Meng Yan: Analysis of the Difficulties in the Design of the Economic Model of Double-passed Cards

Many people think that the double-layer pass design is an equity pass plus a circulation pass, and the corresponding nodes can be excited in the place of the incentive. But in practice, how to determine the main incentive role in the design, how to design the circulation of the certificate, how to design the governance rules, how to design the pass-through formula to automatically optimize the configuration with the adjustment of key parameters, to avoid collapse? These issues deserve more detailed discussion.

table of Contents

First, discuss the double-layer certificate

1. What is the double-layer pass?

"Circulation Pass" + "Equity Pass"…

- With a Reg A+ license, is Blockstack's compliant token in the last exchange?

- Noah's wealth of 3.4 billion big thunder detonated, DeFi has come!

- QKL123 market analysis | The market is long and short, and it is expected to see the bottom in the near future (0716)

2. Advantages and disadvantages of double-layer pass:

Second, the best practice of the pass system

Third, the comparison of profit feedback methods

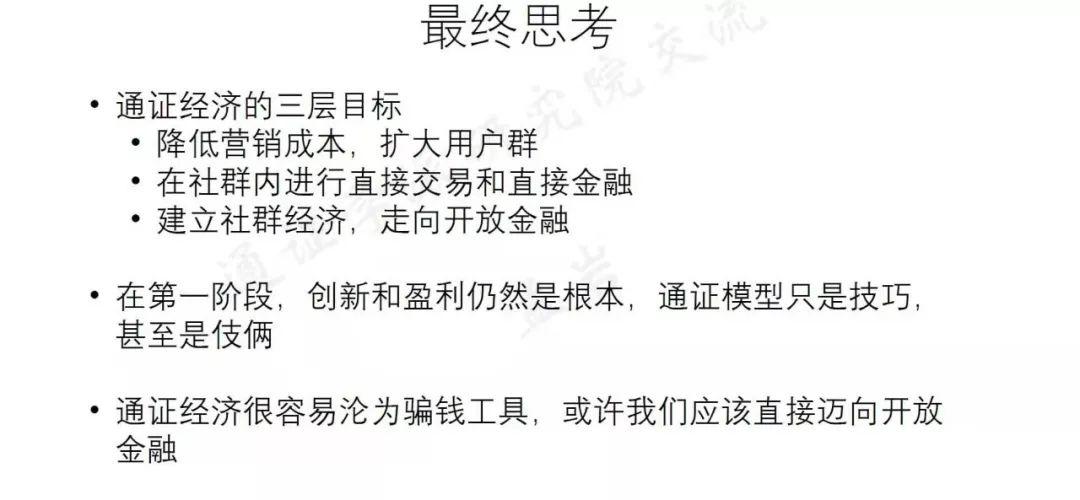

Fourth, the final thinking about the pass-through economy

Hello everyone, let me introduce the second part of the double-pass design.

The last time I talked about the double-layer pass, it was already a few weeks ago. There were a lot of other things happening behind it. For example, Libra, we stopped for a while. This time, we will talk about the last time.

Explain the double-layer certificate

Everyone should be familiar with this picture:

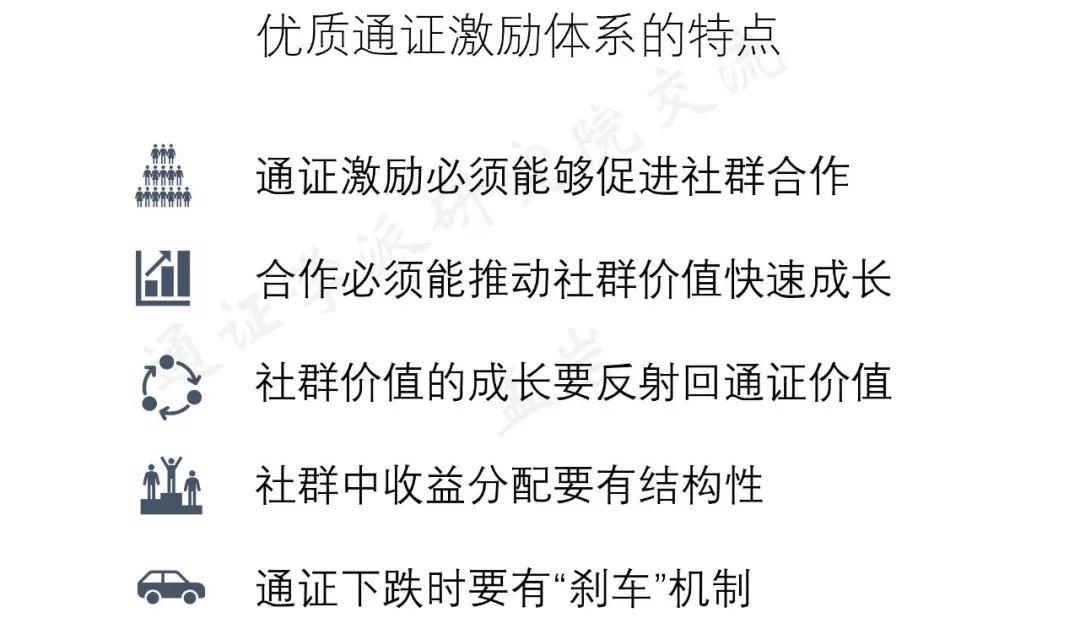

The last time we talked about some of the inherent problems of single-layer pass, I have already suggested that the quality pass incentive design system should have such advantages, but single-layer pass is difficult to meet all of these characteristics.

What is the double-layer pass?

Below I will talk about double-layer certification. The problem of double-layer pass is actually quite complicated. It is not that I have thoroughly understood it. I believe that no one in the world understands it thoroughly. There are many problems that we all need to practice together. I just share some of my experience and experience in my research and design practice with everyone.

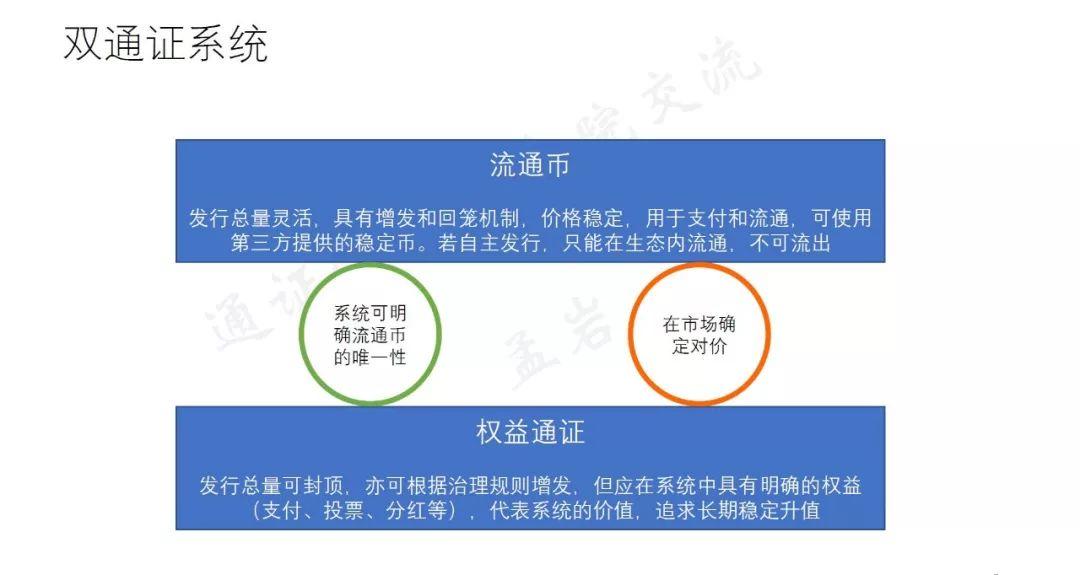

If there is less talk , then the double-pass is usually referred to as the circulation of two passes in one system, one called “circulation pass” and the other called “equity pass” or “equity coin”.

