How to get DeFi out of the niche? Open finance gives you the answer

Decentralized finance (DeFi), which has high hopes for 2019, describes a moving and promising future, but it is still difficult to move from the niche community to the mass market.

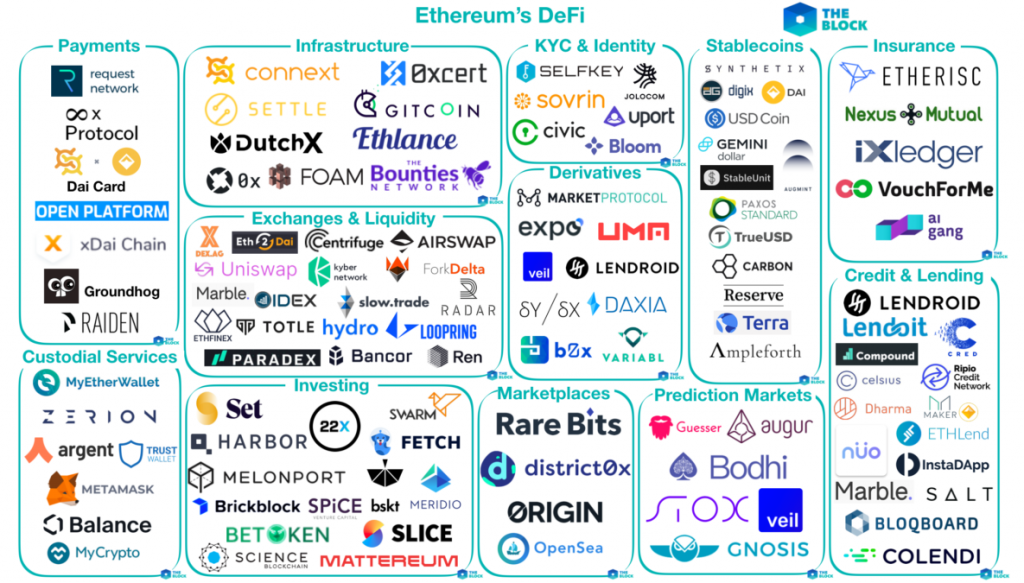

The systematic arrangement of the Ethereum DeFi ecosystem, involving more than 100 projects, source: Block Genesis, 2019.03

The systematic arrangement of the Ethereum DeFi ecosystem, involving more than 100 projects, source: Block Genesis, 2019.03 The gap in this is due to the very different attributes of the two groups:

It seems that highly capable and exploratory hackers are naturally at odds with businesspeople who are paramount and service entities.

