When people are talking about DeFi, what are they actually talking about?

Source: Medium

Translation: First Class (First.VIP)

Overall, the field of blockchain-driven decentralized finance (DeFi) is still in its infancy, but it offers an attractive value proposition that individuals and institutions can access a wider range without trusted intermediaries Financial application. In particular, people who previously had no access to such financial services can benefit. DeFi is committed to building a mature capital market. Do not deny the growth of DeFi, here we do a small analysis.

- DeFi values network effects, and true innovation is achieved through a unique combination of applications.

- Although it is difficult to determine which blockchain protocol and application will get the most use over the long term, the current advanced decentralization, programming flexibility and truly enthusiastic developers will put Ethereum in a leading position.

- For Ethereum, whether to adopt DeFi in the future is closely related to the scalability and availability of Ethereum.

- DeFi has not proven to be truly progressive. At present, availability is not intuitive, pricing without risk adjustment, and liquidity cannot compete with centralized alternatives. However, we are optimistic that these are the problems of the new ecosystem.

Note: All data and examples as of November 30, 2019.

- DeFi Series | Borrowing, Spot and Margin Trading: The Syllogism of Decentralized Finance

- Ethereum 2.0 code audit will be completed in February next year, and the storage contract mainnet may be launched in July

- Investment strategy for 2020: "regular army" enters the market to welcome change, and pan 5G integration promotes implementation

What are the hot topics related to DeFi?

DeFi has become a hot topic in the blockchain community. Unlike reaching a decentralized currency through Bitcoin, DeFi's goal is to adopt a broader approach to the decentralization of the traditional financial industry. The core of the plan is to open traditional financial services to everyone and provide an unlicensed financial services ecosystem based on blockchain infrastructure.

Definition of DeFi:

"An ecosystem of applications built on public distributed ledgers facilitates unlicensed financial services."

Broadly speaking, DeFi is an ambitious attempt to decentralize core traditional financial use cases such as transactions, loans, investments, wealth management, payments, and insurance. DeFi is based on decentralized applications (DApps) or protocols. By running these DApps on the blockchain, it provides a peer-to-peer financial network. Just like Lego bricks, each DApp can be combined with each other. Smart contracts act as connectors-comparable to the APIs specified in traditional systems.

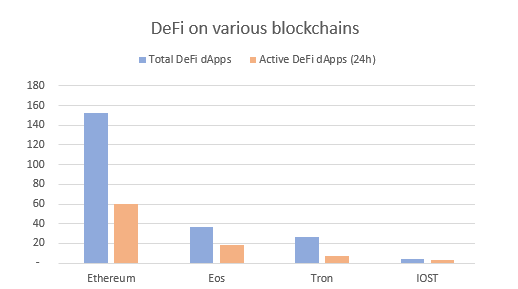

Ethereum dominates the total number of DeFi and activities (source: own data)

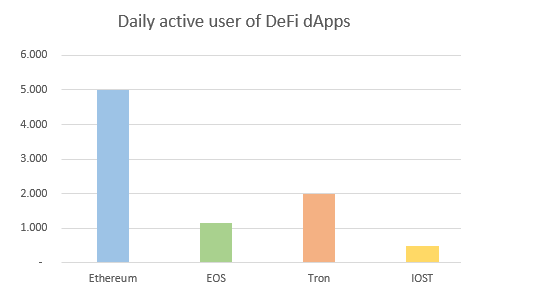

Using DeFi on the blockchain is still in its infancy (source: own data)

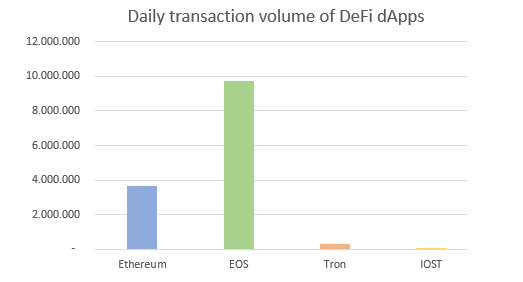

Daily trading volume (USD); EOS is an exception (source: own data)

The rise of DeFi

Although the initiative of open finance is blockchain agnosticism, it flourishes on the basis of more flexible blockchains (that is, programmable smart contracts) and healthy developers. Today, almost all DeFi projects are built on Ethereum, which makes Ethereum the standard default blockchain for many DApps. From the average data in November, Ethereum dominates the existing blockchain in terms of number of applications, application activity, user activity, and number of transactions / locks (limited). The huge transaction volume on EOS is a common phenomenon and is generally considered to be the benefit of zero transaction costs, so it may cause transaction inflation. In any case, this shows that zero transaction costs is an attractive goal to support DeFi development on the blockchain.

In short, DeFi's other competitors are far from us at the moment, because they either lack a healthy developer base (IOST) or they lack true decentralization and thus lack the core advantages of blockchain (EOS). Some are missing both. This raises a common question, whether DeFi can also be copied to the most popular blockchain protocols. Contrary to popular belief, DApps do work on Bitcoin, but programming is much more complicated.