In the system, the circulation certificate is equivalent to the exchange of currency roles. Its total issuance is flexible and has an additional issuance and withdrawal mechanism. Therefore, we hope that its price is stable and used for payment and circulation.

The total amount of the equity pass can be capped, or it can be issued or returned according to the rules of governance. But an important sign is that the Equity Pass must have a clear interest in the system, that is, the Equity Pass represents the value or ownership of the system so that it can appreciate in the long run.

Generally speaking, the circulation certificate tends to adopt a stable currency or a relatively stable price. The reason we have said before, the last time I was talking about the single pass system, I came up with a single pass system, and its liquidity is contradictory to its appreciation. If it is both circulated and appreciated, it is equivalent to a deflationary certificate. But a deflation-type pass, its liquidity will not reach its maximum, because users will tend to store it, which will inevitably damage its liquidity.

Therefore, since we adopt the dual-pass system in it, we hope to let one of the certificates represent the maximum liquidity as much as possible. The two can be either one-way support or two-way mutual support. When two-way mutual support, I call this "bite."

Advantages and disadvantages of double-layer pass

Next, let's talk about the advantages and disadvantages of the dual pass system.

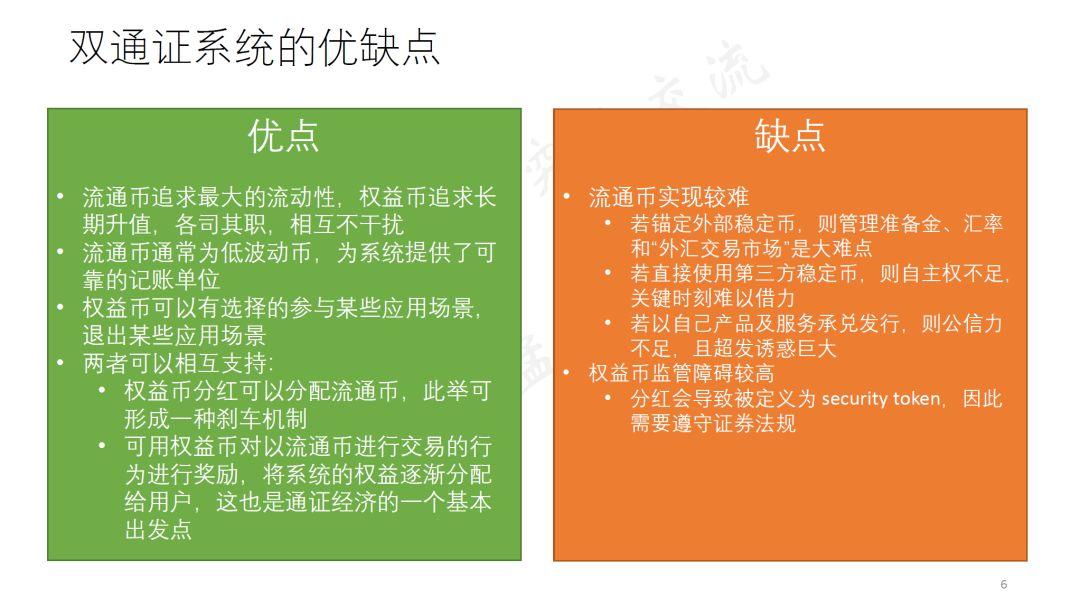

- Its advantages are of course outstanding. That is, the circulation certificate can pursue the maximum liquidity as much as possible, while the equity currency only focuses on the pursuit of long-term appreciation. These two certificates are their own duties and do not interfere with each other. This is the biggest advantage.

- The second advantage is that the circulation certificate is usually a low-volatility currency, which makes it a very reliable unit of account for the system. This is also very important. That is to say, if there is not even a native accounting unit in the whole system, the whole application scenario, then when everyone talks about the price of a service, the real value represented by the number itself is rapidly beating. Then we will have a hard time talking about any business, talking about futures and future contracts. Because if you want to make a contract around a future business, you always have to specify a price. If the price does not form a ruler that makes everyone's psychological stability, it is difficult for everyone to agree on certain things in the future.

- The third advantage is that when we use the double-layer pass, the equity pass will not be reduced to a corner, waiting for dividends or voting rights, and the equity pass can also selectively participate in certain scenarios. In fact, in many scenarios, we don't have to worry about price fluctuations. If you want to fluctuate, let it fluctuate. It can also selectively participate in certain scenes and exit certain scenes.

- The last very important advantage is that the two can support each other.

For example, dividends can be distributed through mutual distribution of equity passes; in the case of circulation certificates, such as trading or mining, when you use my circulation certificate to trade, I will give you the equity currency as a reward.

Of course, the dual-pass card system is not only good, no shortcomings, and the shortcomings are obvious:

1. First of all, the realization of the circulation certificate is more difficult, because in general, the circulation certificate is a stable currency with low fluctuations, and everyone knows that it is particularly difficult to achieve stable currency.

First , if you anchor an external stable currency, such as USDT or French currency, then you need to have a reserve. Next, you need to consider a lot of questions, such as full reserve or partial reserve; in the entire exchange rate process, if there is a big deviation, how do you intervene in the market; how do you build a foreign exchange market, how to maintain it? Intervention, and so on.

Second , of course, some people will say that they use third-party stable coins directly. Of course, you can use third-party stable coins directly, but this is similar to the situation: you as a Chinese company, using the US dollar as the settlement, then if it is only a Chinese company, it does not matter; but if used throughout the country A currency issued by a foreign government, then, when some crisis moments come, its autonomy is not enough, it has no way to borrow. For example, when we want to "step on the brakes", we will hope to let our equity pass more stable coins, but at this time, we do not have the right to distribute stable coins, so we have no way to more stable coins. Stabilize the entire system. So at this critical moment, it is difficult to borrow.

Third , there is another way to do this. It is actually the most common practice on the market today: to accept it with your own products or services. For example, if I sell water, then my pass can be exchanged for water. I don't care about anything else, but as long as you take this pass, I can replace it with a bottle of water. This is of course possible, but there are some problems. For example, first, because of the limited circulation of your currency and limited functions, it is impossible for users to need 20,000 bottles of water at once. There is not much meaning, so credibility and acceptance are limited. And because the issuer is not a saint after all, after he has this right, he may be over-expressed, not even possible, but I know that a large number of enterprises in this area have serious super-discovery.

On many occasions, I have cited some examples of well-known Internet company points, each of which is equivalent to their external liabilities, and is bound by the nature of certain products and services that need to be provided by Internet companies. And because the users who get these points will not be accepted immediately, these Internet companies will have an impulse to over-issue too many points. Because "there will be no acceptance of the user for a while." But one day, when they count these points, they will be shocked, because the outstanding points that need to be accepted may have exceeded their long-term sales and profits, which is very scary.

2. Another shortcoming of the Equity Pass is that its regulatory barriers are relatively high , because as long as the Equity Pass is paid, it will be immediately recognized as a Security Token. Therefore, he will be forced to comply with a variety of securities laws. From the current situation, regarding STO, it is not necessary to talk about the issue of "want to comply with it", because even if we obey it, its liquidity will be particularly poor, and there will be no money in the market. Perhaps this situation will improve after one year, because BlockStack has just received approval from the US Securities and Exchange Commission, which may indicate that STO will be gradually activated.