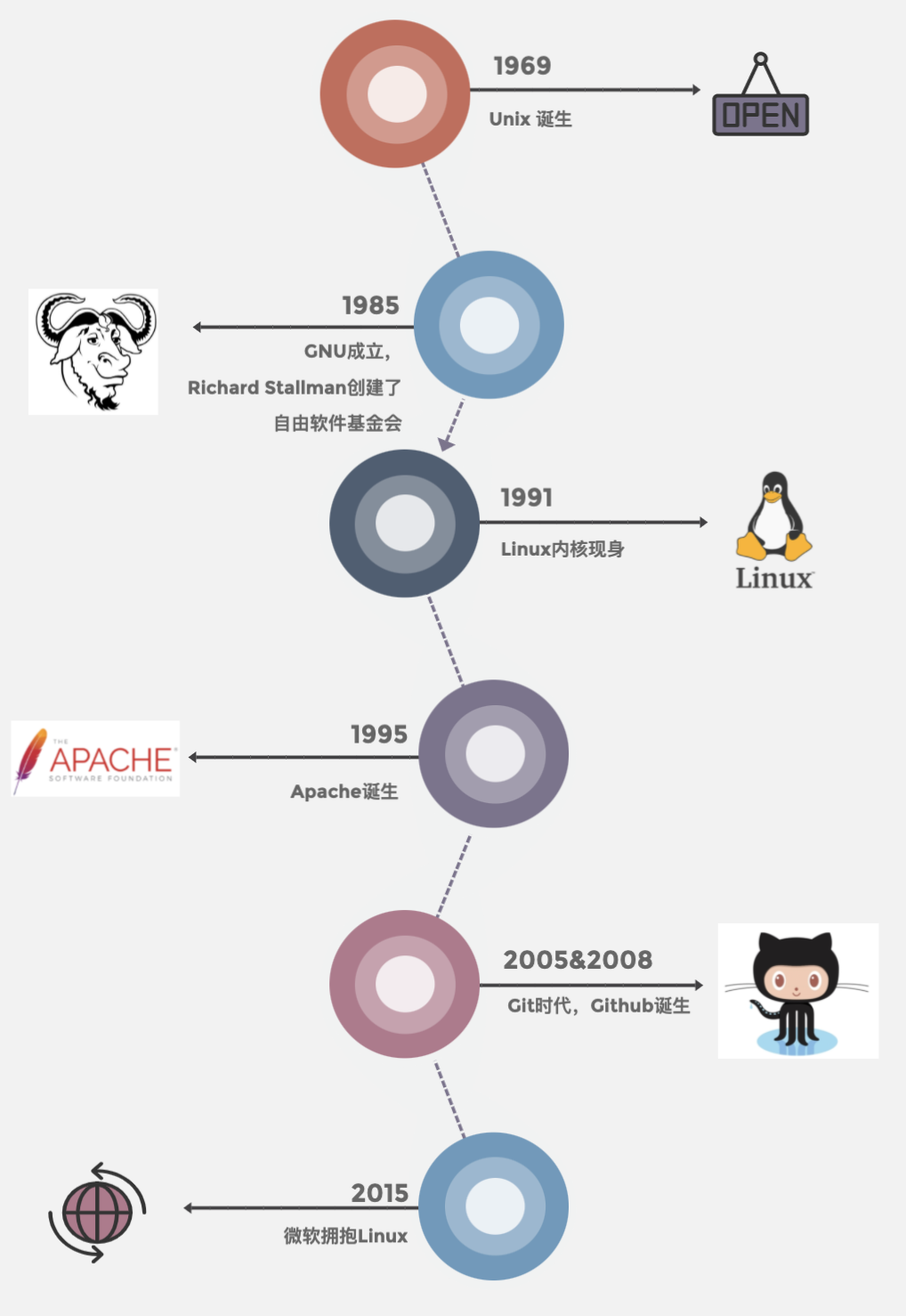

This divide is not inevitable. During the development of the Internet, the process from free software to open source software is a typical case.

- Ba Shusong, Peking University: How can blockchain empower rural finance?

- DeFi week selection 丨 How to play DeFi in 2020? Top investment institutions and project parties give you answers

- Towards decentralization, the Maker Foundation hands control of MKR to the governance community

We look forward to reviewing the history from free software to open source software, combining the current development difficulties of Defi and finance, and giving a bright light.

"Free software" that started in the hacker community

"Solving a problem out of interest, whether it's useful or not, is a hacker."- Richard Stallman Founder, Free Software Foundation

Sometimes it is difficult to imagine why hackers are so obsessed with open environments, and perhaps the protection of the soil where creativity grows freely is also protecting the hackers' own creativity. Among them, of course, the most influential was Richard Stallman, who launched a free software movement with a natural fighter spirit.

"Fully open! Go to copyright!", Declare war on the copyright system.

Free software starts with the GNU Project. The GNU Project expects to develop a 100% free, Unix-compatible, portable operating system. Finally, in 1991, Linus Torvalds wrote the GNU-based kernel core components, which made the GNU / Linux system widely used and made the concept of free software more widely known. The New York Times of 1989 even called Richard Stallman "the last hacker."

Richard Stallman has spent a lot of time promoting his concept of free software, and also proposed the concept of Copyleft as opposed to Copyright to protect this freedom of free software: it allows others to modify and distribute works arbitrarily, but the behavior of distribution and modification and The practice is also limited to copyleft.

