grassroots competition, but the differences in management of this new industry still exist worldwide. Even in the United States, where financial regulation is more mature, cryptocurrencies are still regarded as emerging financial markets and are mainly constrained by securities regulations, with no specialized rules.

Regarding the new policy in Hong Kong, Lennix Lai, the global chief business officer of OKX, said that regulation and regulatory licenses are the keys to the future success of cryptocurrencies and the Web3 industry. Through the new VASP licensing system, the Hong Kong government will be able to establish a strong regulatory framework and a suitable environment to support Hong Kong’s development into an international leading virtual asset center.

Accepting Hong Kong’s regulation and review means that a field has emerged in mainland China that allows for the legal and compliant operation of virtual asset trading services. As a highly prosperous Chinese financial center, Hong Kong has historically connected the mainland with the world.

Gary Tiu, OSL’s executive director and head of regulatory affairs, believes that within the existing legal framework, investors and institutions from the mainland will become active in Hong Kong, “and there will naturally be more legal constraints, as is well known. But as a potential gateway for legitimate and financial activities, Hong Kong will certainly continue to play this role.”

With the new policy in place, trading platforms native to the virtual asset industry have become busy, vying to obtain a Hong Kong virtual asset service provider (VASP) license. According to public information, native cryptocurrency exchanges such as OKX, HashKey, OSL, Bitmex, and Bybit are all preparing to obtain licenses.

As early as March of this year, OKX announced the establishment of a Hong Kong company to conduct virtual asset services in the region and revealed plans to apply for a VASP license. The trading platform was established in 2017 and has been seeking compliance opportunities around the world during its six years of operation. On June 15th, the OKX Middle East division already obtained an MVP provisional license from the Dubai Virtual Asset Management Authority (VARA), and the platform has obtained relevant licenses or permits in countries and regions such as France and the Bahamas.

In order to meet expected regulatory requirements for organization, product, security, and compliance, Lennix Lai revealed in an interview in February of this year that the OKX team had started preparing to apply for a license in Hong Kong a year ago and had formed a dedicated team of more than 20 people responsible for Hong Kong compliance procedures, with team members from the SFC, SEC, international law firms, or licensed financial institutions. Currently, OKX has more than 500 employees in Hong Kong, consisting of product development and compliance teams.

It is worth noting that the new policy “allows virtual asset trading platforms to accept business from retail investors,” provided that investor protection measures are taken.

On June 1st, OSL, a digital asset trading platform that provides services to professional investors, announced that it had applied to the SFC to upgrade its existing license to include retail trading. The platform is one of only two digital asset trading platforms in Hong Kong that are licensed to provide services to professional investors. Another digital asset financial service provider, HashKey Pro, also stated that it has submitted a license application to the SFC to provide retail services and has created a platform specifically for retail investors.

The head of OKX stated in an interview with the media that in addition to the relevant process of applying for approval of retail services, after the SFC published new guidelines, OKX opened up a testing program for retail investors, which lasted about 10 days and had several thousand Hong Kong users registered, with trading volumes exceeding one million US dollars. He believes that trying out operations during the transition period can allow the Hong Kong Securities and Futures Commission to comprehensively understand the actual number of operators in the market, collect better data, and then evaluate risks.

Not only native cryptocurrency trading platforms, but also traditional financial institutions such as Tiger Securities (Hong Kong) and Greenland Financial Holdings’ subsidiary Greenland Financial Innovation have expressed their intention to apply for VASP licenses. Interactive Brokers also launched virtual currency trading in Hong Kong through cooperation with OSL, which holds SFC-issued Class 1 and Class 7 digital asset licenses, enabling its professional investor clients to trade mainstream cryptocurrencies such as Bitcoin and Ethereum.

Both old and new financial institutions are crowding into Hong Kong to operate virtual asset trading platforms in compliance, revealing the popularity of VASP licenses and marking the intersection of Web3 new finance and traditional finance in Hong Kong. Cryptographic assets are also gradually merging into the mainstream financial world.

SFC sets a strict regulatory tone

In order to implement comprehensive and effective supervision of virtual asset trading platforms, the Securities and Futures Commission of Hong Kong has also done a lot of work.

As early as February 20th of this year, the SFC issued a consultation paper on proposed regulatory requirements for licensed virtual asset trading platform operators, inviting the public to provide comments. The consultation period ended on March 31, during which time the SFC received 152 comments from professional companies in the industry, market participants, licensed corporations, etc. I finally made a decision to allow retail investors to use licensed virtual asset trading platforms.