But in the current situation, I think that if you want to do STO, then go to compliance, find a STO exchange, find qualified investors, and then attract them to invest – the whole process is almost desperate. Therefore, if our Equity Pass is positioned as STO, it will bring a lot of trouble.

Best Practices for the Pass System

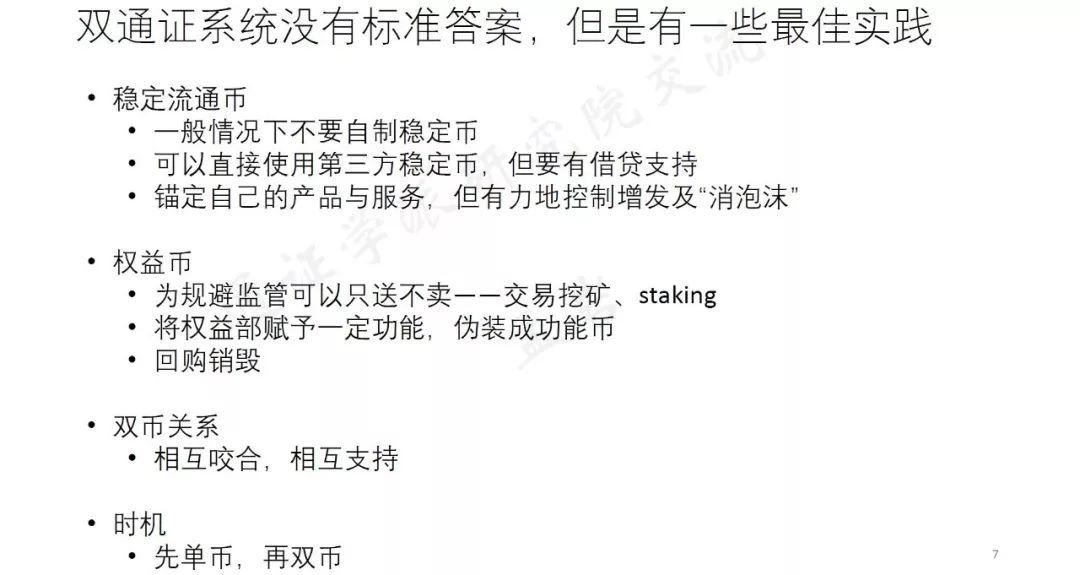

There is no standard answer in the double-layer pass design. Don't think that I share these contents with you, which means that I am very familiar with this aspect or have a good idea. No, in practice, I did take a lot of cases, but I found that each case has its own characteristics, not to say that it can be generalized. I am here to introduce you to some common best practices.

Stable circulation certificate

My first suggestion is that, under normal circumstances, don't make stable coins, because it is very difficult to make stable coins. If you want to win the trust of the people, then get regulatory approval, and then get a lot of liquidity. To do this, not only requires you to have a level, but you also need luck. So in fact, it is very difficult to make a stable coin.

So can we use third-party stable coins? Yes, for example, after Libra is in the future, we can use Libra as a circulation certificate in our entire system. But one thing is important: if you use a circulation certificate in your own system, you need to have strong lending support. That is to say, at a critical moment, when you need a part of the stable currency to come to the rescue, you can borrow it. This is very important.

This situation is very similar to today's banks, because today's banks are part of the reserve, so every night, they may find that they can not meet the requirements of the central bank's reserve ratio, so he will be very urgent The land borrows some cash from the market to meet the central bank’s reserve requirements. At this time, banks need to have a market to help it borrow, which is the familiar interbank lending market (also known as the overnight lending market). This market must exist.

At this stage, our infrastructure in this area is not very sound, so using third-party stable coins is a good idea in the long run. The reason is that in the short term, many people may still worry about the poor control of the homemade stable currency. After all, anchoring your own products and services, this is equivalent to the barber shop to store the value card, "I sent the card you bought first, I promise that when you come with this card, I will give you the service of redemption."

Then the most successful in this way is of course the Tencent of the year, sending Q coins to buy skin, buy clothing, buy equipment and so on. Tencent has a good control of the issue of circulation, and has always anchored 1:1. They also have a good way to eliminate the bubble: if you are too big, you will send more virtual items. However, under normal circumstances, it is difficult for us to have a kind of bubble-reducing mechanism like Q coins in the real economy. Therefore, we need to find ways to combine with some games and combine with some virtual ecology , so that there will be better. The way to eliminate the bubble.

Of course, the elimination of foam does not necessarily require the use of virtual items, but also the use of real things , provided that this real thing has high profits, such as liquor, tea, health products. The price of such items can be very high, but in reality the cost is not very high. This can also help to eliminate the bubble, but it is not as good as the game.

Equity certificate

Let's talk about the issue of equity pass. There are several best practices for Equity Pass, and I will also introduce it to you here.

First of all, because the Equity Clearance is very troublesome, we now have some options. For example:

The first method is called "only send and not sell" . Since the equity pass is not sold and is not used for financing, it is blameless. Because of this, I am simply a company that trades mining, user behavior mining, I will distribute these rights and passes to these behaviors that contribute to my system.

The second method is to give a part of the function of the equity pass , pretending to be a functional pass. To put it more explicit, it is because the Equity Pass is functional in the system. It is not only a pure but pure pass for dividends. It is functional and can be bought or sold, or Voting can be used as a function of weight or collateral on certain special occasions. With such a function, there is room for rebuttal.

The third method, the so-called repurchase destruction , is also the most effective one. Although it is clearly a functional certificate, if I do a repurchase and destroy, I will repurchase my equity pass through the so-called profit, which is in fact equivalent to allocating this profit to those markets that have not been repurchased in the market. Pass. In essence, it is a kind of equity distribution, but at the same time there is no naked, blatant dividend, so this is a useful way to realize the rights and interests of the pass.

Dual currency relationship: mutual bite, mutual support

In terms of the dual currency relationship, my suggestion is that everyone should consider "coincidence" as much as possible, and do not unilaterally support them. They must find ways to bite each other and support each other. In terms of my actual design experience, we feel that this is more organic. It can support each other more closely. There are many ways to support when you "step on the brakes" or "climbing up" at a critical moment. . We will talk about it in detail in the following case.

Timing: first currency, then double currency

Finally, from the timing point of view, in many cases, perhaps you should not do double currency as soon as you come up. You can do a single currency for a period of time. Obviously, it should be the whole system, and it will be used as a currency certificate in the future. It is a wave of currency.

So why can you make this wave of currency at the beginning? Because we know that the main shortcomings of the single pass system, or the main danger, are that when the whole system is fired high and begins to collapse, any brake mechanism is not there, and it will fall all the way. Then, if the whole system is still very low at the beginning, because the price is still very low, then at this time, there is no particular risk in using the pass. On the other hand, if you come up with a double pass, the first thing is that users don't understand easily. They don't know which pass is used. Don't overestimate the user's IQ, so it must be simplified.

Therefore, when I design a lot of projects, I will choose the single pass certificate in the early stage, and then wait until the whole ecology has reached a certain stage. I have a certain strength, and I have a certain amount of users, and then I will go through the double pass.

Comparison of profit feedback methods

Let's talk about the way in which equity passes back profits.