Richard Stallman, with his influence in the American hacker community and his spirit of advocating freedom, attracted a group of top computer hackers to develop free software, and established the Free Software Foundation.

But at that time, the development of free software encountered a bottleneck.

The Dilemma of Free Software

This compulsory sharing agreement gives the end user maximum freedom, but also prevents developers from making profits, and loses the possibility of maintaining livelihoods by developing free software.

The copyright system of free software and intellectual property rights is hostile and has not been integrated into business.

Richard has gone too far on the road to idealization. The free software movement expects everyone to first uphold a set of strongly restrictive rules with idealism, and then act in accordance with the rules. Although free software rules can bring sharing, but The environment was antithetical. The development of free software does not bring commercial returns, making its influence difficult to expand.

In fact, the promotion of free software is very difficult. After the release of GNOME 1.0 in 1999, the people using and maintaining it were still confined to the hacker community. Free software has gradually become a mysterious existence in the hacker community.

Open source software forks free software

Bruce Perens (one of the founders of Debian) defines the core of open source software as open source code and shares the code that has been developed or is being developed, which does not restrict people from using those open source code for commercial purposes. This approach to embracing the market also further allowed the open source culture to quickly spread and be widely used by the developer community.

Open source software has finally become mainstream

When Github allows the most dedicated people in a specific field to collaborate and share the results more widely with users who need the results, and can quickly collect feedback and respond immediately, this has led to this group of the best people More effective, clearer and more creative work. These steps are implemented on Github without exception by simple tools.

Inspiration of Free Software to the Dilemma of Decentralized Finance

Hackers are an alternative group of people who create and expect to solve difficult problems based on their interests. So, for them, solving the technical problems of the world is their fun, and the creative process itself gives them enough returns, so that they don't have much energy to think about some obstacles that users will actually encounter.

But in fact, really great hackers often can think further. When they create great works, they are also concerned about the benefits and benefits that others can get, and they are even willing to reduce the gains they can get. Focus on the needs of actual users and use superb technology to serve these real needs.

Satoshi Nakamoto, the founder of Bitcoin, gave us a very positive example. It was the transposition of the interests of BTC defenders that prompted him to design a POW reward mechanism .

Decentralized Finance (Defi) Scalability Dilemma

It is expected that the distributed ledger will have decentralization, scalability, and security at the same time, which is called the "trilemma" by the industry. From the current point of view, it is impossible to achieve both at the same time.

Difficulties encountered by traditional finance

When ordinary people face the complicated financial products introduced by bancassurance securities, they are always prohibitive. There are many recommendations from "experts", but they are mixed and cannot be identified. Traditional insurance contracts, fund specifications, and wealth management products are confusing to ordinary people. The understanding of contract regulations in the financial system and the understanding of code are completely different. Many conditions are more or less intentionally hidden. You need to guess the intent behind it, which greatly weakens the service of finance for ordinary people.

If commerce is a market way for humans to allocate resources efficiently, then finance is optimizing this allocation of resources.

From a historical perspective, the accounting system now allows corporate finances to be transparent and open, and has achieved joint-stock companies, while the financial market allows shares and other securities to be listed and traded freely, so that capital flows are more adequate, and the purpose of finance is to help the people served and served. Have easier interactions, break the deadlock of distrust due to interests, and enable each other to better collaborate and exchange and share resources; help public resources be better managed in a unified way, and allow supply and demand side to establish more direct Relationship.

In the pursuit of optimal resource allocation, centralization has never been the primary issue. If there is a central organization or individual that is particularly reliable, capable, and adaptable to change, and only does good deeds, then trusting the central organization or individual is the most labor-saving and economical way. The core question is, in what form should resources be concentrated and dispersed, which is best for overall development?

