IMF Report: The Rise of Digital Currency

Emerging payment/currency forms such as Alipay, WeChat payment, Libra, Paxos, Stabilizingcoin, M-Pesa, Swish are on the rise, and the financial payment sector is also being subverted.

Yesterday, the International Monetary Fund (IMF) released the latest report " The rise of digital money" to summarize and analyze the current currency / payment field, the IMF report mentioned, "The two most common The currency form (cash and bank deposits) will face fierce competition and may even be surpassed."

From the report, it can be seen that blockchain technology is one of the core basic technologies in the future financial payment field, and it is an indispensable role. It can even be said that the blockchain is the future of payment.

- Bitcoin fluctuates frequently, does it hold money (HODL) or trade?

- Bitcoin fluctuated within a narrow range, and the market once again adjusted back. How did the follow-up market develop?

- Hearing Prospects | Bullying Congress White, not saying how to make a profit, what are the loopholes in Libra's congressional testimony?

Payment pattern and future

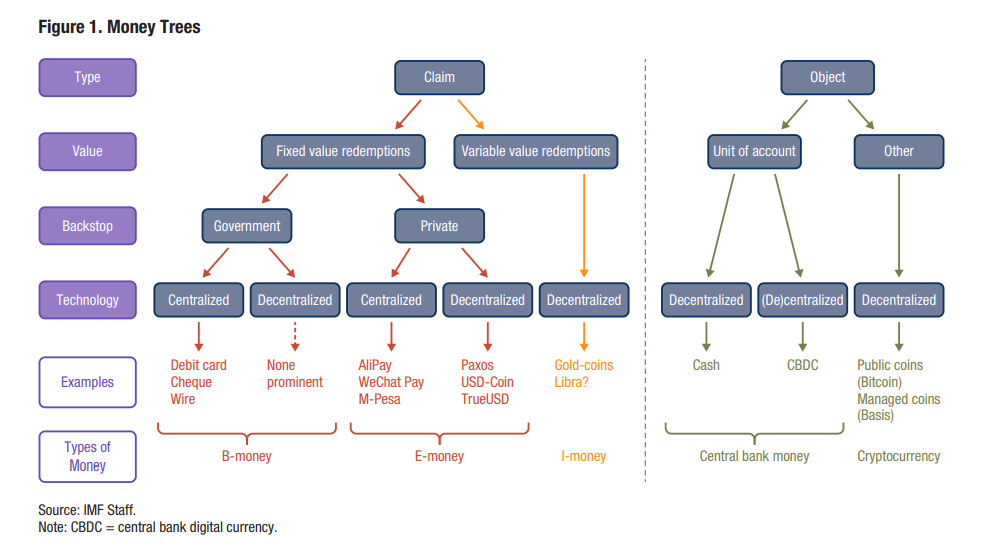

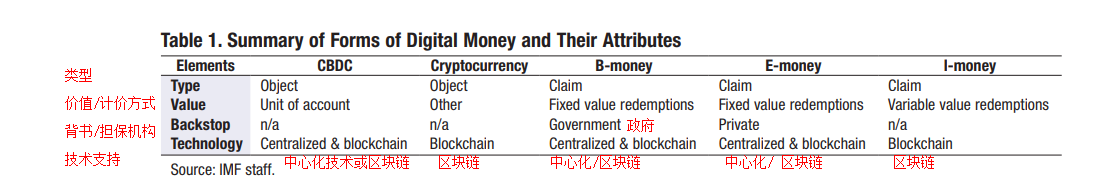

The IMF report divides the current payment methods (currency) into five categories: central bank currency, cryptocurrency, B-money, E-money, and I-money. The content and characteristics of the report can be summarized as follows:

- Central bank money: It is issued by the central bank, including cash and central bank digital currency (CBDC). Cash is the most common form of currency, denominated in local units and decentralized between parties to the transaction. The digital counterpart of cash is the central bank's digital currency , which may not be anonymous, and may be centralized or decentralized.

- Cryptographic currency: It is created (cast) by a non-bank , denominated in its own account unit, and issued on the blockchain, in a regulatory grey area.

- B-money: usually covers commercial bank deposits, which are often carried out through centralized technology such as debit cards, wire transfers and checks. One of its key features is that its redemption guarantees are supported by the government and are closely regulated by the government .

- E-money: An emerging payment method offered by the private sector , including centralized electronic money based on the central bank system, such as Alipay, WeChat, and decentralized electronic money based on blockchain, such as Gemini, Paxos , Dollar USD and other stable currencies. E-money is similar to B-money, but its redemption guarantee is not supported by the government.

- I-money: A potential new payment method issued by private investment funds . I-money is similar to E-money, but a very important feature is that it provides variable value conversion, which is volatility, so it is a similar equity tool. Such as Digital Swiss Gold, Libra.

It is worth noting that cryptocurrency and I-money are undoubtedly based on the currency form of blockchain technology. At the same time, central bank digital currency, E-money (electronic money) and B-money can continue the current centralized mode in the future. It is also possible to shift to the decentralized mode.

The IMF mentioned that the two most common forms of money will face fierce competition and may even be surpassed. Cash and bank deposits will compete with electronic money, an electronic storage currency (stable currency) that is linked to the euro, the US dollar, the renminbi, or a basket of currencies.

In other words, e-money is the current form of emerging payment, but stable currency, cryptocurrency and I-money are new ways of payment, and there may be future trends. Blockchain technology is indispensable in the future payment field.

The low-cost, trustworthy and more convenient financial services launched by large financial and technology companies in the future will put pressure on traditional banks. As large financial and technology companies gradually change the financial system, traditional banks will not be eliminated, but they must choose to take risks, otherwise they will face a backward fate.

The report also mentioned that “policy makers should be prepared for some disruptions in the banking industry.” In order to cope with the change, issuing a central bank digital currency is a viable move.

The 20-page report only mentions Bitcoin three times.

Much of the IMF's entire report focuses on analyzing electronic money and central bank digital currency (CBDC), with little mention of bitcoin or other cryptocurrencies. In this regard, a number of Reddit users said that the IMF is deliberately downplaying the significant impact of the cryptocurrency.

Netizen etmetm: Surprisingly, this article only mentions three bitcoins in the text…

Netizen bearCatBird: If they want to play it down (bitcoin). Facebook's Libra is a new competitor to their SDR.

User eamox: This is almost a literature review, and the conclusion is very bleak. Ten years after the invention of Bitcoin, is this basic nonsense what the IMF can do? Surprising.

Source: Shallot blockchain

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Comment: The hearing is imminent, why is the United States jealous of Libra?

- Blockchain Weekly | US SEC approves first token sales, blockchain promotes regulatory progress

- A picture proves that there are a large number of cleaning transactions on the exchange

- Meng Yan: Analysis of the Difficulties in the Design of the Economic Model of Double-passed Cards

- With a Reg A+ license, is Blockstack's compliant token in the last exchange?

- Noah's wealth of 3.4 billion big thunder detonated, DeFi has come!

- QKL123 market analysis | The market is long and short, and it is expected to see the bottom in the near future (0716)