Bitcoin emphasizes security, which is very important in financial infrastructure. Therefore, Bitcoin may fit into a healthy but significantly smaller DeFi ecosystem. By far the most successful DeFi application for Bitcoin is the Lightning Network. These applications were developed over the past few years and are based on a technology called state channels. Lightning Network supports ultra-high-speed and low-fee payment, and achieved amazing growth in 2019, with more than 6,000 active users and $ 6.2 million locked in the network. Other well-known Bitcoin DApps are decentralized exchanges (such as Bisq or Sparkswap).

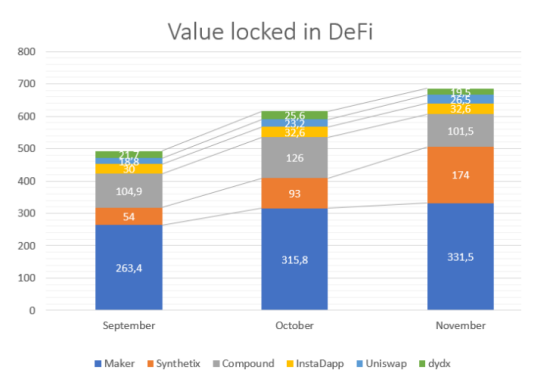

Although it is difficult to determine which protocols and applications will receive the most long-term use, the current advanced decentralization, programming flexibility, and enthusiastic developer base put Ethereum in a leading position. Therefore, DApps based on Ethereum will be the focus of this report. The DeFi project now holds a considerable share of Ethereum's huge ecosystem. In particular, Ethereum (ETH), which is locked in smart contracts, is often used as an indicator of the growth of DeFi projects. The total value of locked ETH is more than $ 680 million (about 2.5 million ETH). In terms of the amount of ETH locked, MakerDAO dominates the main applications, followed by Synthetix, Compound, InstaDapp, Uniswap, and dYdX. However, in the past few months, MakerDAO's dominance has begun to decline, and other platforms have started to collect ETH in large quantities. With the innovative integration of DApps (such as InstaDapp), the DeFi technology stack has become increasingly interdependent.

Comparison of monthly locked funds with the first 6 agreements (in millions of dollars) (source: own data)

A very important point is that the fuel that keeps DeFi running is ETH and DAI. Ethereum needs ETH to pay for blockchain transaction fees, and ETH is also the easiest to convert into other cryptocurrencies. DAI is a kind of token generated on the Ethereum blockchain, which provides the advantages of stablecoin: completely decentralized and pegged to the US dollar, so it is less volatile. A major factor driving this success has been the ability to circulate DAI between different DeFi protocols as a unit of account on these DApps.

What are DeFi's core strengths now?

DeFi is built on top of the blockchain. The blockchain is called the universal infrastructure layer, so DeFi can be seen as a DApp cluster on top of this infrastructure. This allows DeFi to have the core characteristics of decentralization. It should be noted that this is only true if the blockchain itself is decentralized. Under this premise, the core benefits of open financing are shared with the core benefits of blockchain:

- True decentralization allows censorship to be resisted, global participation regardless of social status, and distribution to trusted third parties.

- Using blockchain as a technology infrastructure can achieve relatively high speed and low cost transactions / settlement, immutable financial contracts and contract automation.

- DeFi applications usually allow users to keep private keys. This is called unmanaged in the blockchain ecosystem. There are no trusted third parties, and users have full control of these funds.

- Increase the transparency of the ecosystem, thereby increasing prices and market efficiency. Because there is no asymmetric information and personal interests are bound by transparent agreements, the risk of entrusting agents is minimal.

- DeFi respects network effects and realizes many innovations by uniquely combining different DeFi applications.

For example, the largest active DeFi contract locks up $ 10 million without a bank account and without a third party, and customers can always own these base cryptocurrencies.

This is in sharp contrast to the traditional financial industry, which allocates a large amount of resources to build a trust system, which is heavily centralized (such as too-big-too-fail banks), transparency (Such as the 2007 crisis) and censorship / discrimination in many countries. In addition, the system failed to keep up with the pace of the digital age: an average cross-border transaction takes 3 working days and costs approximately 6.8%.

So why hasn't it skyrocketed?

However, the adoption of DeFi currently lacks useful theoretical support. In order to widely adopt decentralized applications, DeFi must overcome some major obstacles.

- The DeFi ecosystem is an area of technological experimentation and innovation. Accessibility is global, but not intuitive enough in terms of user experience. In addition, because it is based on cryptocurrencies, you must first convert traditional currencies into cryptocurrencies.

- Liquidity is replaced by a centralized alternative. This is important because liquidity is critical to effective pricing in the financial industry. In fact, most protocols currently cannot compete as efficient, low-cost competitors. Considering double-digit stability fees, MakerDAO is not currently used as an unlicensed credit provider, but as a decentralized way to create leverage in Ethereum. By exchanging ETH for DAI and reinvesting it in ETH, this follows a centralized strategy for leveraged longs.