Two types: repurchase and distribution

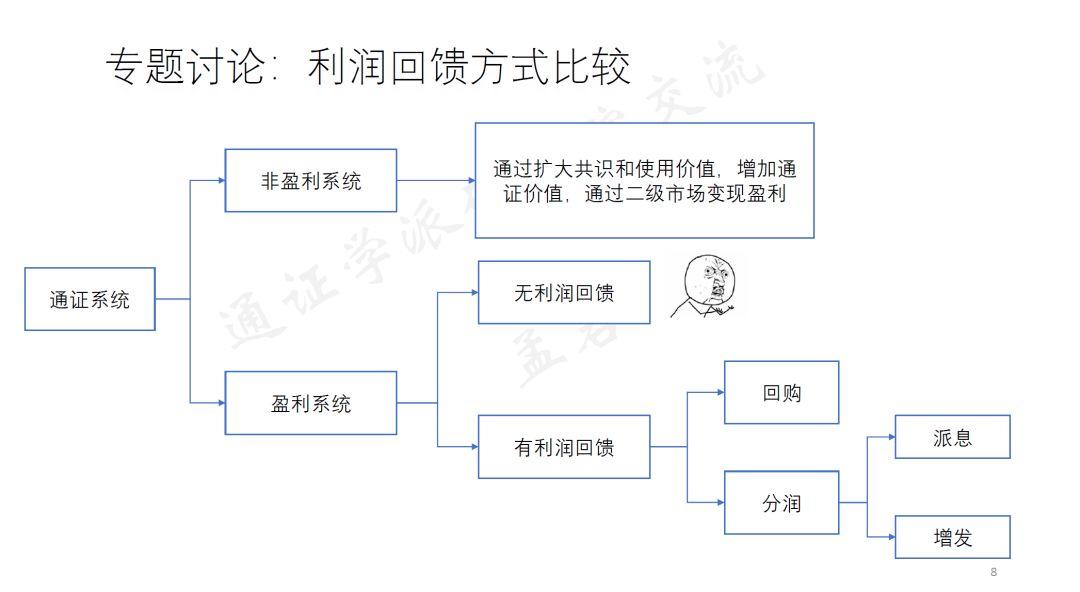

I drew a picture here, the most crucial thing is actually the bottom right corner of the picture: there is profit feedback.

In fact, profit feedback is probably divided into two types, one is repurchase, and the other is diversion.

Then the separation is divided into two types, one is dividend payout, and the other is additional issue. The so-called dividend payout is the dividend distributed by the individual's equity pass, which is the form of circulation certificate or the form of hard currency in the market (such as USDT). The additional issuance refers to the equity pass, that is, the dividends distributed are distributed, which is reflected in more equity certificates.

So briefly introduce these two ways of separation, today, I personally think that the way to use repurchase destruction is relatively easy to operate, the score is easier. However, the repurchase destruction certainly has its shortcomings, especially the black box operation. **In the past two days, Li Lin, the founder of the fire coin, wrote a long article to criticize some of the practices of the currency. This article mainly refers to the repurchase and destruction of the currency security, that is, the currency is not repurchased, only destroyed, there are many black box operations inside.

The black box operation is actually not using my profits to buy back the pass in the market, but to destroy my inventory, according to the pricing on the current pass market, to destroy a part.

Because my inventory part of the certificate is not what I really bought, I printed it in advance, the cost of printing is very low, and my destruction of these certificates gives the market confidence. The impact of all aspects is actually the same, but this does not consume my profits, so everyone can understand the meaning of the operation.

However, if this practice is popular, it will obviously make the effect of repurchase destruction greatly reduced. Therefore, we must also weigh the difference. The real meaning of real gold and silver to the market and repurchase and destroy it to the market is still different. of.

Another important question: If it is diversified, is it a good dividend or a good issuance? **** Obviously, the dividend is better . If you pay dividends, you can realize the mutual support of the two certificates and bite each other. But many times, this can't help but choose, because you may not have enough interest to send it out. Of course, you can say how much of the profitable part of my system is sent. But if you do this, you will often find that the profitability is pitiful and the user is not too good. So sometimes, especially at the beginning, we may have to adopt more ways to issue additional shares. The way to issue additional is also a lot of discussion now.

The picture below is more complicated, and I can't elaborate on it today:

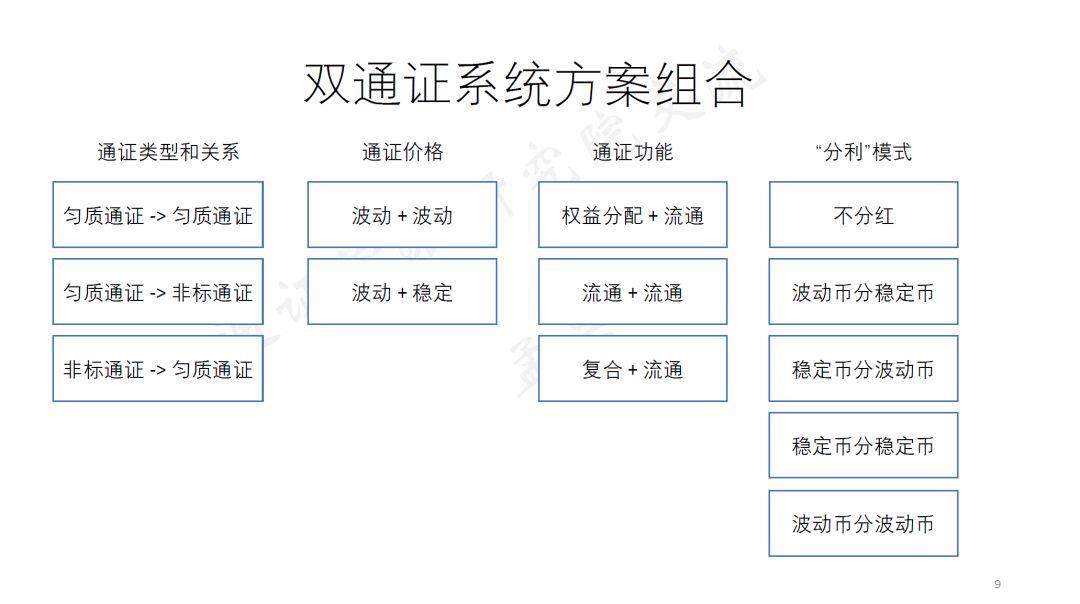

I will explain a little bit about the type and relationship of the pass on the left. That is to say, it can be a homogeneous pass to support a homogeneous pass (this arrow indicates support), a homogeneous pass to support a non-standard pass, or a non-standard pass to support a homogeneous pass. What is support? I will explain it to you through an example. In the latter part of the pass price, it can be volatility plus volatility, or volatility plus stability. The function can be equity plus circulation, circulation plus circulation, or compound plus circulation (that is, a certain type of certificate is both a pass and a pass). There are also a variety of classification methods, you can choose a combination inside.

I will give a few examples below.

case study

Libra+LIT

The first example is that we now have a lot of discussion about Libra Investment Token (LIT) , which is Libra plus LIT.

Many people think that Libra is a single currency system because Libra has issued a stable currency. But it is not. Libra is a dual currency system. Libra distributes a certificate called Libra Investment Token (LIT) among its one hundred nodes. The certificate is used to distribute the profits and profits in the system.

Libra's white paper uses two words to describe this part of the pass to be divided. It is mentioned that the profits and rewards are assigned. So as for what is profit and what is reward, the white paper is not too clear, we need his future explanation. But in fact it is not difficult to understand, let me tell you about my understanding.