The increase in rent-seeking costs has led to a lack of sufficient transparency within the organization, which has reduced trust within the organization. In a complex system where altruistic people are constantly damaged, people can only survive through self-interested behaviors, which greatly increases the cost of resource allocation and exchange, and runs counter to the purpose of finance itself.

This is a good way to understand why "decentralized finance" is so exciting. But the core is still not "decentralization", but to make it easier for more people to use finance.

For this purpose, we feel that using "open finance" instead of "decentralized finance" can better serve this goal.

Agreement, make finance more friendly

In our opinion, the invaluable treasure that Defi has given us is that it can make financial services no longer "platform-based", but rather "protocol-based . " Open finance, of course, also advocates financial services agreement.

What is the difference between "agreement" and "platform"? In a word, the difference between a protocolized application and a platform application is that the protocolized application itself is a service , or the service provided by the protocolized application is itself. The core problem that Defi solves is that the process of value transfer can be completed at the same time when the protocol application is used.

From "platform" to "agreement", this change is huge. If the process of providing services and the process of collecting service compensation are independent, then friction will occur in the process of binding services and payments, and Defi will be distributed through Ledgers and smart contracts to complete this binding process.

For simple logic like borrowing, you can use smart contracts to build processes without human intervention, and for some complex logical scenarios, this binding process also requires some human intervention, so smart contracts and Oracle also Node maintainers and other roles will be added, but compared to the traditional platform business model, it is much more convenient.

This is an indisputable trend. More and more Internet industry giants are beginning to understand that protocolization can eventually replace platformization, and they are looking forward to a self-reform. Problems that cannot be solved by the super platform can be solved through protocol services.

In addition, for platforms, when the number of people grows exponentially, the crisis of trust will become more serious, and Facebook ’s privacy leak scandal is an indisputable example.

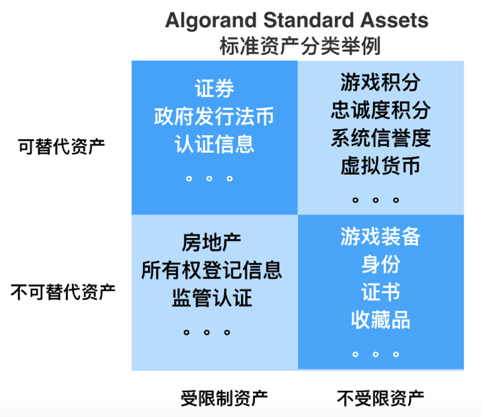

Therefore, if financial services are to be protocolized, each financial service can freely choose the required node configuration method according to the scenario. With the help of blockchain technology, regardless of single-center nodes (platform mode), multi-center nodes (alliance mode) ), Decentralized nodes (public chain model), and other methods can become possible items. This has greatly increased the flexibility and convenience of financial services, and played a better role in optimizing the allocation of resources.

Open finance is the way to break the situation

"The deeper meaning of asset digitization is that data information will be native, can be penetrated and traced, and can be self-certified and other evidence, thus extending from the financial model, the economic prospects and significance are immeasurable."

References:

2. 15 years of free software

3. The New York Times: A Fight for Artificial Free Software

4. A monument in the history of free and open source software

5. What is copyleft

6. Why are many good software companies and developers willing to open source and share?

7. Multicoin: exchanges are open finance

8. Open source movement, from community to commercialization

How much decentralized finance is decentralized

10. Definition of Open Source Software

11. Open financial map

12. Algorand 2.0 — Technical Innovations and Use Cases

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- What the blockchain looks like now: the DOS operating system of the year

- With only 10 days left in 2019, what new variables will be in 2020?

- A week in review | Bitcoin plummets, history soars, U.S. crypto regulatory framework emerges

- Babbitt Column | Development in the Blockchain Industry Starts with Finding Your Own Belief

- When people are talking about DeFi, what are they actually talking about?

- DeFi Series | Borrowing, Spot and Margin Trading: The Syllogism of Decentralized Finance

- Ethereum 2.0 code audit will be completed in February next year, and the storage contract mainnet may be launched in July