- Product over-collateralization: Because there is currently no credit score or shared collateral, many products must be over-collateralized (sometimes up to 150%), which reduces the leverage of professional traders and gives users the opportunity to not control their funds. Traditional credit scoring is based on identity and complex deleveraging systems, clearing algorithms, and insurance funds, making centralized systems with high capital efficiency. This is a research direction.

- Due to the novelty of these methods, technical risks (such as bugs in smart contracts or blockchain infrastructure) are difficult to detect. By design, fake or fraudulent transactions are irreversible on the blockchain.

- In addition, there are operational risks due to price feedback (the so-called "god") and the failure / manipulation of complex governance agreements.

- The interdependence of the DeFi protocol brings potential system risks. This can be observed from the "too-big-too-fail" state of MakerDAO. Considering the field's dependence on oracles and stablecoins, it can be said that this is the most critical infrastructure inside DeFi. MakerDAO is open source and mostly decentralized, which at least to some extent eliminates the "too-big-too-fail" debate. However, current market participants are faced with few practical options other than the dominant loan agreement and its oracle.

Some issues with Ethereum itself (below) can cause problems for DeFi:

- Network congestion: During periods of high usage, there will be some blocking issues on the Ethereum blockchain. If the network is congested, transactions may remain pending, which ultimately leads to inefficient markets and delayed information.

- High transaction costs (such as gas fees on the chain): Because transaction processing priorities are determined based on gas fees, transactions with lower gas fees may wait for longer transaction processing times.

- Since the state of the blockchain is updated on average every 15 seconds, this is very rare for traditional finance. In DeFi, interest and price are calculated on a block basis, and stable operation requires stable block mining.

These issues are closely related to Ethereum, but similar issues may exist on any blockchain. Specifically, due to the popularity and use of Ethereum, these network performance issues are sometimes faced. In contrast, most existing blockchains currently do not face scalability issues because they do not have enough traffic or are more centralized in design, thus achieving higher speeds and better performance. However, we believe that most of the issues raised are because the open finance industry is still in its early stages and applications are still in the experimental stage, and they are expected to become more mature to solve many of the key issues that currently exist.

Different DeFi use cases

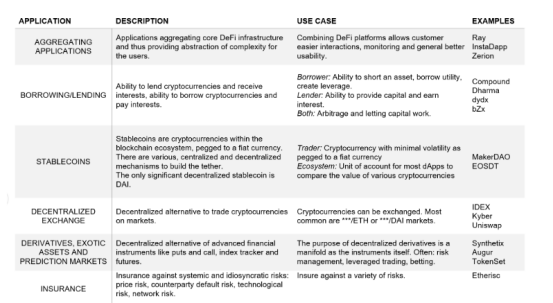

DeFi is a general term for decentralized, unlicensed financial infrastructure, so a variety of customer-facing applications can be found. Currently the most interesting areas are lending / crediting and exchange agreements. The following table lists a different set of DeFi use cases that share the main advantages of DeFi.

DeFi use case summary

At present, we discuss the provision of financial services for the cryptocurrency ecosystem from two perspectives: centralization and decentralization. For example, the exchange of two currencies can be centralized (such as Coinbase) or decentralized (such as Uniswap, Kyber). In addition, the stable assets linked to the US dollar also exist in the form of centralization (such as USDT, which maps US dollars on the blockchain) and decentralization (such as DAI, which maps US dollars on the chain).

Looking to the future

Despite the increasing number of decentralized financial applications, these projects are difficult to attract other users besides those who are already familiar with blockchain and Ethereum. Therefore, the growth in 2019 is mainly due to blockchain enthusiasts.

DeFi has to overcome some major obstacles, especially the lack of accessibility and mobility. From this we can see that DeFi is still in the experimental stage of innovation and is not a professional financial business. However, for most crypto ecosystems, this can be done.

In order to fill the gap between theory and practice, DeFi needs to overcome its core obstacles: low liquidity, unintuitive user experience and accessibility, capital inefficiency, potential risks, and regulation, all of which are restrained to a certain extent DeFi adoption. Due to their complexity, these issues may be mitigated as the industry matures. We believe that good solutions are on the way, and 2020 will be an exciting year.

original:

https://medium.com/@victor.wachter.von/decentralized-finance-defi-what-do-you-need-to-know-ae7673346879 Draft source (translation): https://first.vip/shareNews? id = 2591 & uid = 1

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- To Southern Miners: A Guide to Heating for Miners

- Popular Science | The Cryptography of Bitcoin System and the Impact of Quantum Computing

- Japanese financial giant SBI teamed up with Germany's second largest stock exchange, hoping to "create global digital asset demand"

- Where will the blockchain go in 2020? Outlier Ventures shared 12 predictions

- Panoramic scan security incidents in 2019: 28 exchange cases involving 1.3 billion U.S. dollars

- IBM and Maersk Blockchain platform TradeLens add another member-Vietnam Gaimei International Terminal

- Zero fee for Bitcoin transactions, Coinbase CEO gets patent for trading Bitcoin via email