I think Libra's profits come from the fees, transaction fees, service fees for cross-border transfers, and various institutional profits that it receives during the entire Libra trading process. And what is the bonus? I have to guess, because it is not explicitly written in the white paper, but I guess some of the bonuses in its white paper may come from a part of the profit, or it may come from some special coinage mechanism, and then They will put a part of the cast into a prize pool and use this part to reward the LIT holder.

One obvious possibility is that as the exchange rate changes, a part of Libra may be added out of thin air , which is possible. Everyone can imagine. In this case, this part of Libra can be used to make bonuses.

Having said that, in short, Libra is actually a model that I recommend to everyone without brains, that is, a pass is dedicated to circulation, and the other is only used to divide the profits generated during the circulation process. complex. Then you may ask, is the profit distributed in the flow process touched the STO line again? Indeed, Libra's LIT is a fake STO, so if it wants to go public in the future, it must follow the STO regulatory path.

But what's interesting about it is that it's likely that the LIT didn't go on the market in the first place, and for a long time, only flowing in the internal small market, that is, flowing inside a hundred nodes. Then this situation should not violate the so-called securities law, because it is not available to the public.

MakerDAO

So for the double-layer pass, I also suggest that a classic case for everyone to study is MakerDAO . When you study the double-layer pass, you must study this example, it will bring you a lot of inspiration. However, the MakerDAO example is also more complicated, and I will explain it succinctly.

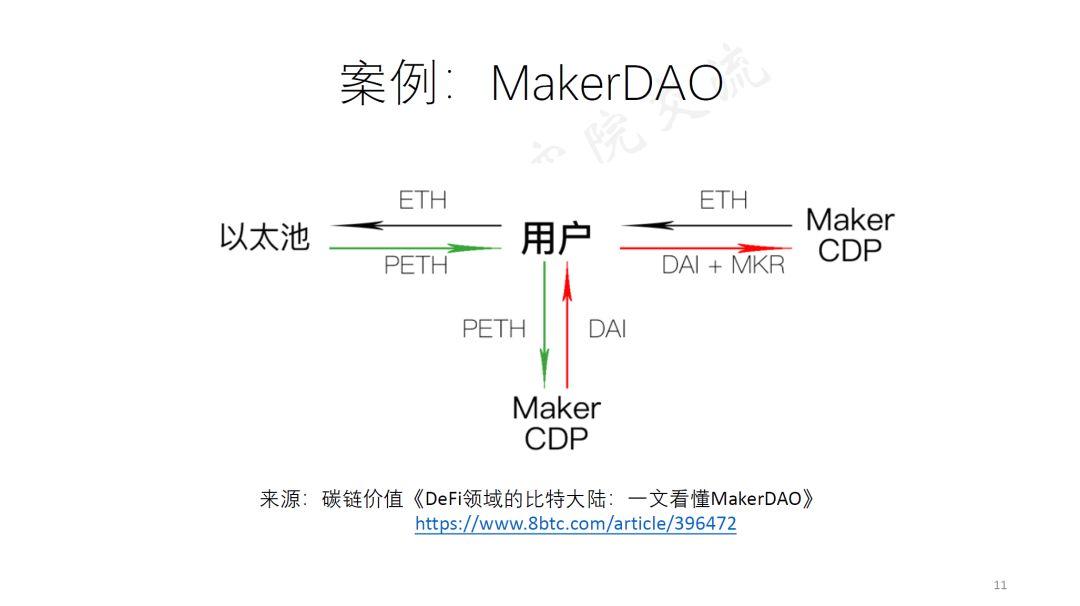

The goal of MakerDAO is to create a dollar-stabilized coin called DAI. It actually sets up two kinds of certificates in the system, one is DAI, and the other is called MKR.

Of course, you can also say that there is still a third type of certificate in the system, which is the Ethereum of Ethereum. This system turns the Ethereum into an ERC20 certificate called PETH, then stores the PETH as a reserve, stores it in the warehouse, and issues the DAI on a reserve basis. But we must know that if we must regard this part of the ether as a kind of currency, it is ok, but in fact it can also be gold, it can be an asset's MBS, or it can be a warehouse receipt. These things are all right, so we don't think of it as one of the system's dual coins. We still mainly study the relationship between DAI and MKR.

We know that MakerDAO's entire economic system has undergone a big change recently, and what I am describing is mainly its previous version of the economic system. I recommend you read an article, "Bit Continental in the DeFi Field: I understand MakerDAO in a text." This is an article that is specifically asked by two experts to analyze the carbon chain value and then write it out. Not long, but I think that you can understand MakerDAO basically when you understand it. I will explain it briefly here.

What everyone should pay attention to is the role of MKR. MKR is the evidence of the whole system , its origin value (the person who has attended my class should know what the origin value is, that is, you have to find the most basic value for the entire pass), if You want to return the DAI and redeem the ether. In this case, you have to pay a part of the MKR as a fee. In other words, if you want to use too much to mortgage DAI, this one-way arrow is very smooth, without any problems.

But when you reverse the need to use DAI to redeem the ether, you have to pay a part of MKR as a toll, which gives MKR a clear and unambiguous rigid demand scenario. This is in line with what I just said, "Give your rights and pass a special exact function in the system." As a result, once the Ethereum price plummets, the value of the entire Ethereum warehouse may plummet, which may result in the outflow of DAI liabilities exceeding the current safe level of Ethereum. At this critical juncture, their smart contracts will automatically mortgage a portion of MKR into the warehouse to add warehousing and support the value of the externally issued DAI.

Maybe you will ask, if the whole system is completely collapsed, the value of DAI and MKR is also plummeting, so no matter how many MKRs are put in, how to press the ball is not enough, then what should I do? In this case, it is clear that the system has collapsed. MKR, as the revenue holder of the entire system, also bears the risk of the entire system crash, and the benefits and risks are still symmetrical. So this system I think everyone can study it carefully.

Of course, the most subtle part of the MakerDAO system is the design of a stable DAI value. Including when the value is higher than 1 dollar, how to wait below 1 dollar, you can study it carefully. However, our double-layer pass is mainly to study the interaction between MKR and DAI.

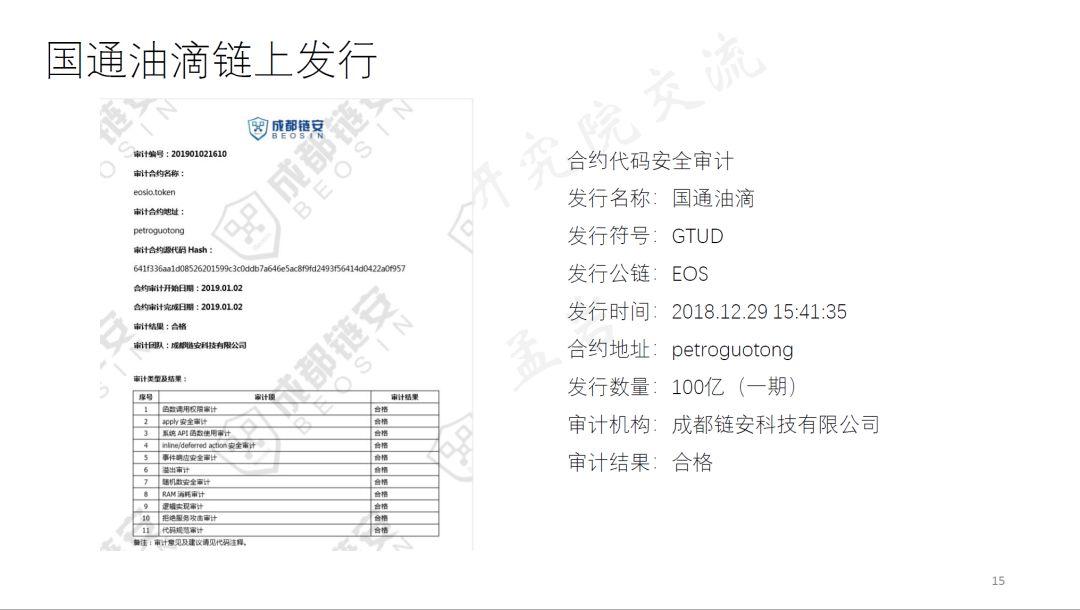

A special dual pass system: Guotong oil drop

In fact, there are many examples of double-layer certificates. I originally wanted to add another project as an example, but I don’t think I have to talk too much, because in fact everyone knows that there are all kinds of different double passes, like Kowala, which is stable currency. For three-level STEEM, you can find more examples.