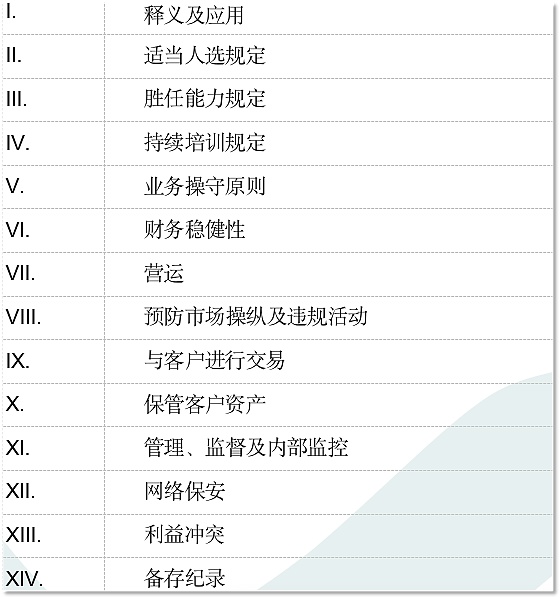

In order to better understand the regulatory requirements for applying for a VASP license, the SFC released a 99-page “Guidance for Virtual Asset Trading Platform Operators” in early June. This policy document requires that virtual asset trading platforms meet investor protection, fully paid capital, anti-money laundering, private key management, internal monitoring, network security and other conditions in order to be eligible for a license.

At the beginning of this guide, the SFC emphasized that the Securities and Futures Commission will also issue regulations on letters and frequently asked questions from time to time, “where there are any discrepancies between the provisions of this guide and those of the regulations, the stricter provisions shall prevail.”

SFC guide document directory

The SFC has set a strict regulatory tone for virtual asset trading platforms.

During the preparation period for applying for a license, OKX has cooperated with the Securities and Futures Commission’s review many times. Lennix Lai said that in strict compliance with SFC’s requirements for network security, asset custody, anti-money laundering and compliance, OKX expects to show “the ability to meet or even exceed strict regulatory requirements under the current system.”

Regarding the financial stability of the platform that applies for the license, the SFC has made detailed requirements. The document states that platform operators should always have assets with sufficient liquidity in Hong Kong entities, and the amount should be equivalent to at least 12 months of operational expenses of the platform; platform operators must always maintain a fully paid-up capital of no less than HKD 5 million; platform operators must always maintain Quick assets of no less than the quick assets of the platform operator’s specified quick assets (usually HKD 3 million).

SFC does this to ensure that the trading platform has sufficient liquidity and operational strength. In fact, last year, the FTX exchange went bankrupt due to the misappropriation of customer assets, and since then, the cryptocurrency exchange industry has started to “internalize” transparency. Dozens of trading platforms, including OKX, have used the “Merkle Tree Proof” mechanism to demonstrate the adequacy of asset reserves to the outside world, in order to regain market trust for the entire industry.

Taking OKX Global as an example, the reserve certificate page on the official website publicly displays a set of on-chain wallet addresses, supporting users to audit the reserve status of the platform at any time. According to this page, in the latest audit, the reserve ratio of mainstream assets on OKX is greater than or equal to 100%, and the reserve ratios of BTC, ETH, and USDT are all 103%.

OKX reserve status

In terms of specific operations, the SFC requires licensed platforms to establish a token inclusion and review committee to conduct due diligence on virtual assets listed on the platform, including project team background, market maturity and liquidity, technical development, smart contracts, etc. Facing platform customers, licensed platforms need to do a good job in KYC, adopt a clear, fair, and reasonable fee structure, and ensure that the risks that customers bear for virtual assets are reasonable.

According to Lennix Lai, Global Chief Business Officer of OKX, when applying for a Hong Kong license, OKX has continuously adjusted its business in accordance with regulatory standards, including adjusting its architecture to comply with SFO MIC standards and adjusting its listing process.

HashKey PRO’s official website shows that it has introduced applicability assessments, implementation of token access, and review committees, and stated that it will conduct strict due diligence and access standards on virtual assets provided to retail users.

Competitors for licenses need to prepare for a marathon

For trading platforms interested in obtaining a license, the SFC has thrown out the “big exam paper” for issuing licenses, and compliance requirements for every detail have discouraged “eleventh-hour” applicants.

According to the SFC’s “Transitional Arrangements for a New Licensing Regime for Virtual Asset Trading Platforms,” virtual asset trading platforms must have provided virtual asset services in Hong Kong before June 1st to be eligible to continue providing virtual asset services in Hong Kong between June 1st, 2023 and May 31st, 2024.

