Where will the blockchain go in 2020? Outlier Ventures shared 12 predictions

Author: Lawrence Lundy, Outlier Ventures partner and head of research

Translation: Deng Jingyi, Song Zibei

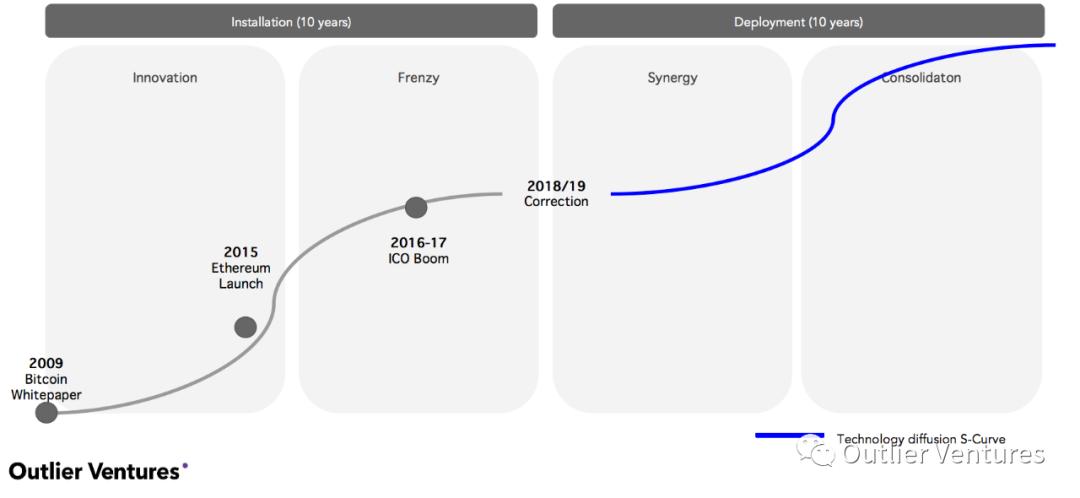

After the birth of Bitcoin for more than 11 years, 2020 will continue to follow the trend of the technology diffusion S curve, from the installation period to the deployment period, and we will start to see Synergy and merger development. At this stage, more and more institutional investors will be involved, and they will pay more attention to the fundamental factor-the real value and application of the project. In the end, the blockchain industry will slowly mature.

S curve of technology diffusion. In 2020, we will enter the second 10 years of blockchain technology

S curve of technology diffusion. In 2020, we will enter the second 10 years of blockchain technology

- Panoramic scan security incidents in 2019: 28 exchange cases involving 1.3 billion U.S. dollars

- IBM and Maersk Blockchain platform TradeLens add another member-Vietnam Gaimei International Terminal

- Zero fee for Bitcoin transactions, Coinbase CEO gets patent for trading Bitcoin via email

At the same time, 2020 also marks that the distributed application network is becoming more mature and more available, creating a fiercely competitive environment for competition between projects and competition for the mainstream. This will be the beginning of a new cycle, built on the background of large-scale requirements and applications, and the next generation of Internet unicorns will be born here. In order to achieve large-scale applications, the technology distribution based on any necessary basic innovation will become the key, which requires the aggregation of open collaborative technologies.

The following summarizes our 12 predictions for the blockchain in 2020.

1. Games, games, games!

The game industry will become a breakthrough blockchain application area in 2020.

By the end of 2020, many components that make a mainstream game come into being will emerge: higher-performance platforms, easier interfaces for digital asset input and output, and tools that are more conducive to players' digital asset storage and distribution. Therefore, all that remains to be considered is to expand the reach of the game and reach more players. If game players are given the ability to rent GPUs and CPUs for rendering and computational tasks, and then gain the ability to use points in a game or even multiple cross-games, it will accelerate the attraction of more players to join .

Prediction: Valve and / or Epic will launch blockchain-based gaming services

2. Telegram will be used a lot in daily life

Telegram currently has about 200 million monthly active users. This communication software with differentiated advantages in privacy and security has become the choice of many people, many of whom are early participants in the cryptocurrency project.

With the launch of Klatyn (KakaoTalk) and Link Network (LINE), the development of TON (Telegram), Mobilecoin (Signal), and Libra sans stablecoin (Facebook), starting in 2020, we will gradually see a blockchain-based practical application platform. Even as a condition of reaching a settlement agreement with the SEC-TON needs to return funds to U.S. investors-TON and its web applications will still have an advantage over Klatyn, LINE, and Facebook in their ready-to-use target audience.

Prediction: By the end of 2020, Telegram will have higher monthly active users than any other blockchain network platform.

Telegram is a cross-platform instant messaging software using a secure encryption protocol. Pictures from the Internet

Telegram is a cross-platform instant messaging software using a secure encryption protocol. Pictures from the Internet

3. Use Corda at work

Corda will become a leader in the blockchain enterprise services market.

While consolidating its leading position in the financial services market, R3 will continue to enter other verticals such as energy and communications. Enterprise-friendly services such as training, customer service, and certification programs will give the platform a differentiated competitive advantage, which will drive more use, which in turn will attract more developers to build the platform. It may not be as hot as building a DeFi application on Ethereum, but in 2020, real customers and real wealth will be generated on the Corda application.