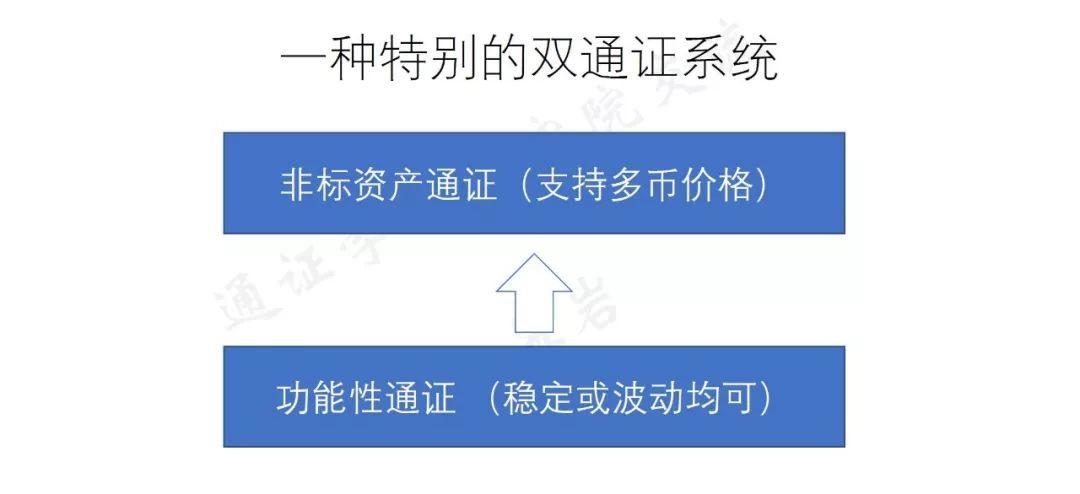

Here, I would like to open a brain hole for everyone. The following explains a special dual-pass card system . In practice, I found that its scope of application is quite wide, and it is quite easy to use, called **" The functional pass supports the model of the non-standard asset pass.

Of course, the "support" I am talking about here is not a one-way support, because the two sides must have a mutual bite relationship, but what is interesting here is that under this system, the functional certificate (ie Circulation certificate can be either stable or fluctuating. The key is that it supports a non-standard asset pass.

Non-standard asset passes often represent virtual game equipment or a certain interest. In this way, often, whether you like it or not, it will be a multi-currency price. In other words, users will automatically use several different currencies to price non-standard assets.

I am talking about this example. It is actually what I have said on many occasions. We have a plan for Guotong Petroleum. We have also released this program, but it belongs to a stable certificate plus a non-standard. Circulation certificate. Guotong Petroleum is a case that I made at the end of last year and at the beginning of this year. It is a company in Chongqing. It is the only company in the country that can issue fuel cards without self-built gas stations. There are more than 5 billion a year. Sales, but its profits are very meager, so it also hopes to be able to move towards a more lucrative business.

I am talking about this example. It is actually what I have said on many occasions. We have a plan for Guotong Petroleum. We have also released this program, but it belongs to a stable certificate plus a non-standard. Circulation certificate. Guotong Petroleum is a case that I made at the end of last year and at the beginning of this year. It is a company in Chongqing. It is the only company in the country that can issue fuel cards without self-built gas stations. There are more than 5 billion a year. Sales, but its profits are very meager, so it also hopes to be able to move towards a more lucrative business.

We issued Guotong oil droplets on EOS, and the number of issues was 10 billion. As everyone knows, this corresponds to 100 million yuan of oil, which will form a very interesting relationship. At the bottom of the picture, I said that the functional pass can be fluctuating. If this functional pass is fluctuating, does it mean that everything I just said can't stand? If the liquidity certificate is ups and downs, is it not very troublesome?

However, due to the non-standard asset certification it supports, the user may consciously and unconsciously take multiple currencies to calculate the price, so in the real world, if it is actually used, it is likely to be due to non-standard assets. The existence of a pass will result in a change in the price of a functional pass in accordance with a goal you expect, rather than a violent ups and downs.

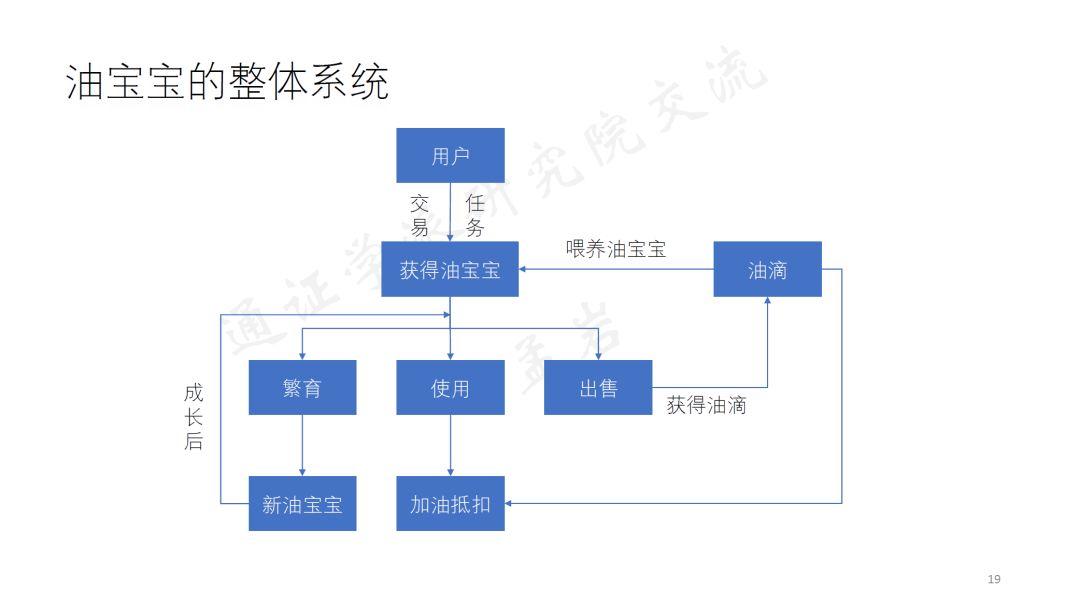

I can't introduce more about the specific situation. Here I will introduce to you the basic design ideas of Guotong Petroleum: We have made two certificates, one is called oil drop , and the other is called oil baby . Oil droplets are a stable certificate. They use the special oil of Guotong Petroleum as an acceptance to support the value of oil droplets. The value of anchoring each drop of oil is a penny.