This means that compliant cryptocurrency trading platforms that intend to be licensed will have to wage a long battle from applying for licensing to obtaining it. The “lucky ones” who can obtain licensing depend on their long-term compliance work and preparedness. Investors are also watching, how many platforms will ultimately obtain a VASP license? “Jinse Universe” sent an inquiry email to the SFC as an investor, and the SFC replied that the Hong Kong Securities Regulatory Commission did not set any restrictions on the number of virtual asset trading platform licenses.

As of now, OKX, BitMEX, Huobi, Gate and other Chinese-speaking users are familiar with trading platforms and have publicly stated that they are preparing to apply for licensing in Hong Kong. The most intuitive manifestation is that these platforms have opened trading platform branches in Hong Kong before June 1.

So, which platforms can investors trade safely on in the future?

The SFC repeatedly emphasized the requirement of “protecting client assets”. In the reply email to “Jinse Universe”, the SFC cited an example: for example (but not limited to), the platform operator should only hold client assets in trust through its connected entities for its clients. The connected entities should not conduct any business except for representing the platform operator to collect or hold client assets. The platform operator should ensure that client virtual assets are segregated from the assets of the platform operator and its connected entities.

Regarding this requirement, Lennix Lai, the Global Institutional Director of OKX, stated that OKX has implemented a reserve fund proof and strictly implemented client fund separation while strengthening overall market monitoring.

The official website of OKX, which serves global users, shows that the platform has always adopted a cold-hot wallet separation strategy internally to ensure the security of user assets through online/offline storage systems, multi-signature and multi-backup mechanisms. Public information shows that OKX has established the “All-inclusive Fund”, which continuously sets aside a certain percentage from the platform’s earnings to protect user assets in the event of digital currency security risks, and has accumulated more than 700 million US dollars.

Another platform OSL has expanded its cold-hot wallet infrastructure to apply for a license that can operate retail transactions, maintaining a strict cold-hot storage ratio to ensure that 98% of client assets are safely stored in cold storage.

Hippo Financial Services Limited, which holds TCSP, will provide trust services for Gate Group in Hong Kong. In contrast, Huobi’s disclosed progress in applying for an IPO is limited, but the sense of competition for Hong Kong’s IPO has already spilled over from the product level.

Just a day before Huobi Hong Kong went live, OKX launched an upgraded Hong Kong trading application that supports Hong Kong users to buy, sell, and hold 16 major crypto assets, including Bitcoin (BTC) and Ethereum (ETH), and users can use Hong Kong dollars, P2P trading, or third-party service providers to trade with Apple Blockingy, Visa, and Mastercard.

“OKX has now contacted more than 10 banks of different sizes to prepare for account opening,” said Lennix Lai, adding that every Hong Kong user has the right to use a reliable and easy-to-use application to explore the world of cryptocurrencies. OKX is continuing to work with local regulators to advance license applications under the new VASP system.

According to the latest news, OKX has submitted a license application to the SFC and invited independent auditing and consulting firms to evaluate the regulatory scope listed by the SFC. It is estimated that the license will be issued in early next year.

Traditional institutions such as Tiger Securities and Greenshoe have disclosed less information about their preparations for VASP licenses, while crypto asset platforms have clearly been more active in displaying their own sincerity in public channels.

Do crypto-native troops have an advantage over traditional institutions in applying for IPOs?

The SFC replied that the SFC formulated virtual asset trading platform regulatory rules based on the principle of “same business, same risks, same rules.” Under the new system, virtual asset trading platforms will be subject to various regulatory requirements, as well as some requirements applicable to the characteristics and risks of virtual assets, including proper asset custody, know-your-customer procedures (KYC), anti-money laundering/terrorist financing, prevention of market manipulation and illegal activities, accounting and auditing, risk management, avoidance of conflicts of interest, and network security.

With the same starting line, the long run of IPO applicants continues, and among the various teams, the crypto-native forces that have served retail or professional investors for many years, such as OKX, cannot be ignored. The final lucky ones will be those who are well prepared and have good endurance in compliance pursuit.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Comparison of Cryptocurrency Policies between Hong Kong and Singapore

- Hong Kong Monetary Authority and Central Bank of the UAE Strengthen Cooperation on Virtual Asset Regulation and Development

- Notice of the General Office of the People’s Government of Beijing Municipality on Printing and Distributing “Several Measures to Promote the Innovative Development of General Artificial Intelligence in Beijing”

- Will the cryptocurrency policy in the US and Canada see a new direction in the 2024 presidential election?

- Interpretation of the "2020 Cryptocurrency Act": New Ideas for the Cryptocurrency Regulation Model

- Investigation | After the ban is lifted, Indian investors are more positive about cryptocurrencies

- Babbitt Column | Case Study: Free Sugar Spreading Gives Miners, Also a Crime?