Prediction: Corda will surpass Hyperledger, Ethereum and Quorum in market share and become the leader in the blockchain enterprise market.

Corda was created by R3 Software and is a blockchain platform dedicated to commerce. Pictures from the Internet

Corda was created by R3 Software and is a blockchain platform dedicated to commerce. Pictures from the Internet

4. China will fully promote the use of digital currencies

The BIS survey of 63 central banks in 2018 revealed that most central banks are researching digital currencies or conducting proof-of-concept work, but most of them are not yet ready for market launch.

European Central Bank President Christine Lagarde said the central bank's digital currency "can meet public policy objectives such as inclusive finance, security and consumer protection; it can also provide privacy payments that the private sector cannot provide ". The central bank will focus on the wholesale market and leave the retail market to those compliant institutions. In 2020, the People's Bank of China's statutory digital currency (DCEP) is expected to be issued in this manner, and its license will be granted to specific exchanges and mainstream platforms (such as Alibaba, Baidu, and Tencent) for distribution to hundreds of millions of users as a distribution platform .

Forecast: By the end of 2020, more than 500 million Chinese citizens will receive services related to the DCEP network.

5. European blockchain market booms

By 2020, Europe will be the first to surpass the United States and become the center of western blockchain application projects, especially the tokenized network, which will achieve autonomy in terms of financing and technology.

It is worth noting that the scope of the impact of Brexit is not yet clear. London was once the second most popular city for early blockchain financing in the world. This is largely due to the European Union's determination to shake off US dominance in the Internet field over the past few decades. The European Union considers Silicon Valley to be an anti-social and exploitative Internet monopoly. At first, the European Union was only concerned about data, but now the emergence of Libra makes the European Union worry about its impact on the stability of the entire financial system.

Prediction: The European market's venture capital investment in blockchain companies will be 700 million U.S. dollars in 2019, and it is expected that it will exceed the historical high of 850 million U.S. dollars in 2018 to reach 900 million U.S. dollars.

6. Huge East-West differences play a role in the blockchain industry

This year, the longer we spend in Asia (especially in China), the more we believe that the application of blockchain (especially digital assets) will make a difference between East and West. Of course, this is not new; in fact, there have always been two versions of the Web, but with the promotion of China's central and local governments, blockchain has been accepted at an alarming rate.

- Although China has officially embarked on a road of licensed and non-tokenized blockchain, due to the dominance of multiple POS networks such as Bitcoin mining and EOS, some people believe that China's blockchain is Company-controlled.

- Most of the exchanges and trading volumes are still generated by the Chinese. It is understood that by the second quarter of 2020, a few leading financial institutions will obtain formal trading permits, and they may initially have a relatively limited amount outside the free trade zone. Way to operate.

- We can expect that provinces and state-owned enterprises will begin to support the development of regional tokenization networks under the guidance of the central government.

- Enforcing mandatory policies on mainstream platforms will allow the Chinese central bank's digital currency (DCEP) to benefit hundreds of millions of consumers overnight, while at the same time being able to further consolidate the business models of mainstream platforms. In the West, we want many people to believe that the Web 2.0 platform is unbundled.

- Perhaps we will see the era of Web 2.5 in Asia or a completely different form of Web 3.0 in the future, which will trigger a battle that is not only technical but also potential financial strength.

Prediction: In 2020, three Chinese exchanges will obtain domestic operating permits and operate under the supervision of regulators.

7. The token market will undergo remediation

There is a big story that will run through 2020, and we call it "The Reckoning" in the token market. The total market value of cryptocurrency assets for most projects has fallen by 88% compared to the high point in early 2018.This is due to the bear market effect, on the other hand, it also reflects that the market has not fully reflected the technology. Development process.

Over time, exchanges will also become more professional, and those "zombie tokens" will be widely removed from the market, and investors will pay more attention to what is behind cryptocurrencies. Contains real project value. At the same time, those projects that were valued at US $ 100 million before they passed the product market test will no longer exist, and valuation will no longer rely solely on project vision and ideas, but more on the project's true value and application For valuation. And projects that simply announce partnerships, release beta releases, or make progress in financing are not enough to reflect the true value and application of the project. We believe that projects like Brave browsers with 10 million monthly active users are the ones that really make early investors proud.

Prediction: More than 5 new indices will be launched in 2020, with a market value of more than $ 5 billion.

8. New applications for Bitcoin

We believe that Bitcoin will shift from a simple "storage value" to a more open "financial platform" in 2020, becoming the most secure and trusted settlement layer in the market.

In 2020, Bitcoin will usher in halving production, which will become the focus of the industry and the media. For most people, the price impact of halving production will be their main concern. However, in the long run, the growth of Lightning Apps (LApps) and the broader data anchoring will become a stronger fundamental signal for the development of the fee market and the long-term sustainability of Bitcoin.

Prediction: In 2020, Bitcoin's market share will increase from the current 66% to at least 75%.