Then this is the use of oil droplets, you can use oil droplets to redeem, use it to deduct the fueling costs when you refuel, simply say this is an ordinary fueling point, and even can say that it does not have too many areas The taste of the blockchain. If you don't match the baby, you will feel that this is a very mediocre thing.

I sent the design of the oil baby completely in this group:

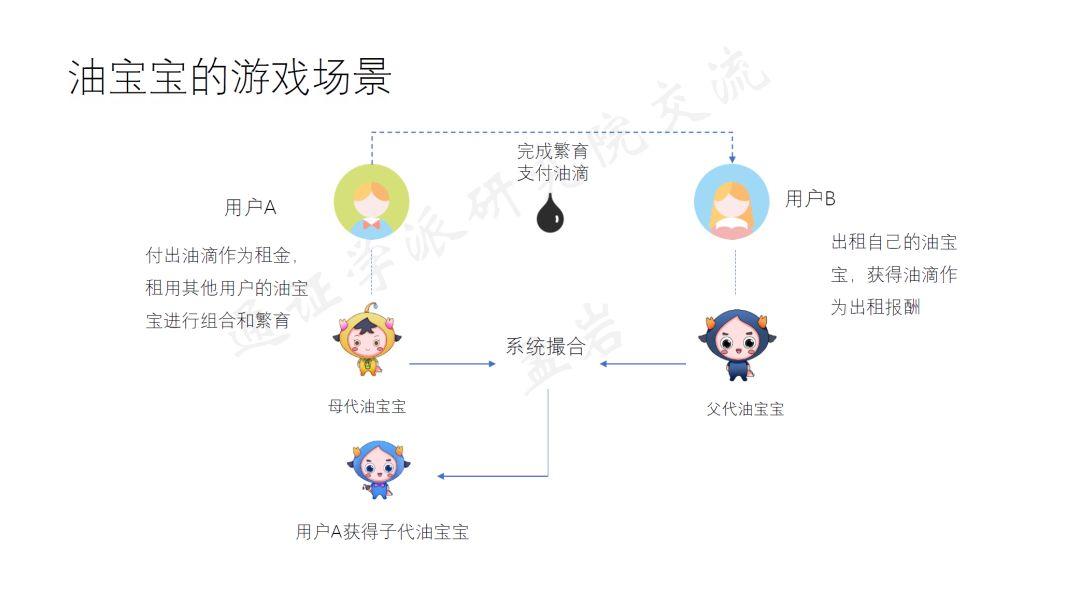

I will briefly introduce that the oil baby is actually a game similar to the encryption cat, it is a blockchain game . But it is not the same as the encrypted cat. Every oil baby, this small cartoon character, we give it the real value in the real world, that is, each oil baby is equivalent to a discount card, it There will be a few diamonds and a few stars on the body, so when the user goes to discount, it will add up the number of his diamonds and stars. For example, 7 diamonds and 8 stars add up to a total of 15, we will Give him 15% off and get 15% off.

What is the same for oil baby and encrypted cat? Two oil babies together, can give birth to a small oil baby, and this time is very interesting. Because each of our oil baby has a few diamonds. As I mentioned earlier, a diamond can be exempted by 1%. This diamond actually represents a lineage, a kind of DNA, which represents an identity level. Two high-drilled oil babies, such as two eight-nine-drilled oil babies, have a high probability that they will have high probability of high-drilling, and the high probability is seven, eight, and nine. For the same reason, low-drilled oil babies, such as two oil-drills with one drill bit or two drill bits, are born with a high probability of low-drilling. However, there are exceptions to everything. We have set up a random algorithm here. The combination of two oily babies with high diamond flavor may also give birth to a low-drilling, low-drilling combination of two oil babies, or it may give birth to a life. Heroes, this increases the playability of the system.

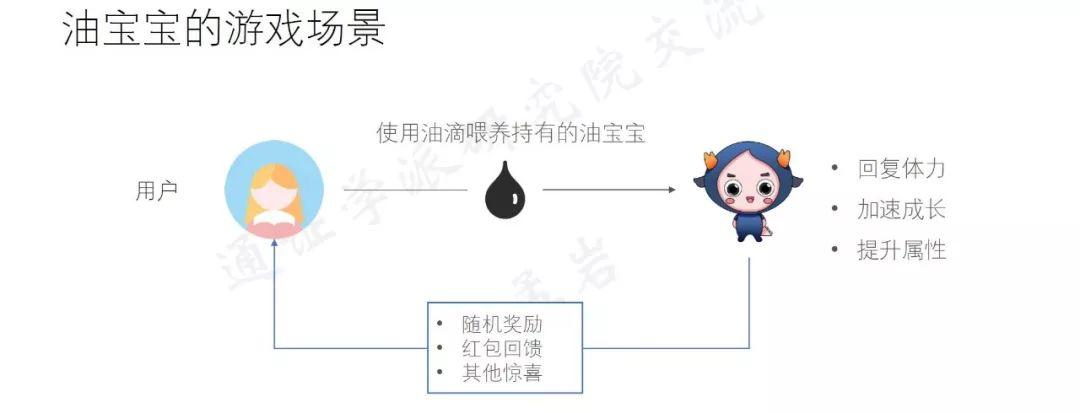

In addition, we have to let any oil baby can earn stars . And how do you earn it? It is to participate in a variety of activities, such as lottery, red envelopes, horse racing system, etc., we plan to develop a series of games that oil baby participates in. You can play without it, let the baby baby play for you. Then, in this way, the achievements of this oil baby are reflected in the red envelopes you get, or in the honor of the car. On the other hand, the oil baby can also accumulate stars in his body.

Of course, one of the most important trades for oil babies is pairing, or marriage . In this way, there will be buying and selling oil baby. In order to find a good gene for yourself, every oil baby wants to find a good oil baby to pair. Of course, it is possible not to buy an oil baby, but to rent a bride's oil baby to come back to have a baby. It is also possible to return it when it is finished.

Then the newborn baby is very important. I just mentioned that the two layers of the card need to be interlocked with each other. The newborn baby who wants to drink oil drops can grow up because they just gave birth and can’t To discount, you can't participate in all kinds of horse racing activities, you can't participate in anything, so they must grow up. In the process of growing up, he needs to eat food, and the food they eat is oil droplets.

In this way, I will eliminate the oil droplets that may be added in my system. What is the most important thing? The most important thing is the oil baby. If you take it for a discount, after using it once, the baby will die. They are either alive, helping you to have children, helping you to play a variety of games, or just killing them once, so we force users to choose between these two forms. We can imagine that many users play with the oil baby to play with emotions, reluctant to let the baby die, or have a baby oil is particularly rare, his hat, eyes may be particularly rare, this user is reluctant to let this baby baby die, this It is equivalent to our oil baby becoming an asset, and users will not go to the system to cash.

Then this example is a double-layer pass. Many people can't see it. It feels like a single pass, that is, the oil drop pass and invented a game. Actually not, the above oil baby is actually a pass, this pass is an ERC721 non-homogeneous pass (NFT), each oil baby is different from all the oil baby, is unique, then this It is not a "one" pass, it is a "layer". The reason why we call the double-layer pass is here.

I did not say that it is "two". I said that it is "two layers" and "two layers of pass certificates". Then in the above layer, you can contain a lot of different certificates, and they bite each other, the oil baby should drink oil drops, the oil drops can be used to buy oil baby, can be used to give the baby a red envelope, this It is the function of oil droplets.

In other words, the oil baby needs to consume oil droplets, they have to eat oil droplets to grow up. After the oil baby grows up, it can also get oil droplets to the user by grabbing the red envelope lottery, so its entire system is up. Of course, there are still many problems in this. If we do it in the future, the people who design the game numerical value need to come in and balance the whole system, but in general, this system better reflects the model I just mentioned. .

If we imagine that oil droplets are not a steady value pass, but what about a volatility pass? In fact, the volatility pass can be used in the same system, the same can be played, but because the oil baby is a discount card, so outside people will use the renminbi to give the oil baby another price. In this case, because there is a specific relationship between the oil baby and the oil drop, although it is not easy to express, then the outside world gives the baby a renminbi price, so in general, it will help the price stability.

Therefore, the "stability" that I am talking about is actually "controllable" in a sense. That is to say, stability is not our goal. Our goal is to have more means to regulate and intervene in the economy of the entire system. situation.

Final Thoughts on the General Economy

I have been in contact with more and more projects in recent months. I have seen a lot of projects in the market. Some projects are still not problematic at present, but they are still successful, but some projects are already very problematic. I have even exploded. I have also handled some projects myself. I also have my own principles and judgments, and I may also make mistakes. But in general, I have some ideas to share with you.

Three-tier goal: from marketing to open finance

I think the general economy can have three different levels of goals from low to high.

The first level is called lowering marketing costs and expanding the user base . At this level, the CIS economy is actually just a marketing tool. Don't think of it too high, or it is too great. Although I have talked about it on many occasions, the goal of the CIS economy is very high and significant, but that is the second and third level of the goal. At the first level, you don't want to be too complicated. It's actually your marketing tactic. Its main goal is to provide a more effective way for the community by enhancing the cohesiveness of the community through a gamification-like approach. Or a more attractive one, and then reduce the marketing cost by returning some of the benefits to the community, enabling the community to bring people, people to pull people, and finally expand our user base. This is the goal of the first level. The one that is most prone to problems is at this level. When your first level has broken through, your entire system is doing better and larger, and in this case, we can enter the second level of the goal.

The second level of goals is, in my opinion, a key turning point. In other words, if I have a relatively large community, there is no big problem in direct trading within my community, but as for whether I can conduct direct finance within my community, put a series of financial actions Go inside my community to achieve.

Of course, under this legal system, it is very easy to reach such a regulatory treaty . At this time, we can also have some circumvention through decentralization, but in general, this matter It is a very important sign. The third level is the ultimate goal I hope to achieve, that is to say, the open economy of the social economy (this I have said on many occasions, it will not be carried out here, which represents a certain social ideal).

We know that in our case of China, in the entire production and distribution process, sales were all intermediary, and the intermediary was our original state-owned supply and marketing system. Then reform and opening up is mainly to cancel this layer. Individual companies can build their own channels, and even use direct sales to customers and users to directly deal with the community (this is my statement). ). Then this has produced a very large effect.

However, in the financial sector, the law is good, and the reasons for all aspects are good. It is also stipulated that all of our financial activities need to be carried out through intermediaries. It is as if we do all the business needs to go through a supply and marketing cooperative. Finally, It will only fatten the supply and marketing cooperatives. It is as if we are buying and selling land in Chinese cities, we must go through the government, and finally we must have fattened the government. In any system, if there is an intermediary that cannot go around, then it is clear that the power of the intermediary will be enormous. Currently, our finance is such a situation.

So, is it possible in the future to develop direct financial activities with the community after building a very large and active community? This is a very interesting behavior. In fact, many of our blockchain communities are already doing this, so we know that this is not impossible. But there are also a lot of risks here, in addition to the risk of compliance, there is indeed a risk of fraud. But why am I putting it on the second floor? In other words, when you have a strong business and a relatively large community, you will do this again. At this time, you will feel that no matter which side of the supply and demand side, you will feel much safer. It is not easy to get out of the situation of cutting the leek.

Pay attention to the first stage

I will talk about the second half of the double pass.

Many of our projects are still in their infancy, so this phase is still very important. We have to be aware of a problem, that is, in the initial stage, you are just a company, just a project to be profitable. At this time, don't take the views mentioned in the second and third stages, what social economy, open finance, etc., don't take these things out and say things. The first stage is a project to make money and make a profit, so innovation and profitability are still fundamental. These models of the pass are only a marketing technique in the first phase, and even a trick.

Everyone may feel a bit unhappy when they hear this. Maybe they say, "Getting it done. It turns out that your pass model is just a marketing technique at the beginning!" But everyone needs to know what the purpose of marketing is. If you go to Philip Kotler's marketing-related writings, you will come to the conclusion that marketing is actually about creating customers and creating customers for the whole company. Creating a customer is obviously the most important mission of a company. Therefore, we say that the general economy is an important marketing technique. This is not a derogatory effect on the first stage of the CIS economy. It is a very important compliment. If the general economy can really help you to significantly reduce marketing costs, help you create customers, and build a community, then it is already very remarkable, so the pass is still very useful, so don't be frustrated.

Is it directly to open finance?

But we also need to recognize some issues. Recently, I have also seen many cases, which made me feel very heavy. I found some content that I have talked about in many classes, including some summaries, skills, and experiences that we have done in the field of the certificate. Finally, many projects have been Take it out and do something that is ugly. To put it bluntly, it is easy to be turned into a tool to defraud money.

Not long ago, at a course at the China Europe Business School, I directly said that "the pass-through economy is only one line away from the Ponzi scheme." I also hope that everyone can take the precautions. At present, many projects are under the banner of the certificate economy. In fact, I am doing a Ponzi scheme.

So what is the difference between it? The difference is this: in the first phase of the pass for the economy, we must pay attention to this system must have consumers, must be in order to obtain the use value, and then take the money to spend here. It cannot be said that all people are financial investors. If all the people involved in the ecology are financial investors and there are no consumers, then this system must be a Ponzi scheme, no matter what kind of economics it contains. And then how much of the CIS economy we have here, or on other occasions, and how it seems to fit the four-distribution framework we proposed earlier. So as long as there is no consumer in a system, no one is going to invest a lot of money to buy things, no one supports the system to create high profits, this system is definitely a Ponzi scheme.

Only when it enters the second or even the third stage of the CIS economy, it is likely to reach the level of open finance. Only when you enter the level of open finance, because you are actually in an open system, it is straightforward. When you win the coinage, you establish the coinage right on the basis of the community consensus. Under this premise, you don't have to think about too many problems such as obtaining external profits. This matter is more complicated. It is also a place I have paid more attention to recently, and I feel more heavy. I am not here today.

What needs to be explained is that, in most cases, in most of the projects, in today’s era and at this time, most people’s economics of the economy should be considered for profit, and it is better to be innovative. Achieve high profits. In this case, use the pass-through economy to help you reduce marketing costs, and expand the size of customers, users, and communities as soon as possible. This is the right way!

Author: Meng Yan

Source: General School School (WeChat Public Number)

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Siemens plans to integrate blockchain technology into shared cars and has demonstrated a blockchain-based smart parking solution

- Twitter Featured | US Treasury Secretary: "It can be used to speculate in bitcoin, and it is never allowed to do illegal things."

- Libra project leader: Libra project will not be launched until the supervision

- USDT Final Judgment: "Doomsday" is coming? What do you think about the short-term and long-term?

- Crypto.com Chain (CRO) welcomes the first settlement agents and stable currency partners

- Junk trading? VeriBlock makes bitcoin average block capacity exceed 3MB

- BTC fell below 10,000 yesterday, the bull market is over? We asked about 10 people in the circle.