9. Ethereum will not launch more applications, but Decentralized Finance (DeFi) will continue to be sought after

In addition to crowdfunding and DeFi applications, we expect that the second-tier applications can be applied to more different industries, and look forward to the migration of some game applications that are currently using EOS and Tron to Ethereum, making full use of those idle DeFi Components (lego). With the development of MAST and Taproot on the Bitcoin network, and the main online launch of new smart contracts in 2020, more and more platforms will have their developer stable pool. Decentralized projects on Ethereum will gradually decrease, but a small number of selected DeFi projects such as Maker and Compound will attract more and more monthly active users, and at the same time bring the value of locked positions on the contract (value locked- up). The more difficult prediction is: Will those projects that use DeFi components to build blocks use Ethereum as the base layer? Or will it be an interactive project like the GEO agreement? Or will it be those projects that will gradually reduce their dependence on the base layer over time?

Prediction: The total value of Ethereum DeFi hedging will exceed $ 1 billion by 2020

10. Towards the king of the market, you will miss the new blockchain

A large number of new smart contract platforms will appear on the market in 2020, and they will pay more attention to the needs of developers and consumers. After some time, developers as a whole will become more familiar with platforms based on blockchain technology. However, it is currently estimated that the number of developers using blockchain platforms worldwide is less than 1% of the total number of developers. In 2020, we will continue to see oversupply.

In the forecast 1.0 version, cryptocurrency is widely regarded as a digital commodity, and deviations in the perception of cryptocurrency will have an impact on prices. From a problem-solving perspective, most developers want to be able to use software that is stable, secure, fast, and easy to use. Platforms like Polkadot, Fetch.ai, Dfinity, Hashgraph, Near Protocol, Spacemesh, Solana, Telegram Open Network, Thunder Token, nCent, and platforms like Cardano, Tezos, Holochain, Algorand, Blockstack have already entered the market, they are to a certain extent They all have differences, but the biggest question is: how can these platforms intercept developers so that developers can develop Killer-level applications on their platforms that can attract a large number of consumers?

Therefore, for different developers, the platform should adopt differentiated strategies: contract accelerators, ecological funds, and equipment consoles (Devcons). In 2020, although some platforms will increase the number of developers and increase market share, most platforms will continue to face positive competition with Ethereum and Bitcoin.

Forecast: By the end of 2020, no smart contract platform can have more than 400 applications.

11. The moment of the big shuffle

In 2020, 50% to 75% of the listed tokens will be suspended from listing or trading.

There are currently 2345 actively traded tokens on the market, and by the end of 2020 this number will be reduced to around 1,000. If Binance decides to implement a delisting measure to protect users and prepare for regulation, this number will be less than 500.

Newly listed tokens will become fewer and fewer and more mature. By the end of 2020, the public offering strategy will no longer be suitable for seed companies in the initial stage, and it will no longer be regarded as a target pursued by everyone like the traditional market IPO, but at least there will be products that match the market. The distribution of tokens will continue, just like before ERC20, the distribution activity became a means to increase network activity and also promote the development of the network.

Prediction: Of the tokens currently listed, more than 50% of the tokens will be suspended from listing.

12. Investors don't want to be consumers, they want returns

Due to the collapse of the ICO market and the unsatisfactory returns brought by IEOs, various projects are currently exploring an alternative token distribution strategy, hoping to attract more financing while keeping in line with the interests of network participants.

The ideal allocation method can solve the following problems in the market: speculation, supervision, de-anonymization network, irrational markets and stakeholder alignment. Unique solutions such as Lockdrop, wardrop, and liquid airdrops have now entered the practical application level or are in the testing phase. In 2020, the market for investors who can simultaneously become network participants, because the amount of funding is too small, and lack of financing conditions to establish a global network market. We will return to the model of financing through equity and tokens as user rewards.

Prediction: In Western markets, before the launch of the network, 90% of funds will be raised through equity financing, and equity financing will become the dominant financing method.

About the author: Lawrence Lundy is a partner and head of research at Outlier Ventures and leads the investment philosophy of OV. He is also a Blockchain and AI Expert Advisor to the British All-Party Parliamentary Group (APPG), a member of the Steering Committee of the AI Global Governance Committee, a member of the European Commission Blockchain Observation Mission, the UK Treasury, the Financial Supervisory Authority and the Bank of England Crypto Asset Working Group a member of. He has repeatedly published his opinions and articles in mainstream media such as the BBC, Bloomberg, The Economist, and the Wall Street Journal.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Babbitt column 丨 Gu Yanxi: Libra's impact on the global financial industry from three basic judgments

- Serving 130 million customers, Japan's largest credit card issuer JCB plans to adopt blockchain B2B payment solution

- Ant blockchain ambitions again: this time to promote digital innovation in the field of commodity trading

- Babbitt Site | Telecom Industry Blockchain Exploration at a Glance, 3 Major Operators Unlock 8 Application Cases

- Blockchain supervision has a major event in one day

- Double spend attempts on the BCH network are frequent, and about 10% of double spend transactions are confirmed

- Zhu Jiaming: Wall Street, Silicon Valley, WTO and IMF are declining, and hard technology has developed into a